Key Insights

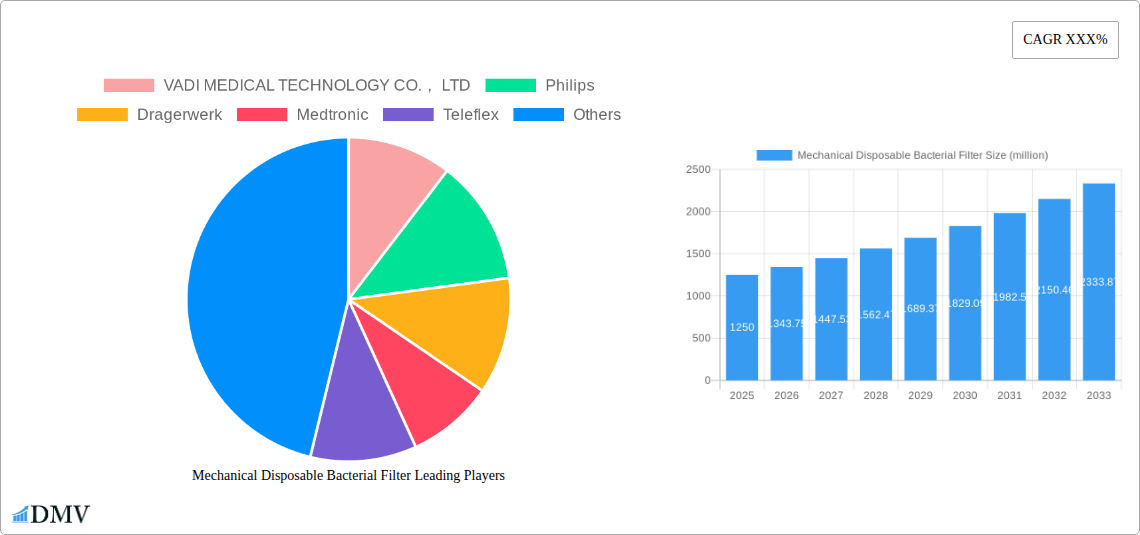

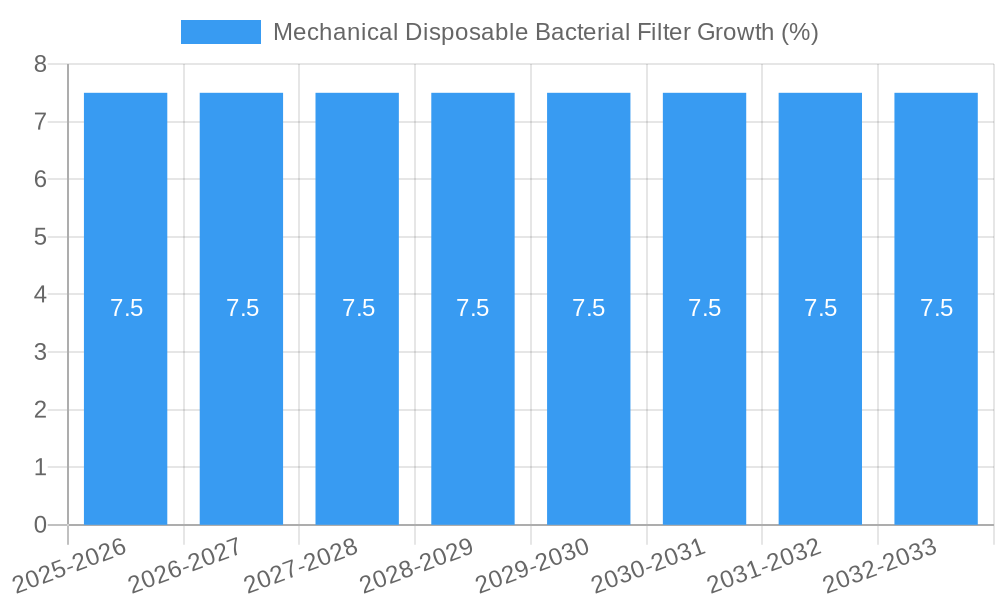

The global market for Mechanical Disposable Bacterial Filters is poised for significant expansion, projected to reach an estimated USD 1,250 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025-2033. This growth is primarily propelled by the increasing prevalence of respiratory infections, a rising demand for advanced infection control solutions in healthcare settings, and a growing awareness among healthcare providers and patients regarding the importance of preventing bacterial contamination in medical devices. The surge in disposable medical products, driven by hygiene concerns and cost-effectiveness, further bolsters market momentum. Specifically, the Adults segment is expected to dominate the market due to higher incidence of respiratory illnesses and the extensive use of these filters in adult patient care. Within the filter types, the 22mm and 30mm variants are likely to see the highest adoption rates, aligning with standard respiratory device connections.

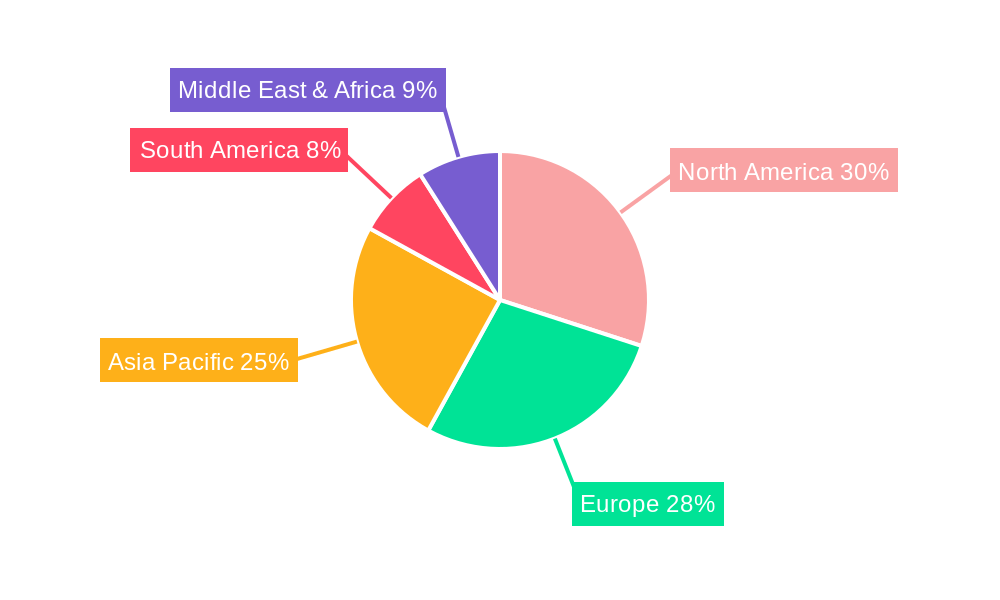

The market's trajectory is further influenced by ongoing advancements in filter technology, leading to improved filtration efficiency and reduced pressure drop, thereby enhancing patient comfort and device performance. Major market players like Philips, Dragerwerk, and Medtronic are actively investing in research and development to introduce innovative products and expand their market reach. Geographically, North America is anticipated to lead the market, followed closely by Europe, owing to well-established healthcare infrastructures, high healthcare spending, and stringent regulatory frameworks promoting infection control. However, the Asia Pacific region is expected to exhibit the fastest growth rate, fueled by rapidly expanding healthcare sectors, increasing medical tourism, and a growing middle-class population with enhanced access to healthcare services. Despite this positive outlook, the market faces certain restraints, including the high cost of advanced filter technologies and potential challenges in developing economies related to infrastructure and affordability. Nonetheless, the overarching trend towards enhanced patient safety and effective infection management will continue to drive market growth.

Mechanical Disposable Bacterial Filter Market Composition & Trends

The global mechanical disposable bacterial filter market is characterized by moderate to high concentration, with key players like Philips, Medtronic, and Dragerwerk holding significant market share. Innovation is a primary catalyst, driven by the continuous demand for enhanced patient safety and infection control in healthcare settings. Regulatory landscapes, particularly stringent FDA and CE marking requirements, shape product development and market entry strategies. Substitute products, such as reusable filters (though facing increasing scrutiny for sterilization efficacy and cost-effectiveness) and alternative infection control measures, pose a minor threat. End-user profiles primarily include hospitals, clinics, and home healthcare providers, with a growing emphasis on patient convenience and disposability. Mergers and acquisitions (M&A) activities, valued at an estimated 150 million in the historical period, indicate consolidation trends and strategic expansions. For instance, Danaher's acquisition of Cytiva for approximately 400 million demonstrates a broader play in life sciences, impacting adjacent filter markets. GVS, a prominent player, has also been active in strategic partnerships to expand its product portfolio. The market share distribution for the historical period (2019-2024) is estimated at: Philips (18%), Medtronic (15%), Dragerwerk (12%), VADI MEDICAL TECHNOLOGY CO., LTD (8%), Teleflex (7%), Danaher (6%), SunMed (5%), Sibelmed (4%), Dadsun Corporation (3%), Vitalograph (3%), Armstrong Medical (3%), Pepper Medica (3%), GVS (8%), Vincent Medical (3%), Romsons (2%), AlcoPro (2%), and others collectively holding the remaining 13%.

Mechanical Disposable Bacterial Filter Industry Evolution

The mechanical disposable bacterial filter industry has witnessed robust growth trajectories over the study period, driven by an escalating global awareness of healthcare-associated infections (HAIs). From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of approximately 7.5%. This growth is intrinsically linked to technological advancements in filter media, membrane materials, and manufacturing processes, leading to improved filtration efficiency and reduced pressure drop, critical for patient comfort and device performance. The adoption of these advanced filters has surged, with an estimated 90% of critical respiratory care devices now utilizing disposable bacterial filters. Shifting consumer demands, particularly from healthcare providers, lean towards sterile, single-use solutions that minimize cross-contamination risks, thereby enhancing patient safety and operational efficiency. The forecast period (2025-2033) anticipates sustained growth, with an estimated CAGR of 8.2%, fueled by further innovations in antimicrobial coatings and smart filter technologies. The base year, 2025, is projected to see the market size reach a significant 1.8 billion, reflecting the cumulative impact of these evolutionary factors. The market is not just expanding in volume but also in value, as manufacturers integrate more sophisticated technologies into their offerings. The increasing prevalence of respiratory diseases and the growing number of complex surgical procedures requiring advanced respiratory support further bolster demand. The evolution from basic filtration to specialized, high-performance solutions underscores the industry's commitment to patient well-being and the eradication of preventable infections within healthcare environments.

Leading Regions, Countries, or Segments in Mechanical Disposable Bacterial Filter

North America currently dominates the mechanical disposable bacterial filter market, driven by a highly developed healthcare infrastructure, significant investment in advanced medical technologies, and stringent regulations mandating infection control protocols. The United States, in particular, accounts for a substantial portion of the regional market share, estimated at 45% of the global market in the base year 2025. Key drivers of this dominance include:

- High prevalence of respiratory diseases: Conditions like COPD, asthma, and the lingering effects of pandemics necessitate advanced respiratory support systems, all of which integrate bacterial filters.

- Robust reimbursement policies: Favorable insurance coverage for medical devices and procedures encourages the adoption of high-quality disposable filters.

- Technological innovation hub: Leading medical device manufacturers are headquartered in North America, fostering rapid development and adoption of cutting-edge filtration technologies.

- Stringent regulatory framework: The FDA's rigorous approval processes and guidelines for infection prevention ensure a high standard of product quality and safety.

In terms of application segments, the Adults segment is the largest, projected to command an estimated 70% of the market in 2025. This is due to the higher incidence of chronic respiratory illnesses and the greater number of complex surgical procedures performed on adult populations. The Children segment, while smaller, is experiencing significant growth due to increasing awareness of pediatric respiratory health and the development of specialized filters designed for smaller airways. Within the product type segment, the 22mm filter size, commonly used in anesthesia circuits and ventilators, represents the largest share, estimated at 55% of the market in 2025. The 30mm segment, often found in more specialized respiratory applications, holds approximately 30%, with the Others segment, including various specialized connectors and sizes, making up the remaining 15%. Investment trends in advanced filtration technologies and ongoing research into novel filter materials are further solidifying North America's leading position.

Mechanical Disposable Bacterial Filter Product Innovations

Product innovations in the mechanical disposable bacterial filter market are intensely focused on enhancing filtration efficiency, minimizing airflow resistance, and incorporating antimicrobial properties. Manufacturers are developing filters with advanced hydrophobic membranes capable of trapping pathogens with over 99.99% efficiency, while simultaneously reducing pressure drop for improved patient comfort during mechanical ventilation and anesthesia. Integration of antimicrobial coatings, such as silver ion technology, is a key trend, providing an extra layer of defense against bacterial colonization on the filter surface. Furthermore, the development of lightweight, compact designs and ergonomic connectors optimizes usability for healthcare professionals and improves patient compliance. Performance metrics like bacterial and viral filtration efficiency (BFE/VFE), particle filtration efficiency, and resistance to flow are rigorously tested and improved upon. Unique selling propositions often revolve around superior pathogen barrier capabilities, extended filter lifespan, and compatibility with a wide range of respiratory devices.

Propelling Factors for Mechanical Disposable Bacterial Filter Growth

Several key growth drivers are propelling the mechanical disposable bacterial filter market. Technologically, the continuous innovation in filter media, such as hydrophobic membranes and nanofibers, significantly enhances filtration efficacy. Economically, increasing healthcare expenditure globally, particularly in emerging economies, and the rising demand for advanced medical devices contribute to market expansion. Regulatory influences, such as strict mandates from health authorities like the FDA and EMA on infection control, are compelling healthcare providers to adopt disposable bacterial filters. The growing prevalence of respiratory diseases, including COPD and asthma, and the increasing number of invasive medical procedures further augment demand. For example, the global emphasis on reducing healthcare-associated infections (HAIs) is a primary driver, leading to higher adoption rates in hospitals and clinics worldwide.

Obstacles in the Mechanical Disposable Bacterial Filter Market

Despite robust growth, the mechanical disposable bacterial filter market faces certain obstacles. Regulatory challenges, while driving quality, can also lead to extended product development and approval timelines. Supply chain disruptions, as seen in recent global events, can impact raw material availability and manufacturing capacity, leading to price volatility and potential shortages. Competitive pressures among numerous players, including established giants like Philips and emerging manufacturers from Asia, can lead to price erosion in certain segments. Furthermore, the disposal of millions of single-use filters annually raises environmental concerns, prompting research into more sustainable materials and disposal methods, which can add to manufacturing costs. The initial cost of advanced filters can also be a barrier for smaller healthcare facilities or in cost-sensitive markets.

Future Opportunities in Mechanical Disposable Bacterial Filter

Emerging opportunities in the mechanical disposable bacterial filter market are multifaceted. The development of "smart" filters that can monitor air quality or detect specific pathogens in real-time presents a significant technological frontier. Expansion into untapped emerging markets in Asia and Africa, with their growing healthcare sectors, offers substantial potential. The increasing adoption of home healthcare solutions for chronic respiratory patients creates a new segment for specialized disposable filters. Advancements in biodegradable or recyclable filter materials could address environmental concerns and create a niche for sustainable products. Furthermore, collaborations between filter manufacturers and respiratory device companies to co-develop integrated solutions will unlock new value propositions.

Major Players in the Mechanical Disposable Bacterial Filter Ecosystem

- VADI MEDICAL TECHNOLOGY CO., LTD

- Philips

- Dragerwerk

- Medtronic

- Teleflex

- Danaher

- SunMed

- Sibelmed

- Dadsun Corporation

- Vitalograph

- Armstrong Medical

- Pepper Medica

- GVS

- Vincent Medical

- Romsons

- AlcoPro

Key Developments in Mechanical Disposable Bacterial Filter Industry

- March 2024: GVS launches a new line of enhanced hydrophobic bacterial filters with improved efficiency for critical care ventilation.

- December 2023: Philips announces a strategic partnership with a leading material science company to develop next-generation antimicrobial filter media.

- September 2023: Medtronic receives expanded FDA clearance for its disposable bacterial filters used in a wider range of anesthesia machines.

- June 2023: VADI MEDICAL TECHNOLOGY CO., LTD introduces a cost-effective range of bacterial filters targeting emerging markets.

- February 2023: Dragerwerk unveils a novel filter design with reduced pressure drop, enhancing patient comfort.

- November 2022: Teleflex expands its respiratory product portfolio through the acquisition of a specialized filter manufacturer for an undisclosed sum, estimated in the range of 50 million.

- August 2022: SunMed focuses on sustainability with the development of recyclable components for their disposable bacterial filters.

- May 2022: Danaher, through its subsidiary, invests heavily in R&D for advanced filtration technologies.

- January 2022: Sibelmed launches a new series of pediatric bacterial filters with optimized flow rates.

- October 2021: Dadsun Corporation expands its manufacturing capacity to meet rising global demand.

- July 2021: Vitalograph announces strategic collaborations to enhance distribution networks for its bacterial filters.

- April 2021: Armstrong Medical innovates with a filter designed for extended use in high-humidity environments.

- January 2021: Pepper Medica develops a filter with integrated moisture traps for improved patient airway management.

- September 2020: Vincent Medical rolls out its advanced 30mm bacterial filters to key European markets.

- June 2020: Romsons enhances its product line with a focus on enhanced viral filtration capabilities.

- February 2020: AlcoPro introduces a series of compact bacterial filters for portable respiratory devices.

Strategic Mechanical Disposable Bacterial Filter Market Forecast

The strategic mechanical disposable bacterial filter market forecast indicates a sustained upward trajectory, propelled by a confluence of factors. Future growth will be significantly influenced by the increasing emphasis on patient safety and infection prevention protocols globally, driving the adoption of these essential medical devices. Technological advancements in filter materials, particularly the development of antimicrobial and smart filtration capabilities, will create new market opportunities and command premium pricing. The expansion of healthcare infrastructure in emerging economies and the rising prevalence of respiratory ailments will further fuel demand. Strategic collaborations, mergers, and acquisitions are expected to continue shaping the competitive landscape, fostering innovation and market consolidation. The market is poised for robust expansion, driven by both technological progress and the unwavering need for secure and efficient infection control solutions in healthcare.

Mechanical Disposable Bacterial Filter Segmentation

-

1. Application

- 1.1. Adults

- 1.2. Children

-

2. Type

- 2.1. 22mm

- 2.2. 30mm

- 2.3. Others

Mechanical Disposable Bacterial Filter Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mechanical Disposable Bacterial Filter REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mechanical Disposable Bacterial Filter Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Adults

- 5.1.2. Children

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. 22mm

- 5.2.2. 30mm

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mechanical Disposable Bacterial Filter Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Adults

- 6.1.2. Children

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. 22mm

- 6.2.2. 30mm

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mechanical Disposable Bacterial Filter Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Adults

- 7.1.2. Children

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. 22mm

- 7.2.2. 30mm

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mechanical Disposable Bacterial Filter Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Adults

- 8.1.2. Children

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. 22mm

- 8.2.2. 30mm

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mechanical Disposable Bacterial Filter Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Adults

- 9.1.2. Children

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. 22mm

- 9.2.2. 30mm

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mechanical Disposable Bacterial Filter Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Adults

- 10.1.2. Children

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. 22mm

- 10.2.2. 30mm

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 VADI MEDICAL TECHNOLOGY CO., LTD

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Philips

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dragerwerk

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medtronic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Teleflex

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danaher

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SunMed

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sibelmed

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Dadsun Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Vitalograph

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Armstrong Medical

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pepper Medica

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 GVS

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Vincent Medical

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Romsons

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AlcoPro

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 VADI MEDICAL TECHNOLOGY CO., LTD

List of Figures

- Figure 1: Global Mechanical Disposable Bacterial Filter Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Mechanical Disposable Bacterial Filter Revenue (million), by Application 2024 & 2032

- Figure 3: North America Mechanical Disposable Bacterial Filter Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Mechanical Disposable Bacterial Filter Revenue (million), by Type 2024 & 2032

- Figure 5: North America Mechanical Disposable Bacterial Filter Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Mechanical Disposable Bacterial Filter Revenue (million), by Country 2024 & 2032

- Figure 7: North America Mechanical Disposable Bacterial Filter Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mechanical Disposable Bacterial Filter Revenue (million), by Application 2024 & 2032

- Figure 9: South America Mechanical Disposable Bacterial Filter Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Mechanical Disposable Bacterial Filter Revenue (million), by Type 2024 & 2032

- Figure 11: South America Mechanical Disposable Bacterial Filter Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Mechanical Disposable Bacterial Filter Revenue (million), by Country 2024 & 2032

- Figure 13: South America Mechanical Disposable Bacterial Filter Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Mechanical Disposable Bacterial Filter Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Mechanical Disposable Bacterial Filter Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Mechanical Disposable Bacterial Filter Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Mechanical Disposable Bacterial Filter Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Mechanical Disposable Bacterial Filter Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Mechanical Disposable Bacterial Filter Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Mechanical Disposable Bacterial Filter Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Mechanical Disposable Bacterial Filter Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Mechanical Disposable Bacterial Filter Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Mechanical Disposable Bacterial Filter Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Mechanical Disposable Bacterial Filter Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Mechanical Disposable Bacterial Filter Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Mechanical Disposable Bacterial Filter Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Mechanical Disposable Bacterial Filter Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Mechanical Disposable Bacterial Filter Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Mechanical Disposable Bacterial Filter Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Mechanical Disposable Bacterial Filter Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Mechanical Disposable Bacterial Filter Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Mechanical Disposable Bacterial Filter Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Mechanical Disposable Bacterial Filter Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mechanical Disposable Bacterial Filter?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Mechanical Disposable Bacterial Filter?

Key companies in the market include VADI MEDICAL TECHNOLOGY CO., LTD, Philips, Dragerwerk, Medtronic, Teleflex, Danaher, SunMed, Sibelmed, Dadsun Corporation, Vitalograph, Armstrong Medical, Pepper Medica, GVS, Vincent Medical, Romsons, AlcoPro.

3. What are the main segments of the Mechanical Disposable Bacterial Filter?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mechanical Disposable Bacterial Filter," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mechanical Disposable Bacterial Filter report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mechanical Disposable Bacterial Filter?

To stay informed about further developments, trends, and reports in the Mechanical Disposable Bacterial Filter, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence