Key Insights

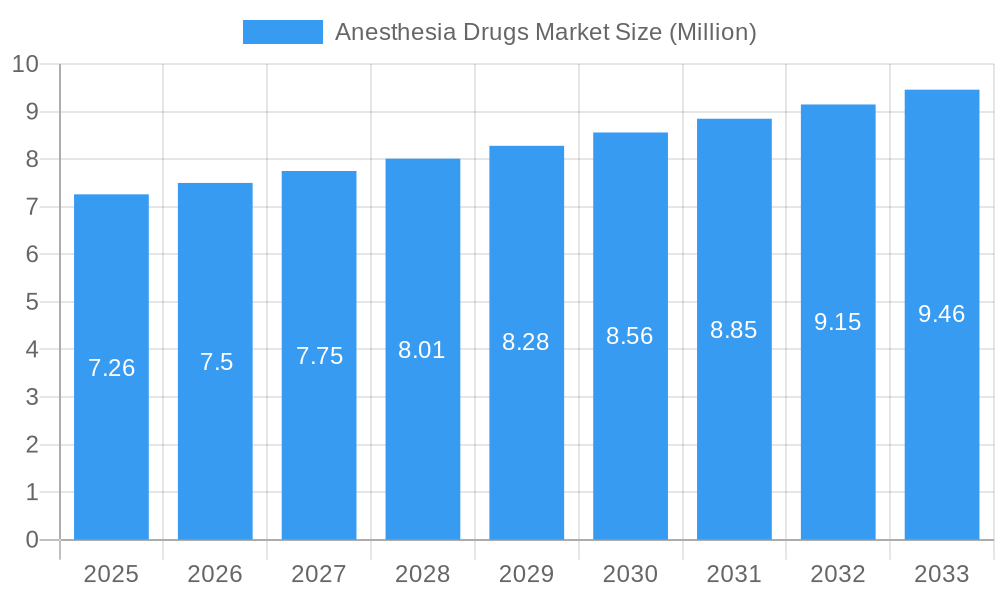

The global Anesthesia Drugs Market is poised for robust growth, projected to reach approximately USD 7.26 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 3.40% extending through 2033. This steady expansion is fueled by several key drivers, including the increasing prevalence of chronic diseases necessitating surgical interventions, a growing aging population demanding more medical procedures, and continuous advancements in anesthetic drug formulations offering improved efficacy and reduced side effects. Furthermore, the rising number of minimally invasive surgeries, coupled with the expanding healthcare infrastructure in emerging economies, presents significant opportunities for market players. The market is segmented by drug type into general and local anesthetics, with general anesthesia drugs like Propofol and Sevoflurane holding a substantial share due to their widespread use in major surgeries. Local anesthetics, crucial for pain management in various procedures, are also experiencing consistent demand. The injection route of administration dominates, reflecting its efficiency and broad applicability across surgical settings. Applications span general, plastic, cosmetic, and dental surgeries, underscoring the pervasive need for anesthesia in diverse medical fields.

Anesthesia Drugs Market Market Size (In Million)

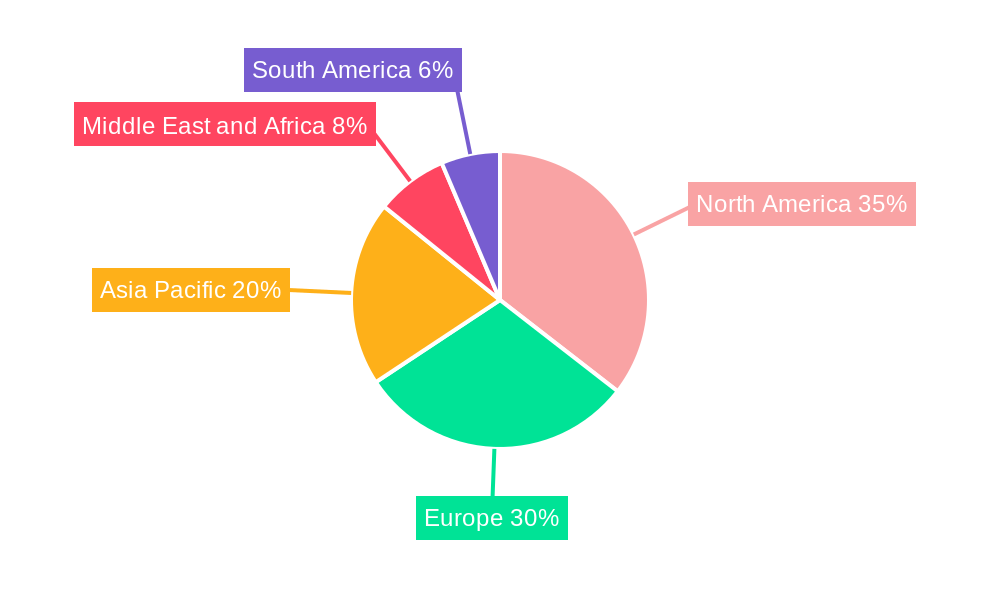

Key trends shaping the Anesthesia Drugs Market include a heightened focus on the development of ultra-short-acting anesthetics to facilitate quicker patient recovery and reduce post-operative complications. Innovations in drug delivery systems, aiming for more precise and controlled administration, are also gaining traction. The market, however, faces certain restraints such as stringent regulatory approvals for new drug formulations, potential drug shortages, and the increasing preference for non-pharmacological pain management techniques in specific contexts. Geographically, North America and Europe currently lead the market due to advanced healthcare systems and high surgical volumes. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by increasing healthcare expenditure, a large patient pool, and expanding medical tourism. Leading companies like Pfizer Inc., Novartis AG, and AbbVie Inc. are actively engaged in research and development to introduce novel anesthetic agents and expand their market presence, contributing to the dynamic and competitive landscape of the anesthesia drugs sector.

Anesthesia Drugs Market Company Market Share

Unlock critical insights into the global Anesthesia Drugs Market with this in-depth report. Spanning from 2019 to 2033, with a base year of 2025, this comprehensive study provides an exhaustive analysis of market dynamics, growth drivers, challenges, and future opportunities. Delve into segment-specific trends for General Anesthesia Drugs (including Propofol, Sevoflurane, Desflurane, Dexmedetomidine, Remifentanil, Midazolam) and Local Anesthesia Drugs (including Bupivacaine, Ropivacaine, Lidocaine, Chloroprocaine, Prilocaine, Benzocaine), and understand their application across General Surgery, Plastic Surgery, Cosmetic Surgery, and Dental Surgery. We meticulously examine inhalation and injection routes of administration, offering a holistic view of market composition and evolution.

Anesthesia Drugs Market Market Composition & Trends

The Anesthesia Drugs Market is characterized by a moderate to high level of concentration, with leading players like Novartis AG, Pfizer Inc., and AbbVie Inc. holding significant market share. Innovation in anesthetic formulations, focusing on improved safety profiles, faster recovery times, and reduced side effects, remains a key catalyst for market growth. The regulatory landscape, governed by bodies such as the FDA and EMA, plays a crucial role in drug approval processes and market access, influencing the pace of new product introductions. Substitute products, including non-pharmacological pain management techniques, present a competitive dynamic, although the demand for effective anesthesia remains robust, particularly with the growing number of surgical procedures globally. End-user profiles primarily consist of hospitals, surgical centers, and dental clinics, each with distinct purchasing patterns and needs. Mergers and acquisitions (M&A) activities, while not always involving blockbuster deals, contribute to market consolidation and strategic portfolio expansion, such as Laboratoires Théa SAS's acquisition to enhance its local anesthetic offerings. Market share distribution is influenced by drug efficacy, cost-effectiveness, and physician preference. The overall M&A deal values are expected to be in the hundreds of millions.

Anesthesia Drugs Market Industry Evolution

The Anesthesia Drugs Market has witnessed a steady and robust growth trajectory over the historical period (2019-2024) and is projected to continue its upward trend through the forecast period (2025-2033). This evolution is largely driven by advancements in medical technology, increasing global healthcare expenditure, and a rising prevalence of chronic diseases and age-related conditions necessitating surgical interventions. Technological advancements in drug delivery systems and the development of novel anesthetic agents with enhanced efficacy and reduced side effects have significantly contributed to market expansion. For instance, the development of ultra-short-acting anesthetics has revolutionized outpatient surgery, enabling faster patient recovery and shorter hospital stays. Furthermore, the growing demand for minimally invasive surgical procedures, which often require precise and controlled anesthesia, is a significant impetus. Shifting consumer demands, influenced by a greater awareness of patient comfort and post-operative outcomes, are pushing manufacturers to innovate and offer more patient-centric anesthetic solutions. The projected Compound Annual Growth Rate (CAGR) for the Anesthesia Drugs Market is anticipated to be around 6.5% during the forecast period. Adoption metrics for new anesthetic drugs are typically tracked by market penetration rates and the volume of prescriptions within the first few years of launch.

Leading Regions, Countries, or Segments in Anesthesia Drugs Market

North America currently dominates the Anesthesia Drugs Market, driven by a sophisticated healthcare infrastructure, high disposable incomes, and a large patient pool undergoing various surgical procedures. The United States, in particular, is a key contributor to this dominance.

- General Anesthesia Drugs: This segment is a major revenue driver, with Propofol and Sevoflurane being the most widely used agents due to their favorable safety profiles and efficacy in a broad range of surgical settings.

- Key Drivers: High volume of general surgeries, increasing adoption of ambulatory surgery centers, and continuous research into improved sedative and hypnotic agents.

- Local Anesthesia Drugs: The demand for local anesthesia drugs is substantial, especially in dental and plastic surgery procedures. Lidocaine and Bupivacaine are cornerstone drugs in this category.

- Key Drivers: Growing cosmetic surgery market, advancements in dental procedures requiring local numbing, and the development of long-acting local anesthetics for extended pain relief.

- Route of Administration - Injection: This route remains the most prevalent due to its rapid onset and precise dosage control, making it indispensable for most surgical and procedural anesthesia.

- Key Drivers: Versatility in administering a wide range of anesthetic agents, established clinical protocols, and advancements in injection devices.

- Application - General Surgery: This application segment constitutes the largest share of the Anesthesia Drugs Market, reflecting the sheer volume of general surgical procedures performed globally.

- Key Drivers: Aging global population, increasing incidence of lifestyle-related diseases requiring surgical intervention, and advancements in surgical techniques.

- Investment Trends: Significant investments are observed in research and development for novel anesthetic compounds and improved delivery systems in North America and Europe.

- Regulatory Support: Favorable regulatory environments in key markets facilitate the approval and commercialization of new anesthetic drugs.

Europe is another significant market, characterized by a well-established healthcare system and a growing elderly population. The Asia-Pacific region is emerging as a rapidly growing market due to increasing healthcare expenditure, expanding medical tourism, and a growing number of skilled medical professionals.

Anesthesia Drugs Market Product Innovations

Product innovations in the Anesthesia Drugs Market are primarily focused on enhancing patient safety, optimizing drug efficacy, and improving post-operative recovery. This includes the development of anesthetics with reduced opioid-induced side effects, faster clearance from the body, and improved control over depth and duration of anesthesia. For instance, novel formulations of existing drugs are being explored to enable targeted delivery or sustained release. Dexmedetomidine, for its sedative and analgesic properties with minimal respiratory depression, exemplifies innovation in general anesthesia. Similarly, advancements in liposomal formulations for local anesthetics are extending their duration of action, reducing the need for repeat injections. These innovations contribute to better patient outcomes, shorter hospital stays, and reduced healthcare costs, solidifying their competitive edge in the market.

Propelling Factors for Anesthesia Drugs Market Growth

The Anesthesia Drugs Market is propelled by several key factors. The increasing global incidence of surgical procedures, driven by an aging population and a rise in lifestyle-related diseases, forms a fundamental growth catalyst. Technological advancements leading to the development of safer, more effective anesthetic agents with reduced side effects, such as Propofol and Dexmedetomidine, are crucial. Furthermore, a growing emphasis on patient-centric care and faster recovery times encourages the adoption of innovative anesthetic drugs. Favorable reimbursement policies in many developed economies and increasing healthcare expenditure in emerging markets also contribute significantly to market expansion.

Obstacles in the Anesthesia Drugs Market Market

Despite its growth, the Anesthesia Drugs Market faces certain obstacles. Stringent regulatory approvals for new anesthetic drugs, requiring extensive clinical trials and significant investment, can be a major hurdle. Patent expirations for blockbuster anesthetic drugs lead to increased generic competition, impacting the revenue of innovator companies. Supply chain disruptions, as witnessed in recent global events, can affect the availability and cost of raw materials and finished products. Moreover, the development of non-pharmacological pain management alternatives and the rising costs associated with healthcare can pose indirect competitive pressures.

Future Opportunities in Anesthesia Drugs Market

Emerging opportunities in the Anesthesia Drugs Market are multifaceted. The growing demand for outpatient surgeries creates a niche for ultra-short-acting anesthetics that facilitate rapid patient discharge. Advances in precision medicine and personalized anesthesia, tailored to individual patient profiles, represent a significant future direction. Expansion into emerging economies with increasing healthcare infrastructure and a growing patient base offers substantial market potential. Furthermore, the development of novel anesthetic agents for specific surgical applications, such as neurosurgery or cardiac surgery, presents opportunities for specialized product development and market penetration. The integration of AI in anesthetic drug discovery and patient monitoring also holds promise.

Major Players in the Anesthesia Drugs Market Ecosystem

- Novartis AG

- Dr Reddy's Laboratories

- Aspen Pharmacare Holdings Limited

- Teva Pharmaceutical Industries Limited

- Eisai Inc

- Fresenius SE & Co KGaA

- AbbVie Inc

- B Braun Melsungen AG

- Abbott Laboratories Inc

- Baxter International Inc

- Pfizer Inc

Key Developments in Anesthesia Drugs Market Industry

- January 2022: Laboratoires Théa SAS (Théa) entered an agreement to purchase seven branded ophthalmic products from Akorn Operating Company LLC. This strategic move enabled Théa to add Akorn branded products to its portfolio, including Akten (lidocaine HCl ophthalmic gel), a local anesthetic indicated for ocular surface anesthesia during ophthalmologic procedures.

- February 2022: Sedana Medical AB announced the launch of Sedaconda (isoflurane) in Germany. Sedaconda (isoflurane) received European DCP approval in July 2021. The product has since received national approvals in 14 countries, with additional applications submitted. The company expected further national approvals in Italy, Poland, Switzerland, and the United Kingdom in 2022.

Strategic Anesthesia Drugs Market Market Forecast

The strategic forecast for the Anesthesia Drugs Market is optimistic, driven by ongoing advancements in anesthetic drug development and an expanding global surgical landscape. The increasing preference for minimally invasive procedures, coupled with a rising aging population, will continue to fuel demand for both general and local anesthetics. Innovations focusing on enhanced safety profiles and faster patient recovery will be key differentiators, creating opportunities for market leaders. The expanding healthcare infrastructure in emerging economies also presents significant untapped potential. The market is expected to witness sustained growth, with strategic investments in research and development and a focus on expanding product portfolios in high-growth segments.

Anesthesia Drugs Market Segmentation

-

1. Drug Type

-

1.1. General Anesthesia Drugs

- 1.1.1. Propofol

- 1.1.2. Sevoflurane

- 1.1.3. Desflurane

- 1.1.4. Dexmedetomidine

- 1.1.5. Remifentanil

- 1.1.6. Midazolam

- 1.1.7. Other General Anesthesia Drugs

-

1.2. Local Anesthesia Drugs

- 1.2.1. Bupivacaine

- 1.2.2. Ropivacaine

- 1.2.3. Lidocaine

- 1.2.4. Chloroprocaine

- 1.2.5. Prilocaine

- 1.2.6. Benzocaine

- 1.2.7. Other Local Anesthesia Drugs

-

1.1. General Anesthesia Drugs

-

2. Route of Administration

- 2.1. Inhalation

- 2.2. Injection

- 2.3. Other Routes of Administration

-

3. Application

- 3.1. General Surgery

- 3.2. Plastic Surgery

- 3.3. Cosmetic Surgery

- 3.4. Dental Surgery

- 3.5. Other Applications

Anesthesia Drugs Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Anesthesia Drugs Market Regional Market Share

Geographic Coverage of Anesthesia Drugs Market

Anesthesia Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Surgeries; New Approvals of Anesthesia Drugs; Reduction in the Cost of Newly Invented Drugs

- 3.3. Market Restrains

- 3.3.1. Side Effects of General Anesthetics; Lack of Skilled Anesthetics

- 3.4. Market Trends

- 3.4.1. The Propofol Segment is Expected to Show the Fastest Growth in the General Anesthesia Drugs Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Anesthesia Drugs Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 5.1.1. General Anesthesia Drugs

- 5.1.1.1. Propofol

- 5.1.1.2. Sevoflurane

- 5.1.1.3. Desflurane

- 5.1.1.4. Dexmedetomidine

- 5.1.1.5. Remifentanil

- 5.1.1.6. Midazolam

- 5.1.1.7. Other General Anesthesia Drugs

- 5.1.2. Local Anesthesia Drugs

- 5.1.2.1. Bupivacaine

- 5.1.2.2. Ropivacaine

- 5.1.2.3. Lidocaine

- 5.1.2.4. Chloroprocaine

- 5.1.2.5. Prilocaine

- 5.1.2.6. Benzocaine

- 5.1.2.7. Other Local Anesthesia Drugs

- 5.1.1. General Anesthesia Drugs

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Inhalation

- 5.2.2. Injection

- 5.2.3. Other Routes of Administration

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. General Surgery

- 5.3.2. Plastic Surgery

- 5.3.3. Cosmetic Surgery

- 5.3.4. Dental Surgery

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Type

- 6. North America Anesthesia Drugs Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 6.1.1. General Anesthesia Drugs

- 6.1.1.1. Propofol

- 6.1.1.2. Sevoflurane

- 6.1.1.3. Desflurane

- 6.1.1.4. Dexmedetomidine

- 6.1.1.5. Remifentanil

- 6.1.1.6. Midazolam

- 6.1.1.7. Other General Anesthesia Drugs

- 6.1.2. Local Anesthesia Drugs

- 6.1.2.1. Bupivacaine

- 6.1.2.2. Ropivacaine

- 6.1.2.3. Lidocaine

- 6.1.2.4. Chloroprocaine

- 6.1.2.5. Prilocaine

- 6.1.2.6. Benzocaine

- 6.1.2.7. Other Local Anesthesia Drugs

- 6.1.1. General Anesthesia Drugs

- 6.2. Market Analysis, Insights and Forecast - by Route of Administration

- 6.2.1. Inhalation

- 6.2.2. Injection

- 6.2.3. Other Routes of Administration

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. General Surgery

- 6.3.2. Plastic Surgery

- 6.3.3. Cosmetic Surgery

- 6.3.4. Dental Surgery

- 6.3.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Drug Type

- 7. Europe Anesthesia Drugs Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 7.1.1. General Anesthesia Drugs

- 7.1.1.1. Propofol

- 7.1.1.2. Sevoflurane

- 7.1.1.3. Desflurane

- 7.1.1.4. Dexmedetomidine

- 7.1.1.5. Remifentanil

- 7.1.1.6. Midazolam

- 7.1.1.7. Other General Anesthesia Drugs

- 7.1.2. Local Anesthesia Drugs

- 7.1.2.1. Bupivacaine

- 7.1.2.2. Ropivacaine

- 7.1.2.3. Lidocaine

- 7.1.2.4. Chloroprocaine

- 7.1.2.5. Prilocaine

- 7.1.2.6. Benzocaine

- 7.1.2.7. Other Local Anesthesia Drugs

- 7.1.1. General Anesthesia Drugs

- 7.2. Market Analysis, Insights and Forecast - by Route of Administration

- 7.2.1. Inhalation

- 7.2.2. Injection

- 7.2.3. Other Routes of Administration

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. General Surgery

- 7.3.2. Plastic Surgery

- 7.3.3. Cosmetic Surgery

- 7.3.4. Dental Surgery

- 7.3.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Drug Type

- 8. Asia Pacific Anesthesia Drugs Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 8.1.1. General Anesthesia Drugs

- 8.1.1.1. Propofol

- 8.1.1.2. Sevoflurane

- 8.1.1.3. Desflurane

- 8.1.1.4. Dexmedetomidine

- 8.1.1.5. Remifentanil

- 8.1.1.6. Midazolam

- 8.1.1.7. Other General Anesthesia Drugs

- 8.1.2. Local Anesthesia Drugs

- 8.1.2.1. Bupivacaine

- 8.1.2.2. Ropivacaine

- 8.1.2.3. Lidocaine

- 8.1.2.4. Chloroprocaine

- 8.1.2.5. Prilocaine

- 8.1.2.6. Benzocaine

- 8.1.2.7. Other Local Anesthesia Drugs

- 8.1.1. General Anesthesia Drugs

- 8.2. Market Analysis, Insights and Forecast - by Route of Administration

- 8.2.1. Inhalation

- 8.2.2. Injection

- 8.2.3. Other Routes of Administration

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. General Surgery

- 8.3.2. Plastic Surgery

- 8.3.3. Cosmetic Surgery

- 8.3.4. Dental Surgery

- 8.3.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Drug Type

- 9. Middle East and Africa Anesthesia Drugs Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 9.1.1. General Anesthesia Drugs

- 9.1.1.1. Propofol

- 9.1.1.2. Sevoflurane

- 9.1.1.3. Desflurane

- 9.1.1.4. Dexmedetomidine

- 9.1.1.5. Remifentanil

- 9.1.1.6. Midazolam

- 9.1.1.7. Other General Anesthesia Drugs

- 9.1.2. Local Anesthesia Drugs

- 9.1.2.1. Bupivacaine

- 9.1.2.2. Ropivacaine

- 9.1.2.3. Lidocaine

- 9.1.2.4. Chloroprocaine

- 9.1.2.5. Prilocaine

- 9.1.2.6. Benzocaine

- 9.1.2.7. Other Local Anesthesia Drugs

- 9.1.1. General Anesthesia Drugs

- 9.2. Market Analysis, Insights and Forecast - by Route of Administration

- 9.2.1. Inhalation

- 9.2.2. Injection

- 9.2.3. Other Routes of Administration

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. General Surgery

- 9.3.2. Plastic Surgery

- 9.3.3. Cosmetic Surgery

- 9.3.4. Dental Surgery

- 9.3.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Drug Type

- 10. South America Anesthesia Drugs Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 10.1.1. General Anesthesia Drugs

- 10.1.1.1. Propofol

- 10.1.1.2. Sevoflurane

- 10.1.1.3. Desflurane

- 10.1.1.4. Dexmedetomidine

- 10.1.1.5. Remifentanil

- 10.1.1.6. Midazolam

- 10.1.1.7. Other General Anesthesia Drugs

- 10.1.2. Local Anesthesia Drugs

- 10.1.2.1. Bupivacaine

- 10.1.2.2. Ropivacaine

- 10.1.2.3. Lidocaine

- 10.1.2.4. Chloroprocaine

- 10.1.2.5. Prilocaine

- 10.1.2.6. Benzocaine

- 10.1.2.7. Other Local Anesthesia Drugs

- 10.1.1. General Anesthesia Drugs

- 10.2. Market Analysis, Insights and Forecast - by Route of Administration

- 10.2.1. Inhalation

- 10.2.2. Injection

- 10.2.3. Other Routes of Administration

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. General Surgery

- 10.3.2. Plastic Surgery

- 10.3.3. Cosmetic Surgery

- 10.3.4. Dental Surgery

- 10.3.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Drug Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Novartis AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dr Reddy's Laboratories

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Apsen Pharmacare Holdings Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Teva Pharmaceutical Industries Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eisai Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fresenius SE & Co KGaA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AbbVie Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 B Braun Melsungen AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Abbott Laboratories Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Baxter International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Novartis AG

List of Figures

- Figure 1: Global Anesthesia Drugs Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Anesthesia Drugs Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Anesthesia Drugs Market Revenue (Million), by Drug Type 2025 & 2033

- Figure 4: North America Anesthesia Drugs Market Volume (K Unit), by Drug Type 2025 & 2033

- Figure 5: North America Anesthesia Drugs Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 6: North America Anesthesia Drugs Market Volume Share (%), by Drug Type 2025 & 2033

- Figure 7: North America Anesthesia Drugs Market Revenue (Million), by Route of Administration 2025 & 2033

- Figure 8: North America Anesthesia Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 9: North America Anesthesia Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 10: North America Anesthesia Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 11: North America Anesthesia Drugs Market Revenue (Million), by Application 2025 & 2033

- Figure 12: North America Anesthesia Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 13: North America Anesthesia Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Anesthesia Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 15: North America Anesthesia Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Anesthesia Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Anesthesia Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Anesthesia Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Anesthesia Drugs Market Revenue (Million), by Drug Type 2025 & 2033

- Figure 20: Europe Anesthesia Drugs Market Volume (K Unit), by Drug Type 2025 & 2033

- Figure 21: Europe Anesthesia Drugs Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 22: Europe Anesthesia Drugs Market Volume Share (%), by Drug Type 2025 & 2033

- Figure 23: Europe Anesthesia Drugs Market Revenue (Million), by Route of Administration 2025 & 2033

- Figure 24: Europe Anesthesia Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 25: Europe Anesthesia Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 26: Europe Anesthesia Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 27: Europe Anesthesia Drugs Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Europe Anesthesia Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 29: Europe Anesthesia Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Europe Anesthesia Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Europe Anesthesia Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Anesthesia Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Anesthesia Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Anesthesia Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Anesthesia Drugs Market Revenue (Million), by Drug Type 2025 & 2033

- Figure 36: Asia Pacific Anesthesia Drugs Market Volume (K Unit), by Drug Type 2025 & 2033

- Figure 37: Asia Pacific Anesthesia Drugs Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 38: Asia Pacific Anesthesia Drugs Market Volume Share (%), by Drug Type 2025 & 2033

- Figure 39: Asia Pacific Anesthesia Drugs Market Revenue (Million), by Route of Administration 2025 & 2033

- Figure 40: Asia Pacific Anesthesia Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 41: Asia Pacific Anesthesia Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 42: Asia Pacific Anesthesia Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 43: Asia Pacific Anesthesia Drugs Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Asia Pacific Anesthesia Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 45: Asia Pacific Anesthesia Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific Anesthesia Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Asia Pacific Anesthesia Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Anesthesia Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Anesthesia Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Anesthesia Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Anesthesia Drugs Market Revenue (Million), by Drug Type 2025 & 2033

- Figure 52: Middle East and Africa Anesthesia Drugs Market Volume (K Unit), by Drug Type 2025 & 2033

- Figure 53: Middle East and Africa Anesthesia Drugs Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 54: Middle East and Africa Anesthesia Drugs Market Volume Share (%), by Drug Type 2025 & 2033

- Figure 55: Middle East and Africa Anesthesia Drugs Market Revenue (Million), by Route of Administration 2025 & 2033

- Figure 56: Middle East and Africa Anesthesia Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 57: Middle East and Africa Anesthesia Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 58: Middle East and Africa Anesthesia Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 59: Middle East and Africa Anesthesia Drugs Market Revenue (Million), by Application 2025 & 2033

- Figure 60: Middle East and Africa Anesthesia Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 61: Middle East and Africa Anesthesia Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 62: Middle East and Africa Anesthesia Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 63: Middle East and Africa Anesthesia Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Middle East and Africa Anesthesia Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Anesthesia Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Anesthesia Drugs Market Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Anesthesia Drugs Market Revenue (Million), by Drug Type 2025 & 2033

- Figure 68: South America Anesthesia Drugs Market Volume (K Unit), by Drug Type 2025 & 2033

- Figure 69: South America Anesthesia Drugs Market Revenue Share (%), by Drug Type 2025 & 2033

- Figure 70: South America Anesthesia Drugs Market Volume Share (%), by Drug Type 2025 & 2033

- Figure 71: South America Anesthesia Drugs Market Revenue (Million), by Route of Administration 2025 & 2033

- Figure 72: South America Anesthesia Drugs Market Volume (K Unit), by Route of Administration 2025 & 2033

- Figure 73: South America Anesthesia Drugs Market Revenue Share (%), by Route of Administration 2025 & 2033

- Figure 74: South America Anesthesia Drugs Market Volume Share (%), by Route of Administration 2025 & 2033

- Figure 75: South America Anesthesia Drugs Market Revenue (Million), by Application 2025 & 2033

- Figure 76: South America Anesthesia Drugs Market Volume (K Unit), by Application 2025 & 2033

- Figure 77: South America Anesthesia Drugs Market Revenue Share (%), by Application 2025 & 2033

- Figure 78: South America Anesthesia Drugs Market Volume Share (%), by Application 2025 & 2033

- Figure 79: South America Anesthesia Drugs Market Revenue (Million), by Country 2025 & 2033

- Figure 80: South America Anesthesia Drugs Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Anesthesia Drugs Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Anesthesia Drugs Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 2: Global Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 3: Global Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 4: Global Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 5: Global Anesthesia Drugs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Anesthesia Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Global Anesthesia Drugs Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Anesthesia Drugs Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 10: Global Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 11: Global Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 12: Global Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 13: Global Anesthesia Drugs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Anesthesia Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Global Anesthesia Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Anesthesia Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 24: Global Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 25: Global Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 26: Global Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 27: Global Anesthesia Drugs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Anesthesia Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Global Anesthesia Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Anesthesia Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 44: Global Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 45: Global Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 46: Global Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 47: Global Anesthesia Drugs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 48: Global Anesthesia Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 49: Global Anesthesia Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Anesthesia Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Australia Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: South Korea Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 64: Global Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 65: Global Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 66: Global Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 67: Global Anesthesia Drugs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 68: Global Anesthesia Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 69: Global Anesthesia Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: Global Anesthesia Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: GCC Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: South Africa Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Anesthesia Drugs Market Revenue Million Forecast, by Drug Type 2020 & 2033

- Table 78: Global Anesthesia Drugs Market Volume K Unit Forecast, by Drug Type 2020 & 2033

- Table 79: Global Anesthesia Drugs Market Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 80: Global Anesthesia Drugs Market Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 81: Global Anesthesia Drugs Market Revenue Million Forecast, by Application 2020 & 2033

- Table 82: Global Anesthesia Drugs Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 83: Global Anesthesia Drugs Market Revenue Million Forecast, by Country 2020 & 2033

- Table 84: Global Anesthesia Drugs Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: Brazil Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: Argentina Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Anesthesia Drugs Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Anesthesia Drugs Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Anesthesia Drugs Market?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Anesthesia Drugs Market?

Key companies in the market include Novartis AG, Dr Reddy's Laboratories, Apsen Pharmacare Holdings Limited, Teva Pharmaceutical Industries Limited, Eisai Inc , Fresenius SE & Co KGaA, AbbVie Inc, B Braun Melsungen AG, Abbott Laboratories Inc, Baxter International Inc, Pfizer Inc.

3. What are the main segments of the Anesthesia Drugs Market?

The market segments include Drug Type, Route of Administration, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Surgeries; New Approvals of Anesthesia Drugs; Reduction in the Cost of Newly Invented Drugs.

6. What are the notable trends driving market growth?

The Propofol Segment is Expected to Show the Fastest Growth in the General Anesthesia Drugs Segment.

7. Are there any restraints impacting market growth?

Side Effects of General Anesthetics; Lack of Skilled Anesthetics.

8. Can you provide examples of recent developments in the market?

In January 2022, Laboratoires Théa SAS (Théa) entered an agreement to purchase seven branded ophthalmic products from Akorn Operating Company LLC. The strategic move will enable Théa to add Akorn branded products to its portfolio, including Akten (lidocaine HCl ophthalmic gel), a local anesthetic indicated for ocular surface anesthesia during ophthalmologic procedures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Anesthesia Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Anesthesia Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Anesthesia Drugs Market?

To stay informed about further developments, trends, and reports in the Anesthesia Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence