Key Insights

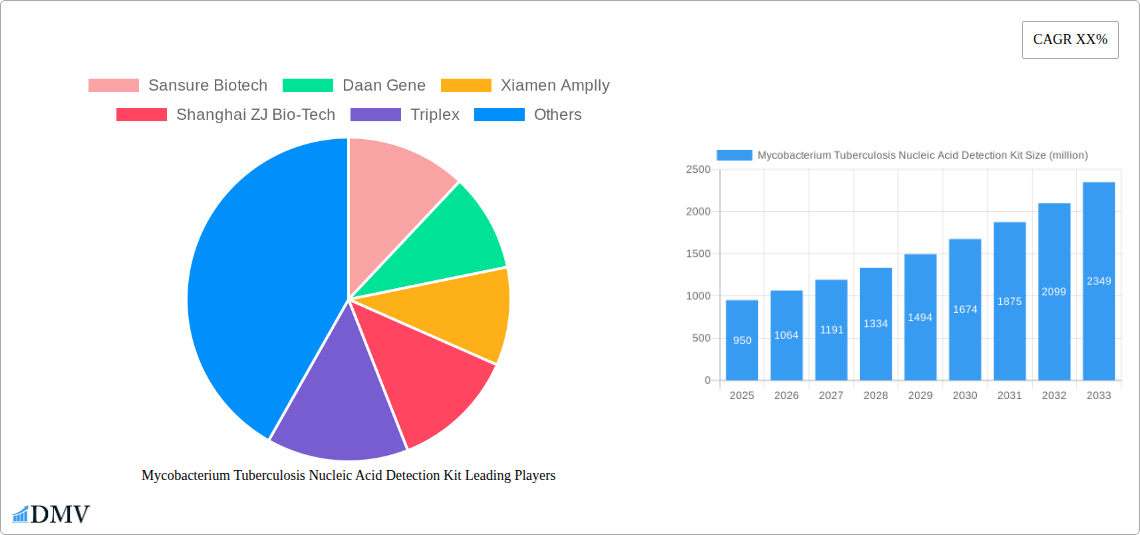

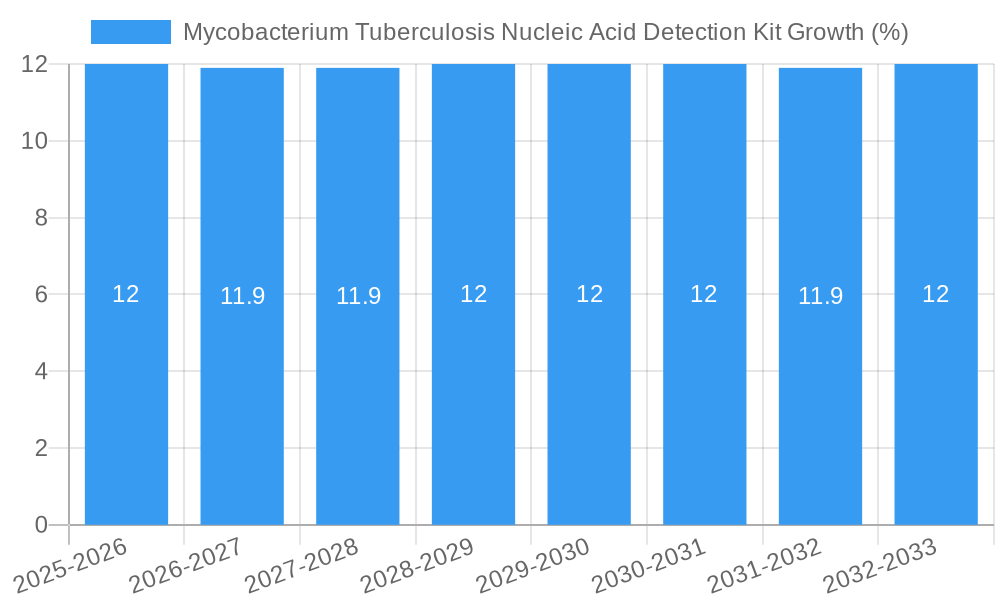

The global Mycobacterium Tuberculosis Nucleic Acid Detection Kit market is poised for significant expansion, projected to reach a substantial market size of approximately $950 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of roughly 12% anticipated between 2025 and 2033. This growth is primarily fueled by the increasing prevalence of tuberculosis (TB) globally, coupled with a heightened awareness and demand for rapid, accurate diagnostic solutions. The urgent need for early detection and effective treatment strategies to combat drug-resistant TB strains further propels market momentum. Advancements in nucleic acid amplification techniques, particularly the widespread adoption of Fluorescent PCR and the emerging potential of RNA Isothermal Amplification Methods, are central to this market expansion, offering enhanced sensitivity and specificity. The market is segmented across key applications, catering to both pediatric and adult populations, reflecting the universal impact of TB.

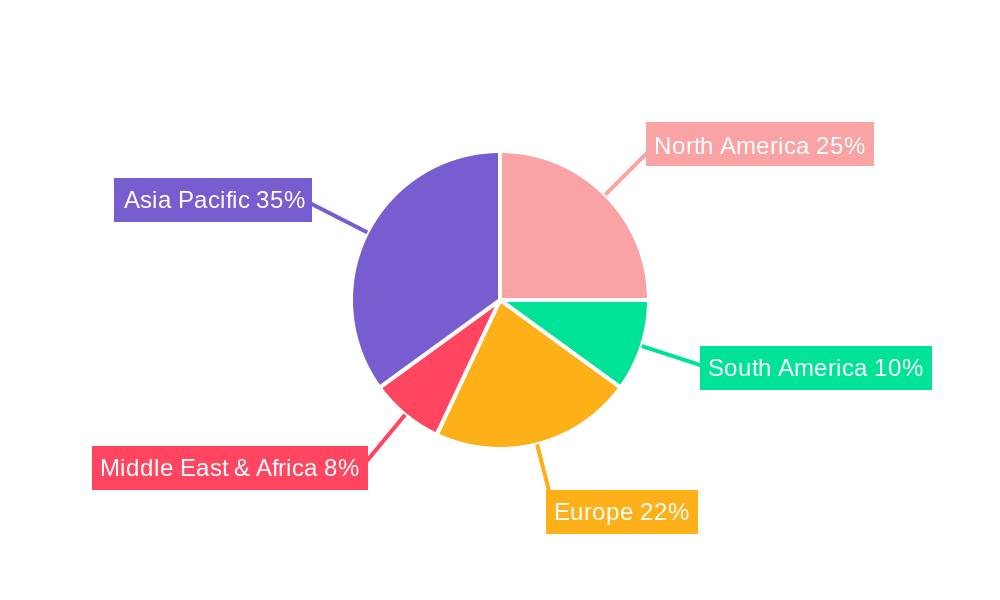

The market's trajectory is further shaped by several driving forces, including supportive government initiatives and healthcare policies aimed at TB eradication, substantial investments in research and development by leading biotechnology firms, and the continuous drive for improved point-of-care diagnostics. However, challenges such as the high cost of advanced diagnostic kits in certain low-resource settings and the stringent regulatory approval processes for novel technologies could pose restraints. Geographically, Asia Pacific, particularly China and India, is expected to dominate the market due to the high TB burden in these regions. North America and Europe will also represent significant markets, driven by advanced healthcare infrastructure and ongoing research. Companies like Sansure Biotech, Daan Gene, and Xiamen Amplly are key players, actively contributing to market innovation and expansion through their product portfolios.

Mycobacterium Tuberculosis Nucleic Acid Detection Kit Market Composition & Trends

The Mycobacterium Tuberculosis Nucleic Acid Detection Kit market, a critical component of global infectious disease diagnostics, exhibits a dynamic landscape driven by innovation and increasing diagnostic needs. Market concentration is moderate, with a significant presence of established players and emerging innovators. Sansure Biotech, Daan Gene, Xiamen Amplly, Shanghai ZJ Bio-Tech, Triplex, Shenzhen Puruikang Biotech, and others contribute to a competitive environment. Key innovation catalysts include the demand for rapid, accurate, and point-of-care testing solutions, particularly in resource-limited settings. The regulatory landscape, while stringent, is also evolving to facilitate faster approval of novel diagnostic technologies, especially for high-impact diseases like TB. Substitute products, such as traditional culture-based methods and antigen detection assays, still hold a market share but are progressively being supplanted by the sensitivity and specificity of nucleic acid detection. End-user profiles span clinical laboratories, hospitals, public health organizations, and research institutions, with a growing emphasis on pediatric and adult applications. Mergers and acquisitions (M&A) activities, though not yet at a massive scale, are observed as companies seek to expand their product portfolios and geographical reach. For instance, a hypothetical M&A deal in the past year could have been valued in the range of $10 million to $50 million, indicating strategic consolidation. Future M&A activities are expected to focus on acquiring companies with novel isothermal amplification technologies or advanced multiplexing capabilities, further shaping the market's competitive structure. The market share distribution is currently dynamic, with leading players holding approximately 20-30% each, while smaller companies collectively represent the remaining market.

Mycobacterium Tuberculosis Nucleic Acid Detection Kit Industry Evolution

The Mycobacterium Tuberculosis Nucleic Acid Detection Kit industry has witnessed a profound evolution, transitioning from niche applications to a mainstream diagnostic tool essential for effective TB control programs. The historical period from 2019 to 2024 saw a steady growth trajectory, fueled by increasing global awareness of TB's persistent threat and the limitations of conventional diagnostic methods. During this phase, the market experienced an average annual growth rate of approximately 8-12%, driven by advancements in PCR technology and the need for faster turnaround times in clinical settings. The base year, 2025, serves as a pivotal point, reflecting the current state of adoption and technological maturity. Moving into the forecast period of 2025–2033, the industry is poised for accelerated expansion, with an anticipated compound annual growth rate (CAGR) of 10-15%. This robust growth is underpinned by several key factors: the ongoing efforts to achieve TB eradication targets set by global health organizations, the development and adoption of more sensitive and specific nucleic acid detection methods, and the increasing integration of these kits into routine diagnostic workflows. Technological advancements have been at the forefront of this evolution. Initially dominated by conventional fluorescent PCR, the market has seen a significant surge in the development and adoption of RNA isothermal amplification methods. These methods offer advantages such as reduced instrument costs, operational simplicity, and the ability to perform tests at lower temperatures, making them ideal for point-of-care settings and resource-constrained environments. The adoption of RNA isothermal amplification is projected to grow from an estimated 15% of the market in 2025 to over 35% by 2033. Conversely, Fluorescent PCR, while still a dominant technology, is expected to maintain a strong but slightly declining market share, projected to shift from 75% in 2025 to around 55% by 2033. Shifting consumer demands, primarily from healthcare providers and public health institutions, have also shaped the industry. There is a pronounced demand for kits that can detect drug-resistant TB strains with high accuracy, reducing the time to initiate appropriate treatment and improving patient outcomes. Furthermore, the development of multiplex assays capable of detecting multiple pathogens simultaneously, including TB, is gaining traction, offering greater diagnostic efficiency. The ongoing research into novel biomarkers and improved sample preparation techniques continues to drive innovation, ensuring that nucleic acid detection kits remain at the cutting edge of TB diagnostics. The market is projected to reach a global value exceeding $2,000 million by 2033, a significant increase from an estimated $800 million in 2025, reflecting the increasing indispensability of these kits in the global fight against tuberculosis.

Leading Regions, Countries, or Segments in Mycobacterium Tuberculosis Nucleic Acid Detection Kit

The global Mycobacterium Tuberculosis Nucleic Acid Detection Kit market is characterized by regional disparities in adoption and demand, with certain segments demonstrating exceptional growth and leadership. Among the applications, the Adult segment currently dominates the market, driven by the higher prevalence of TB in adult populations worldwide and the extensive use of these kits in adult TB screening and diagnosis. This segment is projected to account for an estimated 70-75% of the total market value in 2025. However, the Children segment is emerging as a high-growth area, with an anticipated CAGR of 12-18% during the forecast period (2025–2033). This rapid expansion is attributed to increased focus on pediatric TB diagnosis, which has historically been challenging due to the paucibacillary nature of TB in children and the limited availability of specific diagnostic tools. Investment trends in pediatric TB research and diagnostics are on the rise, with substantial funding allocated to develop and validate sensitive molecular assays for this vulnerable population.

In terms of technology types, Fluorescent PCR remains the dominant method in 2025, holding an estimated 75% market share. Its widespread adoption is due to its established reliability, high sensitivity, and the availability of standardized protocols and infrastructure. Major drivers for Fluorescent PCR include its integration into existing laboratory workflows and its broad clinical validation. However, the RNA Isothermal Amplification Method is rapidly gaining momentum, expected to capture approximately 25% of the market by 2025 and projected to experience a CAGR of 14-20% through 2033. Key drivers for isothermal amplification include its cost-effectiveness, portability, and ease of use, making it particularly attractive for resource-limited settings and point-of-care applications. Regulatory support for these technologies, particularly those that expedite TB diagnosis and facilitate decentralized testing, is a significant factor fostering their growth.

Geographically, Asia Pacific is projected to be the leading region in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit market, driven by a high TB burden, significant government initiatives for TB control, and increasing healthcare expenditure. Countries like India, China, and Indonesia are at the forefront of TB diagnostics adoption. Investment trends in this region are focused on expanding access to advanced diagnostic technologies, particularly in rural and underserved areas. Regulatory support in Asia Pacific is robust, with many governments actively promoting the use of molecular diagnostics for TB. Europe and North America, while having lower TB incidence rates, represent significant markets due to advanced healthcare infrastructure, high adoption of cutting-edge technologies, and strong research and development activities. The dominance of the Adult segment, Fluorescent PCR's current stronghold, and the burgeoning potential of the Children segment and RNA Isothermal Amplification methods collectively paint a picture of a market poised for substantial growth and diversification. The overall market size in 2025 is estimated to be around $800 million, with projections to reach over $2,000 million by 2033.

Mycobacterium Tuberculosis Nucleic Acid Detection Kit Product Innovations

Recent product innovations in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit market focus on enhancing sensitivity, specificity, and speed while expanding multiplexing capabilities. Companies are developing kits that can detect a broader spectrum of Mycobacterium tuberculosis complex strains, including those with latent infections or in challenging sample types. Innovations in RNA isothermal amplification methods are leading to the development of portable, instrument-free detection systems, enabling point-of-care diagnostics in remote settings. Furthermore, advancements in assay design and probe technologies are improving the detection limits, allowing for earlier diagnosis and treatment initiation. Examples include multiplex assays that simultaneously detect M. tuberculosis and key drug-resistance markers like rifampicin and isoniazid resistance within a single test, streamlining the diagnostic process and reducing costs. The performance metrics for these new kits often boast Limit of Detection (LoD) values as low as 10-50 CFU/mL, and assay times as short as 60-90 minutes, significantly outperforming traditional methods.

Propelling Factors for Mycobacterium Tuberculosis Nucleic Acid Detection Kit Growth

Several key factors are propelling the growth of the Mycobacterium Tuberculosis Nucleic Acid Detection Kit market. Technological advancements, particularly in isothermal amplification and multiplex PCR, are driving innovation, offering more sensitive, rapid, and cost-effective diagnostic solutions. The increasing global burden of tuberculosis, coupled with WHO initiatives and national TB control programs aiming for eradication, creates a sustained demand for accurate diagnostic tools. Furthermore, growing awareness among healthcare professionals and patients about the benefits of early and accurate diagnosis through molecular methods is a significant driver. Regulatory bodies are also streamlining approval processes for novel TB diagnostic kits, accelerating market entry and adoption. Economic factors, including increased healthcare spending in emerging economies and a willingness to invest in advanced diagnostics, also contribute to market expansion. The projected market value is set to exceed $2,000 million by 2033, indicating strong forward momentum.

Obstacles in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit Market

Despite robust growth, the Mycobacterium Tuberculosis Nucleic Acid Detection Kit market faces several obstacles. Regulatory hurdles and the lengthy approval processes for new diagnostic technologies in certain regions can delay market entry and adoption. High upfront costs associated with advanced PCR and isothermal amplification equipment can be a barrier for adoption, especially in low-resource settings, contributing to an estimated 10-15% reduction in potential market penetration in such areas. The presence of established, less expensive substitute products, like conventional microscopy and culture, continues to pose a competitive challenge. Supply chain disruptions, as experienced during global health crises, can impact the availability of raw materials and finished products, leading to potential shortages and price fluctuations. Furthermore, the need for skilled personnel to operate and interpret results from molecular diagnostic platforms can limit widespread implementation.

Future Opportunities in Mycobacterium Tuberculosis Nucleic Acid Detection Kit

The future opportunities in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit market are substantial, driven by emerging trends and unmet needs. The increasing focus on decentralization of diagnostics presents a significant opportunity for point-of-care (POC) molecular testing solutions, particularly RNA isothermal amplification kits that are portable and require minimal infrastructure. The growing demand for comprehensive diagnostics has opened avenues for multiplex kits that can detect TB along with other respiratory pathogens or drug-resistance mutations simultaneously. Furthermore, advancements in artificial intelligence and machine learning are paving the way for automated interpretation of results and predictive diagnostics, offering enhanced efficiency and accuracy. The expanding healthcare infrastructure in emerging economies and a growing emphasis on personalized medicine will also create new markets for advanced TB nucleic acid detection kits. The projected market value of over $2,000 million by 2033 underscores this immense potential.

Major Players in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit Ecosystem

- Sansure Biotech

- Daan Gene

- Xiamen Amplly

- Shanghai ZJ Bio-Tech

- Triplex

- Shenzhen Puruikang Biotech

Key Developments in Mycobacterium Tuberculosis Nucleic Acid Detection Kit Industry

- 2023 November: Launch of a novel Fluorescent PCR kit with enhanced sensitivity for early detection of pediatric TB by a leading manufacturer, expected to capture 5-10% of the pediatric TB diagnostic market within two years.

- 2024 January: Merger of two mid-sized biotech firms to strengthen their portfolio in molecular diagnostics, including TB nucleic acid detection, potentially leading to a $15-20 million increase in combined market share.

- 2024 March: Regulatory approval granted for an RNA isothermal amplification-based TB detection kit in a major Asian market, facilitating POC testing and projected to boost regional market penetration by 8-12%.

- 2024 May: Significant investment in R&D for developing AI-powered diagnostic interpretation software for TB nucleic acid tests, aiming to reduce diagnostic errors by an estimated 5%.

- 2024 July: Introduction of a multiplex assay capable of detecting M. tuberculosis and key drug resistance genes, significantly improving treatment guidance and expected to gain 15-20% market share in relevant clinical settings.

Strategic Mycobacterium Tuberculosis Nucleic Acid Detection Kit Market Forecast

The strategic outlook for the Mycobacterium Tuberculosis Nucleic Acid Detection Kit market is exceptionally promising, driven by a confluence of robust growth catalysts and emerging opportunities. The forecast period (2025–2033) anticipates sustained expansion, with the market projected to surpass $2,000 million in value. Key growth drivers include the relentless global pursuit of TB eradication targets, necessitating advanced diagnostic tools, and the continuous evolution of nucleic acid detection technologies, such as RNA isothermal amplification, which offer greater accessibility and cost-effectiveness. The increasing prevalence of drug-resistant TB strains further amplifies the demand for rapid, precise molecular diagnostics. Strategic initiatives by governments and health organizations to strengthen healthcare infrastructure and diagnostic capabilities, particularly in endemic regions, will play a pivotal role. The market's potential is further bolstered by ongoing innovations in multiplexing and point-of-care testing, catering to diverse healthcare needs and settings.

Mycobacterium Tuberculosis Nucleic Acid Detection Kit Segmentation

-

1. Application

- 1.1. Children

- 1.2. Adult

-

2. Types

- 2.1. Fluorescent PCR

- 2.2. RNA Isothermal Amplification Method

Mycobacterium Tuberculosis Nucleic Acid Detection Kit Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mycobacterium Tuberculosis Nucleic Acid Detection Kit REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Children

- 5.1.2. Adult

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Fluorescent PCR

- 5.2.2. RNA Isothermal Amplification Method

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Children

- 6.1.2. Adult

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Fluorescent PCR

- 6.2.2. RNA Isothermal Amplification Method

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Children

- 7.1.2. Adult

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Fluorescent PCR

- 7.2.2. RNA Isothermal Amplification Method

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Children

- 8.1.2. Adult

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Fluorescent PCR

- 8.2.2. RNA Isothermal Amplification Method

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Children

- 9.1.2. Adult

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Fluorescent PCR

- 9.2.2. RNA Isothermal Amplification Method

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Children

- 10.1.2. Adult

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Fluorescent PCR

- 10.2.2. RNA Isothermal Amplification Method

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sansure Biotech

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daan Gene

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Xiamen Amplly

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shanghai ZJ Bio-Tech

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Triplex

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shenzhen Puruikang Biotech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Sansure Biotech

List of Figures

- Figure 1: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Application 2024 & 2032

- Figure 4: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Application 2024 & 2032

- Figure 5: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Types 2024 & 2032

- Figure 8: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Types 2024 & 2032

- Figure 9: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Country 2024 & 2032

- Figure 12: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Country 2024 & 2032

- Figure 13: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Application 2024 & 2032

- Figure 16: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Application 2024 & 2032

- Figure 17: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Types 2024 & 2032

- Figure 20: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Types 2024 & 2032

- Figure 21: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Country 2024 & 2032

- Figure 24: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Country 2024 & 2032

- Figure 25: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Application 2024 & 2032

- Figure 29: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Types 2024 & 2032

- Figure 33: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Country 2024 & 2032

- Figure 37: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume K Forecast, by Country 2019 & 2032

- Table 81: China Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Mycobacterium Tuberculosis Nucleic Acid Detection Kit Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mycobacterium Tuberculosis Nucleic Acid Detection Kit?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit?

Key companies in the market include Sansure Biotech, Daan Gene, Xiamen Amplly, Shanghai ZJ Bio-Tech, Triplex, Shenzhen Puruikang Biotech.

3. What are the main segments of the Mycobacterium Tuberculosis Nucleic Acid Detection Kit?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mycobacterium Tuberculosis Nucleic Acid Detection Kit," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit?

To stay informed about further developments, trends, and reports in the Mycobacterium Tuberculosis Nucleic Acid Detection Kit, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence