Key Insights

The global Electric Vehicle (EV) Test Equipment market is experiencing accelerated growth, propelled by the escalating adoption of electric vehicles worldwide. With a projected Compound Annual Growth Rate (CAGR) of 31.42%, the market is set to reach a size of 211.72 million by the base year 2025. This expansion is attributed to stringent government mandates encouraging EV uptake, rising consumer preference for sustainable transportation, and continuous advancements in EV technology. Key market segments include battery test equipment, crucial for ensuring optimal performance and safety; powertrain testing solutions, vital for validating EV efficiency and durability; and EV charging equipment testing, essential for guaranteeing the integrity of charging infrastructure. Geographically, North America, Europe, and Asia Pacific are leading revenue generators. The competitive landscape features established players such as Intertek, Horiba, and National Instruments, alongside specialized firms including Arbin Instruments and Dynomerk Controls, all focused on innovation and strategic alliances. The increasing complexity of EV systems drives demand for sophisticated testing equipment capable of managing high-voltage architectures and diverse battery chemistries.

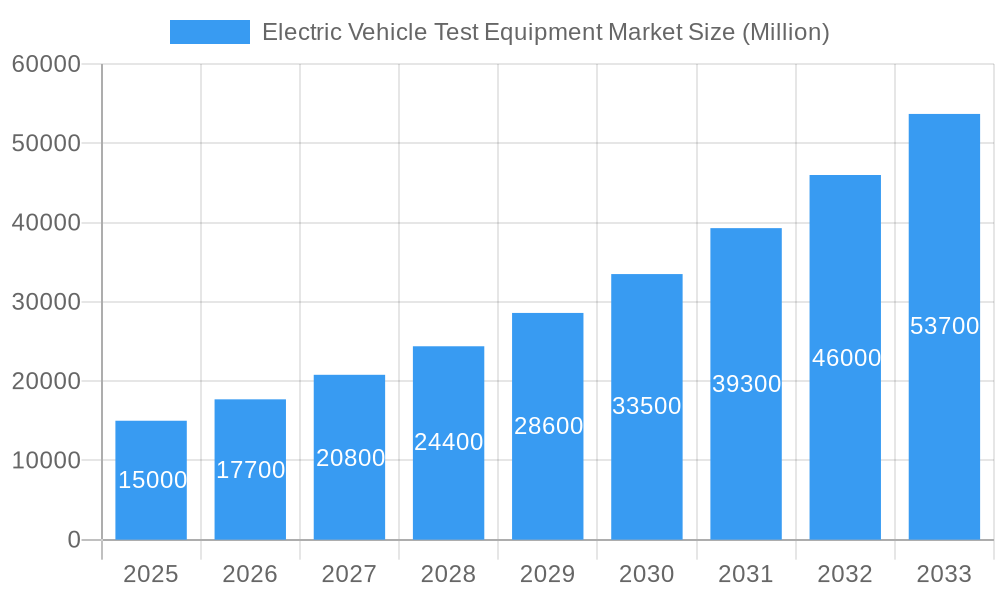

Electric Vehicle Test Equipment Market Market Size (In Million)

Market segmentation highlights a dynamic environment. The Battery Electric Vehicle (BEV) segment is anticipated to lead, reflecting its growing dominance in the overall EV market. Within equipment categories, battery testing equipment commands a substantial share, underscoring the paramount importance of battery performance in EV success. The passenger car segment is projected to outperform the commercial vehicle segment, driven by higher current sales volumes. However, the commercial vehicle segment is expected to witness significant growth due to the increasing deployment of electric buses, trucks, and delivery fleets. Regional disparities are expected to persist, with China, the United States, and European nations remaining pivotal markets, supported by robust EV manufacturing ecosystems and favorable government policies. Continuous innovation in testing methodologies and the development of equipment supporting next-generation battery technologies will be imperative for sustained market competitiveness.

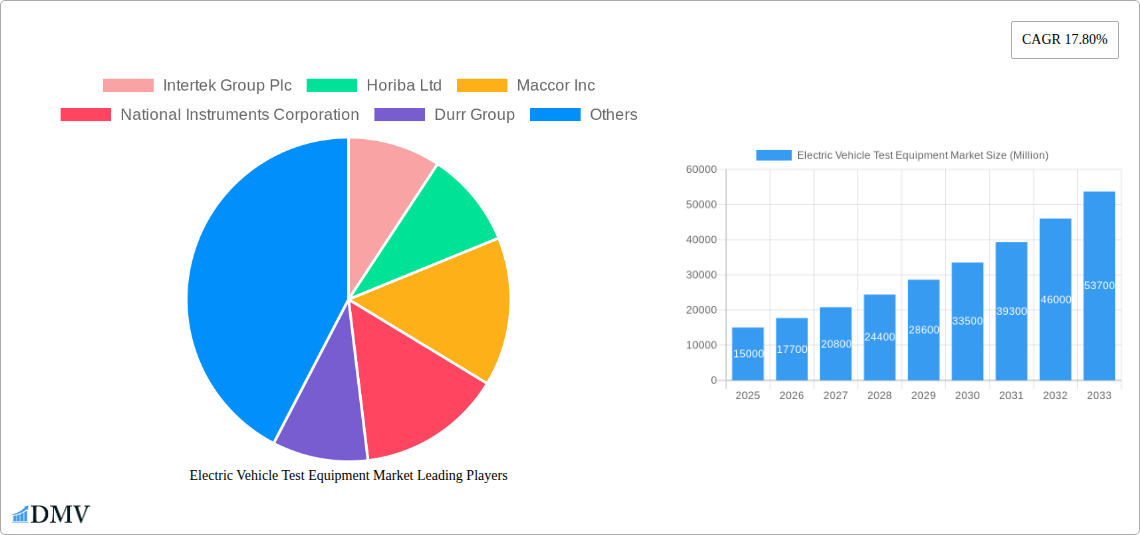

Electric Vehicle Test Equipment Market Company Market Share

Electric Vehicle Test Equipment Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Electric Vehicle (EV) Test Equipment market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025, this study presents valuable insights for stakeholders seeking to understand and capitalize on the burgeoning EV industry. The market is projected to reach xx Million by 2033, demonstrating substantial growth potential.

Electric Vehicle Test Equipment Market Market Composition & Trends

The global Electric Vehicle Test Equipment market is characterized by a moderately concentrated landscape, with key players such as Intertek Group Plc, Horiba Ltd, Maccor Inc, National Instruments Corporation, and Dürr Group holding significant market share. Market share distribution is dynamic, with ongoing mergers and acquisitions (M&A) shaping the competitive dynamics. Innovation is a crucial catalyst, driven by the need for increasingly sophisticated testing methodologies to meet the demands of advanced EV technologies, such as battery performance, charging infrastructure, and autonomous driving features. Stringent regulatory landscapes worldwide, particularly concerning safety and performance standards, significantly influence market growth and adoption. Substitute products are limited, primarily confined to older or less advanced testing technologies, which are gradually being replaced. End-users primarily include EV manufacturers, component suppliers, and independent testing laboratories. M&A activity is robust, with deal values exceeding xx Million in the past five years, reflecting the market's consolidation and expansion.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share.

- Innovation Catalysts: Advancements in battery technology, autonomous driving, and charging infrastructure.

- Regulatory Landscape: Stringent safety and performance standards driving demand for sophisticated testing.

- Substitute Products: Limited, with older technologies facing obsolescence.

- End-User Profiles: EV manufacturers, component suppliers, independent testing labs.

- M&A Activity: Significant activity, with deal values exceeding xx Million in recent years.

Electric Vehicle Test Equipment Market Industry Evolution

The EV Test Equipment market has witnessed exponential growth, mirroring the rapid expansion of the broader EV industry. From 2019 to 2024, the market expanded at a CAGR of xx%, driven by surging EV sales globally and increasing investments in charging infrastructure. Technological advancements, particularly in battery testing and powertrain analysis, have been key growth drivers. The shift towards higher energy density batteries and faster charging capabilities necessitates more sophisticated and accurate testing equipment. Consumer demand for longer driving ranges and improved vehicle performance has further fueled the need for advanced testing solutions. The forecast period (2025-2033) anticipates continued robust growth, fueled by government incentives, stricter emission regulations, and rising consumer adoption of EVs. The market is expected to experience a CAGR of xx% during this period, reaching a market value of xx Million by 2033.

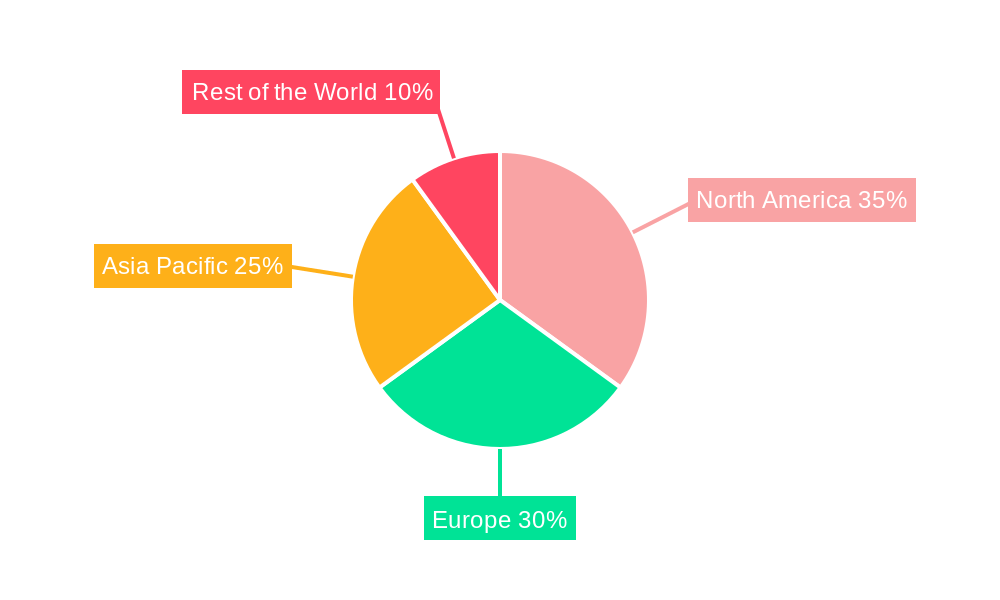

Leading Regions, Countries, or Segments in Electric Vehicle Test Equipment Market

The North American and European regions currently dominate the EV Test Equipment market, driven by robust EV adoption and significant investments in research and development. Within these regions, countries such as the United States, Germany, and China are key players. In terms of segments:

- By Propulsion Type: Battery Electric Vehicles (BEVs) represent the largest and fastest-growing segment, followed by Plug-in Hybrid Electric Vehicles (PHEVs) and Fuel Cell Electric Vehicles (FCEVs).

- By Equipment Type: Battery testing equipment holds the largest market share due to its critical role in ensuring battery safety and performance. Powertrain and EV component testing equipment are also significant segments, witnessing strong growth.

- By Vehicle Type: Passenger cars dominate the market, although commercial vehicle testing is expanding rapidly.

Key Drivers:

- High government investments in EV infrastructure and R&D.

- Stringent emission regulations accelerating EV adoption.

- Growing consumer demand for EVs with enhanced performance and range.

- Technological advancements leading to more sophisticated testing requirements.

Electric Vehicle Test Equipment Market Product Innovations

Recent product innovations focus on enhancing testing accuracy, efficiency, and automation. This includes advancements in battery simulation technologies, advanced powertrain testing systems, and integrated charging infrastructure testing solutions. These innovations deliver faster testing cycles, improved data analysis, and more precise assessments of EV performance and safety. Unique selling propositions often include improved precision, enhanced automation, and integration with data analytics platforms, facilitating comprehensive performance evaluation.

Propelling Factors for Electric Vehicle Test Equipment Market Growth

Several factors contribute to the growth of the Electric Vehicle Test Equipment Market. These include:

- Technological Advancements: The continuous evolution of EV technology necessitates more sophisticated testing equipment to ensure safety and performance.

- Stringent Government Regulations: Governments worldwide are implementing increasingly strict emission standards, driving the adoption of EVs and necessitating comprehensive testing.

- Rising Consumer Demand: The growing popularity of EVs, fueled by environmental concerns and technological advancements, increases the demand for robust testing solutions.

Obstacles in the Electric Vehicle Test Equipment Market Market

Challenges include:

- High Initial Investment Costs: Advanced EV testing equipment requires significant upfront investments, potentially hindering adoption by smaller companies.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and cost of crucial components.

- Intense Competition: The market is becoming increasingly competitive, requiring companies to continuously innovate to maintain market share.

Future Opportunities in Electric Vehicle Test Equipment Market

The future holds exciting opportunities:

- Expansion into Emerging Markets: Growth in EV adoption in developing economies presents significant potential for market expansion.

- Development of Advanced Testing Technologies: Innovation in areas like AI-powered testing and simulation will create new market opportunities.

- Growth of the Commercial Vehicle Segment: The increasing demand for electric commercial vehicles will drive growth in specialized testing solutions.

Major Players in the Electric Vehicle Test Equipment Market Ecosystem

- Intertek Group Plc

- Horiba Ltd

- Maccor Inc

- National Instruments Corporation

- Durr Group

- Tuv Rheinland

- Arbin Instruments

- Toyo System Co Ltd

- Wonik Pne Co Ltd

- Keysight Technologies Inc

- Froude Inc

- Dynomerk Controls

Key Developments in Electric Vehicle Test Equipment Market Industry

- July 2022: TÜV SÜD Thailand opened a new Battery and Automotive Components Testing Centre, expanding its global testing network. This enhances regional capacity and expertise for EV testing.

- July 2022: National Instruments Japan Corporation established a Co-engineering Lab for collaborative research with automakers on advanced EV technologies, fostering innovation and market advancements.

- April 2022: Tevva's partnership with HORIBA MIRA at MIRA Technologies Park provides access to specialized engineering and testing capabilities for electric trucks, driving product development and validation.

Strategic Electric Vehicle Test Equipment Market Market Forecast

The EV Test Equipment market is poised for continued strong growth, driven by the expanding EV sector, increasing regulatory pressures, and ongoing technological advancements. Future opportunities lie in the development of innovative testing solutions for advanced battery technologies, autonomous driving systems, and expanding into new geographic markets. This market shows significant potential for both established and emerging players to innovate and capture market share, creating a dynamic and exciting landscape for the coming decade.

Electric Vehicle Test Equipment Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion Type

- 2.1. Battery Electric Vehicles (BEVs)

- 2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 2.3. Hybrid Electric Vehicles (HEVs)

- 2.4. Fuel Cell Electric Vehicles (FCEVs)

-

3. Equipment Type

- 3.1. Electric Vehicle (EV) Battery Test Systems

- 3.2. Powertrain Testing

- 3.3. Electric Vehicle (EV) Component

- 3.4. Electric Vehicle (EV) Charging

- 3.5. Others (EV Drivetrain Test)

Electric Vehicle Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Vehicle Test Equipment Market Regional Market Share

Geographic Coverage of Electric Vehicle Test Equipment Market

Electric Vehicle Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Vehicle Sales to Fuel Market Growth

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Electric Vehicle Adoption Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Battery Electric Vehicles (BEVs)

- 5.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 5.2.3. Hybrid Electric Vehicles (HEVs)

- 5.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 5.3. Market Analysis, Insights and Forecast - by Equipment Type

- 5.3.1. Electric Vehicle (EV) Battery Test Systems

- 5.3.2. Powertrain Testing

- 5.3.3. Electric Vehicle (EV) Component

- 5.3.4. Electric Vehicle (EV) Charging

- 5.3.5. Others (EV Drivetrain Test)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Battery Electric Vehicles (BEVs)

- 6.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 6.2.3. Hybrid Electric Vehicles (HEVs)

- 6.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 6.3. Market Analysis, Insights and Forecast - by Equipment Type

- 6.3.1. Electric Vehicle (EV) Battery Test Systems

- 6.3.2. Powertrain Testing

- 6.3.3. Electric Vehicle (EV) Component

- 6.3.4. Electric Vehicle (EV) Charging

- 6.3.5. Others (EV Drivetrain Test)

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Battery Electric Vehicles (BEVs)

- 7.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 7.2.3. Hybrid Electric Vehicles (HEVs)

- 7.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 7.3. Market Analysis, Insights and Forecast - by Equipment Type

- 7.3.1. Electric Vehicle (EV) Battery Test Systems

- 7.3.2. Powertrain Testing

- 7.3.3. Electric Vehicle (EV) Component

- 7.3.4. Electric Vehicle (EV) Charging

- 7.3.5. Others (EV Drivetrain Test)

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Battery Electric Vehicles (BEVs)

- 8.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 8.2.3. Hybrid Electric Vehicles (HEVs)

- 8.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 8.3. Market Analysis, Insights and Forecast - by Equipment Type

- 8.3.1. Electric Vehicle (EV) Battery Test Systems

- 8.3.2. Powertrain Testing

- 8.3.3. Electric Vehicle (EV) Component

- 8.3.4. Electric Vehicle (EV) Charging

- 8.3.5. Others (EV Drivetrain Test)

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Battery Electric Vehicles (BEVs)

- 9.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 9.2.3. Hybrid Electric Vehicles (HEVs)

- 9.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 9.3. Market Analysis, Insights and Forecast - by Equipment Type

- 9.3.1. Electric Vehicle (EV) Battery Test Systems

- 9.3.2. Powertrain Testing

- 9.3.3. Electric Vehicle (EV) Component

- 9.3.4. Electric Vehicle (EV) Charging

- 9.3.5. Others (EV Drivetrain Test)

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Intertek Group Plc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Horiba Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Maccor Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 National Instruments Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Durr Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tuv Rheinland

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arbin Instruments

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toyo System Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wonik Pne Co Ltd*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Keysight Technologies Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Froude Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Dynomerk Controls

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global Electric Vehicle Test Equipment Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 3: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 5: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 7: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 8: North America Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 13: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 14: Europe Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 15: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Europe Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 21: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 23: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 24: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 29: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 31: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 32: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 4: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 7: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 8: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 14: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 15: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 24: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 25: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: India Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Japan Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 34: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: South America Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Test Equipment Market?

The projected CAGR is approximately 31.42%.

2. Which companies are prominent players in the Electric Vehicle Test Equipment Market?

Key companies in the market include Intertek Group Plc, Horiba Ltd, Maccor Inc, National Instruments Corporation, Durr Group, Tuv Rheinland, Arbin Instruments, Toyo System Co Ltd, Wonik Pne Co Ltd*List Not Exhaustive, Keysight Technologies Inc, Froude Inc, Dynomerk Controls.

3. What are the main segments of the Electric Vehicle Test Equipment Market?

The market segments include Vehicle Type, Propulsion Type, Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 211.72 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Vehicle Sales to Fuel Market Growth.

6. What are the notable trends driving market growth?

Increased Electric Vehicle Adoption Globally.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: At the Amata City Chonburi Industrial Estate, TÜV SÜD Thailand officially opened its Battery and Automotive Components Testing Centre. This facility will add to TÜV SÜD's existing network of eight battery testing labs located in North America, Germany, and Asia. This integrated facility, which covers over 3,000 square meters, makes it simple to access global and local expertise to meet the quality and safety requirements necessary for e-Mobility to be adopted more quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Test Equipment Market?

To stay informed about further developments, trends, and reports in the Electric Vehicle Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence