Key Insights

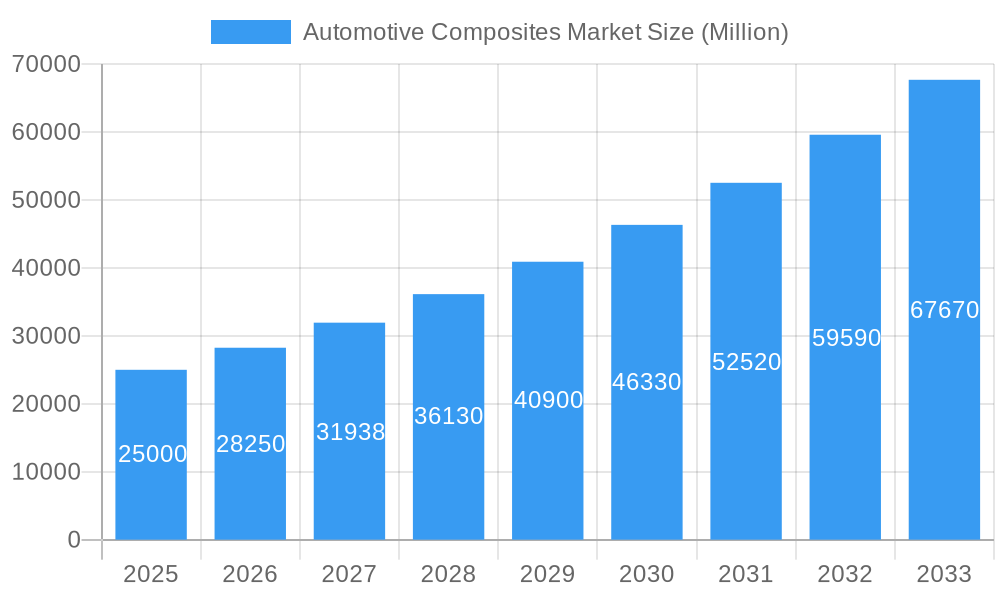

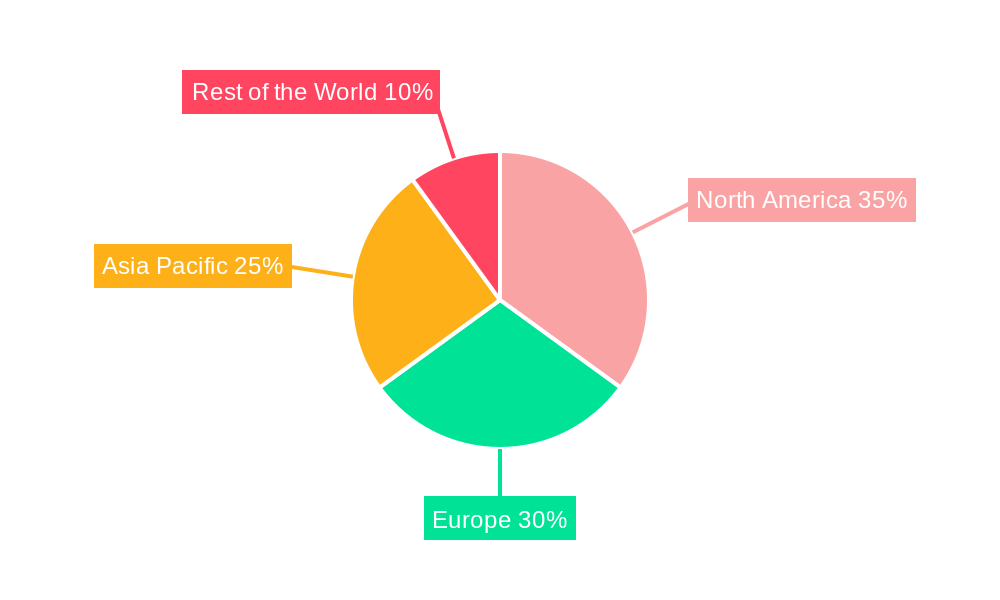

The automotive composites market is experiencing robust growth, driven by increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions. The market, valued at approximately $XX million in 2025, is projected to exhibit a Compound Annual Growth Rate (CAGR) exceeding 13% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, stringent government regulations worldwide are pushing automakers to adopt lighter materials to meet fuel economy standards. Secondly, the rising popularity of electric vehicles (EVs) further accelerates this trend, as composites offer advantages in battery packaging and overall vehicle weight reduction. Technological advancements in composite materials, particularly in high-strength, lightweight options like carbon fiber and advanced thermoplastic polymers, are also contributing to market growth. The structural assembly segment holds a significant market share, followed by powertrain components and interior applications. Geographically, North America and Asia Pacific are leading the market, driven by substantial automotive production and a growing focus on sustainable mobility solutions. However, high material costs and the complex manufacturing processes associated with composites remain key restraints.

Automotive Composites Market Market Size (In Billion)

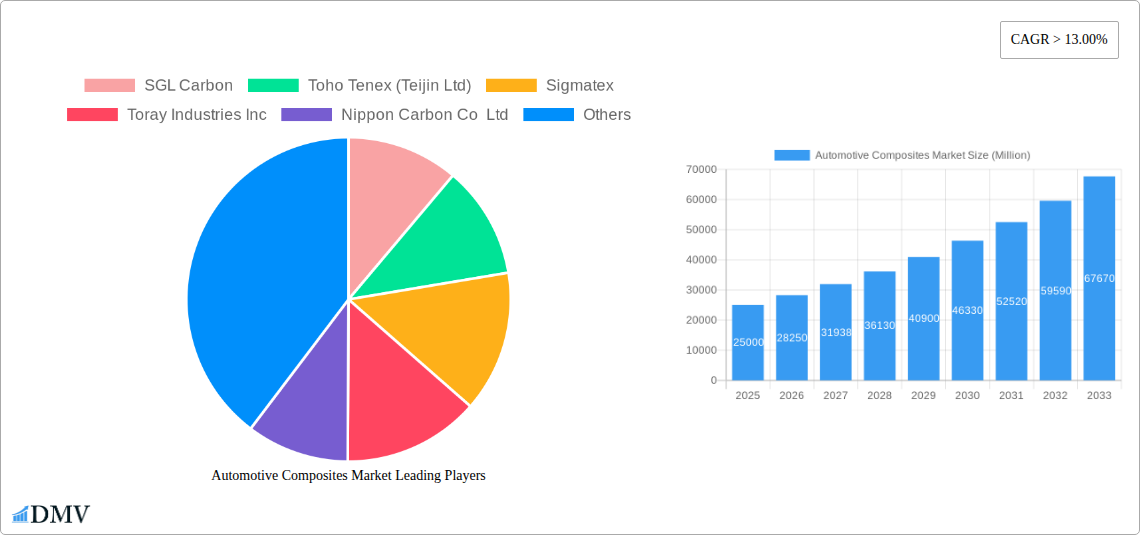

The competitive landscape is characterized by both established players and emerging companies specializing in material production and composite component manufacturing. Key players like SGL Carbon, Toho Tenex, and Toray Industries are actively investing in R&D to develop innovative composite materials and manufacturing techniques. The market is also witnessing increased collaboration between material suppliers and automotive manufacturers to optimize composite applications and streamline the supply chain. Further growth will depend on continued technological advancements, cost reductions in composite material production, and the successful integration of composites into a broader range of vehicle applications. The forecast period of 2025-2033 presents significant opportunities for companies involved in the design, manufacturing, and supply of automotive composites. The market segmentation by material type (thermoset, thermoplastic, carbon fiber, glass fiber) and application (structural, powertrain, interior, exterior) provides valuable insights for strategic decision-making by industry stakeholders.

Automotive Composites Market Company Market Share

Automotive Composites Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Automotive Composites Market, projecting a significant expansion from 2025 to 2033. The study covers key market segments, including Application (Structural Assembly, Powertrain Component, Interior, Exterior) and Material (Thermoset Polymer, Thermoplastic Polymer, Carbon Fiber, Glass Fiber), offering crucial data for stakeholders seeking to navigate this rapidly evolving landscape. With a focus on key players like SGL Carbon, Toho Tenex (Teijin Ltd), and Hexcel Corporation, the report provides a comprehensive overview of market trends, technological advancements, and future growth opportunities. The detailed analysis across historical (2019-2024), base (2025), and forecast (2025-2033) periods ensures a robust understanding of the market's past performance and future potential. The market is estimated to be worth XX Million in 2025 and is expected to reach XX Million by 2033.

Automotive Composites Market Market Composition & Trends

The Automotive Composites Market presents a moderately concentrated landscape, characterized by a few key players dominating significant market share. Innovation stands as a paramount driver, with ongoing advancements in both material science and manufacturing techniques consistently pushing the boundaries of lightweighting and performance enhancement. Stringent environmental regulations, particularly those focusing on fuel efficiency and emissions reduction, are profoundly influencing market dynamics. While traditional metallic materials continue to represent a competitive alternative, the accelerating adoption of electric vehicles is concurrently opening up new and exciting avenues for composite material applications. Evolving end-user preferences for superior fuel economy and enhanced vehicle safety are further fueling market expansion. Mergers and acquisitions (M&A) activity is on a steady upward trajectory, with an estimated deal value of **[Insert specific value here, e.g., $5.2 Billion]** in 2024, underscoring strategic collaborations and consolidation efforts within the industry.

- Market Share Distribution (2024): SGL Carbon (XX%), Toho Tenex (Teijin Ltd) (XX%), Hexcel Corporation (XX%), Others (XX%).

- M&A Deal Values (2019-2024): Total value estimated at approximately **[Insert specific value here, e.g., $28 Billion]**.

- Key Trends: Escalating demand for lightweight vehicles, rapid adoption of electric vehicles, stringent emission regulations, and continuous technological advancements in material science.

Automotive Composites Market Industry Evolution

The Automotive Composites Market has witnessed a remarkable evolution, driven by technological breakthroughs and evolving consumer demands. The market experienced a Compound Annual Growth Rate (CAGR) of XX% during the period 2019-2024, primarily fueled by the growing adoption of lightweight materials in vehicles to improve fuel efficiency. Technological advancements, such as the development of high-performance polymers and carbon fiber reinforced polymers (CFRPs), have significantly enhanced the performance and versatility of automotive composites. The increasing demand for enhanced vehicle safety and durability is further driving market expansion. The shift towards electric vehicles (EVs) is presenting significant opportunities, as composites offer advantages in battery housing and structural components. This trend is expected to accelerate market growth in the coming years, with a projected CAGR of XX% during the forecast period (2025-2033). The global adoption rate of composite materials in new vehicles is expected to increase to approximately XX% by 2033 from XX% in 2024.

Leading Regions, Countries, or Segments in Automotive Composites Market

-

Dominant Region: North America currently leads the Automotive Composites Market, propelled by robust automotive production volumes and substantial investments in advanced material research and development. Europe closely follows, demonstrating considerable growth potential, largely attributed to its stringent emission regulations that mandate lighter vehicle components.

-

Leading Application Segment: The Structural Assembly segment commands a dominant position in the market, accounting for approximately **[Insert specific percentage here, e.g., 45%]** of the total market share in 2024. This leadership is directly linked to the increasing imperative for vehicle lightweighting to achieve improved fuel efficiency and reduced emissions.

-

Key Material Segment: Carbon Fiber exhibits exceptional growth potential due to its unparalleled strength-to-weight ratio. However, its comparatively higher cost relative to glass fiber remains a factor influencing its broader adoption. The Thermoplastic Polymer segment is also experiencing significant growth, driven by its inherent recyclability and ease of processing characteristics.

-

Key Drivers for North American Dominance: High automotive production volumes, significant investments in research and development initiatives, and supportive government policies that champion the development and implementation of advanced materials.

-

Challenges for European Market: Higher labor costs and intense competition from regions offering lower manufacturing expenses present notable challenges for the European market.

Automotive Composites Market Product Innovations

Recent years have witnessed the introduction of several innovative automotive composite materials and manufacturing processes. Solvay's Amodel® Supreme PPA, a high-performance polyphthalamide compound, is designed for demanding e-mobility applications, while Hexcel Corporation's collaboration with NaCa Systems showcases advancements in lightweight carbon fiber and wood fiber composite seat designs. Sigmatex’s launch of recycled carbon fiber non-woven fabric highlights sustainability efforts, offering improved mechanical properties and reduced environmental impact. These innovations underscore the ongoing drive towards enhanced performance, sustainability, and cost-effectiveness in automotive composite materials.

Propelling Factors for Automotive Composites Market Growth

The Automotive Composites Market is propelled by a confluence of strategic factors. Technological breakthroughs, particularly in materials science and advanced manufacturing processes, are enabling the creation of composite parts that are not only lighter and stronger but also more cost-effective to produce. Economic drivers, such as the escalating consumer and regulatory demand for fuel-efficient vehicles, are directly stimulating the adoption of lightweight composite materials. Furthermore, stringent government regulations pertaining to emissions standards and fuel economy are actively incentivizing the integration of composites into automotive applications. For instance, the European Union's ambitious emission targets are compelling automakers to implement aggressive lightweighting strategies to meet these stringent environmental benchmarks.

Obstacles in the Automotive Composites Market Market

Notwithstanding its promising growth trajectory, the Automotive Composites Market encounters several significant hurdles. The complex and rigorous regulatory approval and testing requirements for novel composite materials can introduce delays in their widespread adoption. Disruptions within the supply chain, particularly concerning the procurement of critical raw materials like carbon fiber, can adversely impact production costs and delivery timelines. Intense competition from both established industry veterans and agile new entrants can exert considerable pricing pressure, potentially diminishing profit margins for market participants. These collective challenges can exert a notable influence on the overall market's expansion rate.

Future Opportunities in Automotive Composites Market

The future of the Automotive Composites Market holds significant opportunities. The increasing adoption of electric and autonomous vehicles presents promising applications for composite materials in battery housings, lightweight chassis, and other structural components. Advancements in recycling technologies for composite materials will mitigate environmental concerns and drive sustainability. The development of new, high-performance composite materials with enhanced properties will further expand market potential.

Major Players in the Automotive Composites Market Ecosystem

- SGL Carbon

- Toho Tenex (Teijin Ltd)

- Sigmatex

- Toray Industries Inc

- Nippon Carbon Co Ltd

- Nippon Sheet Glass Company Limited

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Hexcel Corporation

- Solva

- mouldCAM Pty Ltd

Key Developments in Automotive Composites Market Industry

- April 2021: Solvay introduces Amodel® Supreme PPA, a high-performance polyphthalamide compound for e-mobility applications.

- February 2021: Hexcel Corporation collaborates with NaCa Systems to develop a lightweight carbon fiber and wood fiber composite sports car seat.

- September 2020: Sigmatex launches a recycled carbon fiber non-woven fabric.

- September 2020: Mitsubishi Chemical Advanced Materials, Inc. announces a strategic alliance with R3 Composites Corp.

- August 2020: SGL Carbon receives a multi-year order for carbon fiber profiles for BMW windshields.

- February 2020: SGL Carbon unveils a composite battery enclosure and a glass fiber composite leaf spring.

Strategic Automotive Composites Market Market Forecast

The Automotive Composites Market is strategically positioned for substantial and sustained growth, underpinned by the aforementioned driving forces. The continuously increasing demand for lighter-weight vehicles, coupled with ongoing technological advancements and a supportive regulatory environment, will undoubtedly fuel market expansion. The transformative shift towards electric vehicles and the advent of autonomous driving technologies are poised to unlock significant new opportunities for the application of composite materials across a diverse array of automotive components. The future outlook for the market points towards considerable expansion, with persistent innovation and strategic market consolidation continuing to shape the competitive landscape and drive industry evolution.

Automotive Composites Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly

- 1.2. Powertrain Component

- 1.3. Interior

- 1.4. Exterior

- 1.5. Others

-

2. Material Type

- 2.1. Thermoset Polymer

- 2.2. Thermoplastic Polymer

- 2.3. Carbon Fiber

- 2.4. Glass Fiber

Automotive Composites Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Composites Market Regional Market Share

Geographic Coverage of Automotive Composites Market

Automotive Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns

- 3.3. Market Restrains

- 3.3.1. Shift towards Disposable Filters

- 3.4. Market Trends

- 3.4.1. Growing Demand for Lightweight Materials

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly

- 5.1.2. Powertrain Component

- 5.1.3. Interior

- 5.1.4. Exterior

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Thermoset Polymer

- 5.2.2. Thermoplastic Polymer

- 5.2.3. Carbon Fiber

- 5.2.4. Glass Fiber

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. North America Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 6.1.1. Structural Assembly

- 6.1.2. Powertrain Component

- 6.1.3. Interior

- 6.1.4. Exterior

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Material Type

- 6.2.1. Thermoset Polymer

- 6.2.2. Thermoplastic Polymer

- 6.2.3. Carbon Fiber

- 6.2.4. Glass Fiber

- 6.1. Market Analysis, Insights and Forecast - by Application Type

- 7. Europe Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 7.1.1. Structural Assembly

- 7.1.2. Powertrain Component

- 7.1.3. Interior

- 7.1.4. Exterior

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Material Type

- 7.2.1. Thermoset Polymer

- 7.2.2. Thermoplastic Polymer

- 7.2.3. Carbon Fiber

- 7.2.4. Glass Fiber

- 7.1. Market Analysis, Insights and Forecast - by Application Type

- 8. Asia Pacific Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 8.1.1. Structural Assembly

- 8.1.2. Powertrain Component

- 8.1.3. Interior

- 8.1.4. Exterior

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Material Type

- 8.2.1. Thermoset Polymer

- 8.2.2. Thermoplastic Polymer

- 8.2.3. Carbon Fiber

- 8.2.4. Glass Fiber

- 8.1. Market Analysis, Insights and Forecast - by Application Type

- 9. Rest of the World Automotive Composites Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 9.1.1. Structural Assembly

- 9.1.2. Powertrain Component

- 9.1.3. Interior

- 9.1.4. Exterior

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Material Type

- 9.2.1. Thermoset Polymer

- 9.2.2. Thermoplastic Polymer

- 9.2.3. Carbon Fiber

- 9.2.4. Glass Fiber

- 9.1. Market Analysis, Insights and Forecast - by Application Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 SGL Carbon

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Toho Tenex (Teijin Ltd)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sigmatex

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Toray Industries Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Nippon Carbon Co Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nippon Sheet Glass Company Limited

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mitsubishi Chemical Carbon Fiber and Composites Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Hexcel Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Solva

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 mouldCAM Pty Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 SGL Carbon

List of Figures

- Figure 1: Global Automotive Composites Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Automotive Composites Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 3: North America Automotive Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 4: North America Automotive Composites Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 5: North America Automotive Composites Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 6: North America Automotive Composites Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Automotive Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Automotive Composites Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 9: Europe Automotive Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 10: Europe Automotive Composites Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 11: Europe Automotive Composites Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: Europe Automotive Composites Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Automotive Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Automotive Composites Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 15: Asia Pacific Automotive Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 16: Asia Pacific Automotive Composites Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 17: Asia Pacific Automotive Composites Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 18: Asia Pacific Automotive Composites Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Automotive Composites Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Automotive Composites Market Revenue (undefined), by Application Type 2025 & 2033

- Figure 21: Rest of the World Automotive Composites Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Rest of the World Automotive Composites Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 23: Rest of the World Automotive Composites Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 24: Rest of the World Automotive Composites Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Automotive Composites Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 2: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 3: Global Automotive Composites Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 5: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: Global Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 11: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 12: Global Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 19: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 20: Global Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: China Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Automotive Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 27: Global Automotive Composites Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 28: Global Automotive Composites Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: South America Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Middle East and Africa Automotive Composites Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Composites Market?

The projected CAGR is approximately 14.5%.

2. Which companies are prominent players in the Automotive Composites Market?

Key companies in the market include SGL Carbon, Toho Tenex (Teijin Ltd), Sigmatex, Toray Industries Inc, Nippon Carbon Co Ltd, Nippon Sheet Glass Company Limited, Mitsubishi Chemical Carbon Fiber and Composites Inc, Hexcel Corporation, Solva, mouldCAM Pty Ltd.

3. What are the main segments of the Automotive Composites Market?

The market segments include Application Type, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Automotive Industry Continues to Witness Steady Growth in Vehicle Production; Growing Awareness of Air Pollution and Health Concerns.

6. What are the notable trends driving market growth?

Growing Demand for Lightweight Materials.

7. Are there any restraints impacting market growth?

Shift towards Disposable Filters.

8. Can you provide examples of recent developments in the market?

In April 2021, Solvay introduces Amodel® Supreme PPA, a new line of high-performance polyphthalamide (PPA) compounds designed for demanding e-mobility and metal replacement applications. Amodel® Supreme PPA brings a higher level of performance to systems requiring exceptional thermal, mechanical, and electrical properties. Applications range from high-temperature automotive components used in electric drive units including e-motors, power electronics, housings for high-temperature electrical connectors, electric and electronic devices, and telecommunication equipment components that need excellent heat resistance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Composites Market?

To stay informed about further developments, trends, and reports in the Automotive Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence