Key Insights

The global Semiconductor Silicon Intellectual Property (IP) market is set for substantial growth, forecasted to reach $7.9 billion by 2025 and expand at a Compound Annual Growth Rate (CAGR) of 13.9% through 2033. This expansion is driven by the increasing demand for sophisticated electronic devices across consumer electronics, automotive, and industrial sectors. Key factors include the rising complexity of System-on-Chips (SoCs) requiring specialized IP blocks, the widespread adoption of 5G technology, and advancements in artificial intelligence (AI) and machine learning (ML). The trend of fabless semiconductor companies and Integrated Device Manufacturers (IDMs) outsourcing chip design to dedicated IP providers also significantly contributes to market expansion. Processor IP and wired/wireless interface IP are leading categories, addressing the evolving need for high-performance, connected solutions.

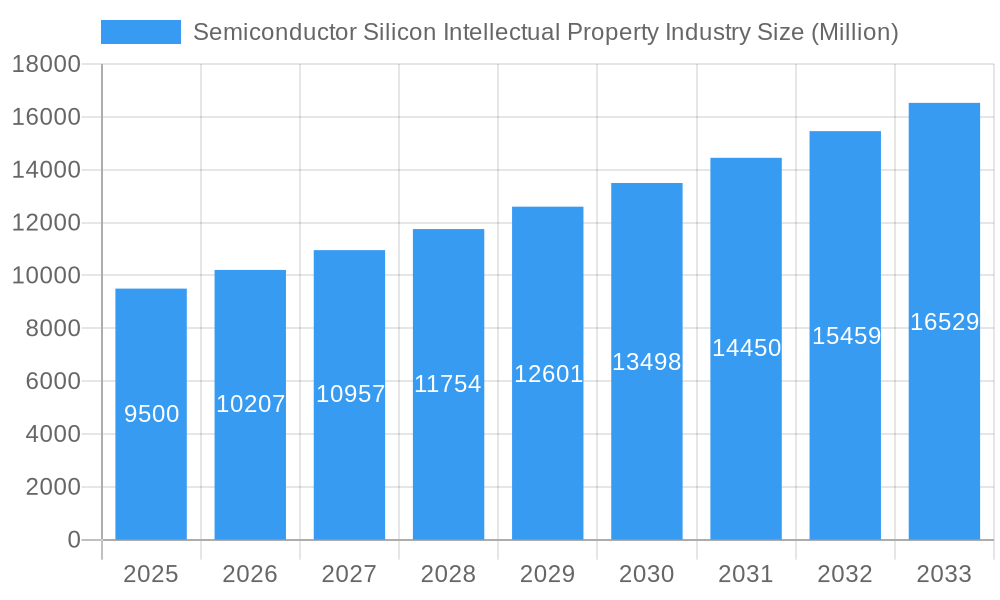

Semiconductor Silicon Intellectual Property Industry Market Size (In Billion)

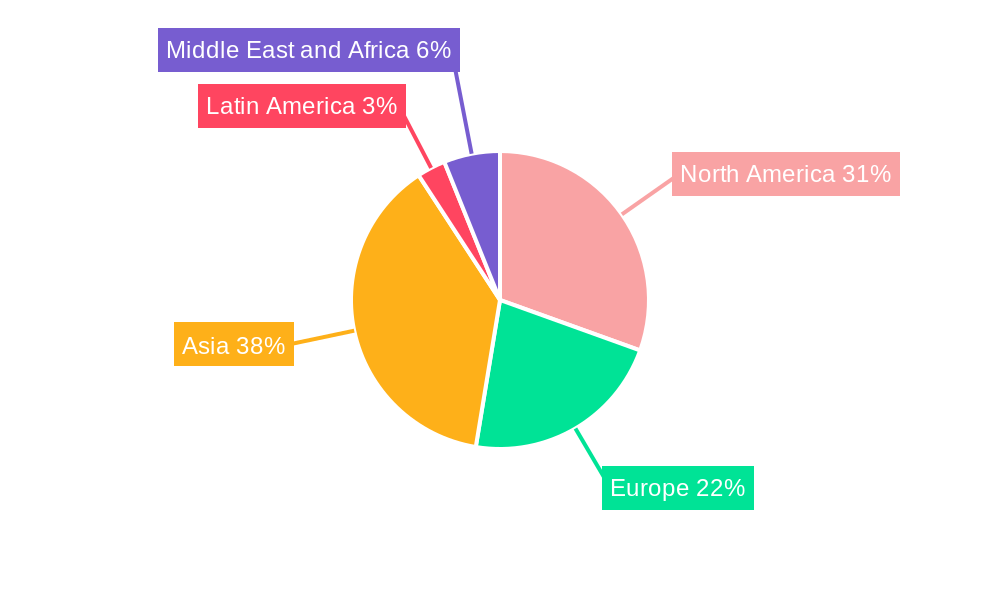

Challenges within the Semiconductor Silicon IP market include the substantial costs associated with IP development and licensing, alongside stringent intellectual property protection regulations, which can present hurdles for emerging companies. Market fragmentation and vendor consolidation may also intensify competition and pricing pressures. Nevertheless, emerging trends such as the growth of open-source IP initiatives, the critical need for energy-efficient IP for IoT devices, and the demand for specialized IP for edge computing are expected to counterbalance these challenges and create new growth opportunities. North America and Asia are anticipated to lead market dominance due to technological innovation and the concentration of major semiconductor manufacturers. Leading companies including Synopsys Inc., Cadence Design Systems Inc., and ARM Ltd. are instrumental in providing a wide array of IP solutions to meet the diverse demands of the semiconductor industry.

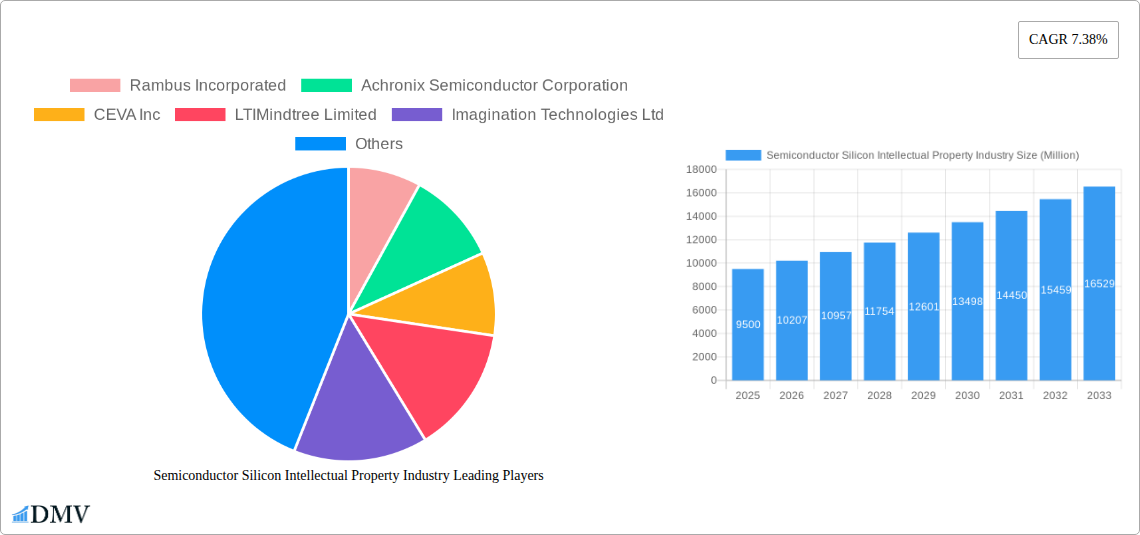

Semiconductor Silicon Intellectual Property Industry Company Market Share

This report offers an in-depth analysis of the Semiconductor Silicon Intellectual Property Industry, providing key insights into market size, growth projections, and future trends.

Semiconductor Silicon Intellectual Property Industry Market Composition & Trends

The Semiconductor Silicon Intellectual Property (IP) Industry is a dynamic and complex ecosystem, crucial for the advancement of modern electronics. This report delves into its core market composition, analyzing the intricate interplay of various revenue streams, IP types, and end-user verticals. We will dissect the market share distribution of License, Royalty, and Services, alongside the dominance of Processor IP, Wired and Wireless Interface IP, and Other IP Types. Understanding the penetration of these IPs into Consumer Electronics, Computers and Peripherals, Automobile, Industrial, and Other End-user Verticals is paramount. Innovation catalysts, such as the increasing demand for AI-driven solutions and advanced connectivity, are shaping the competitive landscape. The regulatory landscape, while fostering innovation, also presents compliance challenges. We will assess the threat of substitute products, the evolving profiles of end-users, and the strategic significance of Mergers & Acquisitions (M&A). Key M&A activities, with deal values projected to reach billions, underscore the consolidation and strategic realignments within the industry. Examining market concentration reveals the influence of major players and the emergence of specialized IP providers. This section will provide a comprehensive overview of the industry's foundational elements and the forces driving its evolution, with an estimated market value of over $XX Million in 2025.

Semiconductor Silicon Intellectual Property Industry Industry Evolution

The Semiconductor Silicon Intellectual Property (IP) industry has witnessed a profound evolution, driven by relentless technological advancements and shifting market demands. Over the study period of 2019–2033, the market has transitioned from providing foundational IP blocks to offering sophisticated, pre-verified solutions that accelerate chip design and reduce time-to-market. The historical period (2019–2024) showcased significant growth, fueled by the proliferation of connected devices and the increasing complexity of System-on-Chips (SoCs). This growth trajectory has been marked by a compound annual growth rate (CAGR) of approximately XX% during these years. The base year, 2025, stands as a pivotal point, with an estimated market valuation of over $XX Million. Looking ahead into the forecast period (2025–2033), the industry is poised for sustained expansion, projected to achieve a CAGR of XX% to reach an estimated market size of over $XX Million by 2033. Key technological advancements, such as the increasing adoption of RISC-V architecture for its open-source flexibility, the maturation of AI/ML accelerators, and the demand for high-performance computing (HPC) IPs, are reshaping product roadmaps. Simultaneously, evolving consumer demands for more immersive experiences in virtual reality (VR) and augmented reality (AR), coupled with the burgeoning needs of the automotive sector for advanced driver-assistance systems (ADAS) and autonomous driving capabilities, are creating new avenues for IP innovation. The industry's ability to adapt to these dynamic forces, offering tailored IP solutions for niche applications and high-volume markets alike, will be critical to its continued success and expansion.

Leading Regions, Countries, or Segments in Semiconductor Silicon Intellectual Property Industry

The dominance within the Semiconductor Silicon Intellectual Property (IP) industry is multi-faceted, with specific regions, countries, and segments exhibiting significant influence. Analyzing Revenue Type, Processor IP stands out as a primary revenue generator, followed by Wired and Wireless Interface IP, reflecting the fundamental need for processing power and seamless connectivity in modern semiconductor designs. In terms of End-user Vertical, Consumer Electronics and Computers and Peripherals continue to be the largest consumers of semiconductor IP, driven by the constant innovation in smartphones, laptops, and gaming consoles, with their market share estimated at over XX% collectively. However, the Automobile and Industrial sectors are experiencing rapid growth in IP adoption, fueled by the automotive industry's push towards electrification and autonomous driving, and the industrial sector's focus on automation and the Industrial Internet of Things (IIoT).

- Dominant IP Type: Processor IP, encompassing CPU cores, GPU cores, and specialized accelerators for AI/ML, is critical. The demand for efficient and high-performance processing power underpins its leading position.

- Key End-User Vertical Drivers:

- Automobile: The increasing integration of advanced driver-assistance systems (ADAS), infotainment, and electrification is driving substantial demand for specialized automotive-grade IP.

- Consumer Electronics: Continuous innovation in mobile devices, wearables, and smart home appliances necessitates cutting-edge IP solutions for enhanced functionality and power efficiency.

- Leading Regions: Asia Pacific, particularly Taiwan, South Korea, and China, are at the forefront of semiconductor manufacturing and design, making them crucial hubs for IP consumption and development. North America, with its strong R&D capabilities and major semiconductor companies, also plays a pivotal role. Europe is showing significant growth in the automotive and industrial IP segments.

- Revenue Stream Dominance: License revenue remains the most significant stream, representing over XX% of the total market value, due to the upfront cost of acquiring advanced IP cores. Royalty revenue is steadily growing, tied to the volume of chip production utilizing licensed IP. Services, including IP integration and customization, are crucial for enabling successful SoC development.

Semiconductor Silicon Intellectual Property Industry Product Innovations

Product innovations in the Semiconductor Silicon IP industry are characterized by increased specialization and enhanced performance. Companies are developing highly optimized IP blocks for AI/ML inference and training, significantly accelerating data processing for edge devices and cloud servers. Advances in low-power processor IP are crucial for extending battery life in mobile and IoT applications. Furthermore, the development of next-generation connectivity IP, including Wi-Fi 7 and advanced 5G/6G modem IPs, is enabling faster and more reliable data transfer. The integration of security features directly into IP blocks is also a significant trend, addressing growing cybersecurity concerns across all end-user verticals. These innovations are not only improving performance metrics like power efficiency and processing speed but also enabling entirely new product categories and functionalities, pushing the boundaries of what is technologically feasible.

Propelling Factors for Semiconductor Silicon Intellectual Property Industry Growth

The growth of the Semiconductor Silicon Intellectual Property (IP) industry is propelled by several key factors. The relentless demand for advanced processing power and specialized functionalities in emerging technologies like Artificial Intelligence (AI), Machine Learning (ML), 5G, and the Internet of Things (IoT) is a primary driver. The increasing complexity of System-on-Chips (SoCs) necessitates the use of pre-designed, verified IP blocks to reduce development time and cost for chip manufacturers. Furthermore, the growing trend of chiplet-based designs and heterogeneous integration encourages the adoption of modular IP. Government initiatives and investments in semiconductor manufacturing and R&D in various regions are also fostering a conducive environment. Economic factors such as the global increase in semiconductor demand across consumer, automotive, and industrial sectors, coupled with a growing number of fabless semiconductor companies, are further fueling this growth. The estimated market size for this sector is expected to exceed $XX Million by 2033.

Obstacles in the Semiconductor Silicon Intellectual Property Industry Market

Despite its robust growth trajectory, the Semiconductor Silicon Intellectual Property (IP) industry faces several significant obstacles. Regulatory hurdles and trade restrictions, particularly those impacting the global semiconductor supply chain, can disrupt product development and market access. The escalating cost of advanced node development and IP licensing can be a barrier for smaller companies. Intense competition among IP providers leads to pricing pressures and the constant need for innovation. Supply chain disruptions, as witnessed in recent years, can impact the availability of essential manufacturing resources and affect the timely delivery of IP-enabled chips. Furthermore, the increasing complexity of IP integration into SoCs requires highly skilled engineers, leading to talent shortages. Ensuring robust IP protection and combating piracy remain ongoing challenges for IP vendors.

Future Opportunities in Semiconductor Silicon Intellectual Property Industry

The Semiconductor Silicon Intellectual Property (IP) industry is ripe with future opportunities. The metaverse and extended reality (XR) are creating demand for high-performance graphics, AI, and advanced connectivity IP. The continued expansion of the automotive sector, with its focus on autonomous driving, electric vehicles (EVs), and in-car connectivity, presents a significant growth area. The ongoing digital transformation across industries, including healthcare and logistics, will drive demand for specialized industrial and IoT IPs. Furthermore, the rise of RISC-V as an open-source architecture offers new opportunities for IP customization and innovation, particularly for niche applications. The increasing demand for energy-efficient computing will also spur innovation in low-power IP solutions. Emerging markets in Asia and Africa are poised to become significant consumers of semiconductor IP as their digital infrastructure develops.

Major Players in the Semiconductor Silicon Intellectual Property Industry Ecosystem

- Rambus Incorporated

- Achronix Semiconductor Corporation

- CEVA Inc

- LTIMindtree Limited

- Imagination Technologies Ltd

- Fujitsu Ltd

- Andes Technology Corporation

- Faraday Technology Corporation

- MIPS Tech LLC

- Digital Media Professionals

- Synopsys Inc

- Cadence Design Systems Inc

- eMemory Technology Inc

- MediaTek Inc

- VeriSilicon Holdings Co Ltd

- ARM Ltd (SoftBank)

Key Developments in Semiconductor Silicon Intellectual Property Industry Industry

- May 2023: CEVA Inc. announced the acquisition of the RealSpace 3D Spatial Audio business, technology, and patents from VisiSonics Corporation. Based in Maryland, close to CEVA's sensor fusion R&D development center, the VisiSonics spatial audio R&D team and software expand the Company's application software portfolio for embedded systems, bolstering CEVA's strong market position in wearables, where spatial audio is fast becoming a must-have component.

- March 2023: Synopsys launched a groundbreaking suite of AI-powered electronic design automation tools that spans the entire chip design process, from architecture to manufacturing. Known as the Synopsys.ai suite, it offers the potential to reduce development time significantly, cut costs, enhance performance, and improve yields. These tools are precious for chip designs targeting advanced nodes like 5 nm, 3 nm, two nm-class, and beyond.

Strategic Semiconductor Silicon Intellectual Property Industry Market Forecast

The strategic forecast for the Semiconductor Silicon Intellectual Property (IP) market points towards sustained and accelerated growth. Driven by the insatiable demand for computational power and connectivity in burgeoning fields like AI, 5G/6G, and the metaverse, the market is poised for expansion. The increasing adoption of chiplet architectures and the rise of RISC-V present significant opportunities for IP innovation and customization. Furthermore, the automotive industry's ongoing transition towards electrification and autonomous driving, coupled with the continuous evolution of consumer electronics, will underpin robust demand for specialized IP solutions. Strategic investments in R&D and an agile approach to emerging technological trends will be critical for market players to capitalize on these opportunities and achieve an estimated market value exceeding $XX Million by 2033.

Semiconductor Silicon Intellectual Property Industry Segmentation

-

1. Revenue Type

- 1.1. License

- 1.2. Royalty

- 1.3. Services

-

2. IP Type

- 2.1. Processor IP

- 2.2. Wired and Wireless Interface IP

- 2.3. Other IP Types

-

3. End-user Vertical

- 3.1. Consumer Electronics

- 3.2. Computers and Peripherals

- 3.3. Automobile

- 3.4. Industrial

- 3.5. Other End-user Verticals

Semiconductor Silicon Intellectual Property Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

-

3. Asia

- 3.1. China

- 3.2. Taiwan

- 3.3. Japan

- 3.4. South Korea

- 3.5. India

- 3.6. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Semiconductor Silicon Intellectual Property Industry Regional Market Share

Geographic Coverage of Semiconductor Silicon Intellectual Property Industry

Semiconductor Silicon Intellectual Property Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Connected Devices; Growing Demand for Modern SoC Designs

- 3.3. Market Restrains

- 3.3.1. IP Business Model and Economies of Scale

- 3.4. Market Trends

- 3.4.1. Consumer Electronics to be the Largest End-user Vertical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Silicon Intellectual Property Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Revenue Type

- 5.1.1. License

- 5.1.2. Royalty

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by IP Type

- 5.2.1. Processor IP

- 5.2.2. Wired and Wireless Interface IP

- 5.2.3. Other IP Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Consumer Electronics

- 5.3.2. Computers and Peripherals

- 5.3.3. Automobile

- 5.3.4. Industrial

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Revenue Type

- 6. North America Semiconductor Silicon Intellectual Property Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Revenue Type

- 6.1.1. License

- 6.1.2. Royalty

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by IP Type

- 6.2.1. Processor IP

- 6.2.2. Wired and Wireless Interface IP

- 6.2.3. Other IP Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Consumer Electronics

- 6.3.2. Computers and Peripherals

- 6.3.3. Automobile

- 6.3.4. Industrial

- 6.3.5. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Revenue Type

- 7. Europe Semiconductor Silicon Intellectual Property Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Revenue Type

- 7.1.1. License

- 7.1.2. Royalty

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by IP Type

- 7.2.1. Processor IP

- 7.2.2. Wired and Wireless Interface IP

- 7.2.3. Other IP Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Consumer Electronics

- 7.3.2. Computers and Peripherals

- 7.3.3. Automobile

- 7.3.4. Industrial

- 7.3.5. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Revenue Type

- 8. Asia Semiconductor Silicon Intellectual Property Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Revenue Type

- 8.1.1. License

- 8.1.2. Royalty

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by IP Type

- 8.2.1. Processor IP

- 8.2.2. Wired and Wireless Interface IP

- 8.2.3. Other IP Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Consumer Electronics

- 8.3.2. Computers and Peripherals

- 8.3.3. Automobile

- 8.3.4. Industrial

- 8.3.5. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Revenue Type

- 9. Latin America Semiconductor Silicon Intellectual Property Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Revenue Type

- 9.1.1. License

- 9.1.2. Royalty

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by IP Type

- 9.2.1. Processor IP

- 9.2.2. Wired and Wireless Interface IP

- 9.2.3. Other IP Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Consumer Electronics

- 9.3.2. Computers and Peripherals

- 9.3.3. Automobile

- 9.3.4. Industrial

- 9.3.5. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Revenue Type

- 10. Middle East and Africa Semiconductor Silicon Intellectual Property Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Revenue Type

- 10.1.1. License

- 10.1.2. Royalty

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by IP Type

- 10.2.1. Processor IP

- 10.2.2. Wired and Wireless Interface IP

- 10.2.3. Other IP Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Consumer Electronics

- 10.3.2. Computers and Peripherals

- 10.3.3. Automobile

- 10.3.4. Industrial

- 10.3.5. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Revenue Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Rambus Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Achronix Semiconductor Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CEVA Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LTIMindtree Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Imagination Technologies Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fujitsu Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Andes Technology Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Faraday Technology Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 MIPS Tech LLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Digital Media Professionals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Synopsys Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cadence Design Systems Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 eMemory Technology Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 MediaTek Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 VeriSilicon Holdings Co Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ARM Ltd (SoftBank )

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Rambus Incorporated

List of Figures

- Figure 1: Global Semiconductor Silicon Intellectual Property Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Revenue Type 2025 & 2033

- Figure 3: North America Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Revenue Type 2025 & 2033

- Figure 4: North America Semiconductor Silicon Intellectual Property Industry Revenue (billion), by IP Type 2025 & 2033

- Figure 5: North America Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by IP Type 2025 & 2033

- Figure 6: North America Semiconductor Silicon Intellectual Property Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 7: North America Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 8: North America Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Revenue Type 2025 & 2033

- Figure 11: Europe Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Revenue Type 2025 & 2033

- Figure 12: Europe Semiconductor Silicon Intellectual Property Industry Revenue (billion), by IP Type 2025 & 2033

- Figure 13: Europe Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by IP Type 2025 & 2033

- Figure 14: Europe Semiconductor Silicon Intellectual Property Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 15: Europe Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 16: Europe Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Revenue Type 2025 & 2033

- Figure 19: Asia Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Revenue Type 2025 & 2033

- Figure 20: Asia Semiconductor Silicon Intellectual Property Industry Revenue (billion), by IP Type 2025 & 2033

- Figure 21: Asia Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by IP Type 2025 & 2033

- Figure 22: Asia Semiconductor Silicon Intellectual Property Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 23: Asia Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Asia Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Revenue Type 2025 & 2033

- Figure 27: Latin America Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Revenue Type 2025 & 2033

- Figure 28: Latin America Semiconductor Silicon Intellectual Property Industry Revenue (billion), by IP Type 2025 & 2033

- Figure 29: Latin America Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by IP Type 2025 & 2033

- Figure 30: Latin America Semiconductor Silicon Intellectual Property Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 31: Latin America Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 32: Latin America Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Revenue Type 2025 & 2033

- Figure 35: Middle East and Africa Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Revenue Type 2025 & 2033

- Figure 36: Middle East and Africa Semiconductor Silicon Intellectual Property Industry Revenue (billion), by IP Type 2025 & 2033

- Figure 37: Middle East and Africa Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by IP Type 2025 & 2033

- Figure 38: Middle East and Africa Semiconductor Silicon Intellectual Property Industry Revenue (billion), by End-user Vertical 2025 & 2033

- Figure 39: Middle East and Africa Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Middle East and Africa Semiconductor Silicon Intellectual Property Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Semiconductor Silicon Intellectual Property Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Revenue Type 2020 & 2033

- Table 2: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by IP Type 2020 & 2033

- Table 3: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 4: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Revenue Type 2020 & 2033

- Table 6: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by IP Type 2020 & 2033

- Table 7: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 8: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Revenue Type 2020 & 2033

- Table 12: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by IP Type 2020 & 2033

- Table 13: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 14: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Revenue Type 2020 & 2033

- Table 19: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by IP Type 2020 & 2033

- Table 20: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 21: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: China Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Taiwan Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Japan Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: South Korea Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia and New Zealand Semiconductor Silicon Intellectual Property Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Revenue Type 2020 & 2033

- Table 29: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by IP Type 2020 & 2033

- Table 30: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 31: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Revenue Type 2020 & 2033

- Table 33: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by IP Type 2020 & 2033

- Table 34: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 35: Global Semiconductor Silicon Intellectual Property Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Silicon Intellectual Property Industry?

The projected CAGR is approximately 13.9%.

2. Which companies are prominent players in the Semiconductor Silicon Intellectual Property Industry?

Key companies in the market include Rambus Incorporated, Achronix Semiconductor Corporation, CEVA Inc, LTIMindtree Limited, Imagination Technologies Ltd, Fujitsu Ltd, Andes Technology Corporation, Faraday Technology Corporation, MIPS Tech LLC, Digital Media Professionals, Synopsys Inc, Cadence Design Systems Inc, eMemory Technology Inc, MediaTek Inc, VeriSilicon Holdings Co Ltd, ARM Ltd (SoftBank ).

3. What are the main segments of the Semiconductor Silicon Intellectual Property Industry?

The market segments include Revenue Type, IP Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Connected Devices; Growing Demand for Modern SoC Designs.

6. What are the notable trends driving market growth?

Consumer Electronics to be the Largest End-user Vertical.

7. Are there any restraints impacting market growth?

IP Business Model and Economies of Scale.

8. Can you provide examples of recent developments in the market?

May 2023: CEVA Inc. announced the acquisition of the RealSpace 3D Spatial Audio business, technology, and patents from VisiSonicsCorporation. Based in Maryland, close to CEVA's sensor fusion R&D development center, the VisiSonicsspatial audio R&D team and software expand the Company's application software portfolio for embedded systems, bolstering CEVA's strong market position in wearables, where spatial audio is fast becoming a must-have component.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Silicon Intellectual Property Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Silicon Intellectual Property Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Silicon Intellectual Property Industry?

To stay informed about further developments, trends, and reports in the Semiconductor Silicon Intellectual Property Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence