Key Insights

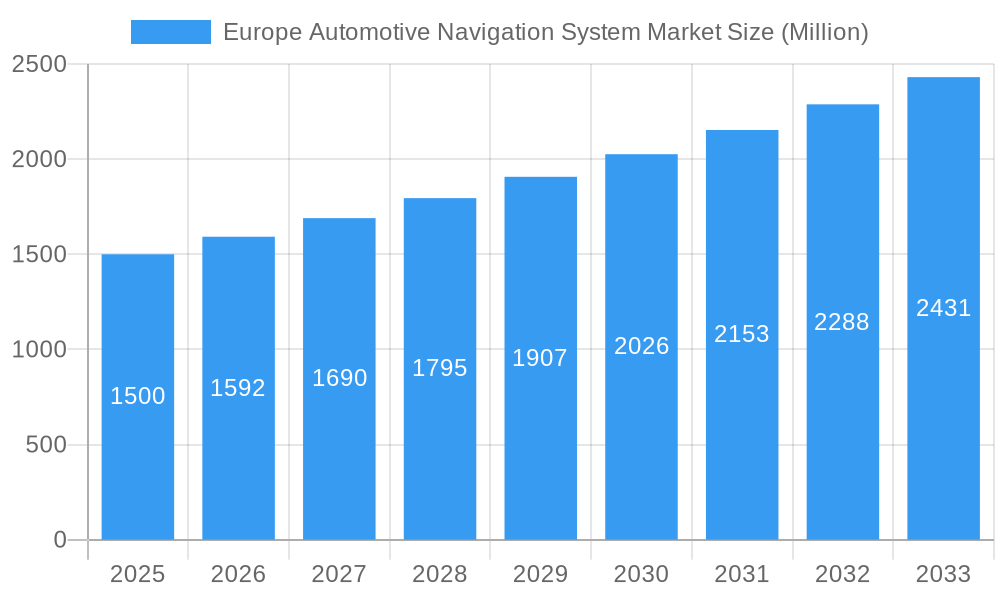

The European automotive navigation system market demonstrates strong expansion, propelled by escalating vehicle production, heightened consumer demand for Advanced Driver-Assistance Systems (ADAS), and the integration of navigation within infotainment systems. The market, valued at €11.4 million in the 2025 base year, is forecast to grow at a Compound Annual Growth Rate (CAGR) of 5.89% from 2025 to 2033. This upward trajectory is supported by several key trends, including the increasing adoption of factory-fitted integrated navigation systems for enhanced user experience. Furthermore, a significant shift from traditional Personal Navigation Devices (PNDs) to feature-rich smartphone navigation applications, offering real-time traffic updates and voice control, is evident. The integration of advanced navigation features, such as augmented reality overlays and connected car services, also contributes to this growth. While the passenger car segment leads, the commercial vehicle sector is experiencing substantial expansion due to evolving logistics and fleet management requirements. Leading industry players are actively investing in research and development to improve navigation accuracy, user interface design, and connectivity, thereby fostering market growth.

Europe Automotive Navigation System Market Market Size (In Million)

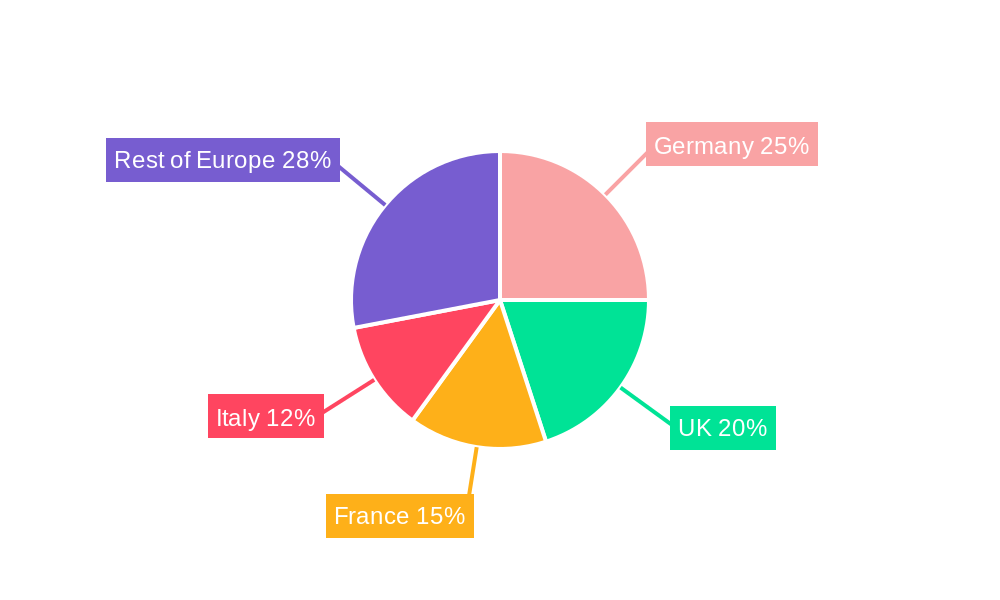

Despite promising growth prospects, the market faces certain challenges. The escalating costs of advanced navigation technologies and the increasing prevalence of smartphone-based navigation solutions pose potential restraints. Intense competition among established players and emerging technology companies necessitates continuous innovation. Market segmentation reveals diverse growth opportunities across vehicle types (passenger car vs. commercial vehicle) and technology platforms (factory-fitted vs. aftermarket). Germany, the UK, France, and Italy are projected to be the primary contributors to the European market share, owing to high vehicle ownership and technology adoption rates. Understanding regional consumer preferences and regulatory frameworks is vital for effective market penetration. This analysis highlights significant opportunities for market participants to leverage technological advancements and evolving consumer preferences.

Europe Automotive Navigation System Market Company Market Share

Europe Automotive Navigation System Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Automotive Navigation System Market, offering a comprehensive overview of its current state, future trends, and key players. Spanning the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study unveils crucial market dynamics and strategic opportunities for stakeholders. The market is segmented by vehicle type (Passenger Car, Commercial Vehicle), technology type (Aftermarket IVS, Factory-fitted IVS, Personal Navigation Devices (PNDs), Smartphones/Tablets), and sales channel type (OEM, Aftermarket). The market is projected to reach xx Million by 2033, exhibiting a significant growth trajectory.

Europe Automotive Navigation System Market Composition & Trends

This section delves into the intricate composition of the European automotive navigation system market. We analyze market concentration, revealing the market share distribution amongst key players. The report also explores the innovative technologies driving market growth, the evolving regulatory landscape influencing market dynamics, and the impact of substitute products, such as smartphone navigation apps. Furthermore, we examine the end-user profiles shaping demand and detail significant mergers and acquisitions (M&A) activities within the industry, including their associated values (e.g., xx Million deals).

- Market Concentration: Analysis of market share held by top players (Clarion, Mitsubishi Electric Corporation, Continental AG, Aisin AW Co Ltd, Garmin, Denso Corporation, Pioneer, Alpine Electronics, etc.). We will present a detailed breakdown of the market share distribution.

- Innovation Catalysts: Exploration of technological advancements, such as AI-powered navigation, cloud-based mapping, and advanced driver-assistance systems (ADAS) integration.

- Regulatory Landscape: Assessment of EU regulations impacting the automotive navigation industry, including data privacy and cybersecurity standards.

- Substitute Products: Evaluation of the competitive threat posed by smartphone navigation apps and their impact on market growth.

- End-User Profiles: Identification of key end-user segments and their specific needs within the market.

- M&A Activities: Analysis of past and projected M&A activity, including deal values and their strategic implications for the market landscape.

Europe Automotive Navigation System Market Industry Evolution

This section offers a comprehensive analysis of the automotive navigation system market’s evolutionary path. We explore the market’s growth trajectory from 2019 to 2024, highlighting key periods of expansion and contraction. The influence of technological advancements, such as the integration of connected car technologies and the rise of electric vehicles (EVs), on market dynamics is meticulously examined. Further, we analyze shifting consumer preferences and their impact on demand for specific navigation system features and functionalities. Specific data points, including precise growth rates (e.g., xx% CAGR) and adoption metrics for various technologies, are presented.

Leading Regions, Countries, or Segments in Europe Automotive Navigation System Market

This section identifies the dominant regions, countries, and market segments within the European automotive navigation system market. We analyze the factors driving the dominance of specific segments. For each, we present key drivers, and provide an in-depth explanation of the factors contributing to their leadership position.

Vehicle Type: Passenger Car vs. Commercial Vehicle - Detailed comparison of market size and growth drivers for both segments.

Technology Type: Aftermarket IVS, Factory-fitted IVS, PNDs, Smartphones/Tablets - Analysis of market share and growth prospects for each technology type.

Sales Channel Type: OEM vs. Aftermarket - Assessment of market share and key dynamics influencing each sales channel.

Key Drivers (Examples): Investment trends in autonomous driving technologies, governmental support for EV adoption, and consumer preference for advanced navigation features.

Europe Automotive Navigation System Market Product Innovations

This section highlights recent product innovations in the European automotive navigation system market. We showcase unique selling propositions and technological advancements, focusing on improved map accuracy, enhanced user interfaces, integration with other vehicle systems, and the introduction of new features such as augmented reality navigation and improved voice control. Performance metrics such as processing speed, map update frequency, and accuracy will also be discussed.

Propelling Factors for Europe Automotive Navigation System Market Growth

Several factors fuel the growth of the European automotive navigation system market. Technological advancements, such as the integration of AI and machine learning, are enhancing navigation accuracy and providing personalized user experiences. Economic factors, like increasing disposable incomes and the growth of the automotive industry, also stimulate demand. Furthermore, supportive government policies and regulations, promoting the adoption of advanced driver-assistance systems (ADAS), contribute to market expansion.

Obstacles in the Europe Automotive Navigation System Market

Despite the growth potential, the European automotive navigation system market faces various challenges. Regulatory hurdles, such as data privacy concerns and stringent testing requirements, can impede market expansion. Supply chain disruptions and fluctuating component costs can impact profitability and production timelines. Intense competition among established players and the rise of new entrants exert pressure on pricing and market share. We estimate these challenges may lead to a xx% reduction in market growth during certain periods.

Future Opportunities in Europe Automotive Navigation System Market

The European automotive navigation system market presents promising opportunities for future growth. Emerging markets within Eastern Europe offer untapped potential. Innovative technologies, such as augmented reality navigation and seamless integration with smart city infrastructure, will shape the future of the market. Changes in consumer preferences, like the growing demand for sustainable transportation options and connected car features, will continue to drive market evolution.

Major Players in the Europe Automotive Navigation System Market Ecosystem

- Clarion

- Mitsubishi Electric Corporation

- Continental AG

- Aisin AW Co Ltd

- Garmin

- Denso Corporation

- Pioneer

- Alpine Electronics

Key Developments in Europe Automotive Navigation System Market Industry

- October 2022: Lotus and ECARX partnered with HERE Technologies for integrated navigation services in the Lotus ELETRE, featuring over-the-air updates. This highlights the growing importance of connected car technologies and seamless software updates.

- September 2022: Renault’s new Austral model showcases integrated navigation within its OpenR infotainment system, demonstrating the increasing integration of navigation with multimedia features.

- August 2022: BMW Group’s collaboration with Linde Material Handling using SLAM technology for autonomous navigation in material handling, showcases the expansion of navigation technology beyond passenger vehicles.

Strategic Europe Automotive Navigation System Market Forecast

The European automotive navigation system market is poised for continued growth, driven by technological advancements, increasing vehicle connectivity, and the rise of autonomous driving features. The market will witness a surge in demand for advanced navigation solutions, particularly those offering enhanced personalization and seamless integration with other vehicle systems. The adoption of cloud-based mapping and over-the-air updates will further enhance the user experience and drive market expansion. The projected growth is expected to be substantial, with a xx Million increase in market value by 2033.

Europe Automotive Navigation System Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Technology Type

- 2.1. Aftermarket IVS

- 2.2. Factory fitted IVS

- 2.3. Personal navigation device (PND's)

- 2.4. Smartphones/Tablets

-

3. Sales Channel Type

- 3.1. OEM

- 3.2. Aftermarket

Europe Automotive Navigation System Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. United Kingdom

- 1.3. France

- 1.4. Italy

- 1.5. Rest of Europe

Europe Automotive Navigation System Market Regional Market Share

Geographic Coverage of Europe Automotive Navigation System Market

Europe Automotive Navigation System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand From Online Channel

- 3.3. Market Restrains

- 3.3.1. Increasing Traffic Problems And Reliability Issues

- 3.4. Market Trends

- 3.4.1. E-commerce and Online Cab Booking Services Mostly Rely on GPS Tracking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Technology Type

- 5.2.1. Aftermarket IVS

- 5.2.2. Factory fitted IVS

- 5.2.3. Personal navigation device (PND's)

- 5.2.4. Smartphones/Tablets

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel Type

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Clarion

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Electric Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aisin Aw Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Garmin

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Denso Corporatio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Pioneer

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alpine Electronics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Clarion

List of Figures

- Figure 1: Europe Automotive Navigation System Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive Navigation System Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive Navigation System Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Automotive Navigation System Market Revenue million Forecast, by Technology Type 2020 & 2033

- Table 3: Europe Automotive Navigation System Market Revenue million Forecast, by Sales Channel Type 2020 & 2033

- Table 4: Europe Automotive Navigation System Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive Navigation System Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive Navigation System Market Revenue million Forecast, by Technology Type 2020 & 2033

- Table 7: Europe Automotive Navigation System Market Revenue million Forecast, by Sales Channel Type 2020 & 2033

- Table 8: Europe Automotive Navigation System Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: Germany Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United Kingdom Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Automotive Navigation System Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive Navigation System Market?

The projected CAGR is approximately 5.89%.

2. Which companies are prominent players in the Europe Automotive Navigation System Market?

Key companies in the market include Clarion, Mitsubishi Electric Corporation, Continental AG, Aisin Aw Co Ltd, Garmin, Denso Corporatio, Pioneer, Alpine Electronics.

3. What are the main segments of the Europe Automotive Navigation System Market?

The market segments include Vehicle Type, Technology Type, Sales Channel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.4 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand From Online Channel.

6. What are the notable trends driving market growth?

E-commerce and Online Cab Booking Services Mostly Rely on GPS Tracking.

7. Are there any restraints impacting market growth?

Increasing Traffic Problems And Reliability Issues.

8. Can you provide examples of recent developments in the market?

October 2022: Lotus and ECARX have chosen HERE Technologies to provide integrated navigation services for the recently launched Lotus ELETRE, the automaker's first pure electric hyper-SUV. The Lotus ELETRE's navigation experience can be updated over the air using HERE navigation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive Navigation System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive Navigation System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive Navigation System Market?

To stay informed about further developments, trends, and reports in the Europe Automotive Navigation System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence