Key Insights

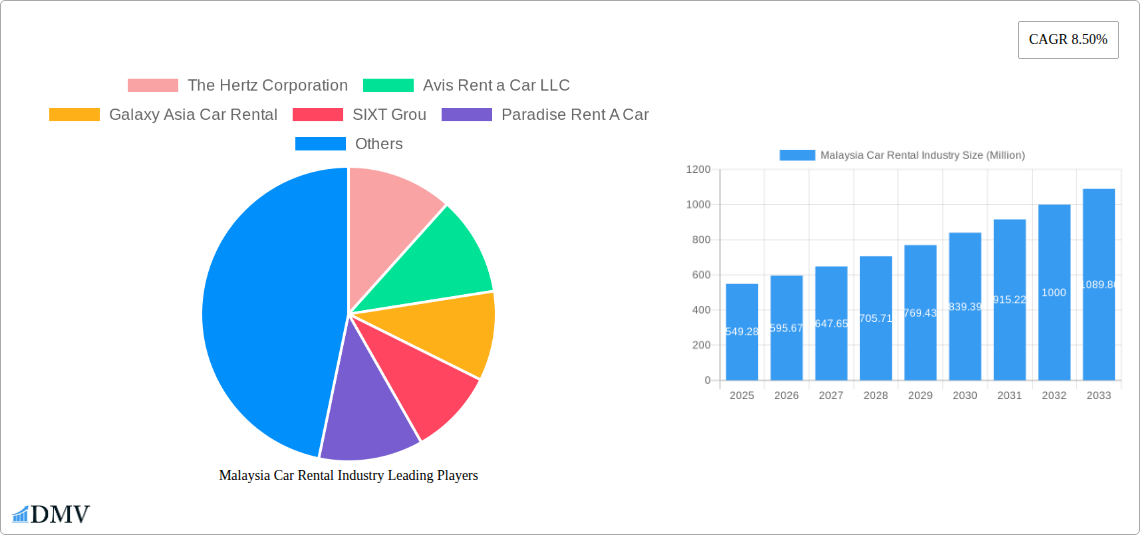

The Malaysian car rental market, valued at RM 549.28 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.50% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning tourism sector in Malaysia significantly contributes to demand, with increasing numbers of both domestic and international travelers opting for rental vehicles for convenient exploration. Furthermore, the rising middle class and increased disposable incomes are driving higher personal vehicle usage, supplementing the demand for short-term rentals. The convenience and flexibility offered by online booking platforms further accelerate market growth. While the market faces challenges such as fluctuating fuel prices and potential economic downturns that could impact consumer spending, the overall positive economic outlook and continued investment in tourism infrastructure suggest a strong growth trajectory. Segmentation analysis reveals that online bookings are gaining traction, overtaking offline bookings, and the short-term rental segment dominates due to tourist activity. SUVs and MPVs are popular choices, reflecting family travel preferences. The competitive landscape includes both international players like Hertz and Avis, and local operators like Galaxy Asia Car Rental, indicating a dynamic and evolving market structure.

Malaysia Car Rental Industry Market Size (In Million)

The future of the Malaysian car rental market is promising, with continued growth expected. Strategic investments by rental companies in technological advancements such as user-friendly mobile apps and expanded fleet options will be crucial for maintaining competitiveness. Expansion into niche segments, such as providing specialized vehicles for corporate events or offering long-term leasing options for expatriates, presents significant opportunities. Understanding evolving consumer preferences, particularly regarding sustainability and eco-friendly vehicles, will be key to sustaining growth. Addressing potential regulatory changes related to vehicle emissions and licensing will be essential for long-term success in this dynamic and increasingly competitive market. The dominance of short-term rentals driven by tourism highlights the need for effective strategies to manage seasonal demand fluctuations and optimize pricing accordingly.

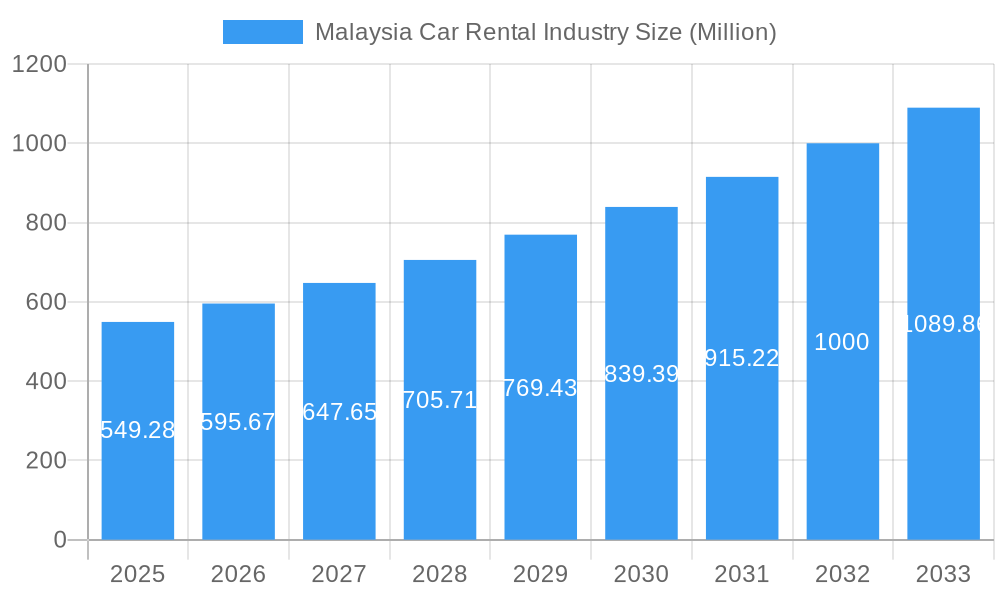

Malaysia Car Rental Industry Company Market Share

Malaysia Car Rental Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Malaysia car rental industry, offering valuable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a base year of 2025, this study unveils market trends, competitive dynamics, and future growth potential. The report projects a market size of xx Million by 2033, highlighting significant opportunities within this dynamic sector.

Malaysia Car Rental Industry Market Composition & Trends

This section delves into the intricate structure of the Malaysian car rental market, examining its concentration, innovation drivers, regulatory environment, and competitive landscape. The market is characterized by a blend of international giants and local players, with a combined revenue exceeding xx Million in 2024.

Market Concentration: The market exhibits moderate concentration, with key players like The Hertz Corporation, Avis Rent a Car LLC, and Europcar Mobility Group holding significant market share, but several smaller, regional players also contributing substantially. The market share distribution is estimated as follows: Hertz (15%), Avis (12%), Europcar (8%), Others (65%).

Innovation Catalysts: The adoption of online booking platforms, electric vehicle integration, and innovative pricing models are key drivers of market innovation. The recent partnership between Sime Darby Auto Bavaria and Hertz Malaysia to offer luxury electric vehicles highlights this trend.

Regulatory Landscape: Government regulations concerning vehicle licensing, insurance, and environmental standards significantly impact market operations. Any changes in these regulations could influence the growth trajectory.

Substitute Products: Ride-hailing services and public transportation present significant competition, particularly for short-term rentals within urban areas.

End-User Profiles: The industry caters to a diverse clientele including tourists, business travelers, and local residents. The report analyzes these segments and their respective rental preferences.

M&A Activities: While major M&A deals were not prevalent in the recent past, smaller acquisitions and partnerships are common. The total value of M&A activity in the historical period (2019-2024) is estimated at xx Million.

Malaysia Car Rental Industry Industry Evolution

This section charts the evolution of the Malaysian car rental market, analyzing growth trajectories, technological advancements, and evolving consumer preferences. The industry experienced substantial growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%.

Technological advancements such as mobile apps, online booking systems, and fleet management software have streamlined operations and improved customer experience. The increasing popularity of online booking, driven by convenience and price transparency, is pushing the industry towards digital transformation. Meanwhile, shifting consumer demands are leading to greater emphasis on vehicle diversity, including the growth of electric vehicle rental options. Furthermore, the market has seen increased interest in long-term rentals, reflecting a shift in customer needs. This trend is supported by an increasing number of businesses opting for fleet rental solutions. The future is likely to see increased competition from new entrants and innovative business models, further shaping the industry's evolution.

Leading Regions, Countries, or Segments in Malaysia Car Rental Industry

The Malaysian car rental market exhibits regional variations in growth and market share. Kuala Lumpur and other major cities, due to high tourist traffic and business activity, constitute the leading regions.

By Booking Type: Online booking is rapidly gaining traction, outpacing offline bookings, driven by convenience and competitive pricing.

By Rental Duration: Short-term rentals constitute the largest segment, catering to tourists and business travelers. However, the long-term rental segment is experiencing notable growth due to corporate demand and relocation needs.

By Vehicle Type: Sedans remain the most popular vehicle type, followed by SUVs, catering to diverse customer needs. Hatchbacks and MPVs also hold a considerable share of the market.

By Application Type: Tourism and business commuting represent the dominant application types. Growth in tourism contributes significantly to short-term rental demand, while business travel and corporate needs fuel long-term rental demand.

Key Drivers:

- Increased investment in technology and infrastructure.

- Supportive government policies promoting tourism and sustainable transportation.

- Rising disposable incomes and increased travel among the population.

Malaysia Car Rental Industry Product Innovations

Recent innovations include the introduction of electric vehicle rental options, reflecting a growing awareness of environmental concerns. Mobile applications offering streamlined booking, payment, and customer service are also gaining prominence. Companies are focusing on enhancing customer experience through integrated loyalty programs, providing additional services such as insurance and GPS navigation. These innovations, along with the introduction of self-service kiosks in airports and other strategic locations, aim to boost efficiency and enhance customer convenience.

Propelling Factors for Malaysia Car Rental Industry Growth

Several factors contribute to the industry's growth, including a burgeoning tourism sector, expanding business travel, increasing disposable incomes within the Malaysian population, and the rising popularity of road trips. Furthermore, government initiatives promoting tourism and improving infrastructure further fuel this growth. The increasing adoption of online booking platforms also contributes to enhanced market access and efficiency.

Obstacles in the Malaysia Car Rental Industry Market

Challenges include the increasing competition from ride-hailing services and public transportation. Fluctuations in fuel prices and potential supply chain disruptions due to global events can also impact profitability. Stringent regulatory requirements and insurance costs can be significant operational barriers. Finally, the impact of economic downturns on travel and tourism expenditure poses a further risk.

Future Opportunities in Malaysia Car Rental Industry

The industry anticipates opportunities in expanding into underserved rural areas, focusing on niche vehicle segments (e.g., luxury cars, campervans), and developing specialized services such as airport transfers and chauffeur-driven rentals. The rise of electric vehicles and the growing demand for sustainable travel options present significant opportunities.

Major Players in the Malaysia Car Rental Industry Ecosystem

- The Hertz Corporation

- Avis Rent a Car LLC

- Galaxy Asia Car Rental

- SIXT Group

- Paradise Rent A Car

- Mayflower Car Rental Sdn Bhd

- Hawk Rent A Car LLC

- Suria Car Rental & Tour Sdn

- Spanco Sdn Bhd

- Europcar Mobility Group

Key Developments in Malaysia Car Rental Industry Industry

February 2024: Sime Darby Auto Bavaria partnered with Sime Darby Rent-A-Car (SDRAC) - Hertz Malaysia to expand luxury electric car rental services nationwide. This significantly impacted the market by introducing high-end electric vehicles and enhancing the overall service offerings.

November 2023: Green Motion's entry into the Malaysian market through a master franchise partnership expanded competition and introduced a wider range of affordable rental options. This move significantly affected the market by introducing a new competitor with a strong international brand reputation.

Strategic Malaysia Car Rental Industry Market Forecast

The Malaysian car rental industry is poised for continued growth, driven by sustained tourism growth, increasing business travel, and technological advancements. The market is expected to experience a steady expansion over the forecast period (2025-2033), with a projected CAGR of xx%. The focus on sustainable practices and the adoption of innovative technologies will shape the industry's trajectory, while the expansion into new segments and regions will further contribute to market expansion.

Malaysia Car Rental Industry Segmentation

-

1. Booking Type

- 1.1. Online Booking

- 1.2. Offline Booking

-

2. Rental Duration

- 2.1. Short-Term

- 2.2. Long-Term

-

3. Vehicle Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. Sport Utility Vehicles

- 3.4. Multi-purpose Vehicles

-

4. Application Type

- 4.1. Tourism

- 4.2. Commuting

Malaysia Car Rental Industry Segmentation By Geography

- 1. Malaysia

Malaysia Car Rental Industry Regional Market Share

Geographic Coverage of Malaysia Car Rental Industry

Malaysia Car Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Activities to Positively Drive the Market

- 3.3. Market Restrains

- 3.3.1. Hike in Fuel Price May Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. The Online Booking Segment Holds Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Car Rental Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online Booking

- 5.1.2. Offline Booking

- 5.2. Market Analysis, Insights and Forecast - by Rental Duration

- 5.2.1. Short-Term

- 5.2.2. Long-Term

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. Sport Utility Vehicles

- 5.3.4. Multi-purpose Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Application Type

- 5.4.1. Tourism

- 5.4.2. Commuting

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Hertz Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Avis Rent a Car LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Galaxy Asia Car Rental

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SIXT Grou

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Paradise Rent A Car

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mayflower Car Rental Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hawk Rent A Car LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Suria Car Rental & Tour Sdn

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Spanco Sdn Bhd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Europcar Mobility Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Hertz Corporation

List of Figures

- Figure 1: Malaysia Car Rental Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Car Rental Industry Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Car Rental Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 2: Malaysia Car Rental Industry Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 3: Malaysia Car Rental Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Malaysia Car Rental Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 5: Malaysia Car Rental Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Malaysia Car Rental Industry Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 7: Malaysia Car Rental Industry Revenue Million Forecast, by Rental Duration 2020 & 2033

- Table 8: Malaysia Car Rental Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: Malaysia Car Rental Industry Revenue Million Forecast, by Application Type 2020 & 2033

- Table 10: Malaysia Car Rental Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Car Rental Industry?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the Malaysia Car Rental Industry?

Key companies in the market include The Hertz Corporation, Avis Rent a Car LLC, Galaxy Asia Car Rental, SIXT Grou, Paradise Rent A Car, Mayflower Car Rental Sdn Bhd, Hawk Rent A Car LLC, Suria Car Rental & Tour Sdn, Spanco Sdn Bhd, Europcar Mobility Group.

3. What are the main segments of the Malaysia Car Rental Industry?

The market segments include Booking Type, Rental Duration, Vehicle Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 549.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Activities to Positively Drive the Market.

6. What are the notable trends driving market growth?

The Online Booking Segment Holds Major Market Share.

7. Are there any restraints impacting market growth?

Hike in Fuel Price May Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

February 2024: Sime Darby Auto Bavaria partnered with Sime Darby Rent-A-Car (SDRAC) - Hertz Malaysia to offer luxury electric cars for rental service. Through this partnership, the company expanded its vehicle fleet and its car rental services across the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Car Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Car Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Car Rental Industry?

To stay informed about further developments, trends, and reports in the Malaysia Car Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence