Key Insights

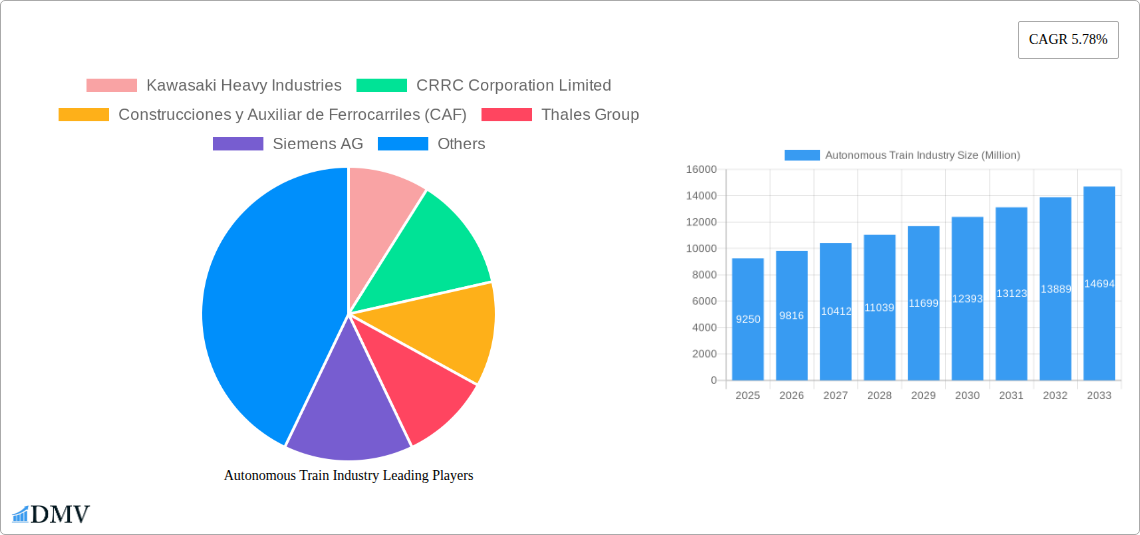

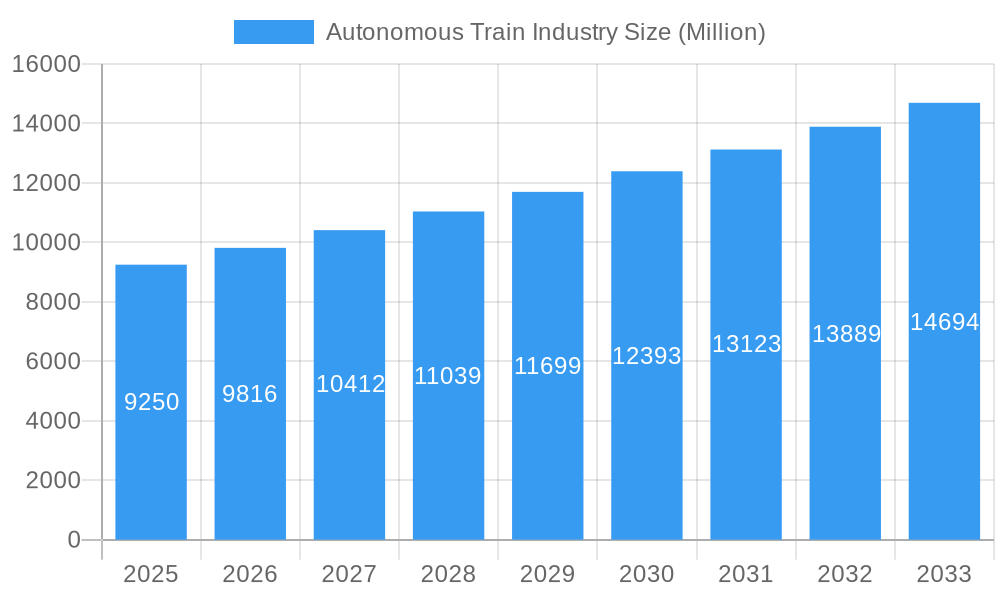

The autonomous train industry is experiencing robust growth, driven by increasing demand for efficient, safe, and sustainable transportation solutions globally. The market, valued at $9.25 billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 5.78% from 2025 to 2033. This growth is fueled by several key factors. Firstly, advancements in technologies like Communication-Based Train Control (CBTC), European Rail Traffic Management System (ERTMS), Automatic Train Control (ATC), and Positive Train Control (PTC) are enabling higher levels of automation and operational efficiency. Secondly, the rising need to improve passenger and freight transportation capacity in urban and intercity areas is pushing governments and private entities to invest heavily in autonomous train systems. Finally, the focus on reducing carbon emissions and promoting environmentally friendly transportation is accelerating the adoption of electric and hybrid autonomous trains. Market segmentation reveals a strong presence across various applications (passenger and freight), train types (metro/monorail, light rail, and high-speed rail), and automation grades (ranging from GoA 1 to GoA 4). Leading players like Kawasaki Heavy Industries, CRRC Corporation Limited, and Siemens AG are actively shaping the market landscape through innovation and strategic partnerships.

Autonomous Train Industry Market Size (In Billion)

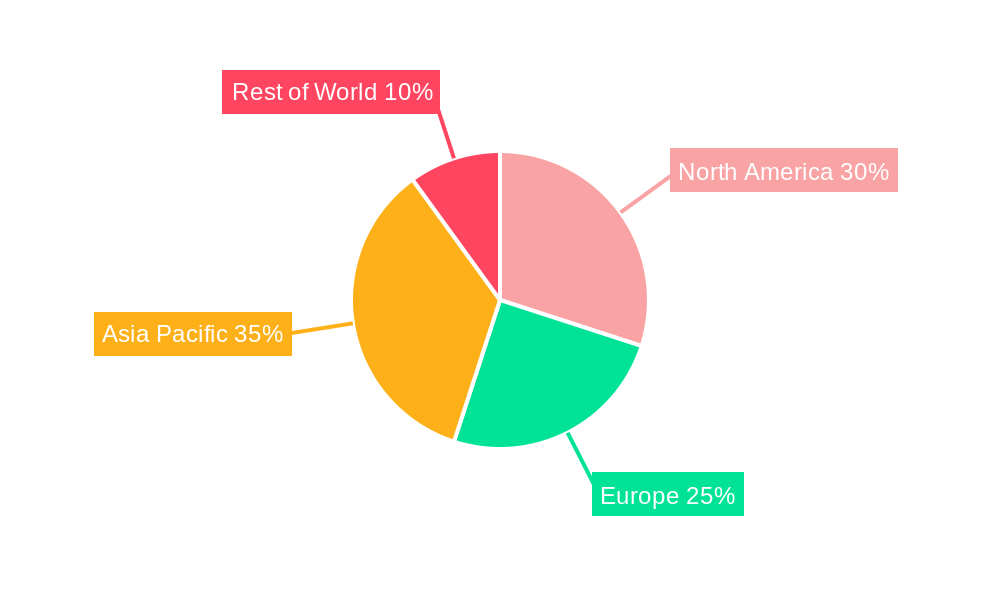

The geographical distribution of the market shows significant growth potential across different regions. While North America and Europe currently hold substantial market shares due to established infrastructure and early adoption of autonomous technologies, the Asia-Pacific region is expected to witness the fastest growth in the coming years, driven by rapid urbanization and infrastructure development. The competitive landscape is characterized by a mix of established players and emerging technology providers, leading to intense innovation and a continuous improvement in the efficiency, safety, and cost-effectiveness of autonomous train systems. This competitive dynamic ensures that the industry remains focused on delivering advanced, reliable, and sustainable transportation solutions to meet the evolving needs of passengers and freight operators worldwide.

Autonomous Train Industry Company Market Share

Autonomous Train Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Autonomous Train Industry, projecting a market valued at $XX Million by 2033. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. This in-depth analysis will equip stakeholders with crucial insights into market trends, technological advancements, and key players shaping the future of autonomous rail transportation.

Autonomous Train Industry Market Composition & Trends

This section evaluates the market's competitive landscape, technological drivers, regulatory frameworks, and key market dynamics. The global autonomous train market is experiencing significant growth, driven by increasing urbanization, rising passenger numbers, and the need for efficient and safe transportation solutions. The market is moderately concentrated, with several major players holding substantial market share.

Market Concentration & M&A Activity:

- Market share distribution: CRRC Corporation Limited and Siemens AG hold the largest shares, each exceeding 15% (estimated). Other significant players including Alstom SA, Kawasaki Heavy Industries, and Hitachi Rail STS, collectively account for approximately 40% of the market.

- M&A deal values: The total value of M&A deals in the sector from 2019-2024 exceeded $XX Million, reflecting strong industry consolidation. These activities are projected to continue in the forecast period, primarily driven by expansion into new technologies and geographies.

Innovation Catalysts & Regulatory Landscape:

- Continuous advancements in AI, sensor technology, and communication systems are fueling innovation. The development of advanced control systems, such as CBTC and ETCS, is enhancing safety and efficiency.

- Governments worldwide are increasingly investing in and regulating the adoption of autonomous rail systems, pushing technological progress and market expansion. The regulatory landscape is however fragmented across countries.

Substitute Products and End-User Profiles:

- Substitute modes of transport, such as road and air travel, pose a degree of competition, particularly for long-distance journeys. However, the advantages of autonomous trains in terms of efficiency and sustainability are gradually winning over passengers and freight operators.

- End-users comprise passenger transportation agencies, freight companies, and government entities. Growth is expected in both passenger and freight application segments.

Autonomous Train Industry Industry Evolution

The autonomous train industry has witnessed remarkable growth from 2019 to 2024, driven by increasing demand for efficient and safe transportation solutions. The market is poised for continued expansion, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Technological advancements, notably in the areas of AI, sensor technology and communication systems such as CBTC, ERTMS, ATC, and PTC, are significantly contributing to this expansion. The adoption of driverless systems has already reached significant levels in certain regions, particularly in metro and light rail systems, signaling a clear consumer preference for modern, efficient, and reliable public transport.

Market growth is largely propelled by increasing urbanization and the resultant need for increased transport capacity alongside labor costs related to drivers. Demand for advanced safety and operational efficiencies are key drivers. Adoption metrics indicate a rapid shift towards higher levels of automation (GoA 4 currently leads, with GoA 5 expected to grow substantially in the forecast period). The shift in consumer preferences towards faster, safer, and more comfortable travel experiences further fuels this growth. Specific numbers concerning adoption metrics and growth rates are detailed in Appendix XX of the full report.

Leading Regions, Countries, or Segments in Autonomous Train Industry

This section highlights the leading segments and regions within the autonomous train market. Several factors contribute to the dominance of certain regions and market segments, primarily related to technology adoption, investments, and regulatory support.

By Automation Grade (GoA): GoA 4 currently dominates the market, representing the majority of currently deployed systems. However, GoA 5 is experiencing rapid growth and is anticipated to hold a significant market share by 2033.

By Application: The passenger segment currently holds the largest market share, predominantly driven by urban metro and light rail systems. However, the freight segment is predicted to witness substantial growth due to ongoing automation initiatives in rail freight transportation.

By Technology: CBTC is currently the most widely adopted technology, driven by its success in urban metro applications. ERTMS is gaining traction in high-speed rail systems and long-distance networks.

By Train Type: Metro/Monorail systems represent the largest segment, owing to the significant implementation of autonomous systems in urban areas. High-speed rail is experiencing a surge in autonomous technology adoption due to the safety and efficiency benefits it offers.

Key Drivers:

- Significant government investments: Many countries are heavily investing in upgrading their rail infrastructure and adopting autonomous technology, particularly in densely populated regions.

- Favorable regulatory environments: Supportive regulatory frameworks are accelerating the deployment of autonomous train systems.

- Technological advancements: The advancements in areas such as AI, sensor technology, and communication systems are improving system capabilities and driving efficiency gains.

Autonomous Train Industry Product Innovations

Recent innovations include the development of advanced sensor systems, improved AI-based control algorithms, and enhanced communication networks for improved reliability and safety. New remote track monitoring services improve operational efficiency and prevent disruptions. This has led to the introduction of highly reliable and efficient autonomous train systems, equipped with features that enhance safety, reduce operational costs, and improve passenger experience. The unique selling propositions center on improved safety, increased operational efficiency, reduced maintenance costs, and enhanced passenger comfort.

Propelling Factors for Autonomous Train Industry Growth

The growth of the autonomous train industry is fueled by several key factors:

- Technological advancements: The development of sophisticated AI, sensor technology, and communication systems is enabling higher levels of automation and improved safety.

- Economic benefits: Autonomous trains offer significant cost savings through reduced labor costs and increased operational efficiency.

- Regulatory support: Governments worldwide are increasingly supportive of autonomous train technology, promoting its development and implementation through policies and funding initiatives. For example, the investment in ETCS deployment in Germany.

Obstacles in the Autonomous Train Industry Market

Several challenges hinder the widespread adoption of autonomous trains:

- Regulatory hurdles: The lack of standardized regulations and the complexities of approval processes in various countries slow down adoption.

- High initial investment costs: Implementing autonomous train systems requires substantial upfront investment, potentially limiting adoption for smaller operators.

- Cybersecurity risks: Autonomous trains are vulnerable to cyberattacks, requiring robust cybersecurity measures to ensure system integrity and safety.

Future Opportunities in Autonomous Train Industry

Future opportunities lie in:

- Expanding into new markets: The adoption of autonomous technology is projected to extend to regions that haven't adopted it yet, opening new market opportunities.

- Developing innovative applications: Autonomous trains can be further developed for specialized applications, such as freight transportation and maintenance.

- Improving system integration: Seamless integration with existing transportation networks and smart city infrastructure will unlock more efficiencies and adoption.

Major Players in the Autonomous Train Industry Ecosystem

- Kawasaki Heavy Industries

- CRRC Corporation Limited

- Construcciones y Auxiliar de Ferrocarriles (CAF)

- Thales Group

- Siemens AG

- Alstom SA

- Hitachi Rail STS (Ansaldo STS)

- Ingeteam Corporation S.A.

- Wabtec Corporation

- Mitsubishi Heavy Industries Ltd

Key Developments in Autonomous Train Industry Industry

- May 2021: Kawasaki Heavy Industries launched new remote track monitoring services in North America.

- July 2021: Ningbo Rail Transit Group and CRRC developed the first smart metro train for Ningbo metro line 5.

- August 2021: Siemens Mobility secured a contract for CBTC technology for the Malaysia-Singapore cross-border rail link.

- September 2021: Mitsubishi Heavy Industries Engineering partnered with Dubai Metro to operate a fully automated driverless rail system.

- June 2022: The German Aerospace Centre (DLR), TU Berlin, and Alstom initiated a project to digitize rail passenger transport in Germany using ETCS.

Strategic Autonomous Train Industry Market Forecast

The autonomous train industry is poised for substantial growth driven by technological advancements, increasing urbanization, and growing demand for efficient and safe transportation solutions. The market is expected to witness a sustained rise in adoption across various segments and regions, leading to significant revenue generation and expansion of the global autonomous train market. The shift towards higher levels of automation (GoA 4 and GoA 5) will be a key driver of future growth and further investment into the field. The market will continue to consolidate with ongoing mergers and acquisitions and will likely see innovation in the areas of both passenger and freight transport.

Autonomous Train Industry Segmentation

-

1. Automation Grade

- 1.1. GoA 1

- 1.2. GoA 2

- 1.3. GoA 3

- 1.4. GoA 4

-

2. Application

- 2.1. Passenger

- 2.2. Freight

-

3. Technology

- 3.1. CBTC

- 3.2. ERTMS

- 3.3. ATC

- 3.4. PTC

-

4. Train Type

- 4.1. Metro/Monorail

- 4.2. Light Rail

- 4.3. High-speed Rail

Autonomous Train Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Autonomous Train Industry Regional Market Share

Geographic Coverage of Autonomous Train Industry

Autonomous Train Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Focus On Safety

- 3.3. Market Restrains

- 3.3.1. High Initial Investment

- 3.4. Market Trends

- 3.4.1. Metro/Monorail Dominating the Global Autonomous Train Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Automation Grade

- 5.1.1. GoA 1

- 5.1.2. GoA 2

- 5.1.3. GoA 3

- 5.1.4. GoA 4

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Passenger

- 5.2.2. Freight

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. CBTC

- 5.3.2. ERTMS

- 5.3.3. ATC

- 5.3.4. PTC

- 5.4. Market Analysis, Insights and Forecast - by Train Type

- 5.4.1. Metro/Monorail

- 5.4.2. Light Rail

- 5.4.3. High-speed Rail

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Automation Grade

- 6. North America Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Automation Grade

- 6.1.1. GoA 1

- 6.1.2. GoA 2

- 6.1.3. GoA 3

- 6.1.4. GoA 4

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Passenger

- 6.2.2. Freight

- 6.3. Market Analysis, Insights and Forecast - by Technology

- 6.3.1. CBTC

- 6.3.2. ERTMS

- 6.3.3. ATC

- 6.3.4. PTC

- 6.4. Market Analysis, Insights and Forecast - by Train Type

- 6.4.1. Metro/Monorail

- 6.4.2. Light Rail

- 6.4.3. High-speed Rail

- 6.1. Market Analysis, Insights and Forecast - by Automation Grade

- 7. Europe Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Automation Grade

- 7.1.1. GoA 1

- 7.1.2. GoA 2

- 7.1.3. GoA 3

- 7.1.4. GoA 4

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Passenger

- 7.2.2. Freight

- 7.3. Market Analysis, Insights and Forecast - by Technology

- 7.3.1. CBTC

- 7.3.2. ERTMS

- 7.3.3. ATC

- 7.3.4. PTC

- 7.4. Market Analysis, Insights and Forecast - by Train Type

- 7.4.1. Metro/Monorail

- 7.4.2. Light Rail

- 7.4.3. High-speed Rail

- 7.1. Market Analysis, Insights and Forecast - by Automation Grade

- 8. Asia Pacific Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Automation Grade

- 8.1.1. GoA 1

- 8.1.2. GoA 2

- 8.1.3. GoA 3

- 8.1.4. GoA 4

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Passenger

- 8.2.2. Freight

- 8.3. Market Analysis, Insights and Forecast - by Technology

- 8.3.1. CBTC

- 8.3.2. ERTMS

- 8.3.3. ATC

- 8.3.4. PTC

- 8.4. Market Analysis, Insights and Forecast - by Train Type

- 8.4.1. Metro/Monorail

- 8.4.2. Light Rail

- 8.4.3. High-speed Rail

- 8.1. Market Analysis, Insights and Forecast - by Automation Grade

- 9. Rest of the World Autonomous Train Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Automation Grade

- 9.1.1. GoA 1

- 9.1.2. GoA 2

- 9.1.3. GoA 3

- 9.1.4. GoA 4

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Passenger

- 9.2.2. Freight

- 9.3. Market Analysis, Insights and Forecast - by Technology

- 9.3.1. CBTC

- 9.3.2. ERTMS

- 9.3.3. ATC

- 9.3.4. PTC

- 9.4. Market Analysis, Insights and Forecast - by Train Type

- 9.4.1. Metro/Monorail

- 9.4.2. Light Rail

- 9.4.3. High-speed Rail

- 9.1. Market Analysis, Insights and Forecast - by Automation Grade

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kawasaki Heavy Industries

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 CRRC Corporation Limited

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Construcciones y Auxiliar de Ferrocarriles (CAF)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Thales Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Siemens AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Alstom SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Hitachi Rail STS (Ansaldo STS)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ingeteam Corporation S

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wabtec Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mitsubishi Heavy Industries Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Kawasaki Heavy Industries

List of Figures

- Figure 1: Global Autonomous Train Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Train Industry Revenue (Million), by Automation Grade 2025 & 2033

- Figure 3: North America Autonomous Train Industry Revenue Share (%), by Automation Grade 2025 & 2033

- Figure 4: North America Autonomous Train Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Autonomous Train Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Autonomous Train Industry Revenue (Million), by Technology 2025 & 2033

- Figure 7: North America Autonomous Train Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 8: North America Autonomous Train Industry Revenue (Million), by Train Type 2025 & 2033

- Figure 9: North America Autonomous Train Industry Revenue Share (%), by Train Type 2025 & 2033

- Figure 10: North America Autonomous Train Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Autonomous Train Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Autonomous Train Industry Revenue (Million), by Automation Grade 2025 & 2033

- Figure 13: Europe Autonomous Train Industry Revenue Share (%), by Automation Grade 2025 & 2033

- Figure 14: Europe Autonomous Train Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Autonomous Train Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Autonomous Train Industry Revenue (Million), by Technology 2025 & 2033

- Figure 17: Europe Autonomous Train Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 18: Europe Autonomous Train Industry Revenue (Million), by Train Type 2025 & 2033

- Figure 19: Europe Autonomous Train Industry Revenue Share (%), by Train Type 2025 & 2033

- Figure 20: Europe Autonomous Train Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Autonomous Train Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Autonomous Train Industry Revenue (Million), by Automation Grade 2025 & 2033

- Figure 23: Asia Pacific Autonomous Train Industry Revenue Share (%), by Automation Grade 2025 & 2033

- Figure 24: Asia Pacific Autonomous Train Industry Revenue (Million), by Application 2025 & 2033

- Figure 25: Asia Pacific Autonomous Train Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Asia Pacific Autonomous Train Industry Revenue (Million), by Technology 2025 & 2033

- Figure 27: Asia Pacific Autonomous Train Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Asia Pacific Autonomous Train Industry Revenue (Million), by Train Type 2025 & 2033

- Figure 29: Asia Pacific Autonomous Train Industry Revenue Share (%), by Train Type 2025 & 2033

- Figure 30: Asia Pacific Autonomous Train Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Autonomous Train Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Autonomous Train Industry Revenue (Million), by Automation Grade 2025 & 2033

- Figure 33: Rest of the World Autonomous Train Industry Revenue Share (%), by Automation Grade 2025 & 2033

- Figure 34: Rest of the World Autonomous Train Industry Revenue (Million), by Application 2025 & 2033

- Figure 35: Rest of the World Autonomous Train Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Rest of the World Autonomous Train Industry Revenue (Million), by Technology 2025 & 2033

- Figure 37: Rest of the World Autonomous Train Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Rest of the World Autonomous Train Industry Revenue (Million), by Train Type 2025 & 2033

- Figure 39: Rest of the World Autonomous Train Industry Revenue Share (%), by Train Type 2025 & 2033

- Figure 40: Rest of the World Autonomous Train Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Rest of the World Autonomous Train Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 2: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 5: Global Autonomous Train Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 7: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 9: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 10: Global Autonomous Train Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 12: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 15: Global Autonomous Train Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 17: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 19: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 20: Global Autonomous Train Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Autonomous Train Industry Revenue Million Forecast, by Automation Grade 2020 & 2033

- Table 22: Global Autonomous Train Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Autonomous Train Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 24: Global Autonomous Train Industry Revenue Million Forecast, by Train Type 2020 & 2033

- Table 25: Global Autonomous Train Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Train Industry?

The projected CAGR is approximately 5.78%.

2. Which companies are prominent players in the Autonomous Train Industry?

Key companies in the market include Kawasaki Heavy Industries, CRRC Corporation Limited, Construcciones y Auxiliar de Ferrocarriles (CAF), Thales Group, Siemens AG, Alstom SA, Hitachi Rail STS (Ansaldo STS), Ingeteam Corporation S, Wabtec Corporation, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Autonomous Train Industry?

The market segments include Automation Grade, Application, Technology, Train Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Focus On Safety.

6. What are the notable trends driving market growth?

Metro/Monorail Dominating the Global Autonomous Train Market.

7. Are there any restraints impacting market growth?

High Initial Investment.

8. Can you provide examples of recent developments in the market?

June 2022: The German Aerospace Centre (DLR) and the TU Berlin, Alstom, is developing technical solutions to gradually digitize rail passenger transport in Germany. The project will explore the possibilities of automation in regional transport via the European Train Control System (ETCS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Train Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Train Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Train Industry?

To stay informed about further developments, trends, and reports in the Autonomous Train Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence