Key Insights

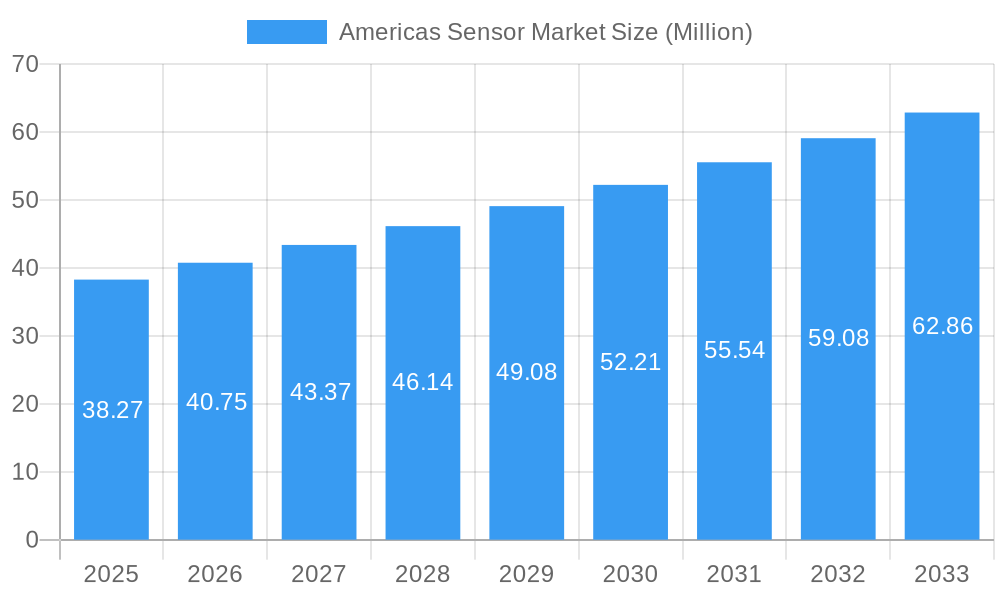

The Americas sensor market is poised for robust growth, projected to reach a substantial market size of USD 38.27 million. This expansion is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 6.48%, indicating sustained demand and innovation across various sectors. Key drivers fueling this ascent include the ever-increasing adoption of smart technologies in consumer electronics, the burgeoning demand for advanced sensor solutions in the automotive industry driven by autonomous driving and electrification, and the critical role sensors play in optimizing industrial automation and energy management. The trend towards miniaturization, enhanced accuracy, and wireless connectivity further propels market penetration, with a growing emphasis on integrated sensor solutions that offer comprehensive data collection and analysis. Furthermore, the expanding applications in medical and wellness devices, alongside stringent safety regulations in aerospace and defense, are significant contributors to this upward trajectory.

Americas Sensor Market Market Size (In Million)

Despite the promising outlook, certain restraints could influence the market’s pace. High initial investment costs for sophisticated sensor technologies and the need for skilled personnel for their integration and maintenance may pose challenges for smaller enterprises. Additionally, concerns regarding data security and privacy associated with widespread sensor deployment require careful consideration and robust mitigation strategies. However, the continuous advancements in sensor technology, such as the development of more energy-efficient and cost-effective solutions, alongside the growing adoption of IoT ecosystems, are expected to outweigh these restraints. The forecast period anticipates a significant surge in demand for sensors capable of measuring a wider array of parameters, including advanced chemical and environmental sensing, alongside innovative operational modes like biosensors and LiDAR, catering to a diverse and evolving end-user landscape across the Americas.

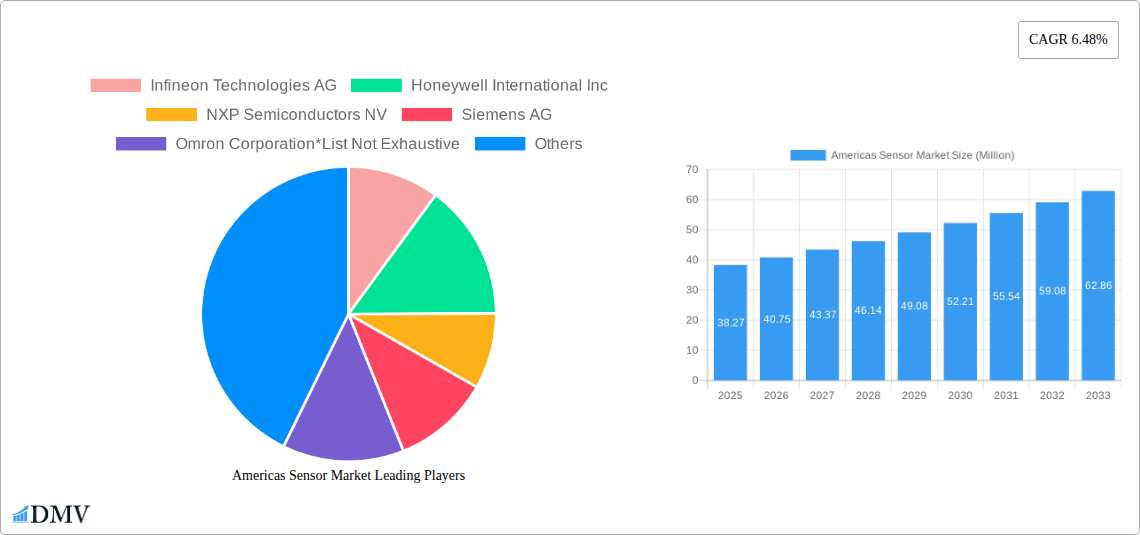

Americas Sensor Market Company Market Share

Americas Sensor Market Report: Insights, Trends, and Future Outlook (2019-2033)

Unlock critical intelligence on the dynamic Americas sensor market with this comprehensive report. Covering the historical period of 2019-2024 and projecting robust growth through 2033, this analysis provides deep dives into market composition, industry evolution, leading segments, and future opportunities. Discover key drivers, emerging trends, and strategic insights for stakeholders in automotive, consumer electronics, industrial automation, medical devices, and beyond.

Americas Sensor Market Market Composition & Trends

The Americas sensor market is characterized by a moderately concentrated landscape, driven by relentless innovation and a stringent regulatory environment. Key innovation catalysts include the growing demand for IoT devices, advancements in AI and machine learning that leverage sensor data, and the increasing miniaturization of electronic components. While substitute products exist in some niche applications, the inherent value and specificity of sensors in enabling advanced functionalities create a strong market moat. End-user profiles are highly diverse, ranging from automotive manufacturers integrating advanced driver-assistance systems (ADAS) to consumer electronics giants embedding sensors in smartphones and wearables, and industrial players optimizing operations through smart automation. Mergers and acquisitions (M&A) play a pivotal role in market consolidation and technological expansion. For instance, strategic acquisitions of smaller, specialized sensor technology firms by larger conglomerates are common, aiming to enhance product portfolios and expand market reach. While specific M&A deal values are dynamic, the overall trend indicates a significant investment in companies possessing cutting-edge sensor capabilities. The market share distribution is influenced by technological leadership, product breadth, and the ability to cater to the evolving needs of diverse industries. Regulatory landscapes, particularly concerning data privacy and safety standards for devices like medical sensors and automotive systems, continuously shape product development and market entry strategies.

Americas Sensor Market Industry Evolution

The Americas sensor market has witnessed a significant evolutionary trajectory, marked by consistent growth and transformative technological advancements. Over the historical period (2019-2024), the market experienced a compound annual growth rate (CAGR) of approximately 7.5%, fueled by the pervasive integration of sensor technologies across a multitude of applications. This growth trajectory is projected to accelerate in the forecast period (2025-2033), with an estimated CAGR of 8.2%. This expansion is underpinned by several key factors. Firstly, the relentless pursuit of enhanced automation and efficiency in industrial settings has propelled the adoption of advanced sensors for process control, predictive maintenance, and quality assurance. The Industrial Internet of Things (IIoT) paradigm, a cornerstone of Industry 4.0, heavily relies on a sophisticated network of sensors to collect real-time data, driving operational intelligence.

Secondly, the burgeoning consumer electronics sector, particularly the rise of smart home devices, wearables, and augmented/virtual reality (AR/VR) applications, has created unprecedented demand for compact, high-performance sensors. Features like advanced gesture recognition, environmental monitoring, and personalized health tracking are now standard expectations, necessitating sophisticated sensing capabilities.

Technological advancements have been a primary driver of this evolution. The transition from electromechanical sensors to microelectromechanical systems (MEMS) has enabled smaller, more power-efficient, and cost-effective solutions. Innovations in materials science have led to the development of novel sensing materials with enhanced sensitivity and specificity, particularly for chemical and biosensing applications. Furthermore, the integration of artificial intelligence (AI) and machine learning (ML) algorithms with sensor data is unlocking new levels of data interpretation and actionable insights, driving the development of intelligent systems.

Shifting consumer demands have also played a crucial role. Consumers increasingly expect connected, intelligent, and personalized experiences, which are intrinsically linked to sensor-driven technologies. The demand for safety and security features in vehicles, the convenience of smart home appliances, and the desire for comprehensive health and fitness tracking all contribute to the market's robust growth. The market is adapting by developing more user-friendly interfaces and intuitive applications that leverage sensor data effectively. This continuous interplay between technological innovation, evolving industry needs, and shifting consumer preferences defines the dynamic evolution of the Americas sensor market.

Leading Regions, Countries, or Segments in Americas Sensor Market

The Americas sensor market is a multifaceted landscape, with distinct regions, countries, and segments exhibiting varying degrees of dominance and growth potential.

Dominant End-user Industry: Automotive

The Automotive industry stands out as a leading end-user industry within the Americas sensor market. This dominance is driven by several critical factors:

- ADAS and Autonomous Driving: The relentless push towards advanced driver-assistance systems (ADAS) and fully autonomous vehicles necessitates an ever-increasing number and sophistication of sensors. This includes:

- Radar and LiDAR for object detection, adaptive cruise control, and collision avoidance.

- Image Sensors for lane keeping, traffic sign recognition, and pedestrian detection.

- Inertial Sensors (Accelerometers, Gyroscopes) for stability control, rollover detection, and precise positioning.

- Pressure Sensors for tire pressure monitoring systems (TPMS) and braking systems.

- Temperature Sensors for engine management and climate control.

- Regulatory Mandates: Increasingly stringent safety regulations in countries like the United States are mandating the inclusion of advanced safety features, directly boosting sensor demand.

- Consumer Demand for Safety and Convenience: Consumers are actively seeking vehicles equipped with enhanced safety features and driver convenience technologies, further accelerating sensor adoption.

- Electrification: The growth of electric vehicles (EVs) introduces new sensing requirements for battery management, thermal management, and charging systems.

Leading Geography: United States

Within the Americas, the United States emerges as the leading country in the sensor market. This leadership is attributed to:

- Technological Hubs and R&D Investment: The presence of major technology companies, research institutions, and significant R&D investments fosters rapid innovation and the development of cutting-edge sensor technologies.

- Strong Automotive and Aerospace Industries: The substantial presence of leading automotive manufacturers and a robust aerospace sector creates a massive demand for a wide array of sensors.

- Pioneering Consumer Electronics Adoption: The United States is a key market for the early adoption of new consumer electronics, driving demand for sensors in smartphones, wearables, and smart home devices.

- Industrial Automation and IIoT Growth: Significant investments in modernizing manufacturing facilities and the adoption of IIoT solutions contribute to the demand for industrial sensors.

- Healthcare Sector Innovation: The advanced healthcare system drives demand for medical-grade sensors in diagnostic equipment, patient monitoring devices, and wearable health trackers.

Key Parameter Measured: Inertial Sensors

Among the various parameters measured, Inertial Sensors are experiencing significant growth and demand:

- Ubiquitous in Mobile Devices: Accelerometers and gyroscopes are fundamental components in smartphones, tablets, and wearables for motion tracking, gaming, and user interface navigation.

- Automotive Safety Systems: Essential for Electronic Stability Control (ESC), anti-lock braking systems (ABS), and increasingly for ADAS features.

- Industrial Applications: Used in robotics, automation, drone navigation, and condition monitoring of machinery to detect vibrations and movement.

- Aerospace and Defense: Critical for navigation, guidance, and control systems in aircraft, missiles, and unmanned aerial vehicles (UAVs).

- Growing Precision Requirements: The demand for higher accuracy and lower power consumption in inertial sensor solutions continues to drive innovation.

Key Mode of Operation: Image Sensors

Image Sensors are another pivotal mode of operation experiencing rapid expansion:

- Automotive Vision Systems: Crucial for ADAS, surround-view cameras, and autonomous driving systems, enabling perception and decision-making.

- Consumer Electronics Dominance: The backbone of smartphone cameras, digital cameras, laptops, and security systems, driving demand for higher resolution and improved low-light performance.

- Medical Imaging: Essential for diagnostic imaging devices, endoscopes, and surgical robots.

- Industrial Inspection and Quality Control: Used in machine vision systems for automated inspection, defect detection, and product sorting.

- AR/VR Headsets: Enabling advanced spatial awareness, gesture tracking, and realistic immersive experiences.

This intricate interplay of dominant industries, geographies, measured parameters, and modes of operation shapes the dynamic and evolving Americas sensor market.

Americas Sensor Market Product Innovations

The Americas sensor market is a hotbed of product innovation, continuously pushing the boundaries of performance and application. Recent advancements include the development of ultra-low-power sensors for extended battery life in IoT devices and wearables, enabling functionalities such as continuous environmental monitoring and sophisticated health tracking. High-sensitivity, high-resolution image sensors are enabling new levels of detail in automotive vision systems and consumer imaging, facilitating enhanced safety and richer user experiences. Furthermore, miniaturization trends are leading to the integration of multiple sensing capabilities into single, compact modules, such as combined pressure and humidity sensors for smart building applications. Innovations in biosensors are paving the way for point-of-care diagnostics and personalized medicine, offering unprecedented accuracy and speed. The unique selling proposition of these innovations lies in their ability to enable smarter, safer, and more efficient systems across diverse industries, driving significant value and performance improvements.

Propelling Factors for Americas Sensor Market Growth

Several critical factors are propelling the growth of the Americas sensor market. Firstly, the relentless expansion of the Internet of Things (IoT) ecosystem, encompassing smart homes, industrial automation, and connected vehicles, creates a foundational demand for an increasing array of sensors to gather data. Secondly, significant advancements in artificial intelligence (AI) and machine learning (ML) are unlocking the potential of sensor data, enabling sophisticated analytics, predictive capabilities, and autonomous decision-making, thus incentivizing the deployment of more advanced sensors. Thirdly, government initiatives and regulatory mandates, particularly in the automotive sector for safety and emissions control, and in healthcare for patient monitoring and diagnostics, are driving adoption. Finally, the growing consumer appetite for smart, connected devices that offer enhanced convenience, safety, and personalized experiences further fuels market expansion. The convergence of these technological, economic, and regulatory influences creates a powerful growth engine for the Americas sensor market.

Obstacles in the Americas Sensor Market Market

Despite its robust growth, the Americas sensor market faces several significant obstacles. High development costs and long product validation cycles, particularly in the automotive and aerospace sectors, can impede the rapid introduction of new technologies. Supply chain disruptions, as evidenced by recent global events, pose a considerable risk, leading to component shortages and increased lead times. Intense competition among numerous players, including both established giants and agile startups, can lead to price erosion and pressure on profit margins. Furthermore, data security and privacy concerns associated with the vast amounts of sensitive data collected by sensors are leading to increasingly stringent regulations and demanding robust cybersecurity measures, adding complexity and cost. The lack of standardization across different sensor types and communication protocols can also create integration challenges for end-users, hindering widespread adoption in certain applications. Quantifiable impacts include extended time-to-market and increased operational expenses for manufacturers.

Future Opportunities in Americas Sensor Market

The Americas sensor market is poised for significant future opportunities driven by emerging trends and unmet needs. The burgeoning field of edge computing presents a substantial opportunity for the development of intelligent, localized sensors capable of processing data directly at the source, reducing latency and bandwidth requirements. The increasing focus on sustainability and environmental monitoring will drive demand for sensors capable of accurately measuring air and water quality, greenhouse gas emissions, and resource consumption. The continued growth of personalized healthcare and wellness will fuel innovation in advanced biosensors and wearable health tracking devices. Furthermore, the development of next-generation smart cities, with their emphasis on intelligent infrastructure, traffic management, and public safety, will require a vast and integrated network of diverse sensors. Advancements in robotics and automation, extending beyond industrial settings into areas like logistics and elderly care, will also create new demand for sophisticated sensing solutions.

Major Players in the Americas Sensor Market Ecosystem

- Infineon Technologies AG

- Honeywell International Inc

- NXP Semiconductors NV

- Siemens AG

- Omron Corporation

- Omega Engineering Inc

- Sick AG

- BOSCH Sensortech GmbH

- TE Connectivity Ltd

- Texas Instruments Incorporated

- Rockwell Automation Inc

- ABB Limited

- AMS AG

Key Developments in Americas Sensor Market Industry

- January 2023: OSRAM announced the launch of its new product, the Mira050, a 2.3 x 2.8 mm, 0.5 Mpixel pipelined, high-sensitivity, global shutter CMOS image sensor. Due to the Mira050's high sensitivity to visible and near-infrared (NIR) light, wearable and mobile devices' size and power consumption can be decreased. The Mira050 can be used for 3D depth sensing for face recognition in smart door locks, eye tracking, gesture tracking, and contextual awareness in AR/VR/MR headsets.

- February 2022: BOSCH announced the launch of the BMP384, a rugged barometric pressure sensor that offers market-leading accuracy in a compact package. Together with the required integration concept, the new sensor's innovative housing design uses a special gel to prevent the ingress of primary water, other liquids and dust. OEMs can easily integrate barometric pressure sensors into products that require a high degree of robustness.

Strategic Americas Sensor Market Market Forecast

The strategic forecast for the Americas sensor market indicates a future characterized by sustained and accelerated growth. Key growth catalysts include the pervasive integration of IoT devices across all sectors, the escalating demand for AI-powered analytics that rely on sensor data, and the increasing regulatory push for safety and efficiency. Emerging opportunities in edge computing, sustainable technology, and advanced healthcare will further solidify market expansion. The continuous pursuit of miniaturization, enhanced accuracy, and lower power consumption will drive product innovation, while strategic partnerships and acquisitions will shape market dynamics. The market is expected to witness substantial investment in research and development, leading to the introduction of novel sensing solutions that will redefine capabilities across automotive, consumer electronics, industrial automation, and medical applications, thereby unlocking significant future market potential.

Americas Sensor Market Segmentation

-

1. Parameters Measured

- 1.1. Temperature

- 1.2. Pessure

- 1.3. Level

- 1.4. Flow

- 1.5. Proximity

- 1.6. Environmental

- 1.7. Chemical

- 1.8. Inertial

- 1.9. Magnetic

- 1.10. Vibration

- 1.11. Other Parameters Measured

-

2. Mode of Operations

- 2.1. Optical

- 2.2. Electrical Resistance

- 2.3. Biosenser

- 2.4. Piezoresistive

- 2.5. Image

- 2.6. Capacitive

- 2.7. Piezoelectric

- 2.8. LiDAR

- 2.9. Radar

- 2.10. Other Modes of Operation

-

3. End-user Industry

- 3.1. Automotive

-

3.2. Consumer Electronics

- 3.2.1. Smartphones

- 3.2.2. Tablets, Laptops, and Computers

- 3.2.3. Wearable Devices

- 3.2.4. Smart Appliances or Devices

- 3.2.5. Other Consumer Electronics

- 3.3. Energy

- 3.4. Industrial and Other

- 3.5. Medical and Wellness

- 3.6. Construction, Agriculture, and Mining

- 3.7. Aerospace

- 3.8. Defense

-

4. Geography

-

4.1. Americas

- 4.1.1. United States

- 4.1.2. Canada

- 4.1.3. Brazil

-

4.1. Americas

Americas Sensor Market Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Brazil

Americas Sensor Market Regional Market Share

Geographic Coverage of Americas Sensor Market

Americas Sensor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Use of Smartphoes and Other Electronics Devices; Growing Advancement in Automation Sector

- 3.3. Market Restrains

- 3.3.1. Design Complexity and Performance Limitations in High-power Applications

- 3.4. Market Trends

- 3.4.1. Increasing Use of Smartphones and Other Electronic Devices to Bolster Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Sensor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 5.1.1. Temperature

- 5.1.2. Pessure

- 5.1.3. Level

- 5.1.4. Flow

- 5.1.5. Proximity

- 5.1.6. Environmental

- 5.1.7. Chemical

- 5.1.8. Inertial

- 5.1.9. Magnetic

- 5.1.10. Vibration

- 5.1.11. Other Parameters Measured

- 5.2. Market Analysis, Insights and Forecast - by Mode of Operations

- 5.2.1. Optical

- 5.2.2. Electrical Resistance

- 5.2.3. Biosenser

- 5.2.4. Piezoresistive

- 5.2.5. Image

- 5.2.6. Capacitive

- 5.2.7. Piezoelectric

- 5.2.8. LiDAR

- 5.2.9. Radar

- 5.2.10. Other Modes of Operation

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Consumer Electronics

- 5.3.2.1. Smartphones

- 5.3.2.2. Tablets, Laptops, and Computers

- 5.3.2.3. Wearable Devices

- 5.3.2.4. Smart Appliances or Devices

- 5.3.2.5. Other Consumer Electronics

- 5.3.3. Energy

- 5.3.4. Industrial and Other

- 5.3.5. Medical and Wellness

- 5.3.6. Construction, Agriculture, and Mining

- 5.3.7. Aerospace

- 5.3.8. Defense

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Americas

- 5.4.1.1. United States

- 5.4.1.2. Canada

- 5.4.1.3. Brazil

- 5.4.1. Americas

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Parameters Measured

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NXP Semiconductors NV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siemens AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Omron Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Omega Engineering Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sick AG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BOSCH Sensortech GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TE Connectivity Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Texas Instruments Incorporated

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Rockwell Automation Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ABB Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 AMS AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Americas Sensor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Americas Sensor Market Share (%) by Company 2025

List of Tables

- Table 1: Americas Sensor Market Revenue Million Forecast, by Parameters Measured 2020 & 2033

- Table 2: Americas Sensor Market Revenue Million Forecast, by Mode of Operations 2020 & 2033

- Table 3: Americas Sensor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Americas Sensor Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Americas Sensor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Americas Sensor Market Revenue Million Forecast, by Parameters Measured 2020 & 2033

- Table 7: Americas Sensor Market Revenue Million Forecast, by Mode of Operations 2020 & 2033

- Table 8: Americas Sensor Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Americas Sensor Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Americas Sensor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Americas Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Americas Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Brazil Americas Sensor Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Sensor Market?

The projected CAGR is approximately 6.48%.

2. Which companies are prominent players in the Americas Sensor Market?

Key companies in the market include Infineon Technologies AG, Honeywell International Inc, NXP Semiconductors NV, Siemens AG, Omron Corporation*List Not Exhaustive, Omega Engineering Inc, Sick AG, BOSCH Sensortech GmbH, TE Connectivity Ltd, Texas Instruments Incorporated, Rockwell Automation Inc, ABB Limited, AMS AG.

3. What are the main segments of the Americas Sensor Market?

The market segments include Parameters Measured, Mode of Operations, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 38.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Use of Smartphoes and Other Electronics Devices; Growing Advancement in Automation Sector.

6. What are the notable trends driving market growth?

Increasing Use of Smartphones and Other Electronic Devices to Bolster Market Growth.

7. Are there any restraints impacting market growth?

Design Complexity and Performance Limitations in High-power Applications.

8. Can you provide examples of recent developments in the market?

January 2023: OSRAM announced the launch of its new product, the Mira050, a 2.3 x 2.8 mm, 0.5 Mpixel pipelined, high-sensitivity, global shutter CMOS image sensor. Due to the Mira050's high sensitivity to visible and near-infrared (NIR) light, wearable and mobile devices' size and power consumption can be decreased. The Mira050 can be used for 3D depth sensing for face recognition in smart door locks, eye tracking, gesture tracking, and contextual awareness in AR/VR/MR headsets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Sensor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Sensor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Sensor Market?

To stay informed about further developments, trends, and reports in the Americas Sensor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence