Key Insights

The European automotive smart key market is poised for significant expansion, driven by increasing vehicle production, growing consumer demand for advanced security and convenience, and the integration of cutting-edge automotive technologies. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of 6%, with an estimated market size of $13.33 billion by 2025. Key growth catalysts include the rising adoption of premium vehicles featuring advanced driver-assistance systems (ADAS) and connected car functionalities, which inherently integrate smart key technology. Furthermore, the increasing popularity of passive keyless entry systems (PKES) offers superior ease of access and enhanced security compared to traditional key fobs. The aftermarket segment also plays a vital role, fueled by the demand for replacements and upgrades of older, less secure systems. Germany, the UK, France, and Italy are leading markets, supported by high vehicle ownership and strong automotive manufacturing bases. Potential challenges such as the higher initial cost of smart key systems and security vulnerability concerns are being proactively addressed through technological innovation. The market is segmented by application (single-function vs. multi-function), technology (RKE vs. PKE), installation (OEM vs. aftermarket), and country.

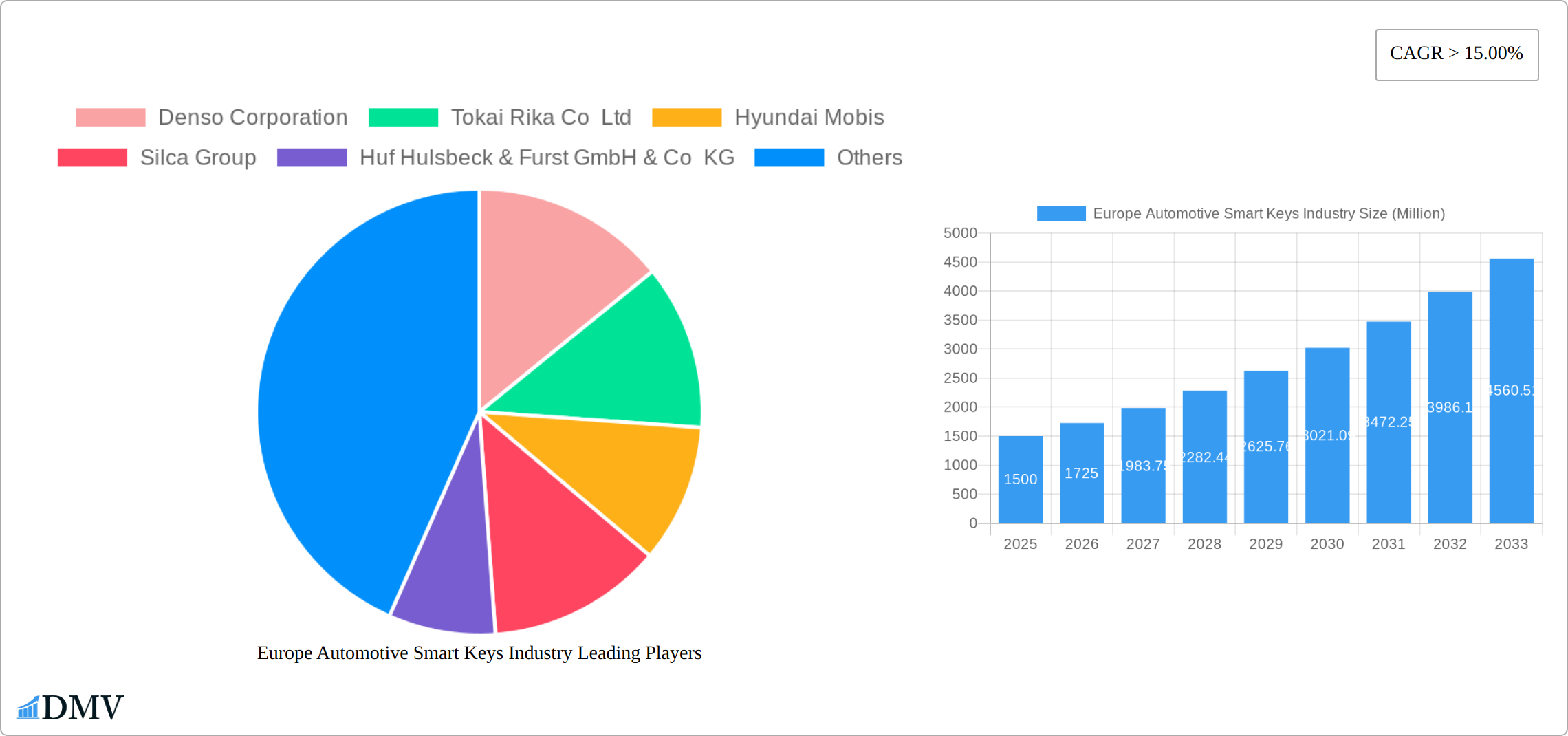

Europe Automotive Smart Keys Industry Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates sustained growth, with a particular emphasis on multi-function smart keys that integrate features like remote vehicle starting and advanced security protocols. Advancements in PKE technology are crucial for mitigating vulnerabilities such as relay attacks. While the OEM segment is expected to maintain dominance due to integrated manufacturing, the aftermarket segment will also experience growth driven by replacement and retrofitting demand. Market expansion is further supported by the increasing penetration of smart key systems in smaller and mid-size vehicles, enhancing accessibility. The burgeoning electric vehicle (EV) market will also contribute positively, as EVs commonly feature advanced smart key systems as standard. This confluence of technological progress, evolving consumer preferences, and dynamic industry trends presents a highly favorable outlook for the European automotive smart key market.

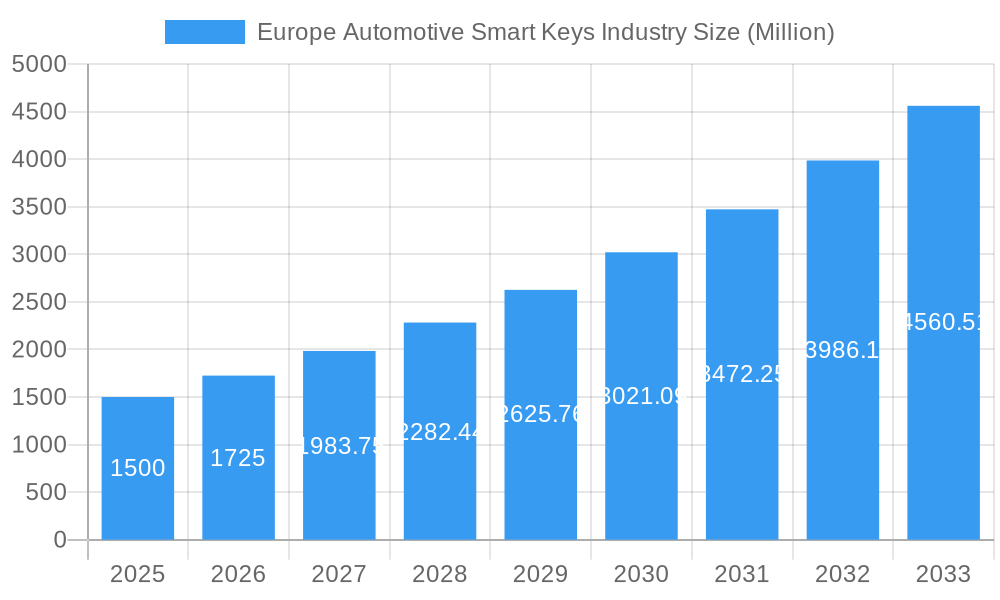

Europe Automotive Smart Keys Industry Company Market Share

Europe Automotive Smart Keys Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Automotive Smart Keys industry, offering a comprehensive overview of market trends, leading players, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033.

Europe Automotive Smart Keys Industry Market Composition & Trends

This section provides a comprehensive analysis of the competitive dynamics within the European automotive smart keys market. We dissect market concentration, identify key innovation drivers, evaluate the impact of regulatory frameworks, assess the threat from substitute products, understand end-user preferences, and scrutinize mergers and acquisitions (M&A) activity. Our analysis includes a detailed breakdown of market share distribution among prominent players such as Denso Corporation, Tokai Rika Co Ltd, Hyundai Mobis, Silca Group, Huf Hulsbeck & Furst GmbH & Co KG, HELLA GmbH & Co KGaA, Continental AG, ALPHA Corporation, Valeo SA, Robert Bosch GmbH, and ZF Friedrichshafen AG. Market concentration is quantified using metrics like the Herfindahl-Hirschman Index (HHI), while key innovation catalysts and their impact on market growth are identified. We further assess the influence of evolving regulatory landscapes, particularly concerning data privacy and cybersecurity, on market evolution. The competitive threat posed by substitute products, including the growing adoption of smartphone-based keyless entry systems, is thoroughly explored. Finally, recent M&A activities are analyzed, including significant deal values and their strategic implications for market consolidation.

- Market Share Distribution: Detailed breakdown of market share held by leading companies in 2025. For example, Bosch might hold xx%, Continental xx%, and Valeo xx%. This analysis will highlight the competitive positioning of key manufacturers and the potential for market shifts.

- M&A Activity: Analysis of significant M&A transactions during the historical period (2019-2024), including deal values (in Millions). Example: Acquisition of Company X by Company Y for xx Million in 2022. This section will examine the strategic rationale behind these consolidations and their impact on the competitive landscape.

- Regulatory Landscape: Assessment of key regulations impacting the market, focusing on their effect on innovation, cybersecurity standards, and market entry barriers. We will examine specific directives and their implications for product development and deployment.

- Substitute Products: In-depth analysis of the competitive threat from substitute technologies, such as digital car keys via smartphones and wearables. This will include an assessment of their market penetration, adoption rates, and the factors influencing consumer preference.

Europe Automotive Smart Keys Industry Industry Evolution

This section provides a detailed analysis of the evolution of the European automotive smart keys market, charting its growth trajectory, technological advancements, and evolving consumer preferences from 2019 to 2033. We examine the factors influencing market growth rates, including technological innovations, such as biometric authentication and improved security features, and changing consumer demands for enhanced convenience and security. The analysis includes specific data points on growth rates (CAGR) for different segments and adoption rates of new technologies. The impact of macroeconomic factors like economic downturns and the adoption of electric vehicles on market growth is also carefully considered.

(This section would contain approximately 600 words of detailed analysis based on the requested data points, including specific growth rates and adoption metrics.)

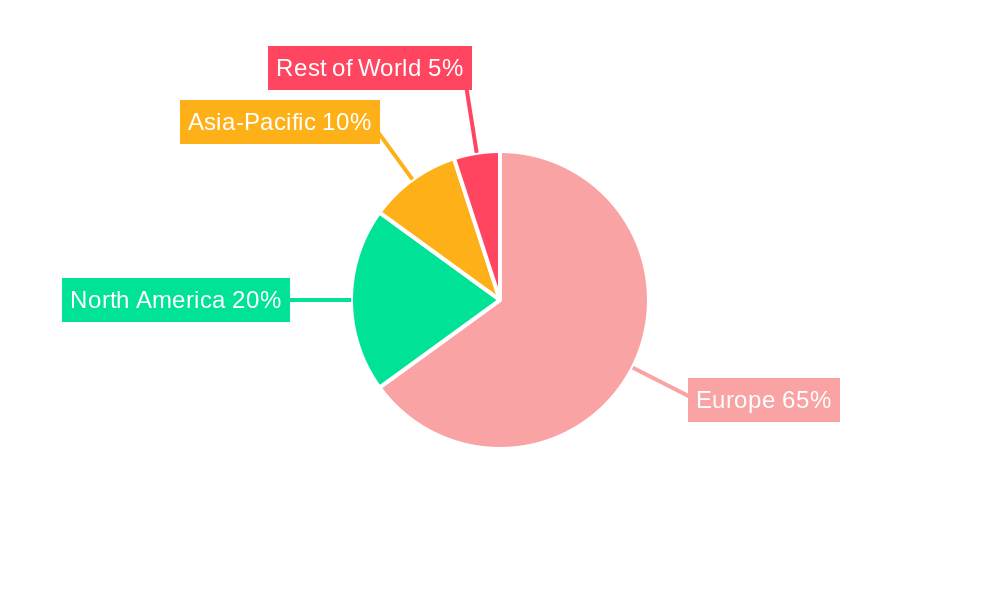

Leading Regions, Countries, or Segments in Europe Automotive Smart Keys Industry

This section meticulously identifies the dominant regions, countries, and segments within the dynamic European automotive smart keys market. We conduct a performance analysis across critical segments: By Application Type (Single Function, Multi-function), By Technology Type (Remote Keyless Entry, Passive Keyless Entry), By Installation Type (OEM, Aftermarket), and By Country (Germany, United Kingdom, Italy, France, Spain, Rest of Europe). The analysis pinpoints the leading segment(s) and delves into the underlying strategic and economic drivers of their sustained dominance, providing actionable insights into market opportunities and potential growth areas.

- Key Drivers for Dominance:

- Germany: Benefiting from a robust automotive manufacturing base, early adoption of advanced automotive technologies, and supportive government incentives, Germany continues to lead in smart key integration and innovation.

- OEM Segment: The OEM segment exhibits strong growth due to persistent demand from major automakers for seamless integration of cutting-edge smart key functionalities into new vehicle models, enhancing vehicle security and user experience from the factory floor.

- Passive Keyless Entry: Passive Keyless Entry (PKE) systems are experiencing escalating consumer preference, driven by their unparalleled convenience and enhanced security features, making them a sought-after technology in the current automotive market.

(This section would contain approximately 600 words of in-depth analysis, utilizing both bullet points and paragraphs to highlight dominance factors and key drivers for each leading region, country, and segment. It will include quantitative data and qualitative insights to support the findings.)

Europe Automotive Smart Keys Industry Product Innovations

This section highlights the forefront of product innovation within the European automotive smart keys market, showcasing unique selling propositions (USPs) and groundbreaking technological advancements. We meticulously examine emerging features such as extended operational range, significantly improved security protocols leveraging advanced encryption algorithms, seamless integration with dedicated smartphone applications for comprehensive remote vehicle control, and the incorporation of sophisticated biometric authentication methods for unparalleled access control. Furthermore, critical performance metrics, including extended battery life and robust signal strength under diverse environmental conditions, are rigorously evaluated to provide a holistic view of product evolution and competitive differentiation.

Propelling Factors for Europe Automotive Smart Keys Industry Growth

The European automotive smart keys market is experiencing robust growth propelled by a confluence of strategic factors. Paramount among these are continuous technological advancements, particularly in the development of more secure, intuitive, and user-friendly smart key systems. Furthermore, a discernible surge in consumer demand for enhanced vehicle security features and sophisticated convenience solutions is a significant market expansion driver. Stringent government regulations that prioritize vehicle safety and security also play a pivotal role in mandating and fostering the adoption of advanced smart key technologies. Lastly, the escalating popularity and widespread adoption of electric and autonomous vehicles are creating a sustained and amplified demand for highly advanced and integrated smart key systems that complement these next-generation mobility solutions.

Obstacles in the Europe Automotive Smart Keys Industry Market

Despite significant growth potential, the European automotive smart keys market faces certain challenges. Regulatory hurdles, such as strict data privacy regulations and cybersecurity standards, can increase compliance costs. Supply chain disruptions, particularly concerning the availability of crucial components like microchips, can impact production and lead times. Intense competition among established players and emerging entrants further complicates the market landscape. For example, supply chain issues in 2022 resulted in a xx% decrease in production for some key players.

Future Opportunities in Europe Automotive Smart Keys Industry

The European automotive smart keys market presents several exciting opportunities for future growth. The expansion into new markets, particularly in Eastern Europe, offers significant potential. Technological innovations, such as the integration of advanced features like digital keys and remote diagnostics, will continue to drive market expansion. Moreover, the growing trend towards connected cars and the Internet of Things (IoT) will create new avenues for smart key system development and integration.

Major Players in the Europe Automotive Smart Keys Industry Ecosystem

Key Developments in Europe Automotive Smart Keys Industry Industry

- 2022 Q3: Continental AG unveiled its latest generation of smart key technology, boasting significantly enhanced security features and extended range capabilities, setting a new benchmark for the industry.

- 2023 Q1: A strategic merger between two prominent, albeit smaller, smart key manufacturers resulted in the formation of a consolidated entity that achieved an estimated xx% increase in its overall market share, signifying a move towards industry consolidation.

- 2024 Q4: New European Union regulations pertaining to data privacy and cybersecurity came into effect, prompting significant adjustments in the design, development, and implementation strategies for smart key systems across the region. (Further critical developments with specific dates and impacts on the market will be detailed in this section.)

Strategic Europe Automotive Smart Keys Industry Market Forecast

The European automotive smart keys market is poised for significant growth over the forecast period (2025-2033). Driving this expansion are technological advancements, increasing consumer demand for enhanced security and convenience features, and supportive government regulations. New opportunities lie in the integration of smart keys with connected car technologies and the expansion into new vehicle segments, such as electric vehicles and autonomous vehicles. The market's future potential is substantial, promising considerable returns for stakeholders who can effectively leverage the emerging opportunities.

Europe Automotive Smart Keys Industry Segmentation

-

1. Application Type

- 1.1. Single Function

- 1.2. Multi-function

-

2. Technology Type

- 2.1. Remote Keyless Entry

- 2.2. Passive Keyless Entry

-

3. Installation Type

- 3.1. OEM

- 3.2. Aftermarket

Europe Automotive Smart Keys Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive Smart Keys Industry Regional Market Share

Geographic Coverage of Europe Automotive Smart Keys Industry

Europe Automotive Smart Keys Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labors Is Anticipated To Restrain The market Growth

- 3.4. Market Trends

- 3.4.1. Security Risks is Hindering the Market Growth.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Smart Keys Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Single Function

- 5.1.2. Multi-function

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Remote Keyless Entry

- 5.2.2. Passive Keyless Entry

- 5.3. Market Analysis, Insights and Forecast - by Installation Type

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tokai Rika Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Mobis

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Silca Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huf Hulsbeck & Furst GmbH & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 HELLA GmbH & Co KGaA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Continental AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ALPHA Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Valeo SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Robert Bosch Gmb

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ZF Friedrichshafen AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: Europe Automotive Smart Keys Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Smart Keys Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Smart Keys Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 2: Europe Automotive Smart Keys Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 3: Europe Automotive Smart Keys Industry Revenue billion Forecast, by Installation Type 2020 & 2033

- Table 4: Europe Automotive Smart Keys Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Smart Keys Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Europe Automotive Smart Keys Industry Revenue billion Forecast, by Technology Type 2020 & 2033

- Table 7: Europe Automotive Smart Keys Industry Revenue billion Forecast, by Installation Type 2020 & 2033

- Table 8: Europe Automotive Smart Keys Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Automotive Smart Keys Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Smart Keys Industry?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the Europe Automotive Smart Keys Industry?

Key companies in the market include Denso Corporation, Tokai Rika Co Ltd, Hyundai Mobis, Silca Group, Huf Hulsbeck & Furst GmbH & Co KG, HELLA GmbH & Co KGaA, Continental AG, ALPHA Corporation, Valeo SA, Robert Bosch Gmb, ZF Friedrichshafen AG.

3. What are the main segments of the Europe Automotive Smart Keys Industry?

The market segments include Application Type, Technology Type, Installation Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand of Electric Vehicles Is Likely To Drive The Market Growth.

6. What are the notable trends driving market growth?

Security Risks is Hindering the Market Growth..

7. Are there any restraints impacting market growth?

Lack of Skilled Labors Is Anticipated To Restrain The market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Smart Keys Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Smart Keys Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Smart Keys Industry?

To stay informed about further developments, trends, and reports in the Europe Automotive Smart Keys Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence