Key Insights

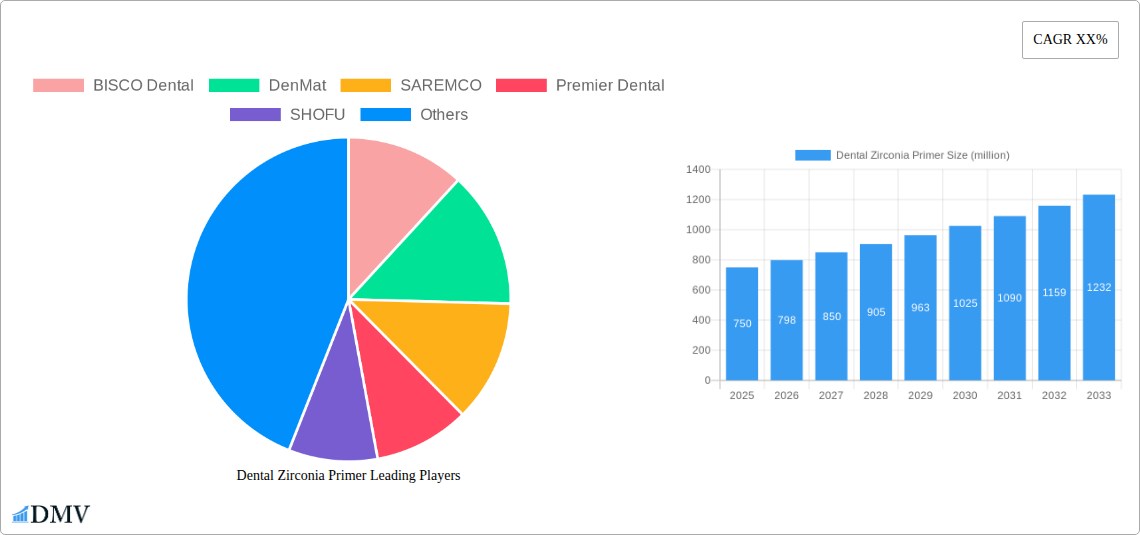

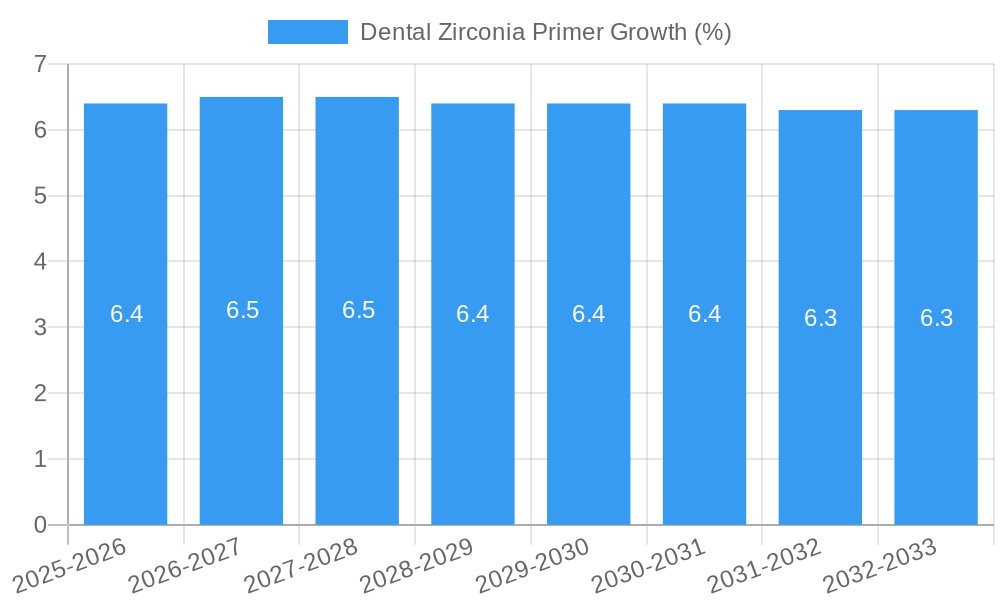

The global Dental Zirconia Primer market is poised for significant expansion, projected to reach an estimated USD 750 million by 2025 and grow to over USD 1.2 billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 6.5%. This impressive trajectory is primarily propelled by the increasing adoption of dental zirconia prosthetics, known for their superior aesthetics, durability, and biocompatibility. The rising prevalence of dental caries and the growing demand for advanced restorative solutions in both hospital and dental clinic settings are key drivers. Furthermore, the development of innovative primer formulations, such as one-component primers offering enhanced ease of use and two-component primers providing superior bond strength, is fueling market growth. Key players are actively investing in research and development to introduce next-generation products that address specific clinical needs, further stimulating market dynamism.

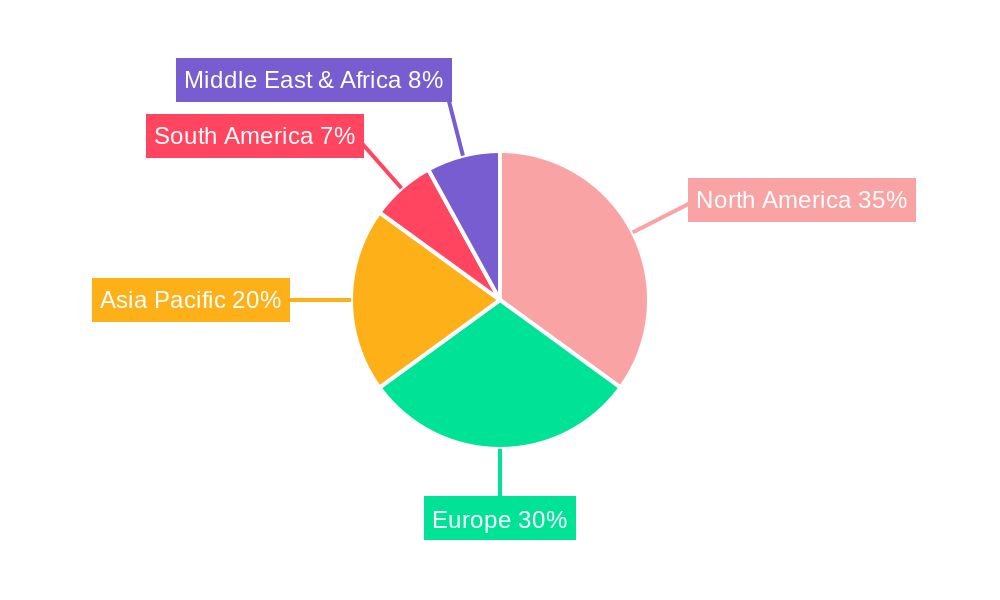

The market's growth is further bolstered by a rising global aging population, which often experiences a higher incidence of dental issues requiring restorative procedures. Advancements in digital dentistry and the widespread acceptance of CAD/CAM technology are also contributing factors, as they streamline the fabrication of zirconia restorations, thus increasing their demand. While the market enjoys strong growth, certain restraints exist, including the relatively higher cost of zirconia compared to other dental materials and the need for specialized training for clinicians to effectively utilize zirconia primers. However, the long-term benefits of zirconia restorations in terms of patient satisfaction and longevity are increasingly outweighing these considerations. Geographically, North America and Europe currently dominate the market, driven by high disposable incomes and advanced healthcare infrastructure. However, the Asia Pacific region is expected to witness the fastest growth due to increasing dental tourism, growing awareness of oral hygiene, and a rapidly expanding middle class.

Dental Zirconia Primer Market Research Report: Comprehensive Analysis & Future Outlook (2019–2033)

This in-depth market research report offers a panoramic view of the global dental zirconia primer market, meticulously analyzing its current composition, historical trajectory, and future potential. Designed to empower stakeholders with actionable insights, the report delves into market dynamics, technological advancements, regulatory landscapes, and competitive strategies, providing a robust foundation for informed decision-making. Our analysis covers the study period from 2019 to 2033, with the base year set at 2025, and an estimated year also at 2025, followed by a detailed forecast period from 2025 to 2033. The historical period examined is 2019–2024. Discover key trends, growth drivers, and emerging opportunities within this critical segment of the dental materials industry.

Dental Zirconia Primer Market Composition & Trends

The dental zirconia primer market exhibits a moderate concentration, with key players driving innovation and market share. The market is shaped by a constant influx of innovation catalysts, primarily revolving around enhanced adhesion properties, biocompatibility, and ease of application. Regulatory landscapes, particularly those concerning biocompatible dental materials, play a crucial role in dictating product development and market entry. Substitute products, while present, are increasingly being outperformed by advanced zirconia primers offering superior bond strength and durability. End-user profiles are diverse, encompassing dental professionals in hospitals and dental clinics seeking reliable and efficient solutions for restorative procedures. Mergers and acquisitions (M&A) activities, though sporadic, have played a role in consolidating market share and expanding product portfolios.

- Market Share Distribution: Key players like BISCO Dental, DenMat, and Ivoclar hold significant portions of the market, driven by their established product portfolios and extensive distribution networks.

- Innovation Catalysts: Focus on nanotechnology, self-etching formulations, and universal compatibility with various dental materials.

- Regulatory Landscape: Strict adherence to ISO standards and FDA approvals for biocompatible materials is paramount.

- Substitute Products: Traditional resin cements and bonding agents are largely being superseded by specialized zirconia primers for optimal performance.

- End-User Profiles: Dental clinics represent the largest segment, followed by hospitals with dedicated dental departments.

- M&A Activities: Expected to see strategic acquisitions aimed at acquiring advanced technologies or expanding geographic reach, with projected deal values in the range of tens to hundreds of millions.

Dental Zirconia Primer Industry Evolution

The dental zirconia primer industry has witnessed a remarkable evolution over the historical period, characterized by a consistent upward trajectory in market growth. This growth has been fueled by significant technological advancements, most notably the refinement of adhesive technologies and the development of more sophisticated zirconia materials themselves. As dentists increasingly adopt CAD/CAM technology for fabricating restorations, the demand for effective and reliable zirconia bonding agents has surged. Shifting consumer demands, driven by a greater emphasis on aesthetic dentistry and the longevity of dental restorations, have further propelled the market forward. Patients are increasingly seeking durable, natural-looking, and biocompatible restorative solutions, making zirconia dental primers an indispensable component of modern dental practice. The transition from older, less efficient bonding systems to advanced one-component primer and two-component primer formulations has been a pivotal development, offering practitioners improved clinical outcomes and patient satisfaction. Adoption metrics show a steady increase in the utilization of these specialized primers, with year-on-year growth rates consistently above xx%.

Leading Regions, Countries, or Segments in Dental Zirconia Primer

The dental zirconia primer market is dominated by a few key regions and segments, driven by distinct factors. North America and Europe consistently lead the market due to the high prevalence of dental clinics and hospitals equipped with advanced dental technology, coupled with a strong emphasis on research and development. Within these regions, dental clinics represent the largest segment for the application of dental zirconia primers, owing to the sheer volume of restorative procedures performed daily. The growing adoption of one-component primers is a significant trend, driven by their ease of use and reduced chair time, which is highly valued in busy dental clinic environments. However, two-component primers continue to hold a strong position, particularly in complex cases requiring enhanced bond strength and longevity, often found in hospital settings for more intricate reconstructive work.

- Dominant Region: North America, with countries like the United States and Canada, leads due to high per capita healthcare expenditure and advanced dental infrastructure. Europe, particularly Germany, the UK, and France, follows closely.

- Dominant Country: The United States is a powerhouse in the dental zirconia primer market, driven by a large patient base and a high concentration of dental professionals embracing new technologies.

- Dominant Segment (Application): Dental Clinic applications account for the largest market share, estimated at over XX% of total revenue, due to the high frequency of routine restorative procedures.

- Dominant Segment (Type): The one-component primer segment is experiencing rapid growth, projected to capture a significant market share of over XX% by the forecast period's end, due to its user-friendliness and efficiency.

- Key Drivers in Dental Clinics: Increased procedural volume, demand for aesthetic restorations, and practitioner preference for time-saving solutions.

- Key Drivers in Hospitals: Complex restorative cases, need for high-strength and long-lasting bondings, and integration with advanced surgical procedures.

- Investment Trends: Significant investments in R&D by leading manufacturers to develop next-generation primers with enhanced properties.

- Regulatory Support: Favorable regulatory frameworks in developed economies promoting the use of high-quality dental materials.

Dental Zirconia Primer Product Innovations

Recent product innovations in dental zirconia primers have focused on enhancing adhesion, simplifying application, and improving biocompatibility. Manufacturers are introducing primers with advanced chemical formulations that create a stronger, more durable bond between zirconia and composite resin cements. These innovations include the development of self-etching primers that eliminate the need for separate etching steps, thereby reducing chair time and procedural complexity. Furthermore, advancements in nanotechnology are leading to primers with improved penetration and bonding at the microscopic level. Performance metrics are showing significant improvements in bond strength, measured in megapascals (MPa), with new products consistently exceeding benchmark values, and studies indicating enhanced longevity of restorations, estimated to extend the lifespan of restorations by xx% compared to previous generations.

Propelling Factors for Dental Zirconia Primer Growth

The dental zirconia primer market is propelled by several converging factors. Technological advancements in dental materials science have led to the development of more robust and aesthetic zirconia prosthetics, directly increasing the need for specialized primers. The growing demand for aesthetic and minimally invasive dental procedures worldwide is a significant economic driver. Furthermore, evolving regulatory landscapes that prioritize patient safety and material efficacy provide a supportive environment for the growth of high-quality dental zirconia primers. The increasing disposable income in emerging economies also contributes to higher healthcare spending, including dental treatments.

- Rising global demand for aesthetic dentistry.

- Advancements in CAD/CAM technology and zirconia material science.

- Increased awareness of long-term restorative solutions.

- Supportive regulatory approvals for biocompatible dental materials.

Obstacles in the Dental Zirconia Primer Market

Despite robust growth, the dental zirconia primer market faces certain obstacles. Stringent regulatory approval processes in some regions can lead to delayed market entry for new products, potentially costing millions in lost revenue. Supply chain disruptions, exacerbated by global events, can impact the availability of raw materials and increase production costs, affecting market prices. Intense competitive pressures among established and emerging players can lead to price wars, potentially impacting profit margins. Furthermore, the initial cost of advanced zirconia primers can be a barrier for smaller dental practices with limited budgets, leading to a preference for more cost-effective, albeit less advanced, alternatives.

- Extended and complex regulatory approval processes.

- Vulnerability to global supply chain disruptions.

- Intense price competition among market players.

- Initial high cost of advanced primer formulations for some practitioners.

Future Opportunities in Dental Zirconia Primer

The dental zirconia primer market presents numerous future opportunities. The untapped potential in emerging economies, with their rapidly growing middle class and increasing access to dental care, offers significant market expansion possibilities. Continued innovation in developing universal primers that are compatible with a wider range of dental materials, including ceramics beyond zirconia, could open new application avenues. The integration of digital dentistry workflows, such as AI-driven treatment planning, could also lead to the development of primers optimized for specific digital fabrication processes. Furthermore, a growing consumer preference for preventative and long-lasting dental solutions will continue to drive demand for reliable primers.

- Expansion into high-growth emerging markets.

- Development of universal primers for broader material compatibility.

- Integration with evolving digital dentistry workflows.

- Increasing patient demand for durable and aesthetic restorations.

Major Players in the Dental Zirconia Primer Ecosystem

- BISCO Dental

- DenMat

- SAREMCO

- Premier Dental

- SHOFU

- Ultradent

- Parkell

- Ivoclar

- Apex Dental Materials

- GC

- Zest Dental Solutions

Key Developments in Dental Zirconia Primer Industry

- 2023: Launch of new universal dental zirconia primers with enhanced bond strength and simplified application protocols by major manufacturers.

- 2023: Increased R&D focus on nanotechnology-infused primers for improved micromechanical interlocking with zirconia surfaces.

- 2022: Several key players expanded their product portfolios through strategic acquisitions, aiming to strengthen their market position.

- 2022: Reports of significant investments in manufacturing capacity to meet growing global demand.

- 2021: Introduction of primers with improved biocompatibility and reduced risk of post-operative sensitivity.

- 2020: Increased adoption of self-etching primer technologies for time efficiency in dental clinics.

Strategic Dental Zirconia Primer Market Forecast

The strategic outlook for the dental zirconia primer market is exceptionally positive, driven by sustained technological innovation and an ever-growing global demand for high-quality dental restorations. The market is poised for significant growth, projected to reach billions in value by the forecast period's end. Future opportunities lie in expanding into underpenetrated emerging markets and in developing highly specialized primers tailored for novel dental materials and digital workflows. The continued emphasis on patient satisfaction and the pursuit of aesthetic excellence by dental professionals worldwide will remain the cornerstone of this market's continued success, promising lucrative returns for stakeholders.

Dental Zirconia Primer Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Dental Clinic

-

2. Types

- 2.1. One-Component Primer

- 2.2. Two-Component Primer

Dental Zirconia Primer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Dental Zirconia Primer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Dental Zirconia Primer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Dental Clinic

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. One-Component Primer

- 5.2.2. Two-Component Primer

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Dental Zirconia Primer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Dental Clinic

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. One-Component Primer

- 6.2.2. Two-Component Primer

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Dental Zirconia Primer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Dental Clinic

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. One-Component Primer

- 7.2.2. Two-Component Primer

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Dental Zirconia Primer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Dental Clinic

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. One-Component Primer

- 8.2.2. Two-Component Primer

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Dental Zirconia Primer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Dental Clinic

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. One-Component Primer

- 9.2.2. Two-Component Primer

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Dental Zirconia Primer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Dental Clinic

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. One-Component Primer

- 10.2.2. Two-Component Primer

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BISCO Dental

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DenMat

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SAREMCO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Premier Dental

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SHOFU

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ultradent

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Parkell

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ivoclar

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Apex Dental Materials

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Zest Dental Solutions

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 BISCO Dental

List of Figures

- Figure 1: Global Dental Zirconia Primer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Dental Zirconia Primer Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Dental Zirconia Primer Revenue (million), by Application 2024 & 2032

- Figure 4: North America Dental Zirconia Primer Volume (K), by Application 2024 & 2032

- Figure 5: North America Dental Zirconia Primer Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Dental Zirconia Primer Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Dental Zirconia Primer Revenue (million), by Types 2024 & 2032

- Figure 8: North America Dental Zirconia Primer Volume (K), by Types 2024 & 2032

- Figure 9: North America Dental Zirconia Primer Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Dental Zirconia Primer Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Dental Zirconia Primer Revenue (million), by Country 2024 & 2032

- Figure 12: North America Dental Zirconia Primer Volume (K), by Country 2024 & 2032

- Figure 13: North America Dental Zirconia Primer Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Dental Zirconia Primer Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Dental Zirconia Primer Revenue (million), by Application 2024 & 2032

- Figure 16: South America Dental Zirconia Primer Volume (K), by Application 2024 & 2032

- Figure 17: South America Dental Zirconia Primer Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Dental Zirconia Primer Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Dental Zirconia Primer Revenue (million), by Types 2024 & 2032

- Figure 20: South America Dental Zirconia Primer Volume (K), by Types 2024 & 2032

- Figure 21: South America Dental Zirconia Primer Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Dental Zirconia Primer Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Dental Zirconia Primer Revenue (million), by Country 2024 & 2032

- Figure 24: South America Dental Zirconia Primer Volume (K), by Country 2024 & 2032

- Figure 25: South America Dental Zirconia Primer Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Dental Zirconia Primer Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Dental Zirconia Primer Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Dental Zirconia Primer Volume (K), by Application 2024 & 2032

- Figure 29: Europe Dental Zirconia Primer Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Dental Zirconia Primer Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Dental Zirconia Primer Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Dental Zirconia Primer Volume (K), by Types 2024 & 2032

- Figure 33: Europe Dental Zirconia Primer Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Dental Zirconia Primer Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Dental Zirconia Primer Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Dental Zirconia Primer Volume (K), by Country 2024 & 2032

- Figure 37: Europe Dental Zirconia Primer Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Dental Zirconia Primer Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Dental Zirconia Primer Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Dental Zirconia Primer Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Dental Zirconia Primer Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Dental Zirconia Primer Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Dental Zirconia Primer Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Dental Zirconia Primer Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Dental Zirconia Primer Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Dental Zirconia Primer Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Dental Zirconia Primer Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Dental Zirconia Primer Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Dental Zirconia Primer Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Dental Zirconia Primer Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Dental Zirconia Primer Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Dental Zirconia Primer Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Dental Zirconia Primer Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Dental Zirconia Primer Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Dental Zirconia Primer Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Dental Zirconia Primer Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Dental Zirconia Primer Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Dental Zirconia Primer Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Dental Zirconia Primer Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Dental Zirconia Primer Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Dental Zirconia Primer Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Dental Zirconia Primer Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Dental Zirconia Primer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Dental Zirconia Primer Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Dental Zirconia Primer Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Dental Zirconia Primer Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Dental Zirconia Primer Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Dental Zirconia Primer Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Dental Zirconia Primer Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Dental Zirconia Primer Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Dental Zirconia Primer Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Dental Zirconia Primer Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Dental Zirconia Primer Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Dental Zirconia Primer Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Dental Zirconia Primer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Dental Zirconia Primer Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Dental Zirconia Primer Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Dental Zirconia Primer Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Dental Zirconia Primer Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Dental Zirconia Primer Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Dental Zirconia Primer Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Dental Zirconia Primer Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Dental Zirconia Primer Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Dental Zirconia Primer Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Dental Zirconia Primer Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Dental Zirconia Primer Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Dental Zirconia Primer Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Dental Zirconia Primer Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Dental Zirconia Primer Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Dental Zirconia Primer Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Dental Zirconia Primer Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Dental Zirconia Primer Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Dental Zirconia Primer Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Dental Zirconia Primer Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Dental Zirconia Primer Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Dental Zirconia Primer Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Dental Zirconia Primer Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Dental Zirconia Primer Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Dental Zirconia Primer Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Dental Zirconia Primer Volume K Forecast, by Country 2019 & 2032

- Table 81: China Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Dental Zirconia Primer Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Dental Zirconia Primer Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Dental Zirconia Primer?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Dental Zirconia Primer?

Key companies in the market include BISCO Dental, DenMat, SAREMCO, Premier Dental, SHOFU, Ultradent, Parkell, Ivoclar, Apex Dental Materials, GC, Zest Dental Solutions.

3. What are the main segments of the Dental Zirconia Primer?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Dental Zirconia Primer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Dental Zirconia Primer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Dental Zirconia Primer?

To stay informed about further developments, trends, and reports in the Dental Zirconia Primer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence