Key Insights

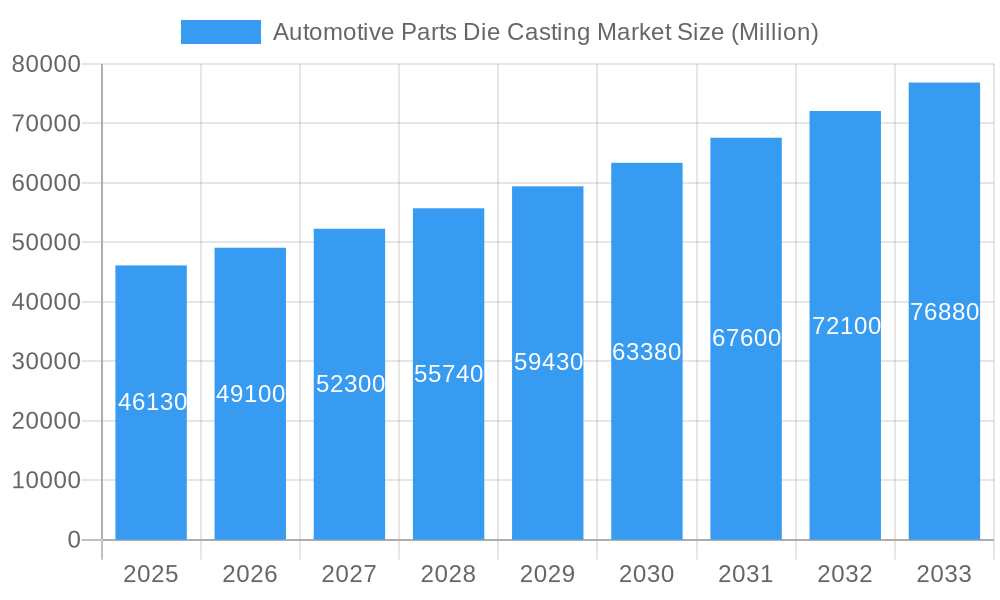

The automotive parts die casting market, valued at $46.13 billion in 2025, is projected to experience robust growth, driven by the increasing demand for lightweight vehicles and the rising adoption of electric vehicles (EVs). The market's Compound Annual Growth Rate (CAGR) exceeding 6.19% from 2025 to 2033 signifies a significant expansion opportunity. Key drivers include the automotive industry's focus on fuel efficiency, improved performance, and reduced emissions. The trend toward higher-precision casting techniques, such as vacuum die casting and semi-solid die casting, is further fueling market growth. These advanced techniques allow for the production of complex parts with tighter tolerances, enhancing vehicle performance and durability. While the rising cost of raw materials like aluminum and zinc presents a challenge, the industry is mitigating this through process optimization and material substitution strategies. Segmentation analysis reveals that aluminum remains the dominant raw material, followed by zinc and magnesium, reflecting their suitability for diverse automotive applications. Body assemblies and engine parts constitute the largest application segments, underscoring the critical role of die casting in vehicle manufacturing. The competitive landscape is characterized by a mix of established global players and regional manufacturers, indicating diverse opportunities for market entry and expansion.

Automotive Parts Die Casting Market Market Size (In Billion)

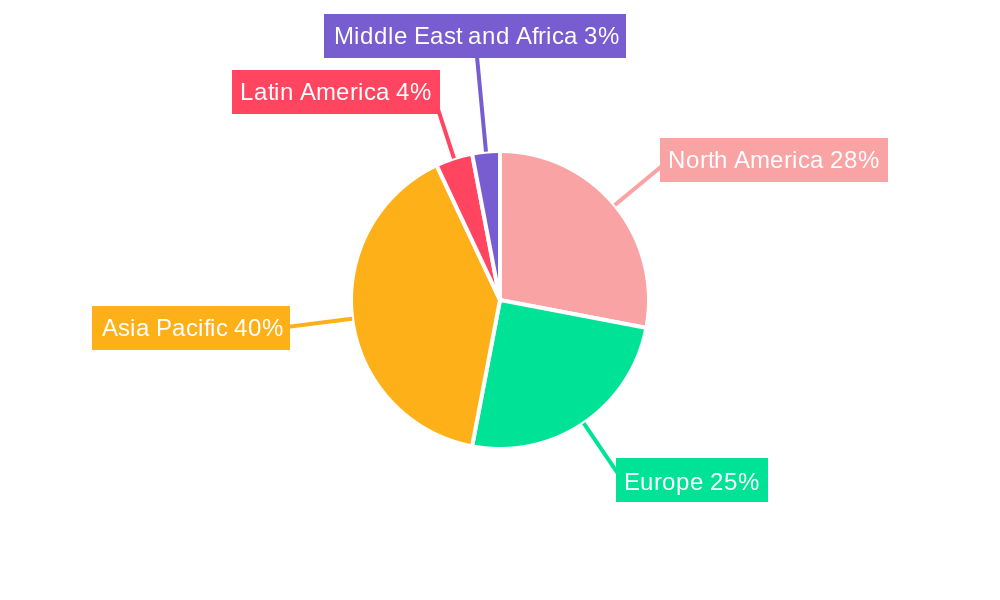

The geographical distribution of the market reflects strong growth in Asia-Pacific, driven by increasing automotive production in countries like China and India. North America and Europe also maintain significant market shares, fueled by the presence of major automotive manufacturers and a strong emphasis on technological advancements in the automotive sector. The market's future growth trajectory hinges on continued innovation in die casting technologies, the adoption of sustainable manufacturing practices, and the ongoing expansion of the global automotive industry, particularly in developing economies. Furthermore, the increasing demand for higher-quality, more intricate parts will likely drive the adoption of more sophisticated die-casting techniques and the development of new materials. Therefore, companies focusing on innovation, efficiency, and sustainability are best positioned to capture significant market share in the coming years.

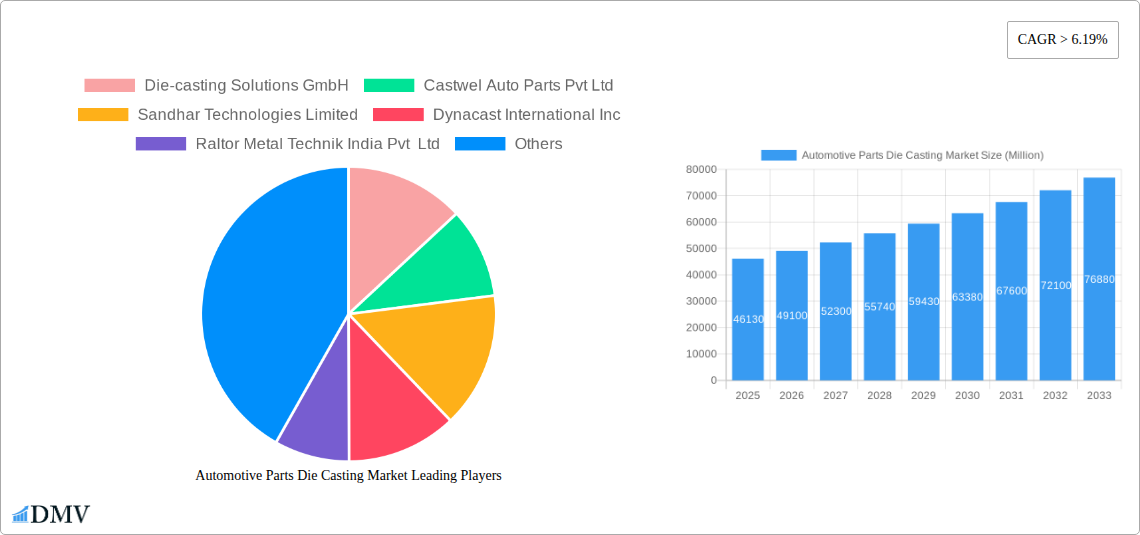

Automotive Parts Die Casting Market Company Market Share

Automotive Parts Die Casting Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Automotive Parts Die Casting Market, offering invaluable perspectives for stakeholders seeking to navigate this dynamic sector. The study period covers 2019-2033, with 2025 as the base and estimated year. The market's size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This report meticulously examines market segmentation, key players, technological advancements, and future opportunities, providing a 360-degree view for informed decision-making.

Automotive Parts Die Casting Market Composition & Trends

The Automotive Parts Die Casting Market is characterized by a moderately consolidated landscape, with key players like Die-casting Solutions GmbH, Castwel Auto Parts Pvt Ltd, and Sandhar Technologies Limited holding significant market share. However, the market also features a diverse range of smaller players, contributing to a competitive environment. Innovation is a crucial driver, with continuous advancements in die-casting technologies (e.g., high-pressure die casting, semi-solid die casting) enhancing efficiency and product quality. Stringent regulatory frameworks concerning emissions and material usage influence manufacturing processes and material selection. Substitute materials like plastics pose a challenge, while the rising demand for lightweight vehicles fuels the market's growth. The automotive industry’s evolving needs, particularly the shift towards electric vehicles (EVs), are significantly impacting the demand for specialized die castings. M&A activities are relatively frequent, with deal values reaching xx Million annually in recent years. For example, the acquisition of Tooling & Equipment International by General Motors underscores the strategic importance of advanced casting technologies in the automotive sector.

- Market Share Distribution: The top 5 players hold approximately xx% of the global market share.

- M&A Deal Values (2019-2024): Averaged xx Million annually.

- Key End-Users: OEMs (Original Equipment Manufacturers) and Tier 1 automotive suppliers.

- Innovation Catalysts: Advancements in die casting processes, materials science, and automation.

- Regulatory Landscape: Stringent emission standards and material regulations.

Automotive Parts Die Casting Market Industry Evolution

The Automotive Parts Die Casting Market has witnessed significant growth throughout the historical period (2019-2024), driven by the increasing demand for automobiles globally. The market experienced a CAGR of xx% between 2019 and 2024. Technological advancements, particularly in high-pressure die casting and the adoption of automation, have improved productivity and reduced production costs. The rising popularity of lightweight vehicles, fueled by fuel efficiency standards and consumer preference, has significantly boosted the demand for aluminum and magnesium die castings. Consumer preference for high-quality, aesthetically pleasing vehicles further strengthens the demand for precision die castings. The automotive industry's ongoing transition towards electric vehicles (EVs) presents both challenges and opportunities. While EVs necessitate different material specifications and design considerations, the demand for lightweight and efficient components remains high, driving innovation in the die casting sector. The adoption of gigacasting technologies, as exemplified by Linamar’s new Ontario plant, signifies a paradigm shift in automotive manufacturing, promising further growth in the years to come. The market is projected to maintain a strong growth trajectory, with the CAGR expected to reach xx% during the forecast period (2025-2033).

Leading Regions, Countries, or Segments in Automotive Parts Die Casting Market

The Asia-Pacific region currently dominates the Automotive Parts Die Casting Market, driven by the rapid growth of the automotive industry in countries like China and India. This dominance is fueled by substantial investments in automotive manufacturing, supportive government policies, and a large pool of skilled labor. Within the market segments, Pressure Die Casting holds the largest share, due to its cost-effectiveness and suitability for high-volume production. Aluminum remains the most widely used raw material, owing to its lightweight nature and excellent mechanical properties. Engine parts constitute a major application segment, followed by body assemblies.

- Key Drivers (Asia-Pacific):

- High automotive production volume.

- Significant foreign direct investment.

- Government initiatives promoting domestic manufacturing.

- Key Drivers (Pressure Die Casting):

- Cost-effectiveness.

- High production rates.

- Versatility in applications.

- Key Drivers (Aluminum):

- Lightweight properties.

- High strength-to-weight ratio.

- Good castability.

Automotive Parts Die Casting Market Product Innovations

Recent innovations in automotive parts die casting encompass the development of high-strength, lightweight alloys, improved die designs for enhanced dimensional accuracy, and the integration of automation and robotics to optimize production processes. The adoption of advanced simulation techniques for optimizing casting parameters further enhances product quality and reduces production defects. These innovations are crucial for addressing evolving automotive demands, including the need for lightweight components in electric vehicles and stricter emission regulations. The focus is on increasing the efficiency of the casting processes while maintaining a high standard of quality.

Propelling Factors for Automotive Parts Die Casting Market Growth

Several factors drive the growth of the Automotive Parts Die Casting Market. The increasing demand for automobiles globally, particularly in emerging economies, remains a key driver. Technological advancements, such as high-pressure die casting and the use of lightweight materials, enhance efficiency and reduce costs. Furthermore, government regulations aimed at improving fuel efficiency and reducing emissions indirectly promote the adoption of lightweight components produced through die casting. The rising popularity of electric vehicles is also a significant factor, as they often require specific die-casting solutions for their components.

Obstacles in the Automotive Parts Die Casting Market

The Automotive Parts Die Casting Market faces several challenges. Fluctuations in raw material prices, particularly for aluminum and zinc, impact profitability. Supply chain disruptions can lead to production delays and increased costs. Intense competition among die casting companies necessitates continuous innovation and cost optimization. Furthermore, environmental regulations related to emissions and waste management require significant investment in clean technologies. Finally, the high capital expenditure needed for setting up and maintaining die-casting facilities represents a major barrier to entry for new players.

Future Opportunities in Automotive Parts Die Casting Market

Future opportunities lie in the development and adoption of advanced die casting technologies, such as gigacasting, for producing large, complex components for electric vehicles. The increasing demand for lightweight materials, such as magnesium and aluminum alloys, offers significant growth potential. The exploration of new markets, particularly in developing countries with rapidly expanding automotive sectors, presents attractive opportunities. Expanding into niche applications within the automotive sector, including advanced driver-assistance systems (ADAS) and autonomous driving technologies, could also prove beneficial.

Major Players in the Automotive Parts Die Casting Market Ecosystem

- Die-casting Solutions GmbH

- Castwel Auto Parts Pvt Ltd

- Sandhar Technologies Limited

- Dynacast International Inc

- Raltor Metal Technik India Pvt Ltd

- Endurance Group

- Ryobi Die-casting Inc

- Sunbeam Auto Pvt Ltd

- Spark Minda Ashok Minda Group

- Sipra Engineers Pvt Ltd

- Rockman Industries Ltd

- Mino Industry USA Inc

- Tyche Diecast Private Limited

- Texas Die-casting

- Ningbo Parison Die-casting Co Ltd

- Kinetic Die-casting Company

- Gibbs Die-casting Group

Key Developments in Automotive Parts Die Casting Market Industry

- November 2023: General Motors Corp. acquired Tooling & Equipment International, enhancing its in-house capabilities for high-volume automotive casting production.

- November 2023: Linamar launched its first North American gigacasting plant, signifying a major technological advancement and expansion into the EV sector.

- November 2023: IDRA Group secured a contract from Volvo Cars for two large-scale giga press machines, indicating a significant investment in advanced die casting technology for EV manufacturing.

Strategic Automotive Parts Die Casting Market Forecast

The Automotive Parts Die Casting Market is poised for sustained growth, driven by technological advancements, the rise of electric vehicles, and the ongoing demand for lightweight automotive components. The increasing adoption of gigacasting and other innovative processes will enhance efficiency and create new opportunities. The market's future hinges on the continued development of sustainable and cost-effective die-casting solutions that address evolving industry needs and environmental concerns. The integration of advanced materials and automation will further optimize production and enhance the quality of die-cast components.

Automotive Parts Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

- 2.4. Other Raw Material Types

-

3. Application Type

- 3.1. Body Assemblies

- 3.2. Engine Parts

- 3.3. Transmission Parts

- 3.4. Other Application Types

Automotive Parts Die Casting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Argentina

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Automotive Parts Die Casting Market Regional Market Share

Geographic Coverage of Automotive Parts Die Casting Market

Automotive Parts Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.19% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for High-Performance Vehicles Will Drive the Market

- 3.3. Market Restrains

- 3.3.1. Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge

- 3.4. Market Trends

- 3.4.1. Pressure Die Casting Holds the Largest Market Share While Vacuum Die Casting is Expected to Witness a High Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.2.4. Other Raw Material Types

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Body Assemblies

- 5.3.2. Engine Parts

- 5.3.3. Transmission Parts

- 5.3.4. Other Application Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. North America Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6.1.1. Pressure Die Casting

- 6.1.2. Vacuum Die Casting

- 6.1.3. Squeeze Die Casting

- 6.1.4. Semi-solid Die Casting

- 6.2. Market Analysis, Insights and Forecast - by Raw Material

- 6.2.1. Aluminum

- 6.2.2. Zinc

- 6.2.3. Magnesium

- 6.2.4. Other Raw Material Types

- 6.3. Market Analysis, Insights and Forecast - by Application Type

- 6.3.1. Body Assemblies

- 6.3.2. Engine Parts

- 6.3.3. Transmission Parts

- 6.3.4. Other Application Types

- 6.1. Market Analysis, Insights and Forecast - by Production Process Type

- 7. Europe Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Process Type

- 7.1.1. Pressure Die Casting

- 7.1.2. Vacuum Die Casting

- 7.1.3. Squeeze Die Casting

- 7.1.4. Semi-solid Die Casting

- 7.2. Market Analysis, Insights and Forecast - by Raw Material

- 7.2.1. Aluminum

- 7.2.2. Zinc

- 7.2.3. Magnesium

- 7.2.4. Other Raw Material Types

- 7.3. Market Analysis, Insights and Forecast - by Application Type

- 7.3.1. Body Assemblies

- 7.3.2. Engine Parts

- 7.3.3. Transmission Parts

- 7.3.4. Other Application Types

- 7.1. Market Analysis, Insights and Forecast - by Production Process Type

- 8. Asia Pacific Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Process Type

- 8.1.1. Pressure Die Casting

- 8.1.2. Vacuum Die Casting

- 8.1.3. Squeeze Die Casting

- 8.1.4. Semi-solid Die Casting

- 8.2. Market Analysis, Insights and Forecast - by Raw Material

- 8.2.1. Aluminum

- 8.2.2. Zinc

- 8.2.3. Magnesium

- 8.2.4. Other Raw Material Types

- 8.3. Market Analysis, Insights and Forecast - by Application Type

- 8.3.1. Body Assemblies

- 8.3.2. Engine Parts

- 8.3.3. Transmission Parts

- 8.3.4. Other Application Types

- 8.1. Market Analysis, Insights and Forecast - by Production Process Type

- 9. Latin America Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Process Type

- 9.1.1. Pressure Die Casting

- 9.1.2. Vacuum Die Casting

- 9.1.3. Squeeze Die Casting

- 9.1.4. Semi-solid Die Casting

- 9.2. Market Analysis, Insights and Forecast - by Raw Material

- 9.2.1. Aluminum

- 9.2.2. Zinc

- 9.2.3. Magnesium

- 9.2.4. Other Raw Material Types

- 9.3. Market Analysis, Insights and Forecast - by Application Type

- 9.3.1. Body Assemblies

- 9.3.2. Engine Parts

- 9.3.3. Transmission Parts

- 9.3.4. Other Application Types

- 9.1. Market Analysis, Insights and Forecast - by Production Process Type

- 10. Middle East and Africa Automotive Parts Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Process Type

- 10.1.1. Pressure Die Casting

- 10.1.2. Vacuum Die Casting

- 10.1.3. Squeeze Die Casting

- 10.1.4. Semi-solid Die Casting

- 10.2. Market Analysis, Insights and Forecast - by Raw Material

- 10.2.1. Aluminum

- 10.2.2. Zinc

- 10.2.3. Magnesium

- 10.2.4. Other Raw Material Types

- 10.3. Market Analysis, Insights and Forecast - by Application Type

- 10.3.1. Body Assemblies

- 10.3.2. Engine Parts

- 10.3.3. Transmission Parts

- 10.3.4. Other Application Types

- 10.1. Market Analysis, Insights and Forecast - by Production Process Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Die-casting Solutions GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Castwel Auto Parts Pvt Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sandhar Technologies Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dynacast International Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Raltor Metal Technik India Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Endurance Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ryobi Die-casting Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sunbeam Auto Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Spark Minda Ashok Minda Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sipra Engineers Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockman Industries Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mino Industry USA Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Tyche Diecast Private Limited*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Texas Die-casting

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Ningbo Parison Die-casting Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Kinetic Die-casting Company

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Gibbs Die-casting Group

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Die-casting Solutions GmbH

List of Figures

- Figure 1: Global Automotive Parts Die Casting Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Parts Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 3: North America Automotive Parts Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 4: North America Automotive Parts Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 5: North America Automotive Parts Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 6: North America Automotive Parts Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 7: North America Automotive Parts Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 8: North America Automotive Parts Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Parts Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Parts Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 11: Europe Automotive Parts Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 12: Europe Automotive Parts Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 13: Europe Automotive Parts Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 14: Europe Automotive Parts Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 15: Europe Automotive Parts Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 16: Europe Automotive Parts Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Parts Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Parts Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Parts Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Parts Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 21: Asia Pacific Automotive Parts Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 22: Asia Pacific Automotive Parts Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Parts Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Parts Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Parts Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Automotive Parts Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 27: Latin America Automotive Parts Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 28: Latin America Automotive Parts Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 29: Latin America Automotive Parts Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 30: Latin America Automotive Parts Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 31: Latin America Automotive Parts Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 32: Latin America Automotive Parts Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Automotive Parts Die Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Automotive Parts Die Casting Market Revenue (Million), by Production Process Type 2025 & 2033

- Figure 35: Middle East and Africa Automotive Parts Die Casting Market Revenue Share (%), by Production Process Type 2025 & 2033

- Figure 36: Middle East and Africa Automotive Parts Die Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 37: Middle East and Africa Automotive Parts Die Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 38: Middle East and Africa Automotive Parts Die Casting Market Revenue (Million), by Application Type 2025 & 2033

- Figure 39: Middle East and Africa Automotive Parts Die Casting Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 40: Middle East and Africa Automotive Parts Die Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Automotive Parts Die Casting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 2: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 3: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 6: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 7: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 8: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 13: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 14: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 15: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 22: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 23: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 24: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: India Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: China Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 31: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 32: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 33: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Mexico Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Brazil Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Argentina Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Production Process Type 2020 & 2033

- Table 38: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 39: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 40: Global Automotive Parts Die Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 41: United Arab Emirates Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Saudi Arabia Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Automotive Parts Die Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Parts Die Casting Market?

The projected CAGR is approximately > 6.19%.

2. Which companies are prominent players in the Automotive Parts Die Casting Market?

Key companies in the market include Die-casting Solutions GmbH, Castwel Auto Parts Pvt Ltd, Sandhar Technologies Limited, Dynacast International Inc, Raltor Metal Technik India Pvt Ltd, Endurance Group, Ryobi Die-casting Inc, Sunbeam Auto Pvt Ltd, Spark Minda Ashok Minda Group, Sipra Engineers Pvt Ltd, Rockman Industries Ltd, Mino Industry USA Inc, Tyche Diecast Private Limited*List Not Exhaustive, Texas Die-casting, Ningbo Parison Die-casting Co Ltd, Kinetic Die-casting Company, Gibbs Die-casting Group.

3. What are the main segments of the Automotive Parts Die Casting Market?

The market segments include Production Process Type, Raw Material, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for High-Performance Vehicles Will Drive the Market.

6. What are the notable trends driving market growth?

Pressure Die Casting Holds the Largest Market Share While Vacuum Die Casting is Expected to Witness a High Growth Rate.

7. Are there any restraints impacting market growth?

Supply Chain Disruption of Raw Materials Could be a Challenge; High Initial Cost Related to the Purchase of Raw Materials is a Challenge.

8. Can you provide examples of recent developments in the market?

November 2023: General Motors Corp. acquired Tooling & Equipment International, a Livonia, MI, developer and manufacturer of casting molds and tooling, as well as prototypes and low-volume production castings. GM will use Tooling & Equipment International's experience in designing molds and core boxes for high-volume manufacturing of automotive castings, including tooling for cylinder heads, cylinder blocks, drivelines, chassis, and suspension castings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Parts Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Parts Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Parts Die Casting Market?

To stay informed about further developments, trends, and reports in the Automotive Parts Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence