Key Insights

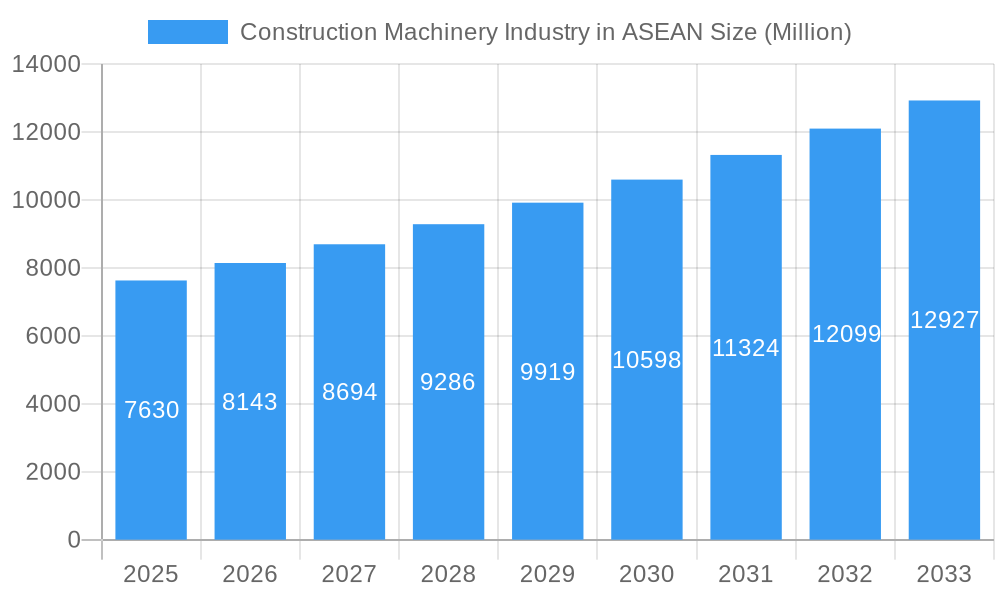

The ASEAN construction machinery market, valued at $7.63 billion in 2025, is projected to experience robust growth, driven by significant infrastructure development across the region. Governments in Indonesia, Thailand, Vietnam, Singapore, Malaysia, and the Philippines are heavily investing in transportation networks, housing, and industrial projects, fueling demand for cranes, excavators, loaders, backhoes, motor graders, and other machinery. The rising urbanization rate and increasing construction activities in these countries contribute to this positive market outlook. Furthermore, technological advancements, such as the integration of automation and digital technologies in construction equipment, are enhancing efficiency and productivity, further stimulating market growth. While challenges like fluctuating raw material prices and potential economic slowdowns exist, the long-term prospects remain promising, supported by consistent government investments and a growing need for modernized infrastructure.

Construction Machinery Industry in ASEAN Market Size (In Billion)

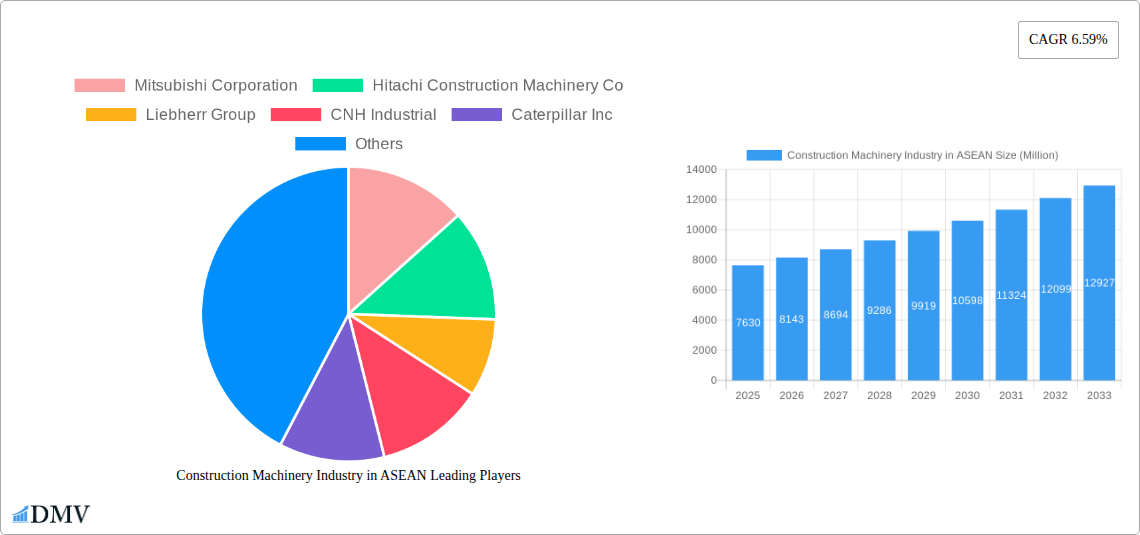

The market segmentation reveals a strong demand across various applications, notably concrete and road construction, earthmoving, and material handling. Major players like Mitsubishi Corporation, Hitachi Construction Machinery, Liebherr Group, CNH Industrial, Caterpillar, JCB, Komatsu, and Xuzhou Construction Machinery Group dominate the market, competing through technological innovation, product differentiation, and strategic partnerships. Growth is expected to be uneven across the ASEAN region, with Indonesia, Thailand, and Vietnam likely leading the expansion due to their large-scale infrastructure projects and rapidly developing economies. The CAGR of 6.59% suggests consistent growth throughout the forecast period (2025-2033), with the market size expected to significantly expand by 2033. Understanding these dynamics is crucial for businesses seeking to capitalize on the opportunities within this dynamic market.

Construction Machinery Industry in ASEAN Company Market Share

Construction Machinery Industry in ASEAN: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Construction Machinery Industry in ASEAN, offering a comprehensive overview of market trends, key players, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The ASEAN construction machinery market is projected to reach xx Million by 2033, exhibiting substantial growth driven by infrastructure development and urbanization.

Construction Machinery Industry in ASEAN Market Composition & Trends

This section evaluates the ASEAN construction machinery market's competitive landscape, identifying key trends shaping its evolution. We delve into market concentration, analyzing the market share distribution among major players like Mitsubishi Corporation, Hitachi Construction Machinery Co, Liebherr Group, CNH Industrial, Caterpillar Inc, JC Bamford Excavators Ltd (JCB), Komatsu Ltd, and Xuzhou Construction Machinery Group Co Ltd. The report examines innovation catalysts, regulatory frameworks across different ASEAN nations, the presence of substitute products, detailed end-user profiles, and the impact of mergers and acquisitions (M&A) activities, including deal values (xx Million).

- Market Concentration: Analysis of market share held by top players. For example, the top 5 players may collectively hold xx% of the market share in 2025.

- Innovation Catalysts: Examination of factors driving innovation, such as government incentives for sustainable technologies and the adoption of Industry 4.0 principles.

- Regulatory Landscape: A comparative analysis of construction machinery regulations across ASEAN countries, including safety standards and environmental regulations.

- Substitute Products: Assessment of alternative solutions and their impact on market dynamics.

- End-User Profiles: Detailed segmentation of end-users, including construction companies, government agencies, and rental firms.

- M&A Activities: Review of significant M&A transactions in the ASEAN construction machinery market, including deal values and strategic implications.

Construction Machinery Industry in ASEAN Industry Evolution

This section analyzes the historical (2019-2024) and projected (2025-2033) growth trajectories of the ASEAN construction machinery market. We examine technological advancements, including the increasing adoption of automation, electrification, and digitalization, and explore how shifting consumer demands for sustainability and efficiency are influencing market dynamics. Specific data points, such as compound annual growth rates (CAGRs) for various machinery types and adoption rates of new technologies, are provided. The analysis considers the impact of macroeconomic factors, infrastructural projects, and evolving construction methods on market growth. For example, the increasing preference for electric and hybrid machinery is expected to drive a xx% CAGR in the segment over the forecast period.

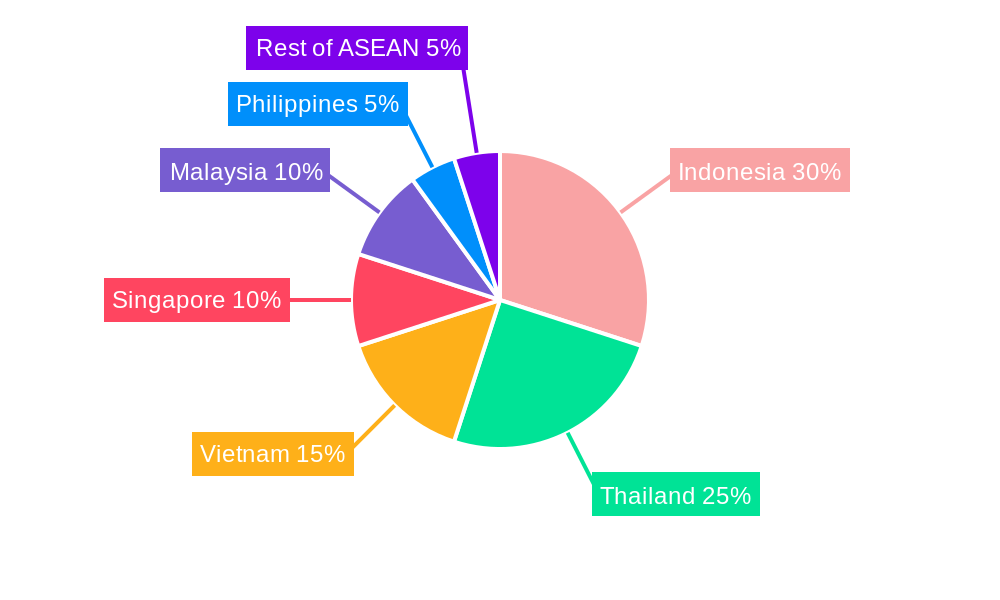

Leading Regions, Countries, or Segments in Construction Machinery Industry in ASEAN

This section pinpoints the dominant regions, countries, and segments within the ASEAN construction machinery market. We analyze performance across different machinery types (Cranes, Excavators, Loaders, Backhoe Loaders, Motor Graders, Other Machinery Types) and applications (Concrete and Road Construction, Earth Moving, Material Handling).

Key Drivers:

- Investment Trends: Analysis of infrastructure investment plans and their influence on demand for specific machinery types.

- Regulatory Support: Assessment of government policies and incentives promoting construction activity in different regions.

Dominance Factors:

[Paragraphs detailing the factors contributing to the dominance of specific regions, countries, or segments, e.g., the high demand for excavators in the rapidly developing infrastructure sector of Indonesia, coupled with favorable government policies promoting infrastructure investments. Similarly, the analysis will cover other market segments, drawing conclusions based on quantitative and qualitative data].

Construction Machinery Industry in ASEAN Product Innovations

Recent years have witnessed significant product innovations in the ASEAN construction machinery market, driven by technological advancements and the increasing focus on sustainability and efficiency. Manufacturers are introducing machines with improved fuel efficiency, enhanced safety features, and advanced automation capabilities. The introduction of electric and hybrid machines is a notable trend, reflecting the industry's commitment to reducing its carbon footprint. For example, Volvo CE's introduction of fully electric machinery marks a significant shift towards sustainable construction practices. The unique selling propositions include improved performance, reduced operating costs, and enhanced operator comfort.

Propelling Factors for Construction Machinery Industry in ASEAN Growth

The growth of the ASEAN construction machinery market is propelled by a confluence of factors:

- Robust Infrastructure Development: Governments across ASEAN are investing heavily in infrastructure projects, driving demand for construction machinery.

- Rapid Urbanization: The increasing urbanization across ASEAN nations fuels construction activity and boosts demand for construction equipment.

- Technological Advancements: Innovations in machinery design and technology increase efficiency and productivity, thereby stimulating market growth.

- Favorable Government Policies: Supportive government policies and regulations encourage investment and development within the construction sector.

Obstacles in the Construction Machinery Industry in ASEAN Market

Despite significant growth potential, the ASEAN construction machinery market faces several challenges:

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of machinery.

- Economic Fluctuations: Economic downturns can reduce investment in infrastructure projects, impacting demand for construction equipment.

- Intense Competition: The market is characterized by intense competition among both local and international players.

- Regulatory Hurdles: Navigating varying regulatory environments across different ASEAN countries can be complex for manufacturers.

Future Opportunities in Construction Machinery Industry in ASEAN

The ASEAN construction machinery market presents several promising future opportunities:

- Growth of Infrastructure Projects: Continued investment in infrastructure development will create sustained demand for construction machinery.

- Adoption of Advanced Technologies: The adoption of automation, digitalization, and electric technologies will present new avenues for growth.

- Focus on Sustainability: Demand for environmentally friendly construction machinery will create new market segments.

- Expansion into Emerging Markets: Untapped markets in smaller cities and rural areas offer significant growth potential.

Major Players in the Construction Machinery Industry in ASEAN Ecosystem

- Mitsubishi Corporation

- Hitachi Construction Machinery Co

- Liebherr Group

- CNH Industrial

- Caterpillar Inc

- JC Bamford Excavators Ltd (JCB)

- Komatsu Ltd

- Xuzhou Construction Machinery Group Co Ltd

Key Developments in Construction Machinery Industry in ASEAN Industry

- June 2023: Volvo Construction Equipment's (Volvo CE) first fully electric construction machinery arrived in Singapore, marking a significant step towards sustainable construction in Southeast Asia.

- May 2022: CASE Construction Equipment launched a range of new products across South Asia, expanding its product portfolio and market reach.

- April 2022: Liebherr's redevelopment of its mid-sized wheel loaders showcases ongoing innovation within the industry.

- January 2022: Liebherr's introduction of three new wheel loaders further strengthens its position in the market.

Strategic Construction Machinery Industry in ASEAN Market Forecast

The ASEAN construction machinery market is poised for substantial growth over the forecast period (2025-2033). Driven by factors such as robust infrastructure development, urbanization, and technological advancements, the market is expected to witness significant expansion. The increasing adoption of sustainable and technologically advanced machinery will further shape market dynamics, presenting lucrative opportunities for players who can adapt and innovate. The market's growth will be influenced by macroeconomic conditions, government policies, and the ongoing evolution of construction practices.

Construction Machinery Industry in ASEAN Segmentation

-

1. Machinery Type

- 1.1. Cranes

- 1.2. Excavators

- 1.3. Loaders

- 1.4. Backhoe

- 1.5. Motor Graders

- 1.6. Other Machinery Types

-

2. Application

- 2.1. Concrete and Road Construction

- 2.2. Earth Moving

- 2.3. Material Handling

-

3. Geography

- 3.1. Indonesia

- 3.2. Thailand

- 3.3. Vietnam

- 3.4. Singapore

- 3.5. Malaysia

- 3.6. Philippines

- 3.7. Rest of ASEAN

Construction Machinery Industry in ASEAN Segmentation By Geography

- 1. Indonesia

- 2. Thailand

- 3. Vietnam

- 4. Singapore

- 5. Malaysia

- 6. Philippines

- 7. Rest of ASEAN

Construction Machinery Industry in ASEAN Regional Market Share

Geographic Coverage of Construction Machinery Industry in ASEAN

Construction Machinery Industry in ASEAN REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Construction Activity May Drive the Market

- 3.3. Market Restrains

- 3.3.1. High Equipment Cost may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Concrete and Road Construction To Propel The Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Excavators

- 5.1.3. Loaders

- 5.1.4. Backhoe

- 5.1.5. Motor Graders

- 5.1.6. Other Machinery Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete and Road Construction

- 5.2.2. Earth Moving

- 5.2.3. Material Handling

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Indonesia

- 5.3.2. Thailand

- 5.3.3. Vietnam

- 5.3.4. Singapore

- 5.3.5. Malaysia

- 5.3.6. Philippines

- 5.3.7. Rest of ASEAN

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.4.2. Thailand

- 5.4.3. Vietnam

- 5.4.4. Singapore

- 5.4.5. Malaysia

- 5.4.6. Philippines

- 5.4.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Indonesia Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6.1.1. Cranes

- 6.1.2. Excavators

- 6.1.3. Loaders

- 6.1.4. Backhoe

- 6.1.5. Motor Graders

- 6.1.6. Other Machinery Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Concrete and Road Construction

- 6.2.2. Earth Moving

- 6.2.3. Material Handling

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Indonesia

- 6.3.2. Thailand

- 6.3.3. Vietnam

- 6.3.4. Singapore

- 6.3.5. Malaysia

- 6.3.6. Philippines

- 6.3.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7. Thailand Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 7.1.1. Cranes

- 7.1.2. Excavators

- 7.1.3. Loaders

- 7.1.4. Backhoe

- 7.1.5. Motor Graders

- 7.1.6. Other Machinery Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Concrete and Road Construction

- 7.2.2. Earth Moving

- 7.2.3. Material Handling

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Indonesia

- 7.3.2. Thailand

- 7.3.3. Vietnam

- 7.3.4. Singapore

- 7.3.5. Malaysia

- 7.3.6. Philippines

- 7.3.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8. Vietnam Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 8.1.1. Cranes

- 8.1.2. Excavators

- 8.1.3. Loaders

- 8.1.4. Backhoe

- 8.1.5. Motor Graders

- 8.1.6. Other Machinery Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Concrete and Road Construction

- 8.2.2. Earth Moving

- 8.2.3. Material Handling

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Indonesia

- 8.3.2. Thailand

- 8.3.3. Vietnam

- 8.3.4. Singapore

- 8.3.5. Malaysia

- 8.3.6. Philippines

- 8.3.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9. Singapore Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 9.1.1. Cranes

- 9.1.2. Excavators

- 9.1.3. Loaders

- 9.1.4. Backhoe

- 9.1.5. Motor Graders

- 9.1.6. Other Machinery Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Concrete and Road Construction

- 9.2.2. Earth Moving

- 9.2.3. Material Handling

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Indonesia

- 9.3.2. Thailand

- 9.3.3. Vietnam

- 9.3.4. Singapore

- 9.3.5. Malaysia

- 9.3.6. Philippines

- 9.3.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10. Malaysia Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 10.1.1. Cranes

- 10.1.2. Excavators

- 10.1.3. Loaders

- 10.1.4. Backhoe

- 10.1.5. Motor Graders

- 10.1.6. Other Machinery Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Concrete and Road Construction

- 10.2.2. Earth Moving

- 10.2.3. Material Handling

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Indonesia

- 10.3.2. Thailand

- 10.3.3. Vietnam

- 10.3.4. Singapore

- 10.3.5. Malaysia

- 10.3.6. Philippines

- 10.3.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11. Philippines Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Machinery Type

- 11.1.1. Cranes

- 11.1.2. Excavators

- 11.1.3. Loaders

- 11.1.4. Backhoe

- 11.1.5. Motor Graders

- 11.1.6. Other Machinery Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Concrete and Road Construction

- 11.2.2. Earth Moving

- 11.2.3. Material Handling

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Indonesia

- 11.3.2. Thailand

- 11.3.3. Vietnam

- 11.3.4. Singapore

- 11.3.5. Malaysia

- 11.3.6. Philippines

- 11.3.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Machinery Type

- 12. Rest of ASEAN Construction Machinery Industry in ASEAN Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Machinery Type

- 12.1.1. Cranes

- 12.1.2. Excavators

- 12.1.3. Loaders

- 12.1.4. Backhoe

- 12.1.5. Motor Graders

- 12.1.6. Other Machinery Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Concrete and Road Construction

- 12.2.2. Earth Moving

- 12.2.3. Material Handling

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Indonesia

- 12.3.2. Thailand

- 12.3.3. Vietnam

- 12.3.4. Singapore

- 12.3.5. Malaysia

- 12.3.6. Philippines

- 12.3.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Machinery Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hitachi Construction Machinery Co

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Liebherr Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 CNH Industrial

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Caterpillar Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 JC Bamford Excavators Ltd (JCB)*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Komatsu Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Xuzhou Construction Machinery Group Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Corporation

List of Figures

- Figure 1: Global Construction Machinery Industry in ASEAN Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 3: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 4: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 5: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 6: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 7: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Indonesia Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 9: Indonesia Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 10: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 11: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 12: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 13: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 14: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 15: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Thailand Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 17: Thailand Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 18: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 19: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 20: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 21: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 22: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 23: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Vietnam Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 25: Vietnam Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 26: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 27: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 28: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 29: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 30: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 31: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Singapore Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 33: Singapore Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 34: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 35: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 36: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 37: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 38: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 39: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Malaysia Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 41: Malaysia Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 42: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 43: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 44: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 45: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 46: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 47: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Philippines Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 49: Philippines Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Machinery Type 2025 & 2033

- Figure 51: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Machinery Type 2025 & 2033

- Figure 52: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Application 2025 & 2033

- Figure 53: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Application 2025 & 2033

- Figure 54: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Geography 2025 & 2033

- Figure 55: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Geography 2025 & 2033

- Figure 56: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue (Million), by Country 2025 & 2033

- Figure 57: Rest of ASEAN Construction Machinery Industry in ASEAN Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 6: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 10: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 14: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 18: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 22: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 26: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 30: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Application 2020 & 2033

- Table 31: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Geography 2020 & 2033

- Table 32: Global Construction Machinery Industry in ASEAN Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Construction Machinery Industry in ASEAN?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Construction Machinery Industry in ASEAN?

Key companies in the market include Mitsubishi Corporation, Hitachi Construction Machinery Co, Liebherr Group, CNH Industrial, Caterpillar Inc, JC Bamford Excavators Ltd (JCB)*List Not Exhaustive, Komatsu Ltd, Xuzhou Construction Machinery Group Co Ltd.

3. What are the main segments of the Construction Machinery Industry in ASEAN?

The market segments include Machinery Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.63 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Construction Activity May Drive the Market.

6. What are the notable trends driving market growth?

Concrete and Road Construction To Propel The Demand.

7. Are there any restraints impacting market growth?

High Equipment Cost may Hamper the Market.

8. Can you provide examples of recent developments in the market?

June 2023: Volvo Construction Equipment's (Volvo CE) first fully electric construction machinery arrived in Singapore and was formally introduced to the Southeast Asia market at a grand event on the island of Sentosa in 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Construction Machinery Industry in ASEAN," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Construction Machinery Industry in ASEAN report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Construction Machinery Industry in ASEAN?

To stay informed about further developments, trends, and reports in the Construction Machinery Industry in ASEAN, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence