Key Insights

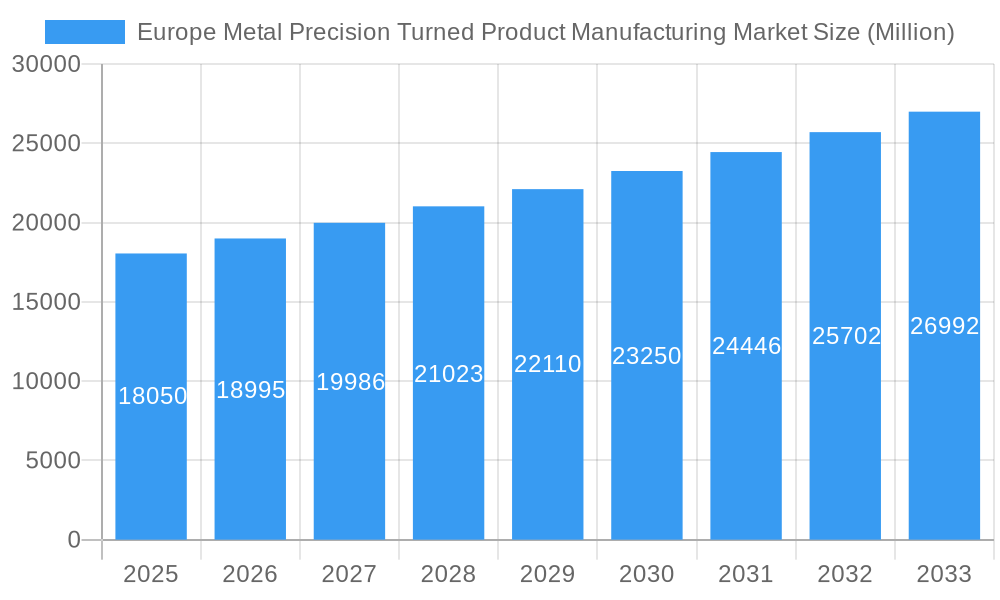

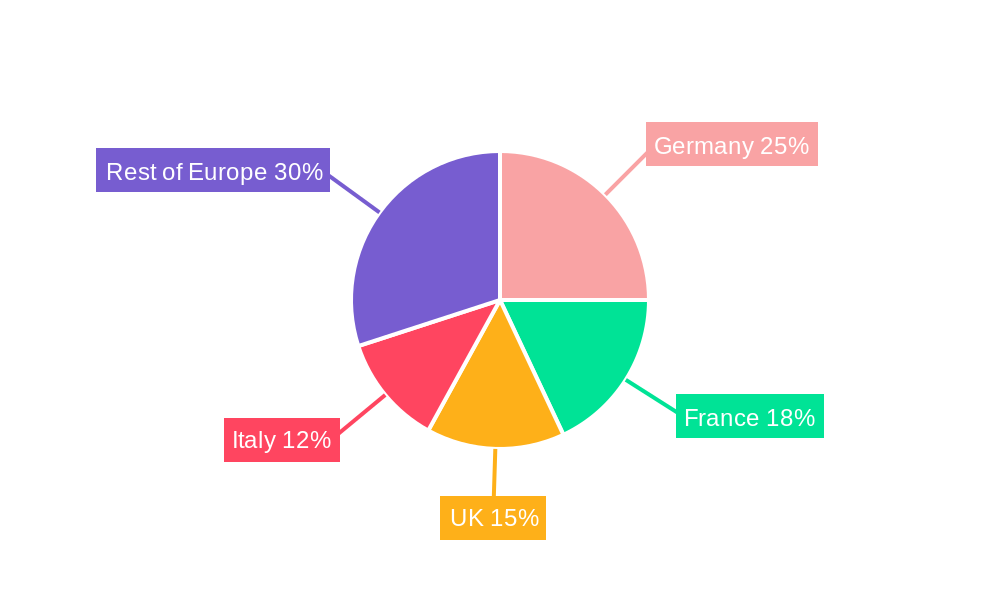

The European metal precision turned product manufacturing market, valued at €18.05 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.11% from 2025 to 2033. This expansion is driven primarily by the increasing demand for precision-engineered components across diverse sectors like automotive, electronics, and healthcare. The automotive industry's push towards lightweighting and fuel efficiency necessitates sophisticated metal components, fueling market growth. Similarly, the electronics industry's ongoing miniaturization trends and the growing adoption of advanced technologies like 5G and IoT are creating demand for intricate, high-precision metal parts. Furthermore, the healthcare sector's demand for precise medical devices and instruments contributes significantly to market expansion. Growth is also spurred by advancements in CNC machining technology, enabling higher production efficiency and improved precision. While supply chain disruptions and fluctuations in raw material prices pose challenges, the overall market outlook remains positive, driven by technological advancements and increased industrial automation. The market is segmented by operation type (manual and CNC), machine type (automatic screw machines, rotary transfer machines, CNC lathes, etc.), and end-user industry. Germany, France, the UK, and Italy represent significant market shares within Europe, benefiting from established manufacturing hubs and strong industrial bases.

Europe Metal Precision Turned Product Manufacturing Market Market Size (In Billion)

The market's segmentation further reveals key opportunities. The CNC operation segment is poised for significant growth due to its superior precision and efficiency compared to manual operations. Within machine types, CNC lathes and turning centers are expected to dominate due to their versatility and adaptability to various applications. The automotive and electronics sectors will continue to be major drivers, while the defense and healthcare sectors are likely to demonstrate strong, albeit smaller, growth trajectories. Strategic partnerships and investments in research and development are key strategies for manufacturers seeking a competitive edge. Increased focus on sustainable manufacturing practices and the adoption of Industry 4.0 principles will also shape the future of this dynamic market. Companies are expected to focus on improving operational efficiency, expanding their product portfolio to cater to specific industry needs and investing in skilled labor to maintain a competitive advantage.

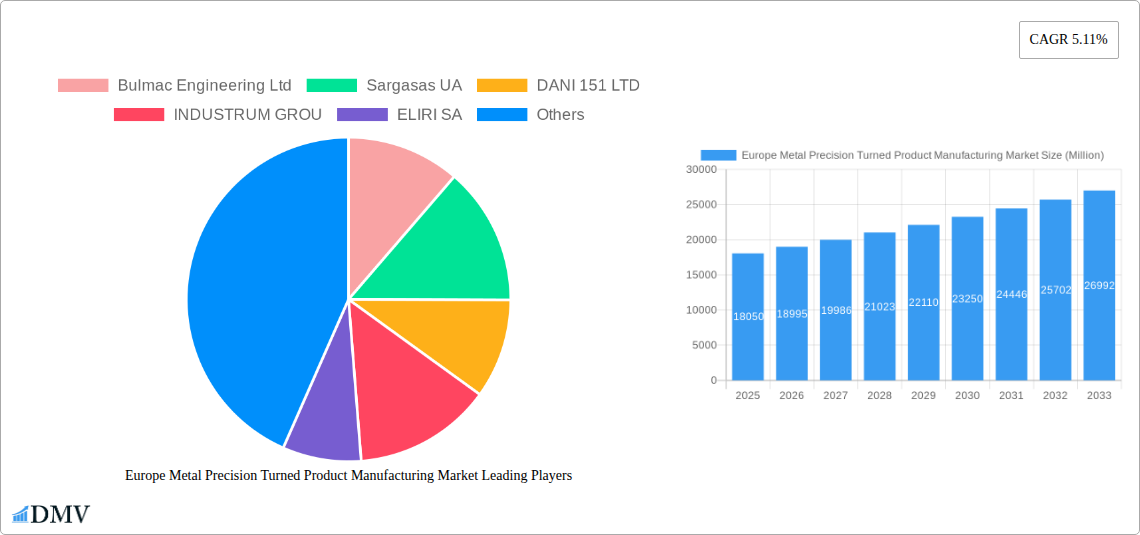

Europe Metal Precision Turned Product Manufacturing Market Company Market Share

Europe Metal Precision Turned Product Manufacturing Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Metal Precision Turned Product Manufacturing Market, offering a comprehensive overview of its current state, future trends, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is expected to reach xx Million by 2033.

Europe Metal Precision Turned Product Manufacturing Market Composition & Trends

This section delves into the intricate composition of the European metal precision turned product manufacturing market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and significant mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, numerous smaller, specialized firms also contribute to the overall market dynamics. Innovation is driven by advancements in CNC technology, automation, and material science, leading to increased precision, efficiency, and product diversification.

- Market Share Distribution (2024): The top 5 players collectively hold approximately xx% of the market share, while the remaining xx% is distributed among numerous smaller players.

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with a combined value of approximately xx Million. These deals primarily focused on expanding geographic reach and enhancing technological capabilities.

- Regulatory Landscape: EU regulations concerning safety, environmental impact, and labor standards significantly influence market practices and operational costs.

- Substitute Products: 3D printing and other additive manufacturing technologies pose a growing competitive threat, particularly for low-volume, high-complexity parts.

- End-User Profiles: The automotive, electronics, and healthcare sectors are major end-users, driving demand for high-precision components.

Europe Metal Precision Turned Product Manufacturing Market Industry Evolution

This section meticulously traces the evolution of the European metal precision turned product manufacturing market, analyzing market growth trajectories, technological advancements, and the ever-shifting consumer demands. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, driven primarily by increased automation and the rising demand for precision components in various industries. The adoption of CNC technology has significantly improved efficiency and precision. Furthermore, growing investments in R&D and the adoption of Industry 4.0 technologies are poised to accelerate market growth in the forecast period. The increasing demand for lightweight and high-strength materials, particularly in the automotive sector, also fuels market expansion. The market is projected to witness a CAGR of xx% from 2025 to 2033, reaching xx Million by the end of the forecast period.

Leading Regions, Countries, or Segments in Europe Metal Precision Turned Product Manufacturing Market

Germany, the UK, and Italy are currently the leading countries in the European metal precision turned product manufacturing market, driven by robust industrial bases and a high concentration of manufacturing companies. The CNC operation segment dominates the market due to its higher precision, efficiency, and automation capabilities compared to manual operations. Within machine types, Computer Numerically Controlled (CNC) machines hold the largest market share due to their flexibility and precision. The automotive industry is the largest end-user, followed by the electronics sector.

- Key Drivers for Germany's Dominance: Strong automotive industry, established manufacturing infrastructure, skilled workforce, government support for advanced manufacturing.

- Key Drivers for the CNC Operation Segment: Higher precision, efficiency, automation, and repeatability compared to manual operations.

- Key Drivers for the Automotive End-User Segment: High demand for precision components in vehicles, stringent quality requirements, and ongoing technological advancements.

Europe Metal Precision Turned Product Manufacturing Market Product Innovations

Recent innovations focus on enhancing precision, speed, and material flexibility. Advancements in CNC technology, such as multi-axis machining and adaptive control systems, enable the production of complex parts with tighter tolerances. The integration of advanced sensors and data analytics improves process monitoring and optimization. New materials, such as high-strength alloys and advanced polymers, are being incorporated to meet the evolving demands of various end-user industries. These innovations are leading to improved product performance, reduced manufacturing costs, and enhanced product lifecycles.

Propelling Factors for Europe Metal Precision Turned Product Manufacturing Market Growth

Several factors contribute to the market's growth. Technological advancements, particularly in CNC machining and automation, drive increased efficiency and precision. The growth of end-user industries, such as automotive and electronics, fuels demand for high-precision components. Favorable government policies and investments in advanced manufacturing further support market expansion. The increasing adoption of Industry 4.0 technologies and the growing focus on sustainability are also important drivers.

Obstacles in the Europe Metal Precision Turned Product Manufacturing Market

The market faces challenges such as rising labor costs, supply chain disruptions, and intense competition. Stringent environmental regulations and the rising cost of raw materials also pose significant hurdles. Fluctuations in global demand and economic uncertainty can impact market growth. Furthermore, the increasing adoption of 3D printing and other additive manufacturing technologies presents a competitive challenge.

Future Opportunities in Europe Metal Precision Turned Product Manufacturing Market

The market presents several promising opportunities. The expansion of electric vehicles and renewable energy technologies will drive demand for specialized components. The growing adoption of automation and Industry 4.0 technologies will create opportunities for innovative solutions. New materials and advanced manufacturing processes will further enhance product performance and efficiency. The increasing demand for customized and high-value components will open new avenues for market players.

Major Players in the Europe Metal Precision Turned Product Manufacturing Market Ecosystem

- Bulmac Engineering Ltd

- Sargasas UA

- DANI 151 LTD

- INDUSTRUM GROU

- ELIRI SA

- R K ENTERPRISES

- VASCHUK LTD

- Arçimed Mold & Injection

- Hardy's Precision Engineering

- Aspired LLC

- Qingdao Guanglai Jiayue International Trade Co Ltd

- UAB Kiruna

Key Developments in Europe Metal Precision Turned Product Manufacturing Market Industry

- July 2023: Indri-MIM acquires CMG Technologies, strengthening its position in the metal injection molding and additive manufacturing market. This acquisition expands Indri-MIM's product portfolio and market reach within Europe.

- January 2023: Xometry Inc. launches Xometry.UK, expanding its global manufacturing marketplace into the UK market. This development increases competition and provides UK customers with access to a broader range of manufacturing services.

Strategic Europe Metal Precision Turned Product Manufacturing Market Forecast

The European metal precision turned product manufacturing market is poised for continued growth, driven by technological advancements, increasing demand from key industries, and supportive government policies. The adoption of Industry 4.0 technologies, the rise of electric vehicles, and the increasing demand for customized and high-precision components will shape market dynamics in the coming years. The market is expected to exhibit a robust growth trajectory, presenting significant opportunities for market players to innovate and expand their market share.

Europe Metal Precision Turned Product Manufacturing Market Segmentation

-

1. Operation

- 1.1. Manual Operation

- 1.2. CNC Operation

-

2. Machine Types

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled(CNC)

- 2.4. Lathes or Turning Center

- 2.5. Other Machine Types

-

3. End-User

- 3.1. Industries

- 3.2. Automobile

- 3.3. Electronics

- 3.4. Defense and Healthcare

- 3.5. Other End-Users

Europe Metal Precision Turned Product Manufacturing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

Europe Metal Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of Europe Metal Precision Turned Product Manufacturing Market

Europe Metal Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand from automobile industry4.; Increased focus on precision products

- 3.3. Market Restrains

- 3.3.1. 4.; The cost of production and transportation4.; Regulations and quality standards

- 3.4. Market Trends

- 3.4.1. Surge in demand from the automotive sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Manual Operation

- 5.1.2. CNC Operation

- 5.2. Market Analysis, Insights and Forecast - by Machine Types

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled(CNC)

- 5.2.4. Lathes or Turning Center

- 5.2.5. Other Machine Types

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Industries

- 5.3.2. Automobile

- 5.3.3. Electronics

- 5.3.4. Defense and Healthcare

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. North America Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operation

- 6.1.1. Manual Operation

- 6.1.2. CNC Operation

- 6.2. Market Analysis, Insights and Forecast - by Machine Types

- 6.2.1. Automatic Screw Machines

- 6.2.2. Rotary Transfer Machines

- 6.2.3. Computer Numerically Controlled(CNC)

- 6.2.4. Lathes or Turning Center

- 6.2.5. Other Machine Types

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Industries

- 6.3.2. Automobile

- 6.3.3. Electronics

- 6.3.4. Defense and Healthcare

- 6.3.5. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Operation

- 7. Europe Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operation

- 7.1.1. Manual Operation

- 7.1.2. CNC Operation

- 7.2. Market Analysis, Insights and Forecast - by Machine Types

- 7.2.1. Automatic Screw Machines

- 7.2.2. Rotary Transfer Machines

- 7.2.3. Computer Numerically Controlled(CNC)

- 7.2.4. Lathes or Turning Center

- 7.2.5. Other Machine Types

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Industries

- 7.3.2. Automobile

- 7.3.3. Electronics

- 7.3.4. Defense and Healthcare

- 7.3.5. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Operation

- 8. Asia Pacific Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operation

- 8.1.1. Manual Operation

- 8.1.2. CNC Operation

- 8.2. Market Analysis, Insights and Forecast - by Machine Types

- 8.2.1. Automatic Screw Machines

- 8.2.2. Rotary Transfer Machines

- 8.2.3. Computer Numerically Controlled(CNC)

- 8.2.4. Lathes or Turning Center

- 8.2.5. Other Machine Types

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Industries

- 8.3.2. Automobile

- 8.3.3. Electronics

- 8.3.4. Defense and Healthcare

- 8.3.5. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Operation

- 9. Middle East and Africa Europe Metal Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operation

- 9.1.1. Manual Operation

- 9.1.2. CNC Operation

- 9.2. Market Analysis, Insights and Forecast - by Machine Types

- 9.2.1. Automatic Screw Machines

- 9.2.2. Rotary Transfer Machines

- 9.2.3. Computer Numerically Controlled(CNC)

- 9.2.4. Lathes or Turning Center

- 9.2.5. Other Machine Types

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Industries

- 9.3.2. Automobile

- 9.3.3. Electronics

- 9.3.4. Defense and Healthcare

- 9.3.5. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Operation

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bulmac Engineering Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sargasas UA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DANI 151 LTD

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 INDUSTRUM GROU

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 ELIRI SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 R K ENTERPRISES

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 VASCHUK LTD

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Arçimed Mold & Injection

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hardy's Precision Engineering

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Aspired LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Qingdao Guanglai Jiayue International Trade Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 UAB Kiruna

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Bulmac Engineering Ltd

List of Figures

- Figure 1: Europe Metal Precision Turned Product Manufacturing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Metal Precision Turned Product Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 2: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 3: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 6: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 7: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 10: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 11: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 14: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 15: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 16: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Operation 2020 & 2033

- Table 18: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Machine Types 2020 & 2033

- Table 19: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Europe Metal Precision Turned Product Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Metal Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the Europe Metal Precision Turned Product Manufacturing Market?

Key companies in the market include Bulmac Engineering Ltd, Sargasas UA, DANI 151 LTD, INDUSTRUM GROU, ELIRI SA, R K ENTERPRISES, VASCHUK LTD, Arçimed Mold & Injection, Hardy's Precision Engineering, Aspired LLC, Qingdao Guanglai Jiayue International Trade Co Ltd, UAB Kiruna.

3. What are the main segments of the Europe Metal Precision Turned Product Manufacturing Market?

The market segments include Operation, Machine Types, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.05 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand from automobile industry4.; Increased focus on precision products.

6. What are the notable trends driving market growth?

Surge in demand from the automotive sector.

7. Are there any restraints impacting market growth?

4.; The cost of production and transportation4.; Regulations and quality standards.

8. Can you provide examples of recent developments in the market?

July 2023: Indri-MIM, one of the world’s leading suppliers of advanced components, announced the acquisition of the UK’s leading MIM producer, CMG Technologies. CMG Technologies is a leading manufacturer of metal injection molding and metal additive manufacturing products based in Woodbridge in Suffolk, United Kingdom.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Metal Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Metal Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Metal Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the Europe Metal Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence