Key Insights

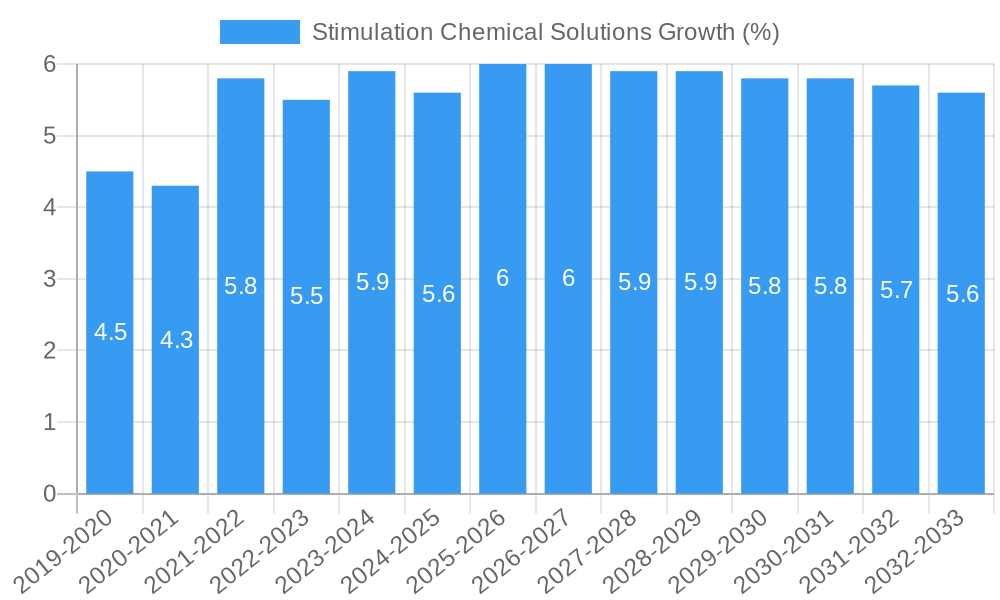

The global Stimulation Chemical Solutions market is poised for significant expansion, projected to reach a market size of approximately $15,000 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 6.5% through 2033. This robust growth is primarily fueled by the escalating demand for enhanced oil and gas recovery from existing reserves, coupled with the increasing complexity of extraction processes that necessitate specialized chemical interventions. The market's value is underpinned by the critical role stimulation chemicals play in improving well productivity, reducing operational costs, and extending the lifespan of oil and gas assets. Key drivers include the pursuit of unconventional resources like shale gas, where hydraulic fracturing and acidizing are indispensable, and the ongoing exploration and development in challenging offshore environments. Furthermore, the industry's commitment to optimizing production efficiency and maximizing hydrocarbon yield directly translates into sustained demand for these essential chemical solutions.

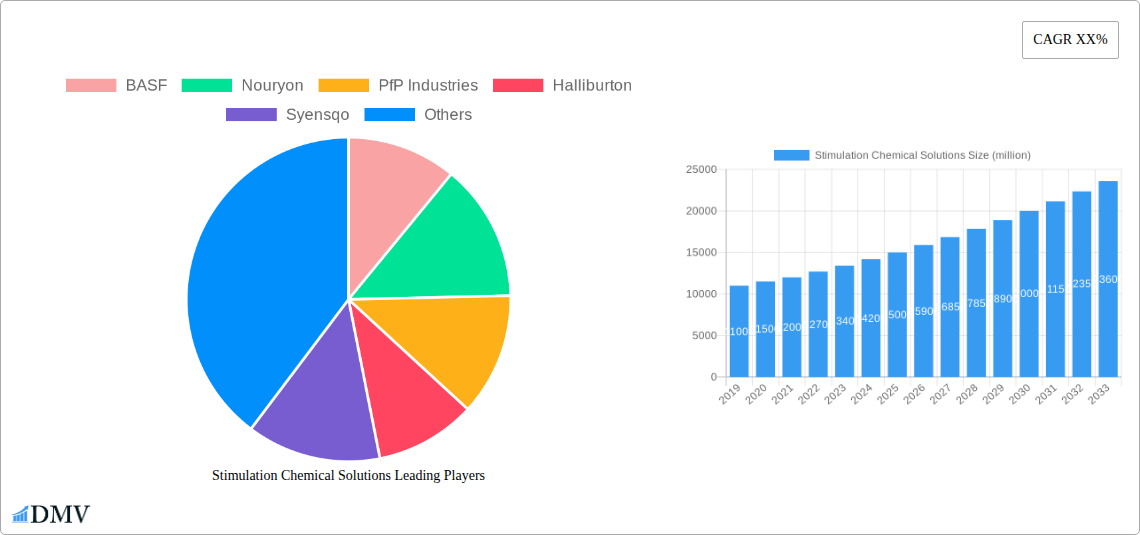

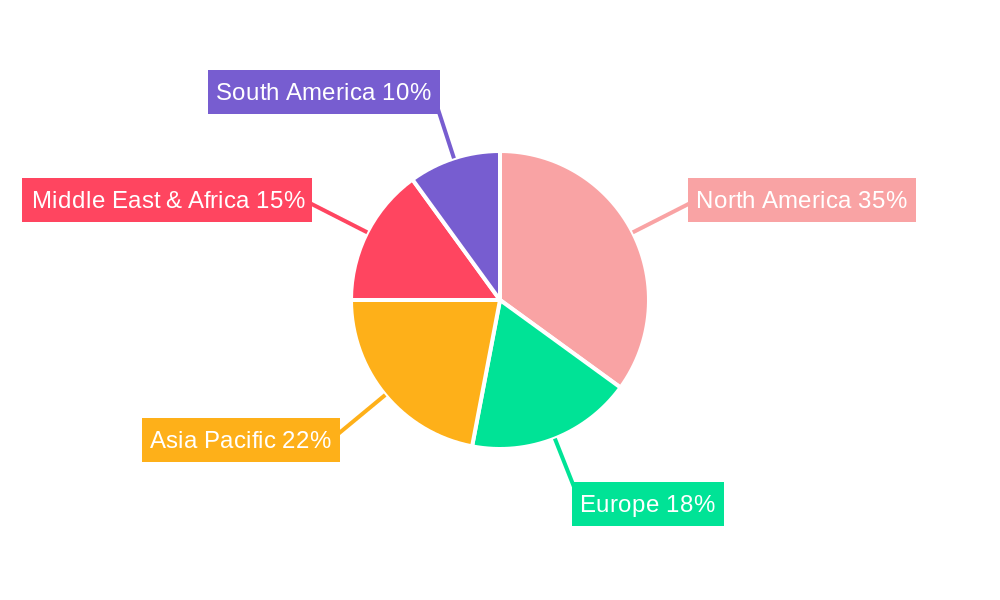

The Stimulation Chemical Solutions market is segmented by application into Oilfield and Other, with the Oilfield segment dominating due to the direct application in hydrocarbon extraction. Within types, Friction Reducers, Foamers, De-Foamers, and Sand Dispersants represent crucial sub-segments, each addressing distinct challenges in the stimulation process. For instance, friction reducers are vital for hydraulic fracturing efficiency, while foamers and de-foamers manage fluid behavior. The market is also characterized by a dynamic competitive landscape, featuring major global players such as BASF, Nouryon, Halliburton, and Syensqo, alongside specialized regional providers. Geographically, North America, driven by extensive shale operations in the United States, is expected to maintain a leading position, followed by the Middle East and Asia Pacific regions, which are witnessing increasing exploration and production activities. Despite the positive outlook, the market faces restraints such as stringent environmental regulations and the fluctuating prices of crude oil, which can impact exploration and production budgets and, consequently, the demand for stimulation chemicals.

Stimulation Chemical Solutions Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a definitive analysis of the global Stimulation Chemical Solutions market, providing critical insights for stakeholders. Covering the historical period from 2019-2024, base year 2025, and a forecast period extending to 2033, this study delves into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. We meticulously examine key segments including Oilfield and Other applications, and product types such as Friction Reducers, Foamers, De-Foamers, Sand Dispersants, and Other formulations. With a focus on market dynamics and strategic forecasting, this report is an indispensable resource for decision-makers navigating this complex and evolving industry.

Stimulation Chemical Solutions Market Composition & Trends

The Stimulation Chemical Solutions market exhibits a moderate concentration, with key players like BASF, Nouryon, Halliburton, and Chevron Phillips Chemical Company holding significant shares, estimated collectively at over $5,000 million. Innovation is primarily driven by the demand for enhanced oil recovery and more efficient, environmentally conscious chemical formulations. Regulatory landscapes, particularly concerning environmental impact and chemical safety in oilfield operations, play a crucial role in shaping product development and market entry strategies. Substitute products, such as advanced mechanical stimulation techniques, represent a growing challenge, necessitating continuous innovation in chemical solutions. End-user profiles are predominantly dominated by oil and gas exploration and production companies, with a smaller but growing segment in other industrial applications. Mergers and Acquisitions (M&A) activity remains a strategic tool for market expansion and portfolio enhancement, with notable deals valued in the hundreds of millions of dollars, such as Syensqo's acquisition of Elementis’s business for approximately $1,000 million.

- Market Share Distribution (2025):

- Top 5 Players: Estimated over $5,000 million

- Fragmented Market for Smaller Players: Estimated over $2,000 million

- Innovation Catalysts:

- Enhanced Oil Recovery (EOR) demand.

- Development of eco-friendly and biodegradable formulations.

- Technological advancements in chemical delivery systems.

- Regulatory Landscapes:

- Strict environmental regulations in North America and Europe.

- Focus on chemical traceability and reduced hazardous waste.

- Substitute Products:

- Mechanical stimulation methods (e.g., hydraulic fracturing alternatives).

- Advanced drilling techniques.

- End-User Profiles:

- Oil & Gas Exploration & Production (E&P): Dominant.

- Other Industries (e.g., mining, water treatment): Emerging segment.

- M&A Activities:

- Strategic consolidation for market access and technology acquisition.

- Notable transactions in the hundreds of millions of dollars.

Stimulation Chemical Solutions Industry Evolution

The Stimulation Chemical Solutions industry has witnessed a dynamic evolution driven by fluctuating energy prices, technological breakthroughs, and an increasing global emphasis on sustainable practices. The historical period (2019-2024) saw significant investment in research and development, spurred by the need for more efficient and environmentally benign chemicals in the oil and gas sector. Market growth trajectories have been influenced by exploration activities in unconventional reserves, particularly in North America, where hydraulic fracturing remains a primary method for hydrocarbon extraction. Technological advancements have focused on developing high-performance friction reducers that minimize energy consumption during fluid pumping, sophisticated foamers and de-foamers to control wellbore stability and production efficiency, and advanced sand dispersants to prevent formation damage. The adoption of these advanced chemical solutions has been steadily increasing, with an estimated growth rate of approximately 5-7% annually during the historical period. Shifting consumer demands, driven by both economic pressures and environmental consciousness, have pushed manufacturers to invest in biodegradable alternatives and chemicals with reduced toxicity. The base year 2025 is projected to see the market valued at over $7,000 million, with a continued upward trend. The forecast period (2025-2033) anticipates sustained growth, albeit with potential regional variations influenced by geopolitical factors and the pace of the global energy transition. The industry is expected to witness further innovation in areas like nanotechnology-based chemical delivery and smart chemicals that respond to specific downhole conditions, leading to more precise and cost-effective stimulation operations. The adoption of digitalization in chemical management and application is also poised to accelerate, further optimizing performance and reducing operational costs. Companies like Nouryon, Sasol, and Cargill are actively contributing to this evolution through their diversified chemical portfolios and commitment to sustainable solutions. The increasing focus on reducing the environmental footprint of oil and gas operations will continue to be a primary catalyst for the adoption of next-generation stimulation chemicals.

Leading Regions, Countries, or Segments in Stimulation Chemical Solutions

The Oilfield application segment stands as the undisputed leader in the global Stimulation Chemical Solutions market, driven by the pervasive need for enhanced hydrocarbon recovery and improved production efficiency. Within this segment, Friction Reducers represent a dominant product type, accounting for an estimated 30-35% of the total market value, followed by Sand Dispersants and Foamers. Geographically, North America, particularly the United States and Canada, spearheads market dominance due to its extensive unconventional oil and gas reserves and the widespread adoption of hydraulic fracturing technologies. Investment trends in this region are robust, fueled by ongoing exploration and production activities. Regulatory support, while evolving to incorporate environmental safeguards, has historically favored the efficient extraction of resources, thereby bolstering the demand for stimulation chemicals.

- Dominant Application Segment: Oilfield

- Key Drivers:

- High demand for enhanced oil recovery (EOR) and shale gas production.

- Technological advancements in fracking and well stimulation techniques.

- Presence of major oil and gas exploration and production hubs.

- Market Share (Estimated 2025): Over $6,000 million.

- Key Drivers:

- Dominant Product Type: Friction Reducers

- Key Drivers:

- Crucial for reducing pumping energy and operational costs in hydraulic fracturing.

- Development of highly efficient and cost-effective formulations.

- Continued expansion of unconventional oil and gas exploration.

- Market Share (Estimated 2025): Approximately $2,100 million.

- Key Drivers:

- Leading Region: North America

- Key Drivers:

- Vast shale oil and gas reserves in the US and Canada.

- Mature infrastructure for oilfield services and chemical supply.

- Technological leadership in hydraulic fracturing.

- Investment Trends: Sustained capital expenditure in upstream oil and gas.

- Regulatory Support: Evolving regulations promoting efficient resource extraction while addressing environmental concerns.

- Key Drivers:

- Other Significant Segments:

- Sand Dispersants: Essential for preventing formation damage and maintaining well productivity.

- Foamers & De-Foamers: Critical for wellbore stability, flow assurance, and efficient fluid management.

Stimulation Chemical Solutions Product Innovations

Product innovation in Stimulation Chemical Solutions is characterized by the development of advanced formulations designed for enhanced performance and reduced environmental impact. Key advancements include the creation of highly effective friction reducers that operate efficiently at lower concentrations, significantly reducing operational costs and fluid volumes. Novel sand dispersants are being engineered to prevent clay swelling and fines migration, thereby safeguarding reservoir permeability. Furthermore, research into eco-friendly foamers and de-foamers, utilizing biodegradable components, addresses growing regulatory pressures and environmental consciousness within the oilfield sector. Companies like ACE FLUID SOLUTIONS and Aegis Chemical Solutions are at the forefront, introducing proprietary chemistries that offer superior performance metrics, such as increased viscosity reduction and improved sand-carrying capacity, contributing to greater well productivity and longevity.

Propelling Factors for Stimulation Chemical Solutions Growth

Several factors are propelling the growth of the Stimulation Chemical Solutions market. The relentless global demand for energy, particularly from the oil and gas sector, remains a primary driver. Technological advancements in unconventional resource extraction, such as hydraulic fracturing, necessitate the continuous use and innovation of specialized chemicals. Growing emphasis on enhanced oil recovery (EOR) techniques to maximize output from mature fields further fuels demand. Additionally, stringent environmental regulations are indirectly fostering growth by encouraging the development and adoption of more efficient and eco-friendlier stimulation chemicals, including biodegradable formulations. Emerging markets and increased upstream investment in developing regions also present significant growth opportunities.

- Increasing Energy Demand: Sustained global need for oil and gas.

- Technological Advancements in Extraction: Sophistication of hydraulic fracturing and EOR.

- Focus on EOR: Maximizing production from existing reserves.

- Environmental Regulations: Driving demand for greener, more efficient chemicals.

- Emerging Market Exploration: Increased upstream activities in new regions.

Obstacles in the Stimulation Chemical Solutions Market

Despite robust growth prospects, the Stimulation Chemical Solutions market faces several obstacles. Volatility in crude oil prices can directly impact exploration and production budgets, subsequently affecting demand for stimulation chemicals. Stringent and evolving environmental regulations, particularly concerning water usage and chemical disposal, can increase operational costs and necessitate significant R&D investment for compliance. Supply chain disruptions, exacerbated by geopolitical events and material shortages, can lead to increased raw material costs and delayed deliveries, impacting the overall market. Intense competition among established players and the emergence of new entrants, coupled with the threat of substitute technologies, also presents a continuous challenge.

- Oil Price Volatility: Fluctuations impacting E&P spending.

- Stringent Environmental Regulations: Increased compliance costs and R&D needs.

- Supply Chain Disruptions: Raw material scarcity and price hikes.

- Intense Competition: Market saturation and pricing pressures.

- Threat of Substitute Technologies: Alternative stimulation methods.

Future Opportunities in Stimulation Chemical Solutions

The Stimulation Chemical Solutions market is ripe with future opportunities. The growing global demand for unconventional hydrocarbon resources will continue to drive demand for advanced stimulation chemicals. The increasing focus on sustainable E&P practices is creating a significant opportunity for companies developing eco-friendly and biodegradable formulations. Expansion into emerging oil and gas markets, particularly in Africa and Southeast Asia, presents new avenues for market penetration. Furthermore, advancements in nanotechnology and smart chemical delivery systems offer potential for highly targeted and efficient stimulation solutions, reducing waste and improving efficacy. The development of integrated chemical management platforms also presents an opportunity for value-added services.

- Unconventional Resource Growth: Continued reliance on advanced stimulation.

- Sustainable & Eco-Friendly Chemicals: High demand for biodegradable and low-toxicity options.

- Emerging Market Penetration: Expansion into new geographical regions.

- Nanotechnology & Smart Chemicals: Development of next-generation solutions.

- Integrated Chemical Management: Value-added service opportunities.

Major Players in the Stimulation Chemical Solutions Ecosystem

- BASF

- Nouryon

- PfP Industries

- Halliburton

- Syensqo

- Elementis

- ACE FLUID SOLUTIONS

- ISI Oilfield Chemicals

- International Chemical Group

- Chevron Phillips Chemical Company

- Azelis

- Aegis Chemical Solutions

- SANCCUS

- Sasol

- Cargill

Key Developments in Stimulation Chemical Solutions Industry

- 2024: Syensqo completes acquisition of Elementis's specialty additives business, impacting a portion of the friction reducer and rheology modifier segments valued at approximately $1,000 million.

- 2023: Halliburton launches new suite of eco-friendly stimulation fluids, demonstrating a commitment to sustainability and regulatory compliance.

- 2023: Nouryon expands its production capacity for surfactants used in foamers and de-foamers to meet growing global demand.

- 2022: BASF invests heavily in R&D for next-generation friction reducers with enhanced performance under extreme conditions.

- 2021: Chevron Phillips Chemical Company announces strategic partnership to develop advanced polymer-based sand dispersants.

- 2020: International Chemical Group acquires a smaller regional player to expand its footprint in the Middle East stimulation chemical market.

- 2019: PfP Industries introduces a proprietary biodegradable friction reducer, aligning with increasing environmental awareness.

Strategic Stimulation Chemical Solutions Market Forecast

The strategic forecast for the Stimulation Chemical Solutions market indicates sustained and robust growth throughout the forecast period (2025-2033). This optimism is underpinned by the continued global energy demand and the indispensable role of stimulation chemicals in maximizing hydrocarbon recovery, especially from unconventional reservoirs. The increasing imperative for sustainable and environmentally responsible operations will act as a significant growth catalyst, driving innovation in green chemistry and biodegradable formulations. Emerging markets and ongoing technological advancements in areas like nanotechnology and digital oilfield integration will further unlock market potential. Stakeholders who focus on R&D, strategic partnerships, and adapting to evolving regulatory landscapes are poised for significant success in this dynamic and essential industry, projected to reach over $9,000 million by 2033.

Stimulation Chemical Solutions Segmentation

-

1. Application

- 1.1. Oilfield

- 1.2. Other

-

2. Types

- 2.1. Friction Reducers

- 2.2. Foamers

- 2.3. De-Foamers

- 2.4. Sand Dispersants

- 2.5. Other

Stimulation Chemical Solutions Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Stimulation Chemical Solutions REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Stimulation Chemical Solutions Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Oilfield

- 5.1.2. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Friction Reducers

- 5.2.2. Foamers

- 5.2.3. De-Foamers

- 5.2.4. Sand Dispersants

- 5.2.5. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Stimulation Chemical Solutions Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Oilfield

- 6.1.2. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Friction Reducers

- 6.2.2. Foamers

- 6.2.3. De-Foamers

- 6.2.4. Sand Dispersants

- 6.2.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Stimulation Chemical Solutions Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Oilfield

- 7.1.2. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Friction Reducers

- 7.2.2. Foamers

- 7.2.3. De-Foamers

- 7.2.4. Sand Dispersants

- 7.2.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Stimulation Chemical Solutions Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Oilfield

- 8.1.2. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Friction Reducers

- 8.2.2. Foamers

- 8.2.3. De-Foamers

- 8.2.4. Sand Dispersants

- 8.2.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Stimulation Chemical Solutions Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Oilfield

- 9.1.2. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Friction Reducers

- 9.2.2. Foamers

- 9.2.3. De-Foamers

- 9.2.4. Sand Dispersants

- 9.2.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Stimulation Chemical Solutions Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Oilfield

- 10.1.2. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Friction Reducers

- 10.2.2. Foamers

- 10.2.3. De-Foamers

- 10.2.4. Sand Dispersants

- 10.2.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BASF

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nouryon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PfP Industries

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Halliburton

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Syensqo

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elementis

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 ACE FLUID SOLUTIONS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ISI Oilfield Chemicals

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 International Chemical Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Chevron Phillips Chemical Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Azelis

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Aegis Chemical Solutions

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 SANCCUS

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sasol

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Cargill

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 BASF

List of Figures

- Figure 1: Global Stimulation Chemical Solutions Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Stimulation Chemical Solutions Revenue (million), by Application 2024 & 2032

- Figure 3: North America Stimulation Chemical Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Stimulation Chemical Solutions Revenue (million), by Types 2024 & 2032

- Figure 5: North America Stimulation Chemical Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Stimulation Chemical Solutions Revenue (million), by Country 2024 & 2032

- Figure 7: North America Stimulation Chemical Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Stimulation Chemical Solutions Revenue (million), by Application 2024 & 2032

- Figure 9: South America Stimulation Chemical Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Stimulation Chemical Solutions Revenue (million), by Types 2024 & 2032

- Figure 11: South America Stimulation Chemical Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Stimulation Chemical Solutions Revenue (million), by Country 2024 & 2032

- Figure 13: South America Stimulation Chemical Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Stimulation Chemical Solutions Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Stimulation Chemical Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Stimulation Chemical Solutions Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Stimulation Chemical Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Stimulation Chemical Solutions Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Stimulation Chemical Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Stimulation Chemical Solutions Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Stimulation Chemical Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Stimulation Chemical Solutions Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Stimulation Chemical Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Stimulation Chemical Solutions Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Stimulation Chemical Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Stimulation Chemical Solutions Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Stimulation Chemical Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Stimulation Chemical Solutions Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Stimulation Chemical Solutions Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Stimulation Chemical Solutions Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Stimulation Chemical Solutions Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Stimulation Chemical Solutions Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Stimulation Chemical Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Stimulation Chemical Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Stimulation Chemical Solutions Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Stimulation Chemical Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Stimulation Chemical Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Stimulation Chemical Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Stimulation Chemical Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Stimulation Chemical Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Stimulation Chemical Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Stimulation Chemical Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Stimulation Chemical Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Stimulation Chemical Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Stimulation Chemical Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Stimulation Chemical Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Stimulation Chemical Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Stimulation Chemical Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Stimulation Chemical Solutions Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Stimulation Chemical Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Stimulation Chemical Solutions Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Stimulation Chemical Solutions?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Stimulation Chemical Solutions?

Key companies in the market include BASF, Nouryon, PfP Industries, Halliburton, Syensqo, Elementis, ACE FLUID SOLUTIONS, ISI Oilfield Chemicals, International Chemical Group, Chevron Phillips Chemical Company, Azelis, Aegis Chemical Solutions, SANCCUS, Sasol, Cargill.

3. What are the main segments of the Stimulation Chemical Solutions?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Stimulation Chemical Solutions," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Stimulation Chemical Solutions report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Stimulation Chemical Solutions?

To stay informed about further developments, trends, and reports in the Stimulation Chemical Solutions, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence