Key Insights

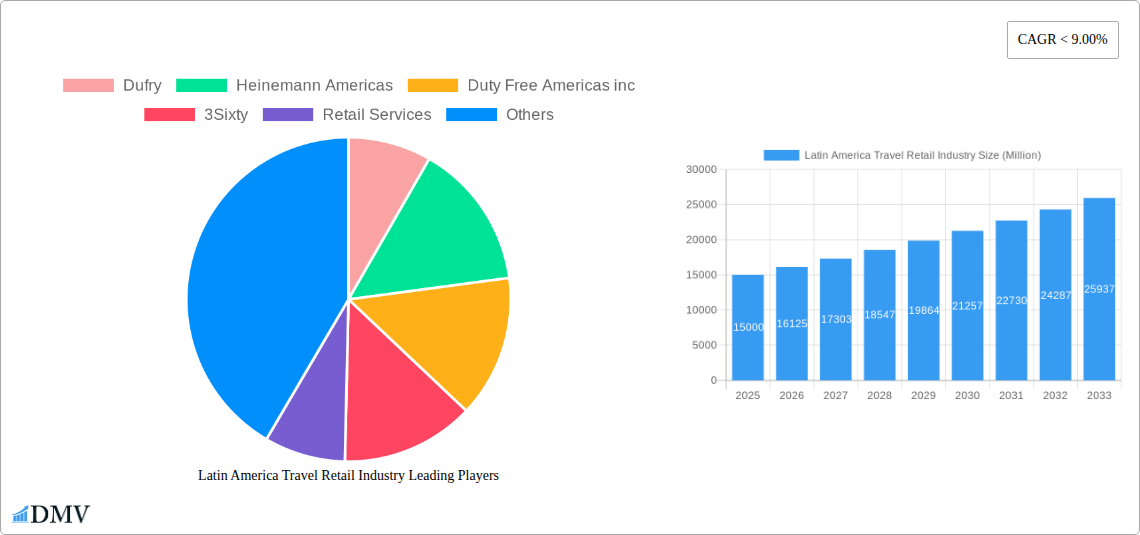

The Latin America Travel Retail market is projected to reach $72.57 billion by 2025, with an estimated CAGR of 5.4% from 2025-2033. This expansion is fueled by rising disposable incomes, a growing middle class with increased international travel aspirations, and significant investments in enhancing passenger experiences across airports and travel hubs. Despite recent global disruptions, historical data from 2019-2024 indicates market resilience and recovery. Key growth drivers include expanding air connectivity, a return to pre-pandemic travel volumes, and a rising demand for premium and unique retail offerings. Leading segments anticipated to drive this growth include beauty and personal care, confectionery, and luxury goods.

Latin America Travel Retail Industry Market Size (In Billion)

Travel retail plays a vital role in stimulating Latin American economies and providing regional brands with international visibility. Governments and airport authorities are actively supporting this sector through infrastructure development and favorable retail policies. The market's robust rebound post-2024 positions it for substantial growth, with the projected 2025 market size expected to be exceeded. The forecast period (2025-2033) indicates sustained expansion, driven by digitalization, e-commerce integration, and personalized shopping experiences to meet evolving traveler preferences.

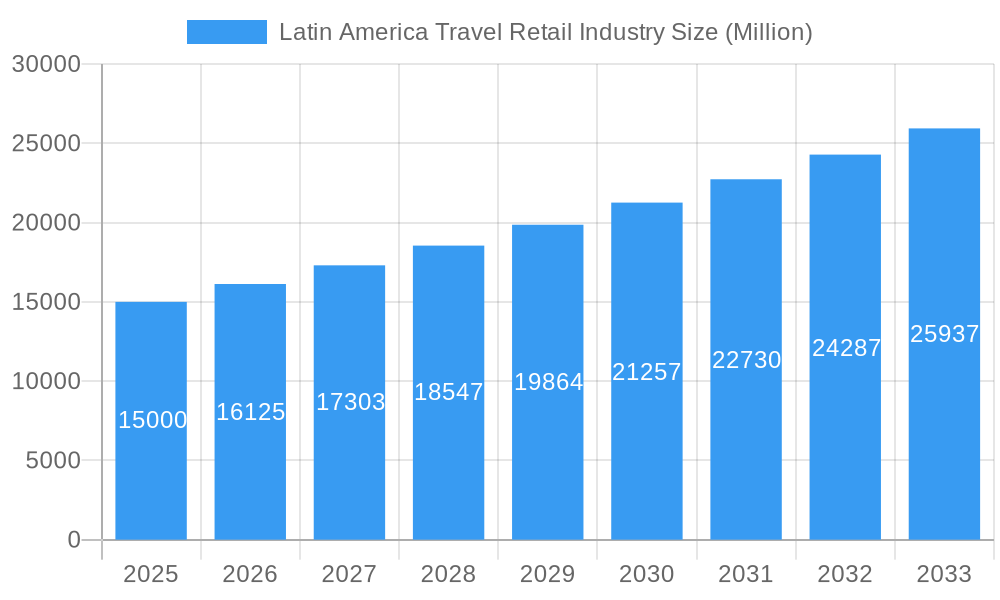

Latin America Travel Retail Industry Company Market Share

This report offers a comprehensive analysis of the Latin America Travel Retail Industry, examining market size, growth forecasts from 2019 to 2033, and key trends. It details market segmentation, identifies influential industry players, and provides insights into the Latin American duty-free market, airport retail trends, and opportunities within fashion and accessories, wine and spirits, and cosmetics and fragrances.

Latin America Travel Retail Industry Market Composition & Trends

The Latin America Travel Retail Industry is characterized by a moderate market concentration, with key players like Dufry and Heinemann Americas holding significant market share. Innovation is primarily driven by digital integration and personalized customer experiences. Regulatory landscapes vary across countries, influencing import duties and operational frameworks. Substitute products, while present in domestic markets, often struggle to replicate the unique proposition of travel retail offerings. End-user profiles are diverse, encompassing leisure travelers, business professionals, and a growing segment of millennial and Gen Z consumers seeking value and novelty. Mergers and Acquisitions (M&A) activities are anticipated to continue, consolidating market presence and expanding geographic reach, with an estimated M&A deal value of $150 Million in the historical period. Market share distribution sees Airports dominating the distribution channels, accounting for approximately 75% of the market.

Latin America Travel Retail Industry Industry Evolution

The Latin America Travel Retail Industry has witnessed a remarkable evolution, consistently outpacing global travel retail growth rates. From 2019 to 2024, the industry experienced an average annual growth rate of 8.5%, a testament to the region's increasing appeal as a tourist destination and the expanding middle class with higher disposable incomes. Technological advancements have been instrumental in this transformation. The adoption of e-commerce platforms and digital marketing strategies by distributors such as Monarq Group has revolutionized brand engagement. Dufry's strategic partnerships, exemplified by the Lancôme flagship store in South America, demonstrate a commitment to creating immersive and personalized retail experiences, driving footfall and increasing average transaction values. This shift towards omnichannel retail is crucial for meeting the demands of a digitally savvy consumer base. Shifting consumer demands are also playing a pivotal role. Travelers are increasingly seeking unique, localized products alongside premium international brands. This has led to a greater emphasis on curated selections within fashion and accessories, food and confectionery, and wine and spirits categories. The increasing per capita spending on travel retail, projected to grow by 7% annually during the forecast period, signifies a sustained interest in experiential shopping. Furthermore, the expansion of air travel infrastructure and the rise of new aviation hubs within Latin America are creating new avenues for growth and accessibility for travel retail operators.

Leading Regions, Countries, or Segments in Latin America Travel Retail Industry

The Latin America Travel Retail Industry is a multifaceted landscape with distinct leaders across various dimensions. Geographically, Brazil stands out as the dominant market, driven by its large population, significant international tourist arrivals, and a well-developed airport infrastructure. Its market share is estimated at 30% of the total Latin American travel retail market. The Airports distribution channel consistently reigns supreme, capturing an estimated 75% of all travel retail sales in the region due to high passenger traffic and captive consumer bases. Among the Retail Activity Types, Fragnances and Cosmetics and Wine & Spirits are consistently leading segments, collectively accounting for approximately 45% of the market value.

- Dominant Geography: Brazil

- Key Drivers: High volume of international and domestic tourist arrivals, significant economic activity, and investments in airport modernization.

- In-depth Analysis: Brazil's extensive network of international airports, including São Paulo-Guarulhos and Rio de Janeiro-Galeão, acts as critical gateways, facilitating substantial travel retail sales. Government initiatives promoting tourism and infrastructure development further bolster its leadership position.

- Dominant Distribution Channel: Airports

- Key Drivers: Unparalleled passenger footfall, captive audience, and the presence of global retail giants.

- In-depth Analysis: Airports offer a concentrated consumer base with a high propensity to spend. The increasing focus on enhancing the airport experience, including retail offerings, further solidifies their dominance. Retail Services and Duty Free Americas Inc. have a strong presence here.

- Leading Retail Activity Types: Fragnances and Cosmetics & Wine & Spirits

- Key Drivers: High perceived value, gifting potential, and strong brand presence of international and premium labels.

- In-depth Analysis: These segments benefit from aspirational purchasing, with travelers often indulging in luxury beauty products and premium alcoholic beverages. Brands like Lancôme, through partnerships with Dufry, are actively enhancing consumer engagement in these categories. The Rest of Latin America also shows a growing interest in these premium categories.

Latin America Travel Retail Industry Product Innovations

Product innovation in the Latin America Travel Retail Industry focuses on delivering unique, localized, and digitally integrated experiences. This includes the introduction of exclusive travel-sized beauty kits, artisanal food products reflecting regional flavors, and limited-edition spirits. Technological advancements are enabling personalized recommendations via AI-powered apps and in-store digital displays. Performance metrics highlight increased basket sizes and higher customer engagement rates for brands that successfully integrate these innovations. The emphasis is on creating memorable purchase journeys that go beyond mere transaction.

Propelling Factors for Latin America Travel Retail Industry Growth

The Latin America Travel Retail Industry is propelled by several key factors. Firstly, economic growth and a rising middle class in countries like Colombia and Argentina are increasing disposable incomes and travel frequency. Secondly, expanding air travel infrastructure and the development of new routes are making destinations more accessible. Thirdly, growing tourism, particularly inbound and outbound leisure travel, creates a larger pool of potential customers. Fourthly, strategic partnerships between brands and retailers, such as the collaboration between Lancôme and Dufry, enhance product offerings and customer experiences. Finally, increasing digitalization and e-commerce adoption by players like Monarq Group are expanding reach and improving customer engagement.

Obstacles in the Latin America Travel Retail Industry Market

Despite robust growth, the Latin America Travel Retail Industry faces several obstacles. Regulatory complexities and varying import duties across different countries can hinder seamless cross-border operations and inventory management. Supply chain disruptions, exacerbated by geopolitical factors and logistical challenges, can impact product availability and increase costs, estimated to cause a 5% loss in potential revenue. Intense competition from both established global players and emerging local brands necessitates continuous innovation and investment. Furthermore, currency volatility in several Latin American economies can affect consumer purchasing power and retailer margins.

Future Opportunities in Latin America Travel Retail Industry

Emerging opportunities within the Latin America Travel Retail Industry are significant. The expansion of travel retail into secondary airports and new distribution channels like railway stations and border crossings offers untapped potential. The growing demand for sustainable and ethically sourced products presents a niche for brands focusing on these values. The increasing influence of digital channels and data analytics allows for hyper-personalized marketing and product offerings, appealing to a younger demographic. Exploring the "Rest of Latin America" beyond the major markets will unlock new consumer bases. The integration of technology for seamless pre-ordering and click-and-collect services is also a burgeoning area.

Major Players in the Latin America Travel Retail Industry Ecosystem

- Dufry

- Heinemann Americas

- Duty Free Americas inc

- 3Sixty

- Retail Services

- LURYX

- Provimex

- Sineriz

- Monarq Group

- BERNABEL TRADING S A

Key Developments in Latin America Travel Retail Industry Industry

- April 2021: MONARQ Group shifted its focus to digital marketing, social media, and e-commerce. To promote its brands on social media, the independent premium wine and spirits distributor launched MONARQ's Social Club early on during the pandemic with overwhelmingly positive feedback from participants, driving a projected 10% increase in online engagement.

- February 2021: Lancôme Travel Retail Americas and Dufry partnered to open Lancôme's biggest flagship in South America. Lancôme's new flagship features numerous eye-catching screens and embraces the values of the brand - joy, happiness, and generosity - while offering shoppers a personalized, unique, and immersive retail experience, contributing to a notable uplift in sales for the brand in that location.

Strategic Latin America Travel Retail Industry Market Forecast

The strategic Latin America Travel Retail Industry market forecast indicates sustained and robust growth, fueled by a confluence of factors. The continued expansion of air travel and increasing disposable incomes will drive higher consumer spending. Innovations in digital integration, from e-commerce to personalized in-store experiences, will enhance customer engagement and loyalty. The growing appeal of the region as a tourist destination, coupled with strategic investments by major players like Dufry and Heinemann Americas, will solidify market positions. The focus on premiumization and curated product offerings across segments like Wine & Spirits and Fragnances and Cosmetics will be a key growth catalyst. The estimated market growth rate for the forecast period is 9.2% annually, reaching a projected market value of $8.5 Million.

Latin America Travel Retail Industry Segmentation

-

1. Retail Activity Type

- 1.1. Fashion and Accessories

- 1.2. Jewellery and Watches

- 1.3. Wine & Spirits

- 1.4. Food & Confectionary

- 1.5. Fragnances and Cosmetics

- 1.6. Tobacco

- 1.7. Others (Stationery, Electronics, etc.)

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other(Railway Stations, Border, Downtown)

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Colombia

- 3.4. Rest of Latin America

Latin America Travel Retail Industry Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of Latin America

Latin America Travel Retail Industry Regional Market Share

Geographic Coverage of Latin America Travel Retail Industry

Latin America Travel Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Fragrance & Cosmetics Segment Share is Dominating the Travel Retail Market in North America.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Jewellery and Watches

- 5.1.3. Wine & Spirits

- 5.1.4. Food & Confectionary

- 5.1.5. Fragnances and Cosmetics

- 5.1.6. Tobacco

- 5.1.7. Others (Stationery, Electronics, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other(Railway Stations, Border, Downtown)

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Colombia

- 5.4.4. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 6. Brazil Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 6.1.1. Fashion and Accessories

- 6.1.2. Jewellery and Watches

- 6.1.3. Wine & Spirits

- 6.1.4. Food & Confectionary

- 6.1.5. Fragnances and Cosmetics

- 6.1.6. Tobacco

- 6.1.7. Others (Stationery, Electronics, etc.)

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Airports

- 6.2.2. Airlines

- 6.2.3. Ferries

- 6.2.4. Other(Railway Stations, Border, Downtown)

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Colombia

- 6.3.4. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 7. Argentina Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 7.1.1. Fashion and Accessories

- 7.1.2. Jewellery and Watches

- 7.1.3. Wine & Spirits

- 7.1.4. Food & Confectionary

- 7.1.5. Fragnances and Cosmetics

- 7.1.6. Tobacco

- 7.1.7. Others (Stationery, Electronics, etc.)

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Airports

- 7.2.2. Airlines

- 7.2.3. Ferries

- 7.2.4. Other(Railway Stations, Border, Downtown)

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Colombia

- 7.3.4. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 8. Colombia Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 8.1.1. Fashion and Accessories

- 8.1.2. Jewellery and Watches

- 8.1.3. Wine & Spirits

- 8.1.4. Food & Confectionary

- 8.1.5. Fragnances and Cosmetics

- 8.1.6. Tobacco

- 8.1.7. Others (Stationery, Electronics, etc.)

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Airports

- 8.2.2. Airlines

- 8.2.3. Ferries

- 8.2.4. Other(Railway Stations, Border, Downtown)

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Colombia

- 8.3.4. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 9. Rest of Latin America Latin America Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 9.1.1. Fashion and Accessories

- 9.1.2. Jewellery and Watches

- 9.1.3. Wine & Spirits

- 9.1.4. Food & Confectionary

- 9.1.5. Fragnances and Cosmetics

- 9.1.6. Tobacco

- 9.1.7. Others (Stationery, Electronics, etc.)

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Airports

- 9.2.2. Airlines

- 9.2.3. Ferries

- 9.2.4. Other(Railway Stations, Border, Downtown)

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Brazil

- 9.3.2. Argentina

- 9.3.3. Colombia

- 9.3.4. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Retail Activity Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Dufry

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Heinemann Americas

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Duty Free Americas inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 3Sixty

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Retail Services

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 LURYX

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Provimex

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Sineriz

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Monarq Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 BERNABEL TRADING S A*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Dufry

List of Figures

- Figure 1: Global Latin America Travel Retail Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Brazil Latin America Travel Retail Industry Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 3: Brazil Latin America Travel Retail Industry Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 4: Brazil Latin America Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: Brazil Latin America Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: Brazil Latin America Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: Brazil Latin America Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Brazil Latin America Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Brazil Latin America Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Argentina Latin America Travel Retail Industry Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 11: Argentina Latin America Travel Retail Industry Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 12: Argentina Latin America Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Argentina Latin America Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Argentina Latin America Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Argentina Latin America Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Argentina Latin America Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Argentina Latin America Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Colombia Latin America Travel Retail Industry Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 19: Colombia Latin America Travel Retail Industry Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 20: Colombia Latin America Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Colombia Latin America Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Colombia Latin America Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Colombia Latin America Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Colombia Latin America Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Colombia Latin America Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Latin America Latin America Travel Retail Industry Revenue (billion), by Retail Activity Type 2025 & 2033

- Figure 27: Rest of Latin America Latin America Travel Retail Industry Revenue Share (%), by Retail Activity Type 2025 & 2033

- Figure 28: Rest of Latin America Latin America Travel Retail Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Rest of Latin America Latin America Travel Retail Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of Latin America Latin America Travel Retail Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of Latin America Latin America Travel Retail Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Latin America Latin America Travel Retail Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of Latin America Latin America Travel Retail Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 2: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Latin America Travel Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 6: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Latin America Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 10: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Latin America Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 14: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Latin America Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Latin America Travel Retail Industry Revenue billion Forecast, by Retail Activity Type 2020 & 2033

- Table 18: Global Latin America Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global Latin America Travel Retail Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Latin America Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Travel Retail Industry?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Latin America Travel Retail Industry?

Key companies in the market include Dufry, Heinemann Americas, Duty Free Americas inc, 3Sixty, Retail Services, LURYX, Provimex, Sineriz, Monarq Group, BERNABEL TRADING S A*List Not Exhaustive.

3. What are the main segments of the Latin America Travel Retail Industry?

The market segments include Retail Activity Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.57 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Fragrance & Cosmetics Segment Share is Dominating the Travel Retail Market in North America..

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2021- MONARQ Group shifted its focus to digital marketing, social media and e-commerce. To promote its brands on social media, the independent premium wine and spirits distributor launched MONARQ's Social Club early on during the pandemic with overwhelmingly positive feedback from participants.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Travel Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Travel Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Travel Retail Industry?

To stay informed about further developments, trends, and reports in the Latin America Travel Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence