Key Insights

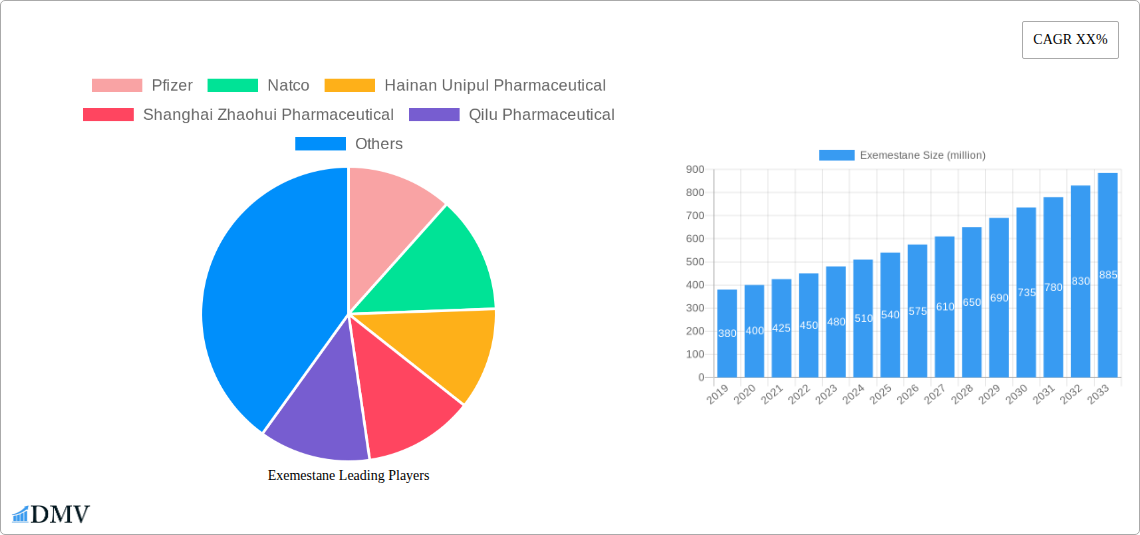

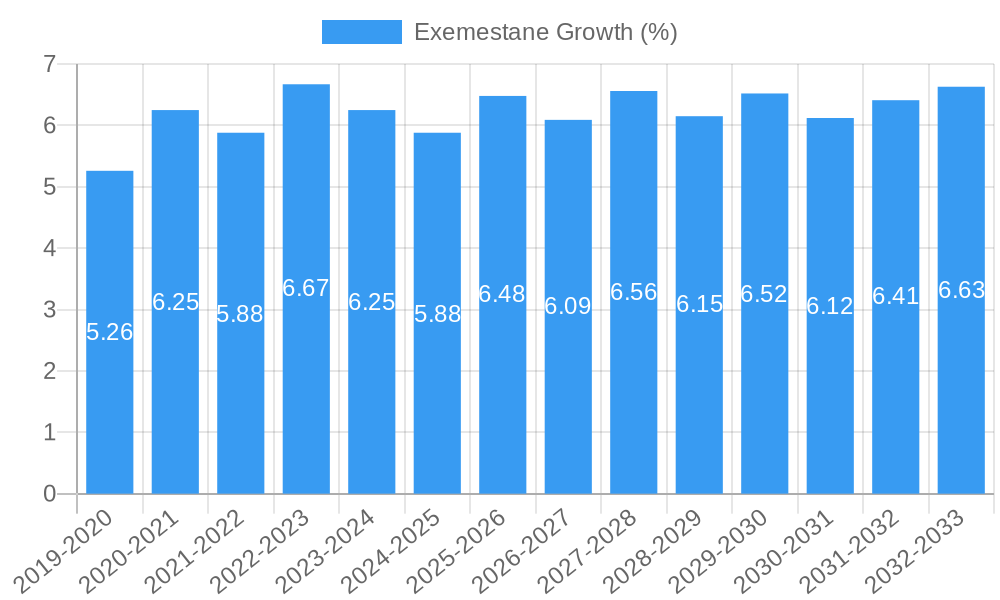

The global Exemestane market is poised for significant expansion, driven by its crucial role in hormone-receptor-positive (HR+) breast cancer treatment. Expected to reach a market size of approximately $550 million by 2025, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of around 6.5% from 2025 to 2033. This robust growth is fueled by the increasing incidence of breast cancer worldwide, particularly in aging populations, and a growing emphasis on adjuvant and neoadjuvant therapies. The rising prevalence of HR+ breast cancer, which accounts for a substantial majority of breast cancer diagnoses, directly translates to higher demand for effective treatments like Exemestane. Furthermore, advancements in diagnostic capabilities leading to earlier and more accurate detection of HR+ breast cancer contribute to a larger patient pool seeking effective pharmaceutical interventions. The market's expansion is also supported by increasing healthcare expenditure in emerging economies and the continuous efforts by pharmaceutical companies to develop improved formulations and explore new therapeutic applications.

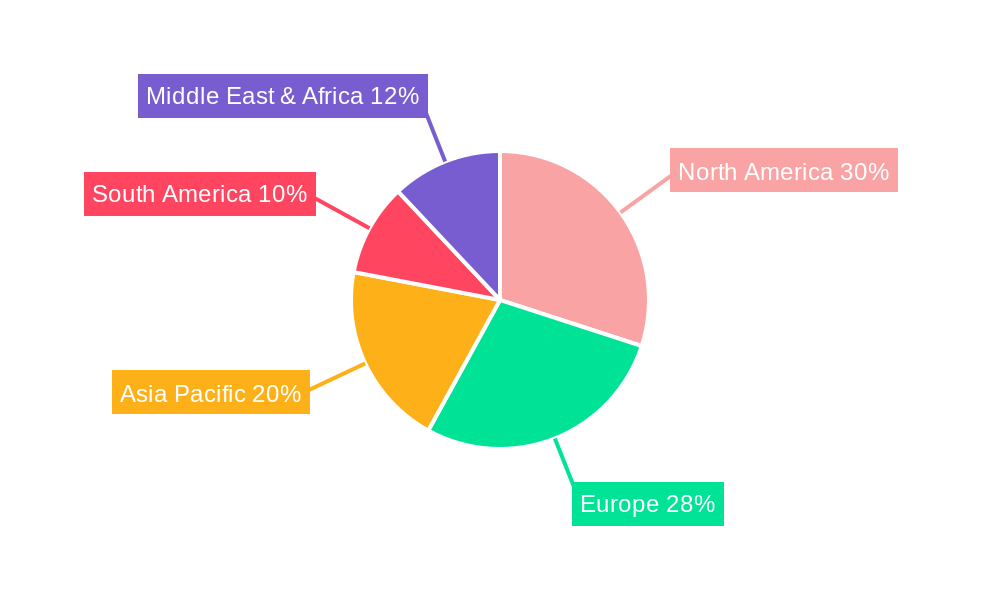

Key growth drivers for the Exemestane market include the expanding patient population, heightened awareness campaigns for breast cancer early detection, and the favorable reimbursement policies in developed nations. The market is segmented by application, with hospitals and clinics emerging as the dominant end-user segments due to specialized cancer treatment facilities and direct patient access. Drug centers also represent a significant segment as treatment progresses. In terms of product type, the 10 and 30 Tables/Box configurations are expected to hold substantial market share, catering to different treatment durations and patient preferences. Geographically, North America and Europe currently lead the market due to advanced healthcare infrastructure and high breast cancer incidence rates. However, the Asia Pacific region, particularly China and India, is anticipated to witness the fastest growth owing to a burgeoning patient base, improving healthcare access, and increasing R&D investments. Restraints, such as the potential development of alternative therapies and pricing pressures, are expected to be mitigated by Exemestane's established efficacy and a strong pipeline of ongoing clinical trials that could further broaden its therapeutic scope.

This definitive report offers an in-depth exploration of the global Exemestane market, providing crucial intelligence for stakeholders in the pharmaceutical and healthcare industries. Spanning the historical period of 2019-2024, base year 2025, and a forecast period extending to 2033, this analysis meticulously dissects market dynamics, identifies key growth drivers, and forecasts future opportunities. The report leverages extensive data to provide actionable insights into Exemestane's market composition, industry evolution, regional dominance, product innovations, growth propellants, market obstacles, and strategic forecasts. With a focus on high-ranking keywords such as "Exemestane market," "aromatase inhibitor," "breast cancer treatment," and "pharmaceutical market analysis," this report is optimized for maximum search visibility and stakeholder engagement.

Exemestane Market Composition & Trends

The Exemestane market exhibits a moderately concentrated landscape, with leading players like Pfizer, Sun Pharmaceutical, and Natco holding significant market share. Innovation catalysts in this sector are primarily driven by ongoing research into optimizing breast cancer treatment regimens and developing novel drug delivery systems for enhanced patient compliance and efficacy. The regulatory landscape remains a critical factor, with stringent approvals from bodies like the FDA and EMA shaping market access and product lifecycle management. Substitute products, primarily other aromatase inhibitors such as Anastrozole and Letrozole, present a constant competitive pressure, necessitating continuous differentiation and value proposition enhancement for Exemestane. End-user profiles are predominantly comprised of hospitals and clinics, with a growing segment utilizing drug centers for specialized oncology care. While M&A activities are present, the market is characterized by strategic partnerships and product portfolio expansions rather than large-scale consolidations. M&A deal values in the broader oncology drug market have reached multi-million dollar figures, underscoring the significant investment in this therapeutic area. The market share distribution reflects the established presence of key players, with an estimated XX% held by the top five companies.

- Market Concentration: Moderately concentrated with a few key players dominating.

- Innovation Catalysts: Focus on breast cancer treatment optimization, novel drug delivery.

- Regulatory Landscape: Strict approvals from FDA, EMA influencing market access.

- Substitute Products: Anastrozole, Letrozole pose significant competition.

- End-User Segments: Hospitals, Clinics, Drug Centers are primary consumers.

- M&A Activities: Strategic partnerships and portfolio expansions are more common than large-scale consolidations. M&A deal values in the oncology sector have reached multi-million dollar figures.

Exemestane Industry Evolution

The Exemestane industry has witnessed a dynamic evolution over the historical period and is poised for continued growth. Market growth trajectories have been primarily influenced by the increasing global incidence of hormone receptor-positive (HR+) breast cancer, which constitutes the largest patient population benefiting from aromatase inhibitor therapy. Technological advancements have played a pivotal role, not only in improving the synthesis and purity of Exemestane but also in the development of more convenient dosage forms and combination therapies. Patient demand has shifted towards treatments that offer improved efficacy with minimized side effects, driving research into personalized medicine approaches and supportive care. During the historical period (2019-2024), the Exemestane market experienced a Compound Annual Growth Rate (CAGR) of approximately XX%. This growth was fueled by increased diagnosis rates, enhanced accessibility to cancer treatments in emerging economies, and a growing understanding of Exemestane's role in adjuvant and extended adjuvant therapy for early-stage breast cancer. The introduction of new formulations and the expansion of clinical applications have further bolstered market penetration. The base year 2025 projects a market value of over $XXX million, with an estimated growth rate of XX% for the subsequent forecast period. Key performance indicators such as patient adherence rates, treatment success rates, and healthcare expenditure on cancer therapeutics are continuously monitored and analyzed to inform strategic decisions. The adoption of Exemestane in various treatment protocols has steadily increased, reflecting its established efficacy and safety profile.

Leading Regions, Countries, or Segments in Exemestane

North America and Europe currently lead the Exemestane market, driven by a combination of high healthcare expenditure, advanced diagnostic infrastructure, and a strong emphasis on cancer research and treatment innovation. The United States, in particular, represents a significant market due to its large patient pool and proactive adoption of new therapeutic agents. In Asia Pacific, countries like China and India are emerging as crucial growth centers, propelled by expanding healthcare access, increasing cancer awareness, and the growing presence of local pharmaceutical manufacturers like Hainan Unipul Pharmaceutical and Shanghai Zhaohui Pharmaceutical.

Within the application segments, hospitals represent the dominant channel for Exemestane distribution. This is attributed to the complex treatment protocols, the need for specialized medical supervision, and the availability of comprehensive oncology services within hospital settings. Clinics also play a vital role, particularly for patients undergoing long-term adjuvant therapy, offering accessible and specialized care. Drug centers, while a smaller segment, are gaining traction for their focused approach to dispensing and managing oncology medications, including Exemestane.

In terms of product types, the 30 Tablets/Box packaging consistently accounts for the largest market share. This is primarily due to its cost-effectiveness for long-term treatment regimens and its convenience for patients undergoing extended therapy. The 10 Tablets/Box and 14 Tablets/Box formats cater to specific prescription needs or initial treatment phases.

- Dominant Regions: North America, Europe, with Asia Pacific showing rapid growth.

- Key Country Drivers (North America/Europe): High healthcare spending, advanced diagnostics, robust research.

- Emerging Market Drivers (Asia Pacific): Expanding healthcare access, increasing cancer awareness, local manufacturing capabilities (Hainan Unipul Pharmaceutical, Shanghai Zhaohui Pharmaceutical).

- Application Segment Dominance: Hospitals lead due to specialized care and treatment complexity.

- Clinic Role: Vital for long-term adjuvant therapy and accessible care.

- Drug Center Growth: Increasing focus on specialized oncology medication management.

- Product Type Dominance: 30 Tablets/Box for cost-effectiveness and long-term convenience.

- Other Tablet Sizes: 10 Tablets/Box and 14 Tablets/Box cater to specific prescription needs.

Exemestane Product Innovations

Exemestane product innovations are primarily focused on improving patient experience and therapeutic outcomes. This includes the development of novel formulations for enhanced bioavailability and reduced gastrointestinal side effects. Furthermore, research is exploring combination therapies that synergistically enhance Exemestane's efficacy in treating hormone-sensitive breast cancer, aiming to overcome treatment resistance. Performance metrics such as improved progression-free survival (PFS) and overall survival (OS) rates are key indicators of successful innovation. The unique selling proposition of Exemestane lies in its irreversible aromatase inhibition, offering a distinct mechanism of action compared to other inhibitors. Technological advancements in drug formulation and stability are ensuring the consistent quality and efficacy of Exemestane products.

Propelling Factors for Exemestane Growth

The Exemestane market is propelled by several key factors. A primary driver is the increasing global incidence of hormone receptor-positive breast cancer, the primary indication for Exemestane. Technological advancements in drug synthesis and formulation contribute to improved product quality and patient compliance. Favorable reimbursement policies and increased healthcare expenditure on oncology treatments worldwide are also significant growth catalysts. Furthermore, the growing awareness and early diagnosis of breast cancer lead to a larger patient pool seeking effective treatment options like Exemestane. The expansion of healthcare infrastructure in emerging economies, coupled with the increasing availability of generic Exemestane, further fuels market growth.

- Rising Breast Cancer Incidence: Specifically hormone receptor-positive (HR+) breast cancer.

- Technological Advancements: Improved drug synthesis, formulation, and delivery systems.

- Favorable Reimbursement & Healthcare Spending: Increased investment in cancer care globally.

- Enhanced Cancer Awareness & Early Diagnosis: Leading to a broader patient base.

- Emerging Market Expansion: Growth in developing economies with improving healthcare access.

- Generic Availability: Increased affordability and accessibility through generic manufacturers like Natco and Alkem Laboratories.

Obstacles in the Exemestane Market

Despite robust growth, the Exemestane market faces several obstacles. Stringent regulatory hurdles for new drug approvals and post-market surveillance can be time-consuming and costly. Supply chain disruptions, exacerbated by geopolitical events and manufacturing complexities, can impact product availability. Intense competition from other aromatase inhibitors like Anastrozole and Letrozole, as well as emerging novel therapies, necessitates continuous innovation and competitive pricing strategies. The development of drug resistance in patients over time also poses a significant challenge, requiring ongoing research into combination therapies and treatment sequencing. Furthermore, side effects, while manageable, can sometimes impact patient adherence.

- Regulatory Hurdles: Lengthy approval processes and post-market surveillance.

- Supply Chain Vulnerabilities: Risks from global disruptions and manufacturing challenges.

- Competitive Landscape: Strong presence of other aromatase inhibitors and novel therapies.

- Drug Resistance: The development of resistance in patients over prolonged treatment.

- Adverse Side Effects: Potential impact on patient compliance and adherence.

Future Opportunities in Exemestane

The future of the Exemestane market is replete with promising opportunities. The expansion into new geographical markets, particularly in underserved regions with growing cancer incidences, presents significant untapped potential. Innovations in combination therapies that enhance Exemestane's efficacy and overcome resistance mechanisms offer avenues for market growth. The development of improved drug delivery systems, such as extended-release formulations or targeted delivery methods, could enhance patient convenience and treatment outcomes. Furthermore, the exploration of Exemestane in novel therapeutic indications beyond breast cancer or in different stages of the disease could unlock new market segments. The increasing focus on personalized medicine and the identification of biomarkers that predict treatment response will also shape future opportunities.

- Geographic Expansion: Tapping into emerging markets with rising cancer rates.

- Novel Combination Therapies: Developing synergistic treatments to enhance efficacy and overcome resistance.

- Advanced Drug Delivery Systems: Innovative formulations for improved patient experience and outcomes.

- Exploration of New Indications: Investigating Exemestane's potential in other cancers or disease stages.

- Personalized Medicine: Leveraging biomarkers for optimized treatment selection.

Major Players in the Exemestane Ecosystem

- Pfizer

- Natco

- Hainan Unipul Pharmaceutical

- Shanghai Zhaohui Pharmaceutical

- Qilu Pharmaceutical

- Beijing Unisplendour Pharmaceutical

- Celon Laboratories

- Sun Pharmaceutical

- Alkem Laboratories

- Glenmark Pharmaceuticals

Key Developments in Exemestane Industry

- 2024: Continued expansion of generic Exemestane offerings from players like Alkem Laboratories and Sun Pharmaceutical, leading to increased market accessibility.

- 2023: Focus on clinical trials investigating Exemestane in combination with novel targeted therapies for advanced breast cancer.

- 2022: Increased emphasis on market penetration in emerging economies by global pharmaceutical giants and local manufacturers like Hainan Unipul Pharmaceutical.

- 2021: Advancements in formulation research aimed at reducing the incidence of musculoskeletal adverse events associated with aromatase inhibitors.

- 2020: Significant growth in the demand for Exemestane due to heightened awareness and diagnosis of breast cancer globally.

- 2019: Introduction of refined manufacturing processes by companies like Qilu Pharmaceutical and Beijing Unisplendour Pharmaceutical, ensuring consistent product quality.

Strategic Exemestane Market Forecast

- 2024: Continued expansion of generic Exemestane offerings from players like Alkem Laboratories and Sun Pharmaceutical, leading to increased market accessibility.

- 2023: Focus on clinical trials investigating Exemestane in combination with novel targeted therapies for advanced breast cancer.

- 2022: Increased emphasis on market penetration in emerging economies by global pharmaceutical giants and local manufacturers like Hainan Unipul Pharmaceutical.

- 2021: Advancements in formulation research aimed at reducing the incidence of musculoskeletal adverse events associated with aromatase inhibitors.

- 2020: Significant growth in the demand for Exemestane due to heightened awareness and diagnosis of breast cancer globally.

- 2019: Introduction of refined manufacturing processes by companies like Qilu Pharmaceutical and Beijing Unisplendour Pharmaceutical, ensuring consistent product quality.

Strategic Exemestane Market Forecast

The Exemestane market is projected for sustained growth, driven by the persistent need for effective hormone therapy in breast cancer treatment. Future opportunities lie in the development of advanced combination therapies and innovative drug delivery systems that enhance patient compliance and therapeutic outcomes. Strategic focus on expanding market reach into developing economies, coupled with the continued innovation from key players such as Pfizer and Sun Pharmaceutical, will be instrumental in capturing this growth. Overcoming obstacles related to drug resistance and competition through robust R&D will be crucial for maintaining market leadership. The market forecast indicates a positive trajectory, underscoring the enduring importance of Exemestane in the oncology landscape.

Exemestane Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Drug Center

- 1.4. Others

-

2. Types

- 2.1. 10 Tables/Box

- 2.2. 14 Tables/Box

- 2.3. 30 Tables/Box

Exemestane Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Exemestane REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Exemestane Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Drug Center

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. 10 Tables/Box

- 5.2.2. 14 Tables/Box

- 5.2.3. 30 Tables/Box

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Exemestane Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Drug Center

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. 10 Tables/Box

- 6.2.2. 14 Tables/Box

- 6.2.3. 30 Tables/Box

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Exemestane Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Drug Center

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. 10 Tables/Box

- 7.2.2. 14 Tables/Box

- 7.2.3. 30 Tables/Box

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Exemestane Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Drug Center

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. 10 Tables/Box

- 8.2.2. 14 Tables/Box

- 8.2.3. 30 Tables/Box

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Exemestane Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Drug Center

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. 10 Tables/Box

- 9.2.2. 14 Tables/Box

- 9.2.3. 30 Tables/Box

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Exemestane Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Drug Center

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. 10 Tables/Box

- 10.2.2. 14 Tables/Box

- 10.2.3. 30 Tables/Box

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Natco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hainan Unipul Pharmaceutical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Shanghai Zhaohui Pharmaceutical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Qilu Pharmaceutical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Beijing Unisplendour Pharmaceutical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Celon Laboratories

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sun Pharmaceutical

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alkem Laboratories

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Glenmark Pharmaceuticals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global Exemestane Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Exemestane Revenue (million), by Application 2024 & 2032

- Figure 3: North America Exemestane Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Exemestane Revenue (million), by Types 2024 & 2032

- Figure 5: North America Exemestane Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Exemestane Revenue (million), by Country 2024 & 2032

- Figure 7: North America Exemestane Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Exemestane Revenue (million), by Application 2024 & 2032

- Figure 9: South America Exemestane Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Exemestane Revenue (million), by Types 2024 & 2032

- Figure 11: South America Exemestane Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Exemestane Revenue (million), by Country 2024 & 2032

- Figure 13: South America Exemestane Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Exemestane Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Exemestane Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Exemestane Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Exemestane Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Exemestane Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Exemestane Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Exemestane Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Exemestane Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Exemestane Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Exemestane Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Exemestane Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Exemestane Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Exemestane Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Exemestane Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Exemestane Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Exemestane Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Exemestane Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Exemestane Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Exemestane Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Exemestane Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Exemestane Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Exemestane Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Exemestane Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Exemestane Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Exemestane Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Exemestane Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Exemestane Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Exemestane Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Exemestane Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Exemestane Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Exemestane Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Exemestane Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Exemestane Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Exemestane Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Exemestane Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Exemestane Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Exemestane Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Exemestane Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Exemestane Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Exemestane?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Exemestane?

Key companies in the market include Pfizer, Natco, Hainan Unipul Pharmaceutical, Shanghai Zhaohui Pharmaceutical, Qilu Pharmaceutical, Beijing Unisplendour Pharmaceutical, Celon Laboratories, Sun Pharmaceutical, Alkem Laboratories, Glenmark Pharmaceuticals.

3. What are the main segments of the Exemestane?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Exemestane," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Exemestane report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Exemestane?

To stay informed about further developments, trends, and reports in the Exemestane, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence