Key Insights

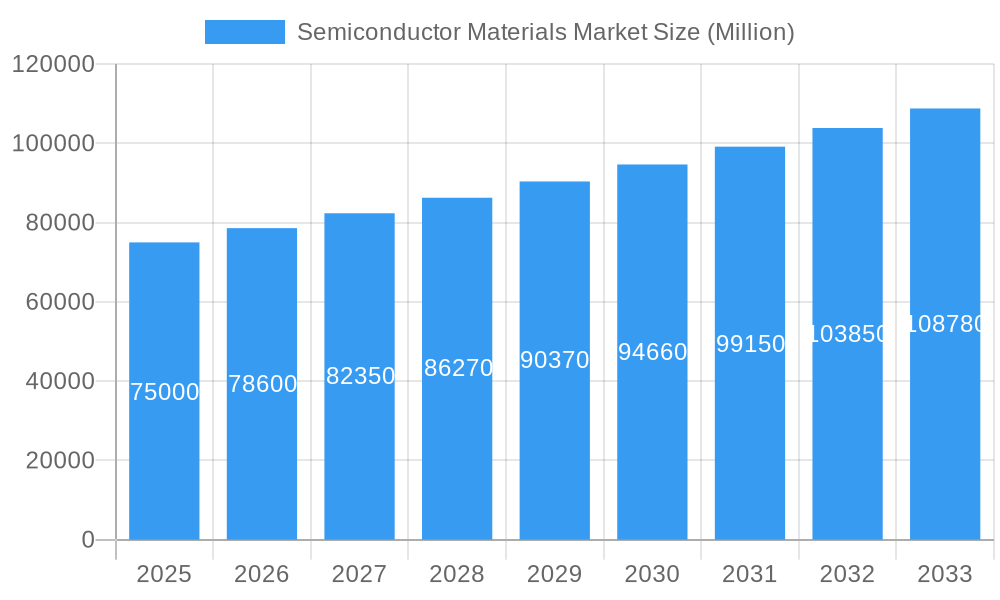

The global semiconductor materials market is projected to reach USD 69.79 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.6% through 2033. This robust growth is driven by increasing demand for advanced fabrication and packaging solutions across diverse end-user industries. The relentless pursuit of faster, smaller, and more efficient electronic devices in consumer electronics and telecommunications significantly fuels market expansion. Furthermore, the growing adoption of sophisticated technologies in the automotive sector, particularly for electric and autonomous vehicles, alongside continuous innovation in energy and utilities, further propels market growth. Key industry leaders, including Nichia Corporation, Sumitomo Chemical Co Ltd, and Indium Corporation, are investing heavily in research and development to introduce novel materials and advanced manufacturing processes, addressing critical challenges in miniaturization, power efficiency, and enhanced performance for next-generation semiconductor technologies.

Semiconductor Materials Market Market Size (In Billion)

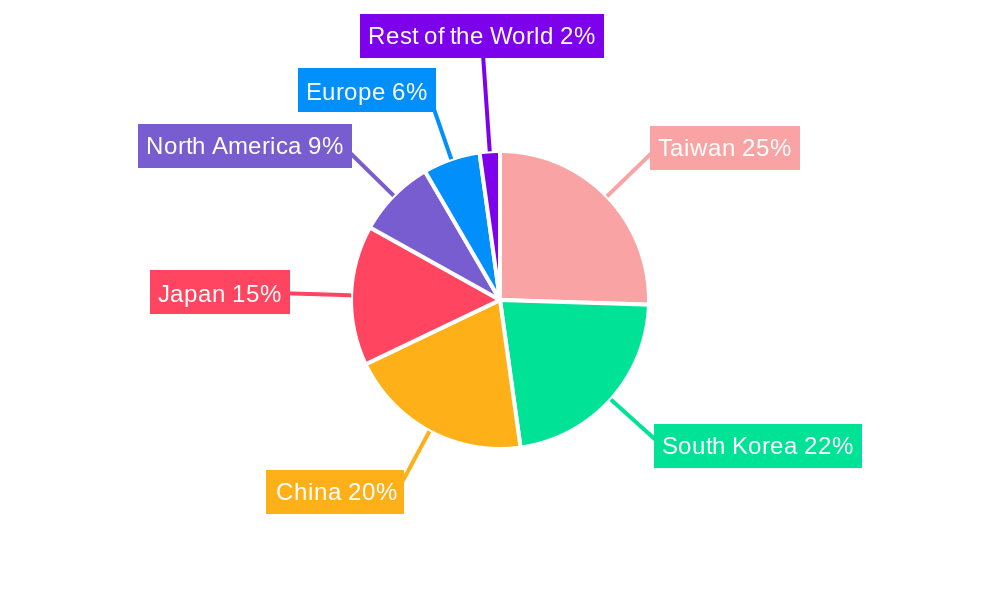

Evolving trends, such as the rise of specialized materials for advanced packaging techniques like 3D stacking and wafer-level packaging, are shaping the market's trajectory by enabling greater functionality and integration. A growing emphasis on sustainable manufacturing practices is also influencing material selection, prioritizing eco-friendly and recyclable options. However, the market faces challenges including high capital expenditure for advanced material research and production, and complex supply chain dynamics that can lead to volatility. Geographically, the Asia Pacific region, particularly China, South Korea, Taiwan, and Japan, is expected to lead the market due to its established semiconductor manufacturing infrastructure and substantial R&D investments. North America and Europe also represent significant markets, driven by strong innovation ecosystems and increasing demand for high-performance computing and artificial intelligence applications.

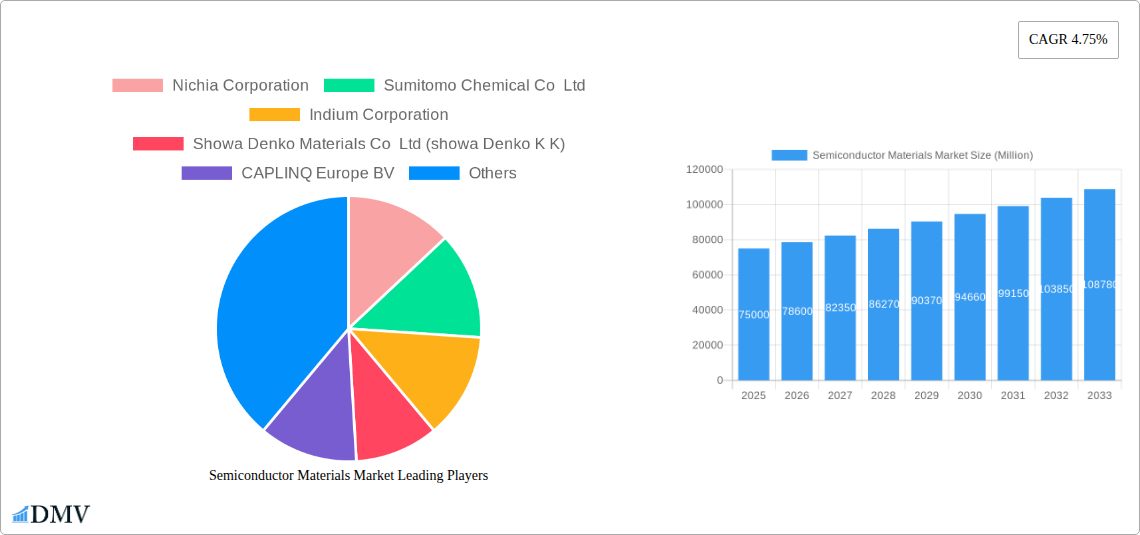

Semiconductor Materials Market Company Market Share

This comprehensive semiconductor materials market report offers in-depth analysis of global market evolution, key trends, and future trajectory. It delves into critical aspects such as semiconductor fabrication materials, packaging materials, and advanced semiconductor substrates, serving as an essential resource for stakeholders seeking to understand the dynamics of this rapidly growing industry. With a detailed study period from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report provides unparalleled insights into market growth, technological innovations, and strategic opportunities within the semiconductor industry.

Semiconductor Materials Market Market Composition & Trends

The semiconductor materials market exhibits a moderate to high concentration, driven by a few dominant players and a growing ecosystem of specialized suppliers. Innovation catalysts are primarily fueled by the relentless demand for smaller, faster, and more power-efficient electronic devices, pushing the boundaries of material science. Regulatory landscapes, while generally supportive of technological advancement, can introduce complexities related to environmental standards and trade policies. Substitute products are constantly emerging, forcing incumbents to innovate aggressively. End-user profiles are increasingly diverse, ranging from the insatiable demands of consumer electronics and telecommunication sectors to the evolving needs of automotive, manufacturing, and energy and utility industries. Mergers and acquisitions (M&A) activities are significant, with recent consolidation trends indicating a drive for scale and synergistic capabilities. For instance, the merger of Showa Denko K.K. and Showa Denko Materials Co., Ltd. to form "Resonac" in January 2023 signifies a strategic move to create a formidable chemical entity. The market share distribution is dynamic, with key players constantly vying for dominance in specific material categories. M&A deal values are substantial, reflecting the strategic importance and high growth potential of companies operating within this sector. Key trends include the increasing adoption of next-generation materials like advanced silicon carbide (SiC) and gallium nitride (GaN) for power electronics, and the rise of specialized materials for advanced packaging solutions.

Semiconductor Materials Market Industry Evolution

The semiconductor materials market has undergone a remarkable evolution, driven by a confluence of technological breakthroughs, shifting global economic landscapes, and escalating consumer demands. From the foundational silicon wafers to the sophisticated compounds powering advanced integrated circuits, the industry's growth trajectory has been nothing short of exponential. Throughout the historical period of 2019-2024, we witnessed a consistent upward trend in the demand for high-purity chemicals, specialized gases, and advanced packaging materials, essential for the fabrication of increasingly complex semiconductor chips. The estimated market size for 2025 is projected to reach significant figures, underscoring the sustained momentum. Technological advancements have been the primary engine of this evolution. The miniaturization of transistors, a phenomenon driven by Moore's Law, necessitates the development of novel materials with superior electrical, thermal, and mechanical properties. This has led to breakthroughs in areas such as extreme ultraviolet (EUV) lithography, which relies on specialized photoresists and reflective coatings, and advanced interconnect materials to reduce signal delay. Furthermore, the burgeoning demand for artificial intelligence (AI), 5G technology, and the Internet of Things (IoT) has created a paradigm shift, spurring innovation in materials for high-performance computing, advanced memory solutions, and power-efficient devices. Consumer demand, particularly in the consumer electronics and telecommunication sectors, has been a powerful force, pushing for devices that are not only more powerful but also more compact, durable, and energy-efficient. This relentless pursuit of enhanced performance and functionality directly translates into a sustained demand for cutting-edge semiconductor materials. The growth rate of the market has been consistently robust, often outpacing broader economic growth, highlighting its strategic importance in the global technology ecosystem. Adoption metrics for new materials are closely monitored, with early adopters often gaining significant competitive advantages. The industry's ability to adapt to these evolving demands, while simultaneously overcoming supply chain challenges and geopolitical uncertainties, demonstrates its inherent resilience and forward-looking nature. The forecast period of 2025–2033 is anticipated to see continued expansion, driven by emerging applications in areas such as autonomous vehicles, quantum computing, and advanced healthcare technologies, all of which rely heavily on the innovation and supply of specialized semiconductor materials.

Leading Regions, Countries, or Segments in Semiconductor Materials Market

The semiconductor materials market is experiencing a pronounced dominance within the Application: Fabrication segment, driven by its foundational role in the entire semiconductor value chain. This segment is intrinsically linked to the production of intricate microchips, demanding a vast array of specialized chemicals, gases, photoresists, CMP slurries, and wafer materials. The unparalleled demand from the End-user Industry: Consumer Electronics and Telecommunication sectors acts as the primary catalyst for this dominance. Billions of smartphones, laptops, servers, and networking equipment are manufactured annually, each requiring sophisticated fabrication processes. Key drivers for the leadership of the Application: Fabrication segment include:

- Massive Investment Trends: Significant global investments are channeled into expanding wafer fabrication capacity, particularly in Asia. Governments are actively promoting domestic semiconductor manufacturing through substantial subsidies and tax incentives, fueling the demand for fabrication-related materials.

- Technological Advancements in Lithography: The continuous evolution of lithography techniques, from DUV to EUV, necessitates the development and widespread adoption of novel photoresists, masks, and cleaning solutions, directly impacting the fabrication segment.

- Demand for Advanced Nodes: The pursuit of smaller and more powerful semiconductor nodes (e.g., 5nm, 3nm, and beyond) requires ultra-pure materials and advanced process chemistries, further solidifying the importance of fabrication materials.

- Supply Chain Integration: The intricate and highly specialized nature of semiconductor manufacturing necessitates a robust and reliable supply of fabrication materials, making this segment a critical bottleneck and a focal point for market activity.

Beyond fabrication, the End-user Industry: Consumer Electronics stands out as a major consumer of semiconductor materials. The insatiable global appetite for smartphones, tablets, wearables, and home entertainment systems drives a colossal demand for memory chips, processors, and other integrated circuits. This, in turn, fuels the demand for all categories of semiconductor materials.

The Telecommunication sector, particularly with the rollout of 5G infrastructure and the increasing complexity of network equipment, is another significant growth driver. The need for high-frequency components and advanced signal processing capabilities in base stations, routers, and end-user devices necessitates the use of specialized semiconductor materials.

The Automotive industry is rapidly emerging as a crucial market. The electrification of vehicles, the proliferation of advanced driver-assistance systems (ADAS), and the development of autonomous driving technology are all heavily reliant on advanced semiconductors, thereby increasing the demand for high-performance and reliable semiconductor materials.

The Manufacturing sector, encompassing industrial automation, robotics, and smart factories, also contributes to market growth. The increasing adoption of Industry 4.0 principles requires a robust supply of semiconductors for control systems, sensors, and communication modules.

The Energy and Utility sector, driven by smart grids, renewable energy integration, and energy storage solutions, is another growing consumer of semiconductors. Power management ICs and specialized sensors are critical components in these applications.

Overall, while all segments are important, the Application: Fabrication segment, heavily influenced by the Consumer Electronics and Telecommunication end-user industries, currently represents the most significant portion of the semiconductor materials market. However, the rapid growth in the Automotive sector signals a significant shift in future market dynamics.

Semiconductor Materials Market Product Innovations

Product innovations in the semiconductor materials market are crucial for enabling the next generation of electronic devices. Key advancements include the development of ultra-high purity precursor materials for atomic layer deposition (ALD) and chemical vapor deposition (CVD) processes, enabling finer feature sizes and improved device performance. For instance, Indium Corporation's GalliTHERM line of gallium-based liquid metals solutions offers enhanced thermal management capabilities for high-power applications. Furthermore, breakthroughs in photoresist technology are critical for advanced lithography, allowing for the precise patterning of intricate circuit designs. Innovations in packaging materials, such as low-loss dielectric films and advanced underfill encapsulants, are also paramount for improving device reliability and miniaturization. These innovations translate directly into enhanced performance metrics such as reduced power consumption, increased processing speed, and improved thermal conductivity in the final semiconductor devices.

Propelling Factors for Semiconductor Materials Market Growth

The semiconductor materials market is propelled by several key factors. Technologically, the relentless pursuit of miniaturization and enhanced performance in electronic devices, driven by Moore's Law and the increasing complexity of integrated circuits, necessitates the development and adoption of advanced materials. Economic factors such as the burgeoning demand for consumer electronics, the rapid expansion of 5G infrastructure, and the growing adoption of electric and autonomous vehicles in the automotive sector create substantial market pull. Regulatory support for domestic semiconductor manufacturing in various regions, coupled with increasing government investments in research and development, further fuels growth. The proliferation of the Internet of Things (IoT) and the ongoing advancements in artificial intelligence (AI) and machine learning are creating new applications and driving demand for specialized semiconductor materials with unique properties.

Obstacles in the Semiconductor Materials Market Market

Despite robust growth, the semiconductor materials market faces several obstacles. Stringent purity requirements and complex manufacturing processes can lead to high production costs and significant capital expenditure for material suppliers. Supply chain disruptions, exacerbated by geopolitical tensions and global logistics challenges, can lead to material shortages and price volatility. Intense competition among established players and emerging entrants puts pressure on profit margins. Furthermore, the long qualification cycles for new materials in the semiconductor industry can slow down adoption rates. Environmental regulations and the need for sustainable sourcing and disposal of hazardous chemicals also present ongoing challenges for market participants.

Future Opportunities in Semiconductor Materials Market

The semiconductor materials market is poised for significant future opportunities. The expansion of emerging technologies such as quantum computing, advanced AI accelerators, and next-generation displays will create demand for novel and highly specialized materials. The increasing focus on sustainable electronics and energy-efficient devices will drive the adoption of materials like silicon carbide (SiC) and gallium nitride (GaN) for power electronics. The growth of the automotive sector, with its increasing reliance on semiconductors for electrification and autonomous driving, presents a substantial untapped market. Furthermore, advancements in 3D packaging and heterogeneous integration will open doors for new material solutions that enhance performance and reduce form factors. The continuous innovation in material science will unlock new frontiers in semiconductor performance and functionality.

Major Players in the Semiconductor Materials Market Ecosystem

- Nichia Corporation

- Sumitomo Chemical Co Ltd

- Indium Corporation

- Showa Denko Materials Co Ltd (Showa Denko K K)

- CAPLINQ Europe BV

- LG Chem Ltd

- ShinEtsu Microsi

- KYOCERA Corporation

- Henkel AG & Company KGAA

- BASF SE

- International Quantum Epitaxy PLC

- Dow Chemical Co (Dow Inc)

Key Developments in Semiconductor Materials Market Industry

- September 2022: Showa Denko K.K. (SDK) announced its merger with Showa Denko Materials Co., Ltd. (SDMC) on January 1, 2023, to form "Resonac." Resonac Holdings Corporation will replace SDK as a holding company, while Resonac Corporation will replace SDMC as an operational corporation. This strategic restructuring aims to establish a significant chemical firm with cutting-edge functional materials.

- August 2022: Indium Corporation introduced products from its GalliTHERM line of gallium-based liquid metals solutions. Leveraging over 60 years of expertise in producing liquid metals based on gallium, this cutting-edge product range is designed to enhance thermal management solutions in demanding applications.

Strategic Semiconductor Materials Market Market Forecast

The strategic semiconductor materials market forecast indicates a period of sustained and robust growth, driven by the confluence of accelerating technological innovation and increasing global demand for advanced electronic devices. The continued expansion of consumer electronics, the critical rollout of telecommunication infrastructure like 5G and beyond, and the transformative electrification and automation of the automotive industry are projected to be key growth catalysts. Emerging applications in areas such as artificial intelligence, the Internet of Things, and renewable energy will further amplify this demand, necessitating the development and adoption of novel semiconductor materials. Strategic investments in research and development, coupled with supportive government policies aimed at enhancing domestic semiconductor manufacturing capabilities, will foster a conducive environment for market expansion. The forecast period is characterized by an increasing emphasis on high-performance, energy-efficient, and specialized materials, presenting significant market potential for companies that can innovate and adapt to these evolving industry needs.

Semiconductor Materials Market Segmentation

-

1. Application

- 1.1. Fabrication

- 1.2. Packaging

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Telecommunication

- 2.3. Manufacturing

- 2.4. Automotive

- 2.5. Energy and Utility

- 2.6. Other End-user Industries

Semiconductor Materials Market Segmentation By Geography

- 1. Taiwan

- 2. South Korea

- 3. China

- 4. Japan

- 5. North America

- 6. Europe

- 7. Rest of the World

Semiconductor Materials Market Regional Market Share

Geographic Coverage of Semiconductor Materials Market

Semiconductor Materials Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technical Advancements and Product Innovation of the Electronic Materials; Rising Demand for Consumer Electronics Goods; Increased Demand From OSAT/Packaging Companies

- 3.3. Market Restrains

- 3.3.1. Complexity in the Manufacturing Process

- 3.4. Market Trends

- 3.4.1. Rising Demand for Consumer Electronics Goods to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Fabrication

- 5.1.2. Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Telecommunication

- 5.2.3. Manufacturing

- 5.2.4. Automotive

- 5.2.5. Energy and Utility

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Taiwan

- 5.3.2. South Korea

- 5.3.3. China

- 5.3.4. Japan

- 5.3.5. North America

- 5.3.6. Europe

- 5.3.7. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Taiwan Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Fabrication

- 6.1.2. Packaging

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Consumer Electronics

- 6.2.2. Telecommunication

- 6.2.3. Manufacturing

- 6.2.4. Automotive

- 6.2.5. Energy and Utility

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South Korea Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Fabrication

- 7.1.2. Packaging

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Consumer Electronics

- 7.2.2. Telecommunication

- 7.2.3. Manufacturing

- 7.2.4. Automotive

- 7.2.5. Energy and Utility

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. China Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Fabrication

- 8.1.2. Packaging

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Consumer Electronics

- 8.2.2. Telecommunication

- 8.2.3. Manufacturing

- 8.2.4. Automotive

- 8.2.5. Energy and Utility

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Japan Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Fabrication

- 9.1.2. Packaging

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Consumer Electronics

- 9.2.2. Telecommunication

- 9.2.3. Manufacturing

- 9.2.4. Automotive

- 9.2.5. Energy and Utility

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Fabrication

- 10.1.2. Packaging

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Consumer Electronics

- 10.2.2. Telecommunication

- 10.2.3. Manufacturing

- 10.2.4. Automotive

- 10.2.5. Energy and Utility

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Europe Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Fabrication

- 11.1.2. Packaging

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Consumer Electronics

- 11.2.2. Telecommunication

- 11.2.3. Manufacturing

- 11.2.4. Automotive

- 11.2.5. Energy and Utility

- 11.2.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Rest of the World Semiconductor Materials Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Application

- 12.1.1. Fabrication

- 12.1.2. Packaging

- 12.2. Market Analysis, Insights and Forecast - by End-user Industry

- 12.2.1. Consumer Electronics

- 12.2.2. Telecommunication

- 12.2.3. Manufacturing

- 12.2.4. Automotive

- 12.2.5. Energy and Utility

- 12.2.6. Other End-user Industries

- 12.1. Market Analysis, Insights and Forecast - by Application

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nichia Corporation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sumitomo Chemical Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Indium Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Showa Denko Materials Co Ltd (showa Denko K K)

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 CAPLINQ Europe BV

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 LG Chem Ltd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 ShinEtsu Microsi

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 KYOCERA Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Henkel AG & Company KGAA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 BASF SE

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 International Quantum Epitaxy PLC

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Dow Chemical Co (Dow Inc )

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Nichia Corporation

List of Figures

- Figure 1: Global Semiconductor Materials Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Semiconductor Materials Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: Taiwan Semiconductor Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 4: Taiwan Semiconductor Materials Market Volume (K Unit), by Application 2025 & 2033

- Figure 5: Taiwan Semiconductor Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Taiwan Semiconductor Materials Market Volume Share (%), by Application 2025 & 2033

- Figure 7: Taiwan Semiconductor Materials Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 8: Taiwan Semiconductor Materials Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 9: Taiwan Semiconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: Taiwan Semiconductor Materials Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 11: Taiwan Semiconductor Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 12: Taiwan Semiconductor Materials Market Volume (K Unit), by Country 2025 & 2033

- Figure 13: Taiwan Semiconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Taiwan Semiconductor Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South Korea Semiconductor Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 16: South Korea Semiconductor Materials Market Volume (K Unit), by Application 2025 & 2033

- Figure 17: South Korea Semiconductor Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: South Korea Semiconductor Materials Market Volume Share (%), by Application 2025 & 2033

- Figure 19: South Korea Semiconductor Materials Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 20: South Korea Semiconductor Materials Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 21: South Korea Semiconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: South Korea Semiconductor Materials Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 23: South Korea Semiconductor Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 24: South Korea Semiconductor Materials Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: South Korea Semiconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Semiconductor Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 27: China Semiconductor Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 28: China Semiconductor Materials Market Volume (K Unit), by Application 2025 & 2033

- Figure 29: China Semiconductor Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: China Semiconductor Materials Market Volume Share (%), by Application 2025 & 2033

- Figure 31: China Semiconductor Materials Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 32: China Semiconductor Materials Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 33: China Semiconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: China Semiconductor Materials Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 35: China Semiconductor Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 36: China Semiconductor Materials Market Volume (K Unit), by Country 2025 & 2033

- Figure 37: China Semiconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: China Semiconductor Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Japan Semiconductor Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 40: Japan Semiconductor Materials Market Volume (K Unit), by Application 2025 & 2033

- Figure 41: Japan Semiconductor Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Japan Semiconductor Materials Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Japan Semiconductor Materials Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 44: Japan Semiconductor Materials Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 45: Japan Semiconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Japan Semiconductor Materials Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: Japan Semiconductor Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 48: Japan Semiconductor Materials Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Japan Semiconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Japan Semiconductor Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 51: North America Semiconductor Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 52: North America Semiconductor Materials Market Volume (K Unit), by Application 2025 & 2033

- Figure 53: North America Semiconductor Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: North America Semiconductor Materials Market Volume Share (%), by Application 2025 & 2033

- Figure 55: North America Semiconductor Materials Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 56: North America Semiconductor Materials Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 57: North America Semiconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: North America Semiconductor Materials Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 59: North America Semiconductor Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 60: North America Semiconductor Materials Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: North America Semiconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: North America Semiconductor Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Europe Semiconductor Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 64: Europe Semiconductor Materials Market Volume (K Unit), by Application 2025 & 2033

- Figure 65: Europe Semiconductor Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 66: Europe Semiconductor Materials Market Volume Share (%), by Application 2025 & 2033

- Figure 67: Europe Semiconductor Materials Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 68: Europe Semiconductor Materials Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 69: Europe Semiconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Europe Semiconductor Materials Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 71: Europe Semiconductor Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 72: Europe Semiconductor Materials Market Volume (K Unit), by Country 2025 & 2033

- Figure 73: Europe Semiconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 74: Europe Semiconductor Materials Market Volume Share (%), by Country 2025 & 2033

- Figure 75: Rest of the World Semiconductor Materials Market Revenue (billion), by Application 2025 & 2033

- Figure 76: Rest of the World Semiconductor Materials Market Volume (K Unit), by Application 2025 & 2033

- Figure 77: Rest of the World Semiconductor Materials Market Revenue Share (%), by Application 2025 & 2033

- Figure 78: Rest of the World Semiconductor Materials Market Volume Share (%), by Application 2025 & 2033

- Figure 79: Rest of the World Semiconductor Materials Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 80: Rest of the World Semiconductor Materials Market Volume (K Unit), by End-user Industry 2025 & 2033

- Figure 81: Rest of the World Semiconductor Materials Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 82: Rest of the World Semiconductor Materials Market Volume Share (%), by End-user Industry 2025 & 2033

- Figure 83: Rest of the World Semiconductor Materials Market Revenue (billion), by Country 2025 & 2033

- Figure 84: Rest of the World Semiconductor Materials Market Volume (K Unit), by Country 2025 & 2033

- Figure 85: Rest of the World Semiconductor Materials Market Revenue Share (%), by Country 2025 & 2033

- Figure 86: Rest of the World Semiconductor Materials Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Semiconductor Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: Global Semiconductor Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Global Semiconductor Materials Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Semiconductor Materials Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Semiconductor Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 9: Global Semiconductor Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Global Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Semiconductor Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Semiconductor Materials Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global Semiconductor Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Global Semiconductor Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Semiconductor Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Global Semiconductor Materials Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Global Semiconductor Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 20: Global Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Global Semiconductor Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Semiconductor Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Semiconductor Materials Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Global Semiconductor Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Semiconductor Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: Global Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 29: Global Semiconductor Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Semiconductor Materials Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global Semiconductor Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 32: Global Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: Global Semiconductor Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 34: Global Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Semiconductor Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Global Semiconductor Materials Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Global Semiconductor Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 38: Global Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 39: Global Semiconductor Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Semiconductor Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Semiconductor Materials Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: Global Semiconductor Materials Market Revenue billion Forecast, by Application 2020 & 2033

- Table 44: Global Semiconductor Materials Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Global Semiconductor Materials Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 46: Global Semiconductor Materials Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 47: Global Semiconductor Materials Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Global Semiconductor Materials Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Semiconductor Materials Market?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the Semiconductor Materials Market?

Key companies in the market include Nichia Corporation, Sumitomo Chemical Co Ltd, Indium Corporation, Showa Denko Materials Co Ltd (showa Denko K K), CAPLINQ Europe BV, LG Chem Ltd, ShinEtsu Microsi, KYOCERA Corporation, Henkel AG & Company KGAA, BASF SE, International Quantum Epitaxy PLC, Dow Chemical Co (Dow Inc ).

3. What are the main segments of the Semiconductor Materials Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 69.79 billion as of 2022.

5. What are some drivers contributing to market growth?

Technical Advancements and Product Innovation of the Electronic Materials; Rising Demand for Consumer Electronics Goods; Increased Demand From OSAT/Packaging Companies.

6. What are the notable trends driving market growth?

Rising Demand for Consumer Electronics Goods to Drive the Market.

7. Are there any restraints impacting market growth?

Complexity in the Manufacturing Process.

8. Can you provide examples of recent developments in the market?

September 2022 - Showa Denko K.K. (SDK) announced its merger with Showa Denko Materials Co., Ltd. (SDMC) on January 1, 2023, to form "Resonac." Resonac Holdings Corporation will replace SDK as a holding company, while Resonac Corporation will replace SDMC as an operational corporation. Through ongoing restructuring efforts, the Showa Denko Group intends to establish a significant chemical firm with cutting-edge functional materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Semiconductor Materials Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Semiconductor Materials Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Semiconductor Materials Market?

To stay informed about further developments, trends, and reports in the Semiconductor Materials Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence