Key Insights

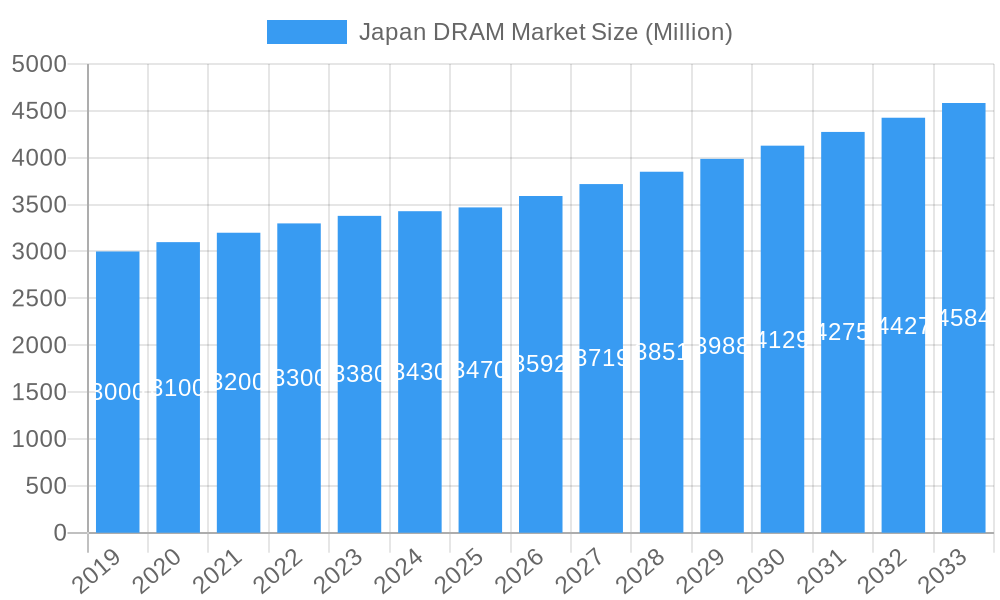

The Japan DRAM market is poised for steady growth, projected to reach approximately ¥3.47 million (assuming the unit is Yen based on the region) by 2025. Driven by a Compound Annual Growth Rate (CAGR) of 3.45%, this expansion signifies a robust and evolving landscape for Dynamic Random-Access Memory (DRAM) in the country. Key growth drivers include the burgeoning demand from the datacenter segment, fueled by increasing cloud adoption and big data analytics, and the continuous innovation in consumer electronics and personal computing, particularly with the advent of newer DDR5 architecture. Smartphones and tablets, alongside the automotive sector, also represent significant application areas contributing to this upward trajectory, as they increasingly integrate higher capacity and faster DRAM modules to support advanced functionalities and user experiences. Furthermore, the ongoing integration of AI and machine learning technologies across various industries in Japan will necessitate more powerful and efficient memory solutions, further bolstering market expansion.

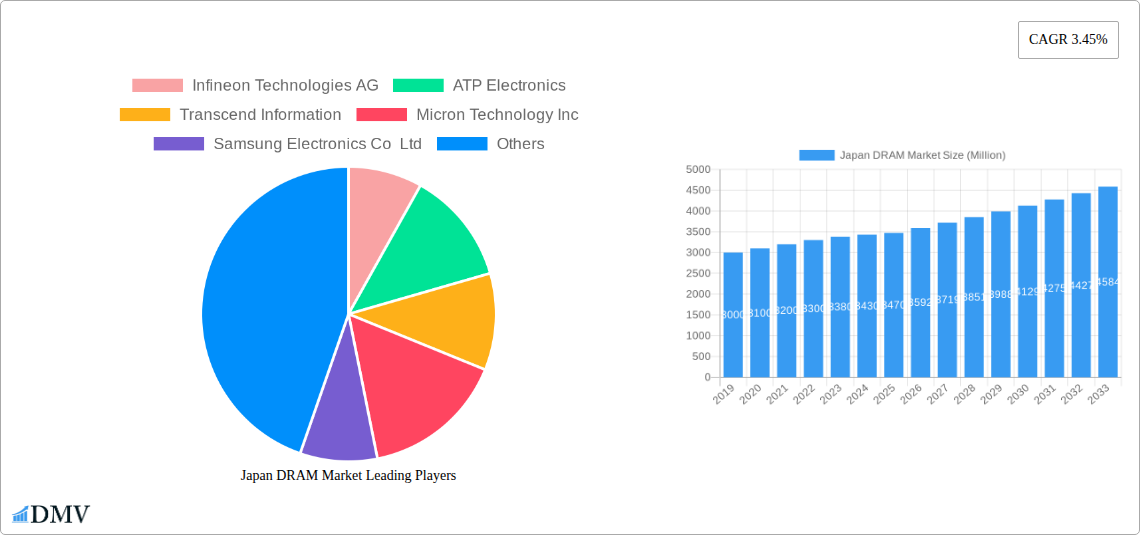

Japan DRAM Market Market Size (In Billion)

Despite the positive outlook, the Japan DRAM market faces certain restraints that could temper its growth rate. Intense price competition among major global and domestic players, including Samsung Electronics Co. Ltd., SK Hynix, and Micron Technology Inc., can impact revenue figures. Additionally, the inherent cyclical nature of the semiconductor industry, characterized by fluctuations in supply and demand, poses a potential challenge. While DDR5 adoption is a significant trend, the cost of newer technologies and the continued prevalence of DDR4 in many existing systems will create a segmented market for some time. Nevertheless, the sustained technological advancements, coupled with Japan's strong presence in high-end manufacturing and research, are expected to ensure a resilient and growing market for DRAM. The market's segmentation across various architectures like DDR3, DDR4, and DDR5, and diverse applications from consumer products to datacenters, highlights its adaptability and broad appeal.

Japan DRAM Market Company Market Share

This in-depth report provides a meticulous analysis of the Japan DRAM Market, offering a critical understanding of its present landscape and future trajectory. With a detailed historical analysis from 2019-2024 and a robust forecast extending to 2033, this report is indispensable for stakeholders seeking to navigate the evolving semiconductor industry. Our analysis leverages precise data, expert insights, and a comprehensive understanding of market dynamics, focusing on the pivotal role of DRAM in Japan's technological advancement.

Japan DRAM Market Market Composition & Trends

The Japan DRAM Market is characterized by a dynamic interplay of established players and emerging technologies. Market concentration is influenced by significant investments from global semiconductor giants, alongside the presence of domestic innovators. Key innovation catalysts include government-backed research initiatives and private sector R&D, driving advancements in memory technologies. The regulatory landscape, while supportive of semiconductor manufacturing, also presents compliance considerations for market participants. Substitute products, though present in niche applications, are largely outpaced by the performance and scalability of DRAM. End-user profiles are diverse, ranging from high-volume consumer electronics manufacturers to specialized industrial and automotive sectors. Mergers and acquisitions (M&A) activities are anticipated to shape market consolidation, with potential deal values reflecting strategic partnerships and technological acquisitions. The market share distribution is a key indicator of competitive intensity, with leading players vying for dominance through technological prowess and market penetration.

- Market Concentration: Dominated by a few key global players with significant domestic presence.

- Innovation Catalysts: Government R&D funding, university-industry collaborations, and private sector investment.

- Regulatory Landscape: Supportive policies for semiconductor manufacturing, with evolving environmental and trade regulations.

- End-User Profiles: Smartphones/Tablets, PC/Laptop, Datacenter, Graphics, Consumer Products, Automotive, Other Applications.

- M&A Activities: Expected to increase as companies seek to consolidate market position and acquire advanced technologies.

- Market Share Distribution: Highly competitive, with leading players holding substantial portions across various DRAM architectures.

Japan DRAM Market Industry Evolution

The evolution of the Japan DRAM Market is a compelling narrative of technological progression, strategic investment, and shifting global demand. Over the historical period of 2019-2024, the market has witnessed substantial growth driven by the increasing pervasiveness of digital technologies across all facets of life. The foundational architectures, such as DDR3 and DDR4, have gradually given way to the more advanced DDR5, reflecting a continuous pursuit of higher speeds, greater capacities, and improved power efficiency. This transition is not merely an upgrade in specifications; it signifies a fundamental shift in the capabilities of computing systems, enabling more sophisticated applications and richer user experiences. The market's growth trajectory has been significantly influenced by rapid advancements in Artificial Intelligence (AI), High-Performance Computing (HPC), and the Internet of Things (IoT), all of which are voracious consumers of high-density, high-speed memory solutions. These burgeoning fields necessitate continuous innovation in DRAM, pushing manufacturers to invest heavily in research and development to meet the ever-increasing performance demands.

Furthermore, the Japanese government has played a pivotal role in fostering this evolution. Recognizing the strategic importance of semiconductor manufacturing, particularly in the context of global supply chain resilience, significant financial incentives and policy support have been extended to both domestic and international players. This has spurred substantial capital expenditures on advanced manufacturing facilities and cutting-edge technologies like Extreme Ultraviolet (EUV) lithography. The adoption metrics for newer DRAM generations, such as DDR5, have seen a marked acceleration as industries pivot towards next-generation computing platforms. Consumer demand has also been a powerful force, with a relentless appetite for more powerful smartphones, faster PCs, and immersive gaming experiences directly fueling the need for advanced DRAM. The automotive sector's increasing reliance on sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and autonomous driving capabilities further diversifies the demand landscape, creating new avenues for growth and innovation within the Japan DRAM market. The industry's ability to adapt to these evolving consumer and industrial demands, coupled with ongoing technological breakthroughs, paints a picture of sustained dynamism and expansion.

Leading Regions, Countries, or Segments in Japan DRAM Market

Within the Japan DRAM Market, the dominance of specific segments is a testament to targeted investment, technological leadership, and evolving application demands. Among the architectural segments, DDR5 has emerged as a leading force, driven by its superior performance characteristics, including higher bandwidth and lower power consumption compared to its predecessors. This architectural shift is a direct response to the escalating requirements of next-generation computing, from high-performance servers to advanced consumer electronics. The widespread adoption of DDR5 is a key indicator of the market's commitment to staying at the forefront of memory technology, enabling more efficient and powerful data processing.

In terms of applications, the Datacenter segment stands out as a primary driver of demand for advanced DRAM. The exponential growth of cloud computing, big data analytics, and AI workloads necessitates vast quantities of high-speed, high-capacity memory. Data centers are continuously upgrading their infrastructure to accommodate these burgeoning demands, making them a critical consumer of the latest DRAM innovations. The increasing sophistication of AI algorithms and the need for rapid data processing in machine learning applications further solidify the datacenter's position as a leading segment.

Dominant Architecture: DDR5:

- Key Drivers: Higher bandwidth, improved power efficiency, and demand for next-generation computing performance.

- Impact: Facilitates faster data processing in high-performance applications, enabling advancements in AI, HPC, and gaming.

- Adoption Trends: Rapid uptake across servers, high-end PCs, and advanced consumer devices.

Dominant Application: Datacenter:

- Key Drivers: Proliferation of cloud computing, big data analytics, AI/ML workloads, and the need for scalable, high-density memory solutions.

- Investment Trends: Significant capital expenditure by cloud providers and enterprises on memory upgrades.

- Regulatory Support: Government initiatives aimed at bolstering domestic data infrastructure and AI capabilities indirectly support DRAM demand.

The synergy between the demand for DDR5 architecture and the needs of the datacenter segment creates a powerful feedback loop, driving innovation and market expansion. As datacenters continue to evolve and embrace more computationally intensive tasks, the demand for cutting-edge DRAM solutions like DDR5 will only intensify. This makes the datacenter application and the DDR5 architecture the twin pillars supporting the current and future growth of the Japan DRAM Market.

Japan DRAM Market Product Innovations

Product innovations in the Japan DRAM Market are centered on enhancing performance, reducing power consumption, and enabling new functionalities. The latest advancements in DDR5 technology are bringing about significant improvements in data transfer speeds and overall efficiency, crucial for next-generation computing. Innovations in 3D stacking techniques are enabling higher memory densities, allowing for more data to be stored in smaller footprints, a critical requirement for mobile devices and compact servers. Furthermore, the development of specialized DRAM for AI accelerators and graphics processing units (GPUs) is leading to tailored solutions that offer optimized performance for these demanding applications. The integration of error correction codes and improved thermal management solutions are also key areas of focus, ensuring reliability and longevity in high-performance environments. These advancements collectively push the boundaries of what is possible in memory technology.

Propelling Factors for Japan DRAM Market Growth

The Japan DRAM Market is propelled by several key growth factors that underscore its strategic importance. The escalating demand for advanced computing power across industries, including AI, IoT, and 5G, necessitates higher performance and capacity DRAM. Government initiatives supporting the semiconductor industry, such as subsidies and R&D funding, are instrumental in driving innovation and manufacturing capabilities. Technological advancements, particularly the transition to DDR5 and the exploration of next-generation memory technologies, are creating new market opportunities. Economic recovery and increasing consumer spending on electronics also contribute to sustained demand. Moreover, the global push for supply chain resilience, with an emphasis on diversifying semiconductor production, positions Japan favorably for increased DRAM manufacturing and export.

Obstacles in the Japan DRAM Market Market

Despite its growth potential, the Japan DRAM Market faces several significant obstacles. Intense global competition from established players in South Korea and Taiwan creates pricing pressures and challenges for market share expansion. High capital expenditure required for setting up and maintaining state-of-the-art DRAM fabrication plants represents a substantial barrier to entry for new companies. Supply chain disruptions, exacerbated by geopolitical factors and raw material availability, can impact production timelines and costs. Evolving technological standards and the rapid obsolescence of older DRAM architectures require continuous investment in R&D and manufacturing upgrades, posing a significant financial burden. Furthermore, the stringent quality control and reliability standards, especially for applications like automotive and industrial, add complexity and cost to the manufacturing process.

Future Opportunities in Japan DRAM Market

The Japan DRAM Market is poised to capitalize on several emerging opportunities. The burgeoning demand for specialized DRAM in areas like AI accelerators and advanced graphics processing units presents a significant growth avenue. The increasing adoption of DDR5 technology across consumer and enterprise segments will continue to drive market expansion. Japan's strategic focus on domestic semiconductor production and its growing ecosystem of semiconductor partners create fertile ground for collaborations and technological advancements. The automotive sector's increasing reliance on advanced in-car computing and autonomous driving technologies will also unlock new markets for high-performance DRAM. Furthermore, the development of novel memory technologies beyond traditional DRAM, such as next-generation non-volatile memory solutions, offers long-term growth potential.

Major Players in the Japan DRAM Market Ecosystem

- Infineon Technologies AG

- ATP Electronics

- Transcend Information

- Micron Technology Inc

- Samsung Electronics Co Ltd

- SK Hynix

- Kingston Technology

- Nanya Technology Corporation

- Elpida Memory Inc

- Winbond Electronics Corporation

Key Developments in Japan DRAM Market Industry

- May 2023: Taiwan Semiconductor Manufacturing Co. (TSMC) announced plans to further expand its investments in Japan and strengthen its collaboration with semiconductor partners in the country. Currently, TSMC is in the process of building its inaugural foundry in Kumamoto Prefecture, located in Southern Japan, in partnership with Sony Group Corp. This ambitious venture, expected to require an investment of USD 8.6 billion, is on track to commence chip production next year. TSMC will leverage advanced technologies, including 12nm, 16nm, and 22nm processes, as well as the specialized 28nm technology.

- March 2023: Micron Technology Inc. unveiled its intention to make a substantial investment of up to JPY 500 billion (equivalent to USD 3.70 billion) in DRAM chips and extreme ultraviolet (EUV) technology, with support from the Japanese government in the coming years. This significant investment will facilitate the adoption of cutting-edge extreme ultraviolet lithography (EUV) chipmaking machines. These machines will be instrumental in manufacturing 1-gamma chips, which play a pivotal role in the efficient production of materials required for intricate applications like image processing networks.

Strategic Japan DRAM Market Market Forecast

The strategic forecast for the Japan DRAM Market indicates robust growth driven by critical factors such as the accelerating demand for advanced computing solutions, particularly in AI and cloud infrastructure. Government support for the semiconductor industry, coupled with significant foreign direct investment, is expected to bolster domestic manufacturing capabilities and technological innovation. The ongoing transition to DDR5 architecture across various applications will fuel market expansion, while the development of specialized DRAM for emerging technologies presents lucrative opportunities. Despite challenges like global competition and capital intensity, the strategic initiatives in place, including advanced technology adoption and supply chain diversification, position the Japan DRAM Market for sustained growth and a significant role in the global semiconductor landscape through 2033.

Japan DRAM Market Segmentation

-

1. Architecture

- 1.1. DDR3

- 1.2. DDR4

- 1.3. DDR5

- 1.4. DDR2/Other Architecture

-

2. Application

- 2.1. Smartphones/Tablets

- 2.2. PC/Laptop

- 2.3. Datacenter

- 2.4. Graphics

- 2.5. Consumer Products

- 2.6. Automotive

- 2.7. Other Applications

Japan DRAM Market Segmentation By Geography

- 1. Japan

Japan DRAM Market Regional Market Share

Geographic Coverage of Japan DRAM Market

Japan DRAM Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of High-End Smartphones and Consumer Electronics

- 3.3. Market Restrains

- 3.3.1. Design and Complexity Challenges for the Development of High-Efficiency Microphones

- 3.4. Market Trends

- 3.4.1. Automotive Sector Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan DRAM Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 5.1.1. DDR3

- 5.1.2. DDR4

- 5.1.3. DDR5

- 5.1.4. DDR2/Other Architecture

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smartphones/Tablets

- 5.2.2. PC/Laptop

- 5.2.3. Datacenter

- 5.2.4. Graphics

- 5.2.5. Consumer Products

- 5.2.6. Automotive

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Architecture

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Infineon Technologies AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ATP Electronics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Transcend Information

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Micron Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung Electronics Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SK Hynix

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kingston Technology

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nanya Technology Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Elpida Memory Inc *List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Winbond Electronics Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Japan DRAM Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan DRAM Market Share (%) by Company 2025

List of Tables

- Table 1: Japan DRAM Market Revenue Million Forecast, by Architecture 2020 & 2033

- Table 2: Japan DRAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Japan DRAM Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan DRAM Market Revenue Million Forecast, by Architecture 2020 & 2033

- Table 5: Japan DRAM Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Japan DRAM Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan DRAM Market?

The projected CAGR is approximately 3.45%.

2. Which companies are prominent players in the Japan DRAM Market?

Key companies in the market include Infineon Technologies AG, ATP Electronics, Transcend Information, Micron Technology Inc, Samsung Electronics Co Ltd, SK Hynix, Kingston Technology, Nanya Technology Corporation, Elpida Memory Inc *List Not Exhaustive, Winbond Electronics Corporation.

3. What are the main segments of the Japan DRAM Market?

The market segments include Architecture, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of High-End Smartphones and Consumer Electronics.

6. What are the notable trends driving market growth?

Automotive Sector Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Design and Complexity Challenges for the Development of High-Efficiency Microphones.

8. Can you provide examples of recent developments in the market?

May 2023: Taiwan Semiconductor Manufacturing Co. (TSMC) announced plans to further expand its investments in Japan and strengthen its collaboration with semiconductor partners in the country. Currently, TSMC is in the process of building its inaugural foundry in Kumamoto Prefecture, located in Southern Japan, in partnership with Sony Group Corp. This ambitious venture, expected to require an investment of USD 8.6 billion, is on track to commence chip production next year. TSMC will leverage advanced technologies, including 12nm, 16nm, and 22nm processes, as well as the specialized 28nm technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan DRAM Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan DRAM Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan DRAM Market?

To stay informed about further developments, trends, and reports in the Japan DRAM Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence