Key Insights

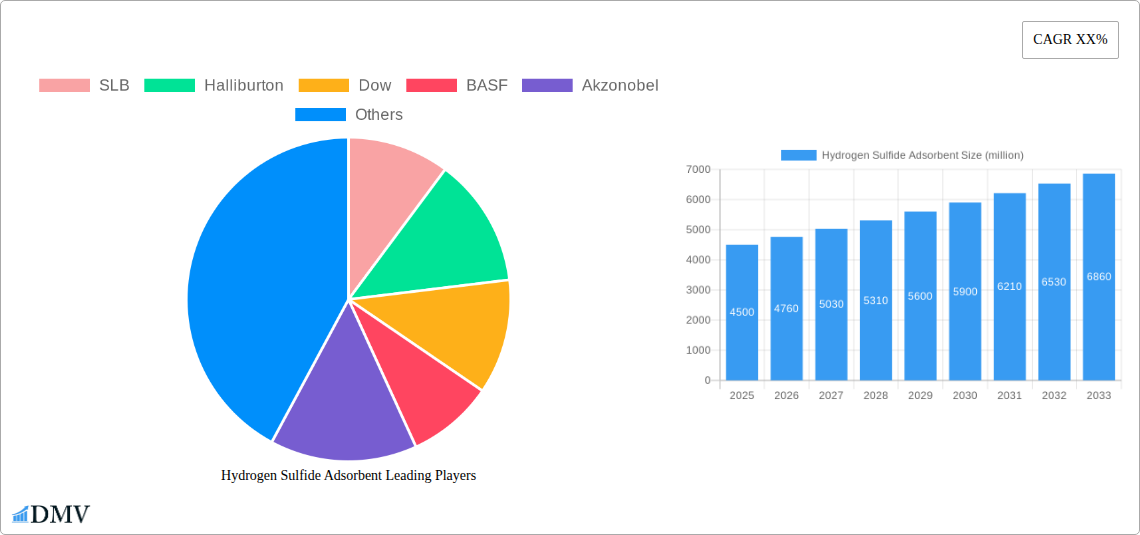

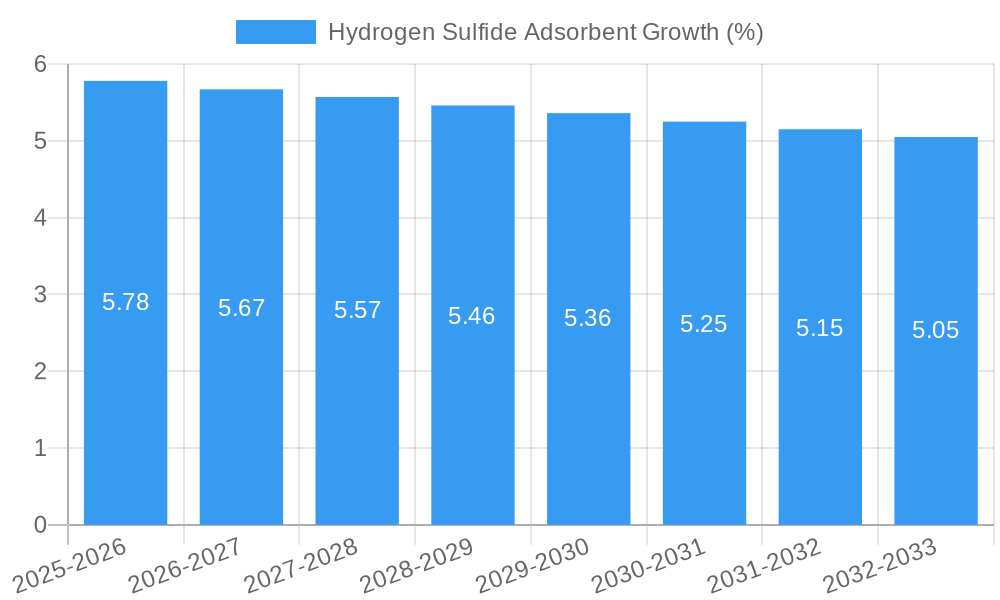

The global Hydrogen Sulfide Adsorbent market is poised for significant expansion, driven by the ever-increasing demand for cleaner energy sources and stringent environmental regulations across key industrial sectors. With an estimated market size of approximately USD 4,500 million in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of around 5.8%, reaching an estimated USD 6,500 million by 2033. This growth is primarily fueled by the critical role of hydrogen sulfide (H2S) removal in optimizing processes within the oil and gas industry, enhancing the efficiency of wastewater treatment facilities, and enabling the production of high-purity hydrogen for various applications. The escalating need to mitigate the corrosive and toxic effects of H2S, alongside the growing focus on sustainability and emissions control, are powerful catalysts for market advancement.

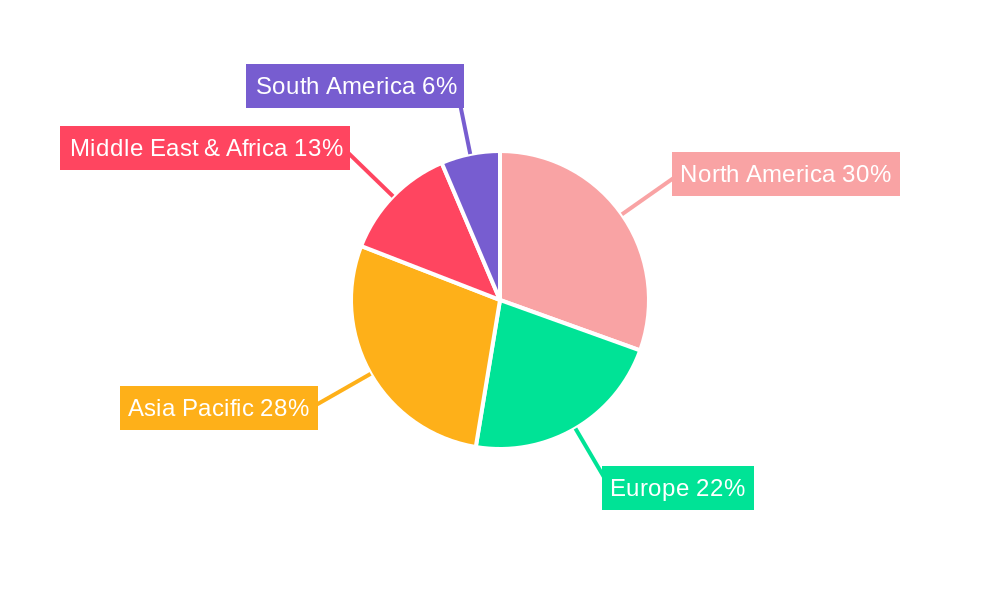

The market is segmented into Regenerative and Non-Regenerative types of adsorbents, with the Regenerative segment expected to dominate due to its cost-effectiveness and environmental benefits over the long term. Applications span the Gas Industry, Oil Industry, and Wastewater Treatment, with the Oil and Gas sector currently holding the largest share due to extensive H2S contamination issues. Emerging applications in renewable energy and industrial gas purification are also contributing to market diversification. Geographically, North America and the Asia Pacific region are expected to lead market growth, owing to substantial investments in oil and gas exploration and production, coupled with rapid industrialization and increasing environmental awareness in countries like China and India. However, restraints such as the initial capital investment for advanced adsorbent technologies and the availability of alternative treatment methods could temper the pace of growth in certain regions. Key players like SLB, Halliburton, Dow, and BASF are actively involved in research and development to introduce more efficient and sustainable H2S adsorbent solutions.

Hydrogen Sulfide Adsorbent Market Analysis: A Comprehensive Report

This report provides an in-depth analysis of the global Hydrogen Sulfide Adsorbent market, covering market dynamics, growth trajectories, regional dominance, product innovations, and future outlook. With a study period spanning from 2019 to 2033, and a base year of 2025, this research offers actionable insights for stakeholders to navigate the evolving landscape of H2S removal solutions.

Hydrogen Sulfide Adsorbent Market Composition & Trends

The Hydrogen Sulfide Adsorbent market exhibits a moderate concentration, with key players like SLB, Halliburton, Dow, BASF, Akzonobel, Huntsman, Ineos, NALCO Water, GE, CLARIANT, Johnson Matthey, ExxonMobil, Dorf Ketal Chemicals, Merichem, Newpoint Gas, Chemical Products Industries, Sinopec, CNPC, Axens, Topsoe, EMEC, Miox, Stepan, AMGAS, and SJ Environmental Corp driving innovation. Catalysts for market growth include stringent environmental regulations mandating H2S removal, increasing upstream oil and gas exploration activities, and the growing demand for clean water treatment solutions. The regulatory landscape is progressively tightening, pushing industries to adopt advanced H2S scavenging technologies. Substitute products, such as biological treatment methods, exist but often lack the efficiency and speed of chemical adsorbents. End-user profiles span diverse sectors, including the Gas Industry, Oil Industry, and Waste Water Treatment, with a growing emphasis on the Non-Regenerative Type for its cost-effectiveness in certain applications and the Regenerative Type for its sustainability and long-term operational benefits. Mergers and acquisitions (M&A) activity, with estimated deal values in the hundreds of millions, continues to shape market consolidation, enabling larger entities to expand their technological portfolios and geographical reach. For instance, a recent M&A transaction in 2024 involved a deal valued at approximately 250 million, aimed at integrating specialized adsorbent technologies into a broader service offering.

Hydrogen Sulfide Adsorbent Industry Evolution

The Hydrogen Sulfide Adsorbent industry has witnessed a dynamic evolution, driven by a confluence of technological advancements, shifting regulatory imperatives, and an ever-growing global demand for cleaner industrial processes. Over the historical period of 2019–2024, the market experienced a steady growth trajectory, propelled by increasing awareness and enforcement of environmental protection laws across major industrial hubs. The adoption rate of advanced H2S removal technologies, particularly within the Oil Industry and Gas Industry segments, has been a significant indicator of this evolution. For example, by 2024, an estimated 70% of new gas processing facilities incorporated advanced adsorbent solutions. The base year, 2025, marks a pivotal point, with projections indicating a continued upward trend in market value, potentially reaching a valuation of over 15,000 million by the forecast period's end. This growth is intrinsically linked to the inherent advantages of hydrogen sulfide adsorbents: their high efficiency in removing toxic and corrosive H2S gas, leading to enhanced operational safety, extended equipment lifespan, and compliance with stringent emission standards. Technological innovations have played a crucial role in this evolution. The development of highly selective and robust adsorbents, capable of operating under extreme temperature and pressure conditions, has expanded their applicability. Furthermore, the refinement of both Regenerative Type and Non-Regenerative Type adsorbents has catered to a broader spectrum of industry needs and economic considerations. Regenerative adsorbents, offering lower operational costs and reduced waste over their lifecycle, have seen increased adoption in continuous processes. Conversely, non-regenerative solutions remain a cost-effective choice for intermittent or smaller-scale applications. By 2025, the market for Regenerative Type adsorbents is estimated to account for approximately 60% of the total market share, a testament to their sustainability appeal. The demand for tailor-made solutions, addressing specific H2S concentrations and process streams, has also spurred innovation, leading to the development of specialized adsorbent formulations. This evolutionary path underscores the industry's responsiveness to both environmental pressures and the economic realities of industrial operations, solidifying the indispensable role of hydrogen sulfide adsorbents in modern industrial practices.

Leading Regions, Countries, or Segments in Hydrogen Sulfide Adsorbent

The Oil Industry segment, closely followed by the Gas Industry, currently asserts dominance in the global Hydrogen Sulfide Adsorbent market. This leadership is primarily attributed to the immense volumes of sour crude oil and natural gas that require extensive H2S treatment to meet processing specifications and environmental regulations. The Waste Water Treatment segment is experiencing a significant surge in growth, driven by increasing awareness and stricter regulations concerning the discharge of sulfide-laden effluents into water bodies.

Key Drivers of Dominance in the Oil and Gas Industries:

- Vast Reserves of Sour Crude and Natural Gas: Regions with substantial reserves of sour crude oil and natural gas, such as the Middle East, North America (particularly the Permian Basin and shale gas plays), and parts of Asia, represent the largest markets for H2S adsorbents. The need to process these hydrocarbon streams efficiently and compliantly is paramount.

- Stringent Environmental Regulations: Governments worldwide are imposing increasingly strict emission standards for sulfur compounds. This regulatory push compels oil and gas companies to invest in effective H2S removal technologies to avoid penalties and maintain operational licenses. For instance, the US Environmental Protection Agency (EPA) and European Union directives have been pivotal in this regard.

- Asset Integrity and Safety: Hydrogen sulfide is highly corrosive and toxic. Its removal is critical for protecting expensive infrastructure from corrosion and ensuring the safety of personnel in oil and gas facilities. The capital expenditure on maintaining these assets necessitates proactive H2S management.

- Technological Advancements in Extraction and Processing: As extraction technologies evolve, enabling the exploitation of more challenging reserves, the need for sophisticated H2S removal solutions intensifies. This includes enhanced oil recovery (EOR) techniques and advanced natural gas processing.

Dominance Factors within Adsorbent Types:

Within the adsorbent types, both Regenerative Type and Non-Regenerative Type play crucial roles, though their market share fluctuates based on application specifics and regional economics.

- Regenerative Type: These adsorbents, often based on activated carbon or molecular sieves, are favored in large-scale, continuous operations where long-term cost-effectiveness and waste reduction are priorities. Their ability to be regenerated and reused significantly lowers operational expenditure and environmental impact. The forecast suggests a continued strong growth of this segment, projected to capture around 65% of the market value by 2030, driven by sustainability initiatives and increasing operational scale in major energy-producing nations. The initial capital investment is higher, but the total cost of ownership over extended periods makes them the preferred choice for major oil and gas producers, particularly in regions with well-established infrastructure and long-term production horizons.

- Non-Regenerative Type: These adsorbents, typically iron-based or amine-based formulations, are often preferred for their lower upfront cost, ease of use, and suitability for intermittent or smaller-scale operations. They are widely used in upstream exploration, smaller refineries, and in situations where regeneration infrastructure is not feasible or economical. The market for non-regenerative adsorbents is expected to maintain a steady share, estimated at 35% by 2030, particularly in emerging markets or for specific niche applications where the capital investment for regenerative systems is prohibitive.

The combination of the extensive needs of the Oil and Gas industries and the distinct advantages offered by both regenerative and non-regenerative adsorbent technologies cements their leading position in the Hydrogen Sulfide Adsorbent market.

Hydrogen Sulfide Adsorbent Product Innovations

Recent product innovations in Hydrogen Sulfide Adsorbents are focused on enhancing efficiency, selectivity, and lifespan while minimizing environmental impact. Companies are developing advanced formulations, such as modified activated carbons and novel metal-oxide composites, capable of achieving ultra-low H2S concentrations (ppb levels) with superior adsorption kinetics. New materials are also being engineered to withstand higher temperatures and pressures, expanding applicability in challenging oil and gas extraction environments. Innovations in regeneration technologies for reusable adsorbents are also gaining traction, promising reduced energy consumption and lower operational costs, making them more competitive. Performance metrics are constantly being pushed, with new adsorbents demonstrating adsorption capacities exceeding 150 mg H2S per gram of adsorbent, and regeneration cycles reaching over 500 times without significant performance degradation.

Propelling Factors for Hydrogen Sulfide Adsorbent Growth

The growth of the Hydrogen Sulfide Adsorbent market is propelled by several key factors. Stringent environmental regulations worldwide are mandating lower sulfur emissions, forcing industries to adopt effective H2S removal solutions. The increasing global demand for energy, particularly from the oil and gas sectors, directly fuels the need for H2S management in exploration, production, and refining processes. Technological advancements in adsorbent materials, leading to higher efficiency, longer lifespan, and improved regeneration capabilities, are making these solutions more attractive and cost-effective. Furthermore, growing awareness of the health and safety risks associated with H2S exposure is prompting proactive adoption of these adsorbents in various industrial settings, including wastewater treatment plants. The estimated market growth rate for the period 2025-2033 is expected to be around 5.5% annually, driven by these robust factors.

Obstacles in the Hydrogen Sulfide Adsorbent Market

Despite robust growth, the Hydrogen Sulfide Adsorbent market faces several obstacles. High upfront capital costs associated with advanced regenerative adsorbent systems can be a barrier for smaller enterprises. Supply chain disruptions, particularly for raw materials and specialized manufacturing components, can lead to price volatility and production delays, impacting the availability of adsorbents. Competition from alternative H2S removal technologies, such as biological treatments and membrane separation, while often less efficient for certain applications, can pose a threat in specific market segments. Furthermore, complex disposal regulations for spent non-regenerative adsorbents can add to the operational costs and environmental burden for end-users. The estimated impact of these obstacles on market growth is approximately a 1.5% reduction in the projected growth rate if not effectively managed.

Future Opportunities in Hydrogen Sulfide Adsorbent

Emerging opportunities in the Hydrogen Sulfide Adsorbent market are abundant. The expansion of renewable energy infrastructure, particularly in biogas production and green hydrogen generation, presents a significant new demand for H2S removal solutions to ensure purity and prevent equipment corrosion. The increasing focus on water resource management and reuse is driving growth in the wastewater treatment segment, as industries seek to remove harmful sulfides from industrial effluents. Development of novel adsorbent materials with enhanced selectivity, capacity, and regeneration efficiency continues to open new application frontiers. Furthermore, the growing trend towards modular and decentralized H2S treatment systems offers opportunities for customized and easily deployable solutions, particularly in remote oil and gas exploration sites or smaller industrial facilities. The forecast predicts a substantial opportunity in the biogas sector, potentially adding over 1,000 million to the market value by 2033.

Major Players in the Hydrogen Sulfide Adsorbent Ecosystem

- SLB

- Halliburton

- Dow

- BASF

- Akzonobel

- Huntsman

- Ineos

- NALCO Water

- GE

- CLARIANT

- Johnson Matthey

- ExxonMobil

- Dorf Ketal Chemicals

- Merichem

- Newpoint Gas

- Chemical Products Industries

- Sinopec

- CNPC

- Axens

- Topsoe

- EMEC

- Miox

- Stepan

- AMGAS

- SJ Environmental Corp

Key Developments in Hydrogen Sulfide Adsorbent Industry

- 2023 Q4: Johnson Matthey launched a new generation of high-performance regenerable adsorbents for natural gas sweetening, offering improved capacity and energy efficiency.

- 2024 Q1: SLB announced a strategic partnership with a leading technology provider to enhance its suite of H2S scavenging solutions for deepwater applications, aiming to reduce operational costs by an estimated 10%.

- 2024 Q2: BASF unveiled a novel iron-based adsorbent with enhanced iron content and surface area, targeting improved performance in challenging wastewater treatment scenarios.

- 2024 Q3: Halliburton acquired a specialized H2S removal technology company, expanding its portfolio of sour gas treatment solutions with an estimated deal value of 300 million.

- 2025 Q1 (Projected): Clariant is expected to introduce a new generation of molecular sieve adsorbents with enhanced selectivity for trace H2S removal in critical industrial processes.

- 2025 Q2 (Projected): Dow plans to expand its production capacity for specialized amine-based H2S scavengers to meet increasing demand from the refining sector.

Strategic Hydrogen Sulfide Adsorbent Market Forecast

The Hydrogen Sulfide Adsorbent market is poised for sustained and robust growth, projected to expand significantly from its current valuation. This upward trajectory will be driven by an escalating global commitment to environmental sustainability and increasingly stringent regulations on sulfur emissions. The burgeoning demand from the oil and gas industries, coupled with the rapid expansion of the biogas and green hydrogen sectors, will serve as primary growth catalysts. Technological innovation, particularly in the development of highly efficient, regenerable, and environmentally benign adsorbent materials, will be crucial in unlocking new market opportunities and enhancing competitive advantages. Strategic investments in research and development, coupled with potential mergers and acquisitions, will continue to shape the competitive landscape. The market is expected to witness a compound annual growth rate (CAGR) of approximately 5.5% between 2025 and 2033, with the total market value projected to exceed 20,000 million by the end of the forecast period.

Hydrogen Sulfide Adsorbent Segmentation

-

1. Application

- 1.1. Gas Industry

- 1.2. Oil Industry

- 1.3. Waste Water Treatment

- 1.4. Others

-

2. Types

- 2.1. Regenerative Type

- 2.2. Non-Regenerative Type

Hydrogen Sulfide Adsorbent Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hydrogen Sulfide Adsorbent REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hydrogen Sulfide Adsorbent Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Gas Industry

- 5.1.2. Oil Industry

- 5.1.3. Waste Water Treatment

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Regenerative Type

- 5.2.2. Non-Regenerative Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hydrogen Sulfide Adsorbent Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Gas Industry

- 6.1.2. Oil Industry

- 6.1.3. Waste Water Treatment

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Regenerative Type

- 6.2.2. Non-Regenerative Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hydrogen Sulfide Adsorbent Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Gas Industry

- 7.1.2. Oil Industry

- 7.1.3. Waste Water Treatment

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Regenerative Type

- 7.2.2. Non-Regenerative Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hydrogen Sulfide Adsorbent Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Gas Industry

- 8.1.2. Oil Industry

- 8.1.3. Waste Water Treatment

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Regenerative Type

- 8.2.2. Non-Regenerative Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hydrogen Sulfide Adsorbent Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Gas Industry

- 9.1.2. Oil Industry

- 9.1.3. Waste Water Treatment

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Regenerative Type

- 9.2.2. Non-Regenerative Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hydrogen Sulfide Adsorbent Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Gas Industry

- 10.1.2. Oil Industry

- 10.1.3. Waste Water Treatment

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Regenerative Type

- 10.2.2. Non-Regenerative Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SLB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Halliburton

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dow

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Akzonobel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huntsman

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ineos

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NALCO Water

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CLARIANT

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Johnson Matthey

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ExxonMobil

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Dorf Ketal Chemicals

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Merichem

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Newpoint Gas

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Chemical Products Industries

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Sinopec

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 CNPC

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Axens

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Topsoe

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 EMEC

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Miox

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Stepan

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 AMGAS

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 SJ Environmental Corp

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.1 SLB

List of Figures

- Figure 1: Global Hydrogen Sulfide Adsorbent Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Hydrogen Sulfide Adsorbent Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Hydrogen Sulfide Adsorbent Revenue (million), by Application 2024 & 2032

- Figure 4: North America Hydrogen Sulfide Adsorbent Volume (K), by Application 2024 & 2032

- Figure 5: North America Hydrogen Sulfide Adsorbent Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Hydrogen Sulfide Adsorbent Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Hydrogen Sulfide Adsorbent Revenue (million), by Types 2024 & 2032

- Figure 8: North America Hydrogen Sulfide Adsorbent Volume (K), by Types 2024 & 2032

- Figure 9: North America Hydrogen Sulfide Adsorbent Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Hydrogen Sulfide Adsorbent Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Hydrogen Sulfide Adsorbent Revenue (million), by Country 2024 & 2032

- Figure 12: North America Hydrogen Sulfide Adsorbent Volume (K), by Country 2024 & 2032

- Figure 13: North America Hydrogen Sulfide Adsorbent Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Hydrogen Sulfide Adsorbent Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Hydrogen Sulfide Adsorbent Revenue (million), by Application 2024 & 2032

- Figure 16: South America Hydrogen Sulfide Adsorbent Volume (K), by Application 2024 & 2032

- Figure 17: South America Hydrogen Sulfide Adsorbent Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Hydrogen Sulfide Adsorbent Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Hydrogen Sulfide Adsorbent Revenue (million), by Types 2024 & 2032

- Figure 20: South America Hydrogen Sulfide Adsorbent Volume (K), by Types 2024 & 2032

- Figure 21: South America Hydrogen Sulfide Adsorbent Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Hydrogen Sulfide Adsorbent Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Hydrogen Sulfide Adsorbent Revenue (million), by Country 2024 & 2032

- Figure 24: South America Hydrogen Sulfide Adsorbent Volume (K), by Country 2024 & 2032

- Figure 25: South America Hydrogen Sulfide Adsorbent Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Hydrogen Sulfide Adsorbent Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Hydrogen Sulfide Adsorbent Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Hydrogen Sulfide Adsorbent Volume (K), by Application 2024 & 2032

- Figure 29: Europe Hydrogen Sulfide Adsorbent Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Hydrogen Sulfide Adsorbent Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Hydrogen Sulfide Adsorbent Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Hydrogen Sulfide Adsorbent Volume (K), by Types 2024 & 2032

- Figure 33: Europe Hydrogen Sulfide Adsorbent Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Hydrogen Sulfide Adsorbent Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Hydrogen Sulfide Adsorbent Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Hydrogen Sulfide Adsorbent Volume (K), by Country 2024 & 2032

- Figure 37: Europe Hydrogen Sulfide Adsorbent Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Hydrogen Sulfide Adsorbent Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Hydrogen Sulfide Adsorbent Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Hydrogen Sulfide Adsorbent Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Hydrogen Sulfide Adsorbent Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Hydrogen Sulfide Adsorbent Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Hydrogen Sulfide Adsorbent Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Hydrogen Sulfide Adsorbent Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Hydrogen Sulfide Adsorbent Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Hydrogen Sulfide Adsorbent Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Hydrogen Sulfide Adsorbent Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Hydrogen Sulfide Adsorbent Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Hydrogen Sulfide Adsorbent Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Hydrogen Sulfide Adsorbent Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Hydrogen Sulfide Adsorbent Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Hydrogen Sulfide Adsorbent Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Hydrogen Sulfide Adsorbent Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Hydrogen Sulfide Adsorbent Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Hydrogen Sulfide Adsorbent Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Hydrogen Sulfide Adsorbent Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Hydrogen Sulfide Adsorbent Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Hydrogen Sulfide Adsorbent Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Hydrogen Sulfide Adsorbent Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Hydrogen Sulfide Adsorbent Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Hydrogen Sulfide Adsorbent Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Hydrogen Sulfide Adsorbent Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Hydrogen Sulfide Adsorbent Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Hydrogen Sulfide Adsorbent Volume K Forecast, by Country 2019 & 2032

- Table 81: China Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Hydrogen Sulfide Adsorbent Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Hydrogen Sulfide Adsorbent Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydrogen Sulfide Adsorbent?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Hydrogen Sulfide Adsorbent?

Key companies in the market include SLB, Halliburton, Dow, BASF, Akzonobel, Huntsman, Ineos, NALCO Water, GE, CLARIANT, Johnson Matthey, ExxonMobil, Dorf Ketal Chemicals, Merichem, Newpoint Gas, Chemical Products Industries, Sinopec, CNPC, Axens, Topsoe, EMEC, Miox, Stepan, AMGAS, SJ Environmental Corp.

3. What are the main segments of the Hydrogen Sulfide Adsorbent?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hydrogen Sulfide Adsorbent," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hydrogen Sulfide Adsorbent report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hydrogen Sulfide Adsorbent?

To stay informed about further developments, trends, and reports in the Hydrogen Sulfide Adsorbent, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence