Key Insights

The North American electric bus market is experiencing significant expansion, driven by stringent emission regulations, heightened environmental awareness, and government incentives for sustainable transport. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14% from a market size of $23.8 billion in the base year 2025. Within the fuel category, Battery Electric Vehicles (BEVs) lead due to technological advancements and declining battery costs. The United States is anticipated to dominate the market share, followed by Canada and Mexico, supported by substantial investments in public transportation infrastructure and urban emission reduction initiatives. Leading companies such as GreenPower Motor Company, GILLIG, and BYD are actively investing in R&D, product development, and strategic partnerships. Advancements in battery technology, offering increased range and faster charging, are making electric buses a more compelling alternative to diesel models. Challenges include high initial investment, limited charging infrastructure in some areas, and the need for specialized maintenance personnel. The forecast period (2025-2033) indicates sustained strong growth, influenced by supportive government policies, technological breakthroughs, and a growing preference for eco-friendly public transit solutions. This market presents a compelling opportunity for investors and stakeholders.

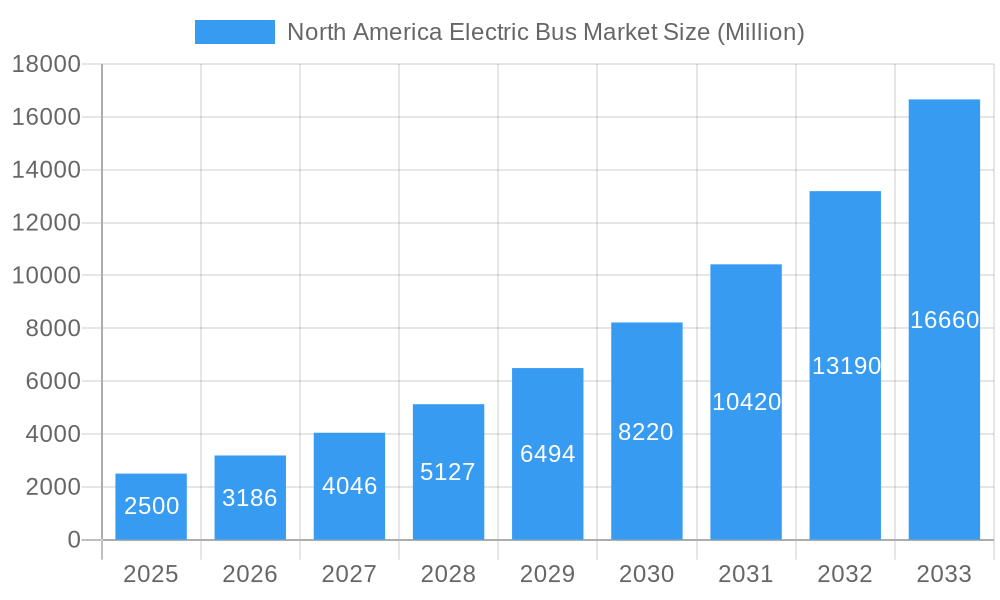

North America Electric Bus Market Market Size (In Billion)

Continued technological innovation will fuel substantial market growth. Enhanced battery technology is expected to provide longer ranges and quicker charging times, mitigating key adoption barriers. Expanding charging infrastructure, particularly in urban centers, will be vital to address range anxiety and support market expansion. The ongoing implementation of stricter emission standards across North America will further accelerate the shift to electric buses. The competitive environment will remain dynamic, with both established players and new entrants competing for market share. Success will depend on effectively managing high upfront costs, establishing robust after-sales service networks, and adapting to technological evolution. The market's future is contingent on sustained investment in sustainable transportation and the development of a comprehensive ecosystem supporting electric bus adoption.

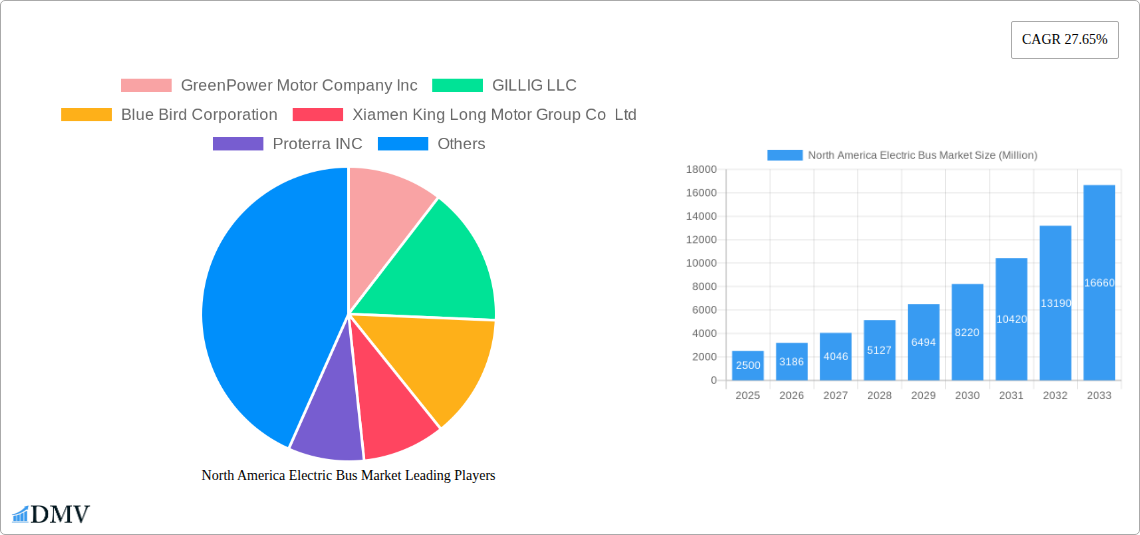

North America Electric Bus Market Company Market Share

North America Electric Bus Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the North America electric bus market, offering a detailed perspective on market dynamics, growth drivers, challenges, and future opportunities. Spanning the period from 2019 to 2033, with a base year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on this rapidly evolving sector. The report covers key segments including Battery Electric Vehicles (BEV), Fuel Cell Electric Vehicles (FCEV), and Hybrid Electric Vehicles (HEV) across the US, Canada, and Mexico. The market is projected to reach xx Million by 2033.

North America Electric Bus Market Composition & Trends

This section delves into the competitive landscape of the North American electric bus market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities.

Market Concentration: The market exhibits a moderately concentrated structure, with key players holding significant market share. Market share distribution is analyzed based on revenue and unit sales, highlighting the dominance of certain manufacturers. For example, BYD Auto Co Ltd and Proterra INC hold a significant portion of the market. However, the presence of several smaller players indicates a dynamic competitive environment.

Innovation Catalysts: Government incentives, stringent emission regulations, and advancements in battery technology are major drivers of innovation. Competition is driving improvements in battery life, charging infrastructure, and vehicle range, leading to increased adoption.

Regulatory Landscape: Stringent emission standards in various North American cities and states are compelling the transition towards electric buses. Government subsidies and grants are further incentivizing the adoption of electric bus technology. The report analyzes the specific regulations and their impact on market growth.

Substitute Products: While electric buses are increasingly preferred, diesel and compressed natural gas (CNG) buses remain alternatives, though their market share is steadily declining due to environmental concerns.

End-User Profiles: The report profiles key end-users including transit authorities, school districts, and private operators, analyzing their specific needs and preferences in electric bus procurement.

M&A Activities: The report details significant M&A activities, including deal values and their impact on market consolidation. Analysis shows an upward trend in M&A activity, driven by the desire for expansion and technological advancement. The total value of M&A deals during the study period (2019-2024) is estimated at xx Million.

North America Electric Bus Market Industry Evolution

This section analyzes the evolution of the North American electric bus market, tracing its growth trajectory from 2019 to 2024 and projecting its future development until 2033. The analysis incorporates technological advancements, shifting consumer preferences, and government policies that have shaped market growth.

The market has witnessed a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). The adoption rate of electric buses has significantly increased due to technological advancements, particularly in battery technology and charging infrastructure. Factors such as decreasing battery costs, increased vehicle range, and improved charging times have made electric buses a more viable option for various operators. Consumer demand is also growing, with a significant push from environmentally conscious stakeholders. We project a CAGR of xx% during the forecast period (2025-2033), driven by continued technological innovation, favorable government policies, and growing environmental concerns.

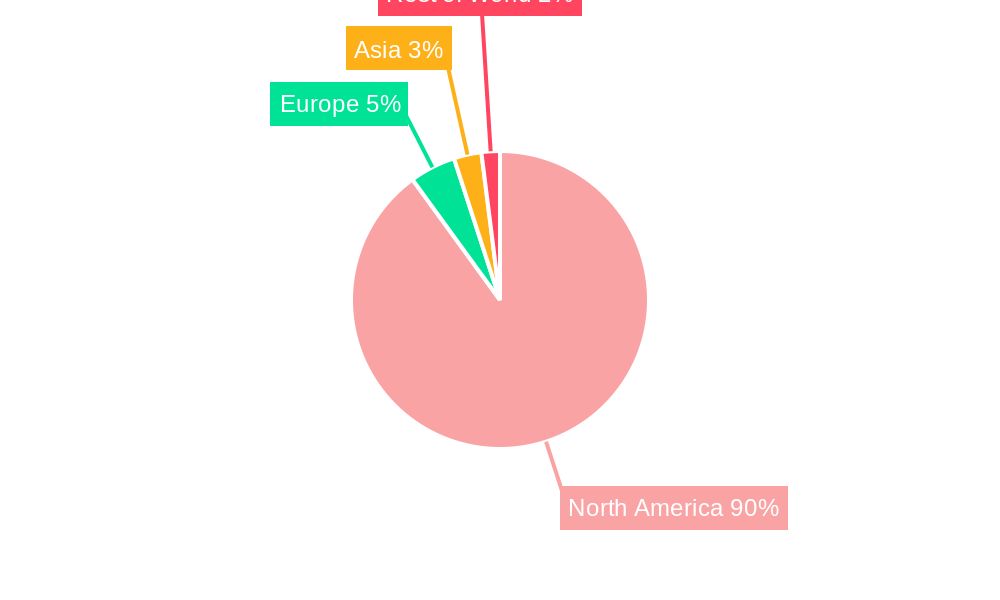

Leading Regions, Countries, or Segments in North America Electric Bus Market

The US currently dominates the North American electric bus market, followed by Canada and Mexico. This dominance is attributed to various factors, including:

United States:

- High Investment in Public Transportation: Significant government funding for public transport infrastructure development is boosting demand.

- Stringent Emission Regulations: Regulations in major cities mandate the adoption of zero-emission vehicles, driving the switch to electric buses.

- Technological Advancements: Several major electric bus manufacturers are based in the US, contributing to innovation and product availability.

Canada:

- Government Incentives: Federal and provincial government incentives promote electric bus adoption.

- Focus on Sustainable Transportation: A strong focus on sustainability is driving demand for environmentally friendly public transportation options.

Mexico:

- Growing Urbanization: Rapid urbanization is increasing the need for efficient and sustainable public transport systems.

- Improved Infrastructure: Investments in charging infrastructure are paving the way for wider electric bus adoption.

The BEV segment currently holds the largest market share within the fuel category, driven by its lower initial cost and increasing technological maturity compared to FCEV. However, the FCEV segment is expected to experience significant growth in the coming years due to advancements in fuel cell technology.

North America Electric Bus Market Product Innovations

Recent years have witnessed significant innovations in electric bus technology, particularly in battery technology, charging infrastructure, and vehicle design. Manufacturers are focusing on extending battery life, improving charging speed, enhancing vehicle range, and incorporating advanced safety features. Key innovations include improved battery management systems, advanced driver-assistance systems (ADAS), and lightweight bus designs to optimize energy consumption. These innovations are creating unique selling propositions for manufacturers and driving market expansion.

Propelling Factors for North America Electric Bus Market Growth

Several factors are propelling the growth of the North American electric bus market:

- Government Regulations: Stricter emission norms are making electric buses a necessity for transit operators.

- Technological Advancements: Improvements in battery technology, charging infrastructure, and vehicle performance are enhancing the viability of electric buses.

- Environmental Concerns: Growing public awareness of environmental issues is driving demand for sustainable transportation solutions.

- Economic Incentives: Government subsidies and tax breaks are making electric buses more affordable.

Obstacles in the North America Electric Bus Market

Several factors are hindering the widespread adoption of electric buses:

- High Initial Investment Costs: The high upfront cost of electric buses compared to diesel buses remains a barrier for many operators.

- Limited Charging Infrastructure: A lack of sufficient charging infrastructure in many areas limits the operational range of electric buses.

- Range Anxiety: Concerns about the limited range of some electric buses compared to diesel buses persist.

- Supply Chain Disruptions: Supply chain bottlenecks can affect the production and availability of electric buses and components.

Future Opportunities in North America Electric Bus Market

The North American electric bus market presents several promising future opportunities:

- Expansion into Smaller Cities and Towns: Growing awareness and improving technology will increase the market in previously underserved areas.

- Development of Advanced Battery Technologies: Next-generation battery technologies promise to address range anxiety and reduce charging times.

- Integration of Smart City Technologies: Electric buses can be integrated with smart city infrastructure to optimize operations and improve traffic management.

Major Players in the North America Electric Bus Market Ecosystem

Key Developments in North America Electric Bus Market Industry

- October 2023: BYD announced a partnership with Los Olivos Elementary School District, resulting in a 100% zero-emission school bus fleet. This highlights the growing adoption of electric buses in the school bus sector.

- October 2023: Solaris Bus & Coach secured a contract to supply eight electric buses and charging infrastructure to Opole, Poland. While not in North America, this underscores the global momentum towards electric bus adoption, impacting technology development and potentially influencing North American players.

- December 2023: Proterra announced a new EV battery factory in South Carolina, responding to surging demand for commercial electric vehicles. This indicates confidence in market growth and a commitment to local production.

Strategic North America Electric Bus Market Forecast

The North American electric bus market is poised for significant growth in the coming years. Continued technological advancements, supportive government policies, and rising environmental awareness will drive market expansion. The increasing affordability of electric buses, combined with improvements in battery technology and charging infrastructure, will further fuel adoption. Opportunities exist in various segments, including school buses, transit buses, and private shuttle services. The market is expected to witness substantial growth across all key regions, particularly in major metropolitan areas.

North America Electric Bus Market Segmentation

-

1. Fuel Category

- 1.1. BEV

- 1.2. FCEV

- 1.3. HEV

North America Electric Bus Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Electric Bus Market Regional Market Share

Geographic Coverage of North America Electric Bus Market

North America Electric Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Electric Bus Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 5.1.1. BEV

- 5.1.2. FCEV

- 5.1.3. HEV

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GreenPower Motor Company Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GILLIG LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Bird Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xiamen King Long Motor Group Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Proterra INC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daimler Truck Holding AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Volvo Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NFI Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CAF Group (Solaris Bus & Coach)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BYD Auto Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lion Electric Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 GreenPower Motor Company Inc

List of Figures

- Figure 1: North America Electric Bus Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Electric Bus Market Share (%) by Company 2025

List of Tables

- Table 1: North America Electric Bus Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 2: North America Electric Bus Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: North America Electric Bus Market Revenue billion Forecast, by Fuel Category 2020 & 2033

- Table 4: North America Electric Bus Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States North America Electric Bus Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Electric Bus Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Electric Bus Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Electric Bus Market?

The projected CAGR is approximately 14%.

2. Which companies are prominent players in the North America Electric Bus Market?

Key companies in the market include GreenPower Motor Company Inc, GILLIG LLC, Blue Bird Corporation, Xiamen King Long Motor Group Co Ltd, Proterra INC, Daimler Truck Holding AG, Volvo Group, NFI Group Inc, CAF Group (Solaris Bus & Coach), BYD Auto Co Ltd, Lion Electric Company.

3. What are the main segments of the North America Electric Bus Market?

The market segments include Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD 23.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Government Focus to Promote the Adoption of Electric Vehicles Fosters the Growth of the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Cost of Setting Up EV Charging Stations Hampers the Growth of the Market.

8. Can you provide examples of recent developments in the market?

December 2023: Proterra announced its new EV battery factory in South Carolina as demand for commercial electric vehicles increased.October 2023: BYD (Build Your Dreams) announced that a partnership with the Los Olivos Elementary School District would bring a BYD Type A electric school bus to Santa Barbara County students, making the Los Olivos Elementary School District the first in the United States to have 100% zero-emission fleet of school buses.October 2023: Solaris Bus & Coach Sp. z o.o. entered a contract with the public transport operator Miejski Zakład Komunikacyjny sp. z o.o. in the city of Opole to supply eight e-buses, including six 12-meter and two 18-meter vehicles, as well as to deliver and install charging infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Electric Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Electric Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Electric Bus Market?

To stay informed about further developments, trends, and reports in the North America Electric Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence