Key Insights

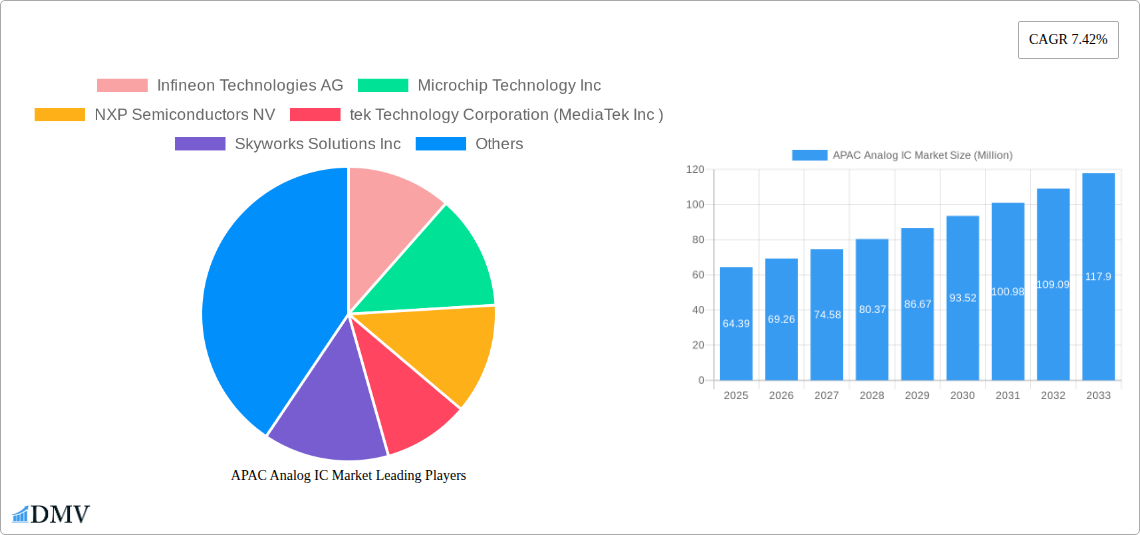

The APAC Analog IC market is poised for robust expansion, projected to reach a substantial USD 64.39 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 7.42% anticipated from 2025 to 2033. This growth is primarily fueled by the region's insatiable demand for consumer electronics, escalating adoption of connected devices, and the burgeoning automotive sector, particularly in areas like infotainment and advanced driver-assistance systems. The increasing prevalence of smartphones, smart home devices, and wearable technology directly translates to a heightened need for sophisticated analog integrated circuits that manage power, process signals, and facilitate communication. Furthermore, the significant investments in communication infrastructure, including 5G deployment, and the continued expansion of the industrial automation landscape are critical drivers. The Asia Pacific region, with its strong manufacturing base and rapidly growing middle class, is a dominant force in both the production and consumption of electronic goods, making it a pivotal market for analog IC manufacturers.

APAC Analog IC Market Market Size (In Million)

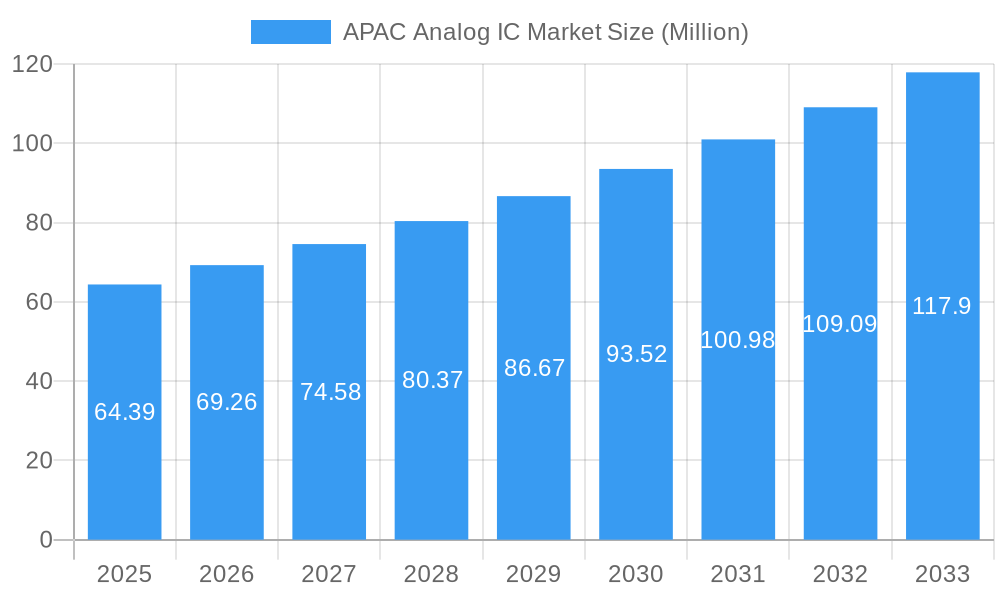

The market segmentation reveals a strong performance across various applications, with Consumer electronics, Communication, and Computer segments emerging as key demand generators. Within the General-purpose IC category, Interface, Power Management, and Signal Conversion ICs are experiencing widespread adoption due to their critical roles in optimizing device performance and energy efficiency. Application-specific ICs are also seeing significant traction, especially in automotive for advanced infotainment and safety features, and in communication for enhancing mobile device capabilities and network infrastructure. Major players like Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors NV, and Texas Instruments Incorporated are actively investing in research and development and expanding their production capacities within the APAC region to capitalize on these growth opportunities. The region's dynamic technological evolution and its central role in global electronics supply chains ensure its continued dominance and influence on the global analog IC market trajectory.

APAC Analog IC Market Company Market Share

Uncover the dynamic landscape of the APAC Analog Integrated Circuit (IC) market with this in-depth report. Spanning from 2019 to 2033, this analysis provides critical insights into market composition, industry evolution, regional dominance, product innovations, growth drivers, obstacles, and future opportunities. Essential for stakeholders seeking to navigate the complexities of the fast-growing Asia-Pacific semiconductor sector, this report delves into the strategic plays of major industry players and highlights pivotal recent developments. The base year for this analysis is 2025, with a forecast period extending from 2025 to 2033.

APAC Analog IC Market Market Composition & Trends

The APAC Analog IC market is characterized by a moderate to high concentration, with leading players like Texas Instruments Incorporated, Analog Devices Inc., and Infineon Technologies AG holding significant market share. Innovation remains a primary catalyst, driven by the relentless demand for higher performance, lower power consumption, and miniaturized solutions across diverse applications. Regulatory landscapes, while generally supportive of the semiconductor industry in key economies like China, Japan, and South Korea, present nuanced compliance requirements that companies must adeptly manage. Substitute products, primarily in the form of discrete components or lower-end integrated solutions, pose a minor threat due to the increasing complexity and performance demands of modern electronics. End-user profiles are diverse, encompassing rapidly expanding sectors such as consumer electronics, automotive, communication infrastructure, and industrial automation. Mergers and acquisitions (M&A) are a recurring theme, with strategic deals aimed at consolidating market position, acquiring advanced technologies, or expanding geographical reach. For instance, recent M&A activities have focused on strengthening capabilities in areas like power management ICs and high-frequency analog components, with deal values often reaching hundreds of millions of dollars. The market's trajectory is heavily influenced by global supply chain dynamics and geopolitical factors.

APAC Analog IC Market Industry Evolution

The APAC Analog IC market has undergone a profound evolution, mirroring the broader technological and economic shifts witnessed globally. Over the historical period (2019-2024), the market experienced robust growth, fueled by the burgeoning demand from emerging economies and the rapid adoption of advanced technologies. The study period (2019-2033) encompasses significant transformative phases, where the market's growth trajectory has been shaped by a confluence of factors. Technological advancements have been central, with continuous innovation in areas such as Gallium Nitride (GaN) and Silicon Carbide (SiC) power devices, advanced sensor integration, and high-speed signal processing. These advancements have enabled the development of more efficient, smaller, and more powerful analog ICs, catering to increasingly sophisticated applications. Shifting consumer demands have played an equally crucial role. The insatiable appetite for feature-rich smartphones, advanced automotive systems (including electric vehicles and autonomous driving), and the proliferation of the Internet of Things (IoT) devices have created sustained demand for specialized analog components. For example, the increasing complexity of smartphone camera systems and audio processing units has directly translated into higher demand for sophisticated analog ICs. Similarly, the transition to electric vehicles has spurred a surge in demand for high-performance power management ICs and battery management systems. The industrial sector's embrace of Industry 4.0 principles has also been a significant growth driver, necessitating precision analog components for automation, robotics, and smart manufacturing. The forecast period (2025-2033) is expected to witness continued expansion, albeit with potential moderations influenced by global economic conditions and the ongoing semiconductor supply chain recalibrations. The anticipated compound annual growth rate (CAGR) for the APAC region remains highly optimistic, projected to be in the range of 8-10%, indicating sustained industry vitality.

Leading Regions, Countries, or Segments in APAC Analog IC Market

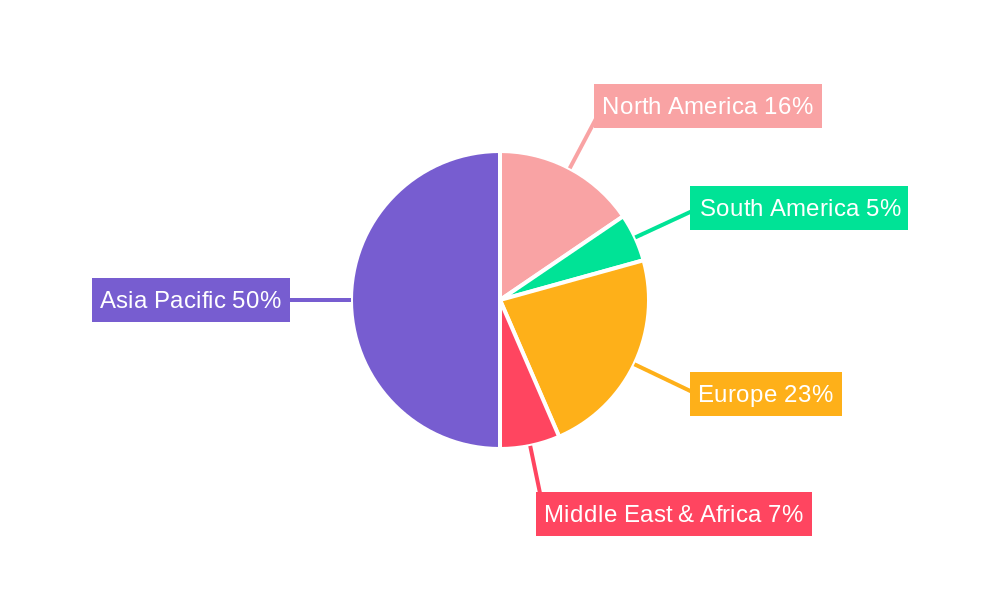

The APAC Analog IC market's dominance is intricately linked to the robust growth and technological prowess of its key economies, with China emerging as the undisputed leader. This leadership is driven by a potent combination of factors that underscore the region's strategic importance in the global semiconductor ecosystem.

- China's Ascendancy: China's leading position is cemented by its massive domestic market, extensive manufacturing capabilities, and increasing government support for indigenous semiconductor development. The sheer volume of consumer electronics, automotive production, and telecommunications infrastructure manufactured and consumed within China creates an unparalleled demand for analog ICs.

- Key Drivers for Dominance:

- Manufacturing Hub: China's established role as the world's manufacturing hub for electronics provides a captive market for analog ICs, ranging from general-purpose interface and power management ICs to application-specific solutions for consumer electronics and communication devices.

- Government Initiatives: Significant government investment and policy support, particularly through initiatives like "Made in China 2025," are fueling domestic R&D and production capabilities in the analog IC sector. This has led to increased domestic production and reduced reliance on imported components.

- Expanding Application Segments: The rapid growth of the automotive sector in China, driven by the burgeoning electric vehicle market and advancements in autonomous driving, is a major contributor. Analog ICs are critical for infotainment systems, advanced driver-assistance systems (ADAS), and battery management.

- Communication Infrastructure Boom: The ongoing deployment of 5G networks and the expansion of wired and wireless communication infrastructure necessitate a vast array of high-performance analog components, including RF front-end ICs, signal converters, and power management solutions.

- Consumer Electronics Proliferation: The insatiable demand for smartphones, wearables, smart home devices, and advanced audio-visual equipment continues to drive the demand for a wide spectrum of general-purpose and application-specific analog ICs.

In terms of segments, Application-specific ICs, particularly within the Communication and Automotive sectors, are witnessing the most significant growth. The communication segment, driven by the evolution of mobile devices and network infrastructure, requires highly specialized ICs for signal processing, power efficiency, and high-frequency operation. The automotive segment's transformation towards electrification and autonomous driving is creating unprecedented demand for sophisticated analog ICs that manage power, control sensors, and enable advanced driver-assistance systems. The Industrial and Others segment is also a substantial contributor, driven by the increasing automation and digitalization of manufacturing processes, requiring precise analog control and sensing capabilities. General-purpose ICs, while forming a foundational part of the market, are seeing their growth amplified by the increasing sophistication and integration requirements of end applications.

APAC Analog IC Market Product Innovations

Recent product innovations in the APAC Analog IC market are sharply focused on enhancing performance, reducing power consumption, and miniaturizing form factors. Companies are integrating advanced functionalities directly onto chips, such as Delta-Sigma modulators within power management ICs, as exemplified by Asahi Kasei Microdevices (AKM) in June 2024. This integration streamlines system design by eliminating the need for external components like shunt resistors and isolated ADCs, leading to smaller and more cost-effective solutions. These innovations are crucial for the development of next-generation consumer electronics, advanced automotive systems, and efficient industrial automation. Performance metrics are continuously being pushed, with faster signal conversion rates, lower noise floors, and higher power efficiency becoming standard demands across all application segments.

Propelling Factors for APAC Analog IC Market Growth

The APAC Analog IC market's growth is propelled by several key factors. Technological advancements in areas like advanced packaging, novel semiconductor materials (e.g., GaN and SiC), and higher integration densities are enabling the creation of more capable and efficient analog ICs. The ever-expanding consumer electronics market, particularly in smartphones, wearables, and smart home devices, continues to be a primary demand driver. Furthermore, the rapid growth of the automotive sector, fueled by the adoption of electric vehicles and autonomous driving technologies, necessitates a surge in sophisticated analog ICs for power management, sensor interfacing, and control systems. Government support and initiatives promoting domestic semiconductor manufacturing and innovation in countries like China, Japan, and South Korea are also significant growth catalysts.

Obstacles in the APAC Analog IC Market Market

Despite its robust growth, the APAC Analog IC market faces several obstacles. Supply chain disruptions and geopolitical tensions can lead to component shortages and price volatility, impacting production timelines and profitability. The increasing complexity of product development and manufacturing requires substantial R&D investment and advanced fabrication capabilities, creating high barriers to entry for new players. Stringent regulatory compliance in various countries, particularly concerning environmental standards and product safety, can add to operational costs and complexity. Furthermore, the intense competition among established global players and emerging regional manufacturers can lead to price pressures and compressed profit margins. The semiconductor industry's reliance on specialized materials and equipment also makes it vulnerable to global supply chain vulnerabilities.

Future Opportunities in APAC Analog IC Market

The APAC Analog IC market is ripe with future opportunities. The accelerating adoption of 5G and future wireless communication technologies will drive demand for high-performance RF and signal processing ICs. The continued expansion of the electric vehicle market presents a significant opportunity for analog ICs in battery management, power conversion, and advanced driver-assistance systems. The growth of the Industrial Internet of Things (IIoT), with its increasing need for sensors, control systems, and efficient power management, offers a substantial avenue for expansion. Furthermore, the development of emerging technologies like artificial intelligence (AI) and augmented reality (AR)/virtual reality (VR) will require increasingly sophisticated analog components for processing and interfacing. Regional expansion, particularly into less saturated markets within APAC, also presents opportunities for growth.

Major Players in the APAC Analog IC Market Ecosystem

- Infineon Technologies AG

- Microchip Technology Inc

- NXP Semiconductors NV

- tek Technology Corporation (MediaTek Inc)

- Skyworks Solutions Inc

- ON Semiconductor

- Renesas Electronics Corporation

- Qorvo Inc

- Texas Instruments Incorporated

- Analog Devices Inc

- Stmicroelectronics NV

Key Developments in APAC Analog IC Market Industry

- June 2024: Asahi Kasei Microdevices (AKM) unveiled a cutting-edge line of integrated circuits (ICs), boasting enhanced functionalities in a smaller form factor compared to its predecessors. These ICs come equipped with an inbuilt Delta-Sigma (ΔΣ) modulator, streamlining the need for separate shunt resistors and isolated analog-to-digital converters (ADCs). This development is set to impact power management solutions by reducing component count and improving efficiency in various applications.

- February 2024: Taiwan Semiconductor Manufacturing Co. Ltd (TSMC) launched Japan Advanced Semiconductor Manufacturing Inc. (JASM), in Kumamoto Prefecture, Japan. The event saw the convergence of suppliers, customers, business partners, academia, and representatives from the Japanese government, all coming together to express gratitude for their unwavering support and collaborative efforts that culminated in the project's success. This expansion of TSMC's manufacturing footprint in Japan is poised to strengthen the regional semiconductor supply chain and foster innovation in advanced manufacturing processes, directly benefiting the analog IC ecosystem.

Strategic APAC Analog IC Market Market Forecast

The strategic forecast for the APAC Analog IC market points towards sustained and robust growth over the forecast period (2025–2033). The market will continue to be driven by the relentless demand for advanced consumer electronics, the transformative shift in the automotive sector towards electrification and autonomy, and the ongoing expansion of communication infrastructure, especially 5G and beyond. Emerging technologies like IoT and AI will further fuel the need for specialized analog components. Investments in advanced manufacturing capabilities, coupled with government support for domestic semiconductor ecosystems in key APAC nations, will bolster production and innovation. While challenges such as supply chain volatility and geopolitical risks persist, the fundamental drivers of technological advancement and escalating demand for sophisticated electronic solutions position the APAC Analog IC market for significant expansion and opportunity. The estimated market size is projected to reach several hundred billion dollars by the end of the forecast period.

APAC Analog IC Market Segmentation

-

1. Type

-

1.1. General-purpose IC

- 1.1.1. Interface

- 1.1.2. Power Management

- 1.1.3. Signal Conversion

- 1.1.4. Amplifiers/Comparators (Signal Conditioning)

-

1.2. Application-specific IC

-

1.2.1. Consumer

- 1.2.1.1. Audio/Video

- 1.2.1.2. Digital Still Camera and Camcorder

- 1.2.1.3. Other Consumers

-

1.2.2. Automotive

- 1.2.2.1. Infotainment

- 1.2.2.2. Other Infotainment

-

1.2.3. Communication

- 1.2.3.1. Cell Phone

- 1.2.3.2. Infrastructure

- 1.2.3.3. Wired Communication

- 1.2.3.4. Short Range

- 1.2.3.5. Other Wireless

-

1.2.4. Computer

- 1.2.4.1. Computer System and Display

- 1.2.4.2. Computer Periphery

- 1.2.4.3. Storage

- 1.2.4.4. Other Computers

- 1.2.5. Industrial and Others

-

1.2.1. Consumer

-

1.1. General-purpose IC

APAC Analog IC Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Analog IC Market Regional Market Share

Geographic Coverage of APAC Analog IC Market

APAC Analog IC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surging Demand for Communication Devices; Growing Automtive Sector in the Region

- 3.3. Market Restrains

- 3.3.1. Increasing Design Complexity of Analog IC

- 3.4. Market Trends

- 3.4.1. Surging Demand for Communication Devices Drives Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. General-purpose IC

- 5.1.1.1. Interface

- 5.1.1.2. Power Management

- 5.1.1.3. Signal Conversion

- 5.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 5.1.2. Application-specific IC

- 5.1.2.1. Consumer

- 5.1.2.1.1. Audio/Video

- 5.1.2.1.2. Digital Still Camera and Camcorder

- 5.1.2.1.3. Other Consumers

- 5.1.2.2. Automotive

- 5.1.2.2.1. Infotainment

- 5.1.2.2.2. Other Infotainment

- 5.1.2.3. Communication

- 5.1.2.3.1. Cell Phone

- 5.1.2.3.2. Infrastructure

- 5.1.2.3.3. Wired Communication

- 5.1.2.3.4. Short Range

- 5.1.2.3.5. Other Wireless

- 5.1.2.4. Computer

- 5.1.2.4.1. Computer System and Display

- 5.1.2.4.2. Computer Periphery

- 5.1.2.4.3. Storage

- 5.1.2.4.4. Other Computers

- 5.1.2.5. Industrial and Others

- 5.1.2.1. Consumer

- 5.1.1. General-purpose IC

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America APAC Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. General-purpose IC

- 6.1.1.1. Interface

- 6.1.1.2. Power Management

- 6.1.1.3. Signal Conversion

- 6.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 6.1.2. Application-specific IC

- 6.1.2.1. Consumer

- 6.1.2.1.1. Audio/Video

- 6.1.2.1.2. Digital Still Camera and Camcorder

- 6.1.2.1.3. Other Consumers

- 6.1.2.2. Automotive

- 6.1.2.2.1. Infotainment

- 6.1.2.2.2. Other Infotainment

- 6.1.2.3. Communication

- 6.1.2.3.1. Cell Phone

- 6.1.2.3.2. Infrastructure

- 6.1.2.3.3. Wired Communication

- 6.1.2.3.4. Short Range

- 6.1.2.3.5. Other Wireless

- 6.1.2.4. Computer

- 6.1.2.4.1. Computer System and Display

- 6.1.2.4.2. Computer Periphery

- 6.1.2.4.3. Storage

- 6.1.2.4.4. Other Computers

- 6.1.2.5. Industrial and Others

- 6.1.2.1. Consumer

- 6.1.1. General-purpose IC

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America APAC Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. General-purpose IC

- 7.1.1.1. Interface

- 7.1.1.2. Power Management

- 7.1.1.3. Signal Conversion

- 7.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 7.1.2. Application-specific IC

- 7.1.2.1. Consumer

- 7.1.2.1.1. Audio/Video

- 7.1.2.1.2. Digital Still Camera and Camcorder

- 7.1.2.1.3. Other Consumers

- 7.1.2.2. Automotive

- 7.1.2.2.1. Infotainment

- 7.1.2.2.2. Other Infotainment

- 7.1.2.3. Communication

- 7.1.2.3.1. Cell Phone

- 7.1.2.3.2. Infrastructure

- 7.1.2.3.3. Wired Communication

- 7.1.2.3.4. Short Range

- 7.1.2.3.5. Other Wireless

- 7.1.2.4. Computer

- 7.1.2.4.1. Computer System and Display

- 7.1.2.4.2. Computer Periphery

- 7.1.2.4.3. Storage

- 7.1.2.4.4. Other Computers

- 7.1.2.5. Industrial and Others

- 7.1.2.1. Consumer

- 7.1.1. General-purpose IC

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe APAC Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. General-purpose IC

- 8.1.1.1. Interface

- 8.1.1.2. Power Management

- 8.1.1.3. Signal Conversion

- 8.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 8.1.2. Application-specific IC

- 8.1.2.1. Consumer

- 8.1.2.1.1. Audio/Video

- 8.1.2.1.2. Digital Still Camera and Camcorder

- 8.1.2.1.3. Other Consumers

- 8.1.2.2. Automotive

- 8.1.2.2.1. Infotainment

- 8.1.2.2.2. Other Infotainment

- 8.1.2.3. Communication

- 8.1.2.3.1. Cell Phone

- 8.1.2.3.2. Infrastructure

- 8.1.2.3.3. Wired Communication

- 8.1.2.3.4. Short Range

- 8.1.2.3.5. Other Wireless

- 8.1.2.4. Computer

- 8.1.2.4.1. Computer System and Display

- 8.1.2.4.2. Computer Periphery

- 8.1.2.4.3. Storage

- 8.1.2.4.4. Other Computers

- 8.1.2.5. Industrial and Others

- 8.1.2.1. Consumer

- 8.1.1. General-purpose IC

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa APAC Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. General-purpose IC

- 9.1.1.1. Interface

- 9.1.1.2. Power Management

- 9.1.1.3. Signal Conversion

- 9.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 9.1.2. Application-specific IC

- 9.1.2.1. Consumer

- 9.1.2.1.1. Audio/Video

- 9.1.2.1.2. Digital Still Camera and Camcorder

- 9.1.2.1.3. Other Consumers

- 9.1.2.2. Automotive

- 9.1.2.2.1. Infotainment

- 9.1.2.2.2. Other Infotainment

- 9.1.2.3. Communication

- 9.1.2.3.1. Cell Phone

- 9.1.2.3.2. Infrastructure

- 9.1.2.3.3. Wired Communication

- 9.1.2.3.4. Short Range

- 9.1.2.3.5. Other Wireless

- 9.1.2.4. Computer

- 9.1.2.4.1. Computer System and Display

- 9.1.2.4.2. Computer Periphery

- 9.1.2.4.3. Storage

- 9.1.2.4.4. Other Computers

- 9.1.2.5. Industrial and Others

- 9.1.2.1. Consumer

- 9.1.1. General-purpose IC

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific APAC Analog IC Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. General-purpose IC

- 10.1.1.1. Interface

- 10.1.1.2. Power Management

- 10.1.1.3. Signal Conversion

- 10.1.1.4. Amplifiers/Comparators (Signal Conditioning)

- 10.1.2. Application-specific IC

- 10.1.2.1. Consumer

- 10.1.2.1.1. Audio/Video

- 10.1.2.1.2. Digital Still Camera and Camcorder

- 10.1.2.1.3. Other Consumers

- 10.1.2.2. Automotive

- 10.1.2.2.1. Infotainment

- 10.1.2.2.2. Other Infotainment

- 10.1.2.3. Communication

- 10.1.2.3.1. Cell Phone

- 10.1.2.3.2. Infrastructure

- 10.1.2.3.3. Wired Communication

- 10.1.2.3.4. Short Range

- 10.1.2.3.5. Other Wireless

- 10.1.2.4. Computer

- 10.1.2.4.1. Computer System and Display

- 10.1.2.4.2. Computer Periphery

- 10.1.2.4.3. Storage

- 10.1.2.4.4. Other Computers

- 10.1.2.5. Industrial and Others

- 10.1.2.1. Consumer

- 10.1.1. General-purpose IC

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Infineon Technologies AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Microchip Technology Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NXP Semiconductors NV

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 tek Technology Corporation (MediaTek Inc )

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Skyworks Solutions Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ON Semiconductor

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Renesas Electronics Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qorvo Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Texas Instruments Incorporated

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Analog Devices Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Stmicroelectronics NV

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global APAC Analog IC Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Analog IC Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America APAC Analog IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America APAC Analog IC Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America APAC Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America APAC Analog IC Market Revenue (Million), by Type 2025 & 2033

- Figure 7: South America APAC Analog IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 8: South America APAC Analog IC Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America APAC Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe APAC Analog IC Market Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe APAC Analog IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe APAC Analog IC Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe APAC Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa APAC Analog IC Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Middle East & Africa APAC Analog IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Middle East & Africa APAC Analog IC Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa APAC Analog IC Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC Analog IC Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific APAC Analog IC Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific APAC Analog IC Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific APAC Analog IC Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Analog IC Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global APAC Analog IC Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global APAC Analog IC Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global APAC Analog IC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global APAC Analog IC Market Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Global APAC Analog IC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global APAC Analog IC Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global APAC Analog IC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global APAC Analog IC Market Revenue Million Forecast, by Type 2020 & 2033

- Table 25: Global APAC Analog IC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Analog IC Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global APAC Analog IC Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific APAC Analog IC Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Analog IC Market?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the APAC Analog IC Market?

Key companies in the market include Infineon Technologies AG, Microchip Technology Inc, NXP Semiconductors NV, tek Technology Corporation (MediaTek Inc ), Skyworks Solutions Inc, ON Semiconductor, Renesas Electronics Corporation, Qorvo Inc, Texas Instruments Incorporated, Analog Devices Inc, Stmicroelectronics NV.

3. What are the main segments of the APAC Analog IC Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 64.39 Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Demand for Communication Devices; Growing Automtive Sector in the Region.

6. What are the notable trends driving market growth?

Surging Demand for Communication Devices Drives Market Growth.

7. Are there any restraints impacting market growth?

Increasing Design Complexity of Analog IC.

8. Can you provide examples of recent developments in the market?

June 2024: Asahi Kasei Microdevices (AKM) unveiled a cutting-edge line of integrated circuits (ICs), boasting enhanced functionalities in a smaller form factor compared to its predecessors. These ICs come equipped with an inbuilt Delta-Sigma (ΔΣ) modulator, streamlining the need for separate shunt resistors and isolated analog-to-digital converters (ADCs).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Analog IC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Analog IC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Analog IC Market?

To stay informed about further developments, trends, and reports in the APAC Analog IC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence