Key Insights

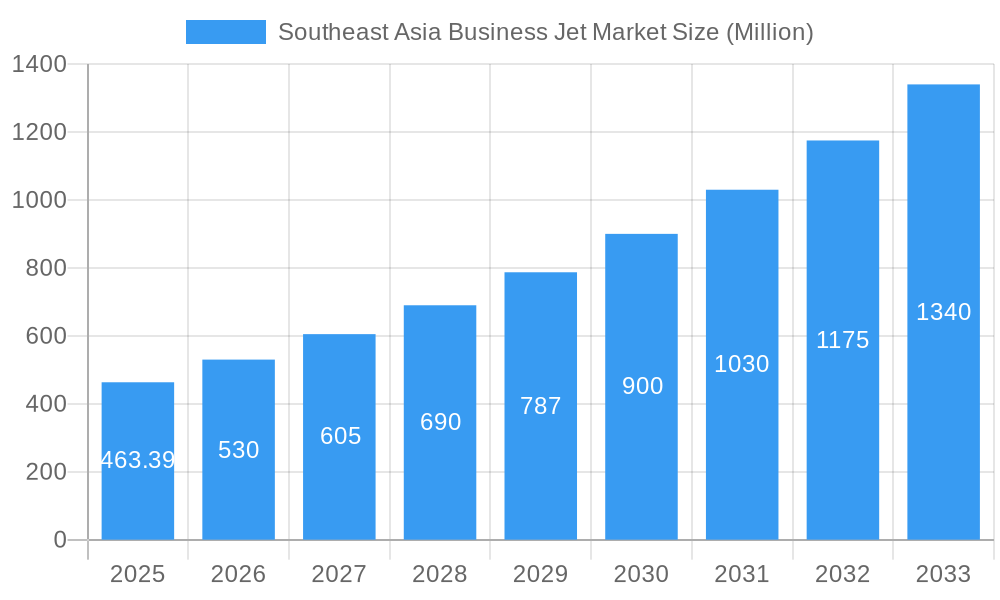

The Southeast Asia business jet market is experiencing robust growth, projected to reach a substantial size driven by increasing high-net-worth individuals (HNWIs) and a burgeoning business travel sector in the region. The market's Compound Annual Growth Rate (CAGR) of 14.36% from 2019 to 2024 suggests a strong upward trajectory, which is expected to continue over the forecast period of 2025-2033. Key drivers include the rising disposable incomes in rapidly developing economies like China, India, and Singapore, fueling demand for private air travel for both business and leisure purposes. Furthermore, improvements in regional infrastructure, including airport expansions and upgraded air traffic management systems, are facilitating increased business jet operations. While potential regulatory hurdles and economic fluctuations could pose challenges, the overall market outlook remains optimistic, with significant opportunities for manufacturers and operators within the segment. The preference for specific aircraft types will likely vary; however, considering the region's diverse landscape, the demand for mid-size jets, balancing cost and capacity, is anticipated to remain a significant portion of the market.

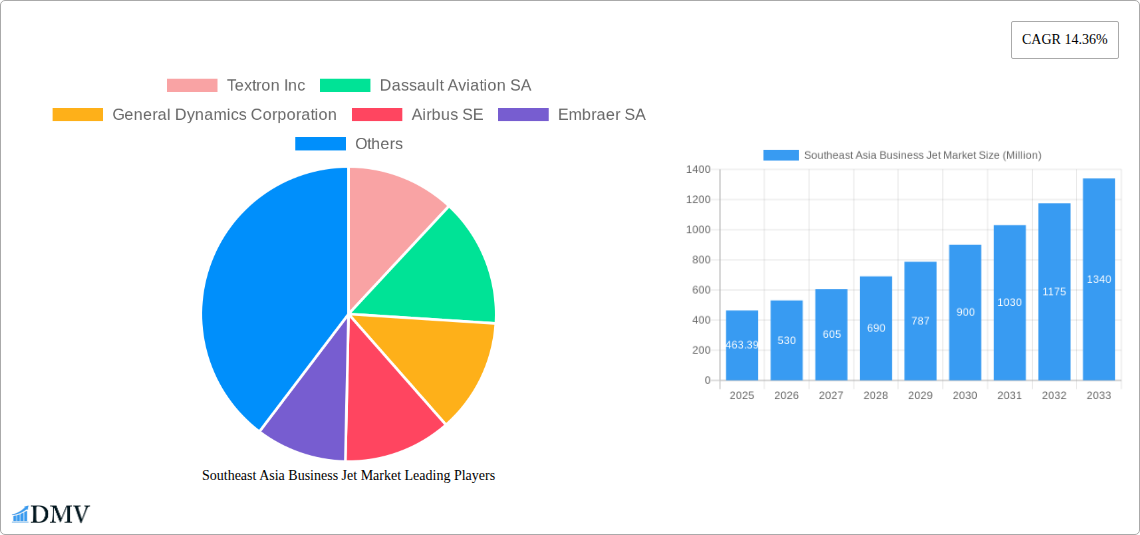

Southeast Asia Business Jet Market Market Size (In Million)

The segmentation by aircraft type (light, mid-size, and large jets) offers insights into specific market demands. While the exact market share for each segment in Southeast Asia is not provided, considering global trends, we can infer that mid-size jets will likely hold the largest market share due to their versatility and suitability for regional travel. Light jets will cater to shorter distances and smaller groups, while large jets will appeal to a niche market of corporations and high-net-worth individuals requiring extensive range and luxury features. Major players like Textron, Dassault Aviation, Bombardier, and Embraer are well-positioned to capitalize on the growth, but emerging regional operators could also gain significant traction. Strategic partnerships and investments in maintenance and support infrastructure will be crucial for success in this competitive yet rapidly expanding market.

Southeast Asia Business Jet Market Company Market Share

This insightful report provides a detailed analysis of the Southeast Asia business jet market, offering invaluable insights for stakeholders seeking to understand the current landscape and future trajectory of this dynamic sector. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report leverages extensive data analysis to offer actionable intelligence. Key players such as Textron Inc, Dassault Aviation SA, General Dynamics Corporation, Airbus SE, Embraer SA, Bombardier Inc, Honda Aircraft Company, and The Boeing Company are thoroughly examined. The report segments the market by aircraft type: Light Jets, Mid-size Jets, and Large Jets, providing granular insights into market dynamics across these segments.

Southeast Asia Business Jet Market Composition & Trends

This section delves into the competitive intensity of the Southeast Asia business jet market, evaluating market concentration through metrics like the Herfindahl-Hirschman Index (HHI) and market share distribution among key players. We analyze the innovative forces driving market evolution, including technological advancements in aircraft design and avionics. The regulatory landscape, including airspace management and safety regulations, is thoroughly assessed for its impact on market growth. Furthermore, the report examines the presence and impact of substitute products, profiles end-users (private owners, charter operators, fractional ownership programs), and scrutinizes mergers and acquisitions (M&A) activity within the sector, including deal values (estimated at xx Million for the period 2019-2024).

- Market Concentration: The market shows a moderately concentrated structure with the top five players holding approximately xx% of the market share in 2024.

- Innovation Catalysts: Advancements in fuel efficiency, enhanced cabin technology, and the rise of sustainable aviation fuels are key drivers of innovation.

- Regulatory Landscape: Stringent safety regulations and evolving airspace management policies are shaping market dynamics.

- Substitute Products: While limited, private helicopters and high-end commercial flights pose some level of substitution.

- End-User Profile: Private owners dominate the market, followed by charter operators and fractional ownership programs.

- M&A Activity: M&A activity in the period 2019-2024 resulted in an estimated xx Million in deal value, primarily focused on consolidation and technology acquisition.

Southeast Asia Business Jet Market Industry Evolution

This section charts the evolution of the Southeast Asia business jet market, examining growth trajectories from 2019-2024 and projecting them to 2033. It analyzes the impact of technological advancements, such as autonomous flight systems and improved in-flight connectivity, on market growth. The evolving preferences and demands of business jet users are also considered, exploring factors such as the rising preference for larger, more luxurious cabins and the growing emphasis on sustainable travel options. The report details growth rates (historical and projected), adoption rates of new technologies, and a qualitative assessment of shifting consumer preferences influencing the market's trajectory. The market experienced a Compound Annual Growth Rate (CAGR) of xx% from 2019-2024 and is projected to grow at a CAGR of xx% from 2025-2033. This growth is significantly driven by factors such as increasing high-net-worth individuals, improving infrastructure, and rising business travel. Specific data points on growth rates and technology adoption will be incorporated based on detailed market research.

Leading Regions, Countries, or Segments in Southeast Asia Business Jet Market

This segment identifies the leading region, country, and aircraft type (Light, Mid-size, and Large Jets) within the Southeast Asia business jet market. A detailed analysis will pinpoint the factors contributing to their dominance. Key drivers will be categorized into investment trends, government support, and infrastructure development.

- Dominant Region: Singapore, due to its strong economic growth, advanced infrastructure, and strategic location.

- Dominant Country: Singapore, due to its established business aviation infrastructure and regulatory environment.

- Dominant Segment: Mid-size jets, balancing cost-effectiveness with sufficient space and range for regional business travel.

Key Drivers:

- Singapore's dominance: Strong economic growth, robust aviation infrastructure (Seletar Airport), and supportive government policies for business aviation.

- Mid-size jet popularity: Optimal balance between cost, range, and cabin space, catering to the prevalent needs of regional business travel.

- Investment trends: Significant investments in airport infrastructure and related services further boosts the market.

Southeast Asia Business Jet Market Product Innovations

This section highlights recent product innovations within the Southeast Asia business jet market. It focuses on new aircraft models, technological advancements in cabin design, avionics, and engine technology. The unique selling propositions (USPs) of these innovations, along with performance metrics (fuel efficiency, range, speed), are analyzed. The emphasis is on technological advancements that contribute to increased efficiency, comfort, and sustainability.

Propelling Factors for Southeast Asia Business Jet Market Growth

Several factors propel the growth of the Southeast Asia business jet market. Technological advancements, such as improved fuel efficiency and advanced avionics, contribute significantly. Economic growth and increasing high-net-worth individuals (HNWIs) fuel demand. Supportive government policies and investments in aviation infrastructure further accelerate market expansion.

Obstacles in the Southeast Asia Business Jet Market

The Southeast Asia business jet market faces challenges, including stringent regulatory hurdles (certification, operational approvals), potential supply chain disruptions impacting manufacturing and maintenance, and intense competition among established and emerging players. These factors can lead to increased costs and affect market growth trajectory. Further research will quantify the impact of these obstacles on overall market growth.

Future Opportunities in Southeast Asia Business Jet Market

Emerging opportunities abound for the Southeast Asia business jet market. The expansion of the HNWIs population, development of new airports and infrastructure, and increasing focus on sustainable aviation fuels (SAFs) present significant growth potentials. Moreover, the adoption of advanced technologies like autonomous flight systems and improved in-flight connectivity could unlock new market segments and enhance the overall user experience.

Major Players in the Southeast Asia Business Jet Market Ecosystem

Key Developments in Southeast Asia Business Jet Market Industry

- 2024 Q4: Airbus SE announces a new regional business jet model tailored for the Southeast Asian market.

- 2023 Q3: Significant investment in Seletar Airport's business aviation infrastructure is announced by the Singaporean government.

- 2022 Q1: A major merger between two regional charter operators consolidates market share. Further details to be added based on market research.

Strategic Southeast Asia Business Jet Market Forecast

The Southeast Asia business jet market is poised for continued growth, driven by factors such as expanding HNWIs demographics, burgeoning regional economies, and the continued investment in airport infrastructure and related services. The emergence of new technologies and increasing focus on sustainable practices promise to further shape the market landscape in the coming years. Future opportunities lie in catering to the growing demand for personalized and luxurious travel experiences among the increasing number of high-net-worth individuals in the region.

Southeast Asia Business Jet Market Segmentation

-

1. Aircraft Type

- 1.1. Light Jets

- 1.2. Mid-size Jets

- 1.3. Large Jets

-

2. Geography

- 2.1. Singapore

- 2.2. Indonesia

- 2.3. Thailand

- 2.4. Philippines

- 2.5. Vietnam

- 2.6. Rest of Southeast Asia

Southeast Asia Business Jet Market Segmentation By Geography

- 1. Singapore

- 2. Indonesia

- 3. Thailand

- 4. Philippines

- 5. Vietnam

- 6. Rest of Southeast Asia

Southeast Asia Business Jet Market Regional Market Share

Geographic Coverage of Southeast Asia Business Jet Market

Southeast Asia Business Jet Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Large Jets Segment held the Largest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 5.1.1. Light Jets

- 5.1.2. Mid-size Jets

- 5.1.3. Large Jets

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Singapore

- 5.2.2. Indonesia

- 5.2.3. Thailand

- 5.2.4. Philippines

- 5.2.5. Vietnam

- 5.2.6. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Singapore

- 5.3.2. Indonesia

- 5.3.3. Thailand

- 5.3.4. Philippines

- 5.3.5. Vietnam

- 5.3.6. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6. Singapore Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 6.1.1. Light Jets

- 6.1.2. Mid-size Jets

- 6.1.3. Large Jets

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Singapore

- 6.2.2. Indonesia

- 6.2.3. Thailand

- 6.2.4. Philippines

- 6.2.5. Vietnam

- 6.2.6. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7. Indonesia Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 7.1.1. Light Jets

- 7.1.2. Mid-size Jets

- 7.1.3. Large Jets

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Singapore

- 7.2.2. Indonesia

- 7.2.3. Thailand

- 7.2.4. Philippines

- 7.2.5. Vietnam

- 7.2.6. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8. Thailand Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 8.1.1. Light Jets

- 8.1.2. Mid-size Jets

- 8.1.3. Large Jets

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Singapore

- 8.2.2. Indonesia

- 8.2.3. Thailand

- 8.2.4. Philippines

- 8.2.5. Vietnam

- 8.2.6. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9. Philippines Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 9.1.1. Light Jets

- 9.1.2. Mid-size Jets

- 9.1.3. Large Jets

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Singapore

- 9.2.2. Indonesia

- 9.2.3. Thailand

- 9.2.4. Philippines

- 9.2.5. Vietnam

- 9.2.6. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10. Vietnam Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 10.1.1. Light Jets

- 10.1.2. Mid-size Jets

- 10.1.3. Large Jets

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Singapore

- 10.2.2. Indonesia

- 10.2.3. Thailand

- 10.2.4. Philippines

- 10.2.5. Vietnam

- 10.2.6. Rest of Southeast Asia

- 10.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11. Rest of Southeast Asia Southeast Asia Business Jet Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 11.1.1. Light Jets

- 11.1.2. Mid-size Jets

- 11.1.3. Large Jets

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Singapore

- 11.2.2. Indonesia

- 11.2.3. Thailand

- 11.2.4. Philippines

- 11.2.5. Vietnam

- 11.2.6. Rest of Southeast Asia

- 11.1. Market Analysis, Insights and Forecast - by Aircraft Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Textron Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Dassault Aviation SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 General Dynamics Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Airbus SE

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Embraer SA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bombardier Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Honda Aircraft Compan

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 The Boeing Company

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Textron Inc

List of Figures

- Figure 1: Southeast Asia Business Jet Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Southeast Asia Business Jet Market Share (%) by Company 2025

List of Tables

- Table 1: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 2: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Southeast Asia Business Jet Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 5: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 8: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 11: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 14: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 17: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Southeast Asia Business Jet Market Revenue Million Forecast, by Aircraft Type 2020 & 2033

- Table 20: Southeast Asia Business Jet Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Southeast Asia Business Jet Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Business Jet Market?

The projected CAGR is approximately 14.36%.

2. Which companies are prominent players in the Southeast Asia Business Jet Market?

Key companies in the market include Textron Inc, Dassault Aviation SA, General Dynamics Corporation, Airbus SE, Embraer SA, Bombardier Inc, Honda Aircraft Compan, The Boeing Company.

3. What are the main segments of the Southeast Asia Business Jet Market?

The market segments include Aircraft Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 463.39 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Large Jets Segment held the Largest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Business Jet Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Business Jet Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Business Jet Market?

To stay informed about further developments, trends, and reports in the Southeast Asia Business Jet Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence