Key Insights

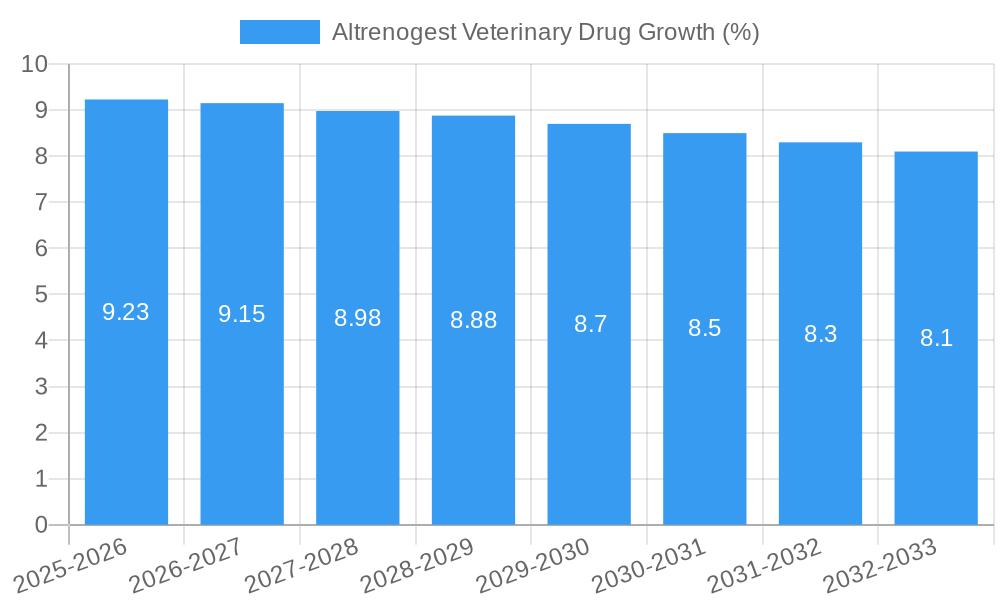

The global Altrenogest veterinary drug market is poised for significant expansion, projected to reach a substantial market size with a robust Compound Annual Growth Rate (CAGR). This growth is primarily fueled by the increasing demand for effective reproductive health management in livestock, particularly for pigs and horses. The rising global meat consumption necessitates optimized breeding cycles and improved litter sizes in swine operations, where Altrenogest plays a crucial role in estrus synchronization and cycle regulation. Similarly, in the equine sector, its application in managing reproductive cycles for breeding purposes contributes to market vitality. The market is characterized by a growing emphasis on proactive animal health management, driven by both economic considerations for producers and advancements in veterinary pharmaceuticals. Innovations in drug delivery systems, such as oral solutions and injections, are enhancing convenience and efficacy, further stimulating market adoption.

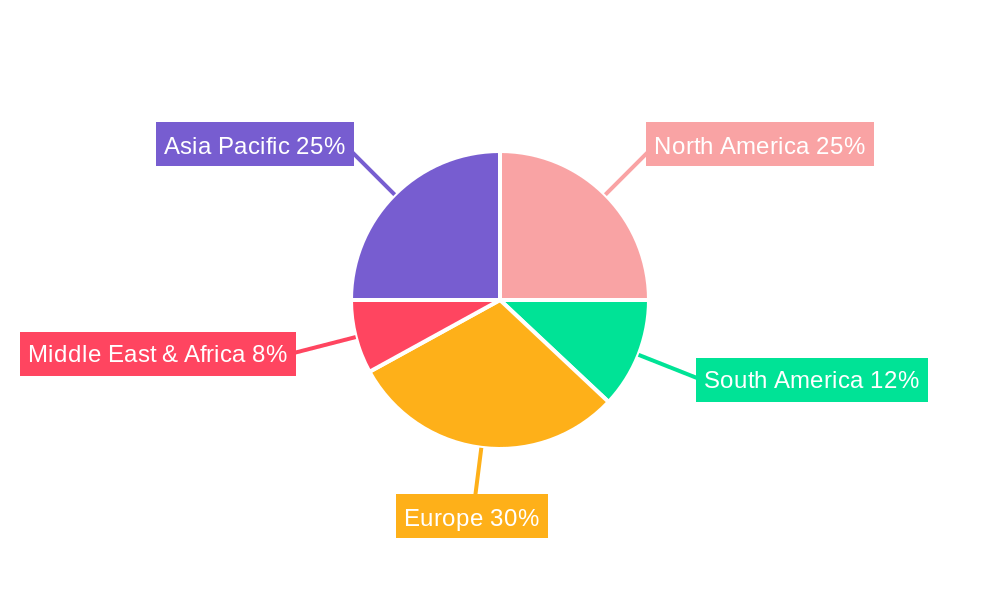

However, the market faces certain restraints that could temper its growth trajectory. Stringent regulatory approvals for veterinary drugs, coupled with the high cost of research and development, present ongoing challenges. Furthermore, the availability of alternative estrus synchronization methods and the growing trend towards alternative protein sources could influence demand dynamics. Despite these hurdles, the expanding global livestock population, particularly in emerging economies, coupled with increasing awareness among veterinarians and farmers regarding the benefits of reproductive management, are expected to drive sustained market growth. Key regions like Asia Pacific and Europe are anticipated to be significant contributors to market expansion, owing to their substantial livestock industries and increasing investments in animal health. The competitive landscape features a mix of established global players and emerging regional manufacturers, all vying for market share through product innovation and strategic partnerships.

Altrenogest Veterinary Drug Market Composition & Trends

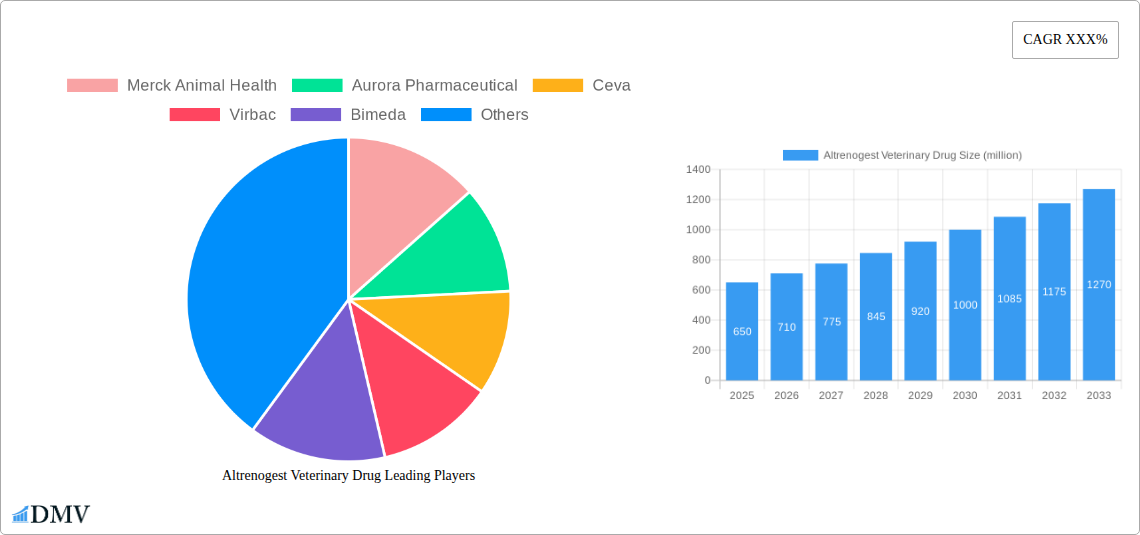

The Altrenogest veterinary drug market demonstrates a moderately concentrated landscape, driven by a combination of established global players and emerging regional manufacturers. Innovation catalysts are primarily focused on enhancing drug delivery systems, improving efficacy in reproductive management for livestock, and expanding therapeutic applications. The regulatory landscape is complex, with stringent approval processes in major veterinary markets influencing market entry and product development timelines. Substitute products, while present in reproductive health, offer varying degrees of efficacy and cost-effectiveness, positioning Altrenogest strategically within its niche. End-user profiles are diverse, encompassing large-scale pig and horse farming operations seeking to optimize breeding cycles and improve herd management. Merger and acquisition (M&A) activities, although not yet at a massive scale, signal strategic consolidations to expand market reach and product portfolios. Key M&A deal values are estimated to be in the tens of millions, reflecting the targeted nature of these transactions.

- Market Share Distribution: Leading companies hold an estimated collective market share of approximately 70%, with the remaining 30% distributed among smaller and regional players.

- Innovation Focus: Research and development efforts are concentrated on long-acting formulations and synergistic combinations to enhance reproductive synchronization.

- Regulatory Hurdles: Significant investments, often in the millions, are required for comprehensive clinical trials and regulatory submissions in key geographical regions.

- Substitute Product Analysis: While progesterone-based alternatives exist, Altrenogest's specific hormonal action and established track record offer distinct advantages in certain applications.

- M&A Activity: The past few years have seen strategic acquisitions aimed at strengthening distribution networks and broadening product offerings within the animal reproductive health segment.

Altrenogest Veterinary Drug Industry Evolution

The Altrenogest veterinary drug industry has witnessed a steady evolutionary growth trajectory over the historical period of 2019–2024, characterized by increasing adoption rates in its core applications, particularly within the swine and equine sectors. The market growth rate during this period has been approximately 5% annually, a testament to the increasing demand for efficient reproductive management solutions in commercial animal husbandry. Technological advancements have played a crucial role, with improvements in drug formulation leading to more convenient and effective administration methods. For instance, the development of oral solutions and improved injection techniques have significantly enhanced user-friendliness and compliance among veterinarians and animal owners. Consumer demands have shifted towards solutions that not only improve reproductive outcomes but also contribute to overall animal welfare and economic efficiency. This has led to a greater emphasis on the precision and predictability of estrus synchronization, where Altrenogest has proven to be a valuable tool. The estimated market size in the base year of 2025 is projected to be over one thousand million dollars, with a projected compound annual growth rate (CAGR) of approximately 6% anticipated throughout the forecast period of 2025–2033. This sustained growth is underpinned by ongoing research into novel applications and the expansion of its use in emerging markets. The industry's resilience is further demonstrated by its ability to navigate economic fluctuations and adapt to evolving agricultural practices, consistently delivering value to the animal health sector. The continuous investment in research and development, coupled with a growing awareness of the economic benefits derived from optimized breeding programs, positions Altrenogest for continued success.

Leading Regions, Countries, or Segments in Altrenogest Veterinary Drug

The swine application segment has emerged as the dominant force within the Altrenogest veterinary drug market, driven by several converging factors. In terms of Application, pigs represent a substantial portion of the global livestock industry, and optimizing their reproductive cycles is paramount for profitability and efficiency in pork production. This translates into a high demand for effective estrus synchronization and management tools like Altrenogest. The Type of administration also plays a critical role in its dominance, with oral solutions and injections being widely adopted due to their ease of use and efficacy in large herds. The North American and European regions are particularly strong contributors to this dominance, owing to advanced agricultural practices and a significant presence of large-scale pig farming operations.

- Dominant Region: North America. This region's leadership is fueled by a highly industrialized swine sector, significant investment in animal health technologies, and supportive regulatory frameworks for veterinary pharmaceuticals. The adoption of advanced breeding technologies and herd management practices drives the demand for Altrenogest.

- Key Drivers in Swine Application:

- Economic Imperative: The profitability of pig farming is directly linked to efficient reproduction, making estrus synchronization a critical management strategy.

- Technological Adoption: Pig producers are quick to adopt technologies that improve productivity and reduce costs, including advanced hormonal treatments.

- Regulatory Support: Favorable regulatory environments in major pork-producing countries facilitate the approval and widespread use of veterinary drugs like Altrenogest.

- Disease Prevention: Optimized breeding cycles can indirectly contribute to herd health by reducing stress associated with irregular reproductive patterns.

- Dominant Type: Injection. While oral solutions are gaining traction, the injection route for Altrenogest remains highly favored due to its rapid bioavailability, precise dosage control, and minimal risk of degradation compared to oral administration in complex digestive systems. This ensures predictable and reliable estrus synchronization results, crucial for large-scale breeding programs. The forecast for the injection segment suggests continued leadership throughout the study period.

- Emerging Markets for Horses: While not as dominant as swine, the equine sector represents a significant and growing market. The use of Altrenogest in managing reproductive cycles in mares for breeding purposes is increasing, particularly in regions with a strong equestrian culture and professional breeding operations. The market for horses is projected to see a healthy CAGR of approximately 5.5% over the forecast period.

Altrenogest Veterinary Drug Product Innovations

Product innovations in Altrenogest veterinary drugs are increasingly focused on enhancing user convenience and treatment efficacy. Advanced formulation techniques have led to the development of longer-acting injectable solutions, reducing the frequency of administration and improving compliance in busy animal husbandry settings. Furthermore, research is exploring combination therapies that synergistically work with Altrenogest to optimize reproductive outcomes, potentially leading to higher conception rates and more predictable estrus cycles. These advancements are crucial for maximizing economic returns in large-scale livestock operations. The unique selling proposition of these innovations lies in their ability to offer more precise reproductive control and reduce labor costs for farmers.

Propelling Factors for Altrenogest Veterinary Drug Growth

Several key factors are propelling the growth of the Altrenogest veterinary drug market. Firstly, the increasing global demand for animal protein necessitates more efficient livestock reproduction, making Altrenogest an essential tool for optimizing breeding cycles in pigs and horses. Secondly, technological advancements in veterinary pharmaceuticals, particularly in drug formulation and delivery systems, are enhancing the efficacy and user-friendliness of Altrenogest. Thirdly, growing awareness among farmers about the economic benefits of estrus synchronization, such as reduced farrowing intervals and improved litter sizes, is driving adoption. Lastly, favorable regulatory environments and supportive government policies in key animal health markets are facilitating the market entry and widespread use of Altrenogest.

Obstacles in the Altrenogest Veterinary Drug Market

Despite its promising growth, the Altrenogest veterinary drug market faces several obstacles. Stringent regulatory approval processes in various countries can lead to extended timelines and significant financial investments for market entry, potentially hindering the availability of new products. Fluctuations in raw material prices and supply chain disruptions can impact production costs and product availability, affecting market stability. Furthermore, the presence of alternative reproductive management strategies and generic competitors can exert price pressures and limit market share expansion. The initial cost of treatment, though often justified by long-term economic benefits, can also be a barrier for smaller producers with limited capital.

Future Opportunities in Altrenogest Veterinary Drug

The Altrenogest veterinary drug market is ripe with future opportunities. Expansion into emerging markets in Asia and South America, where livestock production is rapidly growing, presents a significant avenue for growth. Further research and development into novel drug delivery systems, such as sustained-release implants, could enhance convenience and efficacy, opening new market segments. Exploring new therapeutic applications beyond reproductive management, for instance, in specific hormonal therapies for other animal health conditions, could diversify the product portfolio. The increasing focus on animal welfare and precision agriculture also creates opportunities for Altrenogest-based solutions that offer predictable and humane reproductive control.

Major Players in the Altrenogest Veterinary Drug Ecosystem

- Merck Animal Health

- Aurora Pharmaceutical

- Ceva

- Virbac

- Bimeda

- Tianjin Zhongsheng Challenge Biotechnology

- Cixi No.2 Hormones Factory

- Ningbo Sansheng

- Ningbo Creator

- Qilu Animal Health Products

Key Developments in Altrenogest Veterinary Drug Industry

- 2023: Launch of a new extended-release injectable formulation of Altrenogest by a leading global animal health company, aiming to improve convenience for swine producers.

- 2022: Increased M&A activity with a major player acquiring a regional distributor to expand its market reach in Eastern Europe.

- 2021: Significant investment in R&D for novel Altrenogest combinations to enhance efficacy in equine breeding programs.

- 2020: Regulatory approval for an oral solution of Altrenogest in a key South American market, opening up new avenues for livestock producers.

- 2019: Introduction of enhanced quality control measures by several manufacturers to ensure product consistency and efficacy.

Strategic Altrenogest Veterinary Drug Market Forecast

The Altrenogest veterinary drug market is poised for sustained growth, driven by the increasing demand for efficient reproductive management in the global livestock industry. Strategic initiatives focusing on product innovation, particularly in advanced drug delivery systems, will be critical for capturing market share. The expansion into high-growth emerging markets, coupled with ongoing research into new applications, will further fuel market potential. The market is expected to witness a significant upward trajectory, with an estimated market value exceeding two thousand million dollars by 2033. The commitment of major players to research and development, alongside supportive regulatory frameworks, will ensure Altrenogest remains a vital tool in animal health and production.

Altrenogest Veterinary Drug Segmentation

-

1. Application

- 1.1. Pigs

- 1.2. Horses

- 1.3. Others

-

2. Type

- 2.1. Oral Solution

- 2.2. Injection

- 2.3. Tablet

Altrenogest Veterinary Drug Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Altrenogest Veterinary Drug REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Altrenogest Veterinary Drug Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Pigs

- 5.1.2. Horses

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Oral Solution

- 5.2.2. Injection

- 5.2.3. Tablet

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Altrenogest Veterinary Drug Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Pigs

- 6.1.2. Horses

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Oral Solution

- 6.2.2. Injection

- 6.2.3. Tablet

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Altrenogest Veterinary Drug Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Pigs

- 7.1.2. Horses

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Oral Solution

- 7.2.2. Injection

- 7.2.3. Tablet

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Altrenogest Veterinary Drug Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Pigs

- 8.1.2. Horses

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Oral Solution

- 8.2.2. Injection

- 8.2.3. Tablet

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Altrenogest Veterinary Drug Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Pigs

- 9.1.2. Horses

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Oral Solution

- 9.2.2. Injection

- 9.2.3. Tablet

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Altrenogest Veterinary Drug Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Pigs

- 10.1.2. Horses

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Oral Solution

- 10.2.2. Injection

- 10.2.3. Tablet

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Merck Animal Health

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aurora Pharmaceutical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ceva

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Virbac

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bimeda

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tianjin Zhongsheng Challenge Biotechnology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cixi No.2 Hormones Factory

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ningbo Sansheng

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ningbo Creator

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Qilu Animal Health Products

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Merck Animal Health

List of Figures

- Figure 1: Global Altrenogest Veterinary Drug Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Altrenogest Veterinary Drug Revenue (million), by Application 2024 & 2032

- Figure 3: North America Altrenogest Veterinary Drug Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Altrenogest Veterinary Drug Revenue (million), by Type 2024 & 2032

- Figure 5: North America Altrenogest Veterinary Drug Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Altrenogest Veterinary Drug Revenue (million), by Country 2024 & 2032

- Figure 7: North America Altrenogest Veterinary Drug Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Altrenogest Veterinary Drug Revenue (million), by Application 2024 & 2032

- Figure 9: South America Altrenogest Veterinary Drug Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Altrenogest Veterinary Drug Revenue (million), by Type 2024 & 2032

- Figure 11: South America Altrenogest Veterinary Drug Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Altrenogest Veterinary Drug Revenue (million), by Country 2024 & 2032

- Figure 13: South America Altrenogest Veterinary Drug Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Altrenogest Veterinary Drug Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Altrenogest Veterinary Drug Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Altrenogest Veterinary Drug Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Altrenogest Veterinary Drug Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Altrenogest Veterinary Drug Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Altrenogest Veterinary Drug Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Altrenogest Veterinary Drug Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Altrenogest Veterinary Drug Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Altrenogest Veterinary Drug Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Altrenogest Veterinary Drug Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Altrenogest Veterinary Drug Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Altrenogest Veterinary Drug Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Altrenogest Veterinary Drug Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Altrenogest Veterinary Drug Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Altrenogest Veterinary Drug Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Altrenogest Veterinary Drug Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Altrenogest Veterinary Drug Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Altrenogest Veterinary Drug Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Altrenogest Veterinary Drug Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Altrenogest Veterinary Drug Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Altrenogest Veterinary Drug Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Altrenogest Veterinary Drug Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Altrenogest Veterinary Drug Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Altrenogest Veterinary Drug Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Altrenogest Veterinary Drug Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Altrenogest Veterinary Drug Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Altrenogest Veterinary Drug Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Altrenogest Veterinary Drug Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Altrenogest Veterinary Drug Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Altrenogest Veterinary Drug Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Altrenogest Veterinary Drug Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Altrenogest Veterinary Drug Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Altrenogest Veterinary Drug Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Altrenogest Veterinary Drug Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Altrenogest Veterinary Drug Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Altrenogest Veterinary Drug Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Altrenogest Veterinary Drug Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Altrenogest Veterinary Drug Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Altrenogest Veterinary Drug?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Altrenogest Veterinary Drug?

Key companies in the market include Merck Animal Health, Aurora Pharmaceutical, Ceva, Virbac, Bimeda, Tianjin Zhongsheng Challenge Biotechnology, Cixi No.2 Hormones Factory, Ningbo Sansheng, Ningbo Creator, Qilu Animal Health Products.

3. What are the main segments of the Altrenogest Veterinary Drug?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Altrenogest Veterinary Drug," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Altrenogest Veterinary Drug report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Altrenogest Veterinary Drug?

To stay informed about further developments, trends, and reports in the Altrenogest Veterinary Drug, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence