Key Insights

The European unmanned helicopter market is poised for substantial expansion, driven by escalating demand in both military and civil sectors. The market is estimated at 5.39 billion in 2025, and is projected to grow at a CAGR of 15.3% through 2033. Key growth drivers include significant technological advancements enhancing payload capacity, flight endurance, and autonomous operation, enabling broader applications in surveillance, search and rescue, precision agriculture, and infrastructure inspection. Furthermore, supportive government regulations and initiatives promoting UAV adoption across Europe are stimulating market development. The increasing cost-effectiveness of unmanned helicopters compared to manned aircraft also presents a compelling advantage.

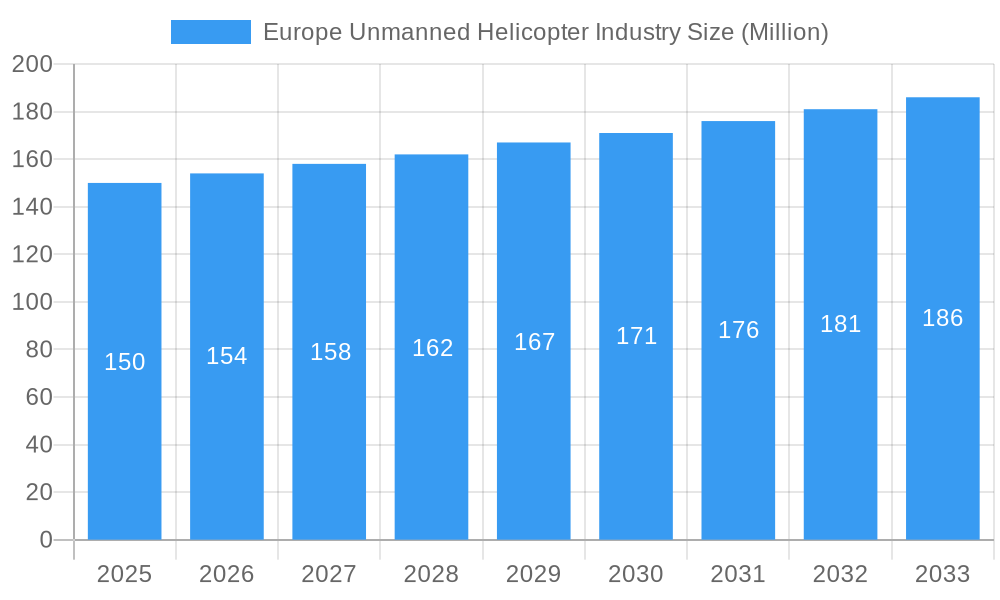

Europe Unmanned Helicopter Industry Market Size (In Billion)

Despite this positive outlook, challenges such as high initial investment costs and concerns regarding data security, airspace management, and safety require careful consideration for widespread adoption. The medium-sized unmanned helicopter segment is expected to lead growth, offering a balance of payload and efficiency. While the military sector remains a primary revenue driver, civil and commercial applications are demonstrating significant potential, fueled by increasing drone utilization for diverse commercial tasks. Key market players including Textron, Airbus, and Leonardo are at the vanguard of innovation, shaping the future of the European unmanned helicopter industry. Major regional markets include Germany, France, the UK, and Italy, characterized by high technological adoption and robust regulatory frameworks.

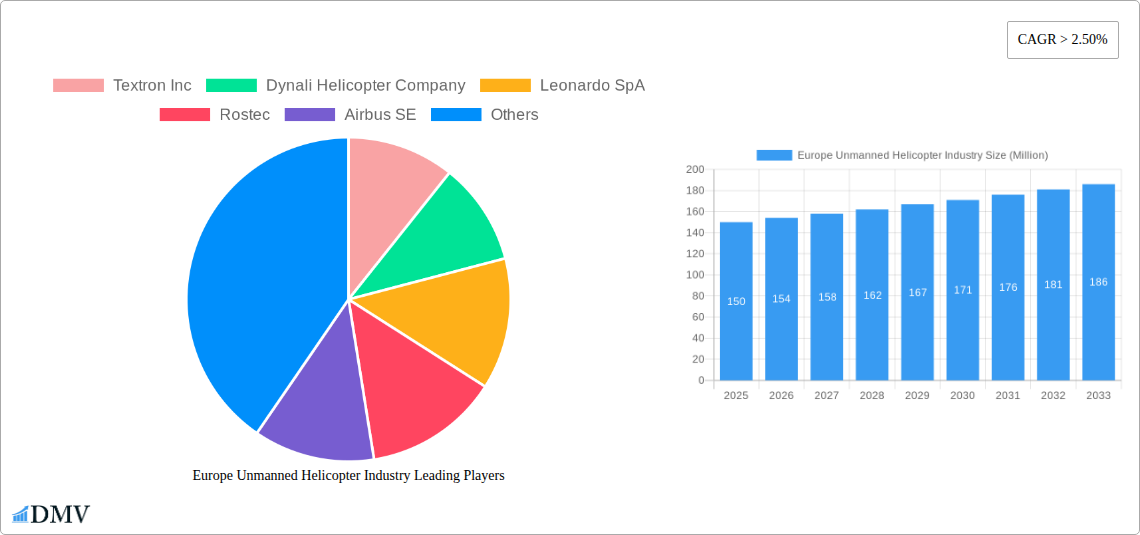

Europe Unmanned Helicopter Industry Company Market Share

Europe Unmanned Helicopter Industry: A Comprehensive Market Analysis (2019-2033)

This insightful report provides a detailed analysis of the European unmanned helicopter industry, offering a comprehensive overview of market trends, key players, technological advancements, and future growth prospects. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period spans 2025-2033, while the historical period encompasses 2019-2024. This report is essential for stakeholders seeking to understand the dynamics of this rapidly evolving sector and make informed strategic decisions. The European unmanned helicopter market is projected to reach xx Million by 2033.

Europe Unmanned Helicopter Industry Market Composition & Trends

This section delves into the competitive landscape of the European unmanned helicopter market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The analysis reveals a market characterized by a moderate level of concentration, with key players such as Airbus SE, Leonardo SpA, and Textron Inc. holding significant market share. However, the emergence of smaller, innovative companies is also notable, contributing to increased competition.

Market Share Distribution (2025):

- Airbus SE: xx%

- Leonardo SpA: xx%

- Textron Inc: xx%

- Others: xx%

Innovation Catalysts: Advancements in battery technology, autonomous navigation systems, and sensor integration are driving innovation. The increasing demand for unmanned aerial vehicles (UAVs) in various applications is further fueling innovation.

Regulatory Landscape: Stringent regulations regarding airspace management and UAV operation are shaping market dynamics. Harmonization of regulations across European countries is crucial for market growth.

Substitute Products: Other aerial surveillance technologies and ground-based solutions pose some level of competitive threat.

End-User Profiles: The primary end-users include military, civil, and commercial sectors, each with unique requirements and preferences.

M&A Activities: The past five years have witnessed several significant M&A deals, with total deal values exceeding xx Million. These activities reflect the consolidation trends within the industry.

Europe Unmanned Helicopter Industry Evolution

The European unmanned helicopter market has experienced significant growth throughout the historical period (2019-2024), driven by technological advancements, increasing demand from various sectors, and supportive government policies. The market is witnessing a rapid adoption of advanced technologies, including Artificial Intelligence (AI), improved sensor capabilities, and enhanced autonomy features. This evolution is transforming the capabilities of unmanned helicopters, enabling them to undertake complex missions across diverse applications, driving expansion into new sectors.

The Compound Annual Growth Rate (CAGR) for the historical period (2019-2024) is estimated at xx%, indicating a robust market expansion. The forecast period (2025-2033) projects a CAGR of xx%, suggesting continued growth, although potentially at a slightly moderated pace due to various factors like saturation in some sectors and economic fluctuations. The shift in consumer demand towards more efficient, autonomous, and cost-effective solutions underscores the industry's evolution. This is largely driven by growing preference for safer and reliable operations across commercial and military sectors. Furthermore, increased adoption of advanced sensor payloads to accommodate diverse mission requirements in both civilian and defense applications is a significant driving force. Technological advancements leading to improved operational efficiencies, higher payload capacities, and enhanced flight ranges also contribute significantly to the market expansion.

Leading Regions, Countries, or Segments in Europe Unmanned Helicopter Industry

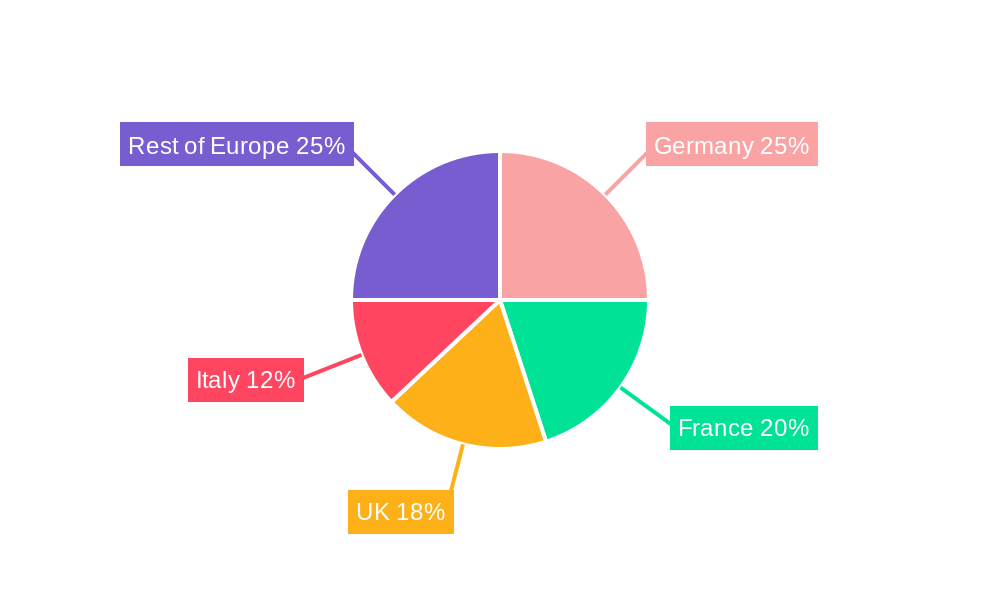

The analysis reveals that the dominant segment within the European unmanned helicopter market is the Light Helicopters category within the Military application segment, primarily driven by the increasing adoption of these UAVs for reconnaissance, surveillance, and target acquisition. Germany and France emerge as the leading countries, exhibiting strong growth trajectories, fuelled by substantial governmental investments in defence technology.

Key Drivers for Dominance in Light Helicopters (Military):

- High Investment in Defence Modernisation: Significant government spending on defence modernization programs fuels demand for advanced UAV technology.

- Operational Advantages: Lightweight, highly maneuverable, and cost-effective nature of light helicopters make them ideal for various military missions.

- Technological Advancements: Continuous improvements in battery life, autonomy features, and sensor technology enhance operational effectiveness and mission capabilities.

Key Drivers for Dominance in Germany and France:

- Strong Domestic Defence Industries: Both countries have well-established defence industries with expertise in UAV development and manufacturing.

- Strategic Geopolitical Positioning: The strategic geopolitical positioning of these nations necessitates robust defence capabilities, including the utilization of unmanned helicopter systems.

- Government Support and Funding: Significant governmental support and funding for R&D and procurement of unmanned systems contributes to market expansion.

Further analysis indicates significant growth potential within the Medium and Heavy helicopter segments, particularly in the Civil and Commercial sectors. Areas such as infrastructure inspection, search and rescue operations, and cargo delivery present vast opportunities for expansion.

Europe Unmanned Helicopter Industry Product Innovations

Recent innovations include enhanced autonomous flight capabilities, improved sensor integration for advanced data acquisition, and the development of hybrid-electric propulsion systems for increased flight endurance and reduced environmental impact. These advancements enhance operational efficiency, expand mission capabilities, and reduce operational costs. Key selling propositions focus on improved reliability, enhanced safety features, and cost-effectiveness compared to traditional manned helicopters.

Propelling Factors for Europe Unmanned Helicopter Industry Growth

Several factors drive the growth of the European unmanned helicopter industry. Technological advancements, particularly in autonomous flight systems and sensor technology, greatly enhance the capabilities and efficiency of these aircraft. Growing demand across various sectors, including military and commercial applications, fuels market expansion. Supportive government policies and increasing investments in research and development further bolster industry growth. Furthermore, the cost-effectiveness of unmanned helicopters compared to manned counterparts makes them attractive to a wider range of users.

Obstacles in the Europe Unmanned Helicopter Industry Market

The market faces challenges such as stringent regulatory frameworks, which can hinder deployment and operation. Supply chain disruptions, particularly in the procurement of key components, can also impact production and delivery schedules. Intense competition among established and emerging players exerts pressure on pricing and profitability. The potential for cybersecurity vulnerabilities and the need for robust safety protocols are also significant considerations for the industry.

Future Opportunities in Europe Unmanned Helicopter Industry

Emerging opportunities lie in the expansion into new applications, such as precision agriculture, environmental monitoring, and disaster relief. The development and integration of advanced technologies like AI and machine learning will further enhance the capabilities and autonomy of unmanned helicopters. Increased collaboration between industry players and regulatory bodies will facilitate market expansion and adoption. Exploration of new markets beyond traditional applications will open up significant growth prospects.

Major Players in the Europe Unmanned Helicopter Industry Ecosystem

- Textron Inc

- Dynali Helicopter Company

- Leonardo SpA

- Rostec

- Airbus SE

- Enstrom Helicopter Corp

- Alpi Aviation srl

- Heli-Sport sr

- Robinson Helicopter Company

- The Boeing Company

- MD HELICOPTERS INC

Key Developments in Europe Unmanned Helicopter Industry Industry

- 2022 Q4: Airbus SE launched a new model of unmanned helicopter with enhanced autonomous flight capabilities.

- 2023 Q1: Leonardo SpA and a partner announced a strategic collaboration to develop a next-generation unmanned helicopter platform.

- 2023 Q2: Textron Inc acquired a smaller UAV manufacturer, expanding its market presence.

Strategic Europe Unmanned Helicopter Industry Market Forecast

The European unmanned helicopter market is poised for substantial growth driven by technological advancements, increasing demand across various sectors, and supportive regulatory environments. The convergence of AI, improved sensor capabilities, and enhanced autonomy features is reshaping the market landscape. Continued investments in R&D and the emergence of innovative applications will significantly propel market expansion. The market is expected to experience sustained growth throughout the forecast period (2025-2033), creating opportunities for both established and emerging players.

Europe Unmanned Helicopter Industry Segmentation

-

1. Maximum Take-off Weight

- 1.1. Light Helicopters

- 1.2. Medium Helicopters

- 1.3. Heavy Helicopters

-

2. Application

- 2.1. Military

- 2.2. Civil and Commercial

Europe Unmanned Helicopter Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Italy

- 1.5. Spain

- 1.6. Russia

- 1.7. Rest of Europe

Europe Unmanned Helicopter Industry Regional Market Share

Geographic Coverage of Europe Unmanned Helicopter Industry

Europe Unmanned Helicopter Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Helicopters to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Unmanned Helicopter Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 5.1.1. Light Helicopters

- 5.1.2. Medium Helicopters

- 5.1.3. Heavy Helicopters

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Military

- 5.2.2. Civil and Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Maximum Take-off Weight

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dynali Helicopter Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leonardo SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rostec

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Airbus SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Enstrom Helicopter Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Alpi Aviation srl

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Heli-Sport sr

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robinson Helicopter Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MD HELICOPTERS INC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Europe Unmanned Helicopter Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Unmanned Helicopter Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 2: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Maximum Take-off Weight 2020 & 2033

- Table 5: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Europe Unmanned Helicopter Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: France Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Germany Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Russia Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Europe Europe Unmanned Helicopter Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Unmanned Helicopter Industry?

The projected CAGR is approximately 15.3%.

2. Which companies are prominent players in the Europe Unmanned Helicopter Industry?

Key companies in the market include Textron Inc, Dynali Helicopter Company, Leonardo SpA, Rostec, Airbus SE, Enstrom Helicopter Corp, Alpi Aviation srl, Heli-Sport sr, Robinson Helicopter Company, The Boeing Company, MD HELICOPTERS INC.

3. What are the main segments of the Europe Unmanned Helicopter Industry?

The market segments include Maximum Take-off Weight, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Helicopters to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Unmanned Helicopter Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Unmanned Helicopter Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Unmanned Helicopter Industry?

To stay informed about further developments, trends, and reports in the Europe Unmanned Helicopter Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence