Key Insights

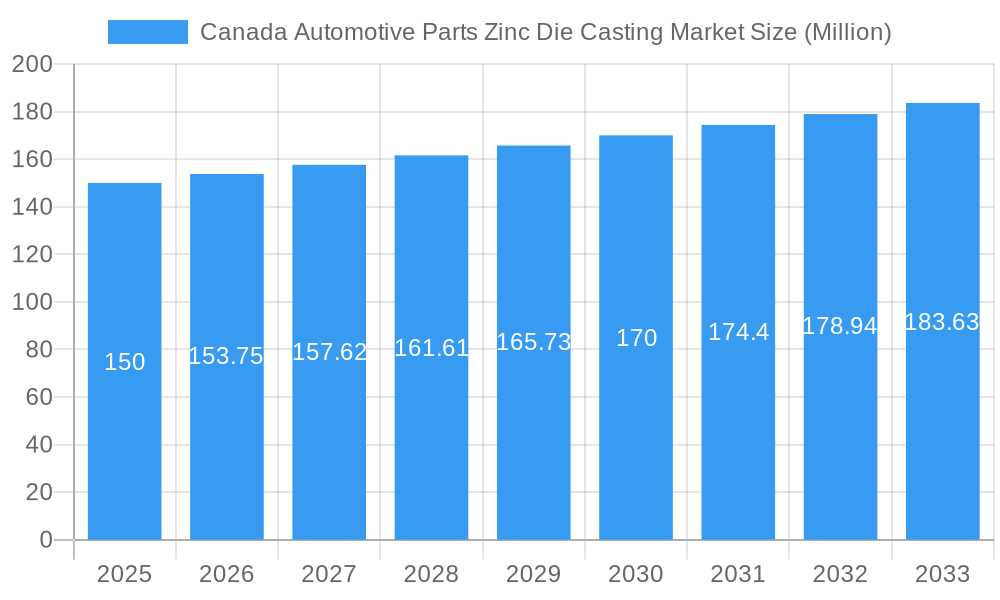

The Canadian automotive parts zinc die casting market is experiencing steady growth, driven by the increasing demand for lightweight and durable automotive components. The market's Compound Annual Growth Rate (CAGR) exceeding 2.50% from 2019 to 2024 indicates a positive trajectory, projected to continue into the forecast period (2025-2033). Key drivers include the rising adoption of electric vehicles (EVs) and the ongoing focus on fuel efficiency, both of which necessitate lightweight yet robust components. Pressure die casting remains the dominant production process, owing to its cost-effectiveness and ability to produce high-volume parts. However, vacuum die casting is gaining traction due to its superior surface finish and dimensional accuracy, particularly for complex engine and transmission components. The market is segmented by application type, with engine parts, transmission components, and body parts representing significant segments. While the market faces certain restraints such as fluctuating zinc prices and environmental regulations concerning zinc emissions, these challenges are being addressed through technological advancements and sustainable manufacturing practices. Major players in the Canadian market include both domestic and international companies, signifying a competitive landscape. Regional variations exist, with Eastern Canada potentially exhibiting higher growth due to a more established automotive manufacturing presence. The overall market outlook is optimistic, indicating substantial growth opportunities for companies specializing in zinc die casting for the automotive sector.

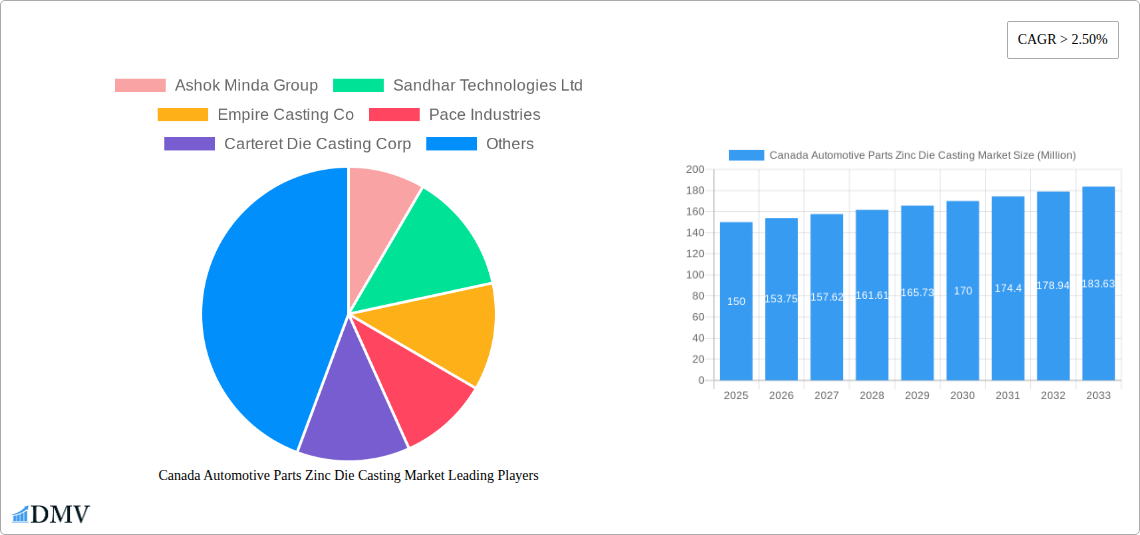

Canada Automotive Parts Zinc Die Casting Market Market Size (In Million)

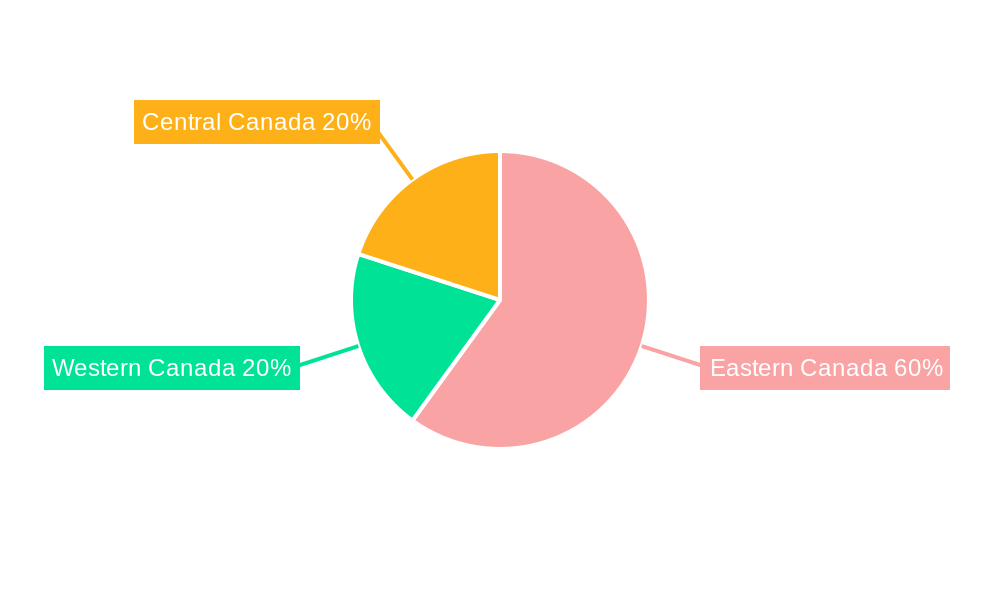

The market size in 2025 is estimated to be around $150 million based on extrapolation from the provided CAGR and considering the overall growth of the Canadian automotive industry. This figure serves as a baseline for projecting future market size, incorporating estimated growth rates, and considering regional distribution. While precise regional breakdowns (Eastern, Western, Central Canada) are unavailable, a reasonable estimation could allocate approximately 60% of the market to Eastern Canada, reflecting its higher concentration of automotive manufacturing facilities. Western and Central Canada would share the remaining 40%, with Western Canada slightly ahead due to its proximity to the US automotive industry. This distribution, alongside market size projections, enables a comprehensive understanding of the market's dynamics and growth potential across the Canadian landscape. Further research into specific regional data is recommended for more precise segmentation.

Canada Automotive Parts Zinc Die Casting Market Company Market Share

Canada Automotive Parts Zinc Die Casting Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Canada Automotive Parts Zinc Die Casting Market, offering a comprehensive overview of market dynamics, trends, and future prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is essential for stakeholders seeking to understand the current market landscape and make informed strategic decisions. The market is estimated to be valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Canada Automotive Parts Zinc Die Casting Market Market Composition & Trends

This section delves into the intricate structure of the Canadian automotive parts zinc die casting market, examining market concentration, innovation drivers, regulatory frameworks, substitute product analysis, end-user profiles, and mergers & acquisitions (M&A) activities. We analyze market share distribution amongst key players like Ashok Minda Group, Sandhar Technologies Ltd, and Dynacast, revealing a moderately concentrated market with an estimated xx% market share held by the top three players in 2025. The report also examines the impact of evolving regulatory changes, such as increasingly stringent emission standards and safety mandates, on market growth and the adoption of advanced die casting solutions. The escalating demand for lightweight, durable, and high-strength automotive components, crucial for enhancing fuel efficiency and overall vehicle performance, directly fuels the adoption of zinc die casting. Concurrently, the emergence of alternative materials like advanced plastics and aluminum alloys presents a dynamic competitive challenge, necessitating continuous innovation in zinc die casting techniques and material science. M&A activities are analyzed in detail, revealing a total deal value of approximately xx Million in the historical period (2019-2024), with a strategic focus on acquisitions aimed at expanding geographic reach, acquiring advanced technological capabilities, and consolidating market presence.

- Market Concentration: Moderately concentrated, with top 3 players anticipated to hold approximately xx% market share in 2025.

- Innovation Catalysts: Driven by the relentless demand for lightweight vehicles, increasingly stringent emission norms, and the electrification trend.

- Regulatory Landscape: Comprehensive analysis of relevant Canadian automotive regulations, including environmental protection acts, safety standards, and their direct impact on the adoption of advanced die casting materials and processes.

- Substitute Products: In-depth examination of alternative materials such as high-strength plastics, magnesium alloys, and aluminum alloys, along with their competitive implications for zinc die casting.

- End-User Profiles: Detailed analysis of key end-user segments, including Original Equipment Manufacturers (OEMs), Tier-1 automotive suppliers, and aftermarket service providers, outlining their specific requirements and purchasing behaviors.

- M&A Activities: Thorough analysis of completed deals from 2019-2024, detailing strategic rationales and their cumulative impact, with an estimated total deal value of approximately xx Million.

Canada Automotive Parts Zinc Die Casting Market Industry Evolution

This section provides a comprehensive analysis of the market's evolutionary path, meticulously tracing its growth trajectory from 2019 to 2024 and projecting its future trajectory until 2033. We examine key technological advancements that are continuously driving efficiency, precision, and cost-effectiveness in modern die casting processes. The report also explores the significant impact of shifting global consumer preferences towards fuel-efficient, sustainable, and technologically advanced vehicles, which directly influences the demand for lightweight and intricately designed automotive parts. The Canadian automotive parts zinc die casting market witnessed a robust Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024, largely propelled by increased automotive production volumes, the rising adoption of advanced die casting technologies, and the growing demand for complex part designs. The forecast period (2025-2033) anticipates a sustained and accelerated growth rate, influenced by a confluence of factors including ongoing technological innovations in die casting materials and processes, a projected substantial increase in global and domestic automotive production, and supportive government initiatives promoting electric vehicle (EV) adoption and advanced manufacturing. The adoption rate of advanced die casting technologies, such as vacuum die casting and hot chamber die casting enhancements, is projected to experience significant expansion, increasing from an estimated xx% in 2024 to xx% in 2033.

Leading Regions, Countries, or Segments in Canada Automotive Parts Zinc Die Casting Market

This section identifies the leading segments and regions within the Canadian market. Based on our analysis, Ontario emerges as the dominant region, accounting for xx% of the market in 2025. This dominance is attributed to a high concentration of automotive manufacturing facilities and a robust supplier network.

Key Drivers for Ontario's Dominance:

- High Concentration of Automotive Manufacturing: Presence of major OEMs and Tier-1 suppliers.

- Developed Automotive Supply Chain: Well-established network of component manufacturers and suppliers.

- Government Support for Automotive Industry: Incentives and policies promoting manufacturing and innovation.

Dominant Segments:

- Production Process Type: Pressure die casting remains the dominant process, accounting for xx% of the market in 2025 due to its cost-effectiveness and scalability.

- Application Type: Engine parts constitute the largest segment, driven by the demand for lightweight and high-performance components. This segment holds xx% of the market in 2025.

Further analysis shows that the growth of electric vehicles is significantly impacting the demand for specific components, with transmission components and body parts experiencing accelerated growth. The other segments are showing a steady growth trajectory driven by technological advancements and broader automotive industry growth.

Canada Automotive Parts Zinc Die Casting Market Product Innovations

Recent product innovations have focused on enhancing the performance and efficiency of zinc die casting components. Advanced materials with improved mechanical properties, such as high-strength zinc alloys, are being increasingly adopted. Technological advancements in die casting processes, such as high-pressure die casting and vacuum die casting, are leading to greater precision and dimensional accuracy. These innovations deliver unique selling propositions including lighter weight components, increased strength and durability, improved surface finish, and reduced production costs, ultimately boosting the competitiveness of Canadian automotive parts manufacturers.

Propelling Factors for Canada Automotive Parts Zinc Die Casting Market Growth

The sustained growth of the Canadian automotive parts zinc die casting market is propelled by a dynamic interplay of several key factors. Leading the charge are continuous technological advancements in die casting processes, leading to more efficient, precise, and cost-effective production of complex components. The ever-increasing demand for lightweight vehicles, a critical response to stringent fuel efficiency standards and growing environmental consciousness, is a paramount driver for zinc die casting solutions. Furthermore, favorable government incentives and supportive policies within Canada's automotive industry, particularly those aimed at fostering the adoption and manufacturing of electric vehicles, further stimulate market growth and innovation. The expanding Canadian automotive sector, encompassing both traditional and emerging mobility solutions, inherently fuels the demand for high-quality, cost-effective, and performance-driven components manufactured through advanced die casting techniques.

Obstacles in the Canada Automotive Parts Zinc Die Casting Market Market

Despite promising growth prospects, several challenges hinder market expansion. Fluctuations in raw material prices, particularly zinc, can impact profitability. Supply chain disruptions, including logistical challenges and material shortages, can impede production and delivery. Intense competition from established and emerging players creates pressure on pricing and margins. Regulatory compliance and environmental concerns also pose significant challenges for market participants.

Future Opportunities in Canada Automotive Parts Zinc Die Casting Market

Emerging opportunities within the Canadian automotive parts zinc die casting market are predominantly centered around the rapidly expanding electric vehicle (EV) sector, which presents a significant demand for lightweight, high-performance, and complex components. Breakthroughs in die casting technologies, including advancements in additive manufacturing integration (3D printing for tooling), automation, and intelligent process control systems, present substantial avenues for innovation and differentiation. Exploring expansion into new and complementary markets and applications, such as the aerospace industry for lightweight structural components and the medical device sector for precision parts, offers considerable untapped potential. Furthermore, a strategic focus on developing and implementing sustainable and eco-friendly die casting processes, minimizing waste and energy consumption, aligns with escalating environmental concerns and could unlock new, highly sought-after market segments.

Major Players in the Canada Automotive Parts Zinc Die Casting Market Ecosystem

- Ashok Minda Group

- Sandhar Technologies Ltd

- Empire Casting Co

- Pace Industries

- Carteret Die Casting Corp

- Ridco Zinc Die Casting Company

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc

- Northwest Die Casting Company

- Dynacast

Key Developments in Canada Automotive Parts Zinc Die Casting Market Industry

- October 2022: Dynacast, a prominent player, announced a significant strategic investment in new state-of-the-art die casting equipment and facility upgrades to substantially enhance its production capacity and technological capabilities.

- March 2023: Ashok Minda Group executed a strategic acquisition of a smaller, specialized die casting company, aiming to broaden its product portfolio and strengthen its market position within key automotive component segments.

- June 2024: The implementation of new, more stringent Canadian regulations on automotive emissions and fuel economy standards came into effect, directly stimulating increased demand for lightweight, optimized automotive components manufactured using advanced die casting techniques.

Strategic Canada Automotive Parts Zinc Die Casting Market Market Forecast

The Canadian automotive parts zinc die casting market is poised for robust growth over the forecast period (2025-2033). Technological innovations, rising demand for lightweight vehicles, and supportive government policies will be key drivers. The market's expansion will be particularly influenced by the escalating demand for EV components, driving further investment in advanced die casting technologies and capacity expansion. This creates significant opportunities for existing and new market entrants to capitalize on the expanding market.

Canada Automotive Parts Zinc Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Others

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Others

Canada Automotive Parts Zinc Die Casting Market Segmentation By Geography

- 1. Canada

Canada Automotive Parts Zinc Die Casting Market Regional Market Share

Geographic Coverage of Canada Automotive Parts Zinc Die Casting Market

Canada Automotive Parts Zinc Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing EV Sales is Driving the Market Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Proper Charging Infrastructure is a Chgallenge

- 3.4. Market Trends

- 3.4.1. Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Parts Zinc Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ashok Minda Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sandhar Technologies Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Empire Casting Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Pace Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Carteret Die Casting Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ridco Zinc Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Brillcast Manufacturing LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cascade Die Casting Group Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Northwest Die Casting Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ashok Minda Group

List of Figures

- Figure 1: Canada Automotive Parts Zinc Die Casting Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Parts Zinc Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 2: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Production Process Type 2020 & 2033

- Table 5: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Canada Automotive Parts Zinc Die Casting Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Parts Zinc Die Casting Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the Canada Automotive Parts Zinc Die Casting Market?

Key companies in the market include Ashok Minda Group, Sandhar Technologies Ltd, Empire Casting Co, Pace Industries, Carteret Die Casting Corp, Ridco Zinc Die Casting Company, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Northwest Die Casting Company, Dynacast.

3. What are the main segments of the Canada Automotive Parts Zinc Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing EV Sales is Driving the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Vacuum Die Casting and Enactment of Stringent Emission Regulations.

7. Are there any restraints impacting market growth?

Lack of Proper Charging Infrastructure is a Chgallenge.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Parts Zinc Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Parts Zinc Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Parts Zinc Die Casting Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Parts Zinc Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence