Key Insights

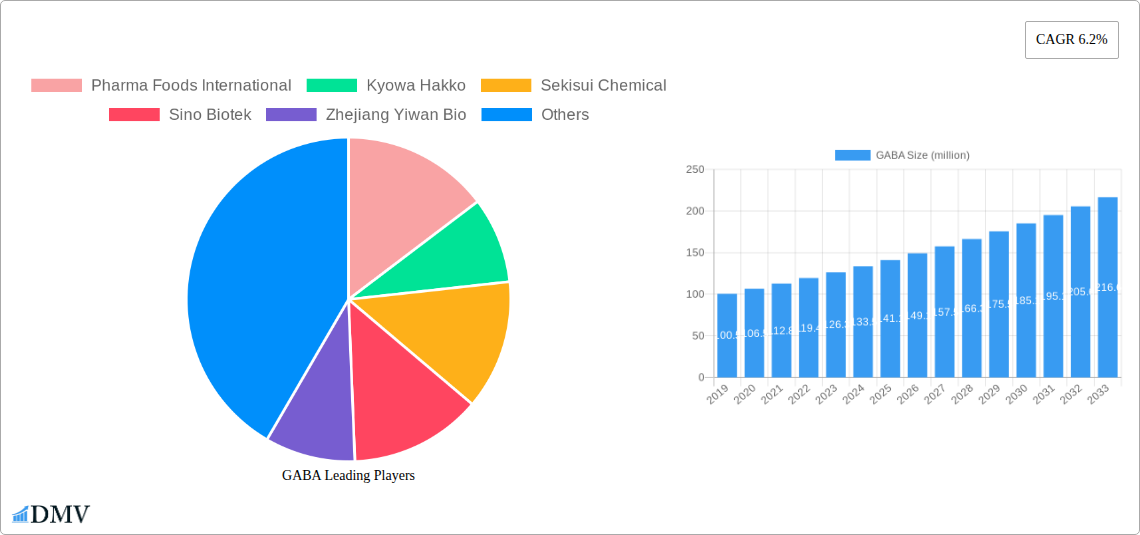

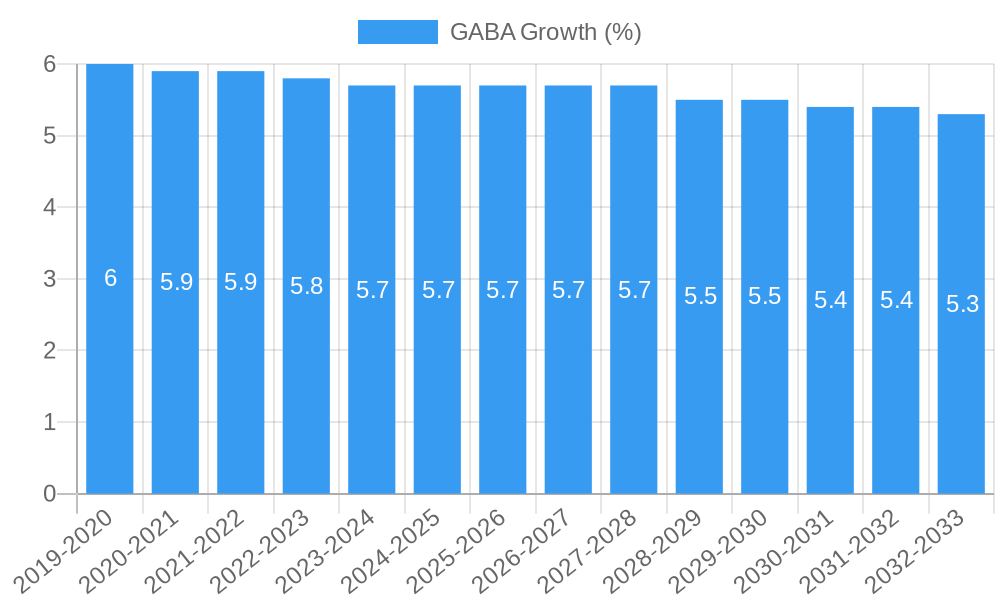

The Gamma-Aminobutyric Acid (GABA) market is poised for significant expansion, projected to reach an estimated USD 153 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.2% over the forecast period of 2025-2033. This growth trajectory is fueled by a confluence of factors, primarily driven by the escalating demand for GABA in the animal feed industry, where its benefits in reducing stress and improving growth performance are increasingly recognized. Furthermore, the burgeoning food and beverage sector, driven by consumer interest in functional foods and natural mood enhancers, represents another substantial driver. The pharmaceutical and nutraceutical industries also contribute significantly, leveraging GABA's anxiolytic and sleep-promoting properties. Emerging applications in cosmetics, focusing on anti-aging and skin-soothing benefits, are also contributing to market diversification and growth. The increasing preference for microbial fermentation-derived GABA over chemically synthesized alternatives, owing to its natural origin and perceived safety, further bolsters market expansion.

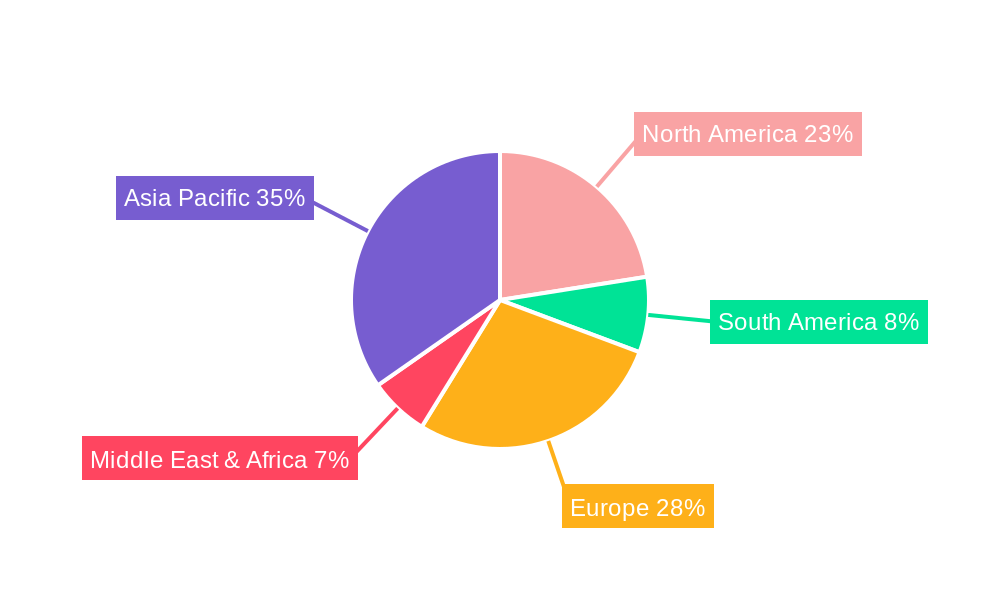

The market's segmentation reveals a dynamic landscape, with Microbial Fermentation (Feed Grade) emerging as a dominant segment, reflecting the agricultural sector's growing adoption. The Food Grade segment is also experiencing substantial traction, aligning with global wellness trends. Geographically, Asia Pacific, led by China and India, is anticipated to be a major growth engine due to a large livestock population and a rapidly expanding food processing industry. North America and Europe are also significant markets, driven by high disposable incomes and increasing consumer awareness of the health benefits of GABA. Key market players are actively engaged in research and development to enhance production efficiency and explore novel applications, ensuring a competitive and innovative market environment. However, challenges such as fluctuating raw material costs and stringent regulatory approvals for certain applications may present moderate restraints to the otherwise optimistic market outlook.

GABA Market Analysis Report: Unlocking Growth and Innovation (2019-2033)

This comprehensive report delves deep into the global Gamma-Aminobutyric Acid (GABA) market, providing an insightful analysis of its current landscape, historical trajectory, and future potential. Examine market dynamics, key players, technological advancements, and emerging opportunities within this rapidly evolving industry. This report is an essential resource for stakeholders seeking to understand the intricate workings of the GABA market and make informed strategic decisions.

GABA Market Composition & Trends

The global GABA market is characterized by a dynamic interplay of established and emerging players, driving innovation and shaping market trends. Market concentration varies across different segments, with Microbial Fermentation (Feed Grade) and Microbial Fermentation (Food Grade) exhibiting robust competition among key manufacturers such as Pharma Foods International, Kyowa Hakko, and Sino Biotek. Chemical synthesis remains a significant production method, with companies like Sekisui Chemical and Zhejiang Yiwan Bio contributing substantially. Innovation catalysts are primarily driven by advancements in fermentation technologies and the increasing demand for natural and bio-based ingredients across various applications, including Animal Feed, Food, Medicine, and Cosmetic. The Plant Growth Promoter segment is also witnessing significant traction. Regulatory landscapes are evolving, with stricter guidelines on ingredient sourcing and production influencing market entry and product development. Substitute products, while present, face challenges in replicating the unique functional benefits of GABA. End-user profiles are diverse, encompassing animal nutrition companies, food and beverage manufacturers, pharmaceutical firms, and cosmetic brands, each seeking specific GABA grades and functionalities. Mergers and acquisitions (M&A) activity is a notable trend, with recent deals valued in the range of xx million to xx million, indicating strategic consolidation and expansion within the industry.

GABA Industry Evolution

The GABA industry has undergone a remarkable transformation over the study period of 2019–2033, driven by escalating market demand and continuous technological progress. The base year of 2025 positions us at a critical juncture, with the market poised for significant expansion throughout the forecast period of 2025–2033. Historically, from 2019 to 2024, the market witnessed steady growth, fueled by growing awareness of GABA's health benefits and its expanding applications. Technological advancements, particularly in microbial fermentation processes, have been pivotal. These advancements have led to more efficient and cost-effective production of high-purity GABA, making it accessible for a wider range of applications. For instance, improvements in strain development and bioreactor optimization have significantly boosted yields and reduced production costs by an estimated xx% compared to earlier methods. Shifting consumer demands towards natural, functional ingredients have also propelled the market forward. Consumers are increasingly seeking products that offer specific health benefits, and GABA, with its known roles in stress reduction and sleep improvement, perfectly aligns with this trend. The adoption of GABA in functional foods and beverages has seen a remarkable surge, with an estimated xx% increase in product launches featuring GABA in the last two years alone. The Animal Feed segment, driven by the need for improved animal welfare and productivity, has also emerged as a substantial growth area, with an estimated xx% year-on-year growth. Similarly, the Cosmetic sector is increasingly incorporating GABA for its anti-aging and skin-calming properties, showcasing an estimated adoption rate of xx% within new product formulations. The overall market growth rate is projected to be around xx% CAGR during the forecast period.

Leading Regions, Countries, or Segments in GABA

The global GABA market demonstrates distinct regional dominance and segment leadership, shaped by a confluence of factors including investment trends, regulatory support, and prevailing consumer preferences. Asia Pacific has emerged as the leading region, driven by robust manufacturing capabilities, a large consumer base, and significant investments in research and development. Countries like China and Japan are at the forefront, with a high concentration of manufacturers and a growing domestic demand for GABA-enriched products.

Key Drivers in Leading Regions & Segments:

Asia Pacific Dominance:

- Manufacturing Prowess: Countries like China possess a well-established chemical synthesis and fermentation infrastructure, allowing for large-scale, cost-effective production of various GABA types. Companies such as Sino Biotek, Zhejiang Yiwan Bio, and Shanghai Richen are key contributors.

- Growing Health Consciousness: An increasing awareness of the health benefits associated with GABA, particularly in stress management and sleep improvement, fuels demand in the Food and Medicine applications.

- Government Support & R&D: Favorable government policies supporting biotechnology and food science, coupled with substantial investments in R&D by both private entities and academic institutions, accelerate innovation and market penetration.

- Expanding Animal Feed Sector: The burgeoning Animal Feed industry in the region, driven by the need for enhanced animal nutrition and welfare, represents a significant growth avenue for feed-grade GABA.

Dominant Segments:

- Microbial Fermentation (Feed Grade): This segment is experiencing immense growth due to the increasing demand for natural and effective feed additives that improve animal health and reduce stress, leading to better production outcomes. Companies like Pharma Foods International and Kyowa Hakko are prominent players.

- Microbial Fermentation (Food Grade): Driven by consumer preference for natural ingredients and the growing functional food market, this segment is witnessing substantial expansion. Its application in beverages, dairy products, and dietary supplements makes it a key growth driver.

- Chemical Synthesis: While microbial fermentation gains traction, chemical synthesis remains a vital production method, particularly for bulk production and specific purity requirements. Sekisui Chemical is a notable player in this area.

Emerging Trends:

- Plant Growth Promoter: This niche segment is showing promising growth potential as agricultural practices seek sustainable solutions for crop yield enhancement and stress resistance.

- Cosmetic Applications: The increasing use of GABA in skincare products for its anti-aging and soothing properties is contributing to market expansion in this segment.

The interplay of these factors underscores the dynamic nature of the GABA market, with Asia Pacific leading the charge and specific segments demonstrating exceptional growth potential due to evolving consumer needs and technological advancements.

GABA Product Innovations

Recent GABA product innovations are focusing on enhancing bioavailability, optimizing delivery mechanisms, and expanding applications across diverse industries. Novel formulations in Microbial Fermentation (Food Grade) are leading to GABA-fortified beverages and snacks with improved taste profiles and extended shelf lives. In the Medicine sector, advancements in sustained-release GABA supplements promise more consistent therapeutic effects. Furthermore, the development of high-purity GABA through refined Chemical Synthesis methods is catering to stringent pharmaceutical requirements. For instance, innovations in encapsulation technology are allowing for targeted delivery of GABA in cosmetic formulations, enhancing its efficacy in anti-aging and stress-relief skincare products. The performance metrics of these new products often highlight increased absorption rates by up to xx% and enhanced stability under various environmental conditions.

Propelling Factors for GABA Growth

The GABA market's robust growth is propelled by several key factors. Firstly, the escalating global awareness of GABA's multifaceted health benefits, particularly its role in stress reduction, anxiety management, and sleep enhancement, is a primary driver. This is reflected in the increasing demand for GABA in functional foods, dietary supplements, and pharmaceuticals. Secondly, significant technological advancements in Microbial Fermentation techniques have led to more efficient, cost-effective, and sustainable production of high-purity GABA. This has broadened its accessibility and appeal. Thirdly, the growing consumer preference for natural and bio-based ingredients, especially in the Food and Cosmetic industries, further bolsters demand for microbially produced GABA. Finally, supportive regulatory frameworks in various regions, coupled with a growing body of scientific research validating GABA's efficacy, are creating a conducive environment for market expansion.

Obstacles in the GABA Market

Despite its promising growth, the GABA market faces certain obstacles. Stringent regulatory approvals for new GABA-based products, especially in the Medicine and Food sectors across different countries, can pose significant delays and increase development costs. Supply chain disruptions, exacerbated by geopolitical events and raw material price volatility, can impact production costs and availability. Furthermore, the existence of competing ingredients with similar perceived benefits in certain applications, such as other adaptogens or calming agents, creates competitive pressure. The cost of high-purity GABA, particularly for niche applications, can also be a limiting factor for some market segments. The estimated impact of these challenges on market growth is approximately xx% annually.

Future Opportunities in GABA

The future of the GABA market is ripe with opportunities. The expanding Animal Feed sector, driven by the demand for improved animal welfare and productivity, presents a substantial growth avenue. Continued research and development into novel applications of GABA, particularly in areas like neuroprotection and cognitive enhancement, will unlock new market segments. The growing demand for natural sleep aids and stress-relief solutions will continue to fuel innovation in the Food and Supplement industries. Emerging markets in developing economies, with their increasing disposable incomes and growing health consciousness, offer significant untapped potential. Furthermore, advancements in personalized nutrition and functional ingredients are likely to create new opportunities for customized GABA formulations.

Major Players in the GABA Ecosystem

- Pharma Foods International

- Kyowa Hakko

- Sekisui Chemical

- Sino Biotek

- Zhejiang Yiwan Bio

- Shanghai Richen

- Luckerkong

- Qandr Biology

- Bloomage Biotech

- Jyswkj

- Zjtr Chemistry

- Xinyou Chemistry

- Bornsun Biology

- Huarui Biology

- Viab Life

- Microbiofeed

- Harworld

Key Developments in GABA Industry

- 2024: Launch of novel GABA-infused functional beverages targeting stress relief and improved sleep quality.

- 2023: Significant investment in R&D for microbial fermentation process optimization, leading to an estimated xx% increase in production efficiency.

- 2023: Expansion of GABA applications in the cosmetic industry with new anti-aging and skin-soothing formulations.

- 2022: Acquisition of a key GABA producer by a major pharmaceutical company, signaling industry consolidation.

- 2021: Introduction of feed-grade GABA with enhanced bioavailability for the animal nutrition market.

- 2020: Growing scientific publications validating GABA's positive impact on mood and cognitive function.

Strategic GABA Market Forecast

The strategic GABA market forecast indicates sustained and robust growth driven by a confluence of increasing consumer demand for health and wellness products, continuous technological advancements in production, and expanding applications across key industries. The Microbial Fermentation segments, particularly for Animal Feed and Food Grade applications, are expected to be the primary growth engines. Emerging opportunities in Plant Growth Promoter and further penetration in the Cosmetic sector will contribute to market diversification. The market's trajectory is firmly set on an upward path, supported by ongoing innovation and a growing understanding of GABA's extensive benefits.

GABA Segmentation

-

1. Application

- 1.1. Animal Feed

- 1.2. Food

- 1.3. Medicine

- 1.4. Plant Growth Promoter

- 1.5. Cosmetic

- 1.6. Other

-

2. Types

- 2.1. Microbial Fermentation (Feed Grade)

- 2.2. Microbial Fermentation (Food Grade)

- 2.3. Chemical Synthesis

GABA Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GABA REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GABA Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Animal Feed

- 5.1.2. Food

- 5.1.3. Medicine

- 5.1.4. Plant Growth Promoter

- 5.1.5. Cosmetic

- 5.1.6. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Microbial Fermentation (Feed Grade)

- 5.2.2. Microbial Fermentation (Food Grade)

- 5.2.3. Chemical Synthesis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America GABA Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Animal Feed

- 6.1.2. Food

- 6.1.3. Medicine

- 6.1.4. Plant Growth Promoter

- 6.1.5. Cosmetic

- 6.1.6. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Microbial Fermentation (Feed Grade)

- 6.2.2. Microbial Fermentation (Food Grade)

- 6.2.3. Chemical Synthesis

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America GABA Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Animal Feed

- 7.1.2. Food

- 7.1.3. Medicine

- 7.1.4. Plant Growth Promoter

- 7.1.5. Cosmetic

- 7.1.6. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Microbial Fermentation (Feed Grade)

- 7.2.2. Microbial Fermentation (Food Grade)

- 7.2.3. Chemical Synthesis

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe GABA Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Animal Feed

- 8.1.2. Food

- 8.1.3. Medicine

- 8.1.4. Plant Growth Promoter

- 8.1.5. Cosmetic

- 8.1.6. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Microbial Fermentation (Feed Grade)

- 8.2.2. Microbial Fermentation (Food Grade)

- 8.2.3. Chemical Synthesis

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa GABA Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Animal Feed

- 9.1.2. Food

- 9.1.3. Medicine

- 9.1.4. Plant Growth Promoter

- 9.1.5. Cosmetic

- 9.1.6. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Microbial Fermentation (Feed Grade)

- 9.2.2. Microbial Fermentation (Food Grade)

- 9.2.3. Chemical Synthesis

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific GABA Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Animal Feed

- 10.1.2. Food

- 10.1.3. Medicine

- 10.1.4. Plant Growth Promoter

- 10.1.5. Cosmetic

- 10.1.6. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Microbial Fermentation (Feed Grade)

- 10.2.2. Microbial Fermentation (Food Grade)

- 10.2.3. Chemical Synthesis

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pharma Foods International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kyowa Hakko

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sekisui Chemical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sino Biotek

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Zhejiang Yiwan Bio

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shanghai Richen

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Luckerkong

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qandr Biology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bloomage Biotech

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Jyswkj

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zjtr Chemistry

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Xinyou Chemistry

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Bornsun Biology

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Huarui Biology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Viab Life

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Microbiofeed

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Harworld

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Pharma Foods International

List of Figures

- Figure 1: Global GABA Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America GABA Revenue (million), by Application 2024 & 2032

- Figure 3: North America GABA Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America GABA Revenue (million), by Types 2024 & 2032

- Figure 5: North America GABA Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America GABA Revenue (million), by Country 2024 & 2032

- Figure 7: North America GABA Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America GABA Revenue (million), by Application 2024 & 2032

- Figure 9: South America GABA Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America GABA Revenue (million), by Types 2024 & 2032

- Figure 11: South America GABA Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America GABA Revenue (million), by Country 2024 & 2032

- Figure 13: South America GABA Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe GABA Revenue (million), by Application 2024 & 2032

- Figure 15: Europe GABA Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe GABA Revenue (million), by Types 2024 & 2032

- Figure 17: Europe GABA Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe GABA Revenue (million), by Country 2024 & 2032

- Figure 19: Europe GABA Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa GABA Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa GABA Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa GABA Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa GABA Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa GABA Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa GABA Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific GABA Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific GABA Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific GABA Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific GABA Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific GABA Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific GABA Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global GABA Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global GABA Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global GABA Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global GABA Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global GABA Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global GABA Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global GABA Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global GABA Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global GABA Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global GABA Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global GABA Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global GABA Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global GABA Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global GABA Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global GABA Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global GABA Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global GABA Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global GABA Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global GABA Revenue million Forecast, by Country 2019 & 2032

- Table 41: China GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania GABA Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific GABA Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GABA?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the GABA?

Key companies in the market include Pharma Foods International, Kyowa Hakko, Sekisui Chemical, Sino Biotek, Zhejiang Yiwan Bio, Shanghai Richen, Luckerkong, Qandr Biology, Bloomage Biotech, Jyswkj, Zjtr Chemistry, Xinyou Chemistry, Bornsun Biology, Huarui Biology, Viab Life, Microbiofeed, Harworld.

3. What are the main segments of the GABA?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 86 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GABA," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GABA report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GABA?

To stay informed about further developments, trends, and reports in the GABA, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence