Key Insights

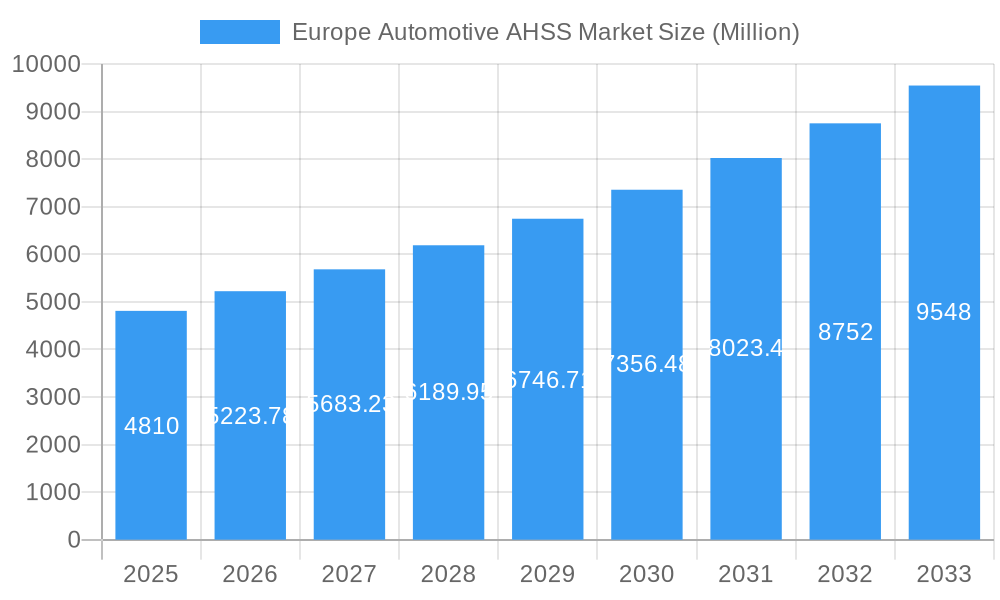

The European automotive Advanced High-Strength Steel (AHSS) market is experiencing robust growth, projected to reach €4.81 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 8.80% from 2025 to 2033. This expansion is driven primarily by the increasing demand for lightweight vehicles to enhance fuel efficiency and meet stringent emission regulations. The shift towards electric vehicles (EVs) and hybrid electric vehicles (HEVs) further fuels this growth, as AHSS plays a crucial role in battery casing and structural components for these vehicles. Germany, the UK, France, and Italy represent the largest national markets within Europe, reflecting their established automotive manufacturing sectors. The market is segmented by propulsion type (ICE, BEV, PHEV, HEV, FCEV), vehicle type (passenger cars, commercial vehicles), and application type (engine parts, transmission components, structural parts, others). Growth is also influenced by technological advancements in AHSS manufacturing, leading to improved material properties and cost-effectiveness. However, fluctuations in raw material prices and potential supply chain disruptions pose challenges to market expansion. The increasing adoption of alternative materials, such as aluminum and carbon fiber, also presents a potential restraint, although AHSS remains a dominant material due to its balance of strength, cost, and formability.

Europe Automotive AHSS Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, driven by the ongoing electrification of the automotive industry and the consistent demand for improved vehicle safety and fuel economy. The market's regional concentration in major European automotive hubs underscores the importance of localized manufacturing and supply chains. The competitive landscape includes major steel producers like ThyssenKrupp AG, ArcelorMittal SA, and others, competing on factors such as material quality, pricing, and technological innovation. Further segmentation analysis within the application types reveals a strong demand for AHSS in structural parts due to the increasing need for lightweighting, particularly in the rapidly expanding EV sector. This ongoing trend suggests a sustained period of growth for the European automotive AHSS market.

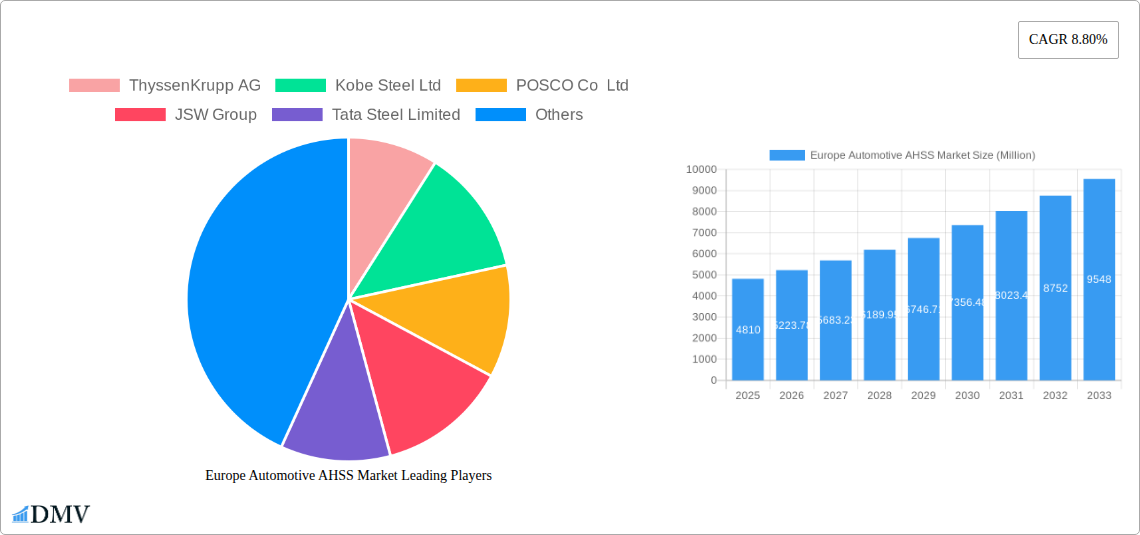

Europe Automotive AHSS Market Company Market Share

Europe Automotive AHSS Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Automotive Advanced High-Strength Steel (AHSS) market, offering invaluable insights for stakeholders seeking to understand market trends, competitive dynamics, and future growth potential. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. This report is essential for automotive manufacturers, steel producers, component suppliers, and investors seeking to navigate this rapidly evolving market. The market is estimated to be worth xx Million in 2025 and is projected to reach xx Million by 2033.

Europe Automotive AHSS Market Composition & Trends

The European Automotive AHSS market is characterized by a moderate level of concentration, with key players holding significant market share. Market share distribution among the top five players in 2025 is estimated to be approximately xx%. Innovation is a key driver, with ongoing advancements in steel grades and manufacturing processes focused on improving strength, lightweighting, and cost-effectiveness. Stringent emission regulations and fuel efficiency standards are shaping demand, pushing the adoption of lighter weight vehicles and promoting the use of AHSS. Substitute materials, such as aluminum and carbon fiber, pose a competitive challenge, although AHSS maintains a cost and performance advantage in many applications. The market is segmented by propulsion type (Internal Combustion Engine, Battery Electric Vehicles, Plug-in Hybrid Electric Vehicles, Hybrid Electric Vehicles, Fuel Cell Electric Vehicles), vehicle type (Passenger Cars, Commercial Vehicles), application type (Engine Parts, Transmission Components, Structural Parts, Others), and country (Germany, United Kingdom, France, Italy, Spain, Rest of Europe).

- Market Concentration: Top 5 players hold approximately xx% market share in 2025.

- Innovation Catalysts: Lightweighting demands, stringent emission regulations, advancements in steel grades (e.g., HSM 380, HSM 420HD).

- Regulatory Landscape: EU emission standards drive demand for lightweight materials.

- Substitute Products: Aluminum and carbon fiber present competitive challenges.

- End-User Profile: Automotive OEMs, Tier-1 and Tier-2 suppliers.

- M&A Activities: Total deal value in the last 5 years estimated at xx Million, with a focus on expanding geographical reach and product portfolios.

Europe Automotive AHSS Market Industry Evolution

The European Automotive AHSS market has experienced significant growth driven by increasing demand for fuel-efficient and safer vehicles. Between 2019 and 2024, the market witnessed a Compound Annual Growth Rate (CAGR) of xx%. Technological advancements, such as the development of advanced high-strength steel grades with enhanced formability and weldability, have enabled wider adoption in automotive applications. Shifting consumer preferences towards safer and more fuel-efficient vehicles further propel market growth. The transition towards electric vehicles is also impacting the market, creating demand for specialized AHSS grades optimized for battery electric vehicle (BEV) applications. The adoption rate of AHSS in BEVs is expected to increase significantly over the forecast period, reaching xx% by 2033. The market is expected to continue its growth trajectory, with a projected CAGR of xx% from 2025 to 2033, driven by factors such as increased vehicle production, stringent emission regulations, and advancements in AHSS technology.

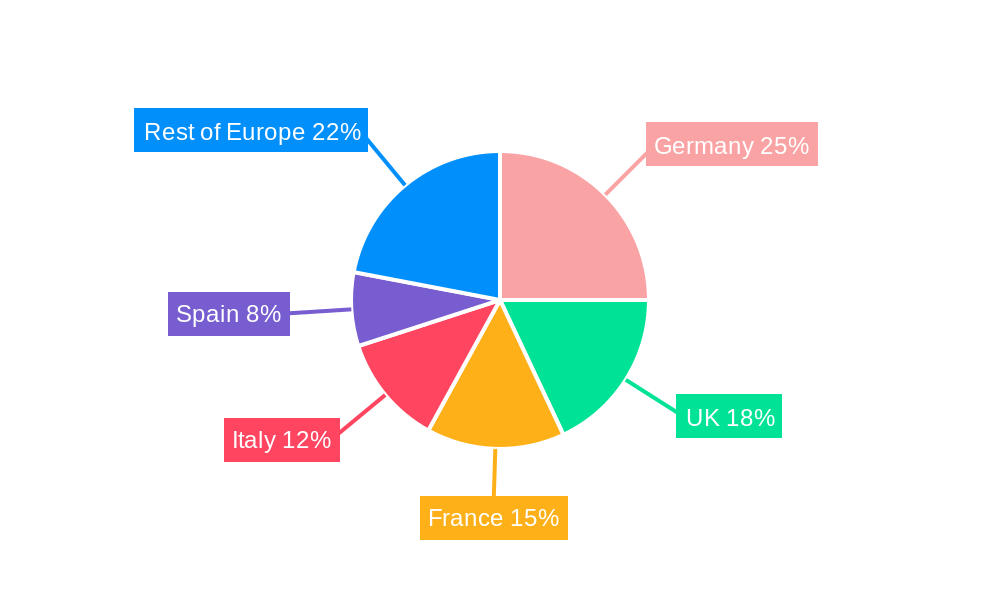

Leading Regions, Countries, or Segments in Europe Automotive AHSS Market

- Dominant Region: Germany, driven by a strong automotive manufacturing base and substantial investments in R&D.

- Dominant Country: Germany, benefiting from its established automotive industry and presence of major AHSS producers.

- Dominant Segment (By Propulsion): Internal Combustion Engine (ICE) vehicles currently dominate; however, Battery Electric Vehicles (BEVs) are experiencing rapid growth.

- Dominant Segment (By Vehicle Type): Passenger cars represent the largest segment, followed by commercial vehicles.

- Dominant Segment (By Application Type): Structural parts account for the largest share, driven by the need for lightweighting and safety.

Key Drivers:

- Germany: Strong automotive industry, significant R&D investment, established supply chains.

- BEVs: Growing demand driven by emission regulations and technological advancements in battery technology.

- Structural Parts: Demand for lightweighting and improved vehicle safety.

Europe Automotive AHSS Market Product Innovations

Recent innovations in AHSS include the development of ultra-high-strength steels (UHSS) with enhanced formability and weldability, allowing for complex component designs and lightweighting. These new grades offer superior strength-to-weight ratios compared to conventional steels, contributing to improved fuel efficiency and vehicle safety. For example, Thyssenkrupp AG's HSM 380 and HSM 420HD steel grades are designed for lightweight seat structures, while their Powercore Traction electrical steel enhances the efficiency of electric vehicle drives. ArcelorMittal’s Fortiform steel allows for cold-forming methods in structural component manufacturing. These innovations are driving market expansion by enabling the production of lighter, stronger, and more cost-effective vehicles.

Propelling Factors for Europe Automotive AHSS Market Growth

Several factors drive the growth of the Europe Automotive AHSS market. Stringent emission regulations across Europe mandate the production of lighter vehicles, fueling demand for AHSS. Technological advancements, like the development of higher-strength and more formable grades, improve vehicle safety and fuel efficiency. The rise of electric vehicles necessitates specialized AHSS grades for battery packs and other components. Economic factors such as increased vehicle production also contribute to market growth.

Obstacles in the Europe Automotive AHSS Market

The market faces several challenges. Fluctuations in raw material prices can impact production costs and profitability. Supply chain disruptions can affect the availability of AHSS, leading to production delays. Competition from alternative materials such as aluminum and carbon fiber poses a significant threat. Regulatory changes and evolving safety standards require continuous innovation and adaptation. The impact of these challenges on market growth is estimated to be approximately xx% reduction in the overall growth rate by 2033.

Future Opportunities in Europe Automotive AHSS Market

Future opportunities lie in the growing demand for electric and hybrid vehicles, driving innovation in AHSS grades specifically designed for these applications. Advancements in manufacturing processes, such as tailored blanks and advanced high-strength steel processing, will enhance the performance and cost-effectiveness of AHSS. Expansion into new markets and applications within the automotive sector, and exploration of partnerships and collaborations across the value chain, present promising avenues for growth.

Major Players in the Europe Automotive AHSS Market Ecosystem

- ThyssenKrupp AG

- Kobe Steel Ltd

- POSCO Co Ltd

- JSW Group

- Tata Steel Limited

- Baoshan Iron & Steel Co Ltd

- SSAB AB

- AK Steel Holding Corporation

- ArcelorMittal SA

- Outokumpu

Key Developments in Europe Automotive AHSS Market Industry

- November 2023: Thyssenkrupp AG launched HSM 380 and HSM 420HD precision steel strip grades for lightweight seat structures and Powercore Traction electrical steel for efficient drives. This innovation enhances lightweighting and efficiency in electric vehicles.

- November 2023: KIRCHHOFF Automotive Germany successfully trialled ArcelorMittal’s Fortiform ultra-high-strength steel, enabling cold-forming methods for structural elements. This opens new possibilities for structural component manufacturing.

Strategic Europe Automotive AHSS Market Forecast

The Europe Automotive AHSS market is poised for continued growth, driven by the increasing demand for lighter, safer, and more fuel-efficient vehicles. The ongoing shift towards electric vehicles will further stimulate demand for specialized AHSS grades. Technological advancements and strategic collaborations within the industry will play a crucial role in shaping the market's future. The market's strong growth trajectory is expected to persist throughout the forecast period, presenting significant opportunities for industry players.

Europe Automotive AHSS Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Structural Parts

- 2.4. Others

-

3. Propulsion

- 3.1. Internal Combustion Engine

- 3.2. Battery Electric Vehicles

- 3.3. Plug-in Hybrid Electric Vehicles

- 3.4. Fuel Cell Electric Vehicles

Europe Automotive AHSS Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Automotive AHSS Market Regional Market Share

Geographic Coverage of Europe Automotive AHSS Market

Europe Automotive AHSS Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Continuous Advancements in Automotive AHSS technology

- 3.3. Market Restrains

- 3.3.1. Availability of Lightweight Alternative Options to Steel

- 3.4. Market Trends

- 3.4.1. Battery Electric Vehicle Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Automotive AHSS Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Structural Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Propulsion

- 5.3.1. Internal Combustion Engine

- 5.3.2. Battery Electric Vehicles

- 5.3.3. Plug-in Hybrid Electric Vehicles

- 5.3.4. Fuel Cell Electric Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ThyssenKrupp AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kobe Steel Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 POSCO Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JSW Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tata Steel Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Baoshan Iron & Steel Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SSAB AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AK Steel Holding Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ArcelorMittal SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Outokump

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ThyssenKrupp AG

List of Figures

- Figure 1: Europe Automotive AHSS Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Automotive AHSS Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Automotive AHSS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Automotive AHSS Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Europe Automotive AHSS Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 4: Europe Automotive AHSS Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Automotive AHSS Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Europe Automotive AHSS Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 7: Europe Automotive AHSS Market Revenue Million Forecast, by Propulsion 2020 & 2033

- Table 8: Europe Automotive AHSS Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Automotive AHSS Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Automotive AHSS Market?

The projected CAGR is approximately 8.80%.

2. Which companies are prominent players in the Europe Automotive AHSS Market?

Key companies in the market include ThyssenKrupp AG, Kobe Steel Ltd, POSCO Co Ltd, JSW Group, Tata Steel Limited, Baoshan Iron & Steel Co Ltd, SSAB AB, AK Steel Holding Corporation, ArcelorMittal SA, Outokump.

3. What are the main segments of the Europe Automotive AHSS Market?

The market segments include Vehicle Type, Application Type, Propulsion.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Continuous Advancements in Automotive AHSS technology.

6. What are the notable trends driving market growth?

Battery Electric Vehicle Dominating the Market.

7. Are there any restraints impacting market growth?

Availability of Lightweight Alternative Options to Steel.

8. Can you provide examples of recent developments in the market?

In November 2023, Thyssenkrupp AG introduced innovative and sustainable steel solutions for automotive applications in Stuttgart, Germany. These include the newly developed procedure HSM 380 and HSM 420HD precision steel strip grades for lightweight steel seat structures, and electrical steel for highly efficient drives under the brand name Powercore Traction.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Automotive AHSS Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Automotive AHSS Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Automotive AHSS Market?

To stay informed about further developments, trends, and reports in the Europe Automotive AHSS Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence