Key Insights

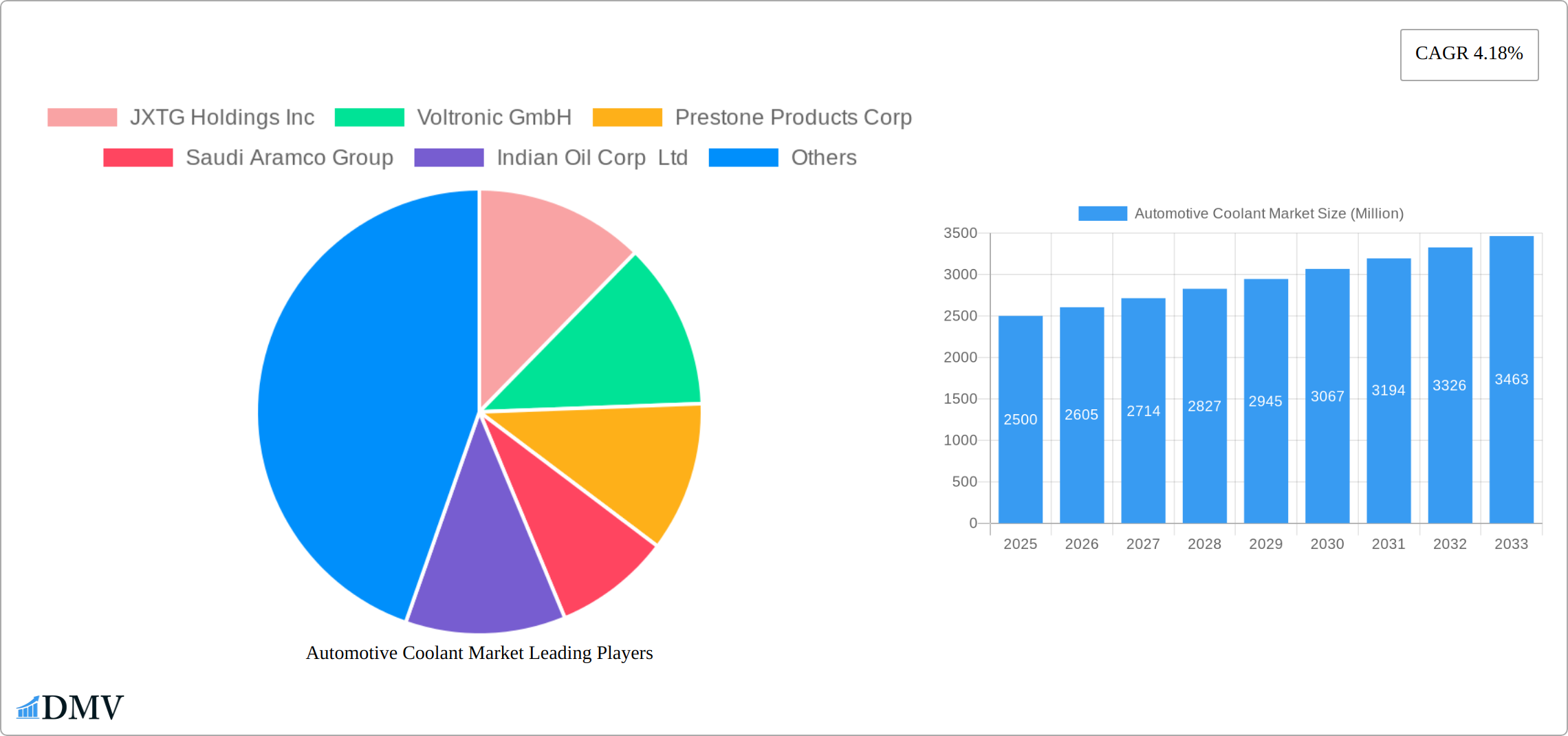

The automotive coolant market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 4.18% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing global vehicle population, particularly in developing economies, significantly boosts demand for automotive coolants. Furthermore, stringent emission regulations and the rising adoption of advanced engine technologies, like hybrid and electric vehicles (although requiring different coolant formulations), are driving innovation and expanding the market. The preference for extended vehicle lifespans and the consequent need for higher-quality, longer-lasting coolants also contribute to market growth. Segment-wise, passenger cars currently dominate the market, owing to their higher production volumes compared to commercial vehicles. However, the commercial vehicle segment is anticipated to witness faster growth due to the increasing demand for heavy-duty vehicles and stringent maintenance requirements in commercial fleets. In terms of chemical type, ethylene glycol holds a significant market share due to its established performance and cost-effectiveness. However, the growing awareness of environmental concerns is gradually increasing the adoption of propylene glycol-based coolants, which are considered more biodegradable and environmentally friendly. Key players like JXTG Holdings Inc, ExxonMobil Corp, and BP PLC are strategically investing in research and development to enhance product performance and expand their market reach.

Automotive Coolant Market Market Size (In Billion)

Despite the promising growth trajectory, the automotive coolant market faces certain challenges. Fluctuations in raw material prices, especially for ethylene and propylene glycol, can impact production costs and profitability. Moreover, the increasing penetration of electric vehicles (EVs) presents a double-edged sword. While EVs also require coolants (albeit different types), their lower coolant consumption compared to internal combustion engine (ICE) vehicles could partially constrain market growth in the long term. Furthermore, intense competition among established players and the emergence of new entrants necessitates continuous innovation and strategic partnerships to maintain market share. Geographical expansion, particularly in developing regions with increasing vehicle penetration, represents a significant opportunity for growth. The market's future hinges on the balance between these driving forces and the aforementioned restraints, with the overall outlook remaining positive due to the continuous growth in the global automotive industry.

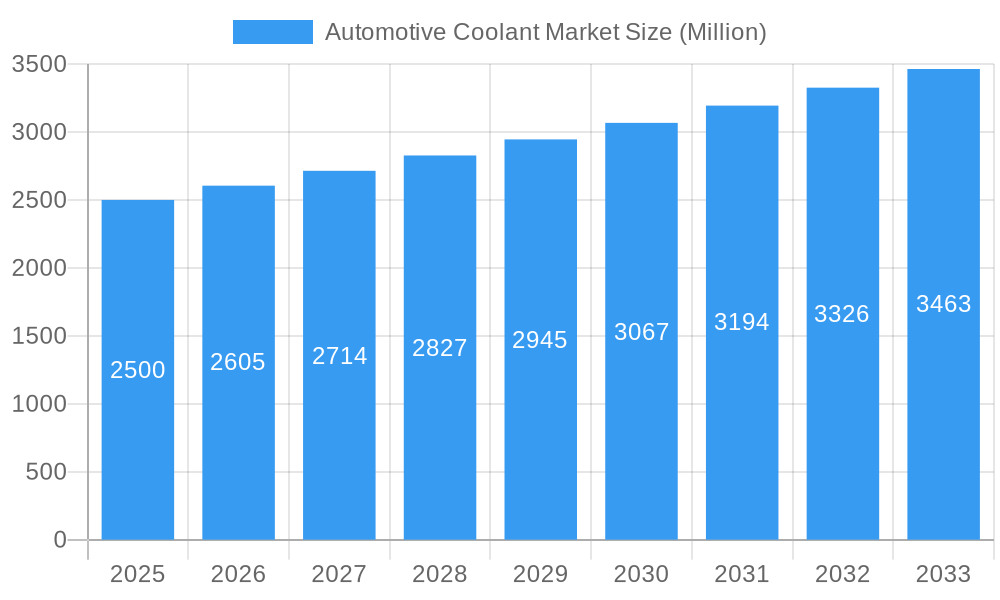

Automotive Coolant Market Company Market Share

Automotive Coolant Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Automotive Coolant Market, encompassing market size, growth drivers, competitive landscape, and future projections from 2019 to 2033. The study period covers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033), offering stakeholders a clear view of past performance and future potential. The market is segmented by vehicle type (passenger car, commercial vehicle) and chemical type (ethylene glycol, propylene glycol), providing granular insights into specific market dynamics. This report is essential for automotive manufacturers, coolant suppliers, investors, and industry analysts seeking a deep understanding of this crucial market. The total market value is projected to reach xx Million by 2033.

Automotive Coolant Market Composition & Trends

This section delves into the intricate structure and evolving dynamics of the automotive coolant market. We analyze market concentration, revealing the share held by key players like ExxonMobil Corp, BP PLC (Castrol), and TotalEnergies SE, among others. We assess the impact of innovation, specifically highlighting the shift towards eco-friendly coolants and the rising demand for extended-life fluids. The regulatory landscape is scrutinized, examining the influence of emission standards and environmental regulations on market trends. Furthermore, the report investigates substitute products and their market penetration, and provides an in-depth analysis of end-user preferences and consumption patterns. Finally, we explore the impact of mergers and acquisitions (M&A) activities, including deal values and their implications for market consolidation.

- Market Share Distribution: ExxonMobil Corp holds an estimated xx% market share, followed by BP PLC (Castrol) at xx%, and TotalEnergies SE at xx%. Other significant players include JXTG Holdings Inc, Voltronic GmbH, Prestone Products Corp, Saudi Aramco Group, Indian Oil Corp Ltd, Amsoil Inc, Royal Dutch Shell PLC, Chevron Corp, and American Mfg Co (Rudson).

- M&A Activity: The past five years have seen xx Million in M&A deals within the automotive coolant sector, primarily driven by strategic acquisitions aiming to expand product portfolios and geographical reach. The average deal value was approximately xx Million.

Automotive Coolant Market Industry Evolution

The automotive coolant market has undergone a significant transformation, driven by technological advancements, evolving environmental regulations, and the rise of electric vehicles. Historically, the market was dominated by traditional ethylene glycol-based coolants. However, a clear shift is underway towards longer-lasting, higher-performance coolants, including Organic Acid Technology (OAT) and Hybrid Organic Acid Technology (HOAT) formulations. These innovations offer extended drain intervals, reducing maintenance costs and minimizing environmental impact through reduced coolant waste. The burgeoning electric vehicle (EV) market presents both challenges and opportunities, demanding specialized coolants optimized for the unique thermal management requirements of EVs, often incorporating advanced materials and formulations. Furthermore, the increasing focus on sustainability is driving the development and adoption of bio-based and carbon-neutral coolants, aligning with global efforts to reduce greenhouse gas emissions. We project the market to experience a compound annual growth rate (CAGR) of [Insert Specific Percentage]% during the forecast period (2024-2033), fueled by increased vehicle production globally, the expanding EV sector, and the widespread adoption of extended-life coolants. Specifically, the market share of environmentally friendly coolants is projected to reach [Insert Specific Percentage]% by 2033.

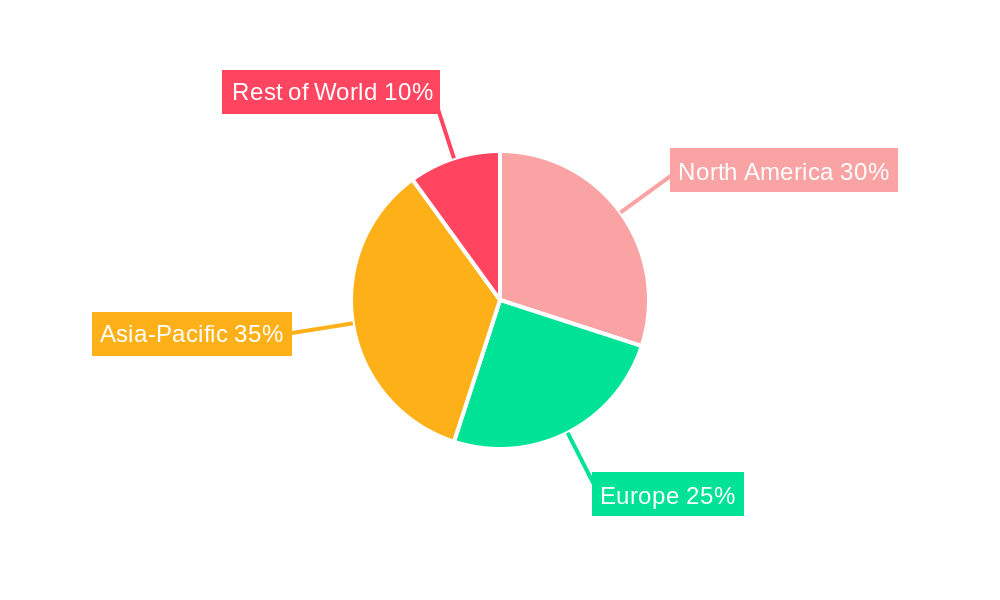

Leading Regions, Countries, or Segments in Automotive Coolant Market

This section identifies the dominant regions, countries, and segments within the automotive coolant market. The analysis reveals the leading segment based on vehicle type and chemical type.

By Vehicle Type:

- Passenger Cars: The passenger car segment dominates the market, driven by the high volume of passenger vehicle production globally. Key growth drivers include rising disposable income levels in developing economies and the increasing popularity of passenger vehicles.

- Commercial Vehicles: The commercial vehicle segment shows promising growth potential, driven by increasing freight transportation and the demand for efficient and durable coolants in heavy-duty vehicles. Stricter emission regulations are also pushing the adoption of advanced coolants in this segment.

By Chemical Type:

- Ethylene Glycol: Ethylene glycol continues to be the dominant chemical type due to its cost-effectiveness and widespread compatibility with various engine types.

- Propylene Glycol: The propylene glycol segment is experiencing growth due to its environmentally friendly nature and increasing demand for bio-based coolants.

Dominance Factors:

The dominance of specific regions and segments is attributed to factors including robust automotive manufacturing sectors, favorable government policies, and strong consumer demand for high-quality, long-lasting coolants. Government regulations driving the adoption of environmentally friendly coolants significantly impact growth in certain regions.

Automotive Coolant Market Product Innovations

Recent innovations in automotive coolants are significantly enhancing performance, extending service life, and minimizing environmental impact. Extended-life coolants, utilizing OAT or HOAT technologies, are becoming increasingly prevalent, offering superior corrosion protection and significantly extended drain intervals, leading to reduced maintenance frequency and operational costs. The development of low-toxicity and biodegradable coolants addresses growing environmental concerns, reducing the ecological footprint of vehicle operation and disposal. Specialized coolants designed for electric vehicles address the unique thermal management challenges posed by high-power density batteries and electric motors, ensuring efficient cooling and preventing thermal runaway. These advanced coolants often feature enhanced heat transfer properties, improved freeze/boil protection, and superior corrosion inhibition, resulting in prolonged engine life and optimal vehicle performance. Furthermore, ongoing research into nanofluids and other advanced materials promises even greater efficiency and performance in future coolant generations.

Propelling Factors for Automotive Coolant Growth

Several key factors fuel the growth of the automotive coolant market. These include:

- Rising Vehicle Production: Global vehicle production continues to increase, driving demand for coolants across various vehicle segments.

- Technological Advancements: Innovation in coolant formulations, such as OAT and HOAT technologies, leads to superior performance and extended service intervals.

- Stringent Emission Regulations: Governments worldwide are enacting stricter emission regulations, promoting the adoption of eco-friendly coolants.

- Increased Consumer Awareness: Growing consumer awareness of the importance of coolant quality and its impact on engine lifespan drives demand for premium products.

Obstacles in the Automotive Coolant Market

Despite the promising growth trajectory, several factors pose challenges to the automotive coolant market:

- Raw Material Price Volatility and Supply Chain Disruptions: Fluctuations in the prices of key raw materials, such as ethylene glycol and propylene glycol, coupled with global supply chain vulnerabilities, create uncertainty in production costs and product availability. This necessitates robust supply chain management and diversification strategies for manufacturers.

- Intense Competition and Market Consolidation: The market is characterized by intense competition among established players and the emergence of new entrants, often with specialized technologies or regional advantages. This competitive landscape necessitates continuous innovation and strategic differentiation to maintain market share.

- Regulatory Landscape and Environmental Compliance: Stringent environmental regulations regarding coolant composition and disposal are increasing, requiring manufacturers to invest in research and development of environmentally friendly formulations and to comply with evolving standards across different regions.

Future Opportunities in Automotive Coolant Market

The future of the automotive coolant market holds several promising opportunities:

- Growth of the EV Market: The booming electric vehicle (EV) market creates a demand for specialized coolants for battery thermal management systems.

- Demand for Sustainable Coolants: Growing environmental concerns fuel the demand for bio-based and carbon-neutral coolants.

- Expansion into Emerging Markets: Developing economies offer significant growth potential for automotive coolant manufacturers.

Major Players in the Automotive Coolant Market Ecosystem

- JXTG Holdings Inc

- Voltronic GmbH

- Prestone Products Corp

- Saudi Aramco Group

- Indian Oil Corp Ltd

- ExxonMobil Corp

- BP PLC (Castrol)

- Amsoil Inc

- TotalEnergies SE

- Royal Dutch Shell PLC

- Chevron Corp

- American Mfg Co (Rudson)

Key Developments in Automotive Coolant Market Industry

- February 2023: UPM Biochemicals and HAERTOL announced a strategic partnership to produce carbon-neutral engine and battery coolants.

- August 2022: Valvoline Cummins launched Valvoline Advanced Coolant, a glycol-based coolant with OAT technology offering a 5-year/500,000 km service life.

- July 2021: Castrol launched Castrol ON e-thermal fluid for EVs, enabling faster charging and improved performance.

- July 2021: Eurol Lubricants introduced Coolant -36°C GLX-AV for Japanese and Korean car brands.

- February 2021: AMSOIL introduced a new Powersports Antifreeze & Coolant with a five-year service life.

Strategic Automotive Coolant Market Forecast

The automotive coolant market is poised for significant growth driven by the expanding global vehicle fleet, increasing demand for high-performance coolants, and the transition toward sustainable solutions. The forecast period is expected to see continued growth across various segments, with the adoption of eco-friendly coolants becoming a major trend. The market's evolution will be shaped by technological advancements, regulatory changes, and evolving consumer preferences. This presents substantial opportunities for manufacturers who can meet the demands for innovative, high-performance, and environmentally responsible coolants.

Automotive Coolant Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Chemical Type

- 2.1. Ethylene Glycol

- 2.2. Propylene Glycol

Automotive Coolant Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Coolant Market Regional Market Share

Geographic Coverage of Automotive Coolant Market

Automotive Coolant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fuel Economy Norms and Government Incentives

- 3.3. Market Restrains

- 3.3.1. Growing Demand For Battery Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Passenger Car Segment Likely to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Coolant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Chemical Type

- 5.2.1. Ethylene Glycol

- 5.2.2. Propylene Glycol

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Automotive Coolant Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Chemical Type

- 6.2.1. Ethylene Glycol

- 6.2.2. Propylene Glycol

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Automotive Coolant Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Chemical Type

- 7.2.1. Ethylene Glycol

- 7.2.2. Propylene Glycol

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Automotive Coolant Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Chemical Type

- 8.2.1. Ethylene Glycol

- 8.2.2. Propylene Glycol

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Automotive Coolant Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Chemical Type

- 9.2.1. Ethylene Glycol

- 9.2.2. Propylene Glycol

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 JXTG Holdings Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Voltronic GmbH

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Prestone Products Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Saudi Aramco Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Indian Oil Corp Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ExxonMobil Corp

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BP PLC ( Castrol)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Amsoil Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 TotalEnergies SE

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Royal Dutch Shell PLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Chevron Corp

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 American Mfg Co (Rudson

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 JXTG Holdings Inc

List of Figures

- Figure 1: Global Automotive Coolant Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Coolant Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 3: North America Automotive Coolant Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Automotive Coolant Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 5: North America Automotive Coolant Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 6: North America Automotive Coolant Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Automotive Coolant Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Coolant Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 9: Europe Automotive Coolant Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Automotive Coolant Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 11: Europe Automotive Coolant Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 12: Europe Automotive Coolant Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Automotive Coolant Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Coolant Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Coolant Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Coolant Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Coolant Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Coolant Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Coolant Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Coolant Market Revenue (undefined), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Automotive Coolant Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Automotive Coolant Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 23: Rest of the World Automotive Coolant Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 24: Rest of the World Automotive Coolant Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Coolant Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Coolant Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Automotive Coolant Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 3: Global Automotive Coolant Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Coolant Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Automotive Coolant Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 6: Global Automotive Coolant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Coolant Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Automotive Coolant Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 12: Global Automotive Coolant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Automotive Coolant Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 20: Global Automotive Coolant Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 21: Global Automotive Coolant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: India Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: China Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Japan Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: South Korea Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Rest of Asia Pacific Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Global Automotive Coolant Market Revenue undefined Forecast, by Vehicle Type 2020 & 2033

- Table 28: Global Automotive Coolant Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 29: Global Automotive Coolant Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: South America Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Middle East and Africa Automotive Coolant Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Coolant Market?

The projected CAGR is approximately 2.4%.

2. Which companies are prominent players in the Automotive Coolant Market?

Key companies in the market include JXTG Holdings Inc, Voltronic GmbH, Prestone Products Corp, Saudi Aramco Group, Indian Oil Corp Ltd, ExxonMobil Corp, BP PLC ( Castrol), Amsoil Inc, TotalEnergies SE, Royal Dutch Shell PLC, Chevron Corp, American Mfg Co (Rudson.

3. What are the main segments of the Automotive Coolant Market?

The market segments include Vehicle Type, Chemical Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Fuel Economy Norms and Government Incentives.

6. What are the notable trends driving market growth?

Passenger Car Segment Likely to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Demand For Battery Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In February 2023, UPM Biochemicals and HAERTOL announced a strategic partnership to produce a new range of carbon-neutral engine and battery coolants that will help automotive manufacturers reduce their CO2 footprint.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Coolant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Coolant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Coolant Market?

To stay informed about further developments, trends, and reports in the Automotive Coolant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence