Key Insights

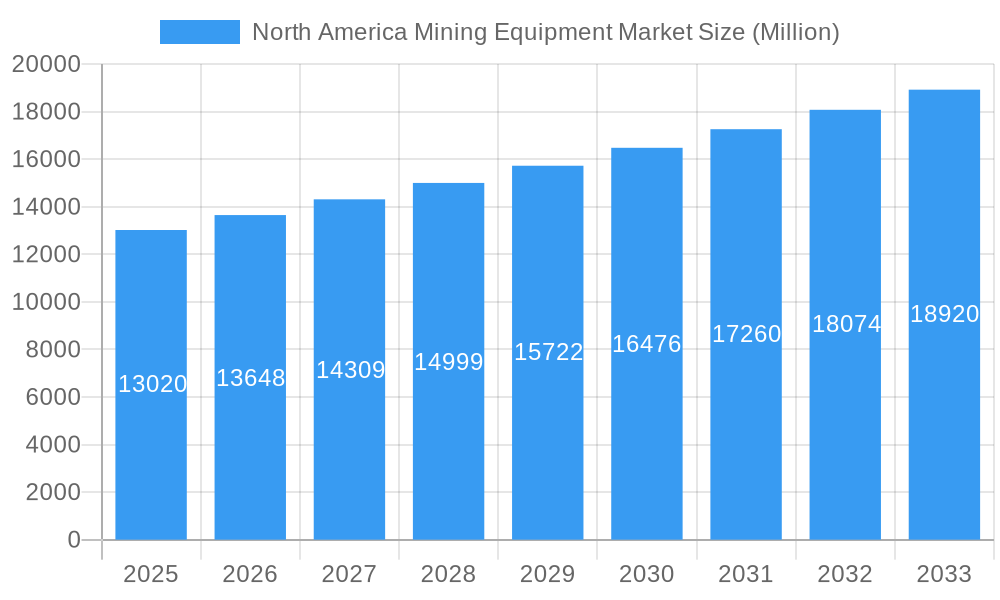

The North American mining equipment market, valued at $13.02 billion in 2025, is projected to experience robust growth, driven by increasing demand for minerals and metals fueled by infrastructure development, technological advancements, and the burgeoning electric vehicle market. The market's Compound Annual Growth Rate (CAGR) of 4.58% from 2025 to 2033 indicates a significant expansion, with substantial contributions expected from the surface mining, underground mining, and mineral processing equipment segments. The United States, as the largest economy in North America, is expected to dominate the market, followed by Canada, with Mexico and the rest of North America contributing to the overall growth. Key market drivers include automation and digitalization initiatives aimed at enhancing productivity and safety, coupled with government investments in infrastructure projects and the rising adoption of sustainable mining practices. However, fluctuating commodity prices and environmental regulations pose significant challenges to market expansion. The competitive landscape features established players like Caterpillar, Komatsu, Metso Outotec, and Liebherr, along with several regional players, leading to intense competition and innovation.

North America Mining Equipment Market Market Size (In Billion)

The segmentation by application reveals that metal mining is currently the largest segment, but mineral mining and coal mining are also expected to see considerable growth over the forecast period. The adoption of advanced technologies such as autonomous vehicles, remote operation systems, and predictive maintenance will be key growth drivers. While environmental concerns and stringent regulations are restraints, the industry is actively adopting eco-friendly practices to mitigate environmental impact and ensure sustainable development. This proactive approach, combined with technological advancements and robust infrastructure projects, positions the North American mining equipment market for sustained expansion throughout the forecast period (2025-2033). The market's growth trajectory will also depend on global economic conditions and geopolitical stability influencing demand for raw materials.

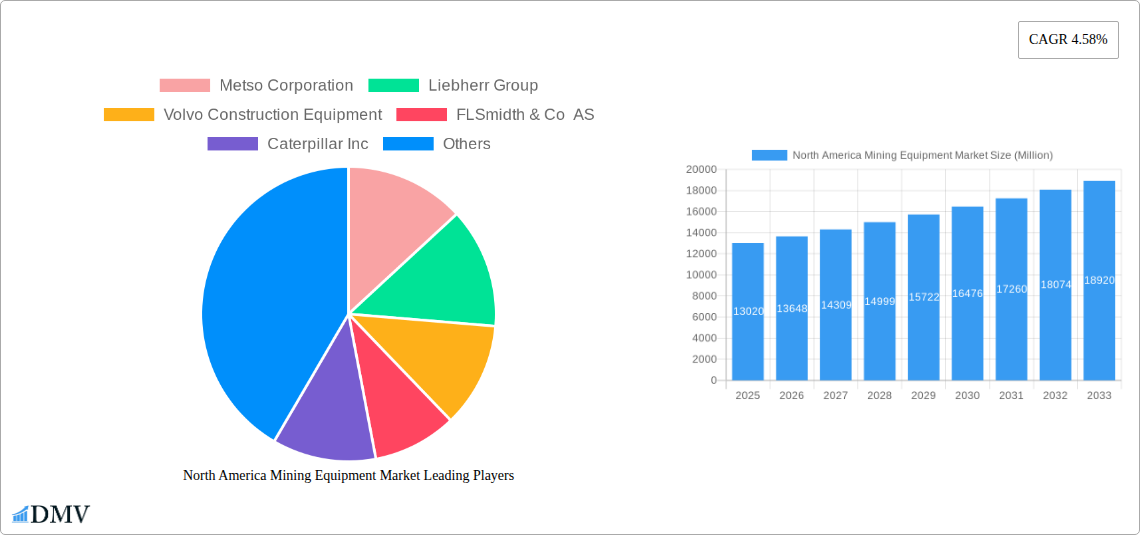

North America Mining Equipment Market Company Market Share

North America Mining Equipment Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America mining equipment market, encompassing historical data (2019-2024), current estimations (2025), and future forecasts (2025-2033). It delves deep into market dynamics, technological advancements, competitive landscapes, and growth opportunities across various segments and geographies, offering crucial insights for stakeholders. The market is projected to reach xx Million by 2033, exhibiting a significant CAGR. This report is essential for businesses seeking strategic advantages in this dynamic sector.

North America Mining Equipment Market Composition & Trends

The North American mining equipment market is characterized by a moderately concentrated landscape, with key players like Caterpillar Inc., Metso Corporation, and Komatsu Ltd. holding significant market share. However, the presence of several regional and specialized players ensures a dynamic competitive environment. Market share distribution currently sees Caterpillar holding approximately xx%, Metso at xx%, and Komatsu at xx%, with the remaining share distributed among other players. Innovation is driven by increasing demand for automation, enhanced safety features, and sustainable mining practices. Stringent environmental regulations and a focus on reducing operational costs are shaping the technological trajectory of the market. Substitute products, primarily focused on improving efficiency and reducing environmental impact, are gaining traction, further intensifying competition. End-users predominantly include large-scale mining companies operating in metal, mineral, and coal mining sectors, driving the demand for heavy-duty and technologically advanced equipment. M&A activity has been considerable, with recent deals like Komatsu’s acquisition of Mine Site Technologies showcasing a growing trend towards consolidation and technological integration. The total value of M&A deals in the past five years has amounted to approximately xx Million.

- Market Concentration: Moderately concentrated, with top players holding xx% of the market share.

- Innovation Catalysts: Automation, safety enhancements, sustainable mining practices.

- Regulatory Landscape: Stringent environmental regulations driving technological advancements.

- Substitute Products: Improved efficiency and environmentally friendly solutions gaining prominence.

- End-User Profile: Large-scale mining companies (metal, mineral, coal).

- M&A Activity: Significant consolidation and technological integration via acquisitions (xx Million in the past 5 years).

North America Mining Equipment Market Industry Evolution

The North American mining equipment market has witnessed consistent growth over the historical period (2019-2024), driven primarily by increasing mining activities and investments in new projects. The market experienced a slight dip in 2020 due to the pandemic, but quickly recovered, demonstrating resilience. Technological advancements, especially in automation and data analytics, are significantly impacting productivity and efficiency. The adoption rate of autonomous haulage systems, for instance, increased from xx% in 2019 to xx% in 2024, highlighting a substantial shift towards technologically advanced solutions. Shifting consumer demands are favoring equipment with enhanced fuel efficiency, reduced emissions, and improved safety features. The market is witnessing a steady transition towards sustainable mining practices, which is a key driver of innovation and investment. Growth is projected to continue at a robust pace in the forecast period (2025-2033), driven by sustained demand from the mining industry, technological innovations, and supportive government policies.

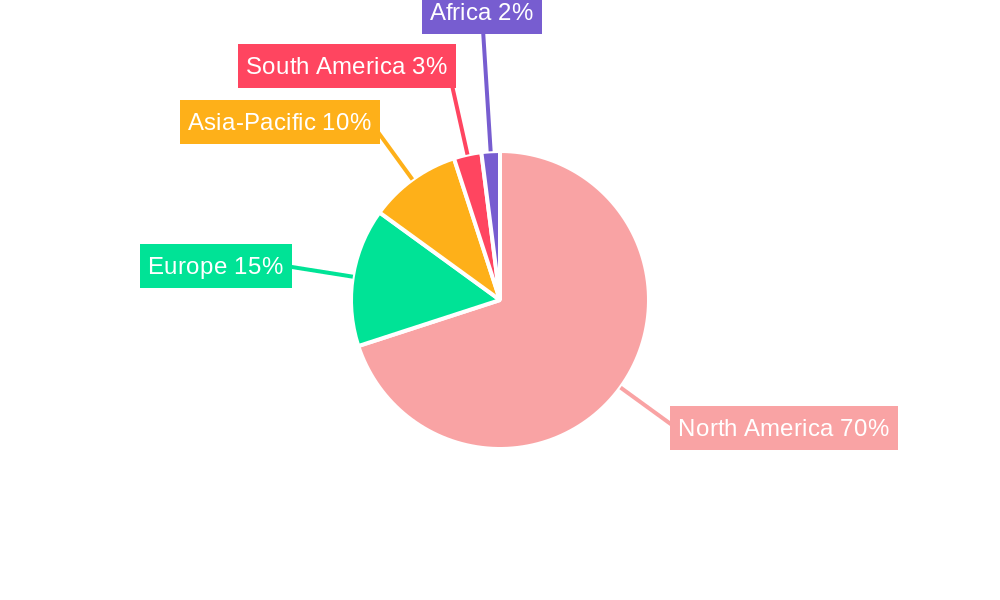

Leading Regions, Countries, or Segments in North America Mining Equipment Market

The United States remains the dominant market for mining equipment in North America, driven by substantial mining activities and investments in various mineral extraction projects. Canada also holds a significant share, especially in the context of its strong mining sector, particularly gold and other precious metals.

- By Type: Surface mining equipment holds the largest market share due to its widespread use in large-scale open-pit mining operations.

- By Application: Metal mining accounts for the largest segment, followed by mineral and then coal mining, reflecting the relative importance of metallic ore extraction in North America.

- By Country: The United States dominates due to its larger mining industry and extensive infrastructure. Canada follows closely, benefiting from significant investments in resource extraction.

Key Drivers for Dominant Segments and Countries:

- United States: Large-scale mining operations, substantial investments in mining infrastructure, and a robust economy.

- Canada: Strong presence of mining companies, significant investments in resource exploration and extraction, and supportive government policies.

- Surface Mining Equipment: High demand from large-scale open-pit mines due to their efficiency and cost-effectiveness.

- Metal Mining: High value of metallic ores and sustained demand for metals drive significant investments in this segment.

Dominance Factors: These key regions and segments benefit from significant investments in mining infrastructure, supportive government policies, a skilled workforce, and a large demand for mining equipment in metal and mineral extraction.

North America Mining Equipment Market Product Innovations

Recent innovations focus on autonomous systems, advanced sensor technologies, and data analytics for improved productivity and safety. The incorporation of IoT and AI facilitates remote monitoring and predictive maintenance, reducing downtime and optimizing operational efficiency. Electric and hybrid-powered equipment is gaining traction due to stricter environmental regulations and a growing focus on sustainable mining practices. Manufacturers are emphasizing modular designs and flexible configurations to cater to the specific needs of diverse mining operations. Unique selling propositions include enhanced fuel efficiency, reduced emissions, and superior safety features integrated with advanced automation and data analysis capabilities.

Propelling Factors for North America Mining Equipment Market Growth

Technological advancements, particularly in automation and data analytics, are boosting productivity and reducing operational costs. Increased government investments in infrastructure development and supportive policies are further driving market growth. The rising demand for metals and minerals, fueled by industrial growth and technological advancements, is creating a strong demand for mining equipment. Furthermore, a focus on sustainable mining practices is driving the adoption of environmentally friendly equipment and technologies.

Obstacles in the North America Mining Equipment Market

Stringent environmental regulations and the increasing cost of compliance pose a challenge for manufacturers and mining operators. Supply chain disruptions, particularly for critical components and raw materials, are impacting production and increasing costs. Intense competition among established players and new entrants is creating pricing pressures and necessitating continuous innovation to maintain market share. The volatility of commodity prices also impacts investment decisions and the overall market demand. These factors cumulatively lead to an estimated reduction of xx Million in projected revenue per annum.

Future Opportunities in North America Mining Equipment Market

The increasing adoption of digital technologies, including AI and machine learning, offers significant growth potential. The demand for sustainable and environmentally friendly mining equipment is expected to grow steadily, driving innovation in this segment. Emerging markets for critical minerals, driven by the growth of renewable energy technologies and electric vehicles, will create new opportunities for equipment manufacturers. Focus on autonomous and remote operation will lead to greater efficiency and safety improvements.

Major Players in the North America Mining Equipment Market Ecosystem

- Metso Corporation

- Liebherr Group

- Volvo Construction Equipment

- FLSmidth & Co AS

- Caterpillar Inc

- RDH-Scharf

- Komatsu Ltd

- Mining Equipment Limited

- SANY Group

- Terex Corporation

Key Developments in North America Mining Equipment Market Industry

- January 2023: Sandvik wins a significant mining equipment order in Canada from New Gold, a Canadian gold mining company, demonstrating strong demand for high-quality equipment in the Canadian mining sector.

- June 2022: Komatsu's acquisition of Mine Site Technologies strengthens its position in providing connectivity solutions for underground mining, indicating a growing trend toward digitalization and automation.

- March 2022: Hitachi Construction Machinery Americas' launch of new machines and technologies focused on reducing operational costs and promoting sustainable practices showcases the industry's commitment to efficiency and environmental responsibility.

Strategic North America Mining Equipment Market Forecast

The North America mining equipment market is poised for continued growth, driven by technological advancements, rising demand for metals and minerals, and a growing focus on sustainable mining practices. Opportunities lie in the adoption of autonomous systems, digitalization, and the development of environmentally friendly equipment. The market is expected to witness significant consolidation through mergers and acquisitions, further shaping the competitive landscape. The strategic investments in new technologies and expansion into emerging markets will determine the success of key players in the coming years. The forecast period will see steady growth with a positive outlook for innovation and expansion.

North America Mining Equipment Market Segmentation

-

1. Type

- 1.1. Surface Mining Equipment

- 1.2. Underground Mining Equipment

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

North America Mining Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Mining Equipment Market Regional Market Share

Geographic Coverage of North America Mining Equipment Market

North America Mining Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing use of Electric Machinery in Mining

- 3.3. Market Restrains

- 3.3.1. Stringent Government Policies Might Hinder the Growth of the Market for Equipment

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Surface Mining Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Mining Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining Equipment

- 5.1.2. Underground Mining Equipment

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Metso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volvo Construction Equipment

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FLSmidth & Co AS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Caterpillar Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 RDH-Scharf*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Komatsu Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mining Equipment Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SANY Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Terex Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Metso Corporation

List of Figures

- Figure 1: North America Mining Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Mining Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Mining Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Mining Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: North America Mining Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Mining Equipment Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: North America Mining Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: North America Mining Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Mining Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Mining Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Mining Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Mining Equipment Market?

The projected CAGR is approximately 4.58%.

2. Which companies are prominent players in the North America Mining Equipment Market?

Key companies in the market include Metso Corporation, Liebherr Group, Volvo Construction Equipment, FLSmidth & Co AS, Caterpillar Inc, RDH-Scharf*List Not Exhaustive, Komatsu Ltd, Mining Equipment Limited, SANY Group, Terex Corporation.

3. What are the main segments of the North America Mining Equipment Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing use of Electric Machinery in Mining.

6. What are the notable trends driving market growth?

Increasing Demand for Surface Mining Equipment.

7. Are there any restraints impacting market growth?

Stringent Government Policies Might Hinder the Growth of the Market for Equipment.

8. Can you provide examples of recent developments in the market?

January 2023: Sandvik wins mining equipment order in Canada from the Canadian gold mining company New Gold.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Mining Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Mining Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Mining Equipment Market?

To stay informed about further developments, trends, and reports in the North America Mining Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence