Key Insights

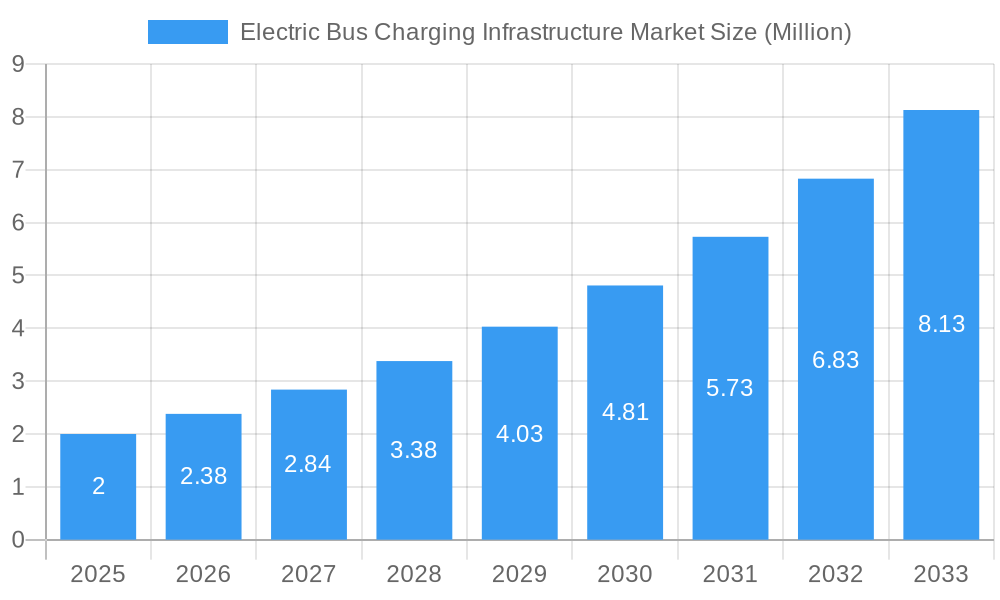

The Electric Bus Charging Infrastructure market is experiencing robust growth, driven by the global shift towards sustainable transportation and increasing adoption of electric buses in urban areas. The market, valued at $2 million in 2025 (the base year), is projected to expand at a Compound Annual Growth Rate (CAGR) of 19% from 2025 to 2033. This significant growth is fueled by several key factors. Government incentives and regulations aimed at reducing carbon emissions are creating a favorable environment for electric bus deployment. Furthermore, advancements in battery technology, leading to longer ranges and faster charging times, are significantly impacting market expansion. The rising concerns regarding air pollution in metropolitan areas are further bolstering demand for cleaner public transportation alternatives, thus driving investment in charging infrastructure. Market segmentation reveals a strong preference for plug-in charging solutions, although overhead charging systems are gaining traction in specialized applications like bus depots. Leading players in the market include established automotive companies like BYD Auto Co Ltd, Volvo, and Mercedes-Benz AG, alongside specialized electric charging infrastructure providers such as ChargePoint Inc and ABB Ltd. The geographical distribution shows strong growth potential in regions like Asia Pacific and North America, particularly in major metropolitan areas with substantial electric bus fleets.

Electric Bus Charging Infrastructure Market Market Size (In Million)

Competition within the market is intensifying, with existing players expanding their product portfolios and new entrants emerging. The market is also witnessing a diversification of charging technologies, with the emergence of high-power fast charging solutions to address the operational challenges of electric bus fleets. However, high initial investment costs for infrastructure development and the need for grid upgrades to support the increased electricity demand represent key restraints. Overcoming these challenges through strategic partnerships, innovative financing models, and effective grid management will be crucial for sustained market growth. The future of the Electric Bus Charging Infrastructure market looks promising, with continued technological advancements and supportive government policies expected to drive market expansion throughout the forecast period. The market will see continued expansion across all major regions, with specific growth opportunities in developing economies witnessing rapid urbanization and the adoption of electric public transport systems.

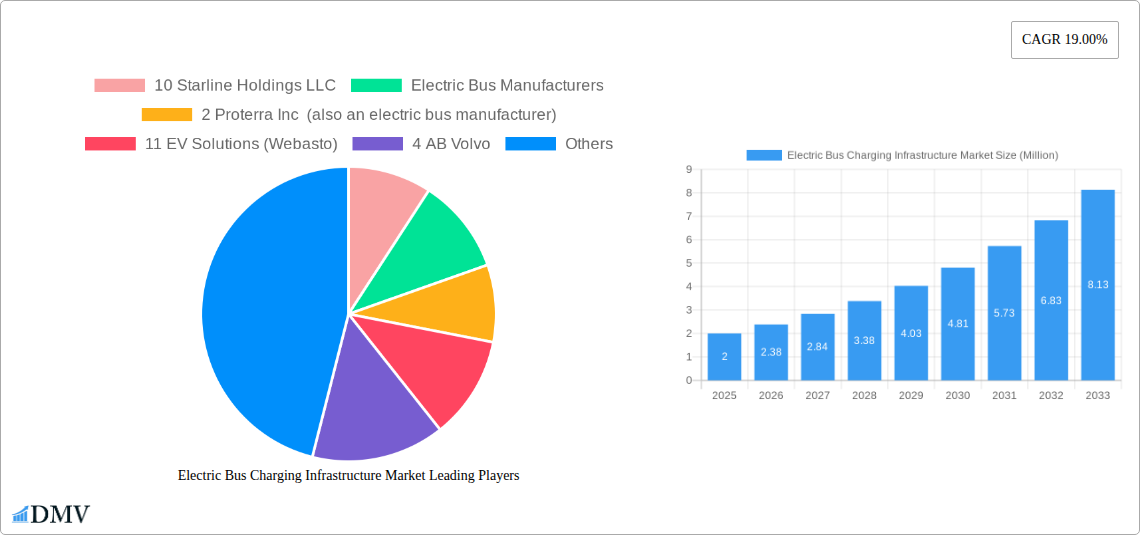

Electric Bus Charging Infrastructure Market Company Market Share

Electric Bus Charging Infrastructure Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Electric Bus Charging Infrastructure Market, offering invaluable data and projections for stakeholders across the value chain. Spanning the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this study unveils key trends, challenges, and opportunities shaping this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Electric Bus Charging Infrastructure Market Market Composition & Trends

The Electric Bus Charging Infrastructure Market exhibits a moderately concentrated landscape, with key players vying for market share. Market concentration is further analyzed in the full report, which includes detailed analysis of market share distribution. Innovation is primarily driven by the need for faster charging times, improved energy efficiency, and the development of smart charging technologies. Stringent environmental regulations and government incentives are major catalysts for growth, while the availability of alternative transportation fuels represents a key challenge. End-users comprise primarily public transportation authorities, private fleet operators, and educational institutions.

- Market Share Distribution (2025): The report details the market share of leading players, including ABB Ltd., ChargePoint Inc., Siemens AG, and others. This section provides a breakdown of market share held by various charging infrastructure suppliers and electric bus manufacturers.

- M&A Activities: The report documents significant mergers and acquisitions, including details on deal values. For instance, ABB E-Mobility's USD 214 Million pre-IPO funding round highlights the substantial investment flowing into the sector.

- Substitute Products: The report assesses the impact of alternative solutions, such as hydrogen fuel cell buses, on market growth.

- Regulatory Landscape: The report analyzes the impact of government policies and regulations worldwide, including those that stimulate the adoption of electric buses and their supporting infrastructure.

Electric Bus Charging Infrastructure Market Industry Evolution

The Electric Bus Charging Infrastructure Market has witnessed significant growth driven by factors such as stringent emission norms, increasing environmental awareness, and government support for electric mobility. The market has experienced a remarkable shift from slow-charging infrastructure to faster charging solutions catering to the growing demand for efficient public and private fleet operations. This evolution has been coupled with technological advancements like intelligent charging systems, wireless charging, and grid integration strategies for efficient power management. Consumer demand continues to shift towards reliable, convenient, and cost-effective charging solutions. The market is anticipated to grow at a healthy CAGR of xx% from 2025 to 2033. Specific data points on growth rates and adoption metrics, broken down by region and charging type, are detailed within the full report.

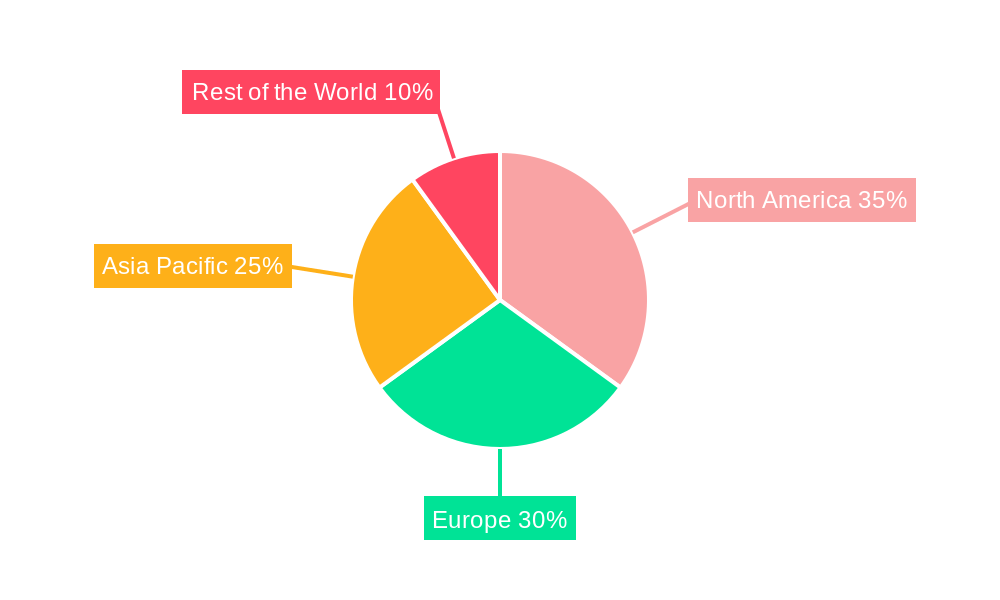

Leading Regions, Countries, or Segments in Electric Bus Charging Infrastructure Market

The report identifies [Region Name] as the dominant region for electric bus charging infrastructure deployment, driven by strong government initiatives, substantial investments in public transportation modernization, and a large and rapidly growing fleet of electric buses. [Country Name] is expected to be a leading growth market due to robust government policies and increasing private sector investment.

Key Drivers in Dominant Regions/Segments:

- Plug-in Charging: High adoption rates driven by established technology, lower initial investment costs compared to overhead charging, and ease of installation.

- Overhead Charging: Increasing adoption in depot settings due to its suitability for overnight charging of large electric bus fleets, higher charging speed, and reduced charging time.

- Investment Trends: Significant public and private sector investments are fueling infrastructure development.

- Regulatory Support: Government subsidies, tax incentives, and mandatory targets for electric bus adoption are significantly driving growth in specific regions.

Dominance factors are analyzed in detail within the full report, including a comparative analysis of plug-in and overhead charging systems across various regions and countries. This section explores the influence of factors such as charging speed, installation costs, infrastructure requirements, and regulatory frameworks on market dominance.

Electric Bus Charging Infrastructure Market Product Innovations

Recent innovations focus on increasing charging speed and efficiency, reducing charging times, and improving grid integration capabilities. This includes advancements in battery technology, charger design, and smart charging management systems. Unique selling propositions (USPs) of different products are based on factors such as charging speed, compatibility with different electric bus models, and smart features that optimize energy usage and minimize grid impact. The report provides a detailed analysis of specific product innovations from leading manufacturers and their impact on the market.

Propelling Factors for Electric Bus Charging Infrastructure Market Growth

Several factors are propelling the growth of the Electric Bus Charging Infrastructure Market. These include:

- Stringent emission regulations: Governments worldwide are implementing stricter emission norms, pushing the transition towards electric vehicles.

- Government incentives and subsidies: Financial support for electric bus adoption and charging infrastructure development accelerates market growth.

- Technological advancements: Improvements in battery technology, charging speeds, and smart charging systems enhance the attractiveness of electric buses.

- Rising environmental concerns: Growing awareness about the environmental impact of transportation is driving demand for sustainable solutions.

Obstacles in the Electric Bus Charging Infrastructure Market Market

The market faces certain challenges:

- High initial investment costs: Setting up charging infrastructure requires significant upfront investment.

- Interoperability issues: Lack of standardization across charging systems can create compatibility problems.

- Grid infrastructure limitations: Existing electricity grids may not always be able to support the increased demand from electric buses.

- Supply chain disruptions: Geopolitical factors and global events can impact the availability of essential components.

Future Opportunities in Electric Bus Charging Infrastructure Market

Future growth will be driven by:

- Expansion into new markets: Developing countries with rapidly growing urban populations present significant opportunities.

- Development of wireless charging technology: This can further improve the user experience and charging convenience.

- Integration of renewable energy sources: Harnessing solar and wind power to support charging operations can enhance sustainability.

- Smart charging solutions: Advanced charging management systems can optimize energy usage and reduce grid strain.

Major Players in the Electric Bus Charging Infrastructure Market Ecosystem

- 10 Starline Holdings LLC

- 2 Proterra Inc

- 11 EV Solutions (Webasto)

- 4 AB Volvo

- 3 ChargePoint Inc ChargePoint Inc

- 1 BYD Auto Co Ltd BYD Auto Co Ltd

- 1 ABB Ltd ABB Ltd

- 8 Heliox Energy

- 6 ALSTOM ALSTOM

- 5 Zhengzhou Yutong Bus Co Ltd

- 7 SemaConnect Inc

- 2 Mercedes-Benz AG Mercedes-Benz AG

- 3 Traton SE Traton SE

- 4 Siemens AG Siemens AG

- 7 NFI Group Inc

- 5 Schneider Electric SE Schneider Electric SE

- 6 IVECO S p A IVECO S p A

- 9 Vital EV Solutions

- Electric Charging Infrastructure Suppliers

Key Developments in Electric Bus Charging Infrastructure Market Industry

- November 2022: ABB E-Mobility secured USD 214 Million in pre-IPO funding, boosting its growth strategy through organic and inorganic means.

- September 2022: ABB E-Mobility launched a new manufacturing facility in South Carolina, creating over 100 jobs and increasing annual production capacity to 10,000 chargers.

- August 2022: Siemens and MAHLE Group partnered to develop cutting-edge wireless charging systems for electric vehicles, focusing on establishing industry standards for inductive charging technology.

Strategic Electric Bus Charging Infrastructure Market Market Forecast

The Electric Bus Charging Infrastructure Market is poised for significant growth, driven by continued government support, technological advancements, and increasing environmental awareness. The market's expansion into new geographical areas, coupled with the adoption of innovative charging solutions, promises substantial market potential. This positive outlook is further strengthened by the ongoing development of wireless charging technology and the increasing integration of renewable energy sources within charging infrastructure. The predicted growth trajectory indicates a substantial increase in market value over the coming years.

Electric Bus Charging Infrastructure Market Segmentation

-

1. Charging Type

- 1.1. Plug-in Charging

- 1.2. Overhead Charging

Electric Bus Charging Infrastructure Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Bus Charging Infrastructure Market Regional Market Share

Geographic Coverage of Electric Bus Charging Infrastructure Market

Electric Bus Charging Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Electric Buses

- 3.3. Market Restrains

- 3.3.1. High Upfront Investment

- 3.4. Market Trends

- 3.4.1. Governmental Efforts to Increase in the Number of Electric Buses Will Boost Overhead Charging Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 5.1.1. Plug-in Charging

- 5.1.2. Overhead Charging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 6. North America Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 6.1.1. Plug-in Charging

- 6.1.2. Overhead Charging

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 7. Europe Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 7.1.1. Plug-in Charging

- 7.1.2. Overhead Charging

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 8. Asia Pacific Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 8.1.1. Plug-in Charging

- 8.1.2. Overhead Charging

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 9. Rest of the World Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 9.1.1. Plug-in Charging

- 9.1.2. Overhead Charging

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 10 Starline Holdings LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Electric Bus Manufacturers

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Proterra Inc (also an electric bus manufacturer)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 11 EV Solutions (Webasto)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 4 AB Volvo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3 ChargePoint Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 1 BYD Auto Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 1 ABB Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 8 Heliox Energy

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 6 ALSTOM

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 5 Zhengzhou Yutong Bus Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 7 SemaConnect Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 2 Mercedes-Benz AG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 3 Traton SE

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 4 Siemens AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 7 NFI Group Inc

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 5 Schneider Electric SE

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 6 IVECO S p A

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 9 Vital EV Solutions

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Electric Charging Infrastructure Suppliers

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 10 Starline Holdings LLC

List of Figures

- Figure 1: Global Electric Bus Charging Infrastructure Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 3: North America Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 4: North America Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 7: Europe Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 8: Europe Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 11: Asia Pacific Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 12: Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 15: Rest of the World Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 16: Rest of the World Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 2: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 4: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 9: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 17: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 24: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: South America Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Middle East and Africa Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Bus Charging Infrastructure Market?

The projected CAGR is approximately 19.00%.

2. Which companies are prominent players in the Electric Bus Charging Infrastructure Market?

Key companies in the market include 10 Starline Holdings LLC, Electric Bus Manufacturers, 2 Proterra Inc (also an electric bus manufacturer), 11 EV Solutions (Webasto), 4 AB Volvo, 3 ChargePoint Inc, 1 BYD Auto Co Ltd, 1 ABB Ltd, 8 Heliox Energy, 6 ALSTOM, 5 Zhengzhou Yutong Bus Co Ltd, 7 SemaConnect Inc, 2 Mercedes-Benz AG, 3 Traton SE, 4 Siemens AG, 7 NFI Group Inc, 5 Schneider Electric SE, 6 IVECO S p A, 9 Vital EV Solutions, Electric Charging Infrastructure Suppliers.

3. What are the main segments of the Electric Bus Charging Infrastructure Market?

The market segments include Charging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Electric Buses.

6. What are the notable trends driving market growth?

Governmental Efforts to Increase in the Number of Electric Buses Will Boost Overhead Charging Type.

7. Are there any restraints impacting market growth?

High Upfront Investment.

8. Can you provide examples of recent developments in the market?

November 2022: ABB E-Mobility, the electric vehicle charging solutions subsidiary of ABB Ltd., successfully raised CHF 200 million (USD 214 million) in a pre-IPO private placement led by a group of minority investors. The capital infusion will play a crucial role in supporting the company's growth strategy, which includes pursuing both organic and inorganic opportunities, such as potential mergers and acquisitions. The transaction is expected to be finalized in the fourth quarter of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Bus Charging Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Bus Charging Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Bus Charging Infrastructure Market?

To stay informed about further developments, trends, and reports in the Electric Bus Charging Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence