Key Insights

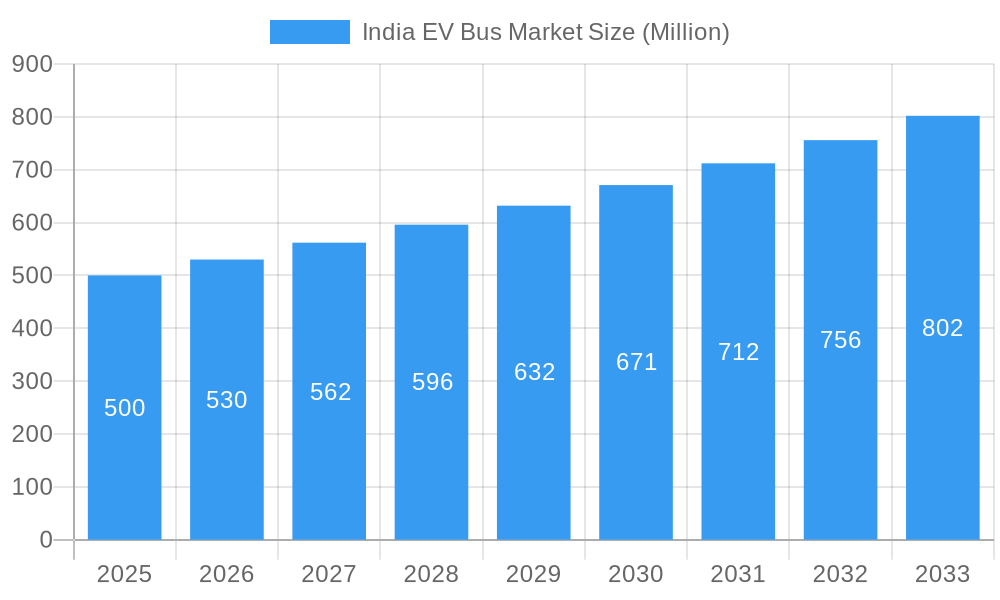

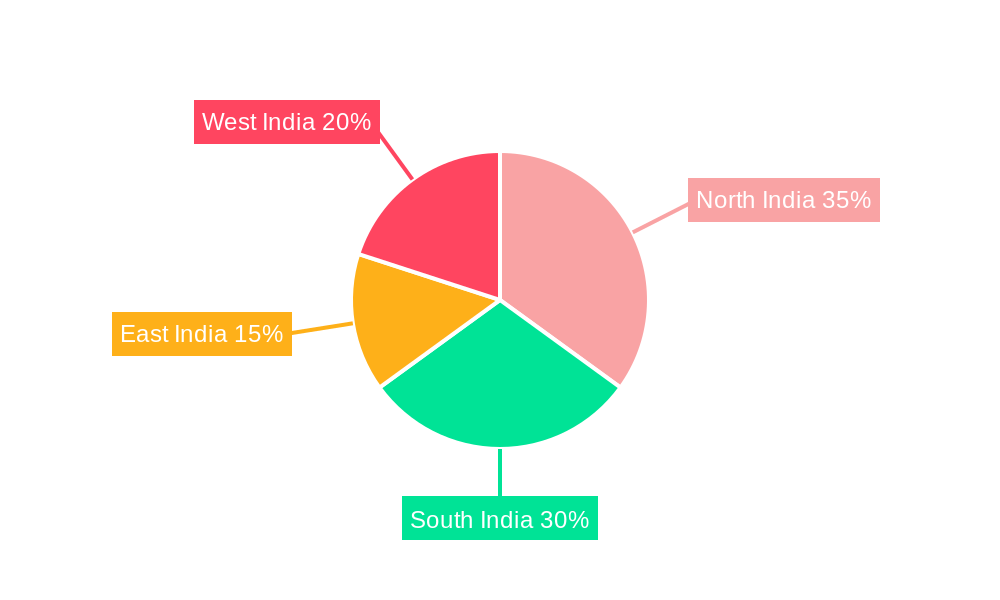

The India EV bus market is experiencing robust growth, driven by government initiatives promoting electric mobility, increasing environmental concerns, and the declining cost of batteries. The market, valued at approximately ₹500 million (estimated) in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 5.89% from 2025 to 2033. This growth is fueled by several key factors. Firstly, substantial investments in charging infrastructure and supportive policies, such as the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles in India (FAME) scheme, are accelerating EV bus adoption. Secondly, rising fuel prices and stringent emission norms are compelling transportation companies to shift towards cleaner alternatives. Thirdly, the improving technology and decreasing battery costs are making electric buses a more economically viable option compared to conventional diesel buses. Different segments within the EV bus market, including Battery Electric Vehicles (BEVs), Fuel Cell Electric Vehicles (FCEVs), Hybrid Electric Vehicles (HEVs), and Plug-in Hybrid Electric Vehicles (PHEVs), are expected to contribute to this overall growth, though BEVs are likely to dominate due to their established technology and widespread availability. Leading players like Tata Motors, Solaris Bus & Coach, and Olectra Greentech are actively participating in this expanding market, offering diverse bus models to cater to varying needs. Regional variations in market penetration exist, with potentially higher adoption rates in urban centers of North and South India, driven by higher population density and better infrastructure.

India EV Bus Market Market Size (In Million)

However, challenges remain. The high initial cost of EV buses compared to diesel buses continues to be a barrier to entry for smaller operators. The limited range of some EV buses and the availability of reliable charging infrastructure, especially in less developed regions, also pose significant hurdles. Furthermore, the development and maintenance of a robust charging network requires considerable investment and coordination between government agencies and private stakeholders. Despite these restraints, the long-term outlook for the India EV bus market remains positive, with sustained growth expected throughout the forecast period. The market is poised to benefit from ongoing technological advancements, further government support, and increasing consumer awareness of environmental sustainability. The focus on improving battery technology, extending the range of EVs, and expanding charging infrastructure will be critical factors determining the speed and scale of market penetration in the coming years.

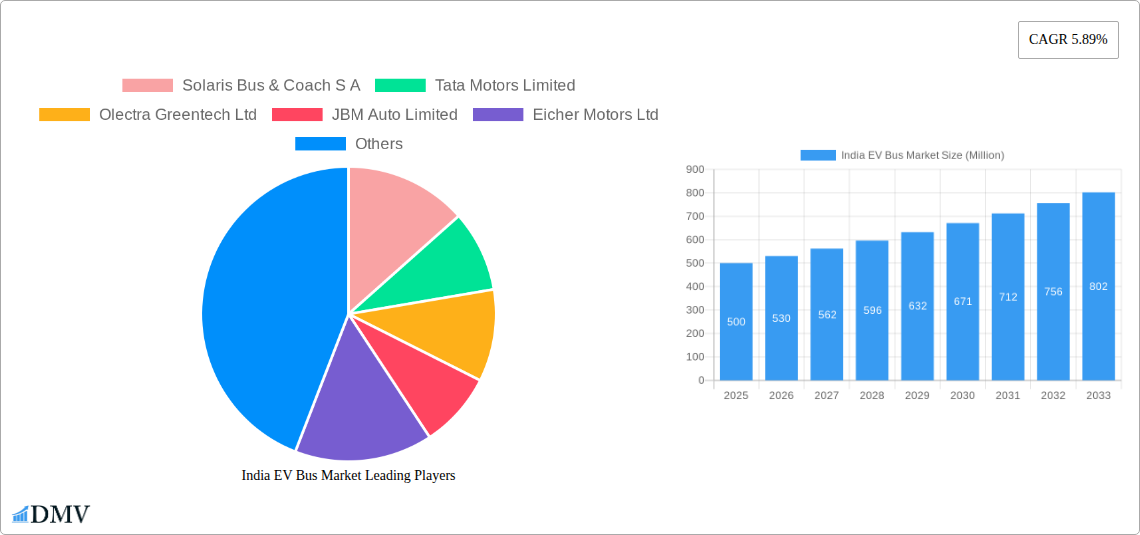

India EV Bus Market Company Market Share

India EV Bus Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the burgeoning India EV Bus market, offering a detailed forecast from 2025 to 2033. With a focus on market trends, technological advancements, and key players, this report is essential reading for stakeholders seeking to understand and capitalize on this rapidly expanding sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The market size is projected to reach xx Million by 2033, driven by significant government initiatives and increasing environmental concerns.

India EV Bus Market Composition & Trends

This section delves into the current state of the Indian EV bus market, examining key aspects influencing its growth. We analyze market concentration, revealing the market share distribution among major players. The report also explores the innovation landscape, identifying key technological advancements and their impact on market dynamics. Furthermore, the regulatory environment, the presence of substitute products, and the evolving end-user profiles are scrutinized. Finally, the report documents significant mergers and acquisitions (M&A) activities, quantifying deal values where available.

- Market Concentration: The Indian EV bus market is currently characterized by [describe concentration level, e.g., moderate concentration with a few dominant players]. Tata Motors holds a significant market share, followed by [list other players with estimated market share percentages].

- Innovation Catalysts: Government incentives, technological advancements in battery technology and charging infrastructure, and the rising demand for sustainable transportation are major drivers of innovation.

- Regulatory Landscape: Favorable government policies promoting EV adoption, including subsidies and tax benefits, significantly influence market growth. [Mention specific policies and regulations].

- Substitute Products: [Discuss substitute transportation options and their market impact, e.g., CNG buses].

- End-User Profiles: Key end-users include state-run transport corporations, private bus operators, and educational institutions.

- M&A Activities: Significant M&A activity has been observed, with [mention examples and estimated deal values, if available, e.g., "Deal X valued at xx Million"]. This consolidation is expected to further shape the market landscape.

India EV Bus Market Industry Evolution

This section provides a detailed historical and projected analysis of the Indian EV bus market's growth trajectory. We examine the market's evolution, highlighting technological advancements such as improved battery technology, faster charging solutions, and enhanced vehicle performance. The report also analyzes shifting consumer demands and preferences, considering factors like improved comfort, safety, and operational efficiency. Specific data points like compound annual growth rates (CAGR) and adoption metrics are provided to illustrate market performance. The analysis covers the historical period (2019-2024) and extends to the forecast period (2025-2033). [Insert detailed paragraph analysis of market growth trajectories, technological advancements, and consumer demand shifts here, including specific data points like growth rates and adoption metrics. Aim for approximately 600 words.]

Leading Regions, Countries, or Segments in India EV Bus Market

This section identifies the dominant regions, countries, or segments within the Indian EV bus market, focusing on fuel categories: BEV, FCEV, HEV, and PHEV. The analysis pinpoints the key drivers behind the dominance of the leading segment.

- Dominant Segment: Currently, [mention the dominant segment, e.g., Battery Electric Vehicles (BEV)] holds the largest market share due to [Reasons].

- Key Drivers:

- Investment Trends: Significant investments in BEV infrastructure, including charging stations and battery manufacturing facilities.

- Regulatory Support: Favorable government policies and subsidies specifically targeting BEV adoption.

- [Add further bullet points as needed.] [Insert a detailed paragraph analysis of the dominance factors for the leading segment, providing approximately 600 words of in-depth analysis.]

India EV Bus Market Product Innovations

Recent innovations in the Indian EV bus market focus on enhancing battery life, improving charging speed, and integrating advanced safety features. Manufacturers are also concentrating on developing more efficient and cost-effective bus designs, incorporating smart technologies to optimize route planning and energy management. Unique selling propositions include longer ranges, superior passenger comfort, and reduced operational costs. These advancements are driving increased adoption and wider market penetration.

Propelling Factors for India EV Bus Market Growth

The growth of the India EV bus market is fueled by several interconnected factors. Government initiatives, such as the Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme, provide substantial financial incentives. The increasing awareness of environmental concerns and the desire to reduce carbon emissions are also significant drivers. Furthermore, advancements in battery technology and charging infrastructure are making electric buses a more viable and practical alternative to conventional diesel buses.

Obstacles in the India EV Bus Market

Despite the promising growth trajectory, the Indian EV bus market faces certain challenges. High initial investment costs for electric buses, coupled with limited charging infrastructure in many areas, remain significant barriers. Furthermore, the dependence on imported components for battery production can lead to supply chain disruptions and price volatility. Competition from established players in the conventional bus market also poses a challenge.

Future Opportunities in India EV Bus Market

The future of the Indian EV bus market presents significant opportunities. Expanding into underserved regions with limited public transportation presents a vast potential market. The development of advanced battery technologies, such as solid-state batteries, and the integration of artificial intelligence (AI) for route optimization will enhance operational efficiency and lower costs further. Increased investment in charging infrastructure will also play a key role.

Major Players in the India EV Bus Market Ecosystem

Key Developments in India EV Bus Market Industry

- September 2023: Tata Motors supplied 400 Starbus EV buses to the Delhi Transport Corporation (DTC), a significant step towards fulfilling a larger 1,500 bus order. This highlights the growing demand for electric buses in major cities.

- August 2023: VE Commercial Vehicles Limited received a INR 5 billion order for 550 intercity buses, demonstrating strong growth in the intercity electric bus segment.

- July 2023: Tata Motors' substantial R&D investment (INR 202.65 billion) and filing of 158 patents in FY 2022-23 showcases a commitment to innovation and technological leadership within the sector.

Strategic India EV Bus Market Forecast

The Indian EV bus market is poised for robust growth, driven by supportive government policies, technological advancements, and increasing environmental awareness. The market's expansion will be significantly influenced by investments in charging infrastructure and the continued development of cost-effective and high-performance electric buses. The potential for substantial market expansion is considerable, particularly in urban and intercity transportation sectors. The market is expected to see sustained growth throughout the forecast period (2025-2033), reaching a projected value of xx Million.

India EV Bus Market Segmentation

-

1. Fuel Category

- 1.1. BEV

- 1.2. FCEV

- 1.3. HEV

- 1.4. PHEV

India EV Bus Market Segmentation By Geography

- 1. India

India EV Bus Market Regional Market Share

Geographic Coverage of India EV Bus Market

India EV Bus Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India EV Bus Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 5.1.1. BEV

- 5.1.2. FCEV

- 5.1.3. HEV

- 5.1.4. PHEV

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Fuel Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solaris Bus & Coach S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tata Motors Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Olectra Greentech Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JBM Auto Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eicher Motors Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 VE Commercial Vehicles Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Switch Mobility (Ashok Leyland Limited)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PMI Electro Mobility Solutions Pvt Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Volvo Buses India Private Limite

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Solaris Bus & Coach S A

List of Figures

- Figure 1: India EV Bus Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India EV Bus Market Share (%) by Company 2025

List of Tables

- Table 1: India EV Bus Market Revenue undefined Forecast, by Fuel Category 2020 & 2033

- Table 2: India EV Bus Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: India EV Bus Market Revenue undefined Forecast, by Fuel Category 2020 & 2033

- Table 4: India EV Bus Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India EV Bus Market?

The projected CAGR is approximately 12.72%.

2. Which companies are prominent players in the India EV Bus Market?

Key companies in the market include Solaris Bus & Coach S A, Tata Motors Limited, Olectra Greentech Ltd, JBM Auto Limited, Eicher Motors Ltd, VE Commercial Vehicles Limited, Switch Mobility (Ashok Leyland Limited), PMI Electro Mobility Solutions Pvt Ltd, Volvo Buses India Private Limite.

3. What are the main segments of the India EV Bus Market?

The market segments include Fuel Category.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth.

8. Can you provide examples of recent developments in the market?

September 2023: Tata Motors announced that it supplied 400 Starbus EV buses to the Delhi Transport Corporation (DTC), via its subsidiary TML CV Mobility Solutions Ltd, as a part of its larger order from DTC to supply, maintain, and operate 1,500 low-floor, air-conditioned electric buses for a period 12-years.August 2023: Ve Commercial Vehicles Limited announced that it has received an order for 550 Intercity Buses from Vijayan Travels and VT, worth INR 5 billion. The order includes 500 Eicher Intercity 13.5m AC and non AC sleeper coaches and 50 Volvo 9600 luxury sleeper coaches.July 2023: Tata Motors, India filed 158 Patents in FY 2022-23, R&D spend reaches INR 202.65 billion

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India EV Bus Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India EV Bus Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India EV Bus Market?

To stay informed about further developments, trends, and reports in the India EV Bus Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence