Key Insights

The China automotive carbon fiber composites market is set for substantial expansion, propelled by the escalating demand for lightweight vehicles. This demand is critical for enhancing fuel efficiency and achieving emission reduction targets. The market demonstrates a robust Compound Annual Growth Rate (CAGR) of 14.5%, indicating significant upward momentum. Key growth drivers include government initiatives supporting sustainable transportation and the automotive sector's persistent drive for improved performance and innovative design. Primary applications span structural assemblies, powertrain components, interior, and exterior parts, utilizing manufacturing techniques such as hand layup, resin transfer molding, vacuum infusion processing, and injection molding.

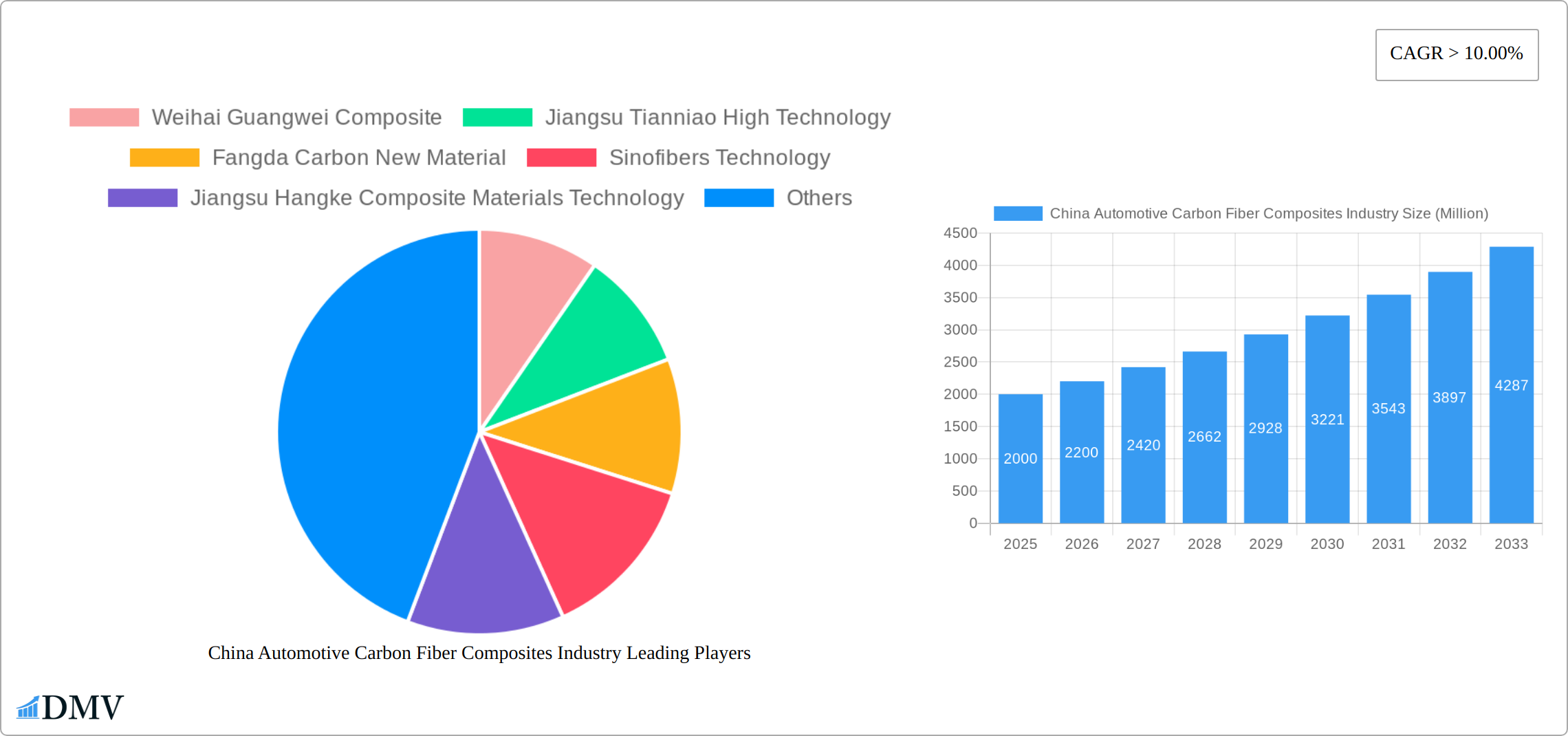

China Automotive Carbon Fiber Composites Industry Market Size (In Billion)

The market is projected to reach a size of $11.1 billion by 2025. While production costs for carbon fiber composites present a challenge compared to conventional materials, ongoing technological advancements and increasing economies of scale are expected to alleviate these pressures. Established players like Weihai Guangwei Composite and Jiangsu Tianniao High Technology define the competitive landscape. The market's segmentation across diverse applications and production methods underscores its versatility in meeting varied automotive requirements. Future growth will be significantly shaped by breakthroughs in material science, manufacturing automation, and the accelerated adoption of electric and hybrid vehicles, further intensifying the need for lightweighting solutions. The Chinese automotive carbon fiber composite market is therefore poised to offer significant opportunities through 2033.

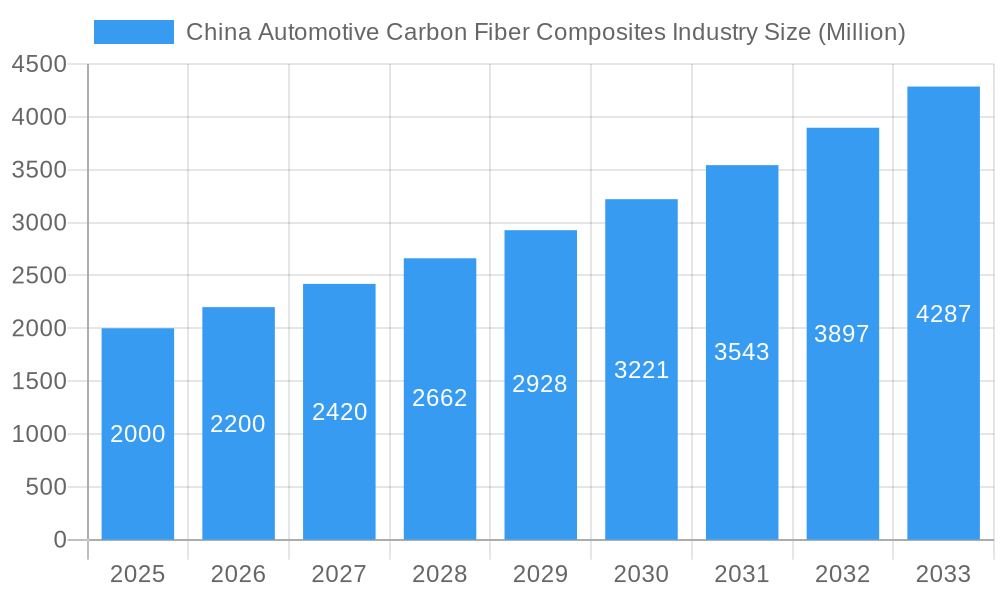

China Automotive Carbon Fiber Composites Industry Company Market Share

China Automotive Carbon Fiber Composites Industry: A Comprehensive Market Analysis (2019-2033)

This insightful report delivers a comprehensive analysis of the burgeoning China Automotive Carbon Fiber Composites industry, offering crucial insights for stakeholders seeking to navigate this dynamic market. The report covers the period from 2019 to 2033, with a focus on the year 2025, providing a detailed historical overview and robust future projections. The market size is expected to reach xx Million by 2033, representing significant growth opportunities. This report is invaluable for investors, manufacturers, suppliers, and industry professionals seeking to understand market trends, identify growth opportunities, and make informed strategic decisions.

China Automotive Carbon Fiber Composites Industry Market Composition & Trends

This section dissects the competitive landscape of the China Automotive Carbon Fiber Composites market, examining market concentration, innovation drivers, regulatory frameworks, substitute materials, end-user behavior, and merger & acquisition (M&A) activity. The report analyzes the market share distribution among key players, revealing a moderately concentrated market with a few dominant players and numerous smaller participants. The market share of the top three players is estimated at xx%, with Weihai Guangwei Composite, Jiangsu Tianniao High Technology, and Fangda Carbon New Material holding significant positions. Several successful M&A deals have shaped the market landscape, with deal values reaching xx Million in recent years. Innovation is driven by government initiatives promoting lightweighting in vehicles and stringent emission regulations. Key substitute materials include steel and aluminum, presenting ongoing challenges. The report meticulously details end-user preferences and profiles, highlighting the growing demand for high-performance composites in electric vehicles.

- Market Concentration: Moderately concentrated, with top three players holding xx% market share.

- Innovation Catalysts: Government initiatives, emission regulations, and increasing demand for lightweight vehicles.

- Regulatory Landscape: Stringent emission standards and safety regulations are driving demand for carbon fiber composites.

- Substitute Products: Steel and aluminum pose competitive challenges.

- End-User Profiles: Primarily automotive OEMs and Tier 1 suppliers.

- M&A Activities: Significant M&A activity observed, with deal values reaching xx Million in recent years.

China Automotive Carbon Fiber Composites Industry Industry Evolution

This section details the evolution of China's automotive carbon fiber composites industry from 2019 to 2033. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to achieve a CAGR of xx% during the forecast period (2025-2033). This robust growth is fueled by several key factors. Technological advancements, including the development of superior resin systems and the implementation of automated manufacturing processes, have significantly enhanced production efficiency and component quality. Simultaneously, a shifting consumer landscape, characterized by a preference for fuel-efficient and eco-friendly vehicles, is driving increased demand for lightweight carbon fiber components. The adoption of carbon fiber composites in automotive applications has accelerated, with injection molding and resin transfer molding techniques showing particularly strong growth. The full report provides detailed data illustrating these trends, including market segmentation by application and manufacturing process, regional breakdowns, and analysis of key players' market share.

Leading Regions, Countries, or Segments in China Automotive Carbon Fiber Composites Industry

This section pinpoints the leading regions, countries, and segments within China's dynamic automotive carbon fiber composites market. The Structural Assembly segment currently holds the largest market share, driven by its widespread use in body panels and chassis components. In terms of manufacturing processes, Resin Transfer Molding (RTM) maintains a significant share due to its cost-effectiveness and ability to produce high-quality components. The key drivers for these leading segments are elaborated below:

- Structural Assembly: The relentless pursuit of vehicle lightweighting to improve fuel efficiency and performance.

- Powertrain Components: The rapid expansion of the electric vehicle (EV) market necessitates lightweight and high-strength components for EV powertrains.

- Interiors & Exteriors: Growing demand for aesthetically pleasing and durable interior and exterior components, leveraging the design flexibility of carbon fiber.

- Resin Transfer Molding (RTM): Its cost-effectiveness and suitability for high-volume production make it a preferred choice for many manufacturers.

- Vacuum Infusion Processing: Ideal for producing high-quality components for specialized applications requiring superior performance characteristics.

- Injection Molding: Its increasing adoption reflects its suitability for high-volume production of complex parts with intricate designs.

The dominance of these segments is underpinned by robust government support for the automotive industry, substantial investments in research and development (R&D), and the exponential growth of the electric vehicle market. Furthermore, the increasing focus on reducing carbon emissions is bolstering the demand for lightweight materials such as carbon fiber composites.

China Automotive Carbon Fiber Composites Industry Product Innovations

Recent product innovations focus on enhancing the performance and cost-effectiveness of carbon fiber composites. New resin systems improve the mechanical properties and durability of the components, while advancements in manufacturing techniques like automated fiber placement (AFP) are boosting production efficiency. These innovations are resulting in lighter, stronger, and more cost-competitive automotive parts, making them attractive to OEMs and Tier 1 suppliers.

Propelling Factors for China Automotive Carbon Fiber Composites Industry Growth

The growth of the China Automotive Carbon Fiber Composites market is fueled by several factors. Firstly, the increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions is a significant driver. Government regulations promoting the use of lightweight materials further stimulate market growth. Secondly, the rapid expansion of the electric vehicle (EV) market necessitates lightweight components, boosting demand for carbon fiber composites. Technological advancements in manufacturing processes and material science are reducing the cost and improving the performance of these composites, thereby further accelerating market adoption.

Obstacles in the China Automotive Carbon Fiber Composites Industry Market

The China Automotive Carbon Fiber Composites market faces certain challenges. High raw material costs, particularly for carbon fiber, can hinder market growth. Supply chain disruptions can lead to production delays and increased costs. Intense competition from established players and the emergence of new entrants pose significant competitive pressures. Moreover, the industry requires substantial investment in R&D and advanced manufacturing infrastructure, which can be a barrier for smaller companies.

Future Opportunities in China Automotive Carbon Fiber Composites Industry

The future of the Chinese automotive carbon fiber composites industry presents significant opportunities. The development of advanced composite materials with enhanced properties (such as improved strength-to-weight ratios and durability) and reduced costs is crucial for continued market expansion. Expansion into new applications, including fuel cell vehicles (FCVs) and autonomous driving systems (ADS), promises substantial growth potential. Further advancements in manufacturing processes, emphasizing automation, digitalization, and predictive maintenance, will significantly improve efficiency and lower production costs. The increasing global focus on lightweight and sustainable transportation solutions offers a vast landscape for market growth and innovation. Moreover, collaborations between automotive manufacturers and composite material suppliers will be vital in driving innovation and accelerating adoption.

Major Players in the China Automotive Carbon Fiber Composites Industry Ecosystem

- Weihai Guangwei Composite

- Jiangsu Tianniao High Technology

- Fangda Carbon New Material

- Sinofibers Technology

- Jiangsu Hangke Composite Materials Technology

- Jiyan High-tech Fibers

- Jiangsu Kangde Xin Composite Material

- Beijing Kangde Xin Composite Material

- Jilin Tangu Carbon

- Jiangsu Hengshen

- Jilin Carbon

Key Developments in China Automotive Carbon Fiber Composites Industry Industry

- 2022-06: Jiangsu Tianniao High Technology announces a new facility for carbon fiber production, increasing capacity by xx Million square meters.

- 2023-03: Fangda Carbon New Material secures a major contract to supply carbon fiber components for a leading EV manufacturer.

- 2024-10: Weihai Guangwei Composite partners with a European firm to develop a next-generation carbon fiber material.

Strategic China Automotive Carbon Fiber Composites Industry Market Forecast

The China Automotive Carbon Fiber Composites industry is poised for substantial growth, driven by a confluence of factors. Technological advancements, supportive government policies promoting the adoption of advanced materials, and the unrelenting demand for lightweight and sustainable vehicles are key catalysts. The market is expected to experience consistent expansion across various automotive applications, resulting in significant growth in both market size and value. The industry's future trajectory will be significantly shaped by a continued focus on innovation, particularly in the realm of high-performance materials and cost-effective manufacturing processes. Supply chain optimization and strategic partnerships will also play a critical role in realizing the full potential of this rapidly evolving market.

China Automotive Carbon Fiber Composites Industry Segmentation

-

1. Production Type

- 1.1. Hand Layup

- 1.2. Resin Transfer Molding

- 1.3. Vacuum Infusion Processing

- 1.4. Injection Molding

- 1.5. Others

-

2. Application Type

- 2.1. Structural Assembly

- 2.2. Powertrain Components

- 2.3. Interiors

- 2.4. Exteriors

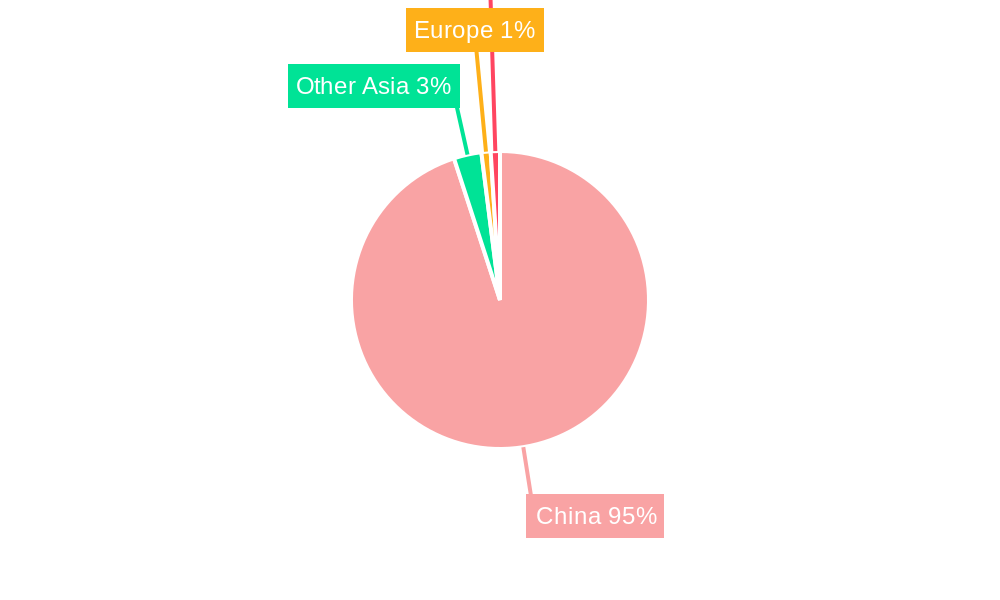

China Automotive Carbon Fiber Composites Industry Segmentation By Geography

- 1. China

China Automotive Carbon Fiber Composites Industry Regional Market Share

Geographic Coverage of China Automotive Carbon Fiber Composites Industry

China Automotive Carbon Fiber Composites Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ease of Steering

- 3.3. Market Restrains

- 3.3.1. Cost and Price Sensitivity

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Carbon Fiber for Greater Fuel Efficiency

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Automotive Carbon Fiber Composites Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 5.1.1. Hand Layup

- 5.1.2. Resin Transfer Molding

- 5.1.3. Vacuum Infusion Processing

- 5.1.4. Injection Molding

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Structural Assembly

- 5.2.2. Powertrain Components

- 5.2.3. Interiors

- 5.2.4. Exteriors

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Production Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Weihai Guangwei Composite

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jiangsu Tianniao High Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fangda Carbon New Material

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sinofibers Technology

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Jiangsu Hangke Composite Materials Technology

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jiyan High-tech Fibers

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jiangsu Kangde Xin Composite Material

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Beijing Kangde Xin Composite Material

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jilin Tangu Carbon

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jiangsu Hengshen

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jilin Carbon

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Weihai Guangwei Composite

List of Figures

- Figure 1: China Automotive Carbon Fiber Composites Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Automotive Carbon Fiber Composites Industry Share (%) by Company 2025

List of Tables

- Table 1: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Production Type 2020 & 2033

- Table 2: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Production Type 2020 & 2033

- Table 5: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: China Automotive Carbon Fiber Composites Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Automotive Carbon Fiber Composites Industry?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the China Automotive Carbon Fiber Composites Industry?

Key companies in the market include Weihai Guangwei Composite, Jiangsu Tianniao High Technology, Fangda Carbon New Material, Sinofibers Technology, Jiangsu Hangke Composite Materials Technology, Jiyan High-tech Fibers, Jiangsu Kangde Xin Composite Material, Beijing Kangde Xin Composite Material, Jilin Tangu Carbon, Jiangsu Hengshen, Jilin Carbon.

3. What are the main segments of the China Automotive Carbon Fiber Composites Industry?

The market segments include Production Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Ease of Steering.

6. What are the notable trends driving market growth?

Increasing Adoption of Carbon Fiber for Greater Fuel Efficiency.

7. Are there any restraints impacting market growth?

Cost and Price Sensitivity.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Automotive Carbon Fiber Composites Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Automotive Carbon Fiber Composites Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Automotive Carbon Fiber Composites Industry?

To stay informed about further developments, trends, and reports in the China Automotive Carbon Fiber Composites Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence