Key Insights

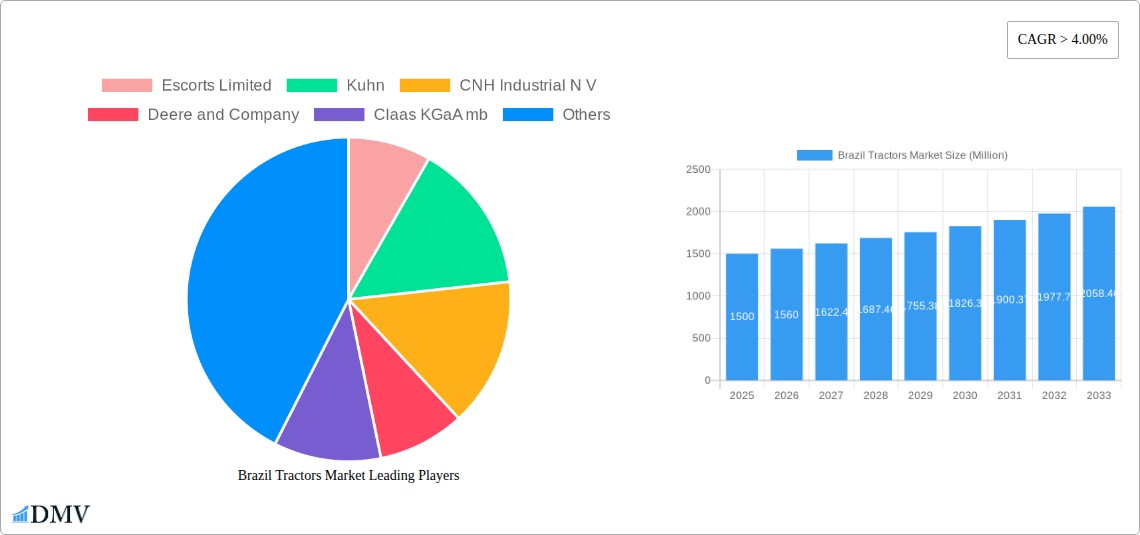

The Brazil tractor market presents a significant investment opportunity, projected to reach $3.6 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 5.02% through 2033. This robust growth is underpinned by increasing agricultural productivity, government initiatives encouraging farm modernization, and the escalating demand for efficient, high-performance tractors across diverse applications such as row crop and orchard farming. The market is segmented by horsepower (under 40 HP, 40-100 HP, over 100 HP), drive type (2WD, 4WD/AWD), and application (row crop, orchard, others). The integration of advanced technologies like precision farming and automation is further boosting market expansion, although fluctuating fuel prices and economic instability pose potential challenges. Key market participants include Escorts Limited, Kuhn, CNH Industrial N.V., Deere & Company, Claas KGaA mbH, AGCO Corporation, Kubota Agricultural Machinery Pvt Ltd, Mahindra & Mahindra Ltd, and Tractors and Farm Equipment Limited (TAFE), all actively innovating to meet the evolving demands of Brazilian farmers.

Brazil Tractors Market Market Size (In Billion)

The expansion of Brazil's agricultural sector, particularly in high-yield crops like soybeans and sugarcane, is a primary driver for tractor demand. Government support for agricultural development and farmer financing programs are fostering an environment conducive to tractor adoption. The preference for higher horsepower tractors is anticipated to persist, driven by the need for enhanced productivity on larger agricultural holdings. The four-wheel drive/all-wheel drive segment is expected to experience strong growth, owing to its superior traction and performance across varied terrains. While economic volatility and credit accessibility may present temporary headwinds, the long-term market outlook remains positive, propelled by ongoing investments in agricultural infrastructure and the continuous modernization of farming practices in Brazil.

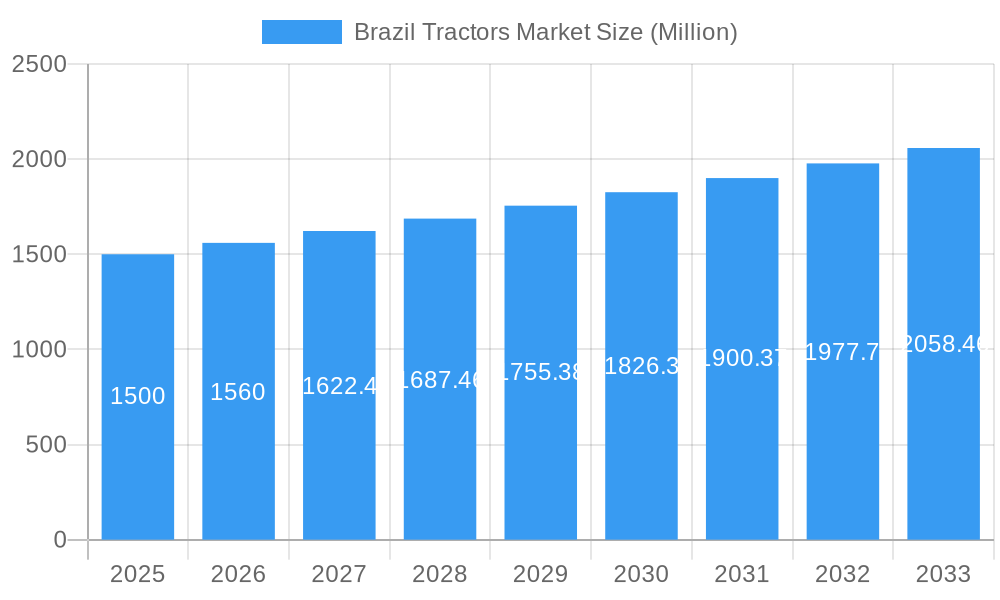

Brazil Tractors Market Company Market Share

Brazil Tractors Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Brazil tractors market, encompassing historical data (2019-2024), the current market (2025), and a comprehensive forecast (2025-2033). It delves into market segmentation, competitive dynamics, technological advancements, and key growth drivers, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. The market size is projected to reach xx Million by 2033, presenting significant opportunities for investment and expansion.

Brazil Tractors Market Composition & Trends

The Brazilian tractors market exhibits a moderately concentrated landscape, with key players like Mahindra & Mahindra Ltd, Deere and Company, and CNH Industrial N V holding significant market share. Market share distribution fluctuates based on product innovation, government policies, and economic conditions. Innovation in areas like precision farming technology and automation is a major catalyst, driving demand for higher-horsepower tractors and advanced features. The regulatory landscape, including environmental regulations and safety standards, significantly influences market dynamics. Substitute products, such as smaller farming equipment and manual labor, represent competitive pressures. The primary end-users are large-scale commercial farms and smaller family-owned operations, each with distinct needs and purchasing power. M&A activity has been moderate in recent years, with deal values ranging from xx Million to xx Million, primarily focusing on enhancing technological capabilities and market reach.

- Market Concentration: Moderately concentrated, with top players holding approximately xx% of market share in 2025.

- Innovation Catalysts: Precision farming, automation, and emission reduction technologies.

- Regulatory Landscape: Stringent environmental and safety standards influencing product development.

- Substitute Products: Smaller farming equipment and manual labor.

- End-User Profiles: Large commercial farms and smaller family farms.

- M&A Activity: Moderate activity, with deal values averaging xx Million.

Brazil Tractors Market Industry Evolution

The Brazilian tractors market has experienced fluctuating growth over the historical period (2019-2024), influenced by factors like agricultural commodity prices, weather patterns, and government policies. However, the market is poised for robust growth during the forecast period (2025-2033), driven by increasing agricultural production, modernization of farming practices, and government initiatives to support mechanization. Technological advancements, such as GPS-guided systems, telematics, and automated steering, are increasingly adopted, enhancing productivity and efficiency. Consumer demand is shifting towards higher-horsepower tractors with advanced features, reflecting the industry’s trend toward precision agriculture and optimized operations. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. The adoption rate of advanced technologies varies across segments, with larger farms leading the way in adopting automation and precision farming solutions.

Leading Regions, Countries, or Segments in Brazil Tractors Market

The Brazilian tractors market is geographically diverse, with strong performance in key agricultural regions such as the Cerrado and the Pantanal. The 40 HP - 100 HP horsepower segment dominates the market due to its versatility and suitability for a wide range of farming operations. Four-Wheel Drive/All-Wheel Drive tractors are preferred for their superior traction and performance in challenging terrains. Row crop tractors also represent a significant portion of the market share, reflecting the prevalence of row-crop farming in Brazil.

- Key Drivers (40 HP - 100 HP Segment): High demand from medium-sized farms, cost-effectiveness, suitability for various crops.

- Key Drivers (Four-Wheel Drive/All-Wheel Drive): Superior traction and stability, particularly beneficial in challenging terrains.

- Key Drivers (Row Crop Tractors): Prevalence of row-crop farming in Brazil.

- Dominance Factors: Suitability for diverse farming operations, cost-effectiveness, government support for agricultural modernization.

Brazil Tractors Market Product Innovations

Recent innovations focus on enhancing efficiency, reducing environmental impact, and improving operator comfort and safety. Features like precision farming technologies (GPS-guided systems, automated steering), advanced powertrain systems, and improved operator cabins are becoming increasingly common. Unique selling propositions include increased fuel efficiency, reduced emissions, and enhanced operator ergonomics. Technological advancements are driven by the need for sustainable and efficient agricultural practices.

Propelling Factors for Brazil Tractors Market Growth

Several factors are driving growth in the Brazilian tractors market. Technological advancements in automation and precision farming are boosting productivity and efficiency. Government initiatives promoting agricultural modernization and providing financial incentives for farmers contribute positively to the market's expansion. Favorable economic conditions and increasing agricultural output are further fueling demand for tractors. Expansion of large-scale farming operations are also increasing demand for higher-horsepower tractors.

Obstacles in the Brazil Tractors Market

Challenges include fluctuating agricultural commodity prices impacting farmer investment decisions. Supply chain disruptions, especially for imported components, can impact availability and costs. Intense competition from both domestic and international players creates price pressure. Furthermore, high financing costs can deter some farmers from investing in new equipment.

Future Opportunities in Brazil Tractors Market

Opportunities lie in the growing adoption of precision farming technologies and the increasing demand for sustainable agricultural practices. The expansion of agricultural land and the government’s continued focus on modernizing the sector present significant growth prospects. The development of specialized tractors for specific crops and farming techniques can unlock new market segments.

Major Players in the Brazil Tractors Market Ecosystem

- Escorts Limited

- Kuhn

- CNH Industrial N V

- Deere and Company

- Claas KGaA mbH

- AGCO Corporation

- Kubota Agricultural Machinery Pvt Ltd

- Mahindra & Mahindra Ltd

- Tractors and Farm Equipment Limited (TAFE)

Key Developments in Brazil Tractors Market Industry

- August 2023: Mahindra and Mahindra unveiled four groundbreaking OJA Tractor Platforms, expanding its four-wheel drive tractor offerings in Brazil and globally. This signifies a major investment in the Brazilian market and commitment to technological advancement.

- August 2023: New Holland Agriculture (CNH Industrial) launched the TL5 'Acessível' tractor, a pioneering inclusive design promoting accessibility and empowering farmers with disabilities. This demonstrates a focus on social responsibility and inclusivity within the industry.

Strategic Brazil Tractors Market Forecast

The Brazilian tractors market is projected to experience substantial growth, driven by continued investment in agricultural modernization, technological innovation, and supportive government policies. Opportunities exist in precision farming, sustainable agriculture, and specialized tractor segments. The market’s potential remains high, promising strong returns for stakeholders willing to navigate the market's dynamics.

Brazil Tractors Market Segmentation

-

1. Horsepower

- 1.1. Below 40 HP

- 1.2. 40 HP - 100 HP

- 1.3. Above 100 H

-

2. Drive Type

- 2.1. Two-Wheel Drive

- 2.2. Four-Wheel Drive/All-Wheel Drive

-

3. Application

- 3.1. Row Crop Tractors

- 3.2. Orchard Tractors

- 3.3. Other Applications

Brazil Tractors Market Segmentation By Geography

- 1. Brazil

Brazil Tractors Market Regional Market Share

Geographic Coverage of Brazil Tractors Market

Brazil Tractors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption Rate Of Mechanization

- 3.3. Market Restrains

- 3.3.1. High Cost Of Tractors May Affect the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Need for Agricultural mechanization

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Tractors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Horsepower

- 5.1.1. Below 40 HP

- 5.1.2. 40 HP - 100 HP

- 5.1.3. Above 100 H

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Two-Wheel Drive

- 5.2.2. Four-Wheel Drive/All-Wheel Drive

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Row Crop Tractors

- 5.3.2. Orchard Tractors

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Horsepower

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Escorts Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kuhn

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CNH Industrial N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere and Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Claas KGaA mb

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGCO Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kubota Agricultural Machinery Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mahindra & Mahindra Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tractors and Farm Equipment Limited (TAFE)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Escorts Limited

List of Figures

- Figure 1: Brazil Tractors Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Brazil Tractors Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Tractors Market Revenue billion Forecast, by Horsepower 2020 & 2033

- Table 2: Brazil Tractors Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Brazil Tractors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Brazil Tractors Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Brazil Tractors Market Revenue billion Forecast, by Horsepower 2020 & 2033

- Table 6: Brazil Tractors Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 7: Brazil Tractors Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Brazil Tractors Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Tractors Market?

The projected CAGR is approximately 5.02%.

2. Which companies are prominent players in the Brazil Tractors Market?

Key companies in the market include Escorts Limited, Kuhn, CNH Industrial N V, Deere and Company, Claas KGaA mb, AGCO Corporation, Kubota Agricultural Machinery Pvt Ltd, Mahindra & Mahindra Ltd, Tractors and Farm Equipment Limited (TAFE).

3. What are the main segments of the Brazil Tractors Market?

The market segments include Horsepower, Drive Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption Rate Of Mechanization.

6. What are the notable trends driving market growth?

Increasing Need for Agricultural mechanization.

7. Are there any restraints impacting market growth?

High Cost Of Tractors May Affect the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Mahindra and Mahindra unveiled four groundbreaking OJA Tractor Platforms. These platforms represent the company's commitment to developing four-wheel drive tractors not only in Brazil but also in various other nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Tractors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Tractors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Tractors Market?

To stay informed about further developments, trends, and reports in the Brazil Tractors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence