Key Insights

The North American automotive upholstery market, valued at approximately $22.5 billion in 2025, is projected for substantial growth. This expansion is driven by escalating consumer demand for premium vehicles featuring enhanced comfort and sophisticated aesthetics, leading to increased adoption of leather and other high-quality upholstery materials. The recovery of the automotive manufacturing sector and advancements in sustainable and durable materials further contribute to market propulsion. The aftermarket segment also presents significant growth opportunities as consumers increasingly seek vehicle personalization and upgrades. While challenges like fluctuating raw material prices persist, the market outlook remains positive. Key segments include Leather, Vinyl, and Other Material Types, catering to diverse consumer needs, alongside OEM and Aftermarket sales channels, each exhibiting distinct market dynamics. Leading players, including Adient Plc, Lear Corp, and Katzkin Leather Inc., are strategically positioned to leverage these opportunities through innovation and partnerships.

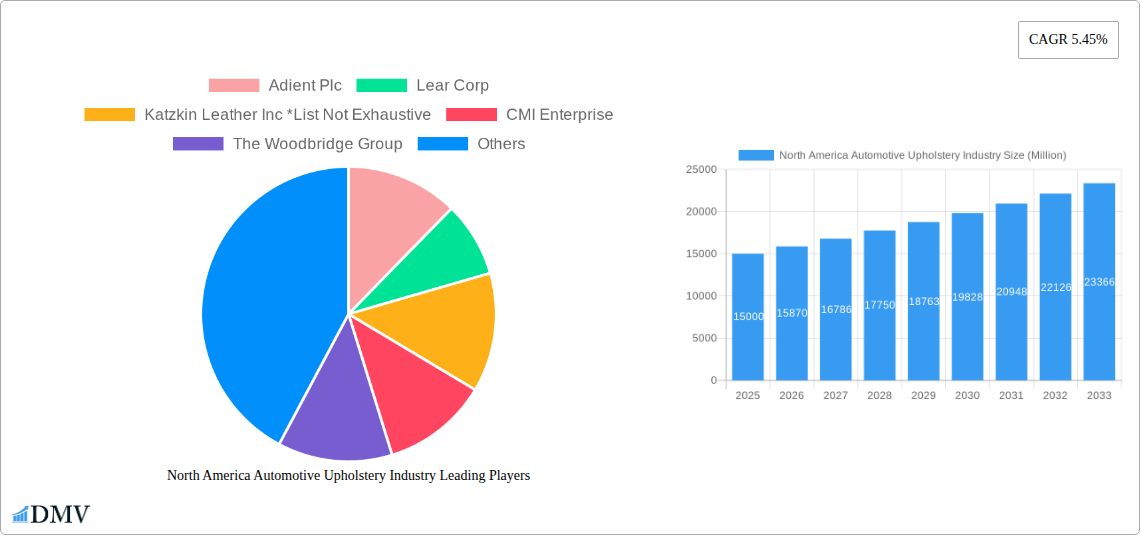

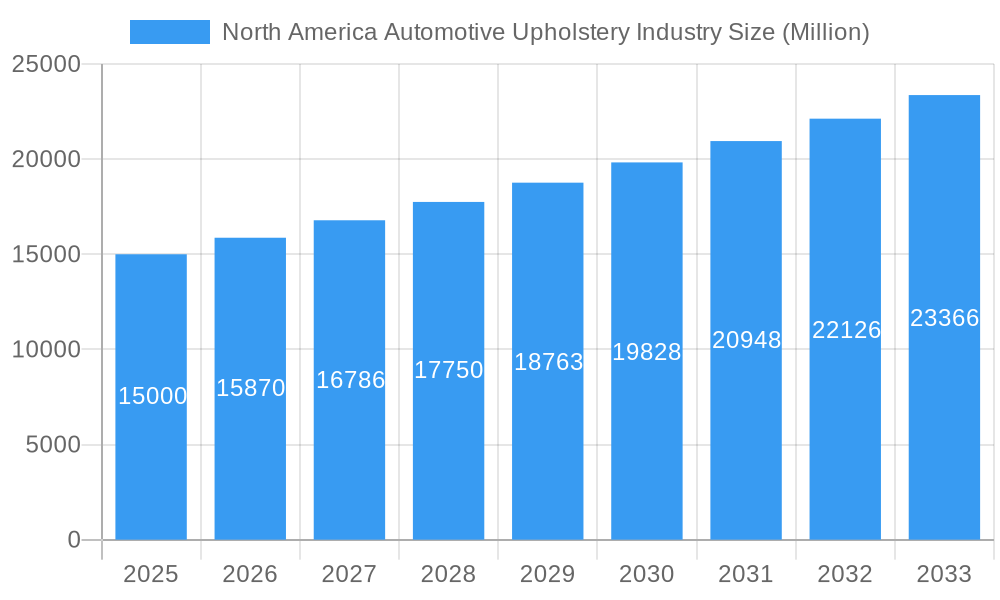

North America Automotive Upholstery Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates a Compound Annual Growth Rate (CAGR) of 5.7%. Growth is expected to be particularly strong in premium material segments and the aftermarket channel. The United States will continue to lead the market, with increasing automotive production in Mexico also fueling growth in Canada and Mexico. Evolving automotive design trends, emphasizing technology integration and sustainability, will significantly shape the market landscape.

North America Automotive Upholstery Industry Company Market Share

North America Automotive Upholstery Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the North America automotive upholstery industry, encompassing market size, trends, leading players, and future projections. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The total market value is projected to reach xx Million by 2033.

North America Automotive Upholstery Industry Market Composition & Trends

This section delves into the competitive landscape of the North America automotive upholstery market, analyzing market concentration, innovation drivers, regulatory influences, substitute products, and end-user profiles. The analysis includes a comprehensive overview of mergers and acquisitions (M&A) activity, providing insights into deal values and market share distribution amongst key players like Adient Plc, Lear Corp, and Katzkin Leather Inc. The report further explores the impact of emerging materials and technologies on market dynamics, examining the shift towards sustainable and vegan alternatives.

- Market Concentration: The North American automotive upholstery market exhibits a moderately concentrated structure, with a few major players holding significant market share. The report details the market share distribution among leading companies.

- Innovation Catalysts: Technological advancements in material science, including the development of sustainable and vegan alternatives like bio-attributed vinyl (BIOVYN), are driving significant innovation within the industry.

- Regulatory Landscape: Government regulations concerning emissions, safety, and material sourcing significantly impact the industry, shaping the demand for eco-friendly upholstery solutions.

- Substitute Products: The rise of alternative materials and manufacturing processes presents both opportunities and challenges for traditional upholstery manufacturers.

- End-User Profiles: The report segments the market by end-user, analyzing the upholstery needs of various vehicle segments, including passenger cars, SUVs, and commercial vehicles.

- M&A Activity: The report analyzes recent M&A activity in the industry, providing detailed information on deal values and the strategic implications of these transactions. Examples of past M&A activity are included, with estimated deal values of xx Million.

North America Automotive Upholstery Industry Evolution

This section provides a comprehensive analysis of the North America automotive upholstery market's growth trajectory from 2019 to 2033. It explores technological advancements, shifting consumer demands, and the impact of macroeconomic factors on market performance. The analysis incorporates specific data points on growth rates and adoption metrics for various material types, sales channels, and product categories, revealing the evolution of this market from 2019 to the projected market size of xx Million in 2033. A detailed breakdown of the historical period (2019-2024) and forecast period (2025-2033) are presented, with an estimated market value of xx Million in 2025.

Leading Regions, Countries, or Segments in North America Automotive Upholstery Industry

This section identifies the dominant regions, countries, and segments within the North American automotive upholstery market. The analysis focuses on Material Type (Leather, Vinyl, Other Material Types), Sales Channel (OEM, Aftermarket), and Product (Dashboard, Seats, Roof Liners, Door Trim). Key drivers, including investment trends and regulatory support, are highlighted using bullet points, while dominance factors are analyzed in depth using paragraphs.

- Dominant Segment: The analysis indicates that [insert dominant segment, e.g., automotive seating for OEM sales] constitutes the largest market share, accounting for xx% of the total market value in 2025.

- Key Drivers:

- Strong demand from the automotive industry.

- Growing preference for luxury and comfort features.

- Government support for sustainable manufacturing practices.

- Dominance Factors: The dominance of [insert dominant segment] is driven by factors such as increasing vehicle production, rising disposable incomes, and a growing preference for premium interior features.

North America Automotive Upholstery Industry Product Innovations

This section showcases recent product innovations in the North American automotive upholstery industry, highlighting technological advancements, unique selling propositions, and performance improvements. Recent examples include the adoption of sustainable materials like BIOVYN and the development of highly sophisticated seating arrangements as seen in Bentley's Airline Seats. These innovations cater to the growing demand for enhanced comfort, durability, and environmentally friendly solutions within the automotive sector.

Propelling Factors for North America Automotive Upholstery Industry Growth

Several key factors are driving growth in the North American automotive upholstery industry. Technological advancements leading to lighter, more durable, and sustainable materials are key. Economic factors, such as rising disposable incomes and increased vehicle sales, further stimulate growth. Finally, supportive government regulations promoting sustainable manufacturing practices are contributing to the industry's expansion.

Obstacles in the North America Automotive Upholstery Industry Market

The North American automotive upholstery industry faces challenges such as stringent environmental regulations impacting material sourcing and manufacturing costs. Supply chain disruptions, particularly in the procurement of raw materials and components, can lead to production delays and increased costs. Finally, intense competition from both established and emerging players puts pressure on profit margins and necessitates continuous innovation.

Future Opportunities in North America Automotive Upholstery Industry

Future growth opportunities are abundant. The expanding electric vehicle (EV) market presents a significant opportunity, with demand for specialized upholstery materials to meet the unique requirements of EV interiors. The increasing popularity of personalized and customized automotive interiors also offers significant potential for growth in the aftermarket segment. Finally, the adoption of advanced manufacturing technologies can lead to increased efficiency and reduced costs.

Major Players in the North America Automotive Upholstery Industry Ecosystem

- Adient Plc

- Lear Corp

- Katzkin Leather Inc

- CMI Enterprise

- The Woodbridge Group

- IMS Nonwoven

- Seiren Co Ltd

- Toyota Boshoku Corp

- Faurecia SE

Key Developments in North America Automotive Upholstery Industry Industry

- August 2023: Bentley's launch of the Bentayga EWB Mulliner with Airline Seats showcases advancements in luxury seating and highlights consumer demand for premium comfort features.

- June 2023: Faurecia's introduction of a modular and sustainable seat design signifies a shift towards environmentally conscious manufacturing practices and enhances product lifecycle management.

- June 2023: The launch of the 2024 Lexus GX highlights improvements in ergonomic design and seating comfort, reflecting the ongoing focus on enhanced driver and passenger experience.

- November 2022: Polestar's integration of INEOS BIOVYN in its Polestar 3 SUV demonstrates the increasing adoption of sustainable materials in automotive upholstery.

- September 2022: BMW Group's commitment to launching vehicles with fully vegan interiors reflects the growing consumer demand for eco-friendly and ethical materials in the automotive industry.

Strategic North America Automotive Upholstery Industry Market Forecast

The North American automotive upholstery market is poised for significant growth over the forecast period. Driven by technological innovations in sustainable materials, rising consumer demand for enhanced comfort and personalization, and the expansion of the EV market, the industry is expected to experience substantial expansion. The increasing focus on eco-friendly manufacturing practices will further contribute to market growth, creating opportunities for companies to develop and deploy innovative and sustainable upholstery solutions.

North America Automotive Upholstery Industry Segmentation

-

1. Material Type

- 1.1. Leather

- 1.2. Vinyl

- 1.3. Other Material Types

-

2. Sales Channel

- 2.1. OEM

- 2.2. Aftermarket

-

3. Product

- 3.1. Dashboard

- 3.2. Seats

- 3.3. Roof Liners

- 3.4. Door Trim

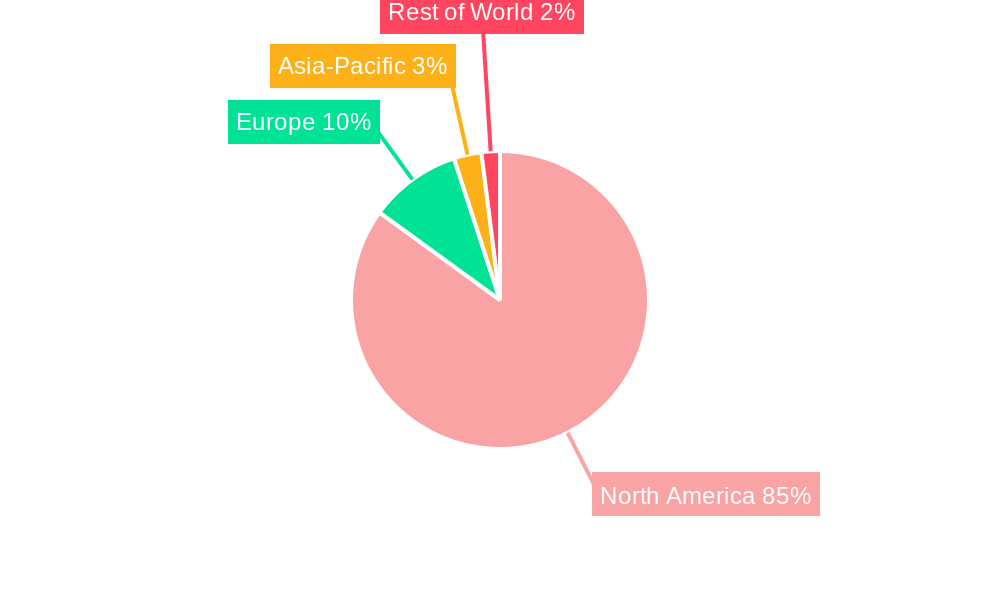

North America Automotive Upholstery Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Automotive Upholstery Industry Regional Market Share

Geographic Coverage of North America Automotive Upholstery Industry

North America Automotive Upholstery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Passenger Car Sales Propelling Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Leather

- 5.1.2. Vinyl

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Dashboard

- 5.3.2. Seats

- 5.3.3. Roof Liners

- 5.3.4. Door Trim

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. United States North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Leather

- 6.1.2. Vinyl

- 6.1.3. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Dashboard

- 6.3.2. Seats

- 6.3.3. Roof Liners

- 6.3.4. Door Trim

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Canada North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Leather

- 7.1.2. Vinyl

- 7.1.3. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Dashboard

- 7.3.2. Seats

- 7.3.3. Roof Liners

- 7.3.4. Door Trim

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Rest Of North America North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Leather

- 8.1.2. Vinyl

- 8.1.3. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Dashboard

- 8.3.2. Seats

- 8.3.3. Roof Liners

- 8.3.4. Door Trim

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adient Plc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Lear Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Katzkin Leather Inc *List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 CMI Enterprise

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 The Woodbridge Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 IMS Nonwoven

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Seiren Co Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Toyota Boshoku Corp

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Faurecia SE

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Adient Plc

List of Figures

- Figure 1: North America Automotive Upholstery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automotive Upholstery Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: North America Automotive Upholstery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 7: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 11: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 12: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 15: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 16: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Upholstery Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the North America Automotive Upholstery Industry?

Key companies in the market include Adient Plc, Lear Corp, Katzkin Leather Inc *List Not Exhaustive, CMI Enterprise, The Woodbridge Group, IMS Nonwoven, Seiren Co Ltd, Toyota Boshoku Corp, Faurecia SE.

3. What are the main segments of the North America Automotive Upholstery Industry?

The market segments include Material Type, Sales Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Passenger Car Sales Propelling Market Growth.

6. What are the notable trends driving market growth?

Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

August 2023: Bentley unveiled the Bentayga Extended Wheelbase Mulliner during Monterey Car Week in California. The Bentayga EWB Mulliner flagship has greater cabin room than any similar premium competition, owing to its Airline Seats. The rear compartment, which is available in 4+1 and 4-seat configurations, comes standard with the Bentley Airline Seat specification, the world's most sophisticated vehicle seating arrangement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Upholstery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Upholstery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Upholstery Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Upholstery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence