Key Insights

The Asia-Pacific mobile crane market is projected for robust expansion, driven by significant investments in construction, infrastructure development, and industrialization. With a Compound Annual Growth Rate (CAGR) of 6.3%, the market is set to reach a size of 26.52 billion by 2025. Key growth catalysts include accelerating urbanization, large-scale infrastructure projects like ports and railways, and the escalating demand for efficient material handling solutions in sectors such as mining and energy. Segment analysis highlights strong demand for wheel-mounted, truck-mounted, and straddle cranes, attributed to their versatility and site adaptability. China, Japan, India, and South Korea are primary growth engines, reflecting substantial infrastructure and industrial investments. The market is also propelled by the adoption of advanced, safer, and more efficient crane technologies. Potential challenges include volatile raw material prices and supply chain disruptions.

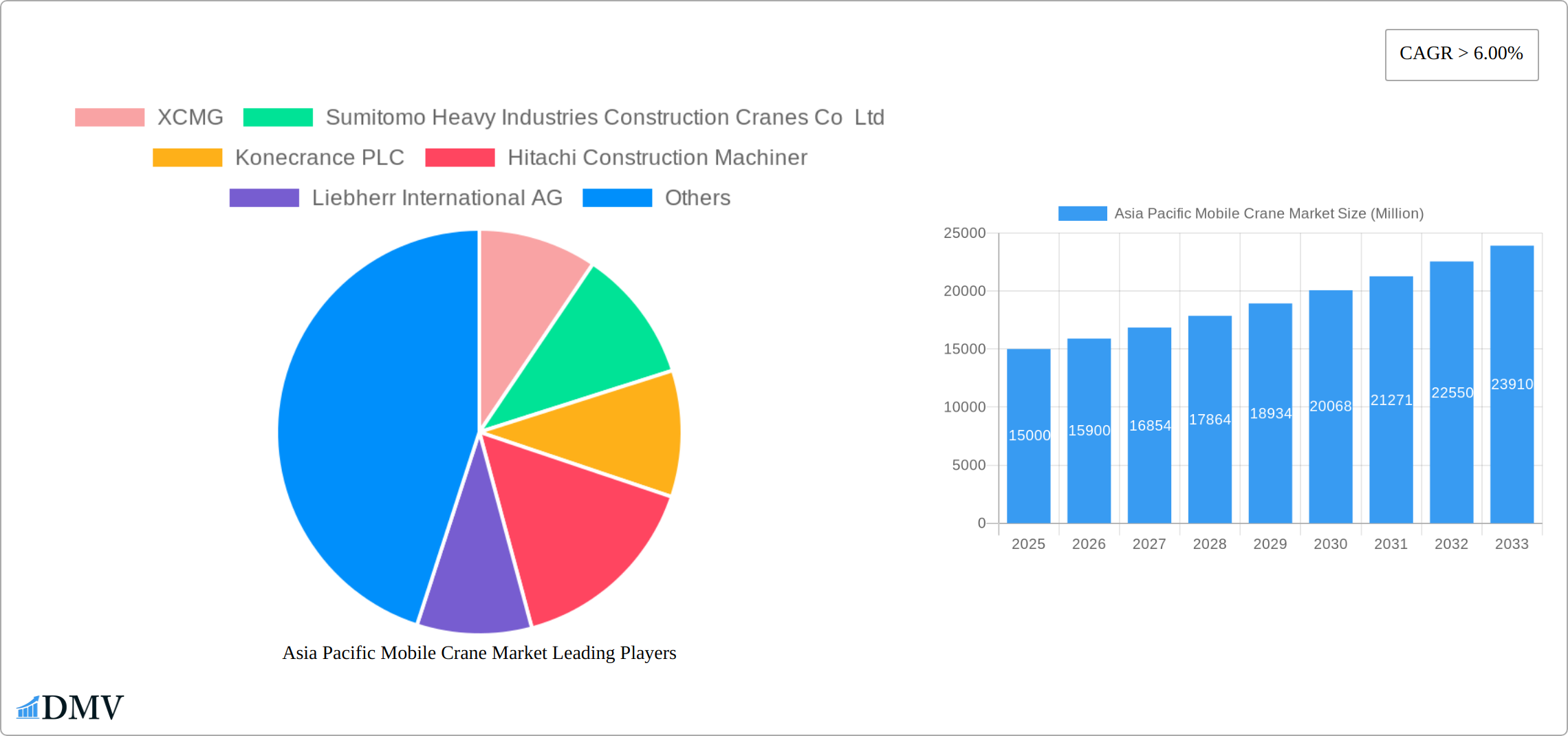

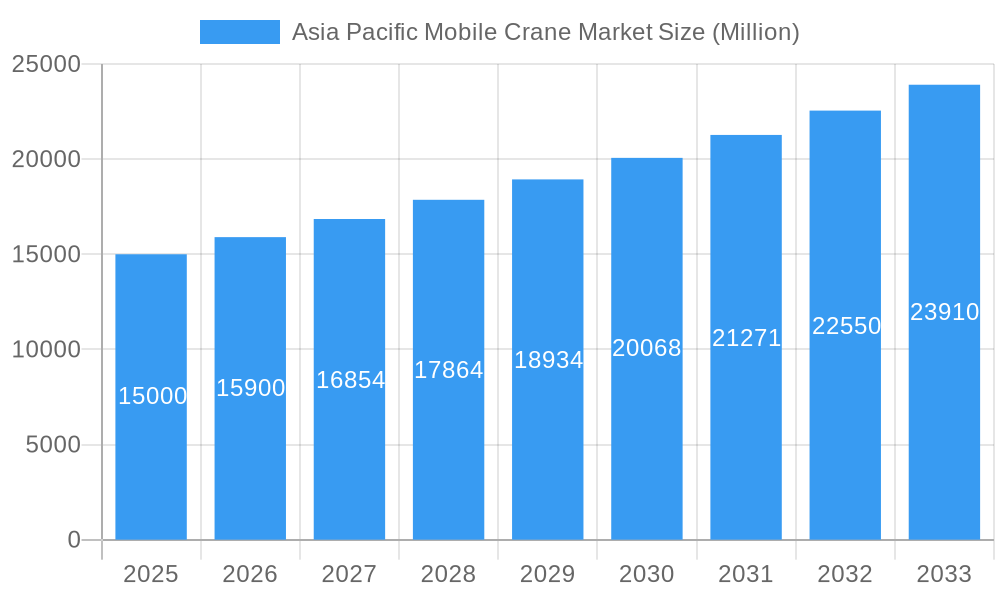

Asia Pacific Mobile Crane Market Market Size (In Billion)

The Asia-Pacific mobile crane market is anticipated to experience sustained growth, fueled by government-led initiatives promoting infrastructure development and industrial modernization. The integration of automation and remote control technologies is expected to boost efficiency and safety. Furthermore, the increasing focus on sustainable construction and eco-friendly equipment will shape market dynamics. Intense competition among leading manufacturers like XCMG, Sumitomo, Konecranes, and Liebherr is fostering innovation, leading to advanced crane technologies and improved product offerings for end-users. Market segmentation by application (construction, mining, marine, industrial) presents significant opportunities for specialized crane providers.

Asia Pacific Mobile Crane Market Company Market Share

Asia Pacific Mobile Crane Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Asia Pacific mobile crane market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Asia Pacific Mobile Crane Market Composition & Trends

This section delves into the intricate composition of the Asia Pacific mobile crane market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market exhibits a moderately concentrated structure, with the top five players holding approximately xx% of the market share in 2025.

- Market Share Distribution (2025): XCMG (xx%), Sumitomo Heavy Industries (xx%), Konecranes PLC (xx%), Hitachi Construction Machinery (xx%), Liebherr International AG (xx%), Others (xx%).

- Innovation Catalysts: The increasing adoption of technologically advanced cranes, such as electric and hybrid models, is driving market innovation. Furthermore, the integration of IoT and AI technologies is enhancing operational efficiency and safety.

- Regulatory Landscape: Stringent safety regulations and emission norms are shaping market dynamics, pushing manufacturers to develop more sustainable and compliant products.

- Substitute Products: While mobile cranes remain dominant, alternative lifting solutions, such as tower cranes and aerial work platforms, pose some competitive pressure in specific applications.

- End-User Profiles: The construction, mining, and industrial sectors represent major end-user segments, while marine and offshore applications are witnessing significant growth.

- M&A Activities: The past five years have witnessed xx M&A deals in the Asia Pacific mobile crane market, with a total deal value of approximately xx Million, reflecting strategic consolidation within the industry.

Asia Pacific Mobile Crane Market Industry Evolution

This section offers a thorough examination of the Asia Pacific mobile crane market's evolution, analyzing growth trajectories, technological advancements, and evolving consumer demands. From 2019 to 2024, the market exhibited a CAGR of xx%, driven primarily by robust infrastructure development across the region. The forecast period (2025-2033) anticipates a continued growth trajectory, fueled by factors such as increasing urbanization, industrial expansion, and rising investments in renewable energy projects. Technological advancements, including the incorporation of telematics, remote diagnostics, and automation features, are significantly impacting operational efficiency and safety standards, leading to a higher adoption rate of technologically advanced cranes. The demand for environmentally friendly, low-emission mobile cranes is also rising in response to stricter environmental regulations.

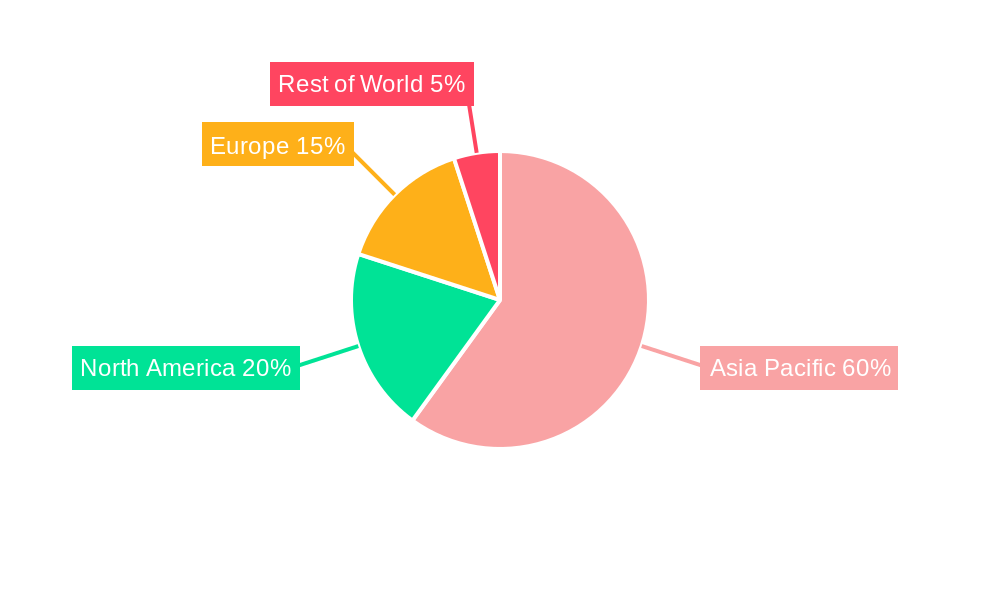

Leading Regions, Countries, or Segments in Asia Pacific Mobile Crane Market

This section highlights the key regional players, dominant countries, and significant segments driving the Asia Pacific mobile crane market. The market is characterized by robust demand stemming from rapid economic development and extensive infrastructure projects across the region.

Dominant Segments:

- Type: Wheel-mounted mobile cranes are projected to maintain their leadership, expected to capture approximately 65-70% of the market share by 2027. Their superior mobility, cost-effectiveness for shorter-term projects, and adaptability across diverse terrains make them the preferred choice for a wide array of applications. Rough-terrain cranes are also witnessing steady growth due to their capabilities in challenging construction sites.

- Application Type: The construction sector continues to be the largest consumer of mobile cranes, propelled by massive investments in urban infrastructure, residential and commercial building, and transportation networks. The industrial sector, particularly manufacturing and energy, also presents a significant and growing demand for heavy-lift capabilities offered by mobile cranes.

Key Driving Countries and Regions:

- China: Remains the undisputed powerhouse, with its ongoing rapid urbanization, massive infrastructure development initiatives (such as Belt and Road Initiative projects), and a burgeoning manufacturing sector contributing to sustained demand.

- India: Experiencing substantial growth driven by government initiatives like "Smart Cities Mission," "Make in India," and significant investments in roads, railways, and airports. The expanding industrial base further bolsters crane demand.

- Southeast Asia: Countries like Indonesia, Vietnam, and the Philippines are witnessing increased demand due to ongoing infrastructure upgrades, foreign direct investment in manufacturing, and development of port facilities and energy projects.

- South Korea and Japan: While mature markets, they continue to contribute through modernization projects, renewal of aging infrastructure, and demand for specialized lifting solutions in industries like shipbuilding and manufacturing.

Dominance Factors: The market's regional and segmental dominance is underpinned by a confluence of factors, including accelerated economic growth, substantial public and private sector investments in infrastructure, supportive government policies promoting industrialization and urban development, and an increasing trend towards project-based construction requiring flexible and mobile lifting equipment.

Asia Pacific Mobile Crane Market Product Innovations

Recent years have witnessed significant product innovations within the Asia Pacific mobile crane market. Manufacturers are focusing on enhancing lifting capacity, improving operational efficiency, and integrating advanced safety features. The introduction of electric and hybrid mobile cranes addresses growing environmental concerns, while telematics systems improve fleet management and reduce downtime. These advancements enhance productivity, reduce operational costs, and improve safety standards.

Propelling Factors for Asia Pacific Mobile Crane Market Growth

The robust expansion of the Asia Pacific mobile crane market is propelled by several significant factors:

- Technological Advancements and Innovation: The industry is witnessing a paradigm shift with the integration of cutting-edge technologies. This includes telematics for real-time monitoring and fleet management, remote diagnostics reducing downtime and maintenance costs, GPS tracking for improved logistics, and the increasing adoption of automation and operator assistance systems to enhance precision, safety, and operational efficiency. The development of hybrid and electric-powered cranes is also gaining traction.

- Sustained Economic Growth and Urbanization: The strong and consistent economic growth observed across many Asia Pacific nations continues to fuel unprecedented levels of urbanization and industrial expansion. This translates directly into a higher demand for construction of residential buildings, commercial complexes, transportation infrastructure, and industrial facilities, all of which heavily rely on mobile cranes.

- Government Initiatives and Infrastructure Spending: Governments across the region are prioritizing and investing heavily in large-scale infrastructure development projects. Initiatives focused on building new cities, upgrading transportation networks (high-speed rail, airports, ports), and expanding renewable energy projects create a sustained and significant demand for mobile cranes of various capacities.

- Increasing Project Complexity and Scale: The trend towards constructing larger and more complex structures, such as supertall buildings, massive industrial plants, and intricate bridge designs, necessitates the use of advanced and high-capacity mobile cranes, further driving market growth.

- Rise in Industrial and Manufacturing Activities: The expansion and modernization of manufacturing facilities, coupled with growth in sectors like oil & gas, mining, and power generation, require specialized lifting equipment for installation, maintenance, and expansion, thereby contributing to the demand for mobile cranes.

Obstacles in the Asia Pacific Mobile Crane Market

Several factors hinder the growth of the Asia Pacific mobile crane market:

- Supply Chain Disruptions: Global supply chain disruptions can impact the availability of components and increase manufacturing costs.

- Intense Competition: The market is highly competitive, with numerous established players and new entrants vying for market share.

- Fluctuations in Raw Material Prices: Fluctuations in steel and other raw material prices impact production costs.

Future Opportunities in Asia Pacific Mobile Crane Market

The Asia Pacific mobile crane market is poised for continued growth, with several promising avenues for future expansion and innovation:

- Emerging and Developing Markets: While China and India are dominant, significant untapped potential lies in less-developed but rapidly industrializing markets within Southeast Asia, Central Asia, and Oceania. Focusing on these regions with tailored solutions can unlock substantial growth.

- Technological Advancements and Digitalization: The ongoing development and adoption of innovative technologies present immense opportunities. This includes the further integration of IoT (Internet of Things) for predictive maintenance, the exploration and implementation of autonomous crane operations for hazardous or repetitive tasks, and the development of advanced virtual reality (VR) and augmented reality (AR) for operator training and site planning.

- Sustainable and Eco-Friendly Solutions: With a growing global emphasis on environmental sustainability, there is a rising demand for environmentally friendly and energy-efficient mobile cranes. Opportunities exist in developing and marketing hybrid, electric, and alternative fuel-powered cranes, as well as those designed for reduced noise pollution and emissions.

- Specialized and High-Capacity Cranes: The trend towards increasingly complex and large-scale construction projects will drive demand for specialized mobile cranes, such as ultra-high capacity all-terrain cranes, lattice boom cranes, and compact crawler cranes for confined spaces.

- Aftermarket Services and Rental Market: The growing complexity of cranes and the need for efficient project execution create opportunities in expanding aftermarket services, including maintenance, repair, parts supply, and training. The rental market, offering flexibility and cost-effectiveness to end-users, is also expected to see significant expansion.

- Data Analytics and AI Integration: Leveraging data collected through telematics and sensors to provide advanced analytics for operational optimization, risk management, and route planning will be a key area for service providers.

Major Players in the Asia Pacific Mobile Crane Market Ecosystem

- XCMG (Xuzhou Construction Machinery Group Co., Ltd.)

- Sumitomo Heavy Industries Construction Cranes Co., Ltd.

- Konecranes PLC

- Hitachi Construction Machinery Co., Ltd.

- Liebherr International AG

- Cargotec Corporation (through its Hiab brand)

- Kobelco Cranes Co., Ltd.

- Tadano Ltd

- Terex Corporation

- Sany Heavy Industry Co., Ltd.

- Zoomlion Heavy Industry Science and Technology Co., Ltd.

- Manitowoc Company, Inc.

Key Developments in Asia Pacific Mobile Crane Market Industry

- 2023-Q3: XCMG launched a new range of electric mobile cranes.

- 2022-Q4: Sumitomo Heavy Industries and Konecranes announced a joint venture.

- 2021-Q2: Liebherr introduced a new generation of its all-terrain mobile cranes with enhanced safety features. (Further developments can be added here as they occur)

Strategic Asia Pacific Mobile Crane Market Forecast

The Asia Pacific mobile crane market is poised for sustained growth, fueled by ongoing infrastructure development, industrial expansion, and technological advancements. The increasing adoption of technologically advanced cranes, along with favorable government policies, will further drive market expansion. The focus on sustainable solutions and the exploration of emerging markets will present significant opportunities for market players in the coming years.

Asia Pacific Mobile Crane Market Segmentation

-

1. Type

- 1.1. Wheel Mounted Mobile Crane

- 1.2. Commercial truck mounted Crane

- 1.3. Side Boom

- 1.4. Straddle Crane

- 1.5. Railroad Crane

- 1.6. Others

-

2. Application Type

- 2.1. Construction

- 2.2. Mining & Excavation

- 2.3. Marine & Offshore

- 2.4. Industrial Applications

- 2.5. Others

Asia Pacific Mobile Crane Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asia Pacific Mobile Crane Market Regional Market Share

Geographic Coverage of Asia Pacific Mobile Crane Market

Asia Pacific Mobile Crane Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electrification of Construction Equipment May Propel the Market Growth

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Government Initiatives Driving Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wheel Mounted Mobile Crane

- 5.1.2. Commercial truck mounted Crane

- 5.1.3. Side Boom

- 5.1.4. Straddle Crane

- 5.1.5. Railroad Crane

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Construction

- 5.2.2. Mining & Excavation

- 5.2.3. Marine & Offshore

- 5.2.4. Industrial Applications

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wheel Mounted Mobile Crane

- 6.1.2. Commercial truck mounted Crane

- 6.1.3. Side Boom

- 6.1.4. Straddle Crane

- 6.1.5. Railroad Crane

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Construction

- 6.2.2. Mining & Excavation

- 6.2.3. Marine & Offshore

- 6.2.4. Industrial Applications

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wheel Mounted Mobile Crane

- 7.1.2. Commercial truck mounted Crane

- 7.1.3. Side Boom

- 7.1.4. Straddle Crane

- 7.1.5. Railroad Crane

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Construction

- 7.2.2. Mining & Excavation

- 7.2.3. Marine & Offshore

- 7.2.4. Industrial Applications

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wheel Mounted Mobile Crane

- 8.1.2. Commercial truck mounted Crane

- 8.1.3. Side Boom

- 8.1.4. Straddle Crane

- 8.1.5. Railroad Crane

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Construction

- 8.2.2. Mining & Excavation

- 8.2.3. Marine & Offshore

- 8.2.4. Industrial Applications

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wheel Mounted Mobile Crane

- 9.1.2. Commercial truck mounted Crane

- 9.1.3. Side Boom

- 9.1.4. Straddle Crane

- 9.1.5. Railroad Crane

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Construction

- 9.2.2. Mining & Excavation

- 9.2.3. Marine & Offshore

- 9.2.4. Industrial Applications

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia Pacific Mobile Crane Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wheel Mounted Mobile Crane

- 10.1.2. Commercial truck mounted Crane

- 10.1.3. Side Boom

- 10.1.4. Straddle Crane

- 10.1.5. Railroad Crane

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Construction

- 10.2.2. Mining & Excavation

- 10.2.3. Marine & Offshore

- 10.2.4. Industrial Applications

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 XCMG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sumitomo Heavy Industries Construction Cranes Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Konecrance PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Construction Machiner

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Liebherr International AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cargotec

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kobelco Cranes Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tadano Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Terex Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sany

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 XCMG

List of Figures

- Figure 1: Asia Pacific Mobile Crane Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Mobile Crane Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 9: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 12: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 15: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Type 2020 & 2033

- Table 17: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 18: Asia Pacific Mobile Crane Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Mobile Crane Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Asia Pacific Mobile Crane Market?

Key companies in the market include XCMG, Sumitomo Heavy Industries Construction Cranes Co Ltd, Konecrance PLC, Hitachi Construction Machiner, Liebherr International AG, Cargotec, Kobelco Cranes Co Ltd, Tadano Ltd, Terex Corporation, Sany.

3. What are the main segments of the Asia Pacific Mobile Crane Market?

The market segments include Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.52 billion as of 2022.

5. What are some drivers contributing to market growth?

Electrification of Construction Equipment May Propel the Market Growth.

6. What are the notable trends driving market growth?

Government Initiatives Driving Growth.

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Mobile Crane Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Mobile Crane Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Mobile Crane Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Mobile Crane Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence