Key Insights

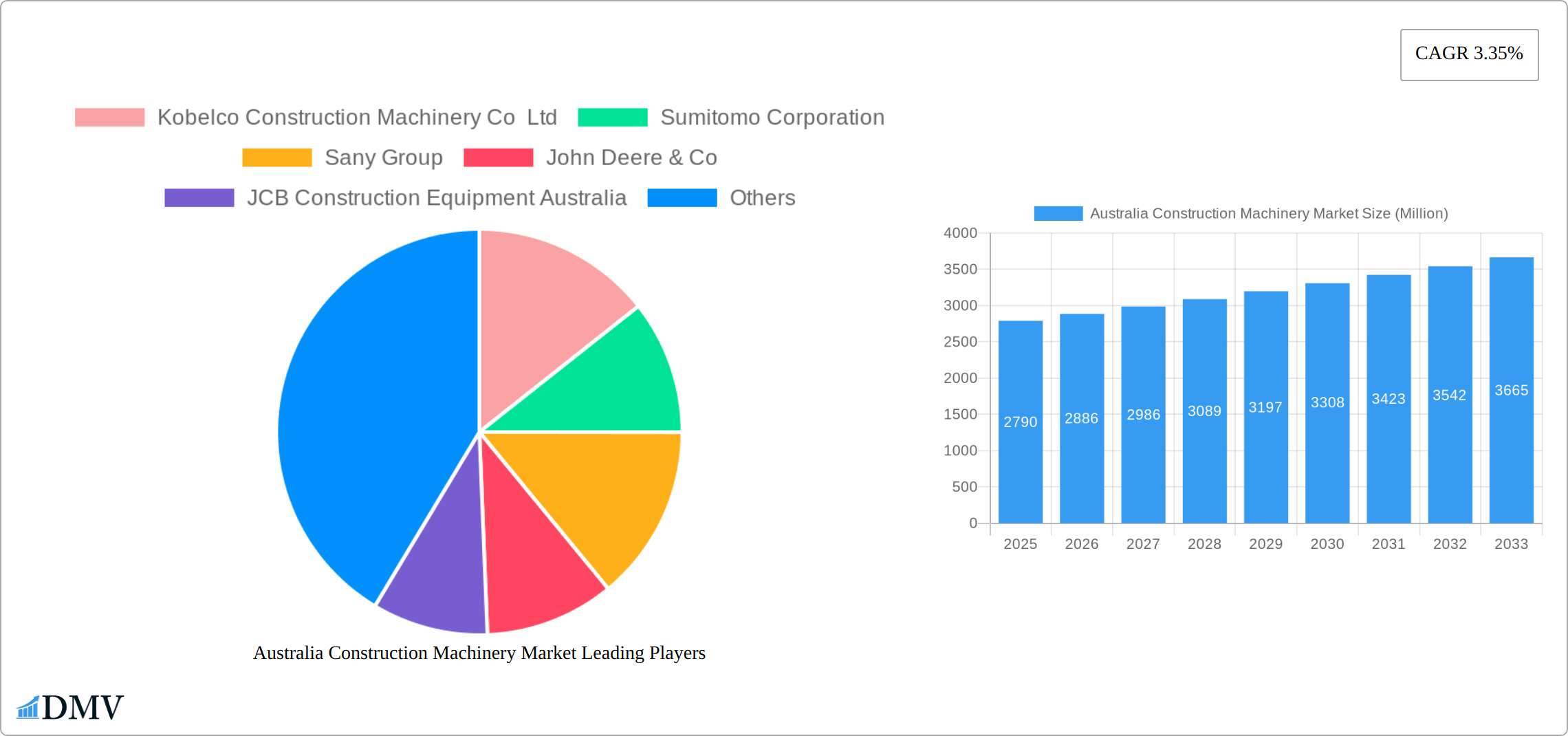

The Australian construction machinery market, valued at $2.79 billion in 2025, is projected to experience steady growth, exhibiting a compound annual growth rate (CAGR) of 3.35% from 2025 to 2033. This growth is fueled by several key factors. Significant infrastructure development projects, including road expansions, building constructions and mining activities, are driving demand for heavy machinery across various segments. Furthermore, ongoing urbanization and population growth are contributing to increased construction activity, further stimulating market expansion. The adoption of technologically advanced machinery, such as automated and digitally integrated equipment, is also influencing the market, boosting efficiency and productivity. However, potential restraints include fluctuating commodity prices impacting mining-related construction and the inherent cyclical nature of the construction industry itself, leading to periods of slower growth or even contraction. The market is segmented by application type (material handling, earth moving, transportation) and machinery type (hydraulic excavators, wheel loaders, crawler trucks, dump trucks, motor graders). Major players such as Caterpillar Inc, Komatsu Ltd, and Hitachi Construction Machinery Co Ltd dominate the landscape, competing through technological innovation, service offerings, and strategic partnerships. The Australian market's growth trajectory is expected to be positively impacted by government investment in infrastructure, creating a favorable environment for sustained market expansion over the forecast period. The competitive dynamics are characterized by a mix of international and domestic players, each striving for market share in diverse segments based on application and machinery type.

Australia Construction Machinery Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates continuous, albeit moderate, growth in the Australian construction machinery market. This sustained growth will be influenced by long-term infrastructure projects which span several years. While economic fluctuations may cause temporary slowdowns, the underlying drivers of population growth and ongoing urbanization are anticipated to provide a consistent baseline of demand. Competitive pressures will likely lead to innovations in product offerings and service packages, improving efficiency and cost-effectiveness for end-users. The market will continue to see a shift towards more technologically advanced machinery with a focus on improved safety features and reduced environmental impact. This will present opportunities for both established industry leaders and new entrants looking to leverage technological advancements. Focus on sustainable practices will be a crucial element for market success in the years ahead.

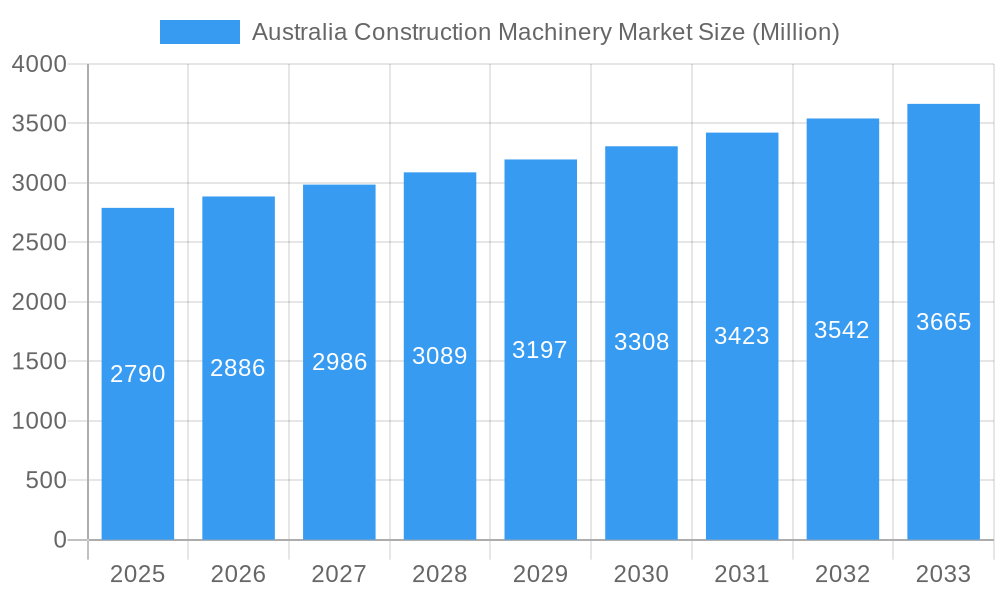

Australia Construction Machinery Market Company Market Share

Australia Construction Machinery Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Australia Construction Machinery Market, offering invaluable insights for stakeholders seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a comprehensive overview of market trends, key players, and future growth opportunities. The market is expected to reach xx Million by 2033.

Australia Construction Machinery Market Composition & Trends

This section delves into the competitive landscape of the Australian construction machinery market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with key players like Caterpillar Inc., Komatsu Ltd., and Volvo Construction Equipment holding significant market share. However, the presence of several smaller, specialized players fosters competition and innovation.

- Market Share Distribution (2024): Caterpillar Inc. (xx%), Komatsu Ltd. (xx%), Volvo Construction Equipment (xx%), Others (xx%). These figures represent estimated market shares based on available data.

- Innovation Catalysts: Government initiatives promoting infrastructure development and sustainable construction practices are driving innovation in areas such as electric machinery and automation.

- Regulatory Landscape: Stringent safety regulations and environmental standards influence product design and market entry.

- Substitute Products: The market faces limited direct substitution, although alternative construction methods and technologies can indirectly impact demand.

- End-User Profiles: Major end-users include construction companies, mining operators, and government agencies.

- M&A Activities (2019-2024): The total value of M&A deals within the Australian construction machinery market during this period is estimated at xx Million. This includes both large-scale acquisitions and smaller strategic partnerships.

Australia Construction Machinery Market Industry Evolution

The Australian construction machinery market has experienced significant growth over the past few years, driven by infrastructure projects and mining activities. The market's evolution is characterized by a shift towards technologically advanced, fuel-efficient, and environmentally friendly machinery. Increased adoption of telematics and automation solutions is enhancing operational efficiency and reducing downtime. Furthermore, evolving consumer demands, particularly towards sustainable and cost-effective solutions, are shaping product development and market strategies. The market demonstrated an average annual growth rate (AAGR) of xx% between 2019 and 2024 and it is predicted to maintain a AAGR of xx% until 2033. The adoption rate of electric excavators, for example, is projected to increase by xx% annually over the forecast period.

Leading Regions, Countries, or Segments in Australia Construction Machinery Market

The Australian construction machinery market is characterized by significant activity and growth across its diverse geographical landscape. States such as New South Wales and Queensland stand out as key hubs, propelled by extensive infrastructure development projects and the continued expansion of the mining and resources sector. The earthmoving segment commands a dominant position, largely fueled by substantial investments in large-scale national infrastructure initiatives. Within the machinery categories, hydraulic excavators hold the largest market share, demonstrating their versatility and widespread application, followed closely by wheel loaders and dump trucks, which are essential for material handling and transportation in major projects.

-

Key Drivers for the Earthmoving Segment:

- Unprecedented investments in critical infrastructure projects, including major road networks, high-speed rail, and public transport systems.

- Sustained growth and exploration within the robust mining and resource extraction industries, demanding heavy-duty earthmoving equipment.

- Proactive government policies and funding initiatives aimed at stimulating national infrastructure development and modernization.

-

Key Drivers for Hydraulic Excavators:

- Exceptional versatility, enabling their application across a wide spectrum of construction environments, from urban development to large-scale civil engineering.

- Continuous technological advancements, leading to enhanced operational efficiency, increased productivity, and improved performance capabilities.

- Consistent and high demand originating from both the thriving construction sector and the dynamic mining industry.

Australia Construction Machinery Market Product Innovations

Innovations within the Australian construction machinery market are at the forefront of driving efficiency, enhancing operator safety, and promoting environmental sustainability. A significant trend is the development and adoption of electric and hybrid machinery, reducing reliance on fossil fuels and lowering operational costs. Advancements in telematics systems are providing real-time data on machine performance, location, and maintenance needs, enabling smarter fleet management. Furthermore, cutting-edge advanced driver-assistance systems (ADAS) are being integrated to bolster safety on construction sites, minimizing accidents. Manufacturers are also concentrating on engineering machines with enhanced durability and robustness to withstand the challenging and diverse climatic and operational conditions prevalent across Australia. These innovations are typically marketed with compelling unique selling propositions, including superior fuel economy, significantly reduced emissions, and improved operator ergonomics and comfort for prolonged work periods.

Propelling Factors for Australia Construction Machinery Market Growth

The growth trajectory of the Australian construction machinery market is significantly propelled by a confluence of robust economic and strategic factors. Foremost among these are substantial government investments in infrastructure development, with a particular emphasis on transforming the nation's transport and energy networks. The mining sector's sustained activity and ambitious expansion plans continue to be a powerful engine for market growth, driving demand for specialized and heavy-duty equipment. Moreover, the rapid pace of technological advancements, including the integration of automation, artificial intelligence, and the shift towards electric powertrains, is accelerating the adoption of modern, high-performance, and eco-friendly machinery. This embrace of innovation ensures the market remains dynamic and responsive to evolving industry needs.

Obstacles in the Australia Construction Machinery Market

Despite its strong growth potential, the Australian construction machinery market encounters several notable challenges that can impact its expansion and operational efficiency. Supply chain disruptions, particularly concerning the sourcing of critical components, continue to pose a significant hurdle, leading to extended production lead times and delivery delays. Fluctuating commodity prices and broader economic uncertainties can create hesitancy in investment decisions and dampen overall market demand. Furthermore, the intense competitive landscape, marked by the presence of both established global players and emerging local manufacturers, exerts considerable pressure on pricing strategies and profit margins. Navigating these obstacles requires strategic planning and adaptability from all stakeholders in the ecosystem.

Future Opportunities in Australia Construction Machinery Market

Future opportunities in the Australian construction machinery market include the growth of renewable energy projects, which will drive demand for specialized construction machinery. The increasing adoption of autonomous and remotely operated machinery promises to improve efficiency and safety. Further, the focus on sustainable construction practices will create opportunities for manufacturers of eco-friendly equipment.

Major Players in the Australia Construction Machinery Market Ecosystem

- Kobelco Construction Machinery Co Ltd

- Sumitomo Corporation

- Sany Group

- John Deere & Co

- JCB Construction Equipment Australia

- Hitachi Construction Machinery Co Ltd

- Manitou BF SA

- Volvo Construction Equipment

- Caterpillar Inc

- Komatsu Ltd

- CNH Australia

- Wacker Neuson

- Liebherr International

- Doosan Infracore Ltd

- Shandong Lin Gong Construction Machinery

- Yanmar Construction Equipment Co Ltd

- XCMG Group

Key Developments in Australia Construction Machinery Market Industry

- October 2023: Isuzu Australia Limited (IAL) announces the launch of its new F-Series medium-duty trucks, featuring four-cylinder engines. This signifies an investment in the Australian market and reflects technological advancements.

- July 2023: Komatsu Ltd. announces the launch of its PC200LCE-11 and 210LCE-11 electric excavators, indicating a significant step towards sustainable construction practices in Australia.

Strategic Australia Construction Machinery Market Forecast

The Australian construction machinery market is poised for continued growth, driven by long-term infrastructure investments and technological innovations. The increasing adoption of sustainable and efficient machinery will further shape market dynamics. The market's expansion will be underpinned by ongoing government support, industry collaboration, and technological advancements, creating lucrative opportunities for both established and emerging players.

Australia Construction Machinery Market Segmentation

-

1. Application Type

- 1.1. Material Handling

- 1.2. Earth Moving

- 1.3. Transportation

-

2. Machinery Type

- 2.1. Hydraulic Excavators

- 2.2. Wheel Loaders

- 2.3. Crawler Trucks

- 2.4. Dump Trucks

- 2.5. Motor Graders

Australia Construction Machinery Market Segmentation By Geography

- 1. Australia

Australia Construction Machinery Market Regional Market Share

Geographic Coverage of Australia Construction Machinery Market

Australia Construction Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Infrastructure Development and Construction Activities to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Regulations and Internal Trade Policies May Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Infrastructure Development and Construction Activities to Drive the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Construction Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Material Handling

- 5.1.2. Earth Moving

- 5.1.3. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Machinery Type

- 5.2.1. Hydraulic Excavators

- 5.2.2. Wheel Loaders

- 5.2.3. Crawler Trucks

- 5.2.4. Dump Trucks

- 5.2.5. Motor Graders

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sumitomo Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sany Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 John Deere & Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JCB Construction Equipment Australia

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hitachi Construction Machinery Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Manitou BF SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Volvo Construction Equipment

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Caterpillar Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komatsu Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CNH Australia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Wacker Neuson

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Liebherr International

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Doosan Infracore Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Shandong Lin gong Construction Machinery*List Not Exhaustive

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Yanmar Construction Equipment Co Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 XCMG Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery Co Ltd

List of Figures

- Figure 1: Australia Construction Machinery Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Construction Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Construction Machinery Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Australia Construction Machinery Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 3: Australia Construction Machinery Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Construction Machinery Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 5: Australia Construction Machinery Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 6: Australia Construction Machinery Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Construction Machinery Market?

The projected CAGR is approximately 3.35%.

2. Which companies are prominent players in the Australia Construction Machinery Market?

Key companies in the market include Kobelco Construction Machinery Co Ltd, Sumitomo Corporation, Sany Group, John Deere & Co, JCB Construction Equipment Australia, Hitachi Construction Machinery Co Ltd, Manitou BF SA, Volvo Construction Equipment, Caterpillar Inc, Komatsu Ltd, CNH Australia, Wacker Neuson, Liebherr International, Doosan Infracore Ltd, Shandong Lin gong Construction Machinery*List Not Exhaustive, Yanmar Construction Equipment Co Ltd, XCMG Group.

3. What are the main segments of the Australia Construction Machinery Market?

The market segments include Application Type, Machinery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Infrastructure Development and Construction Activities to Drive the Market.

6. What are the notable trends driving market growth?

Rising Infrastructure Development and Construction Activities to Drive the Market..

7. Are there any restraints impacting market growth?

Regulations and Internal Trade Policies May Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: Isuzu Australia Limited (IAL) has recently disclosed that the initial release of its advanced truck range in Australia will consist of the new medium-duty F Series models equipped with four-cylinder engines. The unveiling of the F-Series and its forthcoming model launch was announced at the 2023 Japan Mobility Show, where IAL actively participated. This event served as a platform for both commemorating the impending introduction of innovative models in the Australian market and gaining valuable insights into the latest technological advancements and industry updates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Construction Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Construction Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Construction Machinery Market?

To stay informed about further developments, trends, and reports in the Australia Construction Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence