Key Insights

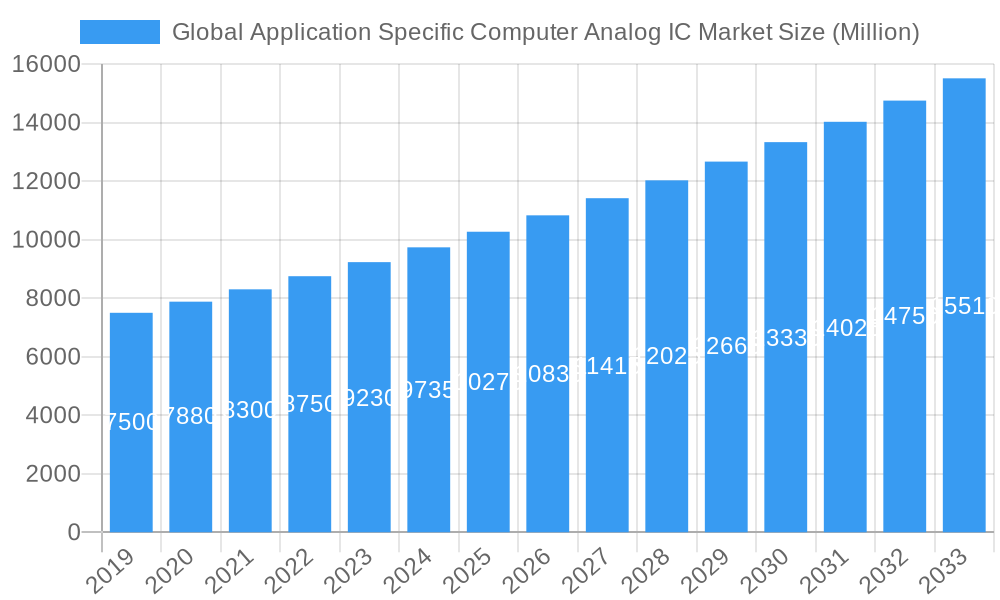

The Global Application Specific Computer Analog IC Market is poised for significant expansion, projected to reach a substantial market size of approximately $XX million by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 5.30%, indicating consistent and strong market momentum through the forecast period ending in 2033. The market is primarily propelled by escalating demand for advanced electronic devices across various sectors, including automotive, industrial automation, consumer electronics, and telecommunications. The increasing complexity of modern systems necessitates specialized analog integrated circuits (ICs) that can efficiently manage and process signals, driving innovation and adoption. Furthermore, the continuous evolution of technologies like the Internet of Things (IoT), artificial intelligence (AI), and 5G connectivity are creating new avenues for analog IC applications, demanding higher performance, lower power consumption, and greater integration capabilities. Key market drivers include the miniaturization trend in electronics, the burgeoning demand for smart devices, and the widespread implementation of sophisticated sensor networks in both consumer and industrial applications.

Global Application Specific Computer Analog IC Market Market Size (In Billion)

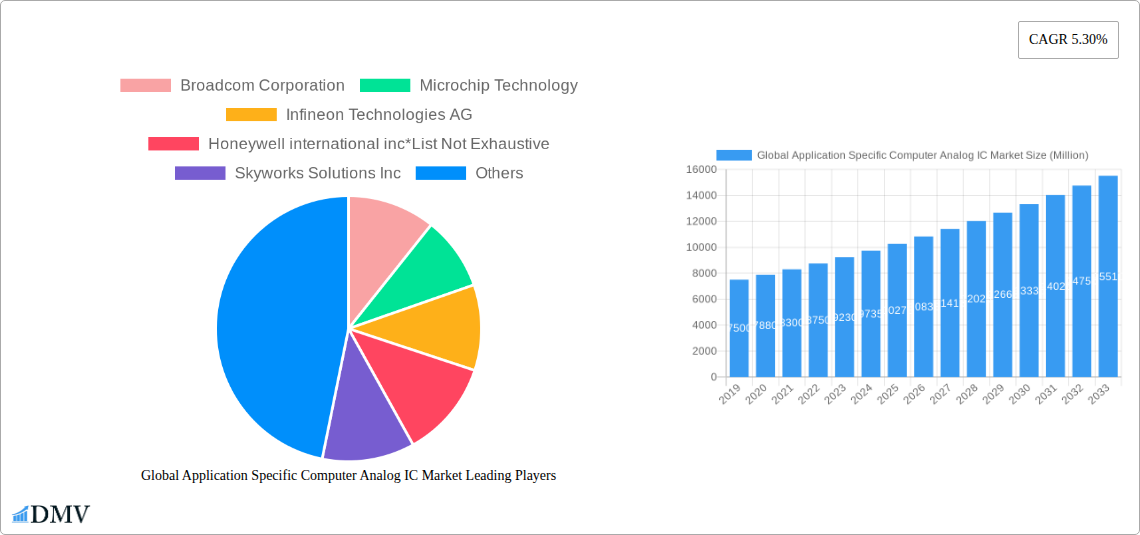

Despite the overwhelmingly positive growth outlook, the market faces certain restraints that warrant strategic consideration. The intense competition among leading players, including Broadcom Corporation, Microchip Technology, Infineon Technologies AG, and Texas Instruments Incorporated, can lead to price pressures and necessitate significant investment in research and development to maintain a competitive edge. Supply chain disruptions and raw material price volatility, as observed in recent global events, also pose potential challenges to consistent production and pricing. However, the overarching trend of digital transformation and the relentless pursuit of enhanced performance and efficiency in electronic systems are expected to outweigh these restraints. Emerging trends such as the integration of advanced power management ICs, the development of high-frequency analog components for next-generation wireless communication, and the increasing focus on energy-efficient solutions are shaping the market landscape. The diverse segmentation across production, consumption, import/export, and price trends reflects the dynamic nature of this market, with specific segments experiencing varying growth rates and influencing overall market performance.

Global Application Specific Computer Analog IC Market Company Market Share

This comprehensive report delves into the Global Application Specific Computer Analog IC Market, providing an unparalleled analysis of its current landscape and future trajectory. Covering the study period of 2019–2033, with a base year of 2025, this research offers critical insights into analog IC trends, semiconductor market dynamics, and integrated circuit innovations for stakeholders across the technology value chain.

Discover detailed Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), and Price Trend Analysis. Understand the impact of industry developments and product innovations driving growth in automotive analog ICs, space-grade ICs, and other specialized applications. This report is essential for investors, manufacturers, and strategic planners seeking to leverage opportunities in the discrete analog semiconductor market and the broader ASIC market.

Global Application Specific Computer Analog IC Market Market Composition & Trends

The Global Application Specific Computer Analog IC Market is characterized by a moderate to high degree of concentration, with a few key players holding significant market share. Innovation is a primary catalyst, driven by relentless demand for higher performance, lower power consumption, and increased functionality in specialized electronic systems. The regulatory landscape, particularly concerning semiconductor manufacturing and environmental standards, plays a crucial role in shaping market entry and operational strategies. Substitute products, while present in broader analog IC applications, are less of a threat in the highly specialized application-specific segment where performance and integration are paramount. End-user profiles are diverse, spanning industries like automotive, aerospace, industrial automation, and consumer electronics, each with unique demands for high-reliability analog circuits. Mergers and acquisitions (M&A) activities are strategic moves to consolidate market presence, acquire cutting-edge technologies, and expand product portfolios. Anticipated M&A deal values for the forecast period are estimated to be in the billions of dollars, reflecting the strategic importance of this sector. Market share distribution is dynamic, with leading companies continuously investing in R&D to maintain their competitive edge.

- Market Concentration: Moderate to High

- Innovation Catalysts: Demand for performance, power efficiency, miniaturization.

- Regulatory Landscape: Growing emphasis on sustainability, data security, and supply chain resilience.

- Substitute Products: Limited direct substitutes for highly specialized application-specific integrated circuits (ASICs).

- End-User Profiles: Automotive, Aerospace & Defense, Industrial, Consumer Electronics, Telecommunications.

- M&A Activities: Strategic consolidation, technology acquisition, market expansion.

- Estimated M&A Deal Values (Forecast Period): > $XX Billion

Global Application Specific Computer Analog IC Market Industry Evolution

The Global Application Specific Computer Analog IC Market has undergone significant evolution, driven by the relentless pace of technological advancement and shifting consumer and industrial demands. Historically, the market has witnessed a steady upward trajectory, fueled by the increasing integration of electronics across diverse sectors. From the early days of discrete analog components, the industry has progressed towards highly sophisticated Application-Specific Integrated Circuits (ASICs) designed to perform precise functions within complex systems. This evolution is marked by key technological breakthroughs, including advancements in silicon-on-insulator (SOI) technology, FinFET processes, and the development of specialized analog front-ends for high-frequency and low-noise applications. The compound annual growth rate (CAGR) for the market has consistently been robust, projected to remain strong throughout the forecast period.

Consumer demand for more sophisticated and integrated electronic devices has played a pivotal role. For instance, the automotive industry’s transition towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) has created a surge in demand for specialized analog ICs for battery management, sensor fusion, and powertrain control. Similarly, the burgeoning Internet of Things (IoT) ecosystem necessitates low-power, highly integrated analog components for sensing, connectivity, and signal processing. The aerospace and defense sector, with its stringent requirements for radiation hardening and high reliability, continues to be a significant driver, pushing the boundaries of analog IC design. The increasing complexity of embedded systems in industrial automation, healthcare devices, and communication infrastructure further solidifies the market's growth path. Industry players are continuously adapting by investing heavily in research and development, focusing on miniaturization, energy efficiency, and enhanced performance metrics to meet these evolving needs. This has led to a paradigm shift from general-purpose analog ICs to highly tailored solutions that offer superior performance and cost-effectiveness for specific applications. The adoption rate of these advanced analog ICs is directly correlated with the speed at which industries integrate new technologies, making the market highly responsive to emerging trends.

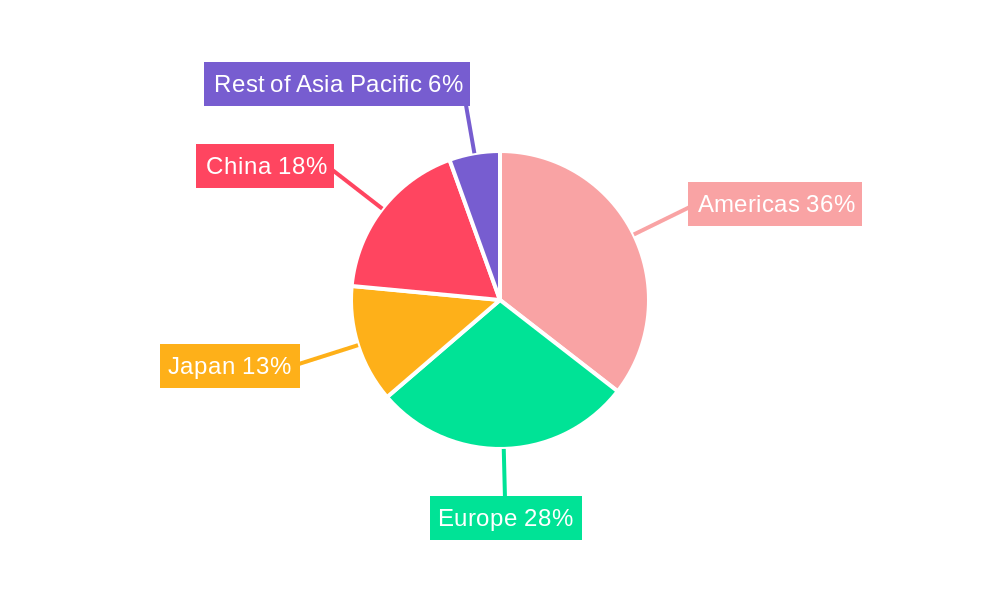

Leading Regions, Countries, or Segments in Global Application Specific Computer Analog IC Market

The Global Application Specific Computer Analog IC Market exhibits distinct regional strengths and dominance across various analytical segments.

Production Analysis: Asia-Pacific, particularly Taiwan and South Korea, leads in semiconductor fabrication and is a powerhouse for analog IC manufacturing. The region's advanced foundry capabilities, extensive supply chain networks, and government support for the semiconductor industry contribute to its production dominance. North America and Europe also maintain significant production capabilities, especially in specialized and high-end analog ICs.

- Dominant Region: Asia-Pacific

- Key Countries: Taiwan, South Korea, China

- Key Drivers: Advanced manufacturing infrastructure, skilled workforce, government incentives, robust foundry services.

Consumption Analysis: North America and Europe represent the largest consumption markets for application-specific computer analog ICs, primarily driven by their advanced automotive, industrial, and aerospace sectors. The strong presence of leading technology companies and a high rate of adoption for advanced electronic systems contribute to their significant consumption share. The Asia-Pacific region is rapidly growing in consumption due to its expanding manufacturing base and burgeoning consumer electronics market.

- Dominant Regions: North America, Europe

- Key Drivers: High adoption rates of advanced technologies, strong industrial base, significant R&D investment, growing demand for sophisticated electronics in automotive and industrial sectors.

Import Market Analysis (Value & Volume): Countries with substantial domestic manufacturing of end-products but limited advanced semiconductor fabrication facilities often exhibit high import volumes. This includes countries in Southeast Asia and certain emerging economies within Latin America and Africa that rely on imported ICs for their electronics assembly.

- Key Import Markets: Southeast Asian nations, select emerging economies.

- Drivers: Demand for electronics manufacturing, limited domestic production capacity, favorable trade agreements.

Export Market Analysis (Value & Volume): Leading semiconductor manufacturing nations, especially those in Asia-Pacific and North America, are the primary exporters of application-specific computer analog ICs. The high value and volume of these exports reflect their technological leadership and production scale.

- Key Export Markets: Taiwan, South Korea, United States, European Union nations.

- Drivers: Advanced manufacturing capabilities, proprietary technology, economies of scale, strong global demand.

Price Trend Analysis: Prices are heavily influenced by production costs, technological complexity, demand-supply dynamics, and the level of customization. Highly specialized and low-volume radiation-hardened ICs for aerospace command significantly higher prices compared to more widely adopted automotive analog ICs. Semiconductor shortages and geopolitical factors have also historically impacted price trends, leading to price volatility.

- Price Influences: Technological complexity, production volume, R&D investment, supply chain disruptions, customization level.

Global Application Specific Computer Analog IC Market Product Innovations

Product innovations in the Global Application Specific Computer Analog IC Market are centered on enhancing performance, reducing power consumption, and increasing integration capabilities for specialized functions. Recent advancements include the development of ultra-low noise amplifiers for sensitive sensor applications, high-efficiency power management ICs for battery-operated devices, and robust analog front-ends for advanced communication systems. The increasing demand for miniaturization is driving innovations in System-in-Package (SiP) solutions, integrating multiple analog and digital components onto a single chip. Performance metrics like improved signal-to-noise ratio (SNR), extended bandwidth, and reduced form factors are key differentiators. Unique selling propositions often lie in tailored solutions that address specific industry challenges, such as enhanced automotive safety ICs or aerospace-grade analog components capable of withstanding extreme conditions.

Propelling Factors for Global Application Specific Computer Analog IC Market Growth

The growth of the Global Application Specific Computer Analog IC Market is propelled by several key factors. The accelerating adoption of Internet of Things (IoT) devices, which require specialized analog interfaces for sensing and communication, is a major driver. The burgeoning automotive electronics market, particularly the shift towards electric vehicles (EVs) and autonomous driving systems, fuels demand for advanced automotive analog ICs for power management, sensor integration, and control. Furthermore, the increasing sophistication of industrial automation and the expansion of 5G infrastructure necessitate high-performance analog components. Government initiatives promoting domestic semiconductor manufacturing and R&D investments also contribute significantly to market expansion, creating a favorable ecosystem for innovation and production of discrete analog semiconductor solutions.

Obstacles in the Global Application Specific Computer Analog IC Market Market

Despite robust growth, the Global Application Specific Computer Analog IC Market faces several obstacles. Supply chain disruptions, exacerbated by geopolitical tensions and natural disasters, can lead to material shortages and production delays, impacting delivery timelines and costs. The semiconductor industry's capital-intensive nature, requiring substantial investment in advanced fabrication facilities, poses a barrier to entry for smaller players. Furthermore, increasingly stringent environmental regulations and the need for sustainable manufacturing practices add to operational complexities and costs. The highly specialized nature of application-specific ICs also means that a downturn in a particular end-user industry can have a significant impact on demand. Intellectual property protection and the constant threat of counterfeiting also present ongoing challenges.

Future Opportunities in Global Application Specific Computer Analog IC Market

The Global Application Specific Computer Analog IC Market is poised for significant future opportunities. The ongoing digital transformation across all sectors will continue to drive demand for increasingly sophisticated analog solutions. The expansion of the metaverse and augmented reality (AR)/virtual reality (VR) technologies presents new avenues for high-performance analog ICs for advanced display and sensor interfaces. Furthermore, the growing focus on renewable energy and smart grids will create substantial demand for specialized analog components for energy management and power conversion. The advancement of artificial intelligence (AI) and machine learning (ML) at the edge will also necessitate more efficient and integrated analog hardware. Emerging markets in developing economies also offer untapped potential for growth as they adopt advanced electronic technologies.

Major Players in the Global Application Specific Computer Analog IC Market Ecosystem

- Broadcom Corporation

- Microchip Technology

- Infineon Technologies AG

- Honeywell international inc

- Skyworks Solutions Inc

- STMicroelectronics N V

- NXP Semiconductors

- ON Semiconductor

- Renesas Electronics Corporation

- Taiwan Semiconductor Co Ltd

- Texas Instruments Incorporated

- Analog Devices Inc

- Maxim Integrated Products Inc

- Qualcomm Inc

- Intel Corporation

Key Developments in Global Application Specific Computer Analog IC Market Industry

- March 2022: STMicroelectronics Introduces Low-Cost Radiation-Hardened ICs for Low-Cost 'New Space' Satellites. STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications, is simplifying the design and volume production of a new generation of reliable small, low-cost satellites capable of delivering services such as earth observation and broadband internet from low-Earth orbits (LEOs). ST's new radiation-hardened power, analog, and integrated logic circuits in low-cost plastic packaging provide key functions for the satellites' electronic circuitry.

- June 2021: NXP Semiconductors N.V. places the strongest role in automotive processing, and TSMC announced the release of NXP's S32G2 vehicle network processors and the S32R294 radar processor into volume production on TSMC's advanced 16 nanometers (nm) FinFET process technology. The S32G2 vehicle networking processors provide service-oriented gateways for secure cloud connectivity and over-the-air upgrades, enabling a slew of data-driven applications, including usage-based insurance and vehicle health management. S32G2 processors may also act as domain and zonal controllers in next-generation vehicle designs and high-performance ASIL D safety processors in advanced driver assistance and autonomous driving systems. The transition to TSMC's 16nm technology enabled S32G2 to combine numerous devices into one, resulting in a powerful System-on-Chip (SoC) with a smaller processing footprint.

Strategic Global Application Specific Computer Analog IC Market Market Forecast

The strategic forecast for the Global Application Specific Computer Analog IC Market points towards sustained and robust growth, driven by the relentless digital transformation across industries. Key growth catalysts include the burgeoning demand for advanced automotive electronics, the expansion of IoT networks, and the development of next-generation communication infrastructure. The increasing adoption of AI and ML at the edge will also create new opportunities for specialized analog processing. The market is expected to benefit from ongoing investments in R&D, focusing on miniaturization, energy efficiency, and enhanced performance. Emerging technologies and new market applications, coupled with supportive government policies for the semiconductor industry, will further solidify the market's potential and ensure its continued expansion throughout the forecast period.

Global Application Specific Computer Analog IC Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Global Application Specific Computer Analog IC Market Segmentation By Geography

- 1. Americas

- 2. Europe

- 3. Japan

- 4. China

- 5. Rest of Asia Pacific

Global Application Specific Computer Analog IC Market Regional Market Share

Geographic Coverage of Global Application Specific Computer Analog IC Market

Global Application Specific Computer Analog IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for advanced consumer electronics products; Artificial Intelligence and Machine learning capabilities to expand application specific analog computer Integrated Circuit Market

- 3.3. Market Restrains

- 3.3.1. Complex designing of analog integrated circuits is expected to hinder the global market growth

- 3.4. Market Trends

- 3.4.1. Consumer Electronics and Automotive Industry drive growth towards the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Application Specific Computer Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Americas

- 5.6.2. Europe

- 5.6.3. Japan

- 5.6.4. China

- 5.6.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Americas Global Application Specific Computer Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Global Application Specific Computer Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Japan Global Application Specific Computer Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. China Global Application Specific Computer Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Rest of Asia Pacific Global Application Specific Computer Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Broadcom Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Microchip Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Infineon Technologies AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Honeywell international inc*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Skyworks Solutions Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 STMicroelectronics N V

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 NXP Semiconductors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 ON Semiconductor

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Renesas Electronics Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Taiwan Semiconductor Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Texas Instruments Incorporated

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Analog Devices Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Maxim Integrated Products Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Qualcomm Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Intel Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Broadcom Corporation

List of Figures

- Figure 1: Global Global Application Specific Computer Analog IC Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Americas Global Application Specific Computer Analog IC Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: Americas Global Application Specific Computer Analog IC Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: Americas Global Application Specific Computer Analog IC Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: Americas Global Application Specific Computer Analog IC Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: Americas Global Application Specific Computer Analog IC Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: Americas Global Application Specific Computer Analog IC Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: Americas Global Application Specific Computer Analog IC Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: Americas Global Application Specific Computer Analog IC Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: Americas Global Application Specific Computer Analog IC Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: Americas Global Application Specific Computer Analog IC Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: Americas Global Application Specific Computer Analog IC Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Americas Global Application Specific Computer Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Global Application Specific Computer Analog IC Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: Europe Global Application Specific Computer Analog IC Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Global Application Specific Computer Analog IC Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Global Application Specific Computer Analog IC Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Global Application Specific Computer Analog IC Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Global Application Specific Computer Analog IC Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Global Application Specific Computer Analog IC Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Global Application Specific Computer Analog IC Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Global Application Specific Computer Analog IC Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Global Application Specific Computer Analog IC Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Global Application Specific Computer Analog IC Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Global Application Specific Computer Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan Global Application Specific Computer Analog IC Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Japan Global Application Specific Computer Analog IC Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Japan Global Application Specific Computer Analog IC Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Japan Global Application Specific Computer Analog IC Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Japan Global Application Specific Computer Analog IC Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Japan Global Application Specific Computer Analog IC Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Japan Global Application Specific Computer Analog IC Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Japan Global Application Specific Computer Analog IC Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Japan Global Application Specific Computer Analog IC Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Japan Global Application Specific Computer Analog IC Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Japan Global Application Specific Computer Analog IC Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Japan Global Application Specific Computer Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: China Global Application Specific Computer Analog IC Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: China Global Application Specific Computer Analog IC Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: China Global Application Specific Computer Analog IC Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: China Global Application Specific Computer Analog IC Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: China Global Application Specific Computer Analog IC Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: China Global Application Specific Computer Analog IC Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: China Global Application Specific Computer Analog IC Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: China Global Application Specific Computer Analog IC Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: China Global Application Specific Computer Analog IC Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: China Global Application Specific Computer Analog IC Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: China Global Application Specific Computer Analog IC Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: China Global Application Specific Computer Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue (undefined), by Country 2025 & 2033

- Figure 61: Rest of Asia Pacific Global Application Specific Computer Analog IC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 14: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 20: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 32: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Global Application Specific Computer Analog IC Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Application Specific Computer Analog IC Market?

The projected CAGR is approximately 10.3%.

2. Which companies are prominent players in the Global Application Specific Computer Analog IC Market?

Key companies in the market include Broadcom Corporation, Microchip Technology, Infineon Technologies AG, Honeywell international inc*List Not Exhaustive, Skyworks Solutions Inc, STMicroelectronics N V, NXP Semiconductors, ON Semiconductor, Renesas Electronics Corporation, Taiwan Semiconductor Co Ltd, Texas Instruments Incorporated, Analog Devices Inc, Maxim Integrated Products Inc, Qualcomm Inc, Intel Corporation.

3. What are the main segments of the Global Application Specific Computer Analog IC Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for advanced consumer electronics products; Artificial Intelligence and Machine learning capabilities to expand application specific analog computer Integrated Circuit Market.

6. What are the notable trends driving market growth?

Consumer Electronics and Automotive Industry drive growth towards the market.

7. Are there any restraints impacting market growth?

Complex designing of analog integrated circuits is expected to hinder the global market growth.

8. Can you provide examples of recent developments in the market?

March 2022: STMicroelectronics Introduces Low-Cost radiation-hardened ICs for Low-Cost 'New Space' Satellites. STMicroelectronics, a global semiconductor leader serving customers across the spectrum of electronics applications, is simplifying the design and volume production of a new generation of reliable small, low-cost satellites capable of delivering services such as earth observation and broadband internet from low-Earth orbits (LEOs). ST's new radiation-hardened power, analog, and integrated logic circuits in low-cost plastic packaging provide key functions for the satellites' electronic circuitry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Application Specific Computer Analog IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Application Specific Computer Analog IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Application Specific Computer Analog IC Market?

To stay informed about further developments, trends, and reports in the Global Application Specific Computer Analog IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence