Key Insights

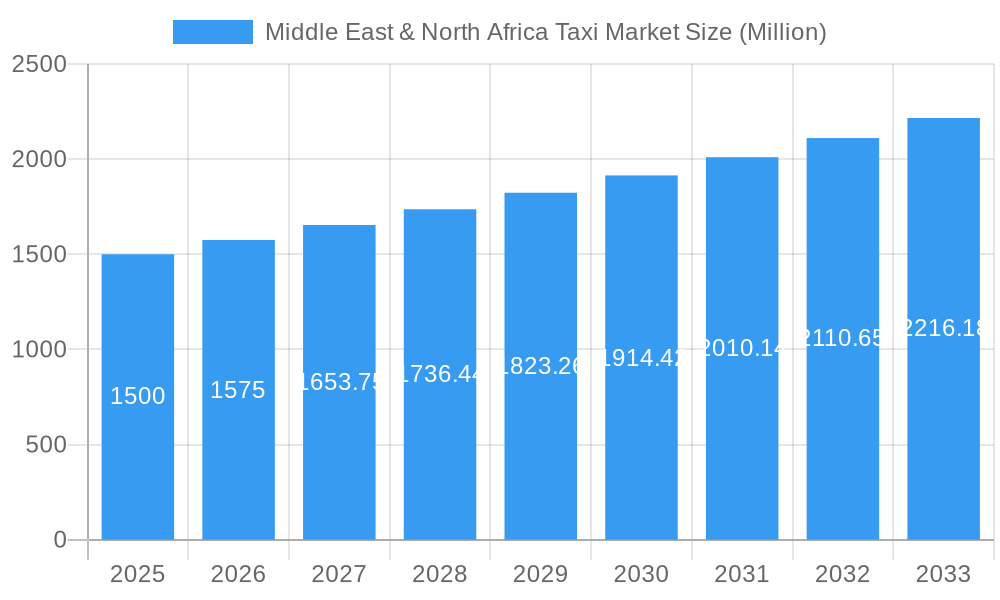

The Middle East & North Africa (MENA) taxi market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. Key drivers include rapid urbanization, increased disposable incomes, and the widespread adoption of ride-hailing applications and GPS technology, which enhance user experience and booking efficiency. While online bookings are gaining traction, offline transactions remain relevant, particularly in regions with limited internet access. The market caters to a diverse customer base with options for both budget-friendly and premium vehicle services. Intense competition from global leaders like Uber and Lyft, and regional players such as Careem, fosters innovation and operational improvements. However, regulatory complexities and infrastructural gaps in select MENA nations may present some growth impediments.

Middle East & North Africa Taxi Market Market Size (In Billion)

Despite these challenges, the long-term outlook for the MENA taxi market is highly promising. Ongoing infrastructure investments and enhancements to transportation networks are expected to catalyze further growth. Diversified service offerings, including airport transfers and corporate solutions, will also contribute to market expansion. The integration of advanced technologies like electric and autonomous vehicles is anticipated to revolutionize the MENA taxi industry, unlocking new avenues for innovation and sustainable development.

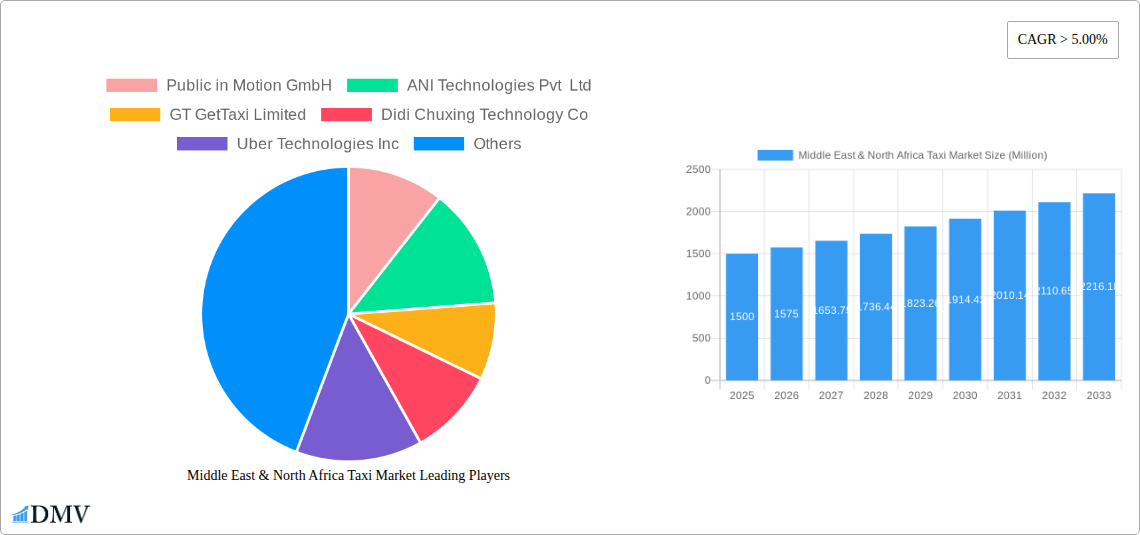

Middle East & North Africa Taxi Market Company Market Share

Middle East & North Africa Taxi Market: Growth and Forecast (2025-2033)

This comprehensive report analyzes the dynamic Middle East & North Africa (MENA) taxi market from 2025 to 2033, with a base year of 2025. The MENA taxi market is estimated at 265.51 billion in 2025 and is projected to expand significantly by 2033. This report offers in-depth insights into market size, segmentation, key competitive strategies, and emerging trends, providing essential data for informed investment and strategic planning.

Middle East & North Africa Taxi Market Market Composition & Trends

This section delves into the competitive landscape of the MENA taxi market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user behavior. We examine the impact of mergers and acquisitions (M&A) activities, providing insights into deal values and their influence on market share distribution. Key players like Uber Technologies Inc, Careem (ANI Technologies Pvt Ltd), and Bolt Technology OÜ are analyzed for their strategies and market positioning. The report also examines the rise of innovative ride-sharing models and the impact of evolving regulations on market growth. We assess the influence of substitute transportation modes, such as public transit and ride-sharing apps, on the taxi market's evolution. Furthermore, we present a detailed analysis of end-user preferences and their impact on service type demand. Data on market share distribution (e.g., Uber holding xx% market share in 2025) and M&A deal values (e.g., an average of xx Million per deal in the past five years) provide a comprehensive overview of the market dynamics.

- Market Share Distribution by Key Players (2025): Uber - xx%, Careem - xx%, Bolt - xx%, Others - xx%

- Average M&A Deal Value (2019-2024): xx Million

- Number of M&A deals (2019-2024): xx

Middle East & North Africa Taxi Market Industry Evolution

This section offers a detailed analysis of the MENA taxi market's growth trajectory from 2019 to 2033. We examine the impact of technological advancements, including the rise of ride-hailing apps, the introduction of electric and autonomous vehicles, and the integration of advanced technologies like AI and machine learning. The evolving consumer preferences and their influence on service demand are analyzed in detail, alongside an in-depth review of market growth rates and the adoption of new technologies. For example, the shift towards online booking and the increasing popularity of ride-sharing are quantified, providing insights into the market's dynamic nature. We also examine government regulations and their impact on market growth rates, highlighting specific policies that either stimulate or hinder market expansion. The section concludes with an assessment of the overall impact of these factors on the future of the MENA taxi market. Growth rates for the historical period (2019-2024) are estimated at xx% annually and are projected to be at xx% for the forecast period (2025-2033).

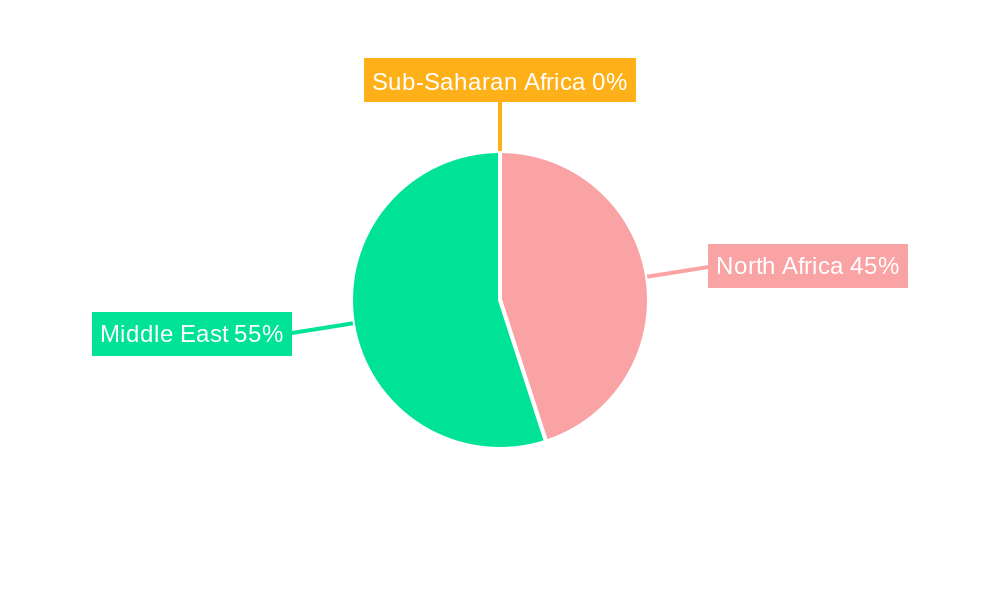

Leading Regions, Countries, or Segments in Middle East & North Africa Taxi Market

This section identifies the leading regions, countries, and segments within the MENA taxi market based on service type (ride-hailing, ride-sharing), booking type (online, offline), and vehicle type (budget, luxury). The dominant regions are analyzed through a multi-faceted approach considering several key factors.

- Key Drivers for Dominant Regions/Countries:

- High population density

- Strong economic growth

- Favorable regulatory environment

- High smartphone penetration

- Significant investments in infrastructure

- Dominant Segments: A detailed examination into the factors driving the dominance of specific segments, such as the high demand for ride-hailing services or the preference for online booking. This section provides a thorough qualitative and quantitative analysis of why these segments outperform others in terms of market share and revenue generation. For instance, the report will analyze why online booking is more popular than offline booking in certain regions.

Middle East & North Africa Taxi Market Product Innovations

This section showcases recent product innovations within the MENA taxi market. The focus lies on unique selling propositions, technological advancements, and performance metrics of newly introduced products or services. This includes the integration of new technologies to enhance services such as GPS tracking, digital payment systems, and in-app communication features. It explores the benefits and potential drawbacks of these innovations, providing valuable insights for businesses seeking to stay competitive in a constantly evolving marketplace. The emergence of electric and autonomous vehicle options for taxis are analyzed for their impact on market dynamics and customer preferences.

Propelling Factors for Middle East & North Africa Taxi Market Growth

Several factors contribute to the growth of the MENA taxi market. Technological advancements, such as the widespread adoption of ride-hailing apps and the introduction of electric vehicles, significantly enhance convenience and efficiency. Furthermore, robust economic growth in several MENA countries fuels increased disposable income, boosting demand for taxi services. Finally, supportive government regulations and policies aimed at promoting transportation innovation further contribute to the market's expansion.

Obstacles in the Middle East & North Africa Taxi Market Market

The MENA taxi market faces several challenges. Regulatory hurdles, including licensing requirements and permit fees, can hinder market entry and expansion. Supply chain disruptions, particularly in the case of vehicle procurement, can lead to operational inefficiencies. Furthermore, intense competition among numerous players, both established and emerging, creates a challenging environment, impacting profitability. These factors collectively impact the overall growth potential of the market.

Future Opportunities in Middle East & North Africa Taxi Market

Despite challenges, significant opportunities exist for growth in the MENA taxi market. The expansion into underserved areas, the adoption of innovative technologies like autonomous vehicles, and the catering to the evolving preferences of customers represent promising avenues for future growth. The increasing focus on sustainability also presents opportunities for environmentally friendly taxi services.

Major Players in the Middle East & North Africa Taxi Market Ecosystem

- Public in Motion GmbH

- ANI Technologies Pvt Ltd (Careem)

- GT GetTaxi Limited

- Didi Chuxing Technology Co

- Uber Technologies Inc

- Lyft Inc

- Leena (Fast Tamkeen For Transportation LLC)

- Private Taxi Hurghada

- Bolt Technology OÜ

- CAR2GO (Goto Global Mobility Ltd)

Key Developments in Middle East & North Africa Taxi Market Industry

- May 2022: All Karwa taxis in Doha are expected to be fully electric, promoting eco-mobility in public transport.

- February 2022: Bayanat and WeRide complete phase 1 trials of an autonomous taxi service (TXAI) in the UAE.

- November 2021: Yassir, an Algerian ride-hailing startup, raises USD 30 Million in Series A funding.

Strategic Middle East & North Africa Taxi Market Market Forecast

The MENA taxi market is poised for significant growth, driven by technological advancements, increasing urbanization, and rising disposable incomes. The adoption of electric and autonomous vehicles, along with innovative business models, will shape the market's future. The forecast period presents substantial opportunities for players who adapt to evolving customer preferences and regulatory landscapes. The market is expected to experience substantial growth in the coming years, surpassing xx Million by 2033.

Middle East & North Africa Taxi Market Segmentation

-

1. Booking Type

- 1.1. Online Booking

- 1.2. Offline Booking

-

2. Vehicle Type

- 2.1. Budget Car

- 2.2. Luxury Car

-

3. Service Type

- 3.1. Ride Hailing

- 3.2. Ride Sharing

Middle East & North Africa Taxi Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East & North Africa Taxi Market Regional Market Share

Geographic Coverage of Middle East & North Africa Taxi Market

Middle East & North Africa Taxi Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inclusion of E-bikes in the Sharing Fleet

- 3.3. Market Restrains

- 3.3.1. Limited Infrastructure May Hinder Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Taxi Services Businesses in Middle East

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & North Africa Taxi Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online Booking

- 5.1.2. Offline Booking

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Budget Car

- 5.2.2. Luxury Car

- 5.3. Market Analysis, Insights and Forecast - by Service Type

- 5.3.1. Ride Hailing

- 5.3.2. Ride Sharing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Public in Motion GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ANI Technologies Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GT GetTaxi Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Didi Chuxing Technology Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Uber Technologies Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Lyft Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Leena (Fast Tamkeen For Transportation LLC)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Private Taxi Hurghada

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bolt Technology OÜ

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CAR2GO (Goto Global Mobility Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Public in Motion GmbH

List of Figures

- Figure 1: Middle East & North Africa Taxi Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East & North Africa Taxi Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East & North Africa Taxi Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 2: Middle East & North Africa Taxi Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Middle East & North Africa Taxi Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 4: Middle East & North Africa Taxi Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Middle East & North Africa Taxi Market Revenue billion Forecast, by Booking Type 2020 & 2033

- Table 6: Middle East & North Africa Taxi Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Middle East & North Africa Taxi Market Revenue billion Forecast, by Service Type 2020 & 2033

- Table 8: Middle East & North Africa Taxi Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East & North Africa Taxi Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & North Africa Taxi Market?

The projected CAGR is approximately 9%.

2. Which companies are prominent players in the Middle East & North Africa Taxi Market?

Key companies in the market include Public in Motion GmbH, ANI Technologies Pvt Ltd, GT GetTaxi Limited, Didi Chuxing Technology Co, Uber Technologies Inc, Lyft Inc, Leena (Fast Tamkeen For Transportation LLC)*List Not Exhaustive, Private Taxi Hurghada, Bolt Technology OÜ, CAR2GO (Goto Global Mobility Ltd).

3. What are the main segments of the Middle East & North Africa Taxi Market?

The market segments include Booking Type, Vehicle Type, Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 265.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inclusion of E-bikes in the Sharing Fleet.

6. What are the notable trends driving market growth?

Increasing Taxi Services Businesses in Middle East.

7. Are there any restraints impacting market growth?

Limited Infrastructure May Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

May 2022: All Karwa taxis around Doha are expected to be fully electric in the country's latest effort to switch to eco-mobility in public transport. Hybrid electric vehicles have a built-in self-charging system and are powered by highly efficient, low-emission gasoline engines and electric motors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & North Africa Taxi Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & North Africa Taxi Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & North Africa Taxi Market?

To stay informed about further developments, trends, and reports in the Middle East & North Africa Taxi Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence