Key Insights

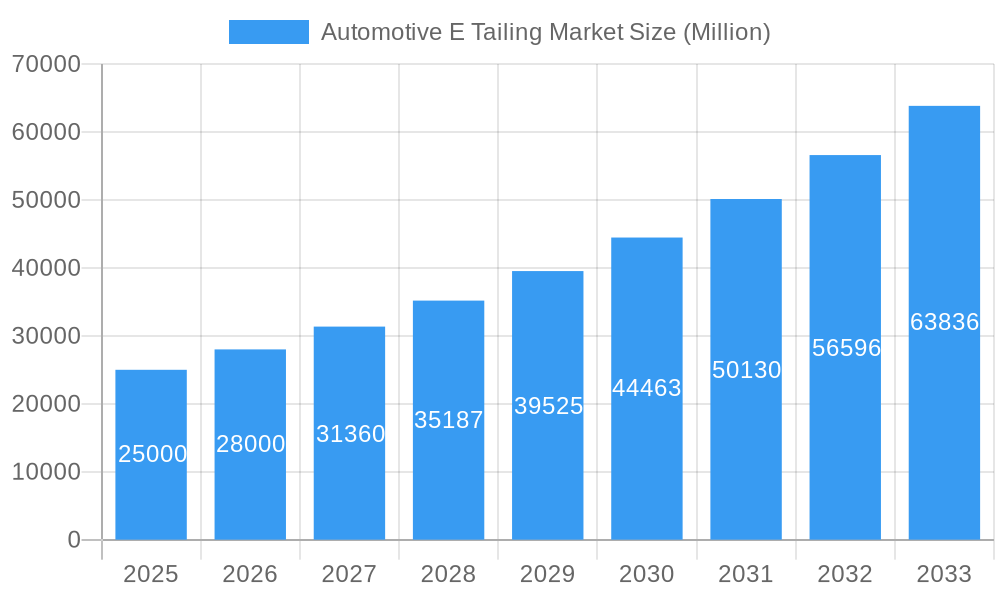

The global automotive e-tailing market is poised for significant expansion, projected to reach a market size of 17.1 billion by 2025, growing at a CAGR of 14.2% from a base year of 2025. This robust growth is propelled by increasing e-commerce adoption, enhanced consumer convenience, and the development of online retail infrastructure. Key growth drivers include rising smartphone penetration and internet access, particularly in emerging economies, facilitating broader access to automotive parts and accessories. Consumers are drawn to competitive pricing and extensive product selection available online. Furthermore, advancements in logistics, delivery networks, and secure online payment systems streamline transactions. The passenger car segment dominates vehicle types, reflecting strong demand for aftermarket parts. Original Equipment Manufacturers (OEMs) also hold a substantial share in vendor types, indicating growing direct-to-consumer e-commerce engagement.

Automotive E Tailing Market Market Size (In Billion)

Sustained market growth is anticipated through the forecast period (2025-2033). Evolving consumer preferences for online shopping, coupled with technological innovations like augmented and virtual reality for product visualization, will elevate the customer experience. The emergence of specialized automotive e-tailing platforms and the integration of online and offline channels (omnichannel strategies) are expected to further accelerate market expansion. Critical considerations for long-term stability include addressing concerns regarding product authenticity, optimizing return policies, and strengthening cybersecurity. Regional variations in growth are expected, with the Asia Pacific region anticipated to lead due to increasing vehicle ownership and expanding internet penetration.

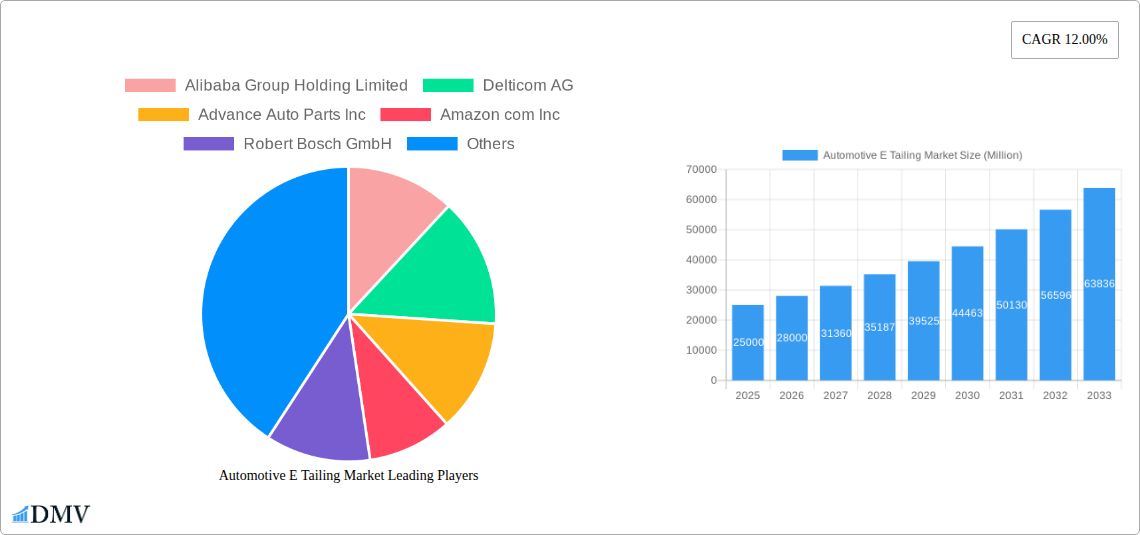

Automotive E Tailing Market Company Market Share

Automotive E-Tailing Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Automotive E-Tailing Market, projecting a market value of xx Million by 2033. It meticulously examines market trends, growth drivers, challenges, and opportunities across diverse segments, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period covers 2025-2033, while the historical period encompasses 2019-2024.

Automotive E-Tailing Market Composition & Trends

This section delves into the competitive dynamics of the automotive e-tailing market, analyzing market concentration, innovation drivers, regulatory environments, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The report assesses market share distribution among key players, including Alibaba Group Holding Limited, Delticom AG, Advance Auto Parts Inc, Amazon.com Inc, Robert Bosch GmbH, AutoZone Inc, Flipkart, eBay Inc, O'Reilly Automotive Inc, and Walmart Inc (list not exhaustive). It examines the impact of technological advancements, such as AI-powered recommendation engines and augmented reality (AR) for parts visualization, on market competitiveness. Furthermore, the report analyzes the influence of regulatory frameworks on e-commerce operations and explores the role of substitute products, such as brick-and-mortar auto parts stores, on market share.

- Market Concentration: The market exhibits a moderately concentrated structure, with a few dominant players controlling a significant portion of the market share. Exact figures will be detailed in the full report.

- Innovation Catalysts: Advancements in e-commerce technologies, including personalized recommendations and streamlined online ordering, are fueling market growth.

- Regulatory Landscape: Government regulations concerning data privacy and e-commerce practices significantly impact market operations.

- Substitute Products: The presence of traditional brick-and-mortar stores poses a competitive challenge.

- End-User Profiles: The target audience spans both individual consumers (DIY enthusiasts) and professional mechanics.

- M&A Activities: The report analyzes completed and potential M&A activities, including deal values and their impact on market consolidation (estimated xx Million in total deal value over the study period).

Automotive E-Tailing Market Industry Evolution

This section analyzes the growth trajectory of the automotive e-tailing market from 2019 to 2033. It examines the impact of technological progress on market growth, specifically focusing on the adoption rates of online automotive parts purchasing. The evolving consumer preferences towards convenience and personalized services are also considered. Detailed analysis of growth rates (xx% CAGR during the forecast period) and market penetration is provided. Furthermore, it explores the shifts in consumer demands, like the preference for eco-friendly products and the increasing demand for electric vehicle components.

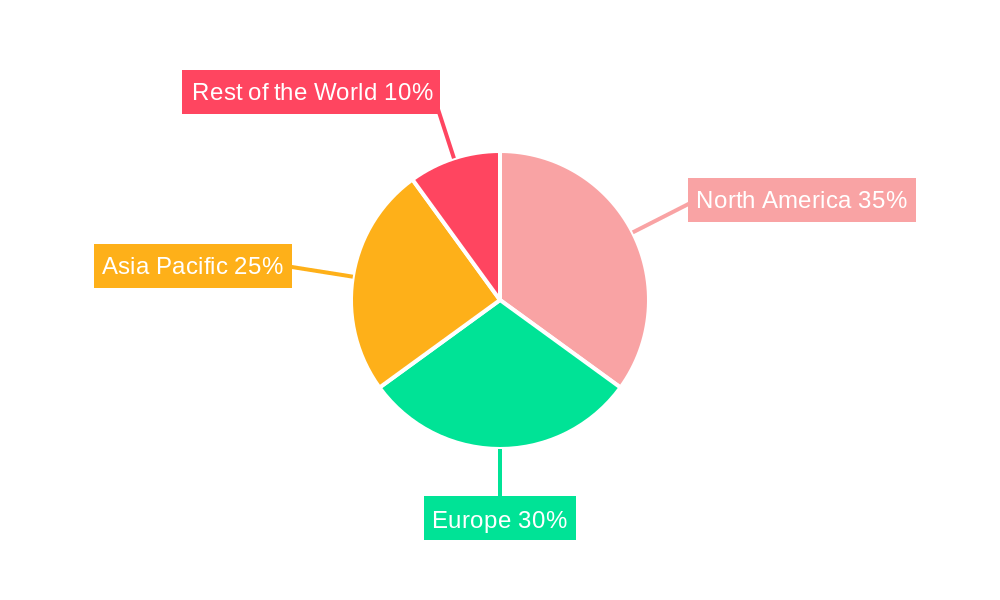

Leading Regions, Countries, or Segments in Automotive E-Tailing Market

This section identifies the leading segments and geographical regions within the automotive e-tailing market, providing a detailed analysis of their dominance factors. It breaks down the market by component type (Electrical Components, Infotainment and Multimedia, Engine Components, Tires and Wheels, Other Component Types), vehicle type (Passenger Cars, Commercial Vehicles, Two-wheelers), and vendor type (OEM, Third-Party Vendor).

Dominant Segment: The Passenger Cars segment for Electrical Components is projected as the leading segment, primarily due to the rapid growth in the adoption of advanced driver-assistance systems (ADAS). Detailed data supporting this will be presented in the full report.

Key Drivers:

- North America: High vehicle ownership rates and robust e-commerce infrastructure.

- Asia-Pacific: Rapid economic growth, increasing vehicle sales, and rising internet penetration.

- Europe: Stringent emission regulations pushing demand for electric vehicle parts.

Detailed analysis: In-depth analysis of each segment and region will be provided, including investment trends and regulatory support impacting their growth.

Automotive E-Tailing Market Product Innovations

Recent innovations in automotive e-tailing include the integration of augmented reality (AR) to visualize parts fitting and AI-driven recommendation engines improving search accuracy. These features enhance customer experience and improve order accuracy, increasing customer satisfaction and loyalty. Improved search functionality and personalized recommendations are creating a more streamlined and efficient online shopping experience.

Propelling Factors for Automotive E-Tailing Market Growth

The growth of the automotive e-tailing market is primarily fueled by the increasing penetration of e-commerce, rising vehicle ownership, and growing technological advancements that facilitate online transactions. Government initiatives promoting digitalization and e-commerce also contribute to market expansion. The convenience and wider selection offered by online platforms are strong driving factors.

Obstacles in the Automotive E-Tailing Market

Key challenges include the complexities of handling large and bulky automotive parts, the need for secure payment gateways, and potential supply chain disruptions impacting delivery times. Intense competition from established players and the risk of counterfeit parts pose additional hurdles. Logistics and the complexities of returns add cost and complexity.

Future Opportunities in Automotive E-Tailing Market

Future opportunities lie in expanding into underserved markets, incorporating cutting-edge technologies like blockchain for enhanced supply chain transparency, and leveraging data analytics to personalize customer experiences. The growth of electric vehicles (EVs) presents a significant opportunity for specialized EV parts e-tailing.

Major Players in the Automotive E-Tailing Market Ecosystem

Key Developments in Automotive E-Tailing Market Industry

- February 2021: CarParts.com partnered with McDowell and Front Row Motorsports (FRM) to boost brand engagement.

- February 2021: Advance Auto Parts partnered with NASCAR and Team Penske to enhance brand visibility.

- November 2021: Advance Auto Parts launched Carquest by Advance, targeting DIY customers and independent auto shops.

- December 2021: Alibaba Group Holding Ltd. reorganized its e-commerce businesses for accelerated growth.

Strategic Automotive E-Tailing Market Forecast

The automotive e-tailing market is poised for significant growth, driven by technological advancements and changing consumer preferences. The expansion of e-commerce infrastructure in emerging markets and increasing adoption of online shopping will fuel further market expansion. The integration of innovative technologies and the focus on customer experience will shape the future of the market.

Automotive E Tailing Market Segmentation

-

1. Component Type

- 1.1. Electrical Components

- 1.2. Infotainment and Multimedia

- 1.3. Engine Components

- 1.4. Tires and Wheel

- 1.5. Other Component Types

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

- 2.3. Two-wheelers

-

3. Vendor Type

- 3.1. OEM

- 3.2. Third-party Vendor

Automotive E Tailing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive E Tailing Market Regional Market Share

Geographic Coverage of Automotive E Tailing Market

Automotive E Tailing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Vehicle Electrification

- 3.3. Market Restrains

- 3.3.1. The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 3.4. Market Trends

- 3.4.1. The Infotainment and Multimedia Segment to Hold Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive E Tailing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Electrical Components

- 5.1.2. Infotainment and Multimedia

- 5.1.3. Engine Components

- 5.1.4. Tires and Wheel

- 5.1.5. Other Component Types

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.2.3. Two-wheelers

- 5.3. Market Analysis, Insights and Forecast - by Vendor Type

- 5.3.1. OEM

- 5.3.2. Third-party Vendor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Automotive E Tailing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Electrical Components

- 6.1.2. Infotainment and Multimedia

- 6.1.3. Engine Components

- 6.1.4. Tires and Wheel

- 6.1.5. Other Component Types

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.2.3. Two-wheelers

- 6.3. Market Analysis, Insights and Forecast - by Vendor Type

- 6.3.1. OEM

- 6.3.2. Third-party Vendor

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Automotive E Tailing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Electrical Components

- 7.1.2. Infotainment and Multimedia

- 7.1.3. Engine Components

- 7.1.4. Tires and Wheel

- 7.1.5. Other Component Types

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.2.3. Two-wheelers

- 7.3. Market Analysis, Insights and Forecast - by Vendor Type

- 7.3.1. OEM

- 7.3.2. Third-party Vendor

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Pacific Automotive E Tailing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Electrical Components

- 8.1.2. Infotainment and Multimedia

- 8.1.3. Engine Components

- 8.1.4. Tires and Wheel

- 8.1.5. Other Component Types

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.2.3. Two-wheelers

- 8.3. Market Analysis, Insights and Forecast - by Vendor Type

- 8.3.1. OEM

- 8.3.2. Third-party Vendor

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Rest of the World Automotive E Tailing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. Electrical Components

- 9.1.2. Infotainment and Multimedia

- 9.1.3. Engine Components

- 9.1.4. Tires and Wheel

- 9.1.5. Other Component Types

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.2.3. Two-wheelers

- 9.3. Market Analysis, Insights and Forecast - by Vendor Type

- 9.3.1. OEM

- 9.3.2. Third-party Vendor

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Alibaba Group Holding Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Delticom AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Advance Auto Parts Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Amazon com Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Robert Bosch GmbH

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 AutoZone Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Flipkart*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 eBay Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 O'reilly Automotive Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Walmart Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Alibaba Group Holding Limited

List of Figures

- Figure 1: Global Automotive E Tailing Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive E Tailing Market Revenue (billion), by Component Type 2025 & 2033

- Figure 3: North America Automotive E Tailing Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Automotive E Tailing Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive E Tailing Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive E Tailing Market Revenue (billion), by Vendor Type 2025 & 2033

- Figure 7: North America Automotive E Tailing Market Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 8: North America Automotive E Tailing Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Automotive E Tailing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive E Tailing Market Revenue (billion), by Component Type 2025 & 2033

- Figure 11: Europe Automotive E Tailing Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 12: Europe Automotive E Tailing Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive E Tailing Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive E Tailing Market Revenue (billion), by Vendor Type 2025 & 2033

- Figure 15: Europe Automotive E Tailing Market Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 16: Europe Automotive E Tailing Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Automotive E Tailing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive E Tailing Market Revenue (billion), by Component Type 2025 & 2033

- Figure 19: Asia Pacific Automotive E Tailing Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 20: Asia Pacific Automotive E Tailing Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive E Tailing Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive E Tailing Market Revenue (billion), by Vendor Type 2025 & 2033

- Figure 23: Asia Pacific Automotive E Tailing Market Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 24: Asia Pacific Automotive E Tailing Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive E Tailing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive E Tailing Market Revenue (billion), by Component Type 2025 & 2033

- Figure 27: Rest of the World Automotive E Tailing Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 28: Rest of the World Automotive E Tailing Market Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 29: Rest of the World Automotive E Tailing Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of the World Automotive E Tailing Market Revenue (billion), by Vendor Type 2025 & 2033

- Figure 31: Rest of the World Automotive E Tailing Market Revenue Share (%), by Vendor Type 2025 & 2033

- Figure 32: Rest of the World Automotive E Tailing Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive E Tailing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive E Tailing Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 2: Global Automotive E Tailing Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive E Tailing Market Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 4: Global Automotive E Tailing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive E Tailing Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 6: Global Automotive E Tailing Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive E Tailing Market Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 8: Global Automotive E Tailing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive E Tailing Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 13: Global Automotive E Tailing Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive E Tailing Market Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 15: Global Automotive E Tailing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive E Tailing Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 22: Global Automotive E Tailing Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Automotive E Tailing Market Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 24: Global Automotive E Tailing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: India Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: China Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive E Tailing Market Revenue billion Forecast, by Component Type 2020 & 2033

- Table 31: Global Automotive E Tailing Market Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Automotive E Tailing Market Revenue billion Forecast, by Vendor Type 2020 & 2033

- Table 33: Global Automotive E Tailing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 34: South America Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive E Tailing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive E Tailing Market?

The projected CAGR is approximately 14.2%.

2. Which companies are prominent players in the Automotive E Tailing Market?

Key companies in the market include Alibaba Group Holding Limited, Delticom AG, Advance Auto Parts Inc, Amazon com Inc, Robert Bosch GmbH, AutoZone Inc, Flipkart*List Not Exhaustive, eBay Inc, O'reilly Automotive Inc, Walmart Inc.

3. What are the main segments of the Automotive E Tailing Market?

The market segments include Component Type, Vehicle Type, Vendor Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.1 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Vehicle Electrification.

6. What are the notable trends driving market growth?

The Infotainment and Multimedia Segment to Hold Major Share in the Market.

7. Are there any restraints impacting market growth?

The Cost of Raw Materials Used in the Manufacturing of Switches is High.

8. Can you provide examples of recent developments in the market?

In February 2021, CarParts.com Partnered with McDowell and Front Row Motorsports (FRM) CarParts.com partnered with Front Row Motorsports (FRM) and McDowell on several contests, sweepstakes, promotions, and other activities to get more involved in the spark engagement and sport.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive E Tailing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive E Tailing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive E Tailing Market?

To stay informed about further developments, trends, and reports in the Automotive E Tailing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence