Key Insights

The China traffic sign recognition market is projected for substantial expansion, driven by the escalating adoption of Advanced Driver-Assistance Systems (ADAS) and autonomous driving technologies. The market is forecast to reach $14.29 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.32%. This growth is underpinned by government mandates championing road safety and intelligent transportation systems, alongside robust vehicle production and sales figures in China. Key market segments encompass color-based, feature-based, and shape-based traffic sign detection, serving both passenger and commercial vehicle sectors. Prominent industry players are actively investing in R&D to enhance accuracy, reliability, and real-time processing. The integration of machine and deep learning algorithms is further bolstering system performance, contributing to enhanced road safety.

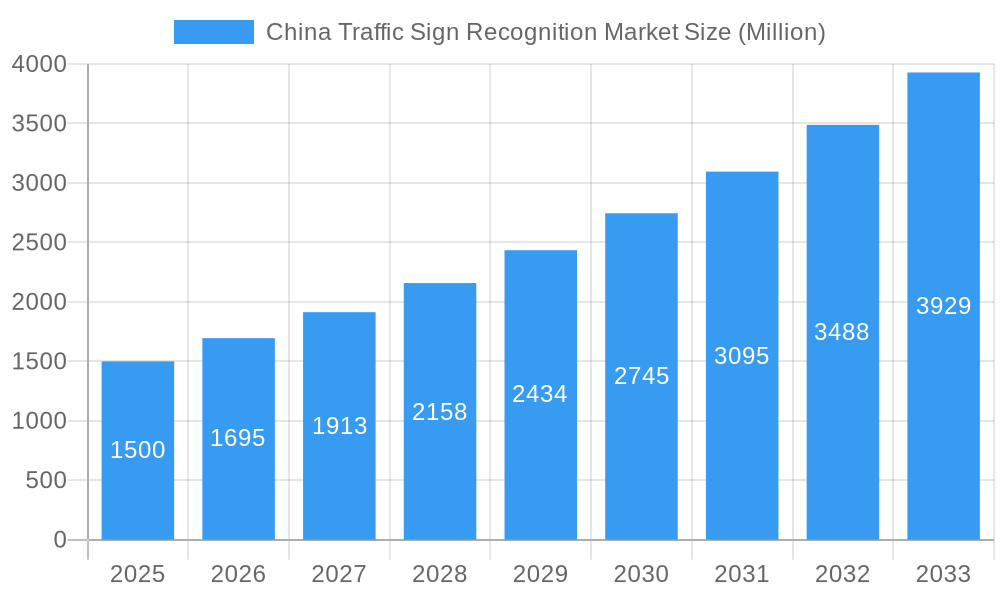

China Traffic Sign Recognition Market Market Size (In Billion)

The forecast period (2025-2033) indicates sustained market growth, propelled by the increasing prevalence of connected and autonomous vehicles. Passenger cars are anticipated to dominate market segmentation due to high sales volumes. However, the commercial vehicle sector is set to experience considerable expansion, driven by heightened attention to fleet management and stringent safety regulations. Advances in sensor technology, computational power, and algorithm development are expected to significantly improve system performance and dependability. Strategic partnerships between technology providers and automotive manufacturers will further catalyze integration into vehicles. China's significant investments in infrastructure development and intelligent transportation systems will serve as a key driver for market growth.

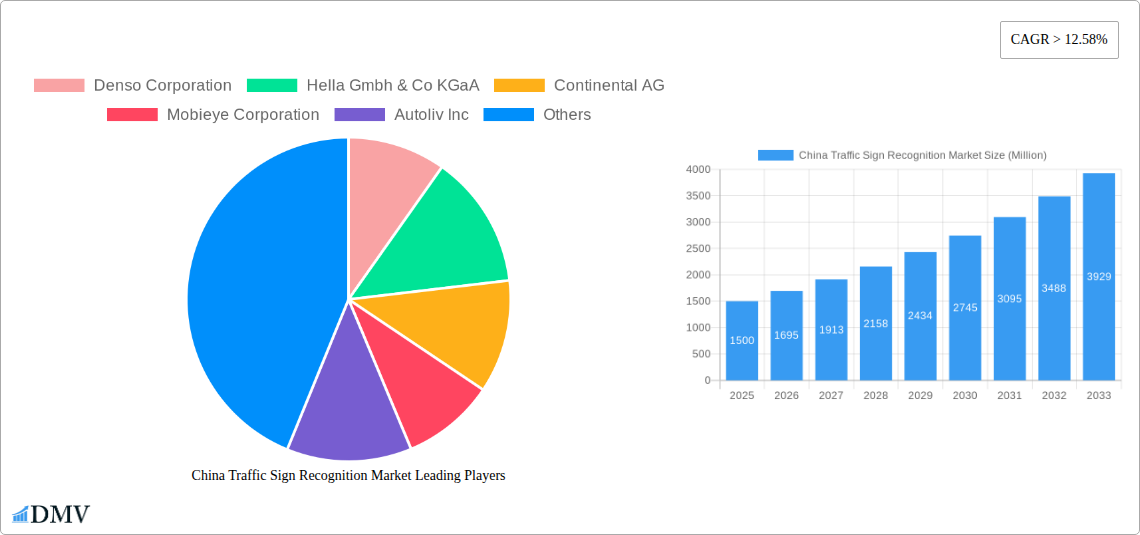

China Traffic Sign Recognition Market Company Market Share

China Traffic Sign Recognition Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning China Traffic Sign Recognition Market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a comprehensive overview of market trends, technological advancements, and future growth potential. The market is expected to reach xx Million by 2033, showcasing significant growth opportunities.

China Traffic Sign Recognition Market Composition & Trends

The China Traffic Sign Recognition Market is characterized by a moderately concentrated landscape, with key players like Denso Corporation, Hella Gmbh & Co KGaA, Continental AG, and Robert Bosch GmbH holding significant market share. Innovation is driven by advancements in AI, computer vision, and sensor technologies, leading to improved accuracy and reliability. Stringent government regulations promoting road safety are further boosting market growth. Substitute products, such as driver assistance systems with limited traffic sign recognition capabilities, exist but are generally less comprehensive. End-users primarily include automotive manufacturers and Tier-1 suppliers integrating these systems into passenger cars and commercial vehicles. M&A activities have been moderate, with deal values averaging xx Million in recent years.

- Market Share Distribution (2024): Continental AG (20%), Denso Corporation (18%), Hella Gmbh & Co KGaA (15%), Others (47%)

- Average M&A Deal Value (2021-2024): xx Million

- Key Market Drivers: Government regulations, rising road accidents, increasing vehicle production, technological advancements.

China Traffic Sign Recognition Market Industry Evolution

The China Traffic Sign Recognition Market has witnessed substantial growth over the historical period (2019-2024), expanding at a CAGR of xx%. This growth is primarily attributed to increasing vehicle ownership, stringent government regulations mandating advanced driver-assistance systems (ADAS), and continuous technological improvements enhancing the accuracy and reliability of traffic sign recognition systems. The market is transitioning towards more sophisticated solutions employing deep learning and AI algorithms, improving recognition accuracy even in challenging weather conditions. Consumer demand is shifting towards integrated, comprehensive ADAS systems incorporating various driver-assistance features, increasing the adoption rate of traffic sign recognition. We project a CAGR of xx% from 2025-2033.

- Market Size (Million): 2019 (xx), 2024 (xx), 2025 (xx), 2033 (xx)

- Adoption Rate (Percentage of new vehicles): 2019 (xx%), 2024 (xx%), 2025 (xx%), 2033 (xx%)

Leading Regions, Countries, or Segments in China Traffic Sign Recognition Market

The coastal regions of China, particularly areas with high vehicle density and robust infrastructure, dominate the market. Within the segments, the feature-based approach currently holds the largest market share due to its effectiveness and relatively lower cost compared to other techniques. The passenger car segment contributes the most to the market size, driven by the country's burgeoning passenger car market and the increasing adoption of ADAS.

- Key Drivers for Passenger Car Segment: Rising disposable incomes, increasing urbanization, government incentives for vehicle purchases, safety concerns

- Key Drivers for Feature-Based Traffic Sign Detection: Cost-effectiveness, robust performance in various lighting conditions, relatively mature technology

- Dominant Region: Coastal regions (e.g., Guangdong, Jiangsu, Zhejiang)

China Traffic Sign Recognition Market Product Innovations

Recent innovations focus on improving accuracy in challenging environments (low light, inclement weather), enhancing processing speed for real-time responsiveness, and integrating with other ADAS features for a more comprehensive safety suite. Advanced machine learning algorithms, advanced sensor fusion, and improved image processing techniques are key technological advancements. Unique selling propositions include higher recognition accuracy, lower false-positive rates, and robust performance across diverse road conditions.

Propelling Factors for China Traffic Sign Recognition Market Growth

Technological advancements in AI and computer vision are significantly driving market growth. Government regulations mandating the adoption of ADAS in new vehicles are also instrumental. Economic factors such as rising disposable incomes and increased vehicle ownership further fuel market expansion.

Obstacles in the China Traffic Sign Recognition Market

Regulatory complexities and inconsistent standards across different regions of China pose challenges. Supply chain disruptions impacting the availability of critical components, and intense competition among established and emerging players, add pressure to profit margins.

Future Opportunities in China Traffic Sign Recognition Market

Expanding into rural areas with developing road infrastructure represents a significant opportunity. The integration of traffic sign recognition with other ADAS functions, like autonomous emergency braking, offers synergistic growth. The development of solutions specifically tailored for the unique challenges of Chinese road conditions presents a lucrative avenue.

Major Players in the China Traffic Sign Recognition Market Ecosystem

- Denso Corporation

- Hella Gmbh & Co KGaA

- Continental AG

- Mobieye Corporation

- Autoliv Inc

- Valeo SA

- Robert Bosch GmbH

- Ford Motor Company

Key Developments in China Traffic Sign Recognition Market Industry

- April 202x: Technology company Continental introduced a new feature called Child-Presence-Detection (CPD) to its digital access system CoSmA. This enhances vehicle safety and indirectly contributes to the broader adoption of ADAS systems incorporating traffic sign recognition.

- March 2023: Toshiba Electronic Devices & Storage Corporation launched its Thermoflagger™ over-temperature detection IC series. While not directly related to traffic sign recognition, these ICs contribute to the broader ecosystem of reliable and durable components needed for the development of sophisticated ADAS systems.

Strategic China Traffic Sign Recognition Market Forecast

The China Traffic Sign Recognition Market is poised for significant growth over the forecast period, driven by technological innovations, supportive government policies, and rising consumer demand. The market will see increasing penetration of advanced features and the integration of traffic sign recognition into broader ADAS and autonomous driving systems. This will present substantial opportunities for market players to capitalize on the growing demand for enhanced road safety and intelligent transportation solutions.

China Traffic Sign Recognition Market Segmentation

-

1. Traffic Sign Detection

- 1.1. Color-Based

- 1.2. Feature-Based

- 1.3. Shape-Based

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Cars

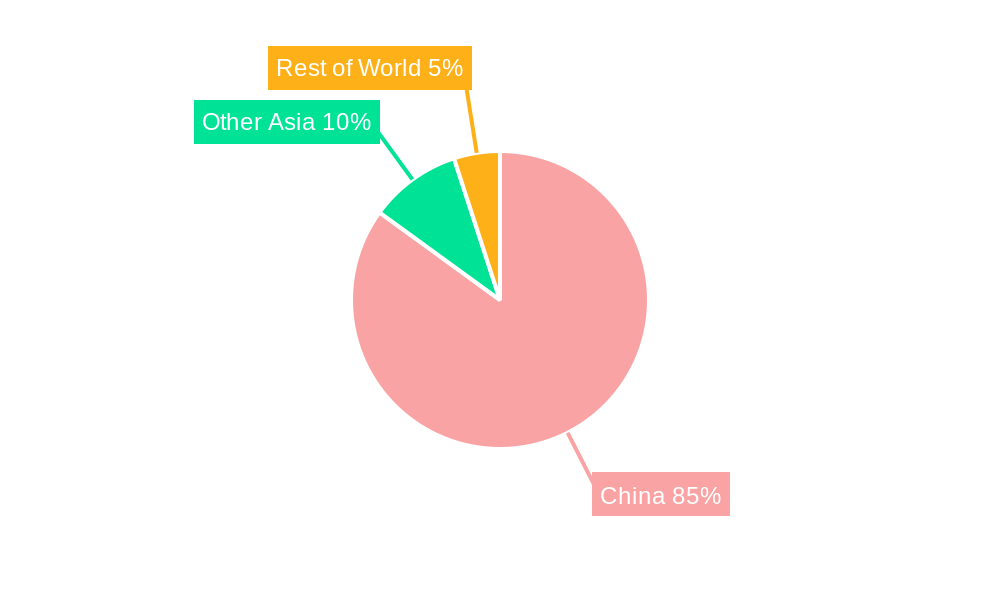

China Traffic Sign Recognition Market Segmentation By Geography

- 1. China

China Traffic Sign Recognition Market Regional Market Share

Geographic Coverage of China Traffic Sign Recognition Market

China Traffic Sign Recognition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Safety Concerns; Technological Advancements; Others

- 3.3. Market Restrains

- 3.3.1. Complex and Diverse Road Conditions; Others

- 3.4. Market Trends

- 3.4.1. Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Traffic Sign Recognition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 5.1.1. Color-Based

- 5.1.2. Feature-Based

- 5.1.3. Shape-Based

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Traffic Sign Detection

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hella Gmbh & Co KGaA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mobieye Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Autoliv Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valeo SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Robert Bosch Gmb

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ford Motor Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: China Traffic Sign Recognition Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Traffic Sign Recognition Market Share (%) by Company 2025

List of Tables

- Table 1: China Traffic Sign Recognition Market Revenue billion Forecast, by Traffic Sign Detection 2020 & 2033

- Table 2: China Traffic Sign Recognition Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: China Traffic Sign Recognition Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Traffic Sign Recognition Market Revenue billion Forecast, by Traffic Sign Detection 2020 & 2033

- Table 5: China Traffic Sign Recognition Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 6: China Traffic Sign Recognition Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Traffic Sign Recognition Market?

The projected CAGR is approximately 8.32%.

2. Which companies are prominent players in the China Traffic Sign Recognition Market?

Key companies in the market include Denso Corporation, Hella Gmbh & Co KGaA, Continental AG, Mobieye Corporation, Autoliv Inc, Valeo SA, Robert Bosch Gmb, Ford Motor Company.

3. What are the main segments of the China Traffic Sign Recognition Market?

The market segments include Traffic Sign Detection, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.29 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Safety Concerns; Technological Advancements; Others.

6. What are the notable trends driving market growth?

Rise in Stringent Government Regulations and Growing Demand for Autonomous Vehicles.

7. Are there any restraints impacting market growth?

Complex and Diverse Road Conditions; Others.

8. Can you provide examples of recent developments in the market?

April 202: Technology company Continental introduced a new feature called Child-Presence-Detection (CPD) to its digital access system CoSmA. This function is designed to detect children left inside the vehicle and issue a warning.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Traffic Sign Recognition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Traffic Sign Recognition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Traffic Sign Recognition Market?

To stay informed about further developments, trends, and reports in the China Traffic Sign Recognition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence