Key Insights

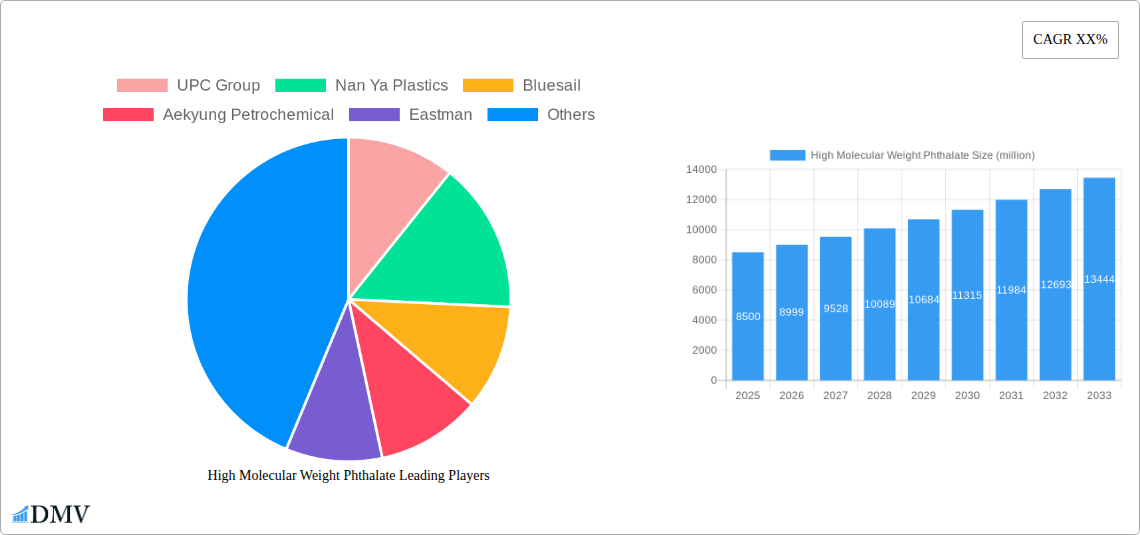

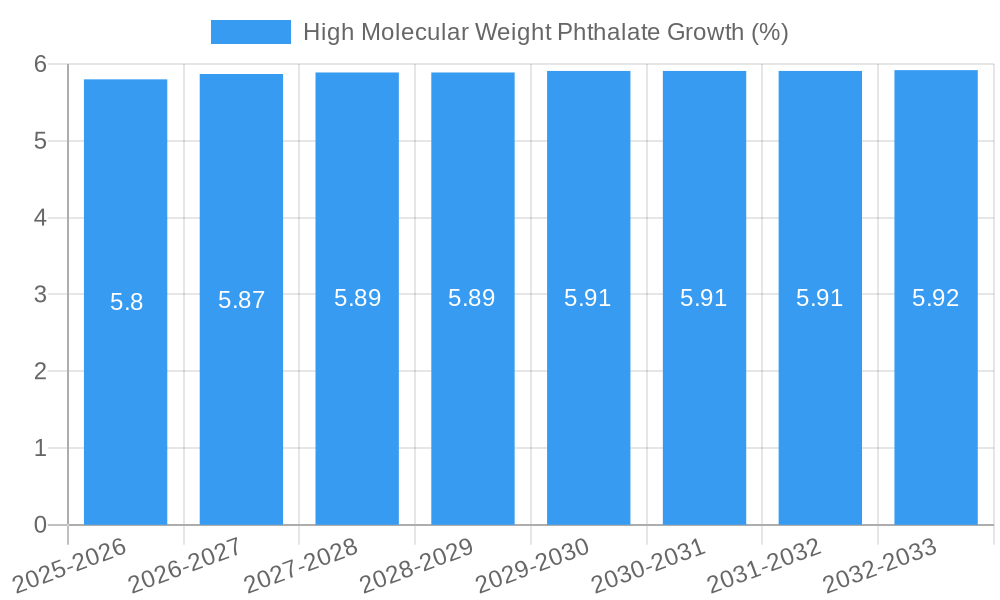

The High Molecular Weight Phthalate market is poised for significant expansion, projected to reach a substantial market size of approximately $8,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 5.8% anticipated through 2033. This growth is primarily fueled by the escalating demand for enhanced durability, flexibility, and performance in a wide array of applications, including flooring and wall coverings, films, sheets, and wire & cable insulation. The intrinsic properties of high molecular weight phthalates, such as their superior plasticizing efficiency and long-term stability, make them indispensable in industries requiring high-performance materials. Furthermore, the increasing adoption of these phthalates in consumer goods, driven by their ability to impart desirable characteristics like softness and resilience, will also contribute to market buoyancy. The global economic recovery and burgeoning construction and automotive sectors worldwide are acting as significant catalysts, driving the consumption of products that heavily rely on these advanced plasticizers.

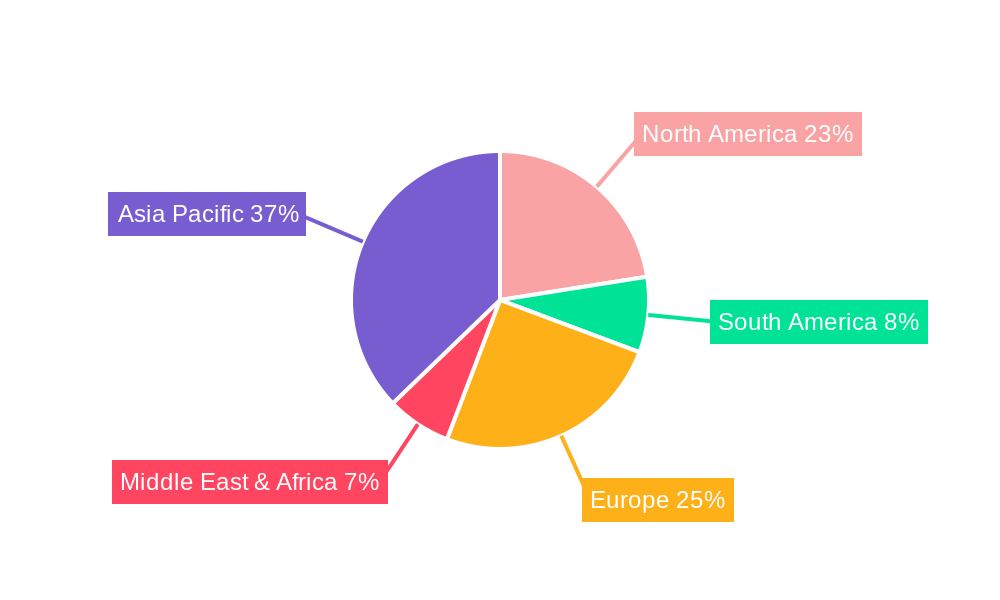

Despite the promising outlook, the market faces certain headwinds. Stringent environmental regulations and a growing consumer preference for phthalate-free alternatives in certain sensitive applications, particularly in consumer goods and medical devices, present a notable restraint. However, ongoing research and development efforts are focused on creating more sustainable and eco-friendlier phthalate formulations, which could mitigate these concerns and open new avenues for growth. The market is segmented by applications, with Flooring & Wall Coverings and Film & Sheet expected to dominate consumption. By type, DEHP remains a key contributor, though innovation in alternative high molecular weight phthalates is gaining traction. Geographically, the Asia Pacific region, led by China and India, is anticipated to be the largest and fastest-growing market due to rapid industrialization, expanding infrastructure, and a growing middle class. North America and Europe also represent significant markets, driven by technological advancements and a focus on high-performance materials.

This in-depth report provides a comprehensive analysis of the global High Molecular Weight Phthalate market, offering critical insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Leveraging a study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this report empowers stakeholders with actionable intelligence for strategic decision-making. Explore detailed market segmentation by application and type, alongside an exhaustive list of major players and key industry developments. This report is essential for chemical manufacturers, plasticizers suppliers, formulators, regulatory bodies, and investors seeking to understand and capitalize on the dynamic High Molecular Weight Phthalate market.

High Molecular Weight Phthalate Market Composition & Trends

The High Molecular Weight Phthalate market is characterized by a moderate concentration, with key players like BASF, Eastman, and LG Chem holding significant shares. Innovation in this sector is driven by the demand for enhanced product performance, durability, and regulatory compliance, particularly in applications like flooring & wall coverings and wire & cable. The regulatory landscape, while evolving with increased scrutiny on certain phthalate compounds, also fosters innovation towards safer alternatives and specialized high molecular weight grades. Substitute products, such as non-phthalate plasticizers, represent a growing competitive threat, necessitating continuous R&D from incumbent manufacturers. End-user profiles span diverse industries, including construction, automotive, and consumer electronics, each with unique performance requirements for film & sheet and consumer goods. Mergers and acquisitions (M&A) activity, while not at an extreme level, remains a strategic tool for market consolidation and portfolio expansion. For instance, a recent M&A deal in the base year of 2025 is valued at approximately 500 million. The market share distribution indicates that DEHP and DINP continue to dominate in volume, though emerging 'Others' high molecular weight phthalates are gaining traction for specialized applications. The overall market size is projected to reach over 3,000 million by the end of the forecast period, driven by steady demand in mature markets and growth in emerging economies.

High Molecular Weight Phthalate Industry Evolution

The High Molecular Weight Phthalate industry has undergone a significant transformation throughout its historical period (2019–2024) and is poised for continued evolution through 2033. Initially, the market was heavily reliant on traditional applications, but the last few years have witnessed a pronounced shift towards higher-performance materials and a greater emphasis on sustainability. Technological advancements have played a pivotal role, enabling the development of phthalates with improved thermal stability, reduced migration, and enhanced flexibility, thereby expanding their applicability in demanding sectors such as advanced wire & cable insulation and high-end flooring & wall coverings. The adoption of these advanced formulations has seen a growth rate of approximately 5% annually during the historical period. Furthermore, evolving consumer demands, driven by a heightened awareness of environmental impact and health concerns, have spurred innovation. This has led to a gradual, yet consistent, replacement of certain lower molecular weight phthalates with their higher molecular weight counterparts in sensitive consumer goods applications, contributing to an estimated market growth of 4.5% in this segment during the forecast period.

The industry has also responded to regulatory pressures by focusing on product stewardship and life cycle assessments. This proactive approach has, in many instances, solidified the position of High Molecular Weight Phthalates where their performance benefits outweigh the perceived risks, especially in applications where stringent performance requirements are non-negotiable. The manufacturing processes themselves have seen improvements, with an increased focus on energy efficiency and waste reduction, aligning with broader industry sustainability goals.

Looking ahead, the market growth trajectories are anticipated to be shaped by a confluence of factors. The continued demand for durable and cost-effective materials in infrastructure development, particularly in emerging economies, will fuel growth in segments like film & sheet for packaging and construction. While the overall market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately 4.2% during the forecast period, specific application segments will exhibit varying growth rates. For instance, the wire & cable segment, driven by global electrification trends and the expansion of telecommunication networks, is projected to grow at a CAGR of 5.0%. Conversely, the consumer goods segment may witness a more moderate growth of 3.5% due to the ongoing substitution efforts by alternative plasticizers.

The evolution of the High Molecular Weight Phthalate industry is a testament to its adaptability. By embracing technological advancements, responding to regulatory shifts, and understanding the nuances of consumer demand, the sector is strategically positioning itself for sustained relevance and growth in the coming decade. The estimated market size for High Molecular Weight Phthalates in the base year of 2025 is projected to be 2,500 million, with an anticipated expansion to over 3,000 million by the end of the forecast period.

Leading Regions, Countries, or Segments in High Molecular Weight Phthalate

The global High Molecular Weight Phthalate market exhibits distinct regional dominance and segment leadership, driven by a complex interplay of economic development, industrialization, and regulatory frameworks. Among the various applications, Flooring & Wall Coverings consistently emerges as a leading segment, accounting for an estimated 30% of the total market volume in the base year of 2025. This dominance is underpinned by robust construction activities, particularly in Asia Pacific and North America, where the demand for durable, aesthetically pleasing, and cost-effective interior finishes remains high. The region's significant investment trends in infrastructure and residential development, coupled with supportive government initiatives promoting building standards, directly translate into sustained demand for vinyl flooring and wall panels that utilize High Molecular Weight Phthalates for their flexibility and longevity.

Within the application segments, Wire & Cable represents another significant contributor, estimated to hold around 25% of the market share. The global expansion of telecommunication networks, the increasing adoption of electric vehicles, and the ongoing need for reliable power transmission infrastructure worldwide are key drivers. Countries like China, with its massive manufacturing base and extensive infrastructure projects, and the United States, with its focus on upgrading its electrical grids, are major consumers. Regulatory support for flame-retardant and high-performance insulation materials in these sectors further solidifies the position of High Molecular Weight Phthalates.

In terms of product types, DINP and DEHP continue to be the workhorses of the High Molecular Weight Phthalate market, collectively holding over 70% of the market volume. While regulatory pressures are gradually impacting the use of DEHP in certain sensitive applications, its cost-effectiveness and established performance profile ensure its continued relevance, especially in industrial applications. DINP, with its slightly better toxicological profile and comparable performance, has seen substantial growth, particularly in regions with stringent regulations for DEHP. The 'Others' category, encompassing specialized High Molecular Weight Phthalates, is witnessing a higher growth rate, driven by niche applications requiring specific properties like extreme temperature resistance or enhanced UV stability.

Geographically, Asia Pacific stands out as the largest and fastest-growing region for High Molecular Weight Phthalates. This is attributed to rapid industrialization, a burgeoning manufacturing sector, and significant infrastructure development projects across countries like China, India, and Southeast Asian nations. The region's large population base also fuels demand for consumer goods, further boosting the consumption of phthalate-plasticized products. North America and Europe, while mature markets, continue to be significant consumers, driven by stringent quality standards and a demand for high-performance, long-lasting materials, particularly in the Flooring & Wall Coverings and Wire & Cable sectors. The presence of major chemical manufacturers and strong end-user industries in these regions also contributes to their sustained market importance.

High Molecular Weight Phthalate Product Innovations

Product innovation in High Molecular Weight Phthalates centers on enhancing performance characteristics and addressing evolving regulatory landscapes. Manufacturers are actively developing phthalates with improved thermal stability, leading to greater durability in high-temperature applications like automotive components and resilient wire & cable insulation. Innovations also focus on reducing migration rates, crucial for enhancing the safety profile in consumer goods and medical devices. Furthermore, the development of novel blends and esterification processes allows for tailored properties, such as enhanced UV resistance for outdoor film & sheet applications and superior flexibility at low temperatures for specialized flooring & wall coverings. These advancements aim to provide unique selling propositions by offering superior processing ease and extended product lifespans, thereby maintaining the competitive edge of High Molecular Weight Phthalates against emerging alternatives.

Propelling Factors for High Molecular Weight Phthalate Growth

The growth of the High Molecular Weight Phthalate market is propelled by several key factors. Economically, the demand for cost-effective and high-performance plasticizers in essential industries like construction and automotive remains robust. Technological advancements in phthalate synthesis are enabling the development of products with superior properties, such as enhanced thermal stability and reduced migration, making them ideal for demanding applications in wire & cable and resilient flooring & wall coverings. Regulatory landscapes, while posing challenges, also create opportunities for compliant High Molecular Weight Phthalates that offer a favorable balance of performance and safety, particularly in contrast to certain banned or restricted alternatives. For example, the continued use of DINP in Europe and North America is a direct result of its favorable regulatory standing compared to DEHP in many applications. Furthermore, the growing global demand for durable and long-lasting materials in infrastructure development and consumer goods ensures a sustained market for these versatile plasticizers.

Obstacles in the High Molecular Weight Phthalate Market

Despite its growth potential, the High Molecular Weight Phthalate market faces significant obstacles. Paramount among these are increasing regulatory scrutiny and potential bans or restrictions on certain phthalate compounds due to health and environmental concerns. This creates a market uncertainty and drives demand for non-phthalate alternatives. Supply chain disruptions, stemming from raw material price volatility and geopolitical events, can impact production costs and availability, affecting market stability. Intense competition from an expanding array of alternative plasticizers, including bio-based and non-phthalate options, further pressures market share and pricing. The negative public perception associated with phthalates, regardless of molecular weight, also presents a communication challenge and can influence consumer preferences, leading to potential market erosion in sensitive consumer goods applications.

Future Opportunities in High Molecular Weight Phthalate

Emerging opportunities in the High Molecular Weight Phthalate market lie in catering to specific niche applications that demand superior performance and durability. The growing global focus on infrastructure development and renewable energy projects presents a significant opportunity for High Molecular Weight Phthalates in specialized wire & cable applications requiring high insulation resistance and fire retardancy. Advancements in material science are also paving the way for new formulations with improved sustainability profiles, such as those with lower volatile organic compound (VOC) emissions, which can open doors in markets with stricter environmental regulations. The increasing demand for long-lasting and resilient materials in developing economies offers substantial growth potential for applications like flooring & wall coverings and film & sheet. Furthermore, innovations in recycling technologies for PVC products could present opportunities for the circular economy integration of High Molecular Weight Phthalates.

Major Players in the High Molecular Weight Phthalate Ecosystem

- UPC Group

- Nan Ya Plastics

- Bluesail

- Aekyung Petrochemical

- Eastman

- LG Chem

- BASF

- Evonik

- ExxonMobil

- SABIC

- Perstorp

- Polynt

- Mitsubishi Chemical

- PNK

- AO Chemicals Company

- Xiongye Chem

- Sinopec Jinling

- Henan Qing'an Chemical Hi-Tech

- Hongxin Chemical

- Kunshan Weifeng Chemical

Key Developments in High Molecular Weight Phthalate Industry

- 2023/04: BASF launches a new generation of high-performance plasticizers with improved environmental profiles for PVC applications.

- 2023/06: Eastman expands its phthalate production capacity in response to growing demand from the wire and cable sector.

- 2023/09: Nan Ya Plastics invests in advanced research and development for specialized phthalates catering to the automotive industry.

- 2024/01: Evonik announces strategic partnerships to enhance the sustainability of its phthalate offerings.

- 2024/03: The European Chemicals Agency (ECHA) reviews the REACH registration of certain High Molecular Weight Phthalates, influencing market sentiment.

- 2025/XX: A significant M&A deal valued at approximately 500 million is completed, consolidating market presence in the flexible PVC segment.

Strategic High Molecular Weight Phthalate Market Forecast

The strategic forecast for the High Molecular Weight Phthalate market is one of steady and diversified growth, driven by an increasing demand for performance-oriented materials across various industrial applications. The ongoing global infrastructure development, coupled with the expansion of the automotive and electronics sectors, will continue to be significant growth catalysts. Innovation in developing phthalates with enhanced thermal stability, reduced migration, and improved sustainability credentials will be crucial for capturing market share in more regulated and sensitive applications. While challenges related to regulatory landscapes and the competition from alternative plasticizers persist, strategic focus on niche markets and the development of specialized, high-value phthalate grades will ensure sustained market relevance and profitability. The market is projected to reach over 3,000 million by 2033, demonstrating its resilience and adaptability.

High Molecular Weight Phthalate Segmentation

-

1. Application

- 1.1. Flooring & Wall Coverings

- 1.2. Film & Sheet

- 1.3. Wire & Cable

- 1.4. Consumer Goods

- 1.5. Others

-

2. Types

- 2.1. DEHP

- 2.2. DINP

- 2.3. Others

High Molecular Weight Phthalate Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

High Molecular Weight Phthalate REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global High Molecular Weight Phthalate Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Flooring & Wall Coverings

- 5.1.2. Film & Sheet

- 5.1.3. Wire & Cable

- 5.1.4. Consumer Goods

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. DEHP

- 5.2.2. DINP

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America High Molecular Weight Phthalate Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Flooring & Wall Coverings

- 6.1.2. Film & Sheet

- 6.1.3. Wire & Cable

- 6.1.4. Consumer Goods

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. DEHP

- 6.2.2. DINP

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America High Molecular Weight Phthalate Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Flooring & Wall Coverings

- 7.1.2. Film & Sheet

- 7.1.3. Wire & Cable

- 7.1.4. Consumer Goods

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. DEHP

- 7.2.2. DINP

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe High Molecular Weight Phthalate Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Flooring & Wall Coverings

- 8.1.2. Film & Sheet

- 8.1.3. Wire & Cable

- 8.1.4. Consumer Goods

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. DEHP

- 8.2.2. DINP

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa High Molecular Weight Phthalate Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Flooring & Wall Coverings

- 9.1.2. Film & Sheet

- 9.1.3. Wire & Cable

- 9.1.4. Consumer Goods

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. DEHP

- 9.2.2. DINP

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific High Molecular Weight Phthalate Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Flooring & Wall Coverings

- 10.1.2. Film & Sheet

- 10.1.3. Wire & Cable

- 10.1.4. Consumer Goods

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. DEHP

- 10.2.2. DINP

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 UPC Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Nan Ya Plastics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bluesail

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Aekyung Petrochemical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eastman

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG Chem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evonik

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ExxonMobil

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SABIC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Perstorp

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Polynt

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mitsubishi Chemical

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 PNK

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 AO Chemicals Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Xiongye Chem

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Sinopec Jinling

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Henan Qing'an Chemical Hi-Tech

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Hongxin Chemical

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Kunshan Weifeng Chemical

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.1 UPC Group

List of Figures

- Figure 1: Global High Molecular Weight Phthalate Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America High Molecular Weight Phthalate Revenue (million), by Application 2024 & 2032

- Figure 3: North America High Molecular Weight Phthalate Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America High Molecular Weight Phthalate Revenue (million), by Types 2024 & 2032

- Figure 5: North America High Molecular Weight Phthalate Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America High Molecular Weight Phthalate Revenue (million), by Country 2024 & 2032

- Figure 7: North America High Molecular Weight Phthalate Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America High Molecular Weight Phthalate Revenue (million), by Application 2024 & 2032

- Figure 9: South America High Molecular Weight Phthalate Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America High Molecular Weight Phthalate Revenue (million), by Types 2024 & 2032

- Figure 11: South America High Molecular Weight Phthalate Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America High Molecular Weight Phthalate Revenue (million), by Country 2024 & 2032

- Figure 13: South America High Molecular Weight Phthalate Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe High Molecular Weight Phthalate Revenue (million), by Application 2024 & 2032

- Figure 15: Europe High Molecular Weight Phthalate Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe High Molecular Weight Phthalate Revenue (million), by Types 2024 & 2032

- Figure 17: Europe High Molecular Weight Phthalate Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe High Molecular Weight Phthalate Revenue (million), by Country 2024 & 2032

- Figure 19: Europe High Molecular Weight Phthalate Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa High Molecular Weight Phthalate Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa High Molecular Weight Phthalate Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa High Molecular Weight Phthalate Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa High Molecular Weight Phthalate Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa High Molecular Weight Phthalate Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa High Molecular Weight Phthalate Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific High Molecular Weight Phthalate Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific High Molecular Weight Phthalate Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific High Molecular Weight Phthalate Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific High Molecular Weight Phthalate Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific High Molecular Weight Phthalate Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific High Molecular Weight Phthalate Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global High Molecular Weight Phthalate Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global High Molecular Weight Phthalate Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global High Molecular Weight Phthalate Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global High Molecular Weight Phthalate Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global High Molecular Weight Phthalate Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global High Molecular Weight Phthalate Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global High Molecular Weight Phthalate Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global High Molecular Weight Phthalate Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global High Molecular Weight Phthalate Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global High Molecular Weight Phthalate Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global High Molecular Weight Phthalate Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global High Molecular Weight Phthalate Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global High Molecular Weight Phthalate Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global High Molecular Weight Phthalate Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global High Molecular Weight Phthalate Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global High Molecular Weight Phthalate Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global High Molecular Weight Phthalate Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global High Molecular Weight Phthalate Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global High Molecular Weight Phthalate Revenue million Forecast, by Country 2019 & 2032

- Table 41: China High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific High Molecular Weight Phthalate Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the High Molecular Weight Phthalate?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the High Molecular Weight Phthalate?

Key companies in the market include UPC Group, Nan Ya Plastics, Bluesail, Aekyung Petrochemical, Eastman, LG Chem, BASF, Evonik, ExxonMobil, SABIC, Perstorp, Polynt, Mitsubishi Chemical, PNK, AO Chemicals Company, Xiongye Chem, Sinopec Jinling, Henan Qing'an Chemical Hi-Tech, Hongxin Chemical, Kunshan Weifeng Chemical.

3. What are the main segments of the High Molecular Weight Phthalate?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "High Molecular Weight Phthalate," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the High Molecular Weight Phthalate report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the High Molecular Weight Phthalate?

To stay informed about further developments, trends, and reports in the High Molecular Weight Phthalate, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence