Key Insights

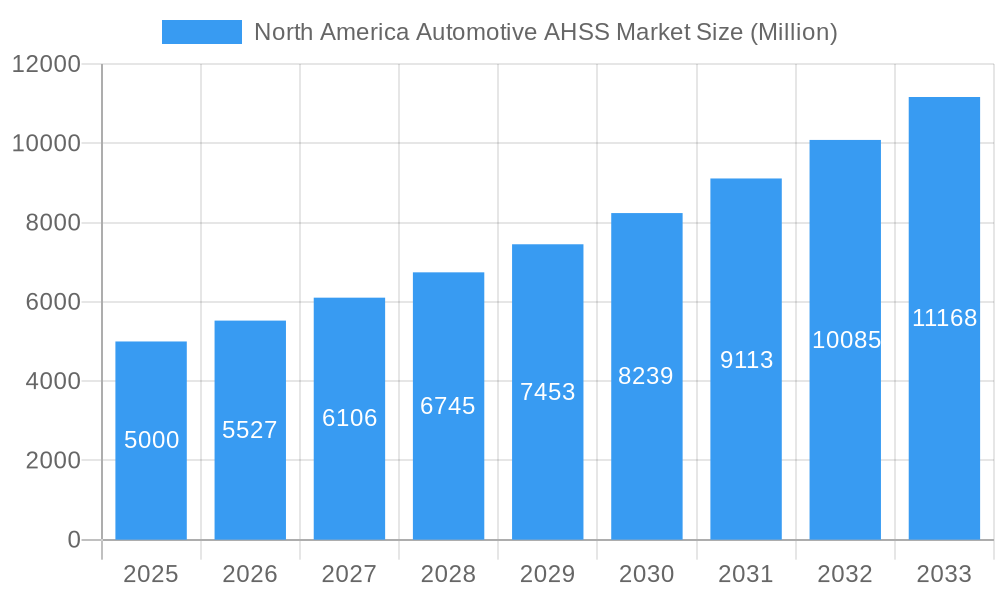

The North American Automotive Advanced High-Strength Steel (AHSS) market is poised for substantial expansion, driven by the escalating demand for lightweight, fuel-efficient vehicles and adherence to rigorous safety mandates. The market, estimated at $26269.5 million in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.27% from 2025 to 2033. This growth is underpinned by the increasing integration of AHSS across critical vehicle components, including structural assemblies, closures, bumpers, and suspension systems. The burgeoning production of passenger vehicles, notably light trucks and SUVs, further accelerates AHSS demand due to its superior strength-to-weight characteristics. Technological innovations in AHSS manufacturing are enhancing material performance and cost-effectiveness, bolstering market potential. A primary driver remains the automotive industry's commitment to improving vehicle safety and fuel economy.

North America Automotive AHSS Market Market Size (In Billion)

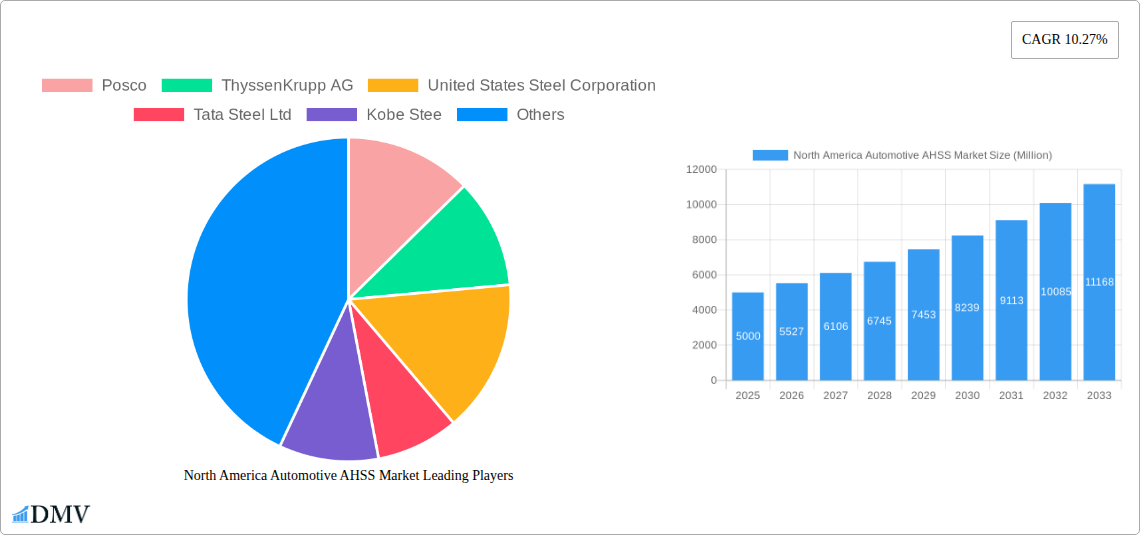

Despite a positive outlook, the market navigates challenges such as fluctuating raw material costs, particularly for steel, which can affect AHSS pricing and profitability. Supply chain volatility and potential economic slowdowns may also pose headwinds. Nevertheless, the overarching trend towards vehicle lightweighting and enhanced safety features is expected to propel the North American automotive AHSS market forward. Leading manufacturers, including Posco, ThyssenKrupp AG, United States Steel Corporation, Tata Steel Ltd, Kobe Steel, ArcelorMittal SA, and AK Steel Holding Corp, are strategically investing in research and development and expanding production capacities to capitalize on this growth. The market's segmentation indicates significant contributions from passenger vehicles and commercial vehicles, with structural assemblies and closures as dominant application areas.

North America Automotive AHSS Market Company Market Share

North America Automotive AHSS Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Automotive Advanced High-Strength Steel (AHSS) market, offering valuable insights for stakeholders across the automotive value chain. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive dynamics, and future growth prospects. The study encompasses detailed segmentation by application type (Structural Assembly & Closures, Bumpers, Suspension, Others) and vehicle type (Passenger Vehicles, Commercial Cars), offering a granular understanding of market performance across diverse segments. With a focus on key players like Posco, ThyssenKrupp AG, United States Steel Corporation, Tata Steel Ltd, Kobe Steel, ArcelorMittal SA, and Ak Steel Holding Corp, this report is an indispensable resource for strategic decision-making.

North America Automotive AHSS Market Composition & Trends

This section analyzes the competitive landscape of the North America Automotive AHSS market, evaluating market concentration, innovation drivers, regulatory influences, substitute materials, end-user behavior, and merger & acquisition (M&A) activities. The report delves into market share distribution among key players, revealing the dominance of established manufacturers and the emergence of new competitors. M&A activities are evaluated by examining deal values and their impact on market consolidation. The analysis incorporates insights into regulatory frameworks impacting AHSS usage in automotive manufacturing, exploring the influence of emission standards and safety regulations. The study also examines the availability and competitiveness of substitute materials such as aluminum and carbon fiber.

- Market Share Distribution (2025 Estimate): Posco (xx%), ArcelorMittal SA (xx%), United States Steel Corporation (xx%), ThyssenKrupp AG (xx%), Others (xx%).

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with an aggregate value of approximately $xx Million. Key deals involved [mention specific significant deals if available, otherwise state "strategic alliances and acquisitions focusing on capacity expansion and technology integration"].

- End-User Profile: The report analyzes the purchasing patterns and preferences of major automotive OEMs in North America, detailing their AHSS sourcing strategies and technological preferences.

- Innovation Catalysts: The report identifies key factors driving innovation in AHSS, including advancements in steelmaking technologies, lightweighting demands, and the increasing adoption of advanced driver-assistance systems (ADAS).

North America Automotive AHSS Market Industry Evolution

This section examines the historical and projected growth trajectory of the North America Automotive AHSS market, identifying key milestones and drivers of market expansion. The analysis encompasses the impact of technological advancements, shifting consumer preferences towards fuel efficiency and safety, and evolving regulatory landscapes. Growth rates are provided for the historical period (2019-2024) and projected for the forecast period (2025-2033). The report also incorporates an analysis of the adoption rates of different grades of AHSS across various vehicle segments.

The North America Automotive AHSS market experienced robust growth between 2019 and 2024, driven primarily by [mention specific drivers like increased demand for lightweight vehicles, stringent fuel efficiency standards, or advancements in AHSS grades]. The market is expected to continue its expansion during the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) of xx%. This growth will be influenced by factors such as the increasing adoption of electric vehicles (EVs), the rising demand for advanced safety features, and continued technological advancements in AHSS production. The report further explores the impact of supply chain disruptions and economic fluctuations on market growth. Specific data points on growth rates, adoption metrics, and production capacities are included in the detailed analysis provided within the full report.

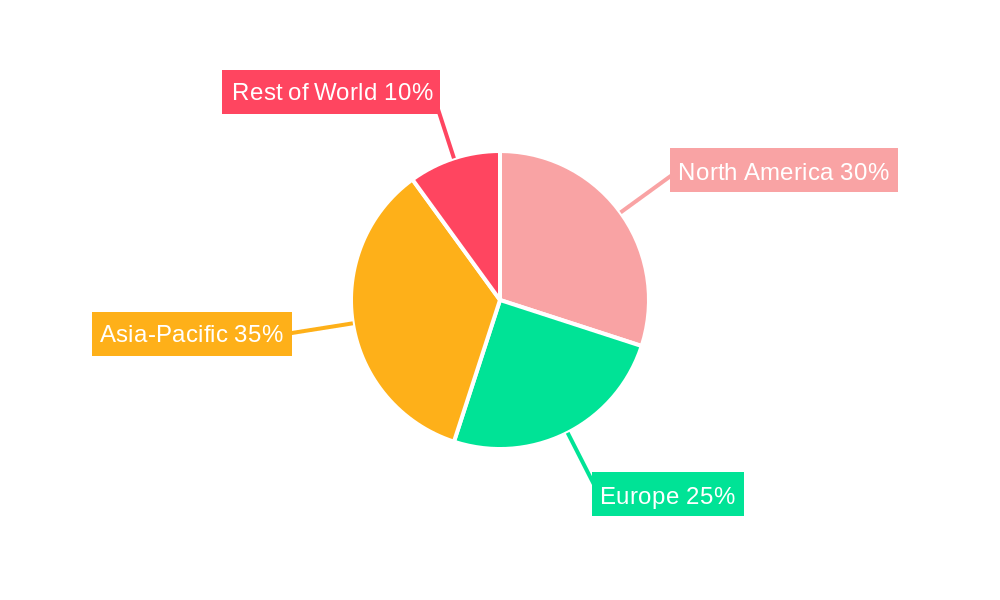

Leading Regions, Countries, or Segments in North America Automotive AHSS Market

This section pinpoints the leading regions, countries, and segments within the North America Automotive AHSS market. Analysis is provided for both application type and vehicle type segments.

Dominant Segments:

- Application Type: Structural Assembly & Closures holds the largest market share, driven by the increasing demand for high-strength, lightweight components in vehicle bodies.

- Vehicle Type: Passenger vehicles represent the dominant segment, owing to the large-scale production of passenger cars and SUVs in North America.

Key Drivers:

- Investment Trends: Significant investments in advanced manufacturing facilities and R&D activities are driving growth in specific regions.

- Regulatory Support: Government incentives and regulations promoting fuel efficiency and safety are boosting the adoption of AHSS.

The dominance of the identified segments is analyzed through in-depth exploration of the market drivers, including technological advancements, regulatory changes, and evolving consumer preferences. The report examines how these factors contribute to regional disparities in AHSS consumption and identifies potential shifts in market leadership over the forecast period.

North America Automotive AHSS Market Product Innovations

Recent product innovations in AHSS include the development of advanced grades with enhanced properties, such as higher tensile strength, improved formability, and superior weldability. These innovations enable automakers to produce lighter and safer vehicles while maintaining structural integrity and cost-effectiveness. Unique selling propositions include increased strength-to-weight ratios, improved crashworthiness, and enhanced fatigue resistance. Technological advancements such as advanced high-strength steel processing technologies and surface treatment methods are driving these improvements.

Propelling Factors for North America Automotive AHSS Market Growth

The North America Automotive AHSS market is experiencing significant growth due to several key factors. The increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions is a primary driver. Stringent government regulations regarding fuel economy and safety standards further incentivize the adoption of AHSS. Technological advancements in steelmaking, allowing for the production of stronger and more formable AHSS grades, also contribute to market expansion. Furthermore, the rising popularity of electric and hybrid vehicles, which require lightweight materials for extended range and performance, fuels demand for AHSS.

Obstacles in the North America Automotive AHSS Market Market

Several factors hinder the growth of the North America Automotive AHSS market. Fluctuations in raw material prices and supply chain disruptions can impact production costs and availability. Intense competition among AHSS manufacturers leads to price pressures and necessitates continuous innovation to maintain market share. Moreover, the high initial investment required for adopting AHSS in automotive manufacturing can pose a barrier for some automakers. Regulatory uncertainty regarding future emission standards and safety regulations can also affect investment decisions and market growth.

Future Opportunities in North America Automotive AHSS Market

The North America Automotive AHSS market presents several promising opportunities. The increasing demand for lightweight materials in electric vehicles (EVs) and hybrid vehicles (HEVs) presents a significant growth avenue. Advancements in AHSS grades with enhanced properties, such as improved formability and weldability, create opportunities for innovative design and manufacturing processes. Expansion into new automotive segments, such as commercial vehicles and light trucks, presents further potential for market growth.

Major Players in the North America Automotive AHSS Market Ecosystem

- Posco

- ThyssenKrupp AG

- United States Steel Corporation

- Tata Steel Ltd

- Kobe Steel

- ArcelorMittal SA

- Ak Steel Holding Corp

Key Developments in North America Automotive AHSS Market Industry

- 2022 Q4: ArcelorMittal announced a significant investment in expanding its AHSS production capacity in North America.

- 2023 Q1: Posco launched a new grade of AHSS with improved formability and weldability.

- 2023 Q3: A major automotive OEM signed a long-term supply agreement with United States Steel for AHSS. [Add more specific developments if available]

Strategic North America Automotive AHSS Market Market Forecast

The North America Automotive AHSS market is poised for continued growth driven by increasing demand for lightweight vehicles, stringent fuel efficiency regulations, and technological innovations in AHSS production. The rising adoption of EVs and the expansion of the commercial vehicle segment will present significant opportunities. However, challenges remain concerning raw material price volatility and supply chain disruptions. The market is expected to witness ongoing consolidation through mergers and acquisitions, with leading manufacturers investing heavily in R&D and capacity expansion to meet the evolving needs of the automotive industry. The forecast indicates a strong and consistent growth trajectory for the foreseeable future.

North America Automotive AHSS Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly & Closures

- 1.2. Bumpers

- 1.3. Suspension

- 1.4. Others

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Cars

North America Automotive AHSS Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Automotive AHSS Market Regional Market Share

Geographic Coverage of North America Automotive AHSS Market

North America Automotive AHSS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Travel and Tourism to Fuel Market Demand

- 3.3. Market Restrains

- 3.3.1. High Maintenance cost of RV Rental Fleets

- 3.4. Market Trends

- 3.4.1. Continuous Evolution in automotive AHSS technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly & Closures

- 5.1.2. Bumpers

- 5.1.3. Suspension

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. United States North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Structural Assembly & Closures

- 6.1.2. Bumpers

- 6.1.3. Suspension

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Vehicles

- 6.2.2. Commercial Cars

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Canada North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Structural Assembly & Closures

- 7.1.2. Bumpers

- 7.1.3. Suspension

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Vehicles

- 7.2.2. Commercial Cars

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Rest Of North America North America Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Structural Assembly & Closures

- 8.1.2. Bumpers

- 8.1.3. Suspension

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Vehicles

- 8.2.2. Commercial Cars

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Posco

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ThyssenKrupp AG

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 United States Steel Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Tata Steel Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kobe Stee

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Arcelor Mittal SA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Ak Steel Holding Corp

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Posco

List of Figures

- Figure 1: North America Automotive AHSS Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Automotive AHSS Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive AHSS Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 2: North America Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 3: North America Automotive AHSS Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: North America Automotive AHSS Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 5: North America Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: North America Automotive AHSS Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: North America Automotive AHSS Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: North America Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 9: North America Automotive AHSS Market Revenue million Forecast, by Country 2020 & 2033

- Table 10: North America Automotive AHSS Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 11: North America Automotive AHSS Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 12: North America Automotive AHSS Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive AHSS Market?

The projected CAGR is approximately 10.27%.

2. Which companies are prominent players in the North America Automotive AHSS Market?

Key companies in the market include Posco, ThyssenKrupp AG, United States Steel Corporation, Tata Steel Ltd, Kobe Stee, Arcelor Mittal SA, Ak Steel Holding Corp.

3. What are the main segments of the North America Automotive AHSS Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 26269.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Travel and Tourism to Fuel Market Demand.

6. What are the notable trends driving market growth?

Continuous Evolution in automotive AHSS technology.

7. Are there any restraints impacting market growth?

High Maintenance cost of RV Rental Fleets.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive AHSS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive AHSS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive AHSS Market?

To stay informed about further developments, trends, and reports in the North America Automotive AHSS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence