Key Insights

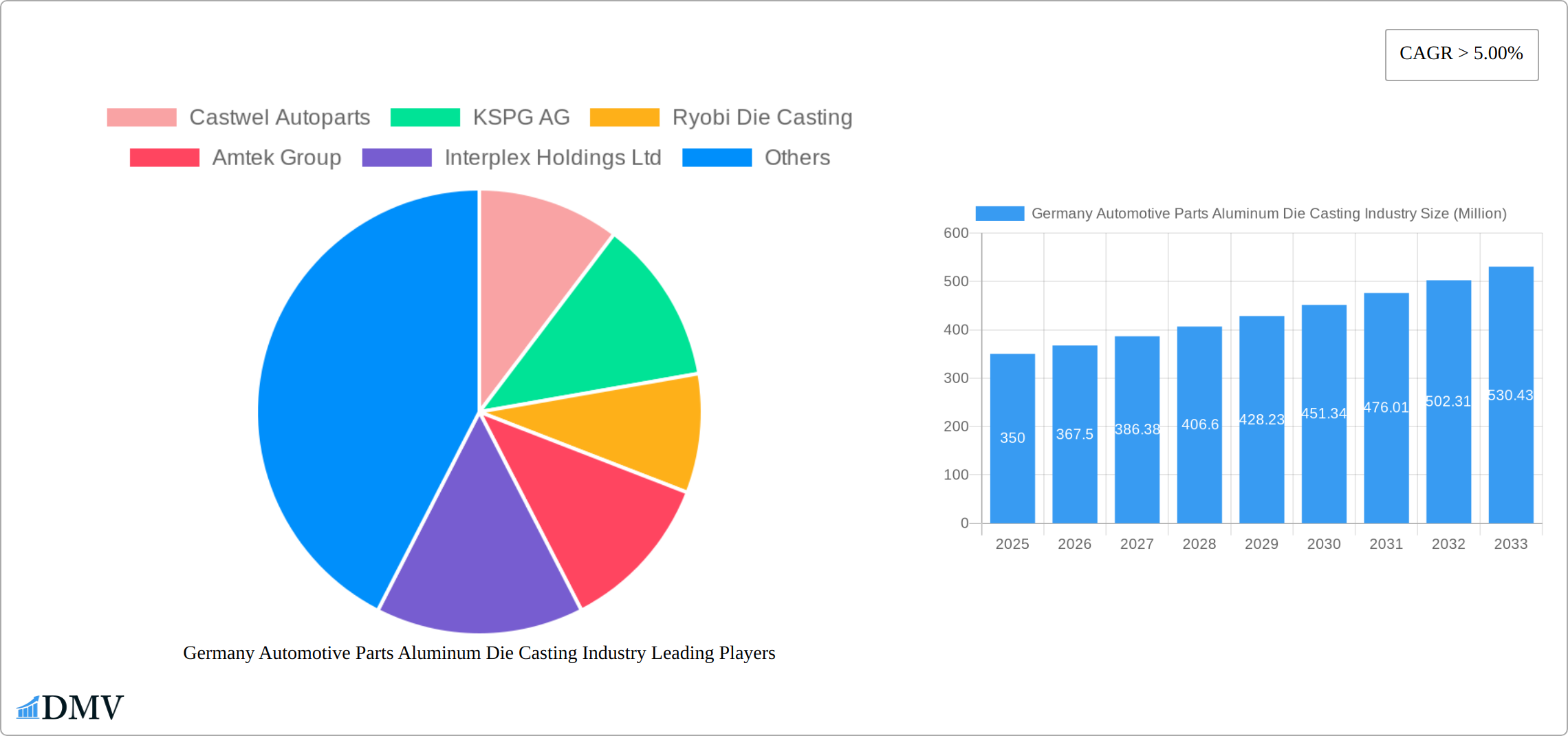

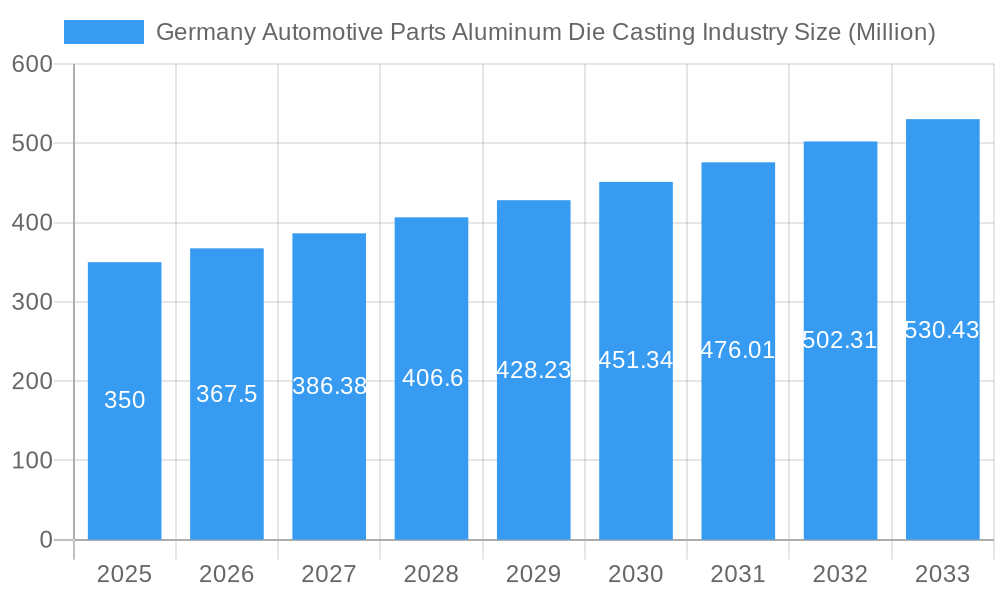

Germany's automotive parts aluminum die casting market is poised for substantial growth, driven by the increasing demand for lightweight vehicles and stringent fuel efficiency mandates. The market is projected to reach $1.45 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.5%. Key growth catalysts include the escalating adoption of electric vehicles (EVs), necessitating lighter components for extended range, and ongoing technological advancements in die casting processes, such as high-pressure and semi-solid die casting, which enhance part quality and reduce manufacturing costs. Market segmentation reveals dominance in pressure die casting, followed by vacuum, squeeze, and semi-solid processes. Dominant application segments include engine, transmission, and body parts. Leading manufacturers like Castwel Autoparts, KSPG AG, and Nemak are strategically investing in advanced manufacturing and supply chain partnerships to leverage these industry trends. Challenges include volatile aluminum prices and the increasing complexity of automotive designs requiring specialized die casting expertise.

Germany Automotive Parts Aluminum Die Casting Industry Market Size (In Billion)

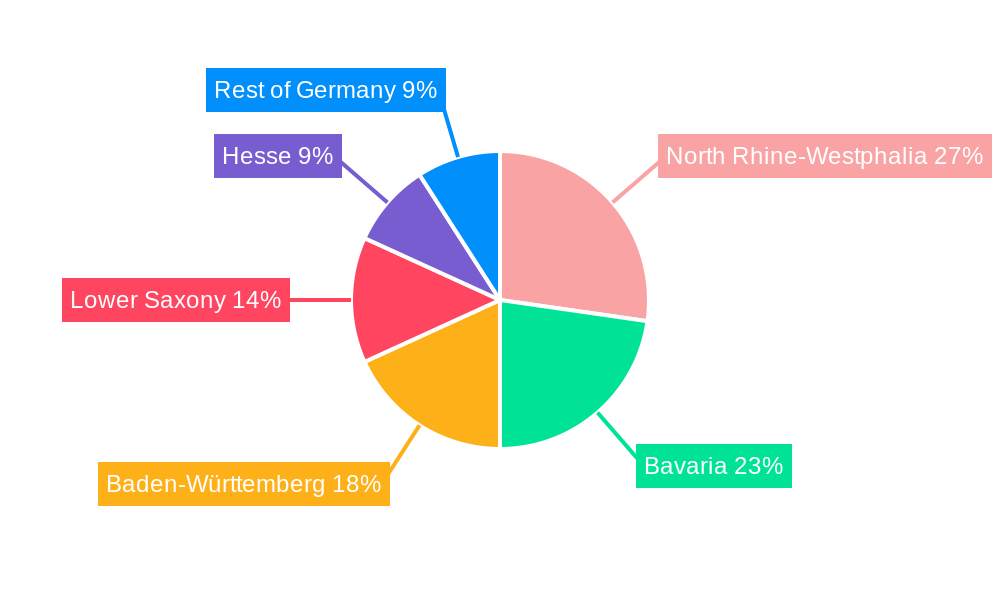

Key manufacturing hubs within Germany are concentrated in North Rhine-Westphalia, Bavaria, Baden-Württemberg, Lower Saxony, and Hesse, owing to the established presence of major automotive manufacturers and their comprehensive supplier networks. The forecast period (2025-2033) indicates sustained expansion, fueled by the transition to electric and hybrid vehicles and advancements in die casting technologies that boost production efficiency and component performance. The industry's focus on sustainability is also expected to drive the adoption of recycled aluminum in die casting, contributing to long-term market growth.

Germany Automotive Parts Aluminum Die Casting Industry Company Market Share

Germany Automotive Parts Aluminum Die Casting Industry: A Comprehensive Market Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Germany automotive parts aluminum die casting industry, offering a detailed market overview, competitive landscape, and future growth projections. Spanning the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving dynamics of this crucial sector. The market size is predicted to reach xx Million by 2033.

Germany Automotive Parts Aluminum Die Casting Industry Market Composition & Trends

This section provides a deep dive into the current state of the German automotive parts aluminum die casting market. We analyze market concentration, revealing the market share distribution amongst key players such as Castwel Autoparts, KSPG AG, Ryobi Die Casting, Amtek Group, Interplex Holdings Ltd, Nemak, ALCOA Inc, Buvo Castings (EU), Dynamic Technologies Ltd, and Gibbs Die Casting Group. The report explores innovation catalysts driving market growth, including advancements in die casting technologies and the increasing demand for lightweight automotive components. We also examine the regulatory landscape, analyzing its impact on industry practices and compliance standards. Furthermore, the report assesses substitute products and their competitive threat, detailed profiles of end-users within the automotive sector, and a review of recent mergers and acquisitions (M&A) activities, including estimated deal values (xx Million for the period 2019-2024). The impact of these M&A activities on market consolidation and competitive dynamics is thoroughly evaluated.

- Market Concentration: The market is characterized by [Describe market concentration - e.g., a moderately concentrated market with a few dominant players].

- Innovation Catalysts: Advancements in pressure die casting, semi-solid die casting, and automation are key drivers.

- Regulatory Landscape: Compliance with EU emission standards and material regulations significantly influences production processes.

- Substitute Products: [Discuss alternative materials and their impact on market share]

- End-User Profiles: [Details on the type of automotive manufacturers and their specific needs]

- M&A Activities: [Summary of significant M&A deals, including deal values (in Millions) and their effects on the market]

Germany Automotive Parts Aluminum Die Casting Industry Industry Evolution

This section meticulously tracks the evolution of the German automotive parts aluminum die casting industry over the study period (2019-2024) and projects its trajectory until 2033. We analyze market growth trajectories, detailing annual growth rates (xx%) during the historical period and projecting future growth (xx% CAGR from 2025 to 2033). This analysis considers technological advancements, such as the adoption of advanced die casting techniques (e.g., the increasing use of semi-solid die casting, adoption rates detailed) and the integration of Industry 4.0 technologies in production processes. The report also considers shifts in consumer demand, focusing on the growing preference for lightweight vehicles and the consequent rise in demand for aluminum die castings. Specific data points illustrate the impact of these factors on market growth and production volumes (xx Million units in 2024, projected to reach xx Million units by 2033). Furthermore, the report examines the influence of evolving automotive designs and the increasing complexity of automotive parts on the industry's growth.

Leading Regions, Countries, or Segments in Germany Automotive Parts Aluminum Die Casting Industry

This section identifies the dominant regions and segments within the German automotive parts aluminum die casting market. We analyze the market share of each segment (Production Process Type: Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-Solid Die Casting; Application Type: Engine Parts, Transmission Components, Body Parts, Others) and pinpoint the leading segments based on factors such as production volume, revenue generation, and future growth potential.

Dominant Segment: [Identify the dominant segment and explain the reasons behind its dominance]. For example, Pressure Die Casting is expected to hold the largest market share due to its cost-effectiveness and high production rates.

Key Drivers:

- Pressure Die Casting: High production rates, cost-effectiveness, suitability for mass production.

- Engine Parts: High demand driven by stringent emission regulations and fuel efficiency standards.

- [Other Dominant Segments and their drivers]: [Analyze other significant segments and their key drivers, using bullet points to highlight investment trends and regulatory support]

In-depth Analysis: [Provide detailed explanations of the dominance factors for the leading segments and regions, including factors such as technological advancements, infrastructural support, government policies, and skilled labor availability].

Germany Automotive Parts Aluminum Die Casting Industry Product Innovations

Recent years have witnessed significant product innovations in the German automotive parts aluminum die casting industry. These innovations focus on enhancing the performance, durability, and lightweight properties of aluminum die castings, primarily targeting improved fuel efficiency and emission reduction in vehicles. Key advancements include the development of high-strength aluminum alloys, optimized die designs, and the integration of advanced surface treatments to enhance corrosion resistance. These innovations offer unique selling propositions, such as improved component strength-to-weight ratios and extended product lifecycles. The adoption of these innovative products is expected to accelerate significantly during the forecast period, driven by the increasing demand for high-performance and sustainable automotive components.

Propelling Factors for Germany Automotive Parts Aluminum Die Casting Industry Growth

The German automotive parts aluminum die casting industry is experiencing robust growth fueled by a confluence of powerful factors. Technological innovation stands at the forefront, with continuous advancements in high-pressure die casting techniques, automation, and intelligent manufacturing (Industry 4.0) enhancing precision, speed, and the overall quality of components. Developments in advanced aluminum alloys are enabling the production of lighter, stronger, and more durable parts, directly supporting the automotive sector's drive towards weight reduction. Economically, the relentless global demand for fuel-efficient and environmentally friendly vehicles, including the burgeoning electric and hybrid segments, creates a sustained need for sophisticated aluminum die-cast parts. Furthermore, the German government's commitment to fostering a sustainable and innovative industrial landscape, through targeted incentives for green manufacturing and research and development, provides a conducive environment for industry expansion and competitiveness.

Obstacles in the Germany Automotive Parts Aluminum Die Casting Industry Market

Despite its strong growth trajectory, the German automotive parts aluminum die casting industry navigates a landscape marked by significant challenges. Increasingly stringent environmental regulations and sustainability mandates necessitate substantial investments in advanced pollution control technologies and energy-efficient processes, potentially increasing operational costs. The inherent volatility in global raw material prices, particularly for aluminum, presents a persistent risk to profit margins and pricing strategies. Complex and often unpredictable supply chain disruptions, exacerbated by geopolitical events and logistical bottlenecks, can compromise production schedules and the timely delivery of critical components. Moreover, the market is characterized by intense global competition, not only from established players but also from emerging manufacturers in lower-cost regions, demanding continuous innovation, operational efficiency, and strategic cost management to maintain a competitive edge and market share.

Future Opportunities in Germany Automotive Parts Aluminum Die Casting Industry

The future outlook for the German automotive parts aluminum die casting industry is rich with promising opportunities. The accelerated global transition towards electric vehicles (EVs) and hybrid powertrains represents a monumental growth avenue, as these vehicles require an extensive array of lightweight, high-performance aluminum die-cast components for battery enclosures, motor housings, chassis parts, and thermal management systems. The integration of cutting-edge technologies such as additive manufacturing (3D printing) in conjunction with traditional die casting offers the potential for creating highly complex, customized, and optimized part designs. Furthermore, advancements in high-performance aluminum alloys and surface treatments are unlocking new possibilities for enhanced durability, corrosion resistance, and functional integration. Strategic exploration and expansion into adjacent high-value sectors, including aerospace, renewable energy infrastructure (e.g., wind turbine components), and advanced industrial machinery, can diversify revenue streams and leverage existing expertise.

Major Players in the Germany Automotive Parts Aluminum Die Casting Industry Ecosystem

- Castwel Autoparts

- KS Huayue (formerly KSPG AG)

- Ryobi Die Casting

- Amtek Group

- Interplex Holdings Ltd

- Nemak

- Arconic (formerly ALCOA Inc's downstream businesses)

- Buvo Castings (EU)

- Dynamic Technologies Ltd

- Gibbs Die Casting Group

- Georg Fischer AG

- Möller Werke GmbH

Key Developments in Germany Automotive Parts Aluminum Die Casting Industry Industry

- [List key developments with year/month and their impact, e.g., "January 2023: Launch of a new high-strength aluminum alloy by ALCOA Inc, leading to improved component durability and market share increase."]

Strategic Germany Automotive Parts Aluminum Die Casting Industry Market Forecast

The German automotive parts aluminum die casting industry is strategically positioned for substantial and sustained growth throughout the forecast period (2025-2033). This expansion will be primarily propelled by the accelerating adoption of lightweight vehicle technologies, the exponential rise of the electric vehicle market, and the ongoing drive for greater manufacturing efficiency. Advancements in Industry 4.0 principles, including AI-driven process optimization and predictive maintenance, will further enhance productivity and quality. The industry's ability to adapt to evolving regulatory landscapes, particularly concerning environmental impact and material sustainability, will be crucial. Emerging material science innovations and the strategic integration of digital manufacturing techniques are expected to unlock new product capabilities and market differentiation. This favorable trajectory indicates significant potential for lucrative investments and the consolidation of Germany's leadership in high-value automotive component manufacturing.

Germany Automotive Parts Aluminum Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Others

Germany Automotive Parts Aluminum Die Casting Industry Segmentation By Geography

- 1. Germany

Germany Automotive Parts Aluminum Die Casting Industry Regional Market Share

Geographic Coverage of Germany Automotive Parts Aluminum Die Casting Industry

Germany Automotive Parts Aluminum Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Use of Lightweight Material in the Automotive Industry to Drives the Market

- 3.3. Market Restrains

- 3.3.1. Rising Aluminum Prices Hindering the Market Growth -

- 3.4. Market Trends

- 3.4.1. Pressure Die Casting Captures the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Automotive Parts Aluminum Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Castwel Autoparts

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 KSPG AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ryobi Die Casting

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amtek Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Interplex Holdings Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nemak

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALCOA Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Buvo Castings (EU)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Dynamic Technologies Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Gibbs Die Casting Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Castwel Autoparts

List of Figures

- Figure 1: Germany Automotive Parts Aluminum Die Casting Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Automotive Parts Aluminum Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: Germany Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Germany Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: Germany Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Germany Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Automotive Parts Aluminum Die Casting Industry?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the Germany Automotive Parts Aluminum Die Casting Industry?

Key companies in the market include Castwel Autoparts, KSPG AG, Ryobi Die Casting, Amtek Group, Interplex Holdings Ltd, Nemak, ALCOA Inc, Buvo Castings (EU), Dynamic Technologies Ltd, Gibbs Die Casting Grou.

3. What are the main segments of the Germany Automotive Parts Aluminum Die Casting Industry?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.45 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Use of Lightweight Material in the Automotive Industry to Drives the Market.

6. What are the notable trends driving market growth?

Pressure Die Casting Captures the Market.

7. Are there any restraints impacting market growth?

Rising Aluminum Prices Hindering the Market Growth -.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Automotive Parts Aluminum Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Automotive Parts Aluminum Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Automotive Parts Aluminum Die Casting Industry?

To stay informed about further developments, trends, and reports in the Germany Automotive Parts Aluminum Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence