Key Insights

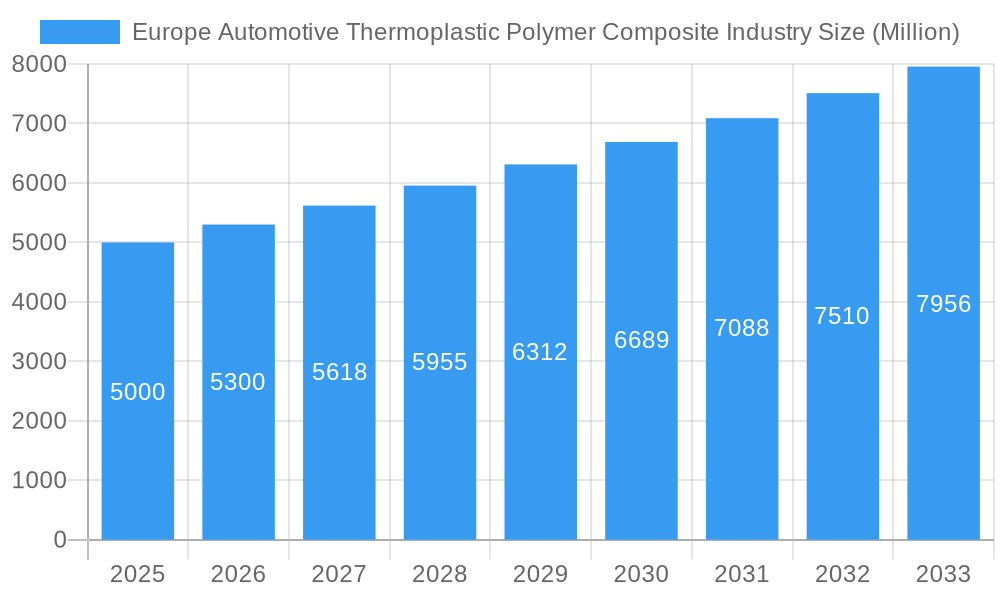

The European automotive thermoplastic polymer composite market is experiencing robust growth, driven by increasing demand for lightweight vehicles to improve fuel efficiency and reduce carbon emissions. The market's Compound Annual Growth Rate (CAGR) exceeding 6% from 2019 to 2024 indicates a significant upward trajectory. This growth is fueled by several key factors. The automotive industry's ongoing transition towards electric vehicles (EVs) presents a significant opportunity, as thermoplastic composites offer advantages in battery housing and other EV components due to their lightweight nature and design flexibility. Furthermore, stringent government regulations aimed at reducing vehicle weight and emissions are compelling automakers to adopt lighter materials, further boosting the demand for thermoplastic polymer composites. The diverse applications within automotive manufacturing, encompassing structural assemblies, powertrain components, interiors, and exteriors, contribute to the market's breadth and potential for future expansion. Major players like DuPont De Nemours, Daicel Polymer Ltd, and Celanese Corporation are driving innovation through advanced material development and strategic partnerships, further strengthening the market's position. While the market faces challenges such as the relatively high initial cost of thermoplastic composites compared to traditional materials and potential supply chain complexities, the long-term benefits in terms of fuel efficiency, durability, and design flexibility are expected to outweigh these challenges, leading to sustained market expansion.

Europe Automotive Thermoplastic Polymer Composite Industry Market Size (In Billion)

The dominant production types within the European market are likely Resin Transfer Molding (RTM), Vacuum Infusion Processing (VIP), and Injection Molding, reflecting the industry's increasing adoption of high-volume, cost-effective manufacturing techniques. The market segmentation by application shows significant demand across various automotive components, with structural assemblies, powertrain components, and interiors likely holding the largest market shares. Regional analysis suggests that Germany, France, and the UK are key markets within Europe, driven by substantial automotive manufacturing hubs and supportive government policies. While precise market size figures are not provided, projecting from the given CAGR and considering the market trends discussed above, we can expect a substantial increase in market value over the forecast period (2025-2033) in the European region, maintaining a robust growth trajectory fueled by technological advancements and stringent environmental regulations.

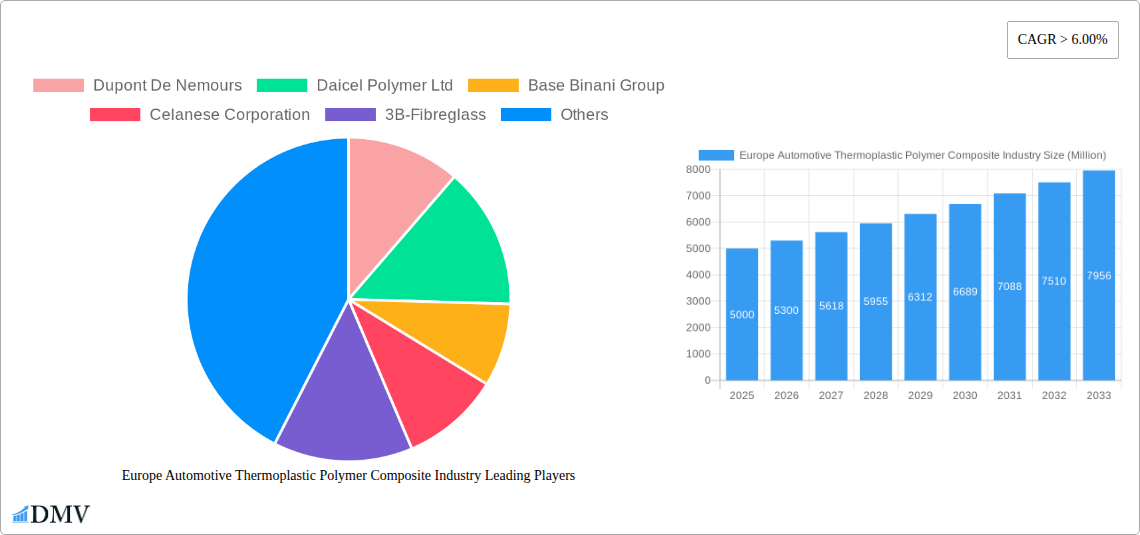

Europe Automotive Thermoplastic Polymer Composite Industry Company Market Share

Europe Automotive Thermoplastic Polymer Composite Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Automotive Thermoplastic Polymer Composite Industry, offering a comprehensive overview of market dynamics, key players, and future growth prospects. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The market size is estimated to be XX Million in 2025, and is projected to reach XX Million by 2033.

Europe Automotive Thermoplastic Polymer Composite Industry Market Composition & Trends

This section dives deep into the competitive landscape of the European automotive thermoplastic polymer composite market. We analyze market concentration, revealing the market share distribution among key players like Dupont De Nemours, Daicel Polymer Ltd, Base Binani Group, Celanese Corporation, 3B-Fibreglass, Arkema Group, Technocompound GmbH, Polyone Corporation, Hexcel Corporation, and Cytec Industries Inc. The report also examines innovation catalysts driving market growth, including advancements in materials science and manufacturing processes. We explore the influence of regulatory landscapes, specifically focusing on emission standards and safety regulations impacting material selection and design. Furthermore, the report assesses the impact of substitute products and analyzes end-user profiles across various automotive segments. Finally, we detail recent mergers and acquisitions (M&A) activities, including deal values and their implications on market consolidation. For example, the XX Million acquisition of Company A by Company B in 2024 significantly altered the market share distribution, shifting the competitive landscape. The report will also include a detailed analysis of the impact of these M&A activities on market concentration and competitive dynamics.

Europe Automotive Thermoplastic Polymer Composite Industry Industry Evolution

This section meticulously traces the evolution of the European automotive thermoplastic polymer composite industry from 2019 to 2033. We analyze market growth trajectories, charting compound annual growth rates (CAGR) and identifying key periods of accelerated expansion. Technological advancements, such as the adoption of lightweighting technologies and the development of high-performance composites, are discussed, alongside their impact on market adoption rates. Shifting consumer demands for fuel efficiency and enhanced vehicle safety play a crucial role and are analyzed in detail with quantitative data support. We detail the increasing preference for sustainable materials and their impact on the market. The impact of the COVID-19 pandemic on supply chains and manufacturing will also be assessed, and its effect on long-term growth trajectories. We will analyze how different segments reacted to external market pressures and supply chain volatility, explaining the industry's ability to adapt and innovate to overcome such challenges.

Leading Regions, Countries, or Segments in Europe Automotive Thermoplastic Polymer Composite Industry

This section pinpoints the leading regions, countries, and segments within the European automotive thermoplastic polymer composite market. We identify the dominant production type(s) among Hand Layup, Resin Transfer Molding, Vacuum Infusion Processing, Compression Molding, and Injection Molding, and the leading application type(s) among Structural Assembly, Power Train Components, Interior, Exterior, and Others.

- Key Drivers (Examples):

- Significant investments in R&D for lightweight materials within Germany.

- Favorable government regulations promoting the adoption of sustainable composites in France.

- High demand for fuel-efficient vehicles in the UK driving the adoption of lightweight composites.

The dominance of specific regions or segments is analyzed by delving into factors such as production capacity, manufacturing infrastructure, regulatory support, and access to skilled labor. For example, Germany's strong automotive manufacturing base and advanced material science research facilities contributes to its leading position in the market.

Europe Automotive Thermoplastic Polymer Composite Industry Product Innovations

Recent years have witnessed significant product innovations in automotive thermoplastic polymer composites, focusing on improved material properties such as enhanced strength-to-weight ratios, superior impact resistance, and improved thermal management. New applications are emerging, including advanced structural components for electric vehicles and integrated electronics within vehicle interiors. These innovations offer unique selling propositions, enabling automakers to meet increasingly stringent regulatory requirements and enhance vehicle performance. Specific performance metrics such as tensile strength, flexural modulus, and impact resistance are analyzed to demonstrate the progress made in material science and manufacturing.

Propelling Factors for Europe Automotive Thermoplastic Polymer Composite Industry Growth

Several factors propel the growth of the Europe Automotive Thermoplastic Polymer Composite Industry. Technological advancements, such as the development of high-performance thermoplastic composites with enhanced properties, are key. Economic factors, including increasing demand for fuel-efficient and lightweight vehicles, contribute significantly. Furthermore, supportive government regulations promoting the adoption of sustainable materials in the automotive sector play a vital role. For example, stricter emission standards mandate the use of lightweight materials.

Obstacles in the Europe Automotive Thermoplastic Polymer Composite Industry Market

Despite positive growth trends, the European automotive thermoplastic polymer composite industry faces several obstacles. Regulatory challenges, such as complex approval processes for new materials, pose significant hurdles. Supply chain disruptions, particularly concerning raw materials and specialized components, can impact production and lead times. Intense competitive pressure from established players and emerging technologies further complicates the market. For instance, supply chain disruptions in 2022 led to a xx% decrease in production for some companies.

Future Opportunities in Europe Automotive Thermoplastic Polymer Composite Industry

The future holds significant opportunities for the European automotive thermoplastic polymer composite industry. Emerging markets for electric vehicles and autonomous driving present substantial growth potential. Advancements in material science and manufacturing techniques, such as additive manufacturing and automated fiber placement, will open new avenues for innovation. Evolving consumer preferences for sustainable and recyclable materials offer promising pathways for companies focusing on environmentally friendly solutions.

Major Players in the Europe Automotive Thermoplastic Polymer Composite Industry Ecosystem

- Dupont De Nemours

- Daicel Polymer Ltd

- Base Binani Group

- Celanese Corporation

- 3B-Fibreglass

- Arkema Group

- Technocompound GmbH

- Polyone Corporation

- Hexcel Corporation

- Cytec Industries Inc

Key Developments in Europe Automotive Thermoplastic Polymer Composite Industry Industry

- January 2023: Launch of a new high-strength thermoplastic composite by Company X.

- March 2022: Merger between Company Y and Company Z, expanding market share.

- June 2021: Introduction of new recycling technology for thermoplastic composites by Company A. (Further developments to be added in the full report.)

Strategic Europe Automotive Thermoplastic Polymer Composite Industry Market Forecast

The European automotive thermoplastic polymer composite industry is poised for sustained growth driven by technological advancements, increasing demand for lightweight vehicles, and supportive government policies. Future opportunities lie in the development of innovative materials with enhanced properties, expansion into new automotive segments like electric vehicles and autonomous driving, and increased adoption of sustainable manufacturing practices. The market is projected to experience a significant increase in the coming years, driven by the factors discussed above and further fueled by ongoing innovation in material science and manufacturing.

Europe Automotive Thermoplastic Polymer Composite Industry Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vaccum Infusion Processing

- 1.4. Compression Molding

- 1.5. Injection Molding

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Power Train Components

- 2.3. Interior

- 2.4. Exterior

- 2.5. Others

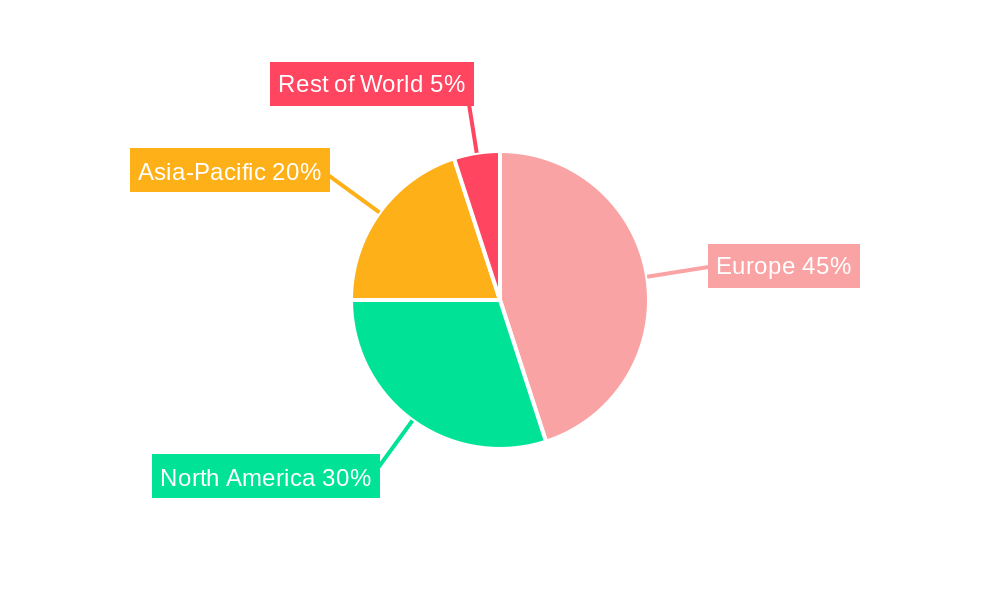

Europe Automotive Thermoplastic Polymer Composite Industry Segmentation By Geography

- 1. Germay

- 2. France

- 3. United Kingdom

- 4. Italy

- 5. Rest of Europe

Europe Automotive Thermoplastic Polymer Composite Industry Regional Market Share

Geographic Coverage of Europe Automotive Thermoplastic Polymer Composite Industry

Europe Automotive Thermoplastic Polymer Composite Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Lightweight Materials

- 3.3. Market Restrains

- 3.3.1. High Expenses of Composite Processing and Manufacturing

- 3.4. Market Trends

- 3.4.1. Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vaccum Infusion Processing

- 5.1.4. Compression Molding

- 5.1.5. Injection Molding

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Power Train Components

- 5.2.3. Interior

- 5.2.4. Exterior

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germay

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Germay Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 6.1.1. Hand Layup

- 6.1.2. Resin Transfer Molding

- 6.1.3. Vaccum Infusion Processing

- 6.1.4. Compression Molding

- 6.1.5. Injection Molding

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Structural Assembly

- 6.2.2. Power Train Components

- 6.2.3. Interior

- 6.2.4. Exterior

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Production Type

- 7. France Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 7.1.1. Hand Layup

- 7.1.2. Resin Transfer Molding

- 7.1.3. Vaccum Infusion Processing

- 7.1.4. Compression Molding

- 7.1.5. Injection Molding

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Structural Assembly

- 7.2.2. Power Train Components

- 7.2.3. Interior

- 7.2.4. Exterior

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Production Type

- 8. United Kingdom Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 8.1.1. Hand Layup

- 8.1.2. Resin Transfer Molding

- 8.1.3. Vaccum Infusion Processing

- 8.1.4. Compression Molding

- 8.1.5. Injection Molding

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Structural Assembly

- 8.2.2. Power Train Components

- 8.2.3. Interior

- 8.2.4. Exterior

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Production Type

- 9. Italy Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 9.1.1. Hand Layup

- 9.1.2. Resin Transfer Molding

- 9.1.3. Vaccum Infusion Processing

- 9.1.4. Compression Molding

- 9.1.5. Injection Molding

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Structural Assembly

- 9.2.2. Power Train Components

- 9.2.3. Interior

- 9.2.4. Exterior

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Production Type

- 10. Rest of Europe Europe Automotive Thermoplastic Polymer Composite Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 10.1.1. Hand Layup

- 10.1.2. Resin Transfer Molding

- 10.1.3. Vaccum Infusion Processing

- 10.1.4. Compression Molding

- 10.1.5. Injection Molding

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Structural Assembly

- 10.2.2. Power Train Components

- 10.2.3. Interior

- 10.2.4. Exterior

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Production Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dupont De Nemours

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daicel Polymer Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Base Binani Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Celanese Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 3B-Fibreglass

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Arkema Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Technocompound GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Polyone Corporatio

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hexcel Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cytec Industries Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dupont De Nemours

List of Figures

- Figure 1: Europe Automotive Thermoplastic Polymer Composite Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Thermoplastic Polymer Composite Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 2: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 5: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 8: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 9: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 11: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 12: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 14: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 15: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Production Type 2020 & 2033

- Table 17: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 18: Europe Automotive Thermoplastic Polymer Composite Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Thermoplastic Polymer Composite Industry?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Europe Automotive Thermoplastic Polymer Composite Industry?

Key companies in the market include Dupont De Nemours, Daicel Polymer Ltd, Base Binani Group, Celanese Corporation, 3B-Fibreglass, Arkema Group, Technocompound GmbH, Polyone Corporatio, Hexcel Corporation, Cytec Industries Inc.

3. What are the main segments of the Europe Automotive Thermoplastic Polymer Composite Industry?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Lightweight Materials.

6. What are the notable trends driving market growth?

Glass Mat Thermoplastic (GMT) is Expected to Grow with a Fast Pace.

7. Are there any restraints impacting market growth?

High Expenses of Composite Processing and Manufacturing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Thermoplastic Polymer Composite Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Thermoplastic Polymer Composite Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Thermoplastic Polymer Composite Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Thermoplastic Polymer Composite Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence