Key Insights

The European satellite launch vehicle market is projected for substantial growth, with a projected Compound Annual Growth Rate (CAGR) of 14.22%. This expansion, expected between 2025 and 2033, is driven by escalating demand for Earth observation, communication, and navigation satellites, alongside expanding governmental and commercial space exploration initiatives. Key growth drivers include increasing demand for Low Earth Orbit (LEO) and Medium Earth Orbit (MEO) launches, crucial for satellite constellations supporting internet and Earth observation applications. The heavy-lift launch vehicle segment is also experiencing heightened activity due to large-scale satellite deployments and interplanetary missions. Major contributors to the European market include Germany, France, Italy, and the United Kingdom, benefiting from established space agencies and robust private sector engagement. However, global competition and the high costs associated with launch vehicle development and operation pose challenges to sustained growth. Future market dynamics will be shaped by the advancement of reusable launch systems, enhanced collaboration between European entities and private companies, and the integration of innovative technologies to reduce launch expenses.

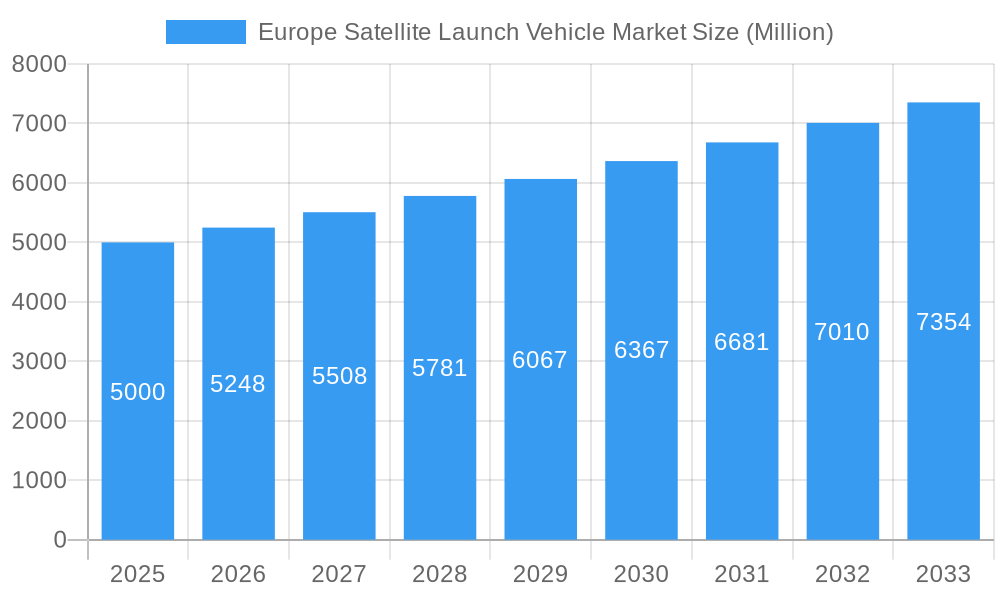

Europe Satellite Launch Vehicle Market Market Size (In Billion)

Strategic partnerships between European nations and private companies are essential for accelerating the development and deployment of advanced launch technologies. Consistent government funding further supports innovation in the space industry, bolstering the capabilities of European players in the global launch vehicle market. While geopolitical considerations and potential regulatory hurdles may present restraints, the overall market outlook remains positive, fueled by the increasing need for reliable and cost-effective satellite launch services across diverse sectors. This necessitates innovative financing models, reduced reliance on traditional providers, and a heightened focus on technological advancement. The competitive landscape is dynamic, featuring key players such as ArianeGroup and Avio, alongside emerging commercial entities. Europe's ability to solidify its market position will depend on efficient collaboration and strategic investments.

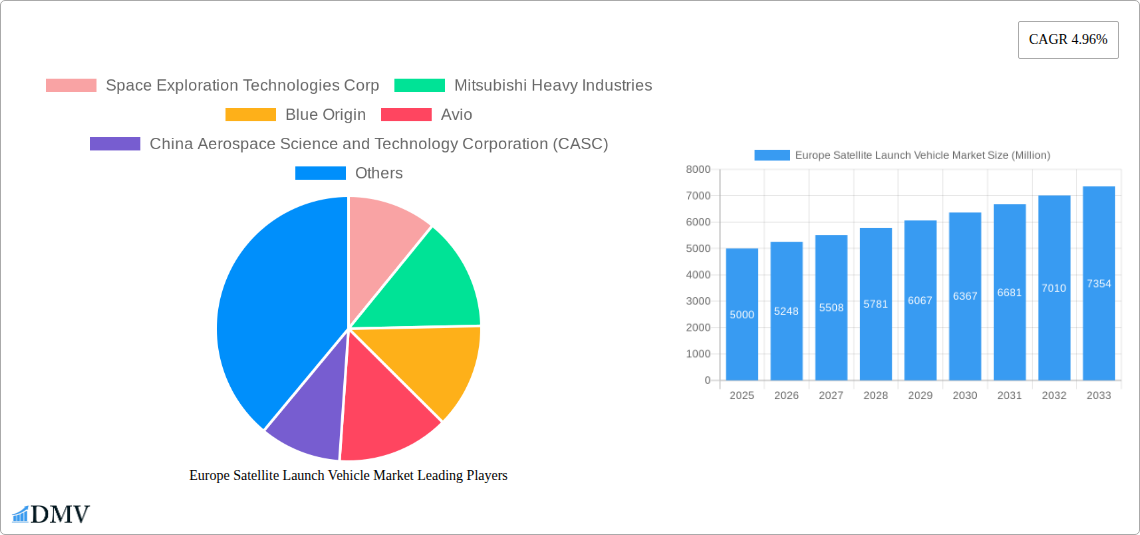

Europe Satellite Launch Vehicle Market Company Market Share

This report offers an in-depth analysis of the European satellite launch vehicle market, providing a comprehensive overview of its current status, future trajectory, and key stakeholders. Covering the period from 2025 to 2033, with a base year of 2025, the market is forecasted to reach $8.39 billion by 2033, exhibiting a CAGR of 14.22% during the forecast period.

Europe Satellite Launch Vehicle Market Composition & Trends

This section delves into the intricate landscape of the European satellite launch vehicle market, evaluating its concentration, driving forces of innovation, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. Market share distribution among key players will be analyzed, revealing the competitive dynamics at play. The report will also examine the impact of recent M&A activities, including deal values and their influence on market consolidation. We will analyze the effects of evolving regulations, the presence of substitute technologies, and the varied needs of end-users across different sectors. We will explore the extent of market fragmentation, identifying key players and their respective market share. Furthermore, the report examines the impact of technological innovation, such as reusable launch vehicles and advanced propulsion systems, on the market structure and competitiveness. The analysis considers both macro-economic factors and industry-specific trends influencing the sector’s evolution.

- Market Concentration: Analysis of market share held by top 5 players.

- Innovation Catalysts: Examination of R&D investments, technological breakthroughs, and their impact.

- Regulatory Landscape: Assessment of European Space Agency (ESA) regulations and their influence.

- Substitute Products: Evaluation of alternative launch technologies and their market penetration.

- End-User Profiles: Detailed segmentation of end-users (e.g., government agencies, commercial entities).

- M&A Activities: Review of significant mergers and acquisitions, including deal values (e.g., xx Million for a specific deal).

Europe Satellite Launch Vehicle Market Industry Evolution

This section provides a deep dive into the evolution of the European satellite launch vehicle market, exploring its historical growth trajectories, technological advancements, and the changing demands of customers. We will chart the market's growth from 2019 to 2024, analyzing key factors driving its expansion, such as increased demand for satellite-based services and the development of new launch technologies. This includes an in-depth analysis of technological breakthroughs, specifically highlighting the role of reusable launch vehicles in reducing launch costs and the adoption of advanced materials for improved performance and reliability. The impact of evolving customer needs, including the shift towards smaller, more frequent launches, will also be discussed, alongside projections for future growth rates based on current market trends and technological forecasts.

Leading Regions, Countries, or Segments in Europe Satellite Launch Vehicle Market

This section identifies the leading regions, countries, and segments within the European satellite launch vehicle market, focusing on key drivers, such as investment trends and regulatory support. Specific analysis will cover Orbit Class (GEO, LEO, MEO), Launch Vehicle MTOW (Heavy, Medium, Light, Interplanetary), and the country of Russia.

Key Drivers for Dominant Segments:

- Investment Trends: Government funding, private investment, and venture capital flow.

- Regulatory Support: Government policies, incentives, and streamlined approval processes.

- Technological Advancements: Innovation in launch vehicle design, propulsion systems, and reusability.

- Market Demand: Growth in satellite constellations, scientific missions, and commercial applications.

In-depth Analysis: A detailed examination of the factors contributing to the dominance of specific segments and geographic locations, drawing upon market data and expert insights. For instance, Russia's historical strength in heavy-lift launch vehicles will be analyzed, alongside the influence of its space program on overall market dynamics.

Europe Satellite Launch Vehicle Market Product Innovations

This section highlights recent product innovations, their applications, and performance metrics. We'll explore advancements in launch vehicle technology, including the development of more efficient and reliable engines, improved guidance systems, and the incorporation of reusable components. The focus will be on unique selling propositions and competitive advantages of each innovation, showcasing their impact on market competitiveness and customer adoption.

Propelling Factors for Europe Satellite Launch Vehicle Market Growth

Several factors are driving the growth of the European satellite launch vehicle market. Technological advancements such as reusable launch vehicles are significantly reducing costs, making space access more affordable. Increased demand for satellite-based services, including communication, navigation, and earth observation, fuels the market's expansion. Favorable regulatory environments in several European countries are creating an environment conducive to investment and innovation. Moreover, government initiatives and private sector investment continue to stimulate market growth.

Obstacles in the Europe Satellite Launch Vehicle Market

The European satellite launch vehicle market faces several challenges. Strict regulatory frameworks can hinder rapid innovation and deployment of new technologies. Supply chain disruptions, particularly in the procurement of critical components, can lead to project delays and cost overruns. Intense competition among established and emerging players creates price pressure and necessitates continuous innovation. These challenges are quantified with data on delays and cost increases.

Future Opportunities in Europe Satellite Launch Vehicle Market

Emerging opportunities exist in the development and deployment of small satellite constellations for various applications, including the Internet of Things (IoT) and Earth observation. The rise of new launch technologies, such as reusable launch vehicles and hypersonic vehicles, presents further opportunities for market expansion. Growing demand from the private sector and increasing government investments in space exploration are creating new avenues for growth.

Major Players in the Europe Satellite Launch Vehicle Market Ecosystem

- Space Exploration Technologies Corp

- Mitsubishi Heavy Industries

- Blue Origin

- Avio

- China Aerospace Science and Technology Corporation (CASC)

- Ariane Group

- Virgin Orbit

- ROSCOSMOS

- Rocket Lab USA Inc

- Indian Space Research Organisation (ISRO)

- The Boeing Company

Key Developments in Europe Satellite Launch Vehicle Market Industry

- March 2023: ISRO launched 36 OneWeb communication satellites into LEO aboard its LVM3 rocket, signifying a significant increase in launch capacity and highlighting the growing demand for low-Earth orbit constellations.

- April 2022: The Long March 3B rocket launched the Chinasat 6D communications satellite, demonstrating continued advancements in Chinese launch capabilities and their increasing competitiveness in the global market.

- March 2022: Boeing and MT Aerospace AG signed a contract to supply structural components for NASA's Space Launch System (SLS), indicating continued collaboration and investment in large-scale launch vehicle programs and strengthening the supply chain for major international projects.

Strategic Europe Satellite Launch Vehicle Market Forecast

The European satellite launch vehicle market is poised for significant growth, driven by increasing demand for satellite-based services, technological advancements, and supportive government policies. The market is expected to witness a steady expansion, with substantial opportunities for companies involved in launch vehicle development, satellite manufacturing, and related services. Continued innovation in launch technologies, such as reusable launch vehicles, will play a crucial role in shaping the future of the market. Furthermore, collaborations and partnerships between government agencies, private companies, and research institutions are likely to spur further growth.

Europe Satellite Launch Vehicle Market Segmentation

-

1. Orbit Class

- 1.1. GEO

- 1.2. LEO

- 1.3. MEO

-

2. Launch Vehicle Mtow

- 2.1. Heavy

- 2.2. Inter Planetary

- 2.3. Light

- 2.4. Medium

Europe Satellite Launch Vehicle Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

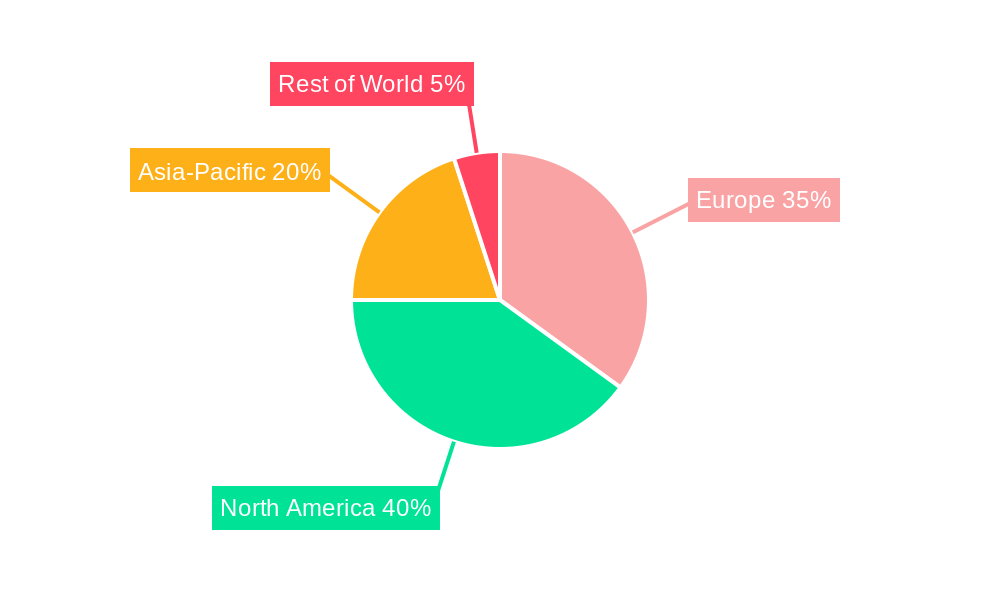

Europe Satellite Launch Vehicle Market Regional Market Share

Geographic Coverage of Europe Satellite Launch Vehicle Market

Europe Satellite Launch Vehicle Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Satellite Launch Vehicle Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Orbit Class

- 5.1.1. GEO

- 5.1.2. LEO

- 5.1.3. MEO

- 5.2. Market Analysis, Insights and Forecast - by Launch Vehicle Mtow

- 5.2.1. Heavy

- 5.2.2. Inter Planetary

- 5.2.3. Light

- 5.2.4. Medium

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Orbit Class

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mitsubishi Heavy Industries

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Blue Origin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Avio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Aerospace Science and Technology Corporation (CASC)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ariane Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Virgin Orbi

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ROSCOSMOS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rocket Lab USA Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Indian Space Research Organisation (ISRO)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Boeing Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Europe Satellite Launch Vehicle Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Satellite Launch Vehicle Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 2: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 3: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 5: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Launch Vehicle Mtow 2020 & 2033

- Table 6: Europe Satellite Launch Vehicle Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Satellite Launch Vehicle Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Satellite Launch Vehicle Market?

The projected CAGR is approximately 14.22%.

2. Which companies are prominent players in the Europe Satellite Launch Vehicle Market?

Key companies in the market include Space Exploration Technologies Corp, Mitsubishi Heavy Industries, Blue Origin, Avio, China Aerospace Science and Technology Corporation (CASC), Ariane Group, Virgin Orbi, ROSCOSMOS, Rocket Lab USA Inc, Indian Space Research Organisation (ISRO), The Boeing Company.

3. What are the main segments of the Europe Satellite Launch Vehicle Market?

The market segments include Orbit Class, Launch Vehicle Mtow.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.39 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: ISRO launched 36 communication satellites of Oneweb aboarding its LVM3 rocket into LEO.April 2022: The Long March 3B rocket was launched from the Xichang launch base with the Chinasat 6D, or Zhongxing 6D, communications satellite.March 2022: Boeing and MT Aerospace AG, which is a subsidiary of OHB SE, have signed a contract to supply structural components for NASA's Space Launch System (SLS)

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Satellite Launch Vehicle Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Satellite Launch Vehicle Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Satellite Launch Vehicle Market?

To stay informed about further developments, trends, and reports in the Europe Satellite Launch Vehicle Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence