Key Insights

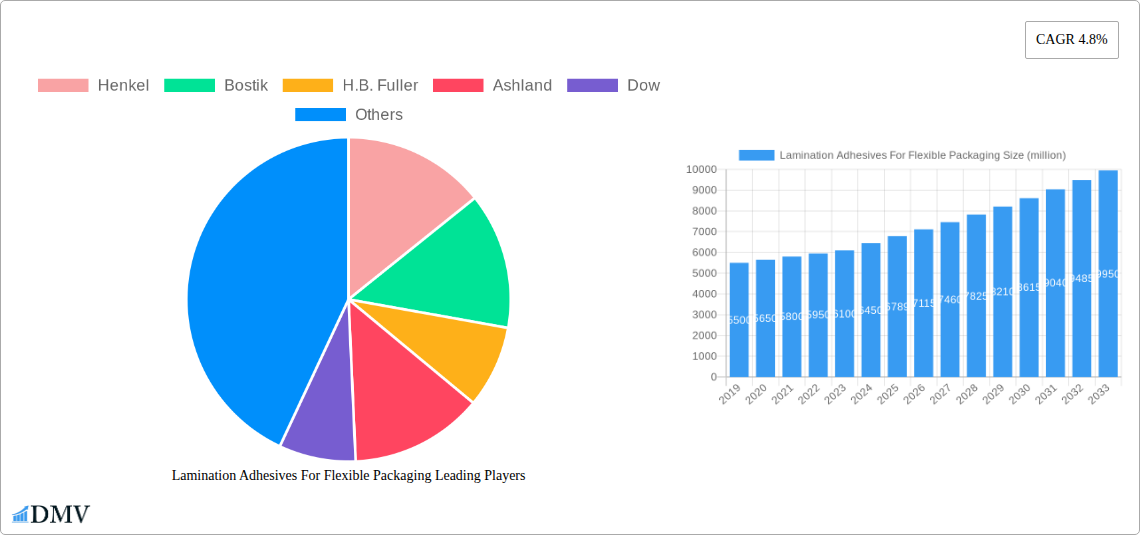

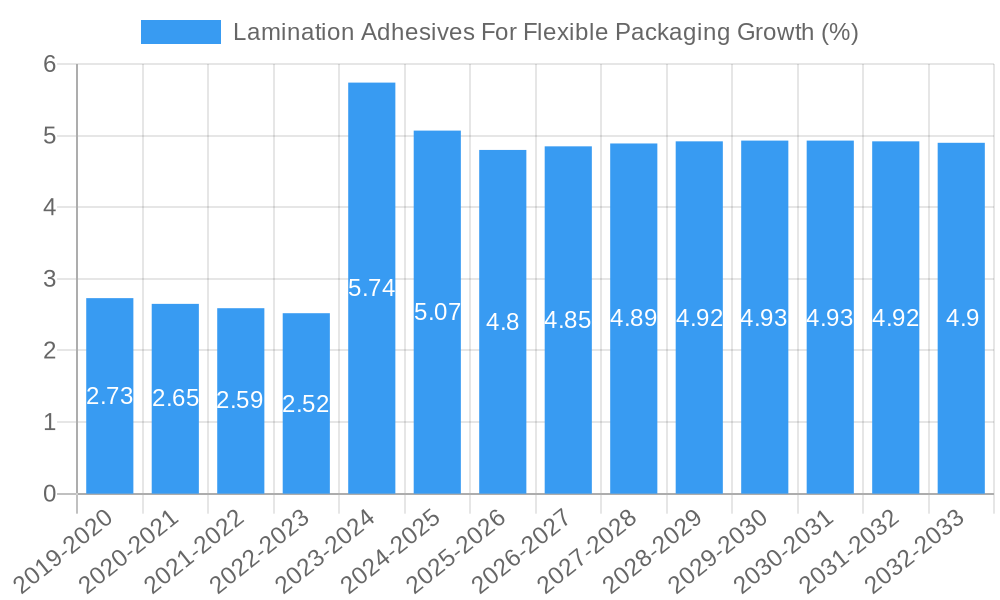

The global Lamination Adhesives for Flexible Packaging market is projected for robust growth, currently valued at an estimated $6,789 million and anticipated to expand at a Compound Annual Growth Rate (CAGR) of 4.8% through 2033. This expansion is primarily fueled by the escalating demand for versatile and high-performance flexible packaging solutions across diverse end-use industries, including food and beverages, pharmaceuticals, and personal care. The inherent properties of lamination adhesives, such as their ability to enhance barrier properties, improve shelf life, and provide aesthetic appeal, make them indispensable in modern packaging. Furthermore, the increasing consumer preference for convenient and sustainable packaging formats is a significant tailwind, driving innovation and adoption of advanced adhesive technologies. The market is witnessing a notable shift towards solvent-free and water-based adhesive systems, reflecting a growing industry emphasis on environmental sustainability and compliance with stringent regulatory standards concerning volatile organic compounds (VOCs).

Key drivers underpinning this market expansion include the burgeoning e-commerce sector, which necessitates durable and protective packaging, and the growing global population, leading to increased consumption of packaged goods. The industrial packaging segment, while perhaps less prominent than food packaging, also contributes significantly to market demand, driven by the need for robust protection during transit and storage of goods. Emerging economies in the Asia Pacific region, particularly China and India, are expected to spearhead growth due to rapid industrialization, rising disposable incomes, and an expanding manufacturing base. Key players in the market are actively engaged in research and development to introduce innovative adhesive formulations that offer superior performance, cost-effectiveness, and reduced environmental impact, thereby catering to evolving market demands and solidifying their competitive positions.

Lamination Adhesives For Flexible Packaging Market Research Report: Forecast 2025-2033

This comprehensive report provides an in-depth analysis of the global lamination adhesives for flexible packaging market. Covering the study period from 2019 to 2033, with a base year of 2025, it delves into critical market dynamics, evolutionary trends, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Stakeholders seeking to understand the trajectory of flexible packaging adhesives, food packaging adhesives, medical packaging adhesives, and industrial packaging adhesives will find this report indispensable. The analysis includes market share distributions for leading companies like Henkel, Bostik, H.B. Fuller, Ashland, Dow, 3M, Vimasco Corporation, Sika Automotive, Coim, Flint Group, Toyo-Morton, DIC Corporation, Huber Group, Comens Material, China Neweast, Jiangsu Lihe, Morchem SA, Shanghai Kangda, Brilliant Polymers, Sungdo, UFlex, Rockpaint, Mitsui Chemicals, Sapicci, Wanhua, and others. It scrutinizes the impact of solvent-based adhesives, solvent-free adhesives, and water-based adhesives on market segmentation and forecasts future growth at an impressive compound annual growth rate (CAGR) of xx%.

Lamination Adhesives For Flexible Packaging Market Composition & Trends

The lamination adhesives for flexible packaging market exhibits a moderate level of concentration, with key players like Henkel, Bostik, and H.B. Fuller holding significant market share, estimated at over XXX million USD in combined revenue. Innovation serves as a primary catalyst, driven by the increasing demand for sustainable and high-performance flexible packaging solutions. Regulatory landscapes, particularly concerning food contact materials and environmental impact, are shaping product development, favoring solvent-free adhesives and low-VOC (Volatile Organic Compound) formulations. Substitute products, such as co-extrusion and other material bonding techniques, present a competitive challenge, albeit with distinct performance trade-offs. End-user profiles are diverse, with food packaging representing the largest segment, followed by medical packaging and industrial packaging. Mergers and acquisitions (M&A) activities are ongoing, with significant deal values in the range of XXX million USD, aimed at expanding product portfolios and geographic reach. For instance, recent M&A activities have seen a consolidation of expertise in developing advanced flexible packaging adhesives.

- Market Share Distribution: Leading companies like Henkel, Bostik, and H.B. Fuller collectively command an estimated XX% of the global market share, with revenues exceeding XXX million USD.

- Innovation Catalysts: Advancements in polymer science and a growing emphasis on sustainability are driving the development of eco-friendly and high-performance lamination adhesives.

- Regulatory Landscapes: Stringent regulations regarding food safety and environmental emissions are pushing the market towards solvent-free adhesives and water-based alternatives.

- Substitute Products: Co-extrusion and direct printing technologies offer alternatives but often lack the specialized barrier properties achieved through lamination.

- End-User Profiles: Food packaging constitutes the largest segment (XX% share), driven by consumer demand for convenience and extended shelf life. Medical packaging (XX% share) requires stringent safety and sterilization compliance, while industrial packaging (XX% share) prioritizes durability and protection.

- M&A Activities: Recent M&A deals, valued at approximately XXX million USD, highlight a trend of consolidation and strategic partnerships to enhance market position and technological capabilities.

Lamination Adhesives For Flexible Packaging Industry Evolution

The lamination adhesives for flexible packaging industry has undergone a remarkable evolution, driven by a confluence of technological advancements, shifting consumer demands, and stringent regulatory mandates. Throughout the historical period (2019-2024), the market witnessed a steady upward trajectory, with an estimated market size of XXX million USD in 2024. Growth trajectories were largely shaped by the increasing demand for convenient and safe packaging solutions across various sectors. Technological advancements have been pivotal, with the development and refinement of solvent-free adhesives and water-based formulations gaining significant traction. These innovations address growing environmental concerns by reducing VOC emissions, a key driver for market expansion. The adoption metrics for solvent-free adhesives, for instance, have surged by approximately XX% over the past five years, reflecting their growing preference. Consumer demands have also played a crucial role. The proliferation of e-commerce has amplified the need for robust and protective flexible packaging, while heightened awareness of health and wellness has fueled the demand for packaging that ensures product integrity and safety, particularly in the food packaging and medical packaging segments. This has spurred innovation in barrier properties, such as oxygen and moisture resistance, achievable through advanced lamination adhesive technologies. The industrial packaging segment, while more mature, continues to evolve with a focus on enhanced durability and cost-effectiveness. The estimated market growth rate for the next decade is projected at a robust xx%, indicating sustained expansion driven by these multifaceted factors. The base year of 2025, with an estimated market value of XXX million USD, serves as a crucial benchmark for forecasting future performance. The forecast period (2025–2033) is expected to see continued innovation in adhesive chemistries, leading to improved performance characteristics like enhanced bond strength, faster curing times, and better recyclability, further solidifying the importance of flexible packaging adhesives.

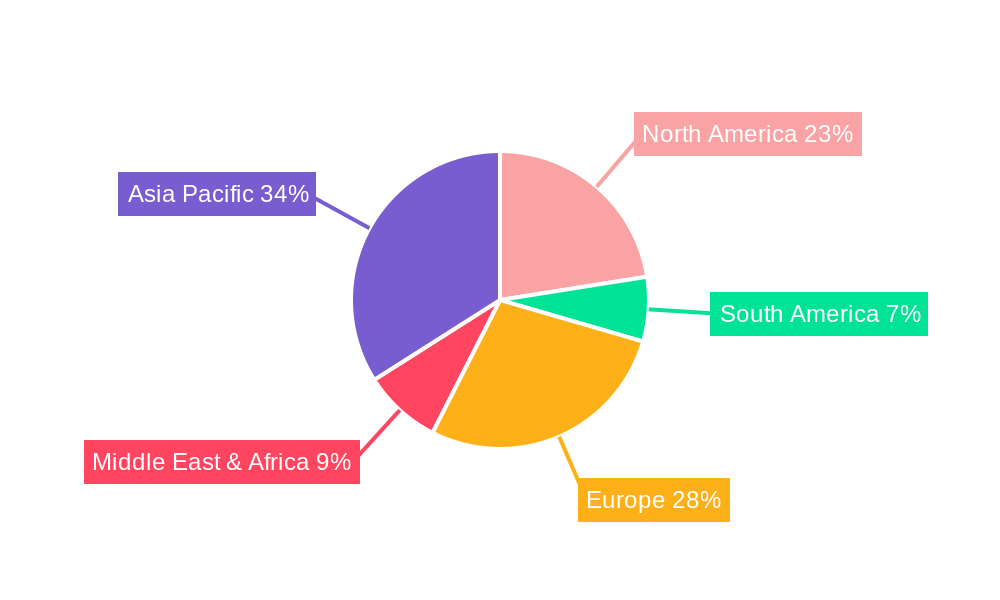

Leading Regions, Countries, or Segments in Lamination Adhesives For Flexible Packaging

The lamination adhesives for flexible packaging market demonstrates significant regional and segmental dominance, with Asia Pacific emerging as the leading region. This prominence is fueled by a burgeoning population, rapid industrialization, and a substantial manufacturing base for flexible packaging. Within Asia Pacific, countries like China and India are key contributors, driven by substantial investments in food processing, healthcare, and consumer goods. The food packaging segment stands out as the largest application, accounting for an estimated XX% of the market share, with consistent demand for extended shelf life and tamper-evident solutions. The growth in this segment is directly linked to increasing disposable incomes and evolving dietary habits across emerging economies. In terms of adhesive type, solvent-free adhesives are increasingly capturing market share due to their environmental benefits and superior performance characteristics, followed closely by solvent-based adhesives in applications where cost-effectiveness and specific performance requirements are paramount. Water-based adhesives are also gaining traction, especially in markets with stringent VOC regulations.

Dominant Region: Asia Pacific

- Key Drivers:

- Rapid economic growth and rising disposable incomes in countries like China and India.

- Significant expansion of the food and beverage industry, driving demand for advanced food packaging.

- Growing healthcare infrastructure and the need for sterile medical packaging.

- Government initiatives promoting domestic manufacturing and exports of flexible packaging.

- Substantial investments in research and development by local and international adhesive manufacturers.

- In-depth Analysis: Asia Pacific's dominance is a direct consequence of its vast consumer base and its role as a global manufacturing hub. The region's demand for flexible packaging is amplified by the growth of the retail sector and the increasing preference for convenient, ready-to-eat food products. Regulatory frameworks are evolving to encourage sustainable practices, further bolstering the adoption of eco-friendly solvent-free adhesives. The region's robust supply chain and competitive manufacturing costs also contribute to its leading position.

- Key Drivers:

Dominant Application: Food Packaging

- Key Drivers:

- Growing global population and demand for packaged foods.

- Increased consumer preference for convenience, freshness, and extended shelf life.

- Evolving retail landscape and the rise of modern trade channels.

- Demand for specialized packaging to protect against spoilage, contamination, and physical damage.

- In-depth Analysis: The food packaging segment's dominance is intrinsically linked to fundamental human needs and evolving lifestyles. Consumers' desire for safe, fresh, and convenient food options directly translates into a sustained demand for high-performance flexible packaging adhesives that can provide essential barrier properties and ensure product integrity throughout the supply chain. The segment’s growth is further propelled by innovations in food safety regulations and consumer awareness regarding the importance of packaging in preserving nutritional value and preventing foodborne illnesses.

- Key Drivers:

Emerging Segment: Solvent-free Adhesives

- Key Drivers:

- Increasing environmental regulations and consumer demand for sustainable products.

- Improved performance characteristics, including faster curing times and higher bond strengths.

- Reduced VOC emissions, contributing to healthier work environments and end-user products.

- Technological advancements leading to broader applicability across various substrates.

- In-depth Analysis: The shift towards solvent-free adhesives represents a significant technological and environmental evolution within the lamination adhesives for flexible packaging market. As regulatory bodies worldwide impose stricter controls on VOC emissions and as consumers become more environmentally conscious, the demand for adhesives that minimize environmental impact is soaring. Manufacturers are increasingly investing in R&D to develop solvent-free adhesives that not only meet environmental standards but also offer enhanced performance, such as faster processing speeds and superior lamination strength, making them a preferred choice across all application segments.

- Key Drivers:

Lamination Adhesives For Flexible Packaging Product Innovations

Product innovation in lamination adhesives for flexible packaging is characterized by the development of advanced chemistries offering superior performance and sustainability. Key innovations include high-barrier adhesives that enhance product shelf life by providing excellent resistance to oxygen, moisture, and light, crucial for food packaging and medical packaging. Furthermore, the development of eco-friendly adhesives, such as bio-based or compostable formulations, is gaining momentum. These innovations focus on improved bond strength, faster curing times, and enhanced adhesion to a wider range of substrates, including challenging films like PET and BOPP. The unique selling proposition lies in balancing performance with environmental responsibility, catering to the evolving demands of global brands and consumers. For example, advancements in polyurethane and epoxy-based adhesives are offering enhanced retort and sterilization resistance, expanding their application in demanding packaging formats.

Propelling Factors for Lamination Adhesives For Flexible Packaging Growth

Several factors are propelling the growth of the lamination adhesives for flexible packaging market. The increasing global demand for processed and packaged foods, driven by urbanization and changing lifestyles, is a primary driver. Advancements in flexible packaging technology, enabling lighter, more durable, and more functional packaging, directly increase the need for high-performance adhesives. Stringent regulations regarding food safety and product integrity also necessitate advanced lamination solutions. Furthermore, the growing emphasis on sustainability and the reduction of environmental impact are accelerating the adoption of eco-friendly adhesives, particularly solvent-free adhesives. The economic growth in emerging markets, leading to increased consumer spending on packaged goods, further fuels this expansion.

Obstacles in the Lamination Adhesives For Flexible Packaging Market

Despite robust growth, the lamination adhesives for flexible packaging market faces several obstacles. Fluctuations in raw material prices, particularly for petrochemical derivatives, can impact manufacturing costs and profit margins. Increasing environmental regulations, while driving innovation, can also lead to higher compliance costs for manufacturers. Supply chain disruptions, as witnessed in recent global events, can affect the availability of raw materials and the timely delivery of finished products. Furthermore, intense competition among a large number of players, including established giants and emerging local manufacturers, can lead to price wars and reduced profitability. The development of cost-effective alternative packaging technologies also poses a competitive threat.

Future Opportunities in Lamination Adhesives For Flexible Packaging

The future opportunities in the lamination adhesives for flexible packaging market are significant and diverse. The burgeoning demand for sustainable and recyclable packaging presents a prime opportunity for adhesive manufacturers to develop bio-based, compostable, and easily de-bondable adhesives. The growth of the e-commerce sector necessitates specialized packaging solutions that offer enhanced protection and tamper-evidence, creating a niche for advanced lamination adhesives. Expansion into emerging economies with growing middle classes and increasing demand for packaged goods offers substantial untapped potential. Furthermore, the development of smart packaging technologies, incorporating sensors or indicators, could create new applications for specialized adhesives.

Major Players in the Lamination Adhesives For Flexible Packaging Ecosystem

- Henkel

- Bostik

- H.B. Fuller

- Ashland

- Dow

- 3M

- Vimasco Corporation

- Sika Automotive

- Coim

- Flint Group

- Toyo-Morton

- DIC Corporation

- Huber Group

- Comens Material

- China Neweast

- Jiangsu Lihe

- Morchem SA

- Shanghai Kangda

- Brilliant Polymers

- Sungdo

- UFlex

- Rockpaint

- Mitsui Chemicals

- Sapicci

- Wanhua

Key Developments in Lamination Adhesives For Flexible Packaging Industry

- 2023/07: Henkel launches a new range of high-performance, solvent-free adhesives for food packaging, enhancing sustainability and product protection.

- 2023/01: Bostik acquires a specialty adhesives company, expanding its portfolio of flexible packaging adhesives and strengthening its presence in Asia.

- 2022/11: Dow introduces innovative adhesive solutions for recyclable flexible packaging, aligning with circular economy initiatives.

- 2022/05: H.B. Fuller develops advanced water-based adhesives for medical packaging, meeting stringent sterilization and safety requirements.

- 2021/09: Flint Group expands its offering of sustainable printing inks and adhesives for flexible packaging, emphasizing eco-friendly solutions.

Strategic Lamination Adhesives For Flexible Packaging Market Forecast

The strategic lamination adhesives for flexible packaging market forecast is exceptionally promising, driven by a clear shift towards sustainable and high-performance solutions. The increasing global demand for convenience in food packaging, coupled with stringent regulatory requirements in medical packaging, will continue to fuel market expansion. The growth of e-commerce presents an opportunity for specialized, protective packaging solutions. The ongoing innovation in adhesive formulations, particularly the rise of solvent-free adhesives and bio-based alternatives, will cater to the growing environmental consciousness of consumers and brands. Strategic investments in R&D, coupled with potential M&A activities, will further shape the competitive landscape. The market is poised for sustained growth, with an estimated CAGR of xx% over the forecast period, representing a significant opportunity for stakeholders to capitalize on evolving market dynamics and technological advancements.

Lamination Adhesives For Flexible Packaging Segmentation

-

1. Application

- 1.1. Food Packaging

- 1.2. Medical Packaging

- 1.3. Industrial Packaging

- 1.4. Others

-

2. Type

- 2.1. Solvent Based Adhesives

- 2.2. Solvent-free Adhesives

- 2.3. Water Based Adhesives

Lamination Adhesives For Flexible Packaging Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Lamination Adhesives For Flexible Packaging REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Lamination Adhesives For Flexible Packaging Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Packaging

- 5.1.2. Medical Packaging

- 5.1.3. Industrial Packaging

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Solvent Based Adhesives

- 5.2.2. Solvent-free Adhesives

- 5.2.3. Water Based Adhesives

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Lamination Adhesives For Flexible Packaging Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Packaging

- 6.1.2. Medical Packaging

- 6.1.3. Industrial Packaging

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Solvent Based Adhesives

- 6.2.2. Solvent-free Adhesives

- 6.2.3. Water Based Adhesives

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Lamination Adhesives For Flexible Packaging Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Packaging

- 7.1.2. Medical Packaging

- 7.1.3. Industrial Packaging

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Solvent Based Adhesives

- 7.2.2. Solvent-free Adhesives

- 7.2.3. Water Based Adhesives

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Lamination Adhesives For Flexible Packaging Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Packaging

- 8.1.2. Medical Packaging

- 8.1.3. Industrial Packaging

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Solvent Based Adhesives

- 8.2.2. Solvent-free Adhesives

- 8.2.3. Water Based Adhesives

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Lamination Adhesives For Flexible Packaging Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food Packaging

- 9.1.2. Medical Packaging

- 9.1.3. Industrial Packaging

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Solvent Based Adhesives

- 9.2.2. Solvent-free Adhesives

- 9.2.3. Water Based Adhesives

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Lamination Adhesives For Flexible Packaging Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food Packaging

- 10.1.2. Medical Packaging

- 10.1.3. Industrial Packaging

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Solvent Based Adhesives

- 10.2.2. Solvent-free Adhesives

- 10.2.3. Water Based Adhesives

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Henkel

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bostik

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 H.B. Fuller

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ashland

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dow

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3M

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vimasco Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sika Automotive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Coim

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Flint Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Toyo-Morton

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DIC Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Huber Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Comens Material

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 China Neweast

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Jiangsu Lihe

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Morchem SA

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Shanghai Kangda

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Brilliant Polymers

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Sungdo

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 UFlex

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Rockpaint

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Mitsui Chemicals

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Sapicci

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Wanhua

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 Henkel

List of Figures

- Figure 1: Global Lamination Adhesives For Flexible Packaging Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Lamination Adhesives For Flexible Packaging Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Lamination Adhesives For Flexible Packaging Revenue (million), by Application 2024 & 2032

- Figure 4: North America Lamination Adhesives For Flexible Packaging Volume (K), by Application 2024 & 2032

- Figure 5: North America Lamination Adhesives For Flexible Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Lamination Adhesives For Flexible Packaging Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Lamination Adhesives For Flexible Packaging Revenue (million), by Type 2024 & 2032

- Figure 8: North America Lamination Adhesives For Flexible Packaging Volume (K), by Type 2024 & 2032

- Figure 9: North America Lamination Adhesives For Flexible Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Lamination Adhesives For Flexible Packaging Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Lamination Adhesives For Flexible Packaging Revenue (million), by Country 2024 & 2032

- Figure 12: North America Lamination Adhesives For Flexible Packaging Volume (K), by Country 2024 & 2032

- Figure 13: North America Lamination Adhesives For Flexible Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Lamination Adhesives For Flexible Packaging Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Lamination Adhesives For Flexible Packaging Revenue (million), by Application 2024 & 2032

- Figure 16: South America Lamination Adhesives For Flexible Packaging Volume (K), by Application 2024 & 2032

- Figure 17: South America Lamination Adhesives For Flexible Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Lamination Adhesives For Flexible Packaging Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Lamination Adhesives For Flexible Packaging Revenue (million), by Type 2024 & 2032

- Figure 20: South America Lamination Adhesives For Flexible Packaging Volume (K), by Type 2024 & 2032

- Figure 21: South America Lamination Adhesives For Flexible Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Lamination Adhesives For Flexible Packaging Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Lamination Adhesives For Flexible Packaging Revenue (million), by Country 2024 & 2032

- Figure 24: South America Lamination Adhesives For Flexible Packaging Volume (K), by Country 2024 & 2032

- Figure 25: South America Lamination Adhesives For Flexible Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Lamination Adhesives For Flexible Packaging Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Lamination Adhesives For Flexible Packaging Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Lamination Adhesives For Flexible Packaging Volume (K), by Application 2024 & 2032

- Figure 29: Europe Lamination Adhesives For Flexible Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Lamination Adhesives For Flexible Packaging Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Lamination Adhesives For Flexible Packaging Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Lamination Adhesives For Flexible Packaging Volume (K), by Type 2024 & 2032

- Figure 33: Europe Lamination Adhesives For Flexible Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Lamination Adhesives For Flexible Packaging Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Lamination Adhesives For Flexible Packaging Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Lamination Adhesives For Flexible Packaging Volume (K), by Country 2024 & 2032

- Figure 37: Europe Lamination Adhesives For Flexible Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Lamination Adhesives For Flexible Packaging Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Lamination Adhesives For Flexible Packaging Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Lamination Adhesives For Flexible Packaging Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Lamination Adhesives For Flexible Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Lamination Adhesives For Flexible Packaging Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Lamination Adhesives For Flexible Packaging Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Lamination Adhesives For Flexible Packaging Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Lamination Adhesives For Flexible Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Lamination Adhesives For Flexible Packaging Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Lamination Adhesives For Flexible Packaging Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Lamination Adhesives For Flexible Packaging Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Lamination Adhesives For Flexible Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Lamination Adhesives For Flexible Packaging Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Lamination Adhesives For Flexible Packaging Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Lamination Adhesives For Flexible Packaging Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Lamination Adhesives For Flexible Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Lamination Adhesives For Flexible Packaging Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Lamination Adhesives For Flexible Packaging Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Lamination Adhesives For Flexible Packaging Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Lamination Adhesives For Flexible Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Lamination Adhesives For Flexible Packaging Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Lamination Adhesives For Flexible Packaging Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Lamination Adhesives For Flexible Packaging Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Lamination Adhesives For Flexible Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Lamination Adhesives For Flexible Packaging Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Lamination Adhesives For Flexible Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Lamination Adhesives For Flexible Packaging Volume K Forecast, by Country 2019 & 2032

- Table 81: China Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Lamination Adhesives For Flexible Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Lamination Adhesives For Flexible Packaging Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Lamination Adhesives For Flexible Packaging?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Lamination Adhesives For Flexible Packaging?

Key companies in the market include Henkel, Bostik, H.B. Fuller, Ashland, Dow, 3M, Vimasco Corporation, Sika Automotive, Coim, Flint Group, Toyo-Morton, DIC Corporation, Huber Group, Comens Material, China Neweast, Jiangsu Lihe, Morchem SA, Shanghai Kangda, Brilliant Polymers, Sungdo, UFlex, Rockpaint, Mitsui Chemicals, Sapicci, Wanhua.

3. What are the main segments of the Lamination Adhesives For Flexible Packaging?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6789 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Lamination Adhesives For Flexible Packaging," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Lamination Adhesives For Flexible Packaging report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Lamination Adhesives For Flexible Packaging?

To stay informed about further developments, trends, and reports in the Lamination Adhesives For Flexible Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence