Key Insights

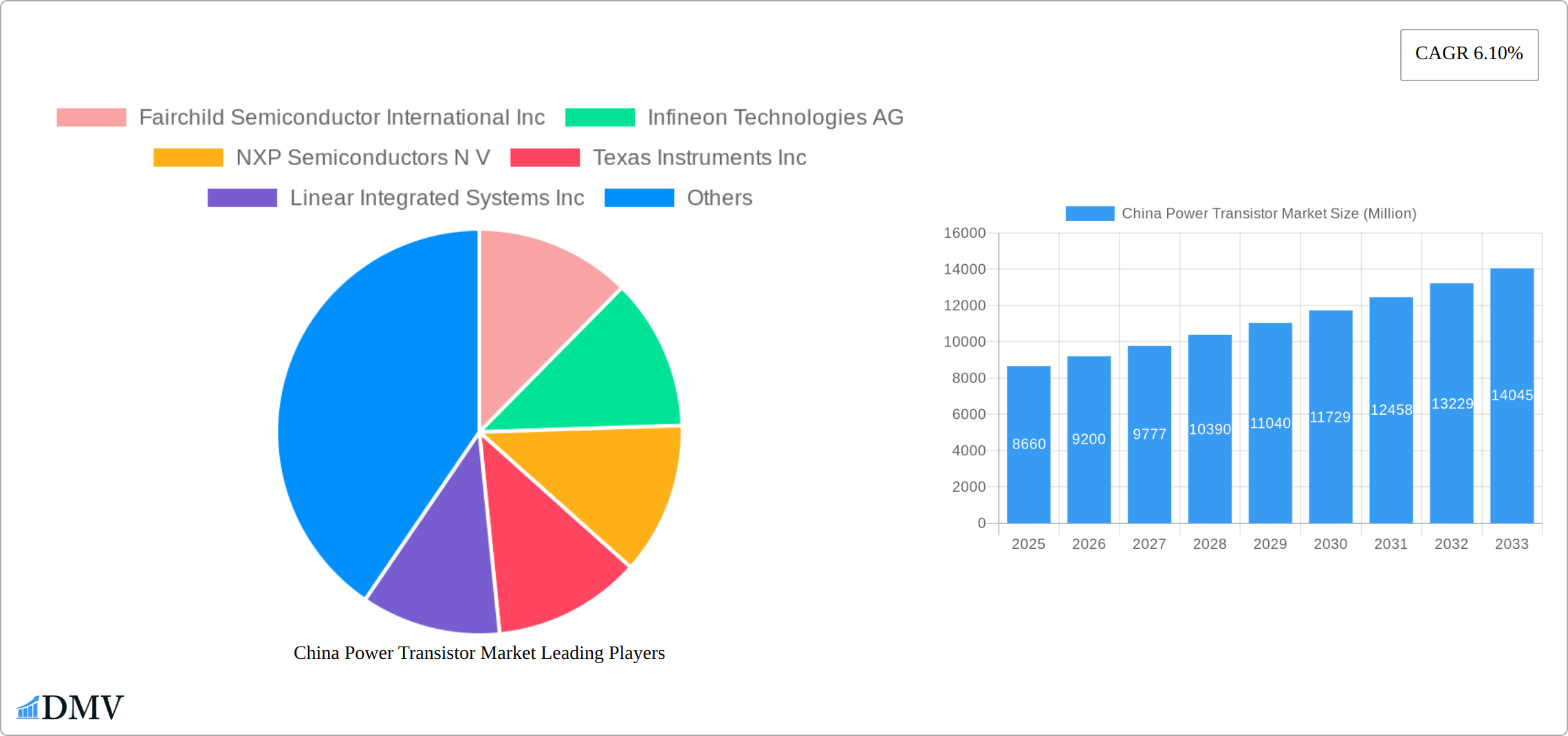

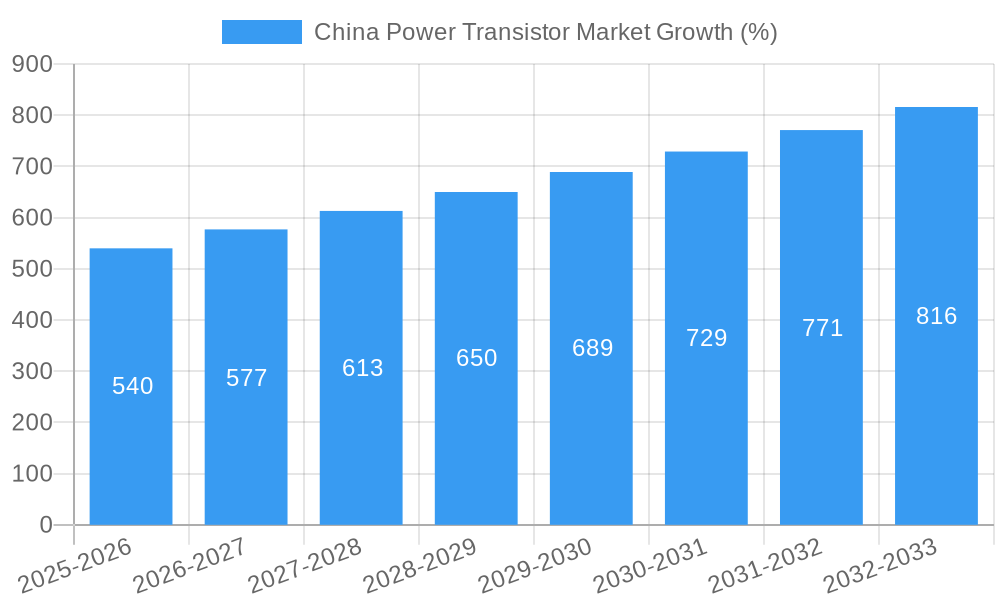

The China power transistor market, valued at $8.66 billion in 2025, is projected to experience robust growth, driven by the nation's expanding electronics manufacturing sector and increasing adoption of electric vehicles (EVs). A compound annual growth rate (CAGR) of 6.10% from 2025 to 2033 indicates a significant market expansion. Key drivers include the surge in demand for consumer electronics, particularly smartphones and smart home devices, along with the rapid growth of the automotive and renewable energy sectors. The increasing integration of power transistors in high-efficiency power supplies and inverters for EVs and renewable energy systems further fuels market growth. Technological advancements, such as the development of GaN transistors offering superior efficiency and power density, represent a significant trend shaping the market landscape. However, potential restraints include fluctuating raw material prices and the global chip shortage which may impact production and pricing. The market is segmented by product type (Low-Voltage FETs, IGBT Modules, RF and Microwave Transistors, High Voltage FETs, IGBT Transistors), transistor type (Bipolar Junction Transistor, Field Effect Transistor, Heterojunction Bipolar Transistor, MOSFET, JFET, NPN Transistor, PNP Transistor, GaN transistor), and end-user industry (Consumer Electronics, Communication & Technology, Automotive, Energy & Power, Manufacturing). Leading players like Infineon Technologies, STMicroelectronics, and Texas Instruments are actively participating in this dynamic market, investing in research and development to enhance product offerings and cater to the growing demand.

The market's segmentation reveals that IGBT modules and high-voltage FETs are expected to dominate due to their critical role in high-power applications. Within the transistor type segment, the field-effect transistor (FET) family, particularly MOSFETs and GaN transistors, are anticipated to witness significant growth owing to their superior switching speeds and efficiency. The automotive and energy & power sectors are expected to be the key growth drivers for the forecast period, fueled by government initiatives promoting electric vehicle adoption and renewable energy integration. Competition amongst established players and emerging companies is likely to remain intense, focusing on innovation, cost optimization, and strategic partnerships to capture market share. Understanding these dynamics will be crucial for stakeholders navigating the opportunities and challenges in this rapidly evolving sector.

China Power Transistor Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the China power transistor market, offering a comprehensive overview of market trends, leading players, and future growth prospects. Spanning the period from 2019 to 2033, with 2025 as the base year, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

China Power Transistor Market Composition & Trends

The China power transistor market is characterized by a moderately concentrated landscape, with key players like Fairchild Semiconductor International Inc, Infineon Technologies AG, NXP Semiconductors N V, Texas Instruments Inc, and others holding significant market share. Innovation is driven by advancements in semiconductor technology, particularly in areas like GaN and SiC transistors, catering to the growing demand for higher efficiency and power density in various applications. The regulatory environment, while evolving, plays a significant role in shaping market dynamics, influencing both domestic and international players. Substitute products, such as alternative power switching technologies, pose a moderate competitive threat. End-user profiles are diverse, encompassing the consumer electronics, communication & technology, automotive, energy & power, and manufacturing sectors, each with unique demands and growth trajectories. M&A activities have been relatively moderate in recent years, with deal values averaging approximately xx Million USD annually (2019-2024).

- Market Share Distribution (2024): Infineon Technologies AG (xx%), Texas Instruments Inc (xx%), STMicroelectronics N V (xx%), others (xx%).

- Average M&A Deal Value (2019-2024): xx Million USD

- Key Innovation Catalysts: GaN technology adoption, SiC transistor advancements, miniaturization trends.

- Regulatory Landscape: Government policies promoting domestic semiconductor manufacturing and technological advancements.

China Power Transistor Market Industry Evolution

The China power transistor market has witnessed consistent growth throughout the historical period (2019-2024), driven by the rapid expansion of end-user industries like consumer electronics, automotive, and renewable energy. Technological advancements, particularly the rise of high-efficiency power transistors (e.g., GaN and SiC), have fueled market expansion, pushing the adoption of more energy-efficient designs. Shifting consumer demands for smaller, faster, and more energy-efficient electronic devices have further augmented market growth. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024 and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching an estimated xx Million by 2033. This growth is fuelled by factors such as increasing demand for electric vehicles and renewable energy infrastructure.

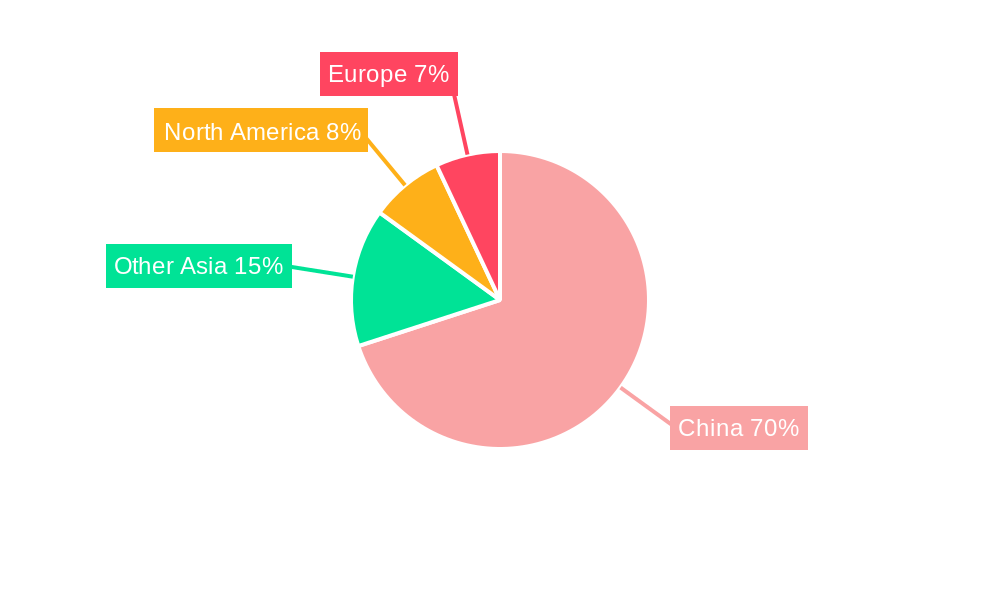

Leading Regions, Countries, or Segments in China Power Transistor Market

The coastal regions of China, particularly Guangdong, Jiangsu, and Shanghai, remain dominant in the power transistor market, fueled by a concentration of advanced manufacturing facilities and robust technological infrastructure. This concentration fosters innovation and efficient supply chains. Within the product landscape, High Voltage FETs and IGBT Modules continue to lead in revenue generation, primarily driven by the explosive growth of industrial automation, smart grids, renewable energy integration (solar and wind power inverters), and the burgeoning electric vehicle (EV) sector. Field Effect Transistors (FETs) maintain their position as the dominant transistor type. The automotive sector remains the leading end-user industry, experiencing unprecedented demand due to the rapid expansion of the electric and hybrid vehicle market and government support for electric mobility.

- Key Drivers (Coastal Regions): Highly skilled workforce, readily available supply chains, government incentives promoting semiconductor manufacturing, and proximity to major consumer markets.

- Key Drivers (High Voltage FETs & IGBT Modules): Increasing demand for high-power applications in electric vehicles, renewable energy systems (e.g., solar inverters, wind turbine converters), industrial motor drives, and data centers, driven by efficiency and miniaturization needs.

- Key Drivers (Automotive Sector): Government policies promoting electric vehicle adoption, stringent emission regulations, advancements in battery technology, and the rising consumer preference for EVs and hybrid vehicles. This sector's demand is further boosted by the expanding charging infrastructure.

- Emerging Drivers: The increasing adoption of 5G and data centers is creating a significant demand for power transistors with improved power density and efficiency.

China Power Transistor Market Product Innovations

Continuous innovation in power transistor technology focuses on enhancing efficiency, minimizing power loss, increasing switching frequencies, and improving thermal management. The adoption of wide-bandgap (WBG) semiconductors, such as Gallium Nitride (GaN) and Silicon Carbide (SiC) transistors, has revolutionized performance, leading to smaller, lighter, and more efficient power supplies and inverters. These advancements are transforming applications across numerous sectors, offering significant advantages including improved energy efficiency, faster charging times (particularly beneficial for EVs), reduced heat dissipation, and extended operational lifespan. Research and development efforts are also exploring new materials and packaging techniques to further improve performance and reliability.

Propelling Factors for China Power Transistor Market Growth

The China power transistor market’s growth is propelled by several key factors: the burgeoning demand for electric vehicles and renewable energy infrastructure, driving the need for efficient power management solutions; advancements in semiconductor technology, leading to higher efficiency and performance; and supportive government policies and initiatives promoting domestic semiconductor manufacturing.

Obstacles in the China Power Transistor Market

Challenges facing the market include potential supply chain disruptions, especially concerning raw materials and specialized components; intensifying competition from both domestic and international players, leading to price pressures; and evolving regulatory landscapes that require constant adaptation and compliance. These factors collectively influence market dynamics and can impact overall growth trajectory.

Future Opportunities in China Power Transistor Market

Emerging opportunities lie in the expansion of 5G infrastructure, necessitating high-performance power transistors; the growth of the renewable energy sector, which requires efficient and reliable power conversion technology; and increased demand for power-efficient consumer electronics and industrial automation systems.

Major Players in the China Power Transistor Market Ecosystem

- Fairchild Semiconductor International Inc

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Texas Instruments Inc.

- STMicroelectronics N.V.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Renesas Electronics Corporation

- Champion Microelectronics Corp

- Several significant domestic Chinese manufacturers are also emerging and gaining market share.

Key Developments in China Power Transistor Market Industry

- February 2024: Mitsubishi Electric Corporation launched a 6.5W silicon RF high-power MOSFET for commercial two-way radios, enhancing range and reducing power consumption.

- March 2024: Cerebras Systems unveiled the WSE-3 chip, featuring four trillion transistors and 125 petaflops of computing power, manufactured using TSMC's 5nm process in China. This significantly advances AI computing capabilities.

Strategic China Power Transistor Market Forecast

The China power transistor market is poised for robust growth in the coming years, driven by continuous technological advancements, expansion into new applications, and increasing government support. The market's potential is substantial, particularly in sectors such as electric vehicles, renewable energy, and 5G infrastructure. Continued innovation in wide-bandgap semiconductors and power management ICs will further fuel market expansion and create exciting opportunities for both established and emerging players.

China Power Transistor Market Segmentation

-

1. Product

- 1.1. Low-Voltage FETs

- 1.2. IGBT Modules

- 1.3. RF and Microwave Transistors

- 1.4. High Voltage FETs

- 1.5. IGBT Transistors

-

2. Type

- 2.1. Bipolar Junction Transistor

- 2.2. Field Effect Transistor

- 2.3. Heterojunction Bipolar Transistor

- 2.4. Other

-

3. End-user Industry

- 3.1. Consumer Electronics

- 3.2. Communication & Technology

- 3.3. Automotive

- 3.4. Energy & Power

- 3.5. Manufacturing

- 3.6. Other End-user Industries

China Power Transistor Market Segmentation By Geography

- 1. China

China Power Transistor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for connected devices; Surging usage of fossil fuels has increasing demand for power-efficient electronic devices

- 3.3. Market Restrains

- 3.3.1 Limitations in Operations due to constraints like temperature

- 3.3.2 frequency

- 3.3.3 reverse blocking capacity

- 3.3.4 etc

- 3.4. Market Trends

- 3.4.1. Automotive Industry is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Power Transistor Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Low-Voltage FETs

- 5.1.2. IGBT Modules

- 5.1.3. RF and Microwave Transistors

- 5.1.4. High Voltage FETs

- 5.1.5. IGBT Transistors

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Bipolar Junction Transistor

- 5.2.2. Field Effect Transistor

- 5.2.3. Heterojunction Bipolar Transistor

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Consumer Electronics

- 5.3.2. Communication & Technology

- 5.3.3. Automotive

- 5.3.4. Energy & Power

- 5.3.5. Manufacturing

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Fairchild Semiconductor International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Infineon Technologies AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NXP Semiconductors N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Texas Instruments Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Linear Integrated Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mitsubishi Electric Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 STMicroelectronics N V

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Champion Microelectronics Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toshiba Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Renesas Electronics Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Fairchild Semiconductor International Inc

List of Figures

- Figure 1: China Power Transistor Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Power Transistor Market Share (%) by Company 2024

List of Tables

- Table 1: China Power Transistor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Power Transistor Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: China Power Transistor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: China Power Transistor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: China Power Transistor Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Power Transistor Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Power Transistor Market Revenue Million Forecast, by Product 2019 & 2032

- Table 8: China Power Transistor Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: China Power Transistor Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: China Power Transistor Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Power Transistor Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the China Power Transistor Market?

Key companies in the market include Fairchild Semiconductor International Inc, Infineon Technologies AG, NXP Semiconductors N V, Texas Instruments Inc, Linear Integrated Systems Inc, Mitsubishi Electric Corporation, STMicroelectronics N V, Champion Microelectronics Corp, Toshiba Corporation, Renesas Electronics Corporation.

3. What are the main segments of the China Power Transistor Market?

The market segments include Product, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for connected devices; Surging usage of fossil fuels has increasing demand for power-efficient electronic devices.

6. What are the notable trends driving market growth?

Automotive Industry is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Limitations in Operations due to constraints like temperature. frequency. reverse blocking capacity. etc.

8. Can you provide examples of recent developments in the market?

March 2024: Cerebras Systems, an AI startup backed by Sequoia Capital, has introduced the WSE-3, an upgraded version of its large-scale chips. This new version offers double the performance while maintaining the original price point. The WSE-3 is powered by four trillion transistors, delivering 125 petaflops of computing power. These chips are manufactured using TSMC's 5nm process, based in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Power Transistor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Power Transistor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Power Transistor Market?

To stay informed about further developments, trends, and reports in the China Power Transistor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence