Key Insights

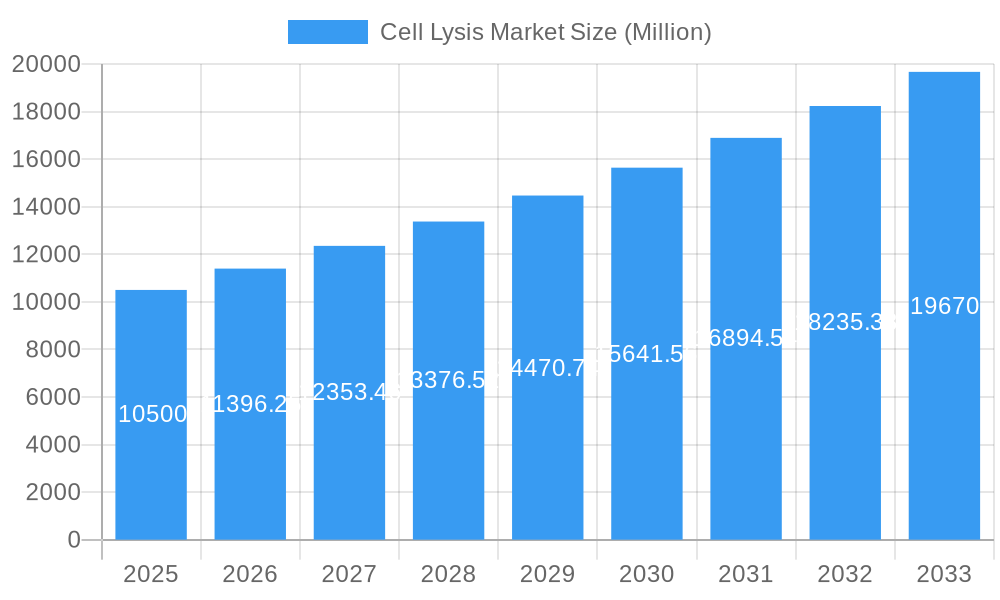

The global Cell Lysis market is projected for significant expansion, estimated to reach approximately $10,500 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 8.50%. This growth is propelled by increased investments in biotechnology and biopharmaceutical research, rising prevalence of chronic diseases, and the escalating demand for personalized medicine. Key drivers include continuous innovation in lysis technologies for efficient cell disruption and expanding applications in genomics, proteomics, and drug discovery. The market also benefits from expanding research infrastructure in emerging economies and the adoption of automated cell lysis solutions.

Cell Lysis Market Market Size (In Billion)

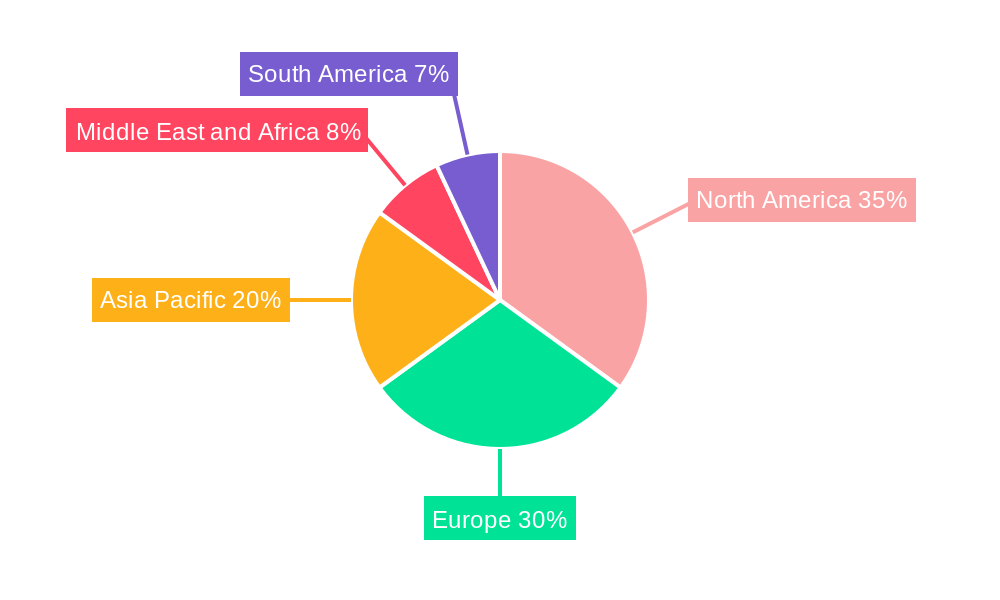

The market is segmented dynamically. Instruments, such as homogenizers and centrifuges, are expected to hold a significant share. Reagents, with advancements in lysis buffers, are crucial. Mammalian cells represent the largest segment in "Type of Cells," but microbial and plant cell lysis are gaining traction. Biotechnology and Biopharmaceutical Companies are leading end-users, followed by Research Laboratories and Academic Institutes. Geographically, North America and Europe are expected to lead, while the Asia Pacific region presents substantial growth opportunities.

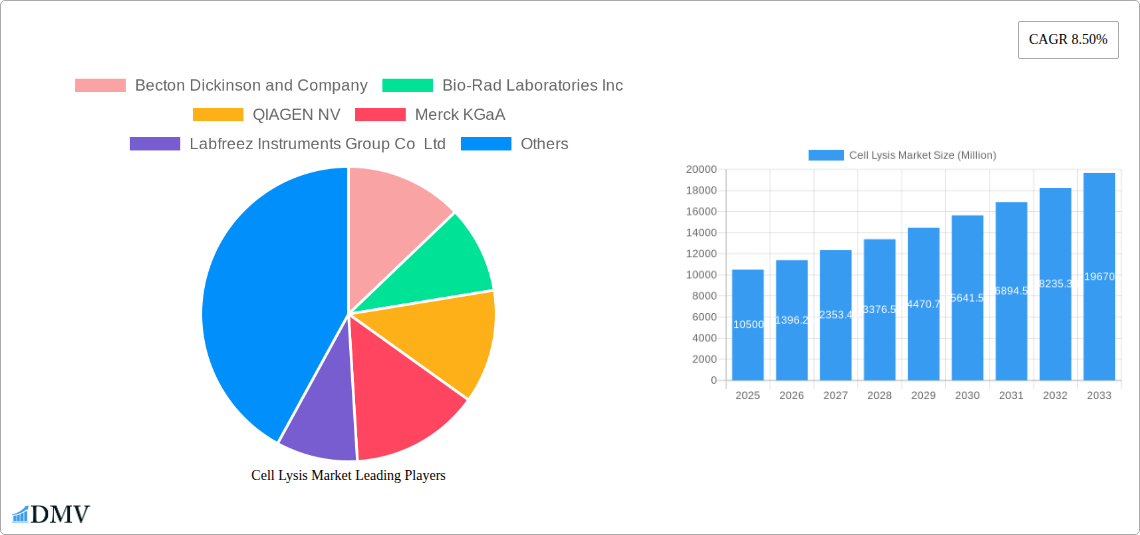

Cell Lysis Market Company Market Share

This comprehensive report delivers definitive analysis of the global Cell Lysis Market, providing critical insights into market dynamics, growth trajectories, and future opportunities. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this study is an indispensable resource for stakeholders. We delve into product innovations, key industry developments, competitive landscapes, and strategic imperatives shaping market expansion.

Cell Lysis Market Market Composition & Trends

The global Cell Lysis Market exhibits a moderate concentration, with key players investing heavily in research and development to drive innovation. Catalysts for innovation include the increasing demand for advanced diagnostics, personalized medicine, and novel drug discovery, all of which rely on efficient and reliable cell lysis techniques. The regulatory landscape, while evolving, generally supports advancements that enhance product safety and efficacy. Substitute products, such as alternative cell preparation methods, exist but are often outpaced by the specificity and efficiency offered by dedicated lysis solutions. End-user profiles reveal a strong reliance from biotechnology and biopharmaceutical companies, research laboratories, and academic institutions. Mergers and acquisitions (M&A) activities have played a significant role in market consolidation and expansion, with deal values estimated to be in the range of hundreds of millions of dollars.

- Market Share Distribution: Dominated by established players with a focus on high-throughput and specialized lysis solutions.

- M&A Deal Values: Significant transactions contributing to market consolidation, estimated in the range of $50 Million to $200 Million annually.

- Innovation Drivers: Growing demand for single-cell analysis, proteomics, and genomics research.

- Regulatory Influence: Increasing compliance requirements driving demand for validated and standardized lysis products.

Cell Lysis Market Industry Evolution

The Cell Lysis Market has witnessed substantial evolution, driven by continuous technological advancements and the escalating needs of the life sciences sector. From 2019 to 2024, the market experienced a steady growth trajectory, fueled by increased investments in biomedical research and the burgeoning field of cell-based therapies. The base year of 2025 sets the stage for projected robust expansion, with the forecast period of 2025–2033 anticipated to see compound annual growth rates (CAGRs) ranging from 6% to 9%. This growth is primarily attributed to the increasing adoption of high-throughput screening in drug discovery, the rising prevalence of genetic diseases requiring advanced molecular diagnostics, and the expanding applications of cell lysis in areas like synthetic biology and agricultural biotechnology. Technological advancements in lysis instruments, including automated homogenizers and advanced centrifugation techniques, have significantly improved efficiency, yield, and sample integrity. Furthermore, the development of specialized lysis reagents, optimized for different cell types and downstream applications such as DNA/RNA extraction, protein purification, and enzyme activity assays, has broadened the market's appeal. Shifting consumer demands, influenced by the push for personalized medicine and rapid diagnostic solutions, are compelling manufacturers to develop more sensitive, specific, and user-friendly cell lysis products. The market's adaptability to these changing needs underscores its dynamic nature and inherent potential for sustained growth. The estimated market size for 2025 is approximately $7 Billion, with projections to reach over $12 Billion by 2033.

Leading Regions, Countries, or Segments in Cell Lysis Market

North America currently dominates the global Cell Lysis Market, driven by robust investments in research and development, a strong presence of leading biotechnology and biopharmaceutical companies, and a supportive regulatory environment. The United States, in particular, is a hub for innovation and adoption of advanced cell lysis technologies. The market segment of Instruments, specifically advancements in homogenizers and centrifugation technologies, has seen significant traction due to their critical role in high-throughput applications. However, the Reagents segment, offering specialized solutions for diverse applications like DNA/RNA extraction and protein analysis, is also experiencing substantial growth. Mammalian Cells remain the most prominent cell type lysed, owing to their extensive use in drug discovery and cell-based research.

- Dominant Region: North America, with an estimated market share of 35% in 2025.

- Key Drivers in North America:

- High R&D expenditure by biotechnology and pharmaceutical companies.

- Presence of leading academic research institutions.

- Favorable government funding for life sciences research.

- Early adoption of novel technologies.

- Key Drivers in North America:

- Dominant Product Type: Instruments (Homogeniser, Centrifugation).

- Key Drivers for Instruments:

- Demand for automation and high-throughput processing in drug discovery.

- Advancements in microfluidics and miniaturization of lysis devices.

- Need for reproducible and efficient sample preparation.

- Key Drivers for Instruments:

- Dominant Cell Type: Mammalian Cells.

- Key Drivers for Mammalian Cells:

- Extensive use in vaccine development and therapeutic protein production.

- Central role in cancer research and regenerative medicine.

- Growing demand for preclinical and clinical studies.

- Key Drivers for Mammalian Cells:

- Dominant End User: Biotechnology or Biopharmaceutical Companies.

- Key Drivers for Biotechnology/Biopharmaceutical Companies:

- Critical need for cell lysis in target validation, drug screening, and quality control.

- Investments in advanced molecular diagnostics and personalized medicine.

- The rapid growth of the biologics market.

- Key Drivers for Biotechnology/Biopharmaceutical Companies:

Cell Lysis Market Product Innovations

Product innovations in the Cell Lysis Market are characterized by a focus on enhancing throughput, specificity, and sample preservation. Advanced homogenizers now incorporate novel technologies for rapid and efficient disruption of even the most resilient cell walls, while next-generation centrifuges offer enhanced precision and sample recovery. The development of reagent kits tailored for specific downstream applications, such as single-cell proteomics sample preparation, represents a significant leap. These innovations are crucial for enabling breakthrough research in areas like gene editing, immunotherapy, and infectious disease diagnostics, ensuring researchers can obtain high-quality lysates for accurate downstream analysis.

Propelling Factors for Cell Lysis Market Growth

The Cell Lysis Market is propelled by several key factors. Technologically, the increasing demand for high-throughput screening in drug discovery and the rise of genomics and proteomics research are driving the need for faster and more efficient lysis methods. Economically, sustained investments in life sciences R&D by governments and private entities, particularly in emerging economies, are expanding the customer base. Regulatory support for novel diagnostic tools and personalized medicine further fuels market growth. For instance, advancements in automated lysis systems directly support the global push for rapid pandemic response and diagnostics.

Obstacles in the Cell Lysis Market Market

Despite its growth, the Cell Lysis Market faces certain obstacles. Stringent regulatory approval processes for new instruments and reagents can slow down market entry. Supply chain disruptions, as witnessed in recent global events, can impact the availability of raw materials and finished products. Furthermore, intense competitive pressures can lead to price erosion in certain market segments, affecting profitability. The high initial cost of advanced lysis instrumentation also presents a barrier for smaller research facilities and academic labs.

Future Opportunities in Cell Lysis Market

Emerging opportunities in the Cell Lysis Market are abundant. The burgeoning field of single-cell analysis presents a significant avenue for growth, requiring highly specialized and sensitive lysis techniques. Advances in liquid biopsy technologies will necessitate innovative cell lysis solutions for extracting nucleic acids and proteins from minute biological samples. Expansion into emerging markets in Asia-Pacific and Latin America, coupled with the development of more cost-effective lysis solutions, will unlock new customer segments and drive market penetration.

Major Players in the Cell Lysis Market Ecosystem

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc

- QIAGEN NV

- Merck KGaA

- Labfreez Instruments Group Co Ltd

- F Hoffmann-La Roche Ltd

- Cell Signaling Technology Inc

- Qsonica LLC

- Thermo Fisher Scientific Inc

- Microfluidics International Corporation

- Eppendorf AG

- Takara Bio Inc

- Miltenyi Biotec

- Danaher Corporation

- Claremont BioSolutions LLC

Key Developments in Cell Lysis Market Industry

- September 2022: SCIENION and Cellenion launched the proteoCHIP LF 48 for label-free single-cell proteomics sample preparation on the cellenONE platform, enhancing capabilities for proteomic research.

- March 2022: Sanofi and IGM Biosciences, Inc. announced signing an exclusive worldwide collaboration agreement to create, develop, manufacture, and commercialize IgM antibody agonists against three oncology targets and three immunology/inflammation targets, indirectly influencing the demand for advanced cell lysis in therapeutic development.

Strategic Cell Lysis Market Market Forecast

The strategic Cell Lysis Market forecast indicates continued robust growth, driven by the increasing integration of cell lysis technologies into advanced research areas like AI-driven drug discovery and precision oncology. The expanding demand for in-vitro diagnostics and the growing emphasis on biopharmaceutical manufacturing quality control will serve as significant market catalysts. Key opportunities lie in the development of miniaturized, high-efficiency lysis solutions for point-of-care diagnostics and the creation of sustainable and cost-effective lysis technologies for broader accessibility. The market is poised for significant expansion as it underpins critical advancements across the entire life sciences spectrum.

Cell Lysis Market Segmentation

-

1. Type of Product

-

1.1. Instruments

- 1.1.1. Homogeniser

- 1.1.2. Centrifugation

- 1.1.3. Other Types of Products

- 1.2. Reagents

-

1.1. Instruments

-

2. Type of Cells

- 2.1. Mammalian Cells

- 2.2. Microbial Cells

- 2.3. Plant Cells

-

3. End User

- 3.1. Biotechnology or Biopharmaceutical Companies

- 3.2. Research Laboratories and Academic Institutes

- 3.3. Other End Users

Cell Lysis Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cell Lysis Market Regional Market Share

Geographic Coverage of Cell Lysis Market

Cell Lysis Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Expenditure in Research and Development; Increasing Application in the Pharmaceutical and Biopharmaceutical Industries; Rising Focus on Personalized Medicine

- 3.3. Market Restrains

- 3.3.1. Regulatory Compliance; Issues in Mechanical Process to Apply at the Microscale Level

- 3.4. Market Trends

- 3.4.1. Instruments are Expected to Witness Significant Growth in the Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cell Lysis Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 5.1.1. Instruments

- 5.1.1.1. Homogeniser

- 5.1.1.2. Centrifugation

- 5.1.1.3. Other Types of Products

- 5.1.2. Reagents

- 5.1.1. Instruments

- 5.2. Market Analysis, Insights and Forecast - by Type of Cells

- 5.2.1. Mammalian Cells

- 5.2.2. Microbial Cells

- 5.2.3. Plant Cells

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Biotechnology or Biopharmaceutical Companies

- 5.3.2. Research Laboratories and Academic Institutes

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Product

- 6. North America Cell Lysis Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 6.1.1. Instruments

- 6.1.1.1. Homogeniser

- 6.1.1.2. Centrifugation

- 6.1.1.3. Other Types of Products

- 6.1.2. Reagents

- 6.1.1. Instruments

- 6.2. Market Analysis, Insights and Forecast - by Type of Cells

- 6.2.1. Mammalian Cells

- 6.2.2. Microbial Cells

- 6.2.3. Plant Cells

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Biotechnology or Biopharmaceutical Companies

- 6.3.2. Research Laboratories and Academic Institutes

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type of Product

- 7. Europe Cell Lysis Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 7.1.1. Instruments

- 7.1.1.1. Homogeniser

- 7.1.1.2. Centrifugation

- 7.1.1.3. Other Types of Products

- 7.1.2. Reagents

- 7.1.1. Instruments

- 7.2. Market Analysis, Insights and Forecast - by Type of Cells

- 7.2.1. Mammalian Cells

- 7.2.2. Microbial Cells

- 7.2.3. Plant Cells

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Biotechnology or Biopharmaceutical Companies

- 7.3.2. Research Laboratories and Academic Institutes

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type of Product

- 8. Asia Pacific Cell Lysis Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 8.1.1. Instruments

- 8.1.1.1. Homogeniser

- 8.1.1.2. Centrifugation

- 8.1.1.3. Other Types of Products

- 8.1.2. Reagents

- 8.1.1. Instruments

- 8.2. Market Analysis, Insights and Forecast - by Type of Cells

- 8.2.1. Mammalian Cells

- 8.2.2. Microbial Cells

- 8.2.3. Plant Cells

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Biotechnology or Biopharmaceutical Companies

- 8.3.2. Research Laboratories and Academic Institutes

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type of Product

- 9. Middle East and Africa Cell Lysis Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 9.1.1. Instruments

- 9.1.1.1. Homogeniser

- 9.1.1.2. Centrifugation

- 9.1.1.3. Other Types of Products

- 9.1.2. Reagents

- 9.1.1. Instruments

- 9.2. Market Analysis, Insights and Forecast - by Type of Cells

- 9.2.1. Mammalian Cells

- 9.2.2. Microbial Cells

- 9.2.3. Plant Cells

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Biotechnology or Biopharmaceutical Companies

- 9.3.2. Research Laboratories and Academic Institutes

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type of Product

- 10. South America Cell Lysis Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 10.1.1. Instruments

- 10.1.1.1. Homogeniser

- 10.1.1.2. Centrifugation

- 10.1.1.3. Other Types of Products

- 10.1.2. Reagents

- 10.1.1. Instruments

- 10.2. Market Analysis, Insights and Forecast - by Type of Cells

- 10.2.1. Mammalian Cells

- 10.2.2. Microbial Cells

- 10.2.3. Plant Cells

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Biotechnology or Biopharmaceutical Companies

- 10.3.2. Research Laboratories and Academic Institutes

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type of Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bio-Rad Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 QIAGEN NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Labfreez Instruments Group Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 F Hoffmann-La Roche Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cell Signaling Technology Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qsonica LLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 6 COMPETITIVE LANDSCAPE6 1 COMPANY PROFILES

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thermo Fisher Scientific Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Microfluidics International Corporation*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eppendorf AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Takara Bio Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Miltenyi Biotec

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Danaher Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Claremont BioSolutions LLC

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Cell Lysis Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cell Lysis Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 3: North America Cell Lysis Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 4: North America Cell Lysis Market Revenue (billion), by Type of Cells 2025 & 2033

- Figure 5: North America Cell Lysis Market Revenue Share (%), by Type of Cells 2025 & 2033

- Figure 6: North America Cell Lysis Market Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Cell Lysis Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Cell Lysis Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Cell Lysis Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Cell Lysis Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 11: Europe Cell Lysis Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 12: Europe Cell Lysis Market Revenue (billion), by Type of Cells 2025 & 2033

- Figure 13: Europe Cell Lysis Market Revenue Share (%), by Type of Cells 2025 & 2033

- Figure 14: Europe Cell Lysis Market Revenue (billion), by End User 2025 & 2033

- Figure 15: Europe Cell Lysis Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Cell Lysis Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Cell Lysis Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Cell Lysis Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 19: Asia Pacific Cell Lysis Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 20: Asia Pacific Cell Lysis Market Revenue (billion), by Type of Cells 2025 & 2033

- Figure 21: Asia Pacific Cell Lysis Market Revenue Share (%), by Type of Cells 2025 & 2033

- Figure 22: Asia Pacific Cell Lysis Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Asia Pacific Cell Lysis Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Cell Lysis Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Cell Lysis Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Cell Lysis Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 27: Middle East and Africa Cell Lysis Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 28: Middle East and Africa Cell Lysis Market Revenue (billion), by Type of Cells 2025 & 2033

- Figure 29: Middle East and Africa Cell Lysis Market Revenue Share (%), by Type of Cells 2025 & 2033

- Figure 30: Middle East and Africa Cell Lysis Market Revenue (billion), by End User 2025 & 2033

- Figure 31: Middle East and Africa Cell Lysis Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Cell Lysis Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Cell Lysis Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Cell Lysis Market Revenue (billion), by Type of Product 2025 & 2033

- Figure 35: South America Cell Lysis Market Revenue Share (%), by Type of Product 2025 & 2033

- Figure 36: South America Cell Lysis Market Revenue (billion), by Type of Cells 2025 & 2033

- Figure 37: South America Cell Lysis Market Revenue Share (%), by Type of Cells 2025 & 2033

- Figure 38: South America Cell Lysis Market Revenue (billion), by End User 2025 & 2033

- Figure 39: South America Cell Lysis Market Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Cell Lysis Market Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Cell Lysis Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cell Lysis Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 2: Global Cell Lysis Market Revenue billion Forecast, by Type of Cells 2020 & 2033

- Table 3: Global Cell Lysis Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Cell Lysis Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cell Lysis Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 6: Global Cell Lysis Market Revenue billion Forecast, by Type of Cells 2020 & 2033

- Table 7: Global Cell Lysis Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Cell Lysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Cell Lysis Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 13: Global Cell Lysis Market Revenue billion Forecast, by Type of Cells 2020 & 2033

- Table 14: Global Cell Lysis Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Cell Lysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Cell Lysis Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 23: Global Cell Lysis Market Revenue billion Forecast, by Type of Cells 2020 & 2033

- Table 24: Global Cell Lysis Market Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global Cell Lysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Cell Lysis Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 33: Global Cell Lysis Market Revenue billion Forecast, by Type of Cells 2020 & 2033

- Table 34: Global Cell Lysis Market Revenue billion Forecast, by End User 2020 & 2033

- Table 35: Global Cell Lysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Cell Lysis Market Revenue billion Forecast, by Type of Product 2020 & 2033

- Table 40: Global Cell Lysis Market Revenue billion Forecast, by Type of Cells 2020 & 2033

- Table 41: Global Cell Lysis Market Revenue billion Forecast, by End User 2020 & 2033

- Table 42: Global Cell Lysis Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Cell Lysis Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell Lysis Market?

The projected CAGR is approximately 8.8%.

2. Which companies are prominent players in the Cell Lysis Market?

Key companies in the market include Becton Dickinson and Company, Bio-Rad Laboratories Inc, QIAGEN NV, Merck KGaA, Labfreez Instruments Group Co Ltd, F Hoffmann-La Roche Ltd, Cell Signaling Technology Inc, Qsonica LLC, 6 COMPETITIVE LANDSCAPE6 1 COMPANY PROFILES, Thermo Fisher Scientific Inc, Microfluidics International Corporation*List Not Exhaustive, Eppendorf AG, Takara Bio Inc, Miltenyi Biotec, Danaher Corporation, Claremont BioSolutions LLC.

3. What are the main segments of the Cell Lysis Market?

The market segments include Type of Product, Type of Cells, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.95 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Expenditure in Research and Development; Increasing Application in the Pharmaceutical and Biopharmaceutical Industries; Rising Focus on Personalized Medicine.

6. What are the notable trends driving market growth?

Instruments are Expected to Witness Significant Growth in the Coming Years.

7. Are there any restraints impacting market growth?

Regulatory Compliance; Issues in Mechanical Process to Apply at the Microscale Level.

8. Can you provide examples of recent developments in the market?

In September 2022, SCIENION and Cellenion launched the proteoCHIP LF 48 for label-free single-cell proteomics sample preparation on the cellenONE platform.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cell Lysis Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cell Lysis Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cell Lysis Market?

To stay informed about further developments, trends, and reports in the Cell Lysis Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence